Key Insights

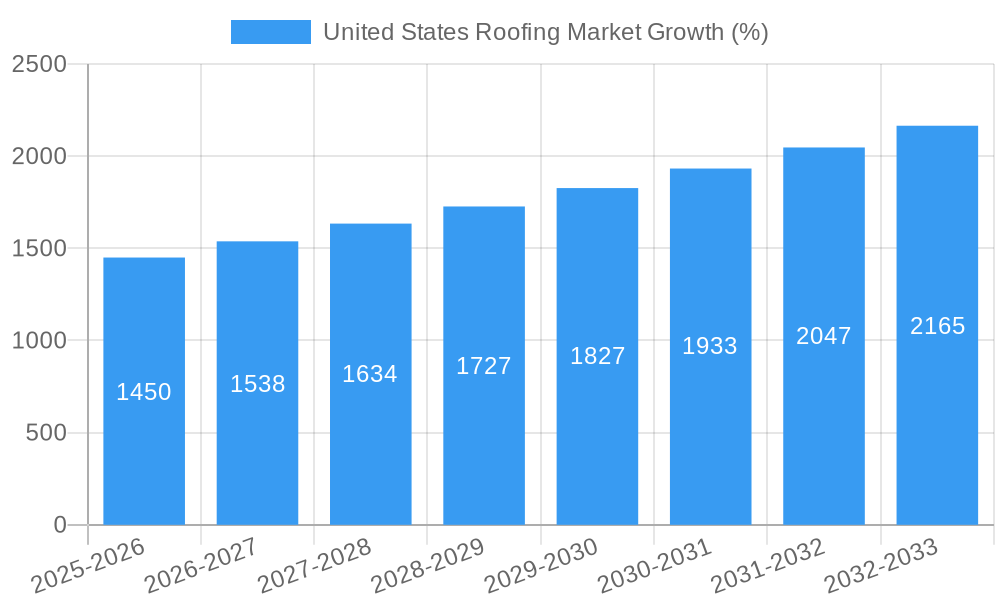

The United States roofing market, valued at $23.35 billion in 2025, is projected to experience robust growth, driven by several key factors. A significant driver is the aging housing stock in the US, necessitating increasing roof replacements and repairs. Furthermore, new construction, particularly in the commercial and residential sectors, fueled by population growth and economic expansion, significantly contributes to market demand. The increasing adoption of energy-efficient roofing materials, such as modified bitumen and thermoplastic polyolefins, is another major trend, pushing market growth. However, the market faces constraints including fluctuating raw material prices, particularly for bitumen and metals, and potential labor shortages impacting installation timelines and costs. The market segmentation reveals a strong presence of commercial construction, followed by residential, with industrial construction showing steady growth. In terms of materials, modified bitumen maintains its dominance, while the thermoplastic polyolefin segment is experiencing faster growth due to its superior performance characteristics. The flat roof segment holds a larger market share compared to slope roofs due to its prevalence in commercial buildings. Key players such as Centimark Corp, Beacon Building Products, and Owens Corning dominate the landscape, leveraging their established distribution networks and brand recognition. The forecast period (2025-2033) anticipates a continuation of this positive trajectory, with the CAGR of 6.17% indicating substantial market expansion.

The competitive landscape is characterized by a mix of large multinational corporations and regional players. The presence of several established players ensures a degree of market consolidation, while the entry of smaller, niche players specializing in specific materials or roofing types introduces innovation and competition. Future growth will likely be influenced by technological advancements in roofing materials, focusing on enhanced durability, energy efficiency, and sustainability. Government regulations promoting energy-efficient building practices will also impact market dynamics. Regional variations will likely persist, with higher growth anticipated in regions experiencing significant construction activity and population increases. Overall, the US roofing market presents a promising investment opportunity with consistent growth potential driven by underlying demographic and economic trends, albeit with challenges related to material costs and labor availability.

United States Roofing Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the United States roofing market, offering crucial data and trends for stakeholders across the industry value chain. With a detailed examination of market segmentation, competitive landscape, and future projections, this report is an invaluable resource for strategic decision-making. The study period covers 2019-2033, with 2025 as the base year and forecasts extending to 2033. The report meticulously analyzes historical data from 2019-2024, providing a solid foundation for future projections. The total market value in 2025 is estimated at $XX Million.

United States Roofing Market Composition & Trends

The United States roofing market is a dynamic landscape characterized by a moderate level of concentration, with key players such as Centimark Corp, Beacon Building Products, Tamko Building Products, IronHead Roofing, Owens Corning, and Baker Roofing holding significant market share. However, the market also includes a large number of smaller regional players and specialized contractors. Market share distribution in 2025 is estimated as follows: Beacon Building Products (15%), Owens Corning (12%), GAF Materials Corporation (10%), and others (63%). Innovation in materials science, particularly in sustainable and energy-efficient roofing solutions, is a major catalyst for growth. Stringent building codes and environmental regulations influence material choices and installation practices. Substitute products, such as solar panels integrated into roofing systems, are gaining traction, while the growing demand for eco-friendly options is impacting material selection. The market experiences considerable M&A activity, with deal values in 2023 exceeding $XX Million. End-users are primarily residential and commercial construction companies, with a growing segment of industrial and infrastructure projects.

- Market Concentration: Moderately concentrated, with a few large players and numerous smaller companies.

- Innovation Catalysts: Sustainable materials, energy-efficient designs, smart roofing technologies.

- Regulatory Landscape: Stringent building codes, environmental regulations, and safety standards.

- Substitute Products: Solar panels, green roofs, and other alternative roofing solutions.

- End-User Profiles: Residential, commercial, and industrial construction sectors.

- M&A Activity: Significant consolidation with deal values exceeding $XX Million in 2023.

United States Roofing Market Industry Evolution

The U.S. roofing market has witnessed steady growth over the past five years, driven by factors such as increasing construction activity, aging infrastructure, and a growing awareness of the importance of energy efficiency. The historical period (2019-2024) showed an average annual growth rate (AAGR) of XX%, with the residential sector consistently outpacing the commercial and industrial segments. Technological advancements, such as the introduction of lighter, stronger, and more durable roofing materials, have increased efficiency and reduced installation time. Consumer demands are shifting towards aesthetically pleasing, energy-efficient, and environmentally friendly roofing solutions. The adoption of new technologies, including drone inspections and advanced modeling software, is streamlining processes and improving project outcomes. The market is projected to maintain a robust growth trajectory during the forecast period (2025-2033), with an anticipated AAGR of XX%. This growth will be fueled by sustained investment in infrastructure projects, increasing urbanization, and rising awareness of the long-term value of proper roofing maintenance.

Leading Regions, Countries, or Segments in United States Roofing Market

- By Sector: The residential construction sector currently dominates the market, driven by a large housing stock and strong demand for new construction and renovations. Commercial construction is a significant segment, particularly in high-growth urban areas. The industrial construction sector exhibits steady growth, driven by infrastructure development and expansion of manufacturing facilities.

- By Material: Modified bitumen remains the leading roofing material due to its cost-effectiveness and durability. However, the demand for sustainable alternatives, such as EPDM rubber and thermoplastic polyolefin (TPO), is growing rapidly due to their energy efficiency and environmental benefits. Metal roofing is gaining traction in commercial and industrial applications due to its longevity and aesthetic appeal.

- By Roofing Type: Slope roofs are more prevalent in residential construction, while flat roofs are predominantly used in commercial and industrial buildings.

The dominance of the residential sector is primarily driven by consistently high demand for housing, renovation projects, and the relatively lower barrier to entry for smaller contractors. The strong growth in the modified bitumen segment reflects its versatility, cost-effectiveness, and long-term performance.

United States Roofing Market Product Innovations

Recent innovations in the roofing industry focus on improving material performance, increasing energy efficiency, and enhancing durability. Lightweight yet exceptionally strong materials are now available, minimizing transportation costs and installation challenges. Self-healing membranes are improving the lifespan of roofs, while advancements in insulation technology are significantly reducing energy consumption. The integration of solar panels and smart sensors is creating “smart roofs” that optimize energy production and provide real-time data on roof performance. These advancements offer unique selling propositions by improving functionality, enhancing aesthetics, and reducing overall costs for consumers.

Propelling Factors for United States Roofing Market Growth

The growth of the U.S. roofing market is propelled by several key factors. Strong economic growth and increased disposable incomes are boosting the demand for home improvements and new construction. Government incentives for energy-efficient buildings and stringent building codes are driving the adoption of sustainable roofing materials. The aging infrastructure in many parts of the country is creating a significant need for roof replacements and repairs. Technological advancements in materials and installation techniques are making roofing solutions more efficient, cost-effective, and aesthetically pleasing.

Obstacles in the United States Roofing Market

The market faces several challenges, including fluctuating raw material prices, supply chain disruptions, and skilled labor shortages. Regulatory hurdles, such as complex permitting processes and compliance requirements, can increase project costs and timelines. Intense competition among numerous roofing companies puts pressure on pricing and profit margins. Natural disasters, such as hurricanes and wildfires, can lead to significant demand surges, creating logistical challenges and price volatility.

Future Opportunities in United States Roofing Market

Emerging opportunities include the growing demand for green roofs, the integration of smart technologies into roofing systems, and the rising adoption of energy-efficient materials. The expansion of the infrastructure renewal market presents a significant growth opportunity. The development of new, sustainable roofing materials and advanced installation techniques continues to drive market innovation. Increased consumer awareness of the importance of roof maintenance and the long-term benefits of investing in high-quality roofing systems are driving growth in the market.

Major Players in the United States Roofing Market Ecosystem

- Centimark Corp

- Beacon Building Products (Beacon Building Products)

- Tamko Building Products

- IronHead Roofing

- Owens Corning (Owens Corning)

- Baker Roofing

- Tecta America

- GAF Materials Corporation (GAF Materials Corporation)

- Atlas Roofing Corporation

- IKO Industries

- Flynn Group

- CertainTeed Corporation (CertainTeed Corporation)

Key Developments in United States Roofing Market Industry

- December 2023: Soundcore Capital Partners completed the acquisition of Roofing Corp.

- November 2023: FirstService Corporation acquired Roofing Corporation of Americas LLC (Roofing Corp).

- February 2024: Beacon Building Products completed its acquisition of Roofers Supply, its largest acquisition to date.

These acquisitions highlight the ongoing consolidation in the industry and underscore the strategic importance of market expansion and diversification.

Strategic United States Roofing Market Market Forecast

The U.S. roofing market is poised for continued growth, driven by robust construction activity, increasing demand for sustainable and energy-efficient solutions, and the ongoing replacement of aging infrastructure. The market is expected to witness significant innovation in materials science and installation technologies, creating new opportunities for market participants. The focus on sustainable practices and the integration of smart technologies will further shape the future of the U.S. roofing market, presenting lucrative prospects for companies that can adapt to evolving consumer demands and technological advancements.

United States Roofing Market Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

-

2. Material

- 2.1. Modified Bitumen

- 2.2. EPDM Rubber

- 2.3. Thermoplastic Polyolefin

- 2.4. PVC Membrane

- 2.5. Metals

- 2.6. Tiles

- 2.7. Others

-

3. Roofing Type

- 3.1. Flat Roof

- 3.2. Slope Roof

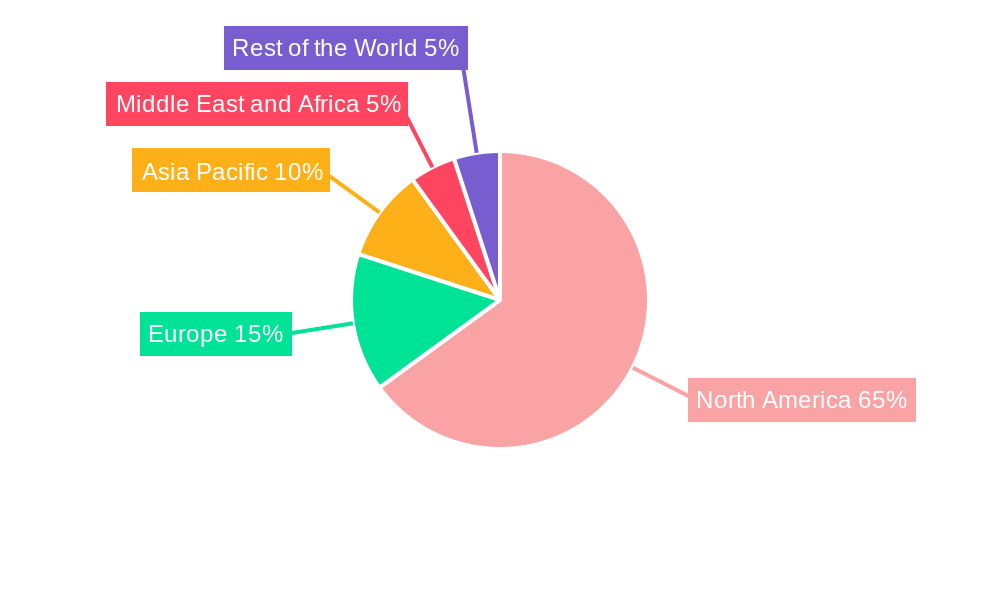

United States Roofing Market Segmentation By Geography

- 1. United States

United States Roofing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.17% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions

- 3.3. Market Restrains

- 3.3.1. The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. Single-Ply Roofing Products are Expected to Gain Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Modified Bitumen

- 5.2.2. EPDM Rubber

- 5.2.3. Thermoplastic Polyolefin

- 5.2.4. PVC Membrane

- 5.2.5. Metals

- 5.2.6. Tiles

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Roofing Type

- 5.3.1. Flat Roof

- 5.3.2. Slope Roof

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Middle East and Africa United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Rest of the World United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Centimark Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Beacon Building Products

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tamko Building Products

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IronHead Roofing

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Owens Corning

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Baker Roofing**List Not Exhaustive 7 2 *List Not Exhaustive7 3 Other Companie

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tecta America

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GAF Materials Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Atlas Roofing Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 IKO Industries

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Flynn Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CertainTeed Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Centimark Corp

List of Figures

- Figure 1: United States Roofing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Roofing Market Share (%) by Company 2024

List of Tables

- Table 1: United States Roofing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Roofing Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: United States Roofing Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: United States Roofing Market Revenue Million Forecast, by Roofing Type 2019 & 2032

- Table 5: United States Roofing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Roofing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Roofing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Roofing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Roofing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States Roofing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States Roofing Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 17: United States Roofing Market Revenue Million Forecast, by Material 2019 & 2032

- Table 18: United States Roofing Market Revenue Million Forecast, by Roofing Type 2019 & 2032

- Table 19: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Roofing Market?

The projected CAGR is approximately 6.17%.

2. Which companies are prominent players in the United States Roofing Market?

Key companies in the market include Centimark Corp, Beacon Building Products, Tamko Building Products, IronHead Roofing, Owens Corning, Baker Roofing**List Not Exhaustive 7 2 *List Not Exhaustive7 3 Other Companie, Tecta America, GAF Materials Corporation, Atlas Roofing Corporation, IKO Industries, Flynn Group, CertainTeed Corporation.

3. What are the main segments of the United States Roofing Market?

The market segments include Sector, Material, Roofing Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions.

6. What are the notable trends driving market growth?

Single-Ply Roofing Products are Expected to Gain Market Share.

7. Are there any restraints impacting market growth?

The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

February 2024: Beacon, a commercial roofing distributor serving North America, announced the completion of its largest acquisition to date. Roofers Supply, based in Greenville, South Carolina, has two additional branches in Charlotte, North Carolina, and Raleigh, North Carolina. This acquisition marks Beacon’s first in 2024. In 2023, Beacon achieved its Ambition 2025 goals for revenue and shareholder return and continues to progress towards full Ambition 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Roofing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Roofing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Roofing Market?

To stay informed about further developments, trends, and reports in the United States Roofing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence