Key Insights

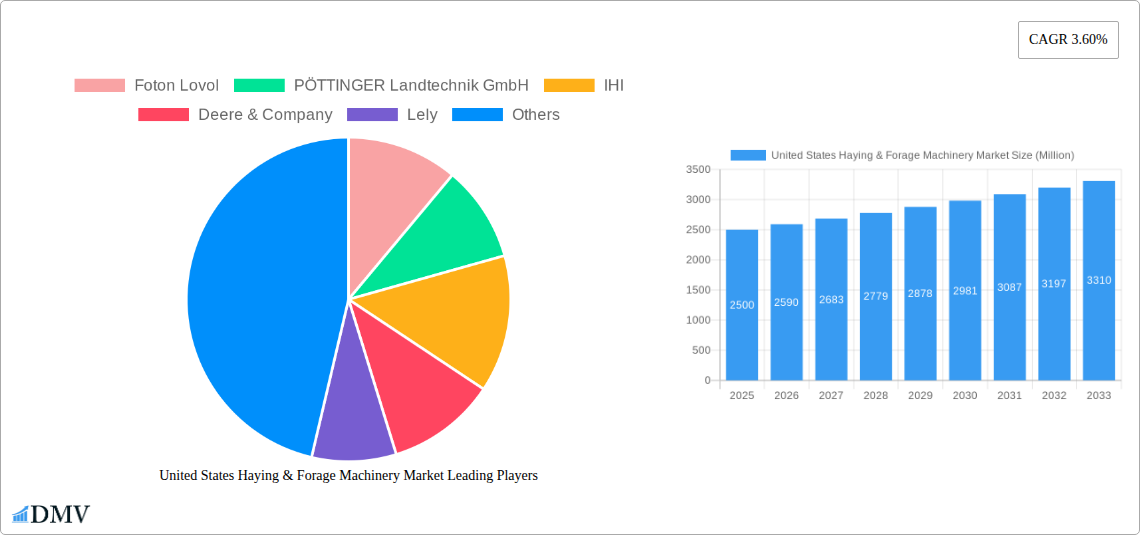

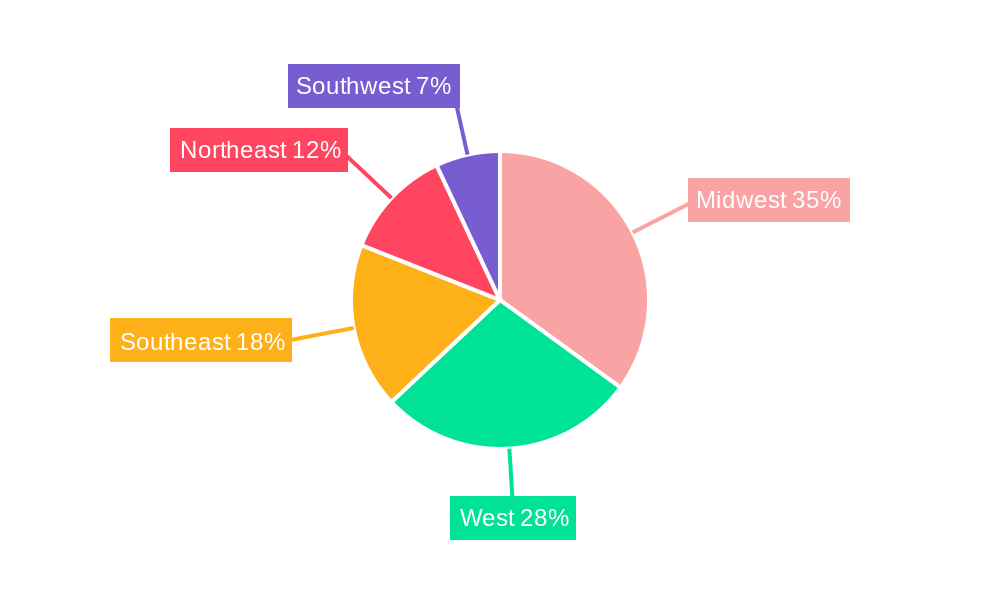

The United States Haying & Forage Machinery market, valued at approximately $2.5 billion in 2025, is projected to experience steady growth, driven by several key factors. Increasing demand for livestock feed, coupled with the expanding dairy and beef industries, fuels the need for efficient hay and forage harvesting equipment. Technological advancements in machinery, such as automated balers and improved forage harvesters with higher throughput, are enhancing productivity and reducing labor costs, further stimulating market expansion. Government initiatives promoting sustainable agriculture practices and precision farming also contribute to the market's positive trajectory. The market is segmented by equipment type, with mowers, balers, and forage harvesters holding significant market shares. Major players like Deere & Company, AGCO Corporation, and Kubota are driving innovation and competition, offering a diverse range of products to cater to the varying needs of farms of different sizes. Regional variations exist, with the Midwest and West likely holding larger market shares due to extensive agricultural lands and established farming practices. However, constraints such as fluctuating hay prices, increasing input costs, and the impact of adverse weather conditions on crop yields can potentially moderate market growth in the coming years.

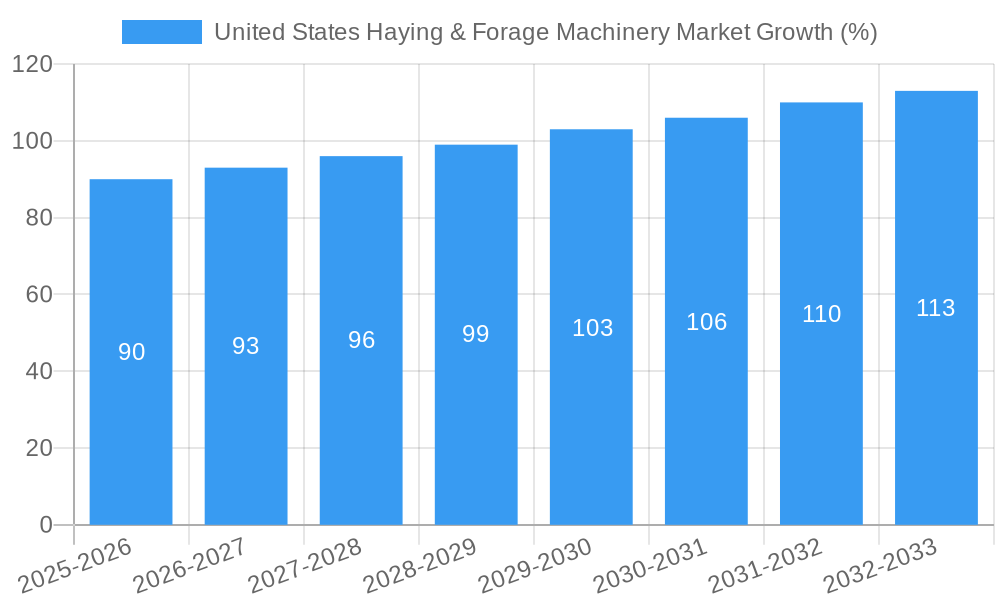

The forecast period (2025-2033) anticipates a continued, albeit moderate, expansion, with the CAGR of 3.6% suggesting a consistent demand for these specialized agricultural machines. The market will likely witness heightened competition as manufacturers strive to offer more fuel-efficient, technologically advanced equipment and comprehensive after-sales services. This competitive landscape will benefit farmers, providing them with greater choice and potentially driving down prices, while simultaneously promoting efficiency and sustainability within the US agricultural sector. The regional breakdown suggests significant opportunities across the United States, though variations in agricultural practices and market maturity could influence regional growth rates. The market is expected to exceed $3.5 billion by 2033.

United States Haying & Forage Machinery Market: A Comprehensive Report (2019-2033)

This insightful report delivers a comprehensive analysis of the United States Haying & Forage Machinery market, offering a detailed examination of market trends, leading players, and future growth prospects. Spanning the period from 2019 to 2033, with a base year of 2025, this study provides crucial insights for stakeholders seeking to understand and capitalize on this dynamic sector. The market is segmented by type (Mowers, Balers, Forage Harvesters, and Others), providing granular data for informed decision-making. The total market value is estimated at XX Million in 2025 and is projected to reach XX Million by 2033.

United States Haying & Forage Machinery Market Market Composition & Trends

This section meticulously analyzes the competitive landscape of the U.S. Haying & Forage Machinery market. We evaluate market concentration, revealing the market share distribution among key players like Deere & Company, CLAAS KGaA mbH, and Kubota. The report delves into the innovation drivers shaping the market, including advancements in automation, precision agriculture technologies, and sustainable practices. Regulatory influences, including environmental regulations and safety standards, are also thoroughly assessed. The impact of substitute products and their potential market share erosion is discussed, along with an examination of end-user profiles (farmers, cooperatives, etc.). Finally, the report investigates mergers and acquisitions (M&A) activities within the sector, analyzing deal values and their influence on market consolidation. Key metrics, such as the average M&A deal value over the historical period (2019-2024), are provided.

- Market Concentration: High/Medium/Low (Specify based on data)

- Top 5 Players Market Share: XX% (Deere & Company), XX% (CLAAS), XX% (Kubota), XX% (AGCO), XX% (Others)

- Average M&A Deal Value (2019-2024): XX Million

- Number of M&A Deals (2019-2024): XX

United States Haying & Forage Machinery Market Industry Evolution

This section provides a detailed historical and projected analysis of the U.S. Haying & Forage Machinery market, charting its growth trajectory from 2019 to 2033. We examine the influence of technological advancements, including the integration of GPS, sensors, and AI, on market growth rates and adoption patterns. The evolving demands of farmers, driven by factors like labor shortages, efficiency needs, and sustainability concerns, are comprehensively explored. Data points such as compound annual growth rate (CAGR) for various segments and the adoption rate of new technologies are presented to illustrate market evolution. The impact of changing agricultural practices and government policies on market dynamics are also examined, helping to paint a clear picture of the industry’s trajectory.

Leading Regions, Countries, or Segments in United States Haying & Forage Machinery Market

This section identifies the leading regions, states, or market segments within the U.S. Haying & Forage Machinery market. We analyze the dominance factors of the leading segment (e.g., Mowers, Balers, Forage Harvesters, Others), providing in-depth analysis of its market share and growth drivers.

- Dominant Segment: [Insert Dominant Segment: e.g., Mowers]

- Key Drivers for Dominance:

- High demand due to: [Explain reasons - e.g., increased acreage under cultivation, technological advancements making mowing more efficient]

- Investment trends: [Explain trends - e.g., increased investments in efficient machinery by large-scale farms]

- Regulatory support: [Explain support - e.g., government subsidies for adopting advanced mowing technology]

United States Haying & Forage Machinery Market Product Innovations

This section highlights the latest product innovations in the U.S. Haying & Forage Machinery market. We detail the features, applications, and performance metrics of innovative products, emphasizing their unique selling propositions and technological advancements. This includes advancements in automation, precision farming technologies, and sustainable features aimed at improving efficiency, reducing environmental impact, and enhancing operational ease for farmers. Examples include autonomous balers, precision-guided mowing systems, and forage harvesters with improved crop handling capabilities.

Propelling Factors for United States Haying & Forage Machinery Market Growth

Several factors contribute to the growth of the U.S. Haying & Forage Machinery market. Technological advancements, such as the development of more efficient and precise machines, are a primary driver. Economic factors, including increased demand for hay and forage due to population growth and livestock production, also play a significant role. Furthermore, government policies that support agricultural modernization and sustainability contribute to market expansion.

Obstacles in the United States Haying & Forage Machinery Market Market

Despite its growth potential, the U.S. Haying & Forage Machinery market faces certain challenges. These include regulatory hurdles concerning emissions and safety, supply chain disruptions impacting component availability, and intense competition from both domestic and international manufacturers. These obstacles can impact profitability and market expansion. For example, xx% increase in material cost has led to increased machine prices, impacting purchasing decisions.

Future Opportunities in United States Haying & Forage Machinery Market

Future opportunities in the U.S. Haying & Forage Machinery market include the adoption of precision agriculture technologies, the development of more sustainable machinery, and the expansion into new markets, such as organic farming. Increased automation and the use of data analytics to optimize farm operations represent significant growth avenues.

Major Players in the United States Haying & Forage Machinery Market Ecosystem

- Foton Lovol

- PÖTTINGER Landtechnik GmbH

- IHI

- Deere & Company

- Lely

- CLAAS KGaA mbH

- Vermee

- Kverneland Group

- CNH Industrial

- Krone North America Inc

- KUHN Group

- AGCO Corporation

- Kubota

Key Developments in United States Haying & Forage Machinery Market Industry

- 2023-06: Deere & Company launched a new self-propelled forage harvester with improved efficiency.

- 2022-11: CLAAS KGaA mbH and a smaller competitor merged, creating a larger market player. (Add further developments with dates and brief descriptions of their market impact).

Strategic United States Haying & Forage Machinery Market Market Forecast

The U.S. Haying & Forage Machinery market is poised for significant growth over the forecast period (2025-2033). Technological advancements, increasing demand driven by rising livestock populations, and supportive government policies will be key drivers. The continued adoption of precision agriculture and sustainable farming practices will create lucrative opportunities for market participants. The market is expected to witness substantial expansion, with specific growth segments outlined in detail within the full report.

United States Haying & Forage Machinery Market Segmentation

-

1. Type

- 1.1. Mowers

- 1.2. Balers

- 1.3. Forage Harvesters

- 1.4. Others

-

2. Type

- 2.1. Mowers

- 2.2. Balers

- 2.3. Forage Harvesters

- 2.4. Others

United States Haying & Forage Machinery Market Segmentation By Geography

- 1. United States

United States Haying & Forage Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Increase in Forage Cultivation Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Haying & Forage Machinery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mowers

- 5.1.2. Balers

- 5.1.3. Forage Harvesters

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Mowers

- 5.2.2. Balers

- 5.2.3. Forage Harvesters

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Northeast United States Haying & Forage Machinery Market Analysis, Insights and Forecast, 2019-2031

- 7. Southeast United States Haying & Forage Machinery Market Analysis, Insights and Forecast, 2019-2031

- 8. Midwest United States Haying & Forage Machinery Market Analysis, Insights and Forecast, 2019-2031

- 9. Southwest United States Haying & Forage Machinery Market Analysis, Insights and Forecast, 2019-2031

- 10. West United States Haying & Forage Machinery Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Foton Lovol

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PÖTTINGER Landtechnik GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IHI

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Deere & Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lely

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CLAAS KGaA mbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vermee

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kverneland Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CNH Industrial

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Krone North America Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 KUHN Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 AGCO Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Kubota

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Foton Lovol

List of Figures

- Figure 1: United States Haying & Forage Machinery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Haying & Forage Machinery Market Share (%) by Company 2024

List of Tables

- Table 1: United States Haying & Forage Machinery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Haying & Forage Machinery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United States Haying & Forage Machinery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: United States Haying & Forage Machinery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Haying & Forage Machinery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Northeast United States Haying & Forage Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Southeast United States Haying & Forage Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Midwest United States Haying & Forage Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southwest United States Haying & Forage Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West United States Haying & Forage Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States Haying & Forage Machinery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: United States Haying & Forage Machinery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: United States Haying & Forage Machinery Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Haying & Forage Machinery Market?

The projected CAGR is approximately 3.60%.

2. Which companies are prominent players in the United States Haying & Forage Machinery Market?

Key companies in the market include Foton Lovol, PÖTTINGER Landtechnik GmbH, IHI, Deere & Company, Lely, CLAAS KGaA mbH, Vermee, Kverneland Group, CNH Industrial, Krone North America Inc, KUHN Group, AGCO Corporation, Kubota.

3. What are the main segments of the United States Haying & Forage Machinery Market?

The market segments include Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Increase in Forage Cultivation Drives the Market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Haying & Forage Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Haying & Forage Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Haying & Forage Machinery Market?

To stay informed about further developments, trends, and reports in the United States Haying & Forage Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence