Key Insights

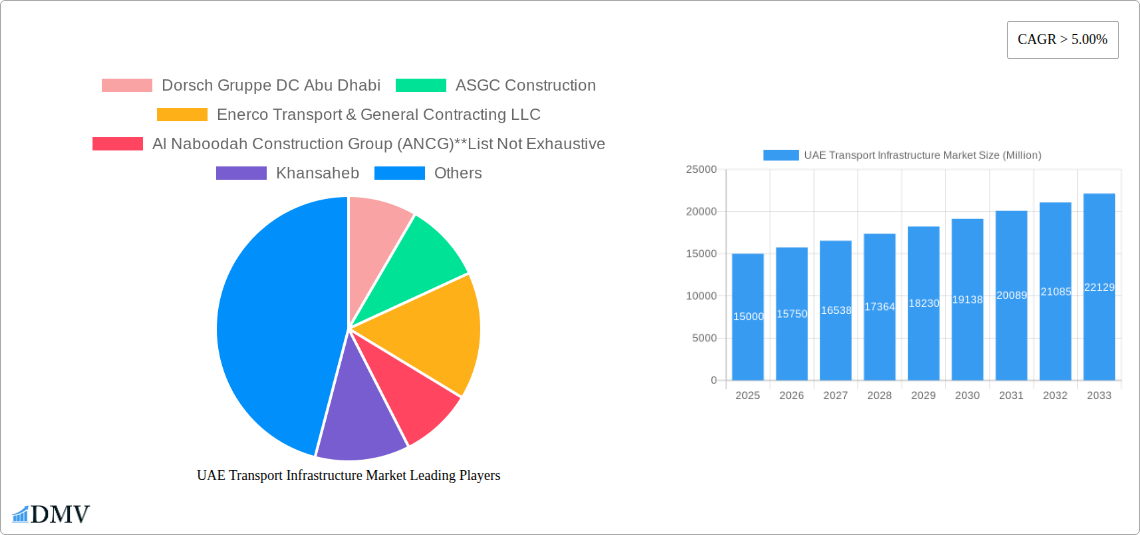

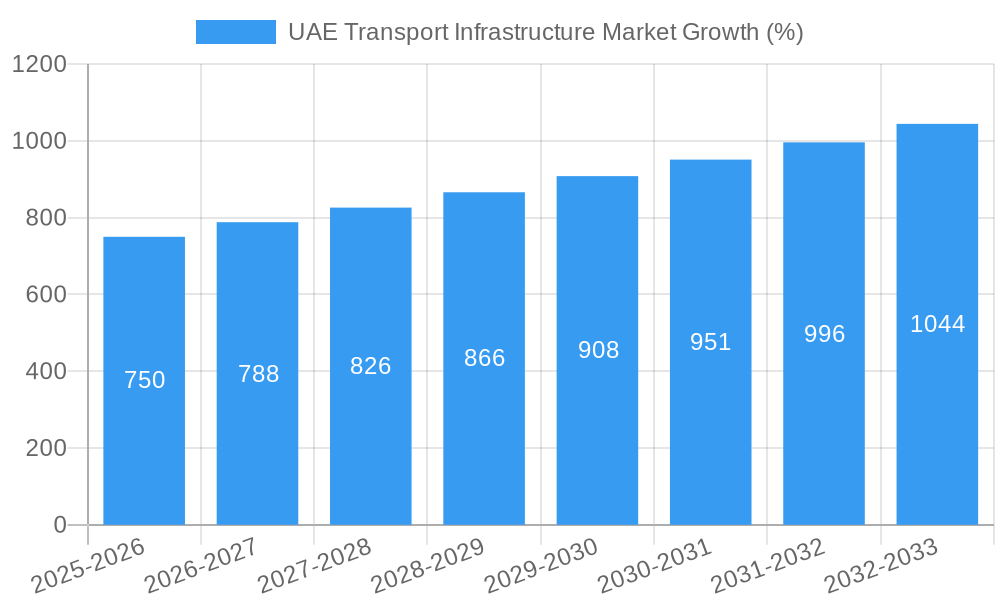

The UAE Transport Infrastructure market is experiencing robust growth, fueled by substantial government investments in expanding and modernizing its transportation networks. With a Compound Annual Growth Rate (CAGR) exceeding 5% between 2019 and 2033, the market is projected to reach significant value by 2033. This expansion is driven by several key factors: the UAE's commitment to hosting major global events, the need to support a rapidly growing population and tourism sector, and a strategic focus on sustainable and efficient transportation solutions. Key segments like railways, roadways, and airports are witnessing significant development, with projects focused on high-speed rail connections, improved road infrastructure, and the expansion of existing airports to handle increased passenger and cargo traffic. The growing adoption of smart city initiatives also contributes to market growth, driving demand for technologically advanced transportation systems and intelligent traffic management solutions. Leading players such as Dorsch Gruppe DC Abu Dhabi, ASGC Construction, and Al Naboodah Construction Group are actively involved in shaping the landscape of the UAE's transport infrastructure, contributing to the nation's ambitious development plans.

While the market faces challenges like fluctuating oil prices and potential labor shortages, these are likely to be offset by the continued government commitment to long-term infrastructural development. The competitive landscape is characterized by both international and local companies vying for major contracts, fostering innovation and efficient project delivery. Waterways, while a smaller segment, are also experiencing growth, driven by investments in port infrastructure and maritime trade. The UAE’s focus on diversification beyond oil, its strategic location, and commitment to becoming a global transportation hub further solidify the positive outlook for the transport infrastructure market in the years to come. The market’s trajectory indicates a sustained period of growth, presenting lucrative opportunities for investors and stakeholders.

UAE Transport Infrastructure Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the UAE transport infrastructure market, encompassing market trends, industry evolution, leading segments, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the dynamic opportunities within this thriving sector. The report incorporates detailed analysis of recent key developments and provides a robust forecast outlining the market's potential for significant expansion. The total market value is predicted to reach XXX Million by 2033.

UAE Transport Infrastructure Market Composition & Trends

This section delves into the competitive landscape of the UAE transport infrastructure market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with several large players holding significant market share. However, smaller specialized firms also play a vital role, particularly in niche segments.

- Market Share Distribution: The top 5 players account for approximately xx% of the total market share in 2024, with a projected xx% by 2033.

- Innovation Catalysts: Government initiatives promoting sustainable transport, technological advancements in smart infrastructure, and the increasing demand for efficient logistics solutions are key innovation drivers.

- Regulatory Landscape: The UAE's robust regulatory framework, focused on safety and sustainability standards, influences market operations and investments.

- Substitute Products: Limited substitute products exist, given the essential nature of transport infrastructure.

- End-User Profiles: Key end-users include government entities (e.g., RTA), private developers, and logistics companies.

- M&A Activities: M&A activity is moderate, driven by the need for consolidation and expansion in specialized areas. The total value of M&A deals within the sector in 2024 was estimated at xx Million, predicted to increase to xx Million by 2033.

UAE Transport Infrastructure Market Industry Evolution

The UAE's transport infrastructure market has experienced significant growth throughout the historical period (2019-2024), fueled by substantial government investments and a rapidly expanding economy. Technological advancements, including the adoption of smart city technologies and digitalization of transport systems, have significantly improved efficiency and connectivity. This section analyses the market's growth trajectory and the factors influencing its evolution, including shifting consumer demands toward sustainable and integrated transport solutions. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 was approximately xx%, with a projected CAGR of xx% from 2025 to 2033. Increased adoption of smart technologies within the sector is projected to contribute xx% to this growth. The rising preference for sustainable transport options is estimated to add another xx% to market expansion.

Leading Regions, Countries, or Segments in UAE Transport Infrastructure Market

This section analyzes the dominant segments within the UAE transport infrastructure market, focusing on: Railways, Roadways, Airports, and Waterways.

Roadways: Roadways currently dominate the market, driven by robust government investment in road expansion and improvement projects, such as the recently completed Dubai-Al Ain Road Improvement Project. The extensive road network facilitates the movement of goods and passengers throughout the UAE. The high vehicle ownership rates and the need for efficient transportation between emirates contribute significantly to this segment's dominance.

Railways: The railway segment is rapidly expanding, especially following the completion of the Etihad Rail link between Dubai and Abu Dhabi in March 2022. This USD 13.61 Billion project significantly enhances national connectivity and is a major catalyst for future growth in this sector. Government initiatives to expand the national rail network further contribute to the sector's rapid growth.

Airports: The UAE boasts world-class airports like Dubai International Airport and Abu Dhabi International Airport, significantly contributing to the country's tourism and trade. Continued investment in airport infrastructure, expansion projects, and technological upgrades support this segment's strong performance.

Waterways: Although a smaller segment, waterways contribute to the overall transport infrastructure. Investments in port modernization and development of maritime infrastructure contribute to the consistent but slower growth of this segment.

UAE Transport Infrastructure Market Product Innovations

Recent innovations focus on enhancing efficiency, sustainability, and safety. Smart traffic management systems, advanced materials in road construction, and the integration of renewable energy sources in transport infrastructure are key examples. These innovations aim to improve overall transportation systems and reduce environmental impact. The implementation of autonomous vehicles and drone delivery systems are also emerging areas of significant innovation within the sector, although still in their early stages of adoption.

Propelling Factors for UAE Transport Infrastructure Market Growth

Several factors drive the growth of the UAE transport infrastructure market. Government investments in mega-projects such as the Etihad Rail network and continuous upgrades of road networks are key contributors. Furthermore, the country's focus on sustainable development, technological advancements in smart city infrastructure, and the rising demand for efficient logistics solutions are critical drivers. The nation's strategic geographical location also contributes to increased demand for transport infrastructure to support international trade.

Obstacles in the UAE Transport Infrastructure Market

Challenges include securing skilled labor, managing the complex regulatory landscape, and mitigating supply chain disruptions that impact construction timelines and costs. Competition among various firms also plays a role, especially in high-demand segments. The volatile nature of global commodity prices can impact project budgets and profitability.

Future Opportunities in UAE Transport Infrastructure Market

Emerging opportunities lie in the expansion of smart city infrastructure, increased adoption of sustainable transport solutions, and the development of integrated transport systems. Investments in high-speed rail networks and advanced airport technologies present significant growth potential. The evolving needs of e-commerce and last-mile delivery will also drive growth within the sector, providing opportunities for innovative logistics solutions.

Major Players in the UAE Transport Infrastructure Market Ecosystem

- Dorsch Gruppe DC Abu Dhabi

- ASGC Construction

- Enerco Transport & General Contracting LLC

- Al Naboodah Construction Group (ANCG)

- Khansaheb

- Al-Futtaim Group

- National Contracting and Transport CO

- Idroesse Infrastructure

- Consolidated Contractors Company

- ALEC Engineering & Contracting LLC

Key Developments in UAE Transport Infrastructure Market Industry

August 2022: Dubai's Roads and Transport Authority (RTA) announced that Al Manama Street's phased improvements were 67% complete. This involved a new 4-lane traffic corridor linking Al Meydan and Al Manama Streets, with a capacity of 8000 vehicles per hour per direction, and slip lanes connecting to the Dubai-Al Ain Road. This signifies significant progress in enhancing road capacity and connectivity.

March 2022: Etihad Rail completed the connection between Dubai and Abu Dhabi, a 256 km direct line involving 29 bridges, 60 crossings, and 137 drainage channels. This USD 13.61 billion project drastically improved inter-emirate connectivity, boosting the efficiency of the national railway network.

Strategic UAE Transport Infrastructure Market Forecast

The UAE transport infrastructure market is poised for continued strong growth, driven by government initiatives, technological advancements, and increased private sector investment. The focus on sustainable development and smart city solutions will shape future infrastructure development, creating substantial opportunities for businesses operating within this sector. The market's potential is substantial, promising further expansion and economic diversification for the UAE.

UAE Transport Infrastructure Market Segmentation

-

1. Transport Mode

- 1.1. Railways

- 1.2. Roadways

- 1.3. Airports

- 1.4. Waterways

UAE Transport Infrastructure Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Transport Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio

- 3.3. Market Restrains

- 3.3.1. Lack of awareness of senior living options; Relatively small size of senior living population

- 3.4. Market Trends

- 3.4.1. Growing Urbanization is Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Transport Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transport Mode

- 5.1.1. Railways

- 5.1.2. Roadways

- 5.1.3. Airports

- 5.1.4. Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Transport Mode

- 6. North America UAE Transport Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Transport Mode

- 6.1.1. Railways

- 6.1.2. Roadways

- 6.1.3. Airports

- 6.1.4. Waterways

- 6.1. Market Analysis, Insights and Forecast - by Transport Mode

- 7. South America UAE Transport Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Transport Mode

- 7.1.1. Railways

- 7.1.2. Roadways

- 7.1.3. Airports

- 7.1.4. Waterways

- 7.1. Market Analysis, Insights and Forecast - by Transport Mode

- 8. Europe UAE Transport Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Transport Mode

- 8.1.1. Railways

- 8.1.2. Roadways

- 8.1.3. Airports

- 8.1.4. Waterways

- 8.1. Market Analysis, Insights and Forecast - by Transport Mode

- 9. Middle East & Africa UAE Transport Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Transport Mode

- 9.1.1. Railways

- 9.1.2. Roadways

- 9.1.3. Airports

- 9.1.4. Waterways

- 9.1. Market Analysis, Insights and Forecast - by Transport Mode

- 10. Asia Pacific UAE Transport Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Transport Mode

- 10.1.1. Railways

- 10.1.2. Roadways

- 10.1.3. Airports

- 10.1.4. Waterways

- 10.1. Market Analysis, Insights and Forecast - by Transport Mode

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dorsch Gruppe DC Abu Dhabi

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ASGC Construction

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Enerco Transport & General Contracting LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Al Naboodah Construction Group (ANCG)**List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Khansaheb

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Al-Futtaim Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 National Contracting and Transport CO

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Idroesse Infrastructure

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Consolidated Contractors Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ALEC Engineering & Contracting LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dorsch Gruppe DC Abu Dhabi

List of Figures

- Figure 1: Global UAE Transport Infrastructure Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: UAE UAE Transport Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 3: UAE UAE Transport Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UAE Transport Infrastructure Market Revenue (Million), by Transport Mode 2024 & 2032

- Figure 5: North America UAE Transport Infrastructure Market Revenue Share (%), by Transport Mode 2024 & 2032

- Figure 6: North America UAE Transport Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America UAE Transport Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America UAE Transport Infrastructure Market Revenue (Million), by Transport Mode 2024 & 2032

- Figure 9: South America UAE Transport Infrastructure Market Revenue Share (%), by Transport Mode 2024 & 2032

- Figure 10: South America UAE Transport Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America UAE Transport Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe UAE Transport Infrastructure Market Revenue (Million), by Transport Mode 2024 & 2032

- Figure 13: Europe UAE Transport Infrastructure Market Revenue Share (%), by Transport Mode 2024 & 2032

- Figure 14: Europe UAE Transport Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe UAE Transport Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa UAE Transport Infrastructure Market Revenue (Million), by Transport Mode 2024 & 2032

- Figure 17: Middle East & Africa UAE Transport Infrastructure Market Revenue Share (%), by Transport Mode 2024 & 2032

- Figure 18: Middle East & Africa UAE Transport Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa UAE Transport Infrastructure Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific UAE Transport Infrastructure Market Revenue (Million), by Transport Mode 2024 & 2032

- Figure 21: Asia Pacific UAE Transport Infrastructure Market Revenue Share (%), by Transport Mode 2024 & 2032

- Figure 22: Asia Pacific UAE Transport Infrastructure Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific UAE Transport Infrastructure Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Transport Mode 2019 & 2032

- Table 3: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Transport Mode 2019 & 2032

- Table 6: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Transport Mode 2019 & 2032

- Table 11: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Transport Mode 2019 & 2032

- Table 16: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Transport Mode 2019 & 2032

- Table 27: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Transport Mode 2019 & 2032

- Table 35: Global UAE Transport Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific UAE Transport Infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Transport Infrastructure Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the UAE Transport Infrastructure Market?

Key companies in the market include Dorsch Gruppe DC Abu Dhabi, ASGC Construction, Enerco Transport & General Contracting LLC, Al Naboodah Construction Group (ANCG)**List Not Exhaustive, Khansaheb, Al-Futtaim Group, National Contracting and Transport CO, Idroesse Infrastructure, Consolidated Contractors Company, ALEC Engineering & Contracting LLC.

3. What are the main segments of the UAE Transport Infrastructure Market?

The market segments include Transport Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio.

6. What are the notable trends driving market growth?

Growing Urbanization is Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

Lack of awareness of senior living options; Relatively small size of senior living population.

8. Can you provide examples of recent developments in the market?

August 2022: Dubai's Roads and Transport Authority (RTA) reported that Al Manama Street's phased improvements were 67% finished. The project is within the domain of the recently opened Dubai-Al Ain Road Improvement Project. The construction includes a new traffic corridor that links Al Meydan Street with Al Manama Street through a bridge of 4 lanes in each direction with a capacity of 8000 vehicles per hour per direction. The project also included the construction of slip lanes to link with the Dubai-Al Ain Road. The construction includes increasing the capacity of the existing road by transforming the first three intersections on Al Manama Street with Aden Street, Sanaa Street, and Nad Al Hamar Street into signalized surface junctions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Transport Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Transport Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Transport Infrastructure Market?

To stay informed about further developments, trends, and reports in the UAE Transport Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence