Key Insights

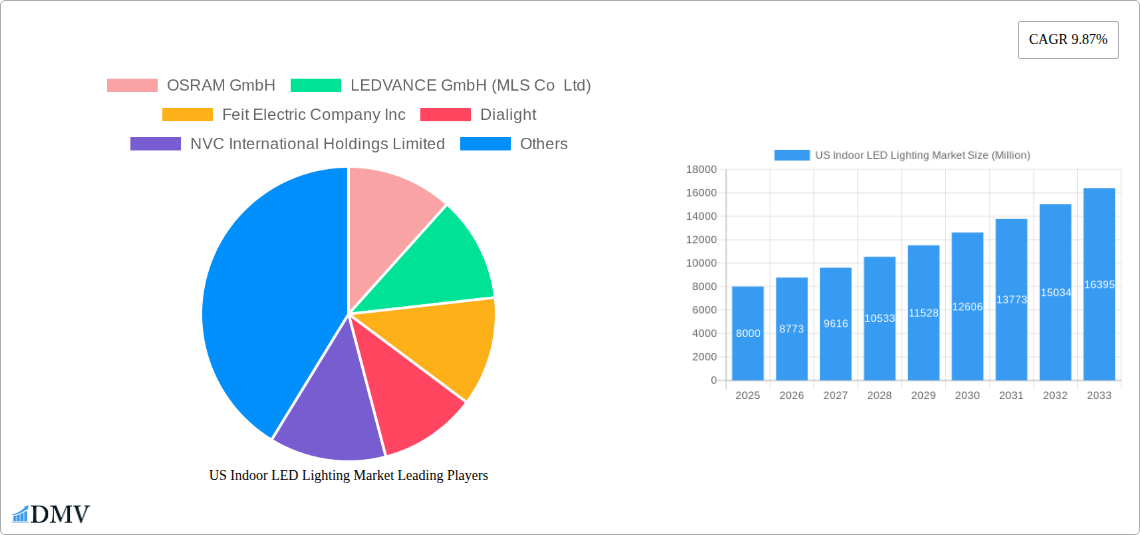

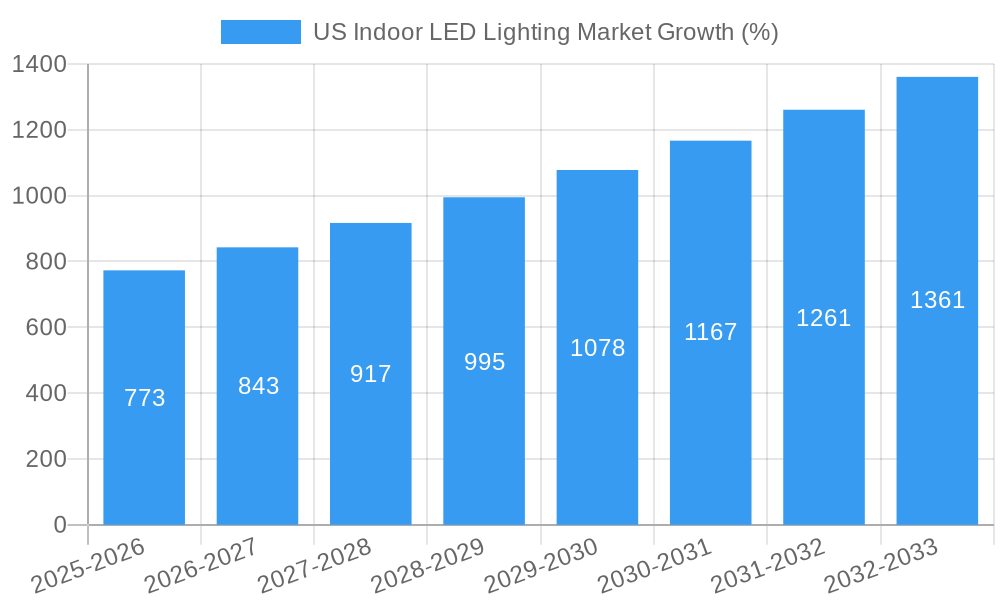

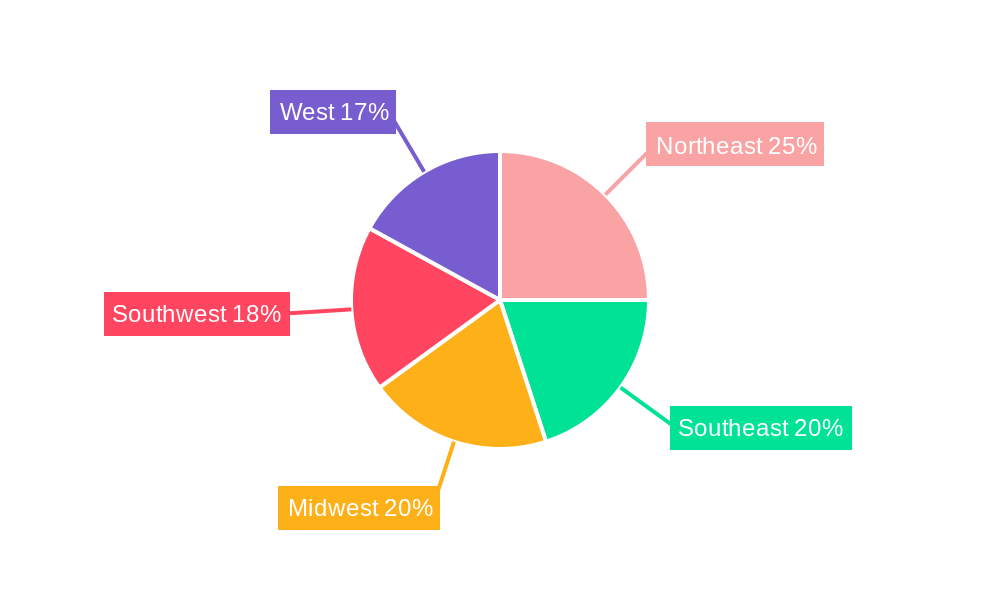

The US indoor LED lighting market is experiencing robust growth, driven by increasing energy efficiency mandates, rising consumer awareness of environmental benefits, and the falling costs of LED technology. The market, segmented into residential, commercial, and industrial/warehouse applications, along with a specialized agricultural lighting segment, shows a Compound Annual Growth Rate (CAGR) of 9.87% from 2019 to 2024. This growth is projected to continue through 2033, fueled by smart home technology integration, advancements in LED efficacy and lifespan, and a shift towards sustainable building practices. The residential segment is a significant contributor, driven by renovations, new construction, and the preference for energy-efficient and long-lasting lighting solutions. Commercial applications, including offices, retail spaces, and hospitality venues, are also experiencing strong growth due to the adoption of LED lighting for cost savings and improved aesthetics. The industrial/warehouse sector benefits from LED's durability and suitability for demanding environments. Key players like Signify (Philips), Osram, Cree, and Acuity Brands are actively shaping the market through product innovation and strategic partnerships, further solidifying the growth trajectory. Regional variations exist, with the West and Northeast regions potentially exhibiting higher adoption rates due to factors such as higher disposable income and stringent energy regulations.

The projected market size for 2025, based on the provided CAGR and assuming a reasonable market size in 2024, is estimated to be approximately $8 billion (USD). This figure represents a significant portion of the overall US lighting market, indicating the continued dominance of LED technology. The forecast for 2033 suggests a substantial increase, largely due to continued technological advancements that drive down costs and improve performance, coupled with increasing consumer and commercial adoption. While some restraints exist, such as the high initial investment costs compared to traditional lighting and potential concerns about light quality and color rendering in certain applications, these factors are expected to be outweighed by the long-term cost savings and sustainability benefits of LED technology. This robust market presents significant opportunities for manufacturers, distributors, and installers in the coming decade.

US Indoor LED Lighting Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the US indoor LED lighting market, offering valuable insights for stakeholders seeking to navigate this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. The market size is projected to reach xx Million by 2033, showcasing significant growth potential.

US Indoor LED Lighting Market Composition & Trends

This section delves into the market's competitive landscape, analyzing market concentration, innovation drivers, regulatory influences, substitute products, end-user profiles, and merger & acquisition (M&A) activities. We assess the market share distribution among key players like OSRAM GmbH, LEDVANCE GmbH, Feit Electric Company Inc, Dialight, NVC International Holdings Limited, EGLO Leuchten GmbH, Current Lighting Solutions LLC, Signify (Philips), Cree LED (SMART Global Holdings Inc), and Acuity Brands Inc. The report quantifies the market concentration using metrics like the Herfindahl-Hirschman Index (HHI) and explores the impact of recent M&A activities, providing estimated deal values where available. Further analysis includes:

- Market Concentration: Analyzing the market share held by the top five players. The market shows a [Level of Concentration: e.g., moderately concentrated] structure, with the top five players holding an estimated xx% of the market share in 2024.

- Innovation Catalysts: Identifying key technological advancements driving market growth, such as advancements in LED technology, smart lighting solutions, and energy-efficient designs.

- Regulatory Landscape: Assessing the impact of energy efficiency standards and environmental regulations on market dynamics.

- Substitute Products: Examining the competitive pressure from alternative lighting technologies and their market penetration.

- End-User Profiles: Profiling key end-user segments (Residential, Commercial, Industrial, Agricultural) and their specific lighting needs and preferences.

- M&A Activity: Analyzing recent mergers and acquisitions in the industry, including deal values (where available) and their impact on market consolidation and competition.

US Indoor LED Lighting Market Industry Evolution

This section provides a comprehensive overview of the US indoor LED lighting market's evolution, examining growth trajectories, technological advancements, and shifting consumer preferences over the study period (2019-2033). The analysis incorporates detailed data points on growth rates (CAGR), adoption rates of new technologies (e.g., smart lighting), and changing consumer preferences toward energy efficiency and aesthetic appeal. We examine the factors influencing market expansion, such as increased energy efficiency mandates, growing awareness of environmental concerns, and the declining cost of LED lighting. We also analyze the impact of technological advancements such as improved LED efficacy, smart lighting integration, and the Internet of Things (IoT) on market growth and adoption. The section also explores changing consumer demands, including preferences for smart home technologies, customizable lighting options, and aesthetically pleasing designs. Projected growth rates for each segment are presented for the forecast period (2025-2033).

Leading Regions, Countries, or Segments in US Indoor LED Lighting Market

This section identifies the dominant segments (Residential, Commercial, Industrial, Agricultural) and geographical areas within the US indoor LED lighting market. Detailed analysis, along with supporting data, clarifies the reasons behind their dominance.

Key Drivers:

- Investment Trends: Analysis of investment patterns in different segments.

- Regulatory Support: Assessment of the impact of government incentives and policies on each segment.

- Market Size & Growth: Detailed market sizing and growth projections for each segment across the forecast period.

In-depth Analysis: Paragraphs elaborating on the factors driving the dominance of specific segments and regions. This includes an examination of market size, growth rates, and key characteristics of each leading segment.

US Indoor LED Lighting Market Product Innovations

This section highlights recent product innovations in the US indoor LED lighting market, emphasizing their unique selling propositions (USPs), technological advancements, and performance metrics (e.g., lumen output, energy efficiency, lifespan). We analyze new product launches, focusing on their application in different segments and the improvements they offer over existing products. Examples include advancements in LED technology, smart lighting features, and innovative lighting designs.

Propelling Factors for US Indoor LED Lighting Market Growth

This section identifies the key drivers propelling the growth of the US indoor LED lighting market, highlighting technological advancements (improved LED efficacy, smart lighting), economic factors (government incentives, energy cost savings), and regulatory influences (energy efficiency standards). Specific examples are provided to illustrate these drivers.

Obstacles in the US Indoor LED Lighting Market

This section outlines the key barriers and restraints affecting the US indoor LED lighting market's growth. These include regulatory challenges (permitting processes, compliance costs), supply chain disruptions (raw material shortages, logistical bottlenecks), and intense competition (pricing pressures, market saturation in certain segments). The quantitative impact of these factors is assessed.

Future Opportunities in US Indoor LED Lighting Market

This section explores emerging opportunities for growth in the US indoor LED lighting market, focusing on new market segments (e.g., smart home integration, healthcare), innovative technologies (e.g., human-centric lighting, IoT-enabled systems), and evolving consumer trends (e.g., demand for customizable lighting).

Major Players in the US Indoor LED Lighting Market Ecosystem

- OSRAM GmbH

- LEDVANCE GmbH (MLS Co Ltd)

- Feit Electric Company Inc

- Dialight

- NVC International Holdings Limited

- EGLO Leuchten GmbH

- Current Lighting Solutions LLC

- Signify (Philips)

- Cree LED (SMART Global Holdings Inc)

- Acuity Brands Inc

Key Developments in US Indoor LED Lighting Market Industry

- March 2023: Cree LED introduced its J Series 5050C E Class LEDs, boasting 228 lumens per watt (LPW) efficacy – three times the output of competitors at the same efficacy. This significantly improves energy efficiency and light output.

- April 2023: Luminaire LED launched its Vandal Resistant Downlight (VRDL) line, its first downlight, designed for durability and aesthetic appeal in demanding environments. This expands product offerings in a niche market.

- April 2023: Luminis unveiled the Inline series of external luminaires. While focused on outdoor applications, this illustrates the company's innovation capabilities, potentially influencing future indoor product development. This development showcases innovation within the parent company.

Strategic US Indoor LED Lighting Market Forecast

The US indoor LED lighting market is poised for continued growth, driven by factors like increasing energy efficiency standards, the rising adoption of smart home technology, and the ongoing decline in LED lighting costs. The market will experience substantial expansion across various segments, particularly in commercial and residential applications. Focus on sustainability, innovative designs, and smart features will shape future market trends, presenting significant opportunities for industry players.

US Indoor LED Lighting Market Segmentation

-

1. Indoor Lighting

- 1.1. Agricultural Lighting

- 1.2. Commercial

- 1.3. Industrial and Warehouse

- 1.4. Residential

US Indoor LED Lighting Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Indoor LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High demand for LED lighting in the outdoor lighting segment driven by smart development initiatives; Increasing awareness among households on LED and favorable government regulations; Steady reduction in the prices of LED lighting products and higher shelf life

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installations

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 5.1.1. Agricultural Lighting

- 5.1.2. Commercial

- 5.1.3. Industrial and Warehouse

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 6. North America US Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 6.1.1. Agricultural Lighting

- 6.1.2. Commercial

- 6.1.3. Industrial and Warehouse

- 6.1.4. Residential

- 6.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 7. South America US Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 7.1.1. Agricultural Lighting

- 7.1.2. Commercial

- 7.1.3. Industrial and Warehouse

- 7.1.4. Residential

- 7.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 8. Europe US Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 8.1.1. Agricultural Lighting

- 8.1.2. Commercial

- 8.1.3. Industrial and Warehouse

- 8.1.4. Residential

- 8.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 9. Middle East & Africa US Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 9.1.1. Agricultural Lighting

- 9.1.2. Commercial

- 9.1.3. Industrial and Warehouse

- 9.1.4. Residential

- 9.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 10. Asia Pacific US Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 10.1.1. Agricultural Lighting

- 10.1.2. Commercial

- 10.1.3. Industrial and Warehouse

- 10.1.4. Residential

- 10.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 11. Northeast US Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 12. Southeast US Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 13. Midwest US Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 14. Southwest US Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 15. West US Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 OSRAM GmbH

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 LEDVANCE GmbH (MLS Co Ltd)

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Feit Electric Company Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Dialight

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 NVC International Holdings Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 EGLO Leuchten GmbH

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Current Lighting Solutions LLC

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Signify (Philips

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Cree LED (SMART Global Holdings Inc )

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Acuity Brands Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 OSRAM GmbH

List of Figures

- Figure 1: Global US Indoor LED Lighting Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global US Indoor LED Lighting Market Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: United states US Indoor LED Lighting Market Revenue (Million), by Country 2024 & 2032

- Figure 4: United states US Indoor LED Lighting Market Volume (K Unit), by Country 2024 & 2032

- Figure 5: United states US Indoor LED Lighting Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: United states US Indoor LED Lighting Market Volume Share (%), by Country 2024 & 2032

- Figure 7: North America US Indoor LED Lighting Market Revenue (Million), by Indoor Lighting 2024 & 2032

- Figure 8: North America US Indoor LED Lighting Market Volume (K Unit), by Indoor Lighting 2024 & 2032

- Figure 9: North America US Indoor LED Lighting Market Revenue Share (%), by Indoor Lighting 2024 & 2032

- Figure 10: North America US Indoor LED Lighting Market Volume Share (%), by Indoor Lighting 2024 & 2032

- Figure 11: North America US Indoor LED Lighting Market Revenue (Million), by Country 2024 & 2032

- Figure 12: North America US Indoor LED Lighting Market Volume (K Unit), by Country 2024 & 2032

- Figure 13: North America US Indoor LED Lighting Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America US Indoor LED Lighting Market Volume Share (%), by Country 2024 & 2032

- Figure 15: South America US Indoor LED Lighting Market Revenue (Million), by Indoor Lighting 2024 & 2032

- Figure 16: South America US Indoor LED Lighting Market Volume (K Unit), by Indoor Lighting 2024 & 2032

- Figure 17: South America US Indoor LED Lighting Market Revenue Share (%), by Indoor Lighting 2024 & 2032

- Figure 18: South America US Indoor LED Lighting Market Volume Share (%), by Indoor Lighting 2024 & 2032

- Figure 19: South America US Indoor LED Lighting Market Revenue (Million), by Country 2024 & 2032

- Figure 20: South America US Indoor LED Lighting Market Volume (K Unit), by Country 2024 & 2032

- Figure 21: South America US Indoor LED Lighting Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America US Indoor LED Lighting Market Volume Share (%), by Country 2024 & 2032

- Figure 23: Europe US Indoor LED Lighting Market Revenue (Million), by Indoor Lighting 2024 & 2032

- Figure 24: Europe US Indoor LED Lighting Market Volume (K Unit), by Indoor Lighting 2024 & 2032

- Figure 25: Europe US Indoor LED Lighting Market Revenue Share (%), by Indoor Lighting 2024 & 2032

- Figure 26: Europe US Indoor LED Lighting Market Volume Share (%), by Indoor Lighting 2024 & 2032

- Figure 27: Europe US Indoor LED Lighting Market Revenue (Million), by Country 2024 & 2032

- Figure 28: Europe US Indoor LED Lighting Market Volume (K Unit), by Country 2024 & 2032

- Figure 29: Europe US Indoor LED Lighting Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Europe US Indoor LED Lighting Market Volume Share (%), by Country 2024 & 2032

- Figure 31: Middle East & Africa US Indoor LED Lighting Market Revenue (Million), by Indoor Lighting 2024 & 2032

- Figure 32: Middle East & Africa US Indoor LED Lighting Market Volume (K Unit), by Indoor Lighting 2024 & 2032

- Figure 33: Middle East & Africa US Indoor LED Lighting Market Revenue Share (%), by Indoor Lighting 2024 & 2032

- Figure 34: Middle East & Africa US Indoor LED Lighting Market Volume Share (%), by Indoor Lighting 2024 & 2032

- Figure 35: Middle East & Africa US Indoor LED Lighting Market Revenue (Million), by Country 2024 & 2032

- Figure 36: Middle East & Africa US Indoor LED Lighting Market Volume (K Unit), by Country 2024 & 2032

- Figure 37: Middle East & Africa US Indoor LED Lighting Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East & Africa US Indoor LED Lighting Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Asia Pacific US Indoor LED Lighting Market Revenue (Million), by Indoor Lighting 2024 & 2032

- Figure 40: Asia Pacific US Indoor LED Lighting Market Volume (K Unit), by Indoor Lighting 2024 & 2032

- Figure 41: Asia Pacific US Indoor LED Lighting Market Revenue Share (%), by Indoor Lighting 2024 & 2032

- Figure 42: Asia Pacific US Indoor LED Lighting Market Volume Share (%), by Indoor Lighting 2024 & 2032

- Figure 43: Asia Pacific US Indoor LED Lighting Market Revenue (Million), by Country 2024 & 2032

- Figure 44: Asia Pacific US Indoor LED Lighting Market Volume (K Unit), by Country 2024 & 2032

- Figure 45: Asia Pacific US Indoor LED Lighting Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Asia Pacific US Indoor LED Lighting Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Indoor LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Indoor LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global US Indoor LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 4: Global US Indoor LED Lighting Market Volume K Unit Forecast, by Indoor Lighting 2019 & 2032

- Table 5: Global US Indoor LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global US Indoor LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Global US Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global US Indoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Northeast US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Northeast US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: Southeast US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Southeast US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Midwest US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Midwest US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Southwest US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Southwest US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: West US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Global US Indoor LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 20: Global US Indoor LED Lighting Market Volume K Unit Forecast, by Indoor Lighting 2019 & 2032

- Table 21: Global US Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global US Indoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 23: United States US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United States US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Canada US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Canada US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Mexico US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Mexico US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Global US Indoor LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 30: Global US Indoor LED Lighting Market Volume K Unit Forecast, by Indoor Lighting 2019 & 2032

- Table 31: Global US Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global US Indoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: Brazil US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Brazil US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Argentina US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Argentina US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Rest of South America US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of South America US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Global US Indoor LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 40: Global US Indoor LED Lighting Market Volume K Unit Forecast, by Indoor Lighting 2019 & 2032

- Table 41: Global US Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global US Indoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: United Kingdom US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Germany US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Germany US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: France US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Italy US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Italy US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Spain US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Spain US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Russia US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Russia US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Benelux US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Benelux US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Nordics US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Nordics US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Rest of Europe US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Europe US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 61: Global US Indoor LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 62: Global US Indoor LED Lighting Market Volume K Unit Forecast, by Indoor Lighting 2019 & 2032

- Table 63: Global US Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Global US Indoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 65: Turkey US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Turkey US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 67: Israel US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Israel US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: GCC US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: GCC US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: North Africa US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: North Africa US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: South Africa US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: South Africa US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 75: Rest of Middle East & Africa US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Rest of Middle East & Africa US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 77: Global US Indoor LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 78: Global US Indoor LED Lighting Market Volume K Unit Forecast, by Indoor Lighting 2019 & 2032

- Table 79: Global US Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 80: Global US Indoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 81: China US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: China US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 83: India US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: India US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 85: Japan US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Japan US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: South Korea US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: South Korea US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: ASEAN US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 91: Oceania US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: Oceania US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific US Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific US Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Indoor LED Lighting Market?

The projected CAGR is approximately 9.87%.

2. Which companies are prominent players in the US Indoor LED Lighting Market?

Key companies in the market include OSRAM GmbH, LEDVANCE GmbH (MLS Co Ltd), Feit Electric Company Inc, Dialight, NVC International Holdings Limited, EGLO Leuchten GmbH, Current Lighting Solutions LLC, Signify (Philips, Cree LED (SMART Global Holdings Inc ), Acuity Brands Inc.

3. What are the main segments of the US Indoor LED Lighting Market?

The market segments include Indoor Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High demand for LED lighting in the outdoor lighting segment driven by smart development initiatives; Increasing awareness among households on LED and favorable government regulations; Steady reduction in the prices of LED lighting products and higher shelf life .

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Initial Cost of Installations.

8. Can you provide examples of recent developments in the market?

April 2023: Luminis, a recognized innovator and manufacturer of specification-grade lighting systems, has developed the Inline series of external luminaires. With various heights and lighting module options, inline bollards and columns elevate outside areas.April 2023: Luminaire LED, a recognized leader in vandal-resistant lighting systems, announced the launch of its Vandal Resistant Downlight (VRDL) line, the company's first downlight. The architecturally designed series has a clean, elegant style while also being able to withstand hard abuse and demanding situations.March 2023: Cree LED has introduced its J Series 5050C E Class LEDs, which have the best efficacy for high-power LEDs: 228 lumens per watt (LPW), typical at 4000K, 70 CRI, and 1W. At the same efficacy level, the new J Series LEDs produce up to three times the light output of competitive 5050 LEDs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Indoor LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Indoor LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Indoor LED Lighting Market?

To stay informed about further developments, trends, and reports in the US Indoor LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence