Key Insights

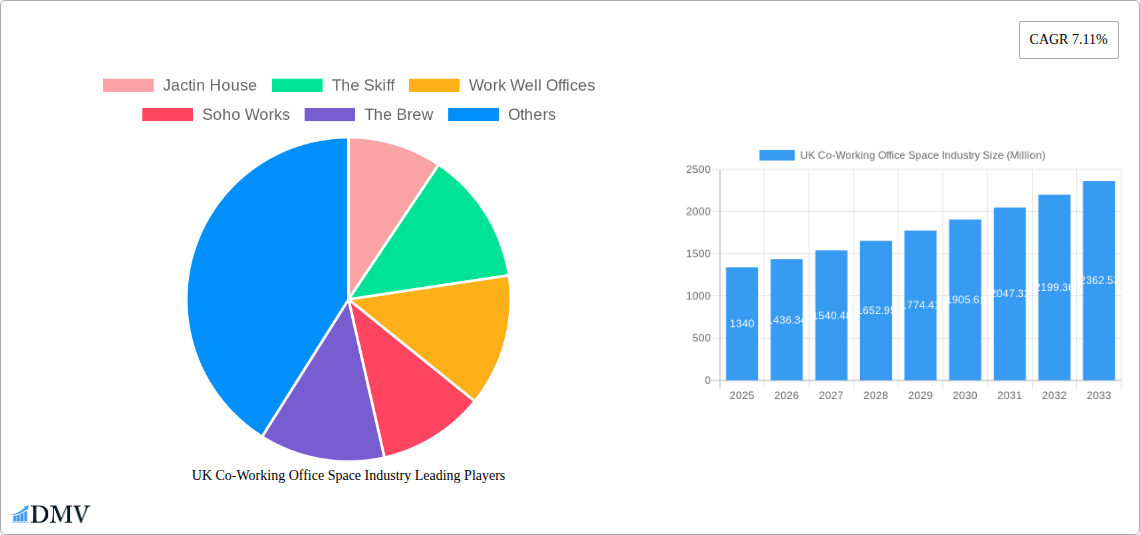

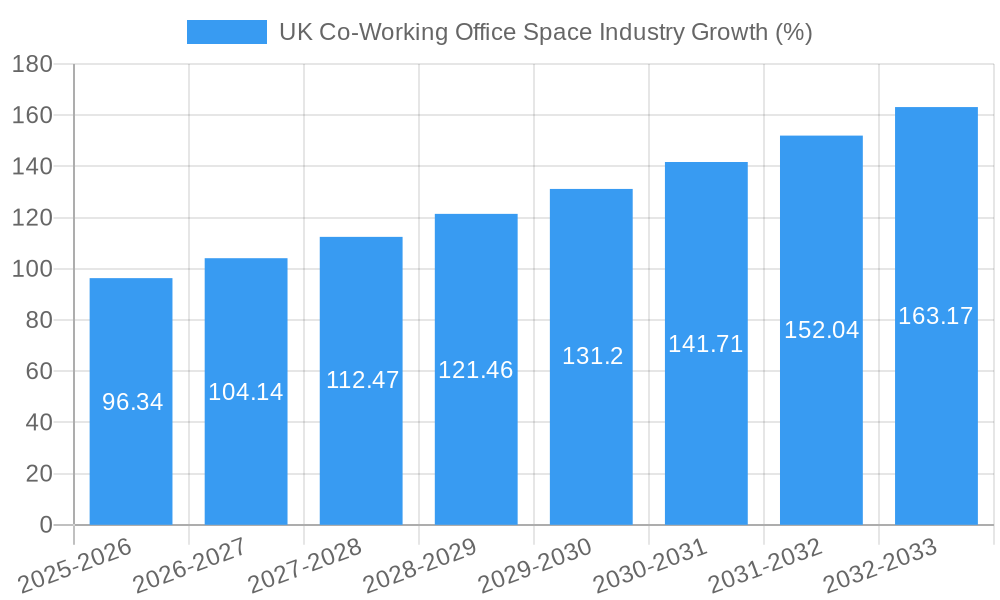

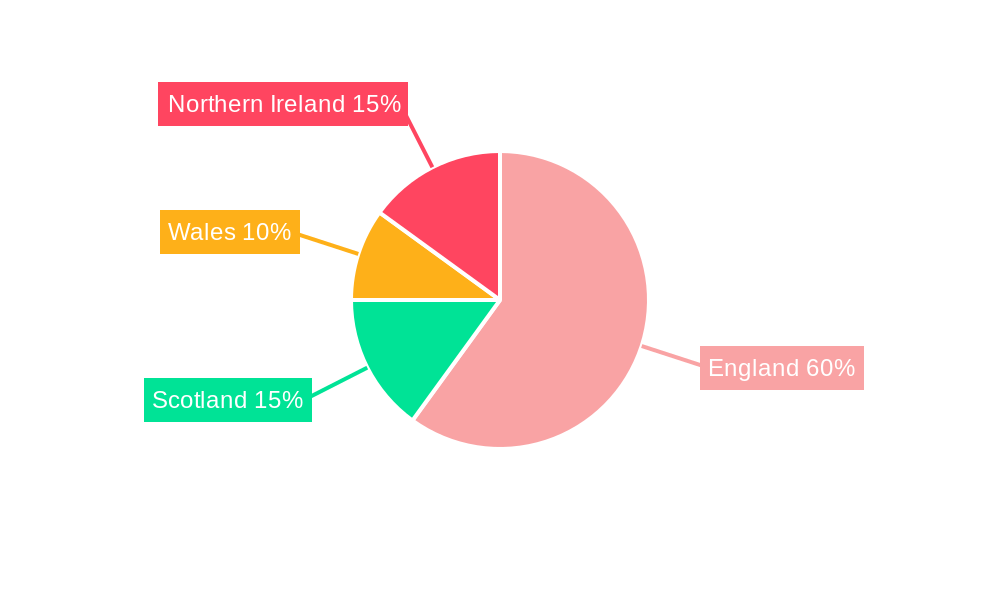

The UK co-working office space industry is experiencing robust growth, driven by a burgeoning freelance workforce, the increasing popularity of flexible work arrangements, and the demand for collaborative work environments among small and large businesses. The market, valued at £1.34 billion in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) of 7.11% from 2025 to 2033, indicating a substantial expansion in the coming years. Several key factors contribute to this positive outlook. The rise of remote work and the gig economy fuels the demand for flexible, cost-effective office spaces, while established companies are increasingly adopting co-working to enhance employee satisfaction and foster innovation through collaboration. Furthermore, the availability of various amenities and services within co-working spaces, such as high-speed internet, meeting rooms, and networking opportunities, add significant value propositions for businesses of all sizes. However, challenges such as fluctuating property prices, competition from traditional office spaces, and the potential impact of economic downturns could moderate growth. The market is segmented by end-user, encompassing personal users, small-scale companies, large-scale companies, and other end-users, reflecting the diverse clientele drawn to this model. Key players, including Regus, The Office Group, and IWG, along with numerous smaller, independent co-working spaces, compete to capture market share across regions such as England, Wales, Scotland, and Northern Ireland.

The geographical distribution of co-working spaces is largely concentrated in major urban centers, reflecting the highest demand in areas with strong economic activity and a significant concentration of businesses and professionals. Competition is fierce, with both established international players and smaller, locally focused providers vying for customers. The success of individual operators hinges on their ability to offer unique value propositions, such as specialized amenities, networking events, or a strong community focus. The long-term forecast suggests sustained growth, but operators must remain adaptable to evolving market needs, including the incorporation of sustainable practices and technological advancements to maintain their competitive edge. Further segmentation by location, service offerings, and pricing models is expected to become increasingly important in the future.

UK Co-Working Office Space Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the UK co-working office space industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report utilizes a combination of historical data (2019-2024) and forward-looking projections to deliver a complete understanding of market trends, opportunities, and challenges. The UK co-working market, valued at £XX Million in 2024, is projected to reach £XX Million by 2033, exhibiting significant growth potential.

UK Co-Working Office Space Industry Market Composition & Trends

This section delves into the competitive landscape of the UK co-working market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute offerings, and end-user profiles. The report also examines mergers and acquisitions (M&A) activity, providing a comprehensive overview of market dynamics.

Market Concentration: The UK co-working market exhibits a moderately concentrated structure, with key players like The Office Group, Regus, and IWG (IWG plc) holding significant market share. However, numerous smaller operators contribute to a vibrant and competitive landscape. The report quantifies market share distribution among major players and assesses the level of competition. Estimated market concentration ratio (CRx) for the top 5 players in 2025 is xx%.

Innovation Catalysts: Technological advancements, such as smart building technologies and flexible booking platforms, are driving innovation within the industry. The increasing demand for flexible workspaces and the adoption of hybrid work models are pushing the industry towards more innovative solutions in terms of space design, technology integration and service offerings.

Regulatory Landscape: Planning regulations and building codes significantly impact the development and expansion of co-working spaces. The report analyzes the regulatory environment and its influence on market growth.

Substitute Products: Traditional office leasing and remote work arrangements represent the primary substitutes for co-working spaces. The report analyzes the competitive pressure from these substitutes and assesses their impact on market share.

End-User Profiles: The market caters to diverse end-users, including personal users, small-scale companies, large-scale companies, and other end-users. The report provides a detailed breakdown of each segment's size and growth prospects.

M&A Activity: The report analyzes recent M&A activity in the UK co-working market, including deal values and their impact on market consolidation. Examples include the acquisition of WeWork spaces (detailed further below) and other significant transactions. Total M&A deal value for 2024 is estimated at £XX Million.

UK Co-Working Office Space Industry Industry Evolution

This section traces the evolution of the UK co-working industry, analyzing market growth trajectories, technological advancements, and evolving consumer preferences. It explores the factors shaping industry dynamics, including the impact of the pandemic and the rise of hybrid work models. Data points such as compound annual growth rate (CAGR) and adoption rates for various technologies are included.

The UK co-working office space market has witnessed significant growth over the past decade driven by several key factors. Technological advancements such as cloud computing, high-speed internet, and video conferencing have enabled remote working. This, in turn, fuelled demand for flexible workspaces that cater to businesses’ varied needs. The rise of freelance and gig economies has also contributed to the increasing popularity of co-working spaces. The sector has further evolved with more sophisticated and technologically-integrated co-working spaces offering a range of amenities and services beyond just desk space.

The Covid-19 pandemic and the subsequent rise of hybrid work models have brought a unique inflection point in the industry. Businesses recognized the potential for flexibility and cost optimization which led to a further increase in the demand for co-working spaces. The demand for advanced health and safety measures also influenced developments and adaptations within co-working facilities.

The report assesses that the market CAGR during the historical period (2019-2024) was approximately xx%. The adoption rate of flexible workspace solutions among SME's is currently estimated at xx%, and this is projected to grow to xx% by 2033.

Leading Regions, Countries, or Segments in UK Co-Working Office Space Industry

This section identifies the dominant regions, countries, or segments within the UK co-working market, focusing on end-user segmentation. London is likely to remain the dominant region due to its concentration of businesses and skilled workforce.

Dominant Segment: Large-scale companies are expected to be the dominant segment due to their increasing adoption of hybrid work models and the need for flexible office solutions.

Key Drivers:

- Investment Trends: Significant capital investment in co-working space development in major cities.

- Regulatory Support: Government initiatives promoting flexible work arrangements and supporting the growth of the sector.

- Demand for Flexibility: The growing preference among large corporations for agile work models and the need for scalable office solutions.

- Amenities and Services: High quality amenities and services offered in co-working spaces which are highly valued by employees and boost recruitment.

The dominance of large-scale companies in this segment can be attributed to their need for flexible office spaces to accommodate fluctuating employee numbers, manage costs effectively, and boost employee morale and productivity.

UK Co-Working Office Space Industry Product Innovations

The co-working industry is constantly evolving, marked by innovative offerings that enhance the user experience. Recent innovations include specialized spaces for specific industries, improved technology integration (e.g., booking systems, meeting room technology), enhanced community-building initiatives, and sustainable design practices. These innovations cater to specific user preferences and aim to increase efficiency, collaboration, and overall satisfaction.

Propelling Factors for UK Co-Working Office Space Industry Growth

Several factors drive the growth of the UK co-working industry: the increasing adoption of hybrid work models, the rise of the gig economy, technological advancements making remote work more efficient, and government support for flexible work arrangements. These factors combine to create a strong demand for flexible and adaptable office spaces. The cost-effectiveness of co-working spaces compared to traditional office leases also contributes significantly to growth.

Obstacles in the UK Co-Working Office Space Industry Market

The UK co-working office space market faces challenges such as intense competition, rising operating costs (including rent and utilities), and the potential for economic downturns to reduce demand. Furthermore, securing suitable locations with appropriate infrastructure presents another hurdle. The overall impact of these obstacles may lead to decreased profitability for some operators.

Future Opportunities in UK Co-Working Office Space Industry

Future opportunities lie in expanding into underserved regions, offering specialized co-working spaces tailored to specific industries, integrating advanced technologies (e.g., AI-powered solutions), and focusing on sustainability initiatives. The incorporation of wellness features and community-building activities is also expected to contribute to market growth.

Major Players in the UK Co-Working Office Space Industry Ecosystem

- Jactin House

- The Skiff

- Work Well Offices

- Soho Works

- The Brew

- Wimbletech CIC

- The Hoxton

- Mare Street Market

- Southbank Centre

- The Office Group

- Regus

- Huckle Tree

- Creative Works

- Labs

- Foyles

- Icon Offices

Key Developments in UK Co-Working Office Space Industry Industry

May 2023: Amazon leased 70,000 sq. ft. of WeWork office space in London, signifying a large corporate commitment to flexible workspaces.

July 2023: WeWork's franchise partnership with Garnier & Garnier in Costa Rica expands its global reach and highlights the growing international demand for flexible workspaces. This expansion, while outside the UK, reflects industry trends impacting the UK market.

Strategic UK Co-Working Office Space Industry Market Forecast

The UK co-working office space market is poised for continued growth, driven by ongoing technological advancements, evolving work preferences, and increasing demand for flexible workspaces. The forecast suggests substantial market expansion, with opportunities for innovation and consolidation among existing and emerging players. Further growth will depend on economic conditions and the continued adoption of hybrid work models.

UK Co-Working Office Space Industry Segmentation

-

1. End User

- 1.1. Personal User

- 1.2. Small Scale Company

- 1.3. Large Scale Company

- 1.4. Other End Users

-

2. Geography

- 2.1. London

- 2.2. Manchester

- 2.3. Birmingham

- 2.4. Leeds

- 2.5. Other UK Cities

-

3. Type

- 3.1. Flexible Managed Office

- 3.2. Serviced Office

-

4. Application

- 4.1. Information Technology (IT and ITES)

- 4.2. Legal Services

- 4.3. BFSI (Banking, Financial Services, and Insurance)

- 4.4. Consulting

- 4.5. Other Applications

UK Co-Working Office Space Industry Segmentation By Geography

- 1. London

- 2. Manchester

- 3. Birmingham

- 4. Leeds

- 5. Other UK Cities

UK Co-Working Office Space Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Shift Toward Co-working Spaces is Driving the Market4.; Increasing Focus on Sustainability is Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Economic Uncertainty is Affecting the Market

- 3.4. Market Trends

- 3.4.1. The Demand for Landlord-Fitted Office Space Surges Amid Rising Costs and Shrinking Availability

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. UK Co-Working Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Personal User

- 5.1.2. Small Scale Company

- 5.1.3. Large Scale Company

- 5.1.4. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. London

- 5.2.2. Manchester

- 5.2.3. Birmingham

- 5.2.4. Leeds

- 5.2.5. Other UK Cities

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Flexible Managed Office

- 5.3.2. Serviced Office

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Information Technology (IT and ITES)

- 5.4.2. Legal Services

- 5.4.3. BFSI (Banking, Financial Services, and Insurance)

- 5.4.4. Consulting

- 5.4.5. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. London

- 5.5.2. Manchester

- 5.5.3. Birmingham

- 5.5.4. Leeds

- 5.5.5. Other UK Cities

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. London UK Co-Working Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Personal User

- 6.1.2. Small Scale Company

- 6.1.3. Large Scale Company

- 6.1.4. Other End Users

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. London

- 6.2.2. Manchester

- 6.2.3. Birmingham

- 6.2.4. Leeds

- 6.2.5. Other UK Cities

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Flexible Managed Office

- 6.3.2. Serviced Office

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Information Technology (IT and ITES)

- 6.4.2. Legal Services

- 6.4.3. BFSI (Banking, Financial Services, and Insurance)

- 6.4.4. Consulting

- 6.4.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Manchester UK Co-Working Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Personal User

- 7.1.2. Small Scale Company

- 7.1.3. Large Scale Company

- 7.1.4. Other End Users

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. London

- 7.2.2. Manchester

- 7.2.3. Birmingham

- 7.2.4. Leeds

- 7.2.5. Other UK Cities

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Flexible Managed Office

- 7.3.2. Serviced Office

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Information Technology (IT and ITES)

- 7.4.2. Legal Services

- 7.4.3. BFSI (Banking, Financial Services, and Insurance)

- 7.4.4. Consulting

- 7.4.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Birmingham UK Co-Working Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Personal User

- 8.1.2. Small Scale Company

- 8.1.3. Large Scale Company

- 8.1.4. Other End Users

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. London

- 8.2.2. Manchester

- 8.2.3. Birmingham

- 8.2.4. Leeds

- 8.2.5. Other UK Cities

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Flexible Managed Office

- 8.3.2. Serviced Office

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Information Technology (IT and ITES)

- 8.4.2. Legal Services

- 8.4.3. BFSI (Banking, Financial Services, and Insurance)

- 8.4.4. Consulting

- 8.4.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Leeds UK Co-Working Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Personal User

- 9.1.2. Small Scale Company

- 9.1.3. Large Scale Company

- 9.1.4. Other End Users

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. London

- 9.2.2. Manchester

- 9.2.3. Birmingham

- 9.2.4. Leeds

- 9.2.5. Other UK Cities

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Flexible Managed Office

- 9.3.2. Serviced Office

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Information Technology (IT and ITES)

- 9.4.2. Legal Services

- 9.4.3. BFSI (Banking, Financial Services, and Insurance)

- 9.4.4. Consulting

- 9.4.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Other UK Cities UK Co-Working Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Personal User

- 10.1.2. Small Scale Company

- 10.1.3. Large Scale Company

- 10.1.4. Other End Users

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. London

- 10.2.2. Manchester

- 10.2.3. Birmingham

- 10.2.4. Leeds

- 10.2.5. Other UK Cities

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Flexible Managed Office

- 10.3.2. Serviced Office

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Information Technology (IT and ITES)

- 10.4.2. Legal Services

- 10.4.3. BFSI (Banking, Financial Services, and Insurance)

- 10.4.4. Consulting

- 10.4.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. England UK Co-Working Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Co-Working Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Co-Working Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Co-Working Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Co-Working Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Jactin House

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 The Skiff

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Work Well Offices

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Soho Works

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 The Brew

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Wimbletech CIC

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 The Hoxton

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Mare Street Market

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Southbank Centre**List Not Exhaustive 6 3 Other Companie

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 The Office Group

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Regus

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Huckle Tree

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Creative Works

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Labs

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Foyles

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Icon Offices

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.1 Jactin House

List of Figures

- Figure 1: UK Co-Working Office Space Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: UK Co-Working Office Space Industry Share (%) by Company 2024

List of Tables

- Table 1: UK Co-Working Office Space Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: UK Co-Working Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 3: UK Co-Working Office Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: UK Co-Working Office Space Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 5: UK Co-Working Office Space Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: UK Co-Working Office Space Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: UK Co-Working Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: England UK Co-Working Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Wales UK Co-Working Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Scotland UK Co-Working Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Northern UK Co-Working Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Ireland UK Co-Working Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: UK Co-Working Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 14: UK Co-Working Office Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: UK Co-Working Office Space Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 16: UK Co-Working Office Space Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: UK Co-Working Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: UK Co-Working Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 19: UK Co-Working Office Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: UK Co-Working Office Space Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 21: UK Co-Working Office Space Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 22: UK Co-Working Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: UK Co-Working Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 24: UK Co-Working Office Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: UK Co-Working Office Space Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 26: UK Co-Working Office Space Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 27: UK Co-Working Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: UK Co-Working Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 29: UK Co-Working Office Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: UK Co-Working Office Space Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 31: UK Co-Working Office Space Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 32: UK Co-Working Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: UK Co-Working Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 34: UK Co-Working Office Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 35: UK Co-Working Office Space Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: UK Co-Working Office Space Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 37: UK Co-Working Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Co-Working Office Space Industry?

The projected CAGR is approximately 7.11%.

2. Which companies are prominent players in the UK Co-Working Office Space Industry?

Key companies in the market include Jactin House, The Skiff, Work Well Offices, Soho Works, The Brew, Wimbletech CIC, The Hoxton, Mare Street Market, Southbank Centre**List Not Exhaustive 6 3 Other Companie, The Office Group, Regus, Huckle Tree, Creative Works, Labs, Foyles, Icon Offices.

3. What are the main segments of the UK Co-Working Office Space Industry?

The market segments include End User, Geography, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.34 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Shift Toward Co-working Spaces is Driving the Market4.; Increasing Focus on Sustainability is Driving the Market.

6. What are the notable trends driving market growth?

The Demand for Landlord-Fitted Office Space Surges Amid Rising Costs and Shrinking Availability.

7. Are there any restraints impacting market growth?

4.; Economic Uncertainty is Affecting the Market.

8. Can you provide examples of recent developments in the market?

May 2023: Amazon took over WeWork Cos.' 70,000 sq. ft office space in London. The tech giant will take over WeWork's refurbished Moore Place office building, which is estimated to house around 1,000 employees.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Co-Working Office Space Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Co-Working Office Space Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Co-Working Office Space Industry?

To stay informed about further developments, trends, and reports in the UK Co-Working Office Space Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence