Key Insights

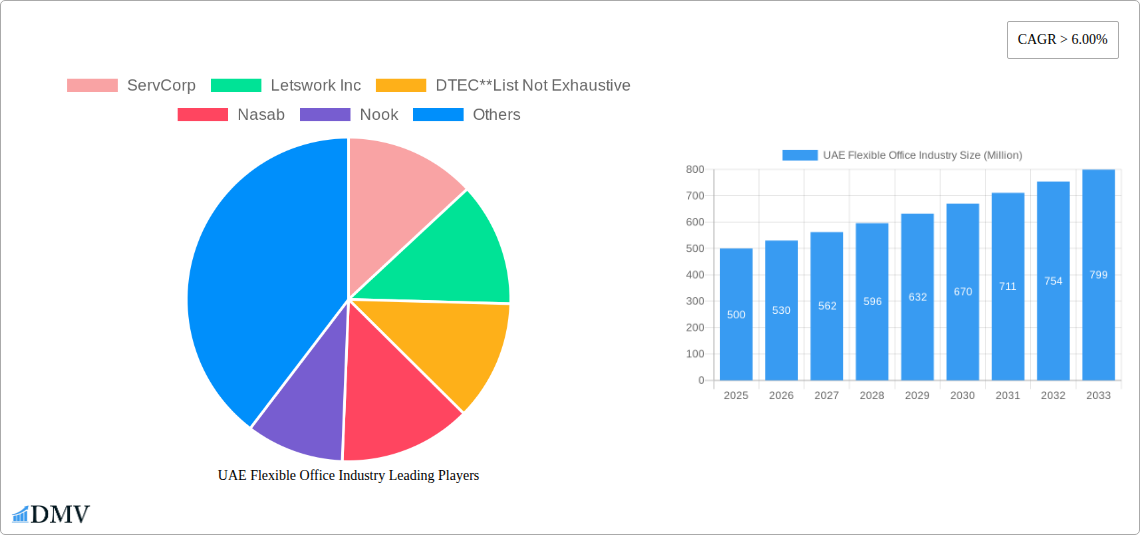

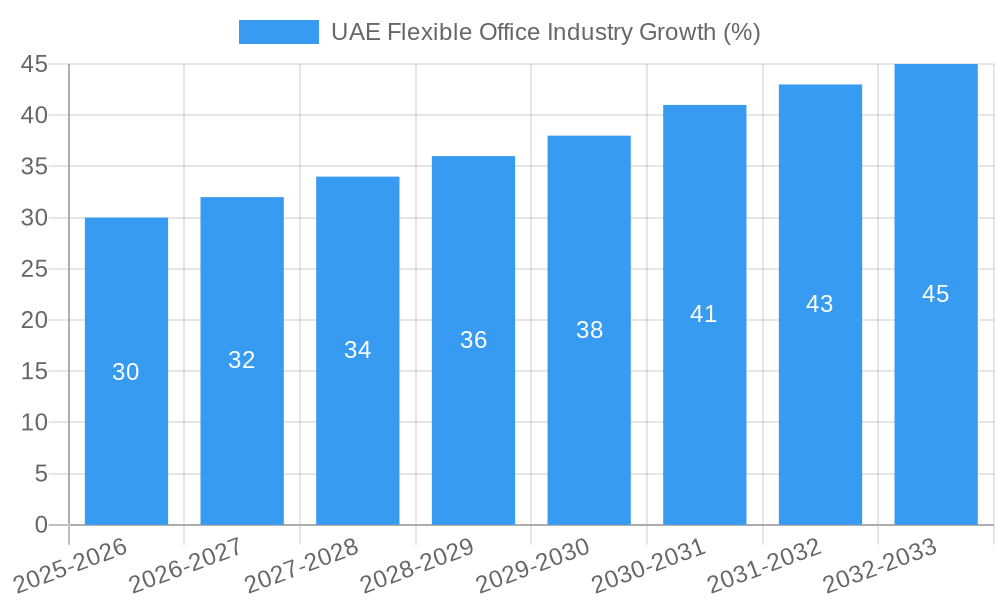

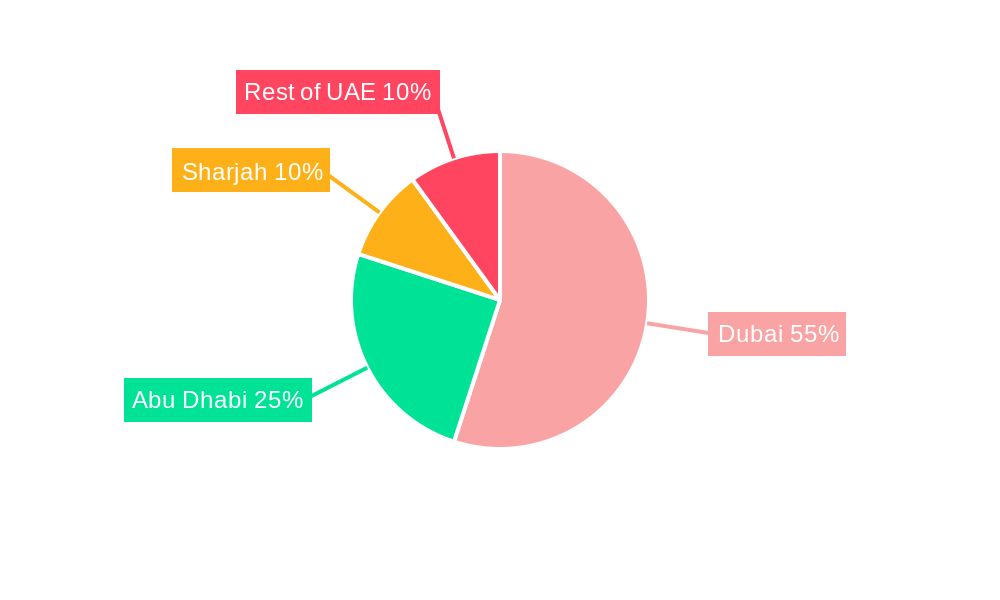

The UAE flexible office market, encompassing private offices, co-working spaces, and virtual offices, is experiencing robust growth, driven by the nation's burgeoning entrepreneurial ecosystem and the increasing adoption of hybrid work models. The market's expansion is fueled by a diverse range of end-users, including IT and telecommunications companies, media and entertainment firms, and retail and consumer goods businesses, all seeking flexible and cost-effective workspace solutions. Dubai, Abu Dhabi, and Sharjah are key market hubs, benefiting from strong economic activity and a concentration of businesses. The market's expansion is further supported by technological advancements, such as improved booking platforms and virtual office solutions, enhancing accessibility and convenience. While competition among established players like Servcorp, Regus, WeWork, and emerging local providers remains intense, the overall market demonstrates significant potential for growth, exceeding a CAGR of 6% over the forecast period (2025-2033). This growth trajectory is expected to continue as businesses increasingly prioritize agility and adaptability in their workspace strategies.

The forecast period (2025-2033) anticipates sustained growth, particularly within the co-working segment which is attracting startups and freelancers. However, potential restraints include fluctuating real estate prices and economic uncertainties that could impact business expansion plans. The market segmentation by city highlights Dubai as the leading market share holder, reflecting its status as a major business and tourism hub. Nevertheless, Abu Dhabi and Sharjah are also witnessing considerable growth, presenting significant opportunities for new entrants. The industry's future success will hinge on adapting to evolving business needs, offering innovative solutions, and strategically navigating the competitive landscape. The presence of established international brands alongside local players contributes to a dynamic and competitive market.

This insightful report provides a comprehensive analysis of the UAE flexible office industry, encompassing market size, trends, key players, and future growth projections from 2019 to 2033. The study delves into the dynamic landscape of co-working spaces, private offices, and virtual offices across major UAE cities, offering valuable insights for investors, businesses, and industry stakeholders. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an indispensable resource for understanding the current state and future potential of this rapidly evolving sector. The total market value in 2025 is estimated at xx Million, with projected growth to xx Million by 2033.

UAE Flexible Office Industry Market Composition & Trends

The UAE flexible office market, valued at xx Million in 2025, showcases a dynamic interplay of established players and emerging entrants. Market concentration is moderate, with key players like WeWork Management LLC, Regus Group, and ServCorp holding significant shares, but a multitude of smaller operators also contributing to the competitive landscape. Innovation is driven by technological advancements, such as smart office solutions and flexible workspace management systems. The regulatory environment, while generally supportive of business growth, presents some challenges regarding licensing and zoning regulations that need close monitoring. Substitute products, such as traditional leased offices, continue to exist, but the appeal of flexibility and cost-effectiveness is driving considerable market shift towards flexible workspaces. Significant M&A activity, with estimated deal values exceeding xx Million in the past five years, further shapes the industry's consolidation.

- Market Share Distribution (2025): WeWork: 20%, Regus: 15%, Servcorp: 10%, Others: 55% (These are estimates).

- M&A Deal Values (2019-2024): xx Million (estimated).

- End-User Profiles: Predominantly IT & Telecommunications, Media & Entertainment, and Retail & Consumer Goods.

UAE Flexible Office Industry Industry Evolution

The UAE flexible office industry has experienced significant growth during the historical period (2019-2024), driven by the increasing adoption of agile work models and a preference for flexible and cost-effective workspace solutions. The market has seen a compound annual growth rate (CAGR) of xx% from 2019 to 2024. Technological advancements, particularly in workspace management software and online booking platforms, have streamlined operations and enhanced user experience. This is complemented by shifting consumer demands for modern, aesthetically pleasing spaces that foster collaboration and productivity. The forecast period (2025-2033) projects continued expansion, fueled by sustained economic growth, the rise of remote work, and increasing demand for flexible office arrangements from diverse business sectors. We project a CAGR of xx% between 2025 and 2033, resulting in substantial market expansion. The adoption rate of flexible workspaces among SMEs, in particular, is a key factor driving this growth.

Leading Regions, Countries, or Segments in UAE Flexible Office Industry

Dubai leads the UAE flexible office market, driven by its strong economic activity, substantial foreign investment, and a large concentration of multinational corporations and startups. Abu Dhabi and Sharjah follow, although at a comparatively slower growth rate. The co-working space segment dominates, representing xx% of the market in 2025, due to its affordability and appeal to freelancers and SMEs.

Key Drivers for Dubai's Dominance:

- Highest concentration of businesses and startups.

- Strong government support for innovation and entrepreneurship.

- Extensive infrastructure and connectivity.

- Large pool of skilled workforce.

Key Drivers for Co-working Space Dominance:

- Cost-effectiveness compared to private offices.

- Fosters collaboration and networking opportunities.

- Suits the needs of freelancers and small businesses.

- Flexible contract terms.

UAE Flexible Office Industry Product Innovations

Recent innovations in the UAE flexible office market include the integration of smart building technologies, enhancing energy efficiency and security. Many spaces now offer advanced communication systems, high-speed internet, and collaborative workspaces tailored to the needs of specific industries. Unique selling propositions focus on providing premium amenities, community building initiatives, and sustainable practices.

Propelling Factors for UAE Flexible Office Industry Growth

The UAE's flexible office market is experiencing robust growth due to several factors: the government's initiatives promoting entrepreneurship and digital transformation, the increasing adoption of remote work models by businesses, and the rising demand for flexible and cost-effective workspace solutions from SMEs. Economic diversification and a robust infrastructure also contribute to the sector’s positive growth trajectory.

Obstacles in the UAE Flexible Office Industry Market

Challenges include securing suitable locations at competitive prices, navigating regulatory hurdles associated with building permits and licensing, and managing competition from established and new market entrants. Supply chain disruptions can affect the construction and fit-out of new flexible workspaces, potentially delaying expansion plans.

Future Opportunities in UAE Flexible Office Industry

Future opportunities include expanding into underserved markets within the UAE, incorporating innovative technologies (such as virtual reality for remote collaboration), and catering to specific industry needs. The growing trend of hybrid work models will further fuel demand for adaptable and technologically advanced workspace solutions.

Major Players in the UAE Flexible Office Industry Ecosystem

- ServCorp

- Letswork Inc

- DTEC

- Nasab

- Nook

- Astrolabs

- Instant Group

- WeWork Management LLC

- WitWork

- Regus Group

Key Developments in UAE Flexible Office Industry Industry

- February 2022: Merex Investment leased 150,000 sq ft to Talabat for its regional HQ in City Walk, Dubai, signifying significant investment in flexible office space for large corporations.

- January 2022: Cloud Spaces launched a flexible workspace at Yas Mall, catering to freelancers and SMEs, showcasing the growing demand for such facilities in non-traditional locations.

Strategic UAE Flexible Office Industry Market Forecast

The UAE flexible office market is poised for continued growth, driven by increasing demand from diverse sectors, technological advancements, and supportive government policies. The market's future potential is significant, with opportunities for expansion, innovation, and further consolidation among key players. The projected growth trajectory indicates a robust and promising future for this dynamic industry.

UAE Flexible Office Industry Segmentation

-

1. Type

- 1.1. Co-working Space

- 1.2. Serviced offices / Executive suites

- 1.3. Others (Hybrid, Virtual Office)

-

2. End Use

- 2.1. Information Technology (IT and ITES)

- 2.2. BFSI (Banking, Financial Services, and Insurance)

- 2.3. Business Consulting & Professional Services

- 2.4. Others

-

3. User

- 3.1. Freelancers

- 3.2. Enterprises

- 3.3. Start-Ups

- 3.4. Others

UAE Flexible Office Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Flexible Office Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Oil and Gas Sector

- 3.3. Market Restrains

- 3.3.1. Skills shortages.

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Commercial Working Space

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Flexible Office Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Co-working Space

- 5.1.2. Serviced offices / Executive suites

- 5.1.3. Others (Hybrid, Virtual Office)

- 5.2. Market Analysis, Insights and Forecast - by End Use

- 5.2.1. Information Technology (IT and ITES)

- 5.2.2. BFSI (Banking, Financial Services, and Insurance)

- 5.2.3. Business Consulting & Professional Services

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by User

- 5.3.1. Freelancers

- 5.3.2. Enterprises

- 5.3.3. Start-Ups

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UAE Flexible Office Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Co-working Space

- 6.1.2. Serviced offices / Executive suites

- 6.1.3. Others (Hybrid, Virtual Office)

- 6.2. Market Analysis, Insights and Forecast - by End Use

- 6.2.1. Information Technology (IT and ITES)

- 6.2.2. BFSI (Banking, Financial Services, and Insurance)

- 6.2.3. Business Consulting & Professional Services

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by User

- 6.3.1. Freelancers

- 6.3.2. Enterprises

- 6.3.3. Start-Ups

- 6.3.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UAE Flexible Office Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Co-working Space

- 7.1.2. Serviced offices / Executive suites

- 7.1.3. Others (Hybrid, Virtual Office)

- 7.2. Market Analysis, Insights and Forecast - by End Use

- 7.2.1. Information Technology (IT and ITES)

- 7.2.2. BFSI (Banking, Financial Services, and Insurance)

- 7.2.3. Business Consulting & Professional Services

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by User

- 7.3.1. Freelancers

- 7.3.2. Enterprises

- 7.3.3. Start-Ups

- 7.3.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UAE Flexible Office Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Co-working Space

- 8.1.2. Serviced offices / Executive suites

- 8.1.3. Others (Hybrid, Virtual Office)

- 8.2. Market Analysis, Insights and Forecast - by End Use

- 8.2.1. Information Technology (IT and ITES)

- 8.2.2. BFSI (Banking, Financial Services, and Insurance)

- 8.2.3. Business Consulting & Professional Services

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by User

- 8.3.1. Freelancers

- 8.3.2. Enterprises

- 8.3.3. Start-Ups

- 8.3.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UAE Flexible Office Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Co-working Space

- 9.1.2. Serviced offices / Executive suites

- 9.1.3. Others (Hybrid, Virtual Office)

- 9.2. Market Analysis, Insights and Forecast - by End Use

- 9.2.1. Information Technology (IT and ITES)

- 9.2.2. BFSI (Banking, Financial Services, and Insurance)

- 9.2.3. Business Consulting & Professional Services

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by User

- 9.3.1. Freelancers

- 9.3.2. Enterprises

- 9.3.3. Start-Ups

- 9.3.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UAE Flexible Office Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Co-working Space

- 10.1.2. Serviced offices / Executive suites

- 10.1.3. Others (Hybrid, Virtual Office)

- 10.2. Market Analysis, Insights and Forecast - by End Use

- 10.2.1. Information Technology (IT and ITES)

- 10.2.2. BFSI (Banking, Financial Services, and Insurance)

- 10.2.3. Business Consulting & Professional Services

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by User

- 10.3.1. Freelancers

- 10.3.2. Enterprises

- 10.3.3. Start-Ups

- 10.3.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ServCorp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Letswork Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DTEC**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nasab

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nook

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Astrolabs

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Instant Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 WeWork Management LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 WitWork

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Regus Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ServCorp

List of Figures

- Figure 1: Global UAE Flexible Office Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: UAE UAE Flexible Office Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: UAE UAE Flexible Office Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UAE Flexible Office Industry Revenue (Million), by Type 2024 & 2032

- Figure 5: North America UAE Flexible Office Industry Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America UAE Flexible Office Industry Revenue (Million), by End Use 2024 & 2032

- Figure 7: North America UAE Flexible Office Industry Revenue Share (%), by End Use 2024 & 2032

- Figure 8: North America UAE Flexible Office Industry Revenue (Million), by User 2024 & 2032

- Figure 9: North America UAE Flexible Office Industry Revenue Share (%), by User 2024 & 2032

- Figure 10: North America UAE Flexible Office Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America UAE Flexible Office Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America UAE Flexible Office Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: South America UAE Flexible Office Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: South America UAE Flexible Office Industry Revenue (Million), by End Use 2024 & 2032

- Figure 15: South America UAE Flexible Office Industry Revenue Share (%), by End Use 2024 & 2032

- Figure 16: South America UAE Flexible Office Industry Revenue (Million), by User 2024 & 2032

- Figure 17: South America UAE Flexible Office Industry Revenue Share (%), by User 2024 & 2032

- Figure 18: South America UAE Flexible Office Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: South America UAE Flexible Office Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe UAE Flexible Office Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe UAE Flexible Office Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe UAE Flexible Office Industry Revenue (Million), by End Use 2024 & 2032

- Figure 23: Europe UAE Flexible Office Industry Revenue Share (%), by End Use 2024 & 2032

- Figure 24: Europe UAE Flexible Office Industry Revenue (Million), by User 2024 & 2032

- Figure 25: Europe UAE Flexible Office Industry Revenue Share (%), by User 2024 & 2032

- Figure 26: Europe UAE Flexible Office Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe UAE Flexible Office Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa UAE Flexible Office Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Middle East & Africa UAE Flexible Office Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Middle East & Africa UAE Flexible Office Industry Revenue (Million), by End Use 2024 & 2032

- Figure 31: Middle East & Africa UAE Flexible Office Industry Revenue Share (%), by End Use 2024 & 2032

- Figure 32: Middle East & Africa UAE Flexible Office Industry Revenue (Million), by User 2024 & 2032

- Figure 33: Middle East & Africa UAE Flexible Office Industry Revenue Share (%), by User 2024 & 2032

- Figure 34: Middle East & Africa UAE Flexible Office Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa UAE Flexible Office Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific UAE Flexible Office Industry Revenue (Million), by Type 2024 & 2032

- Figure 37: Asia Pacific UAE Flexible Office Industry Revenue Share (%), by Type 2024 & 2032

- Figure 38: Asia Pacific UAE Flexible Office Industry Revenue (Million), by End Use 2024 & 2032

- Figure 39: Asia Pacific UAE Flexible Office Industry Revenue Share (%), by End Use 2024 & 2032

- Figure 40: Asia Pacific UAE Flexible Office Industry Revenue (Million), by User 2024 & 2032

- Figure 41: Asia Pacific UAE Flexible Office Industry Revenue Share (%), by User 2024 & 2032

- Figure 42: Asia Pacific UAE Flexible Office Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific UAE Flexible Office Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAE Flexible Office Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UAE Flexible Office Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global UAE Flexible Office Industry Revenue Million Forecast, by End Use 2019 & 2032

- Table 4: Global UAE Flexible Office Industry Revenue Million Forecast, by User 2019 & 2032

- Table 5: Global UAE Flexible Office Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global UAE Flexible Office Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Global UAE Flexible Office Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Global UAE Flexible Office Industry Revenue Million Forecast, by End Use 2019 & 2032

- Table 9: Global UAE Flexible Office Industry Revenue Million Forecast, by User 2019 & 2032

- Table 10: Global UAE Flexible Office Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global UAE Flexible Office Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global UAE Flexible Office Industry Revenue Million Forecast, by End Use 2019 & 2032

- Table 16: Global UAE Flexible Office Industry Revenue Million Forecast, by User 2019 & 2032

- Table 17: Global UAE Flexible Office Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Brazil UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Argentina UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of South America UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global UAE Flexible Office Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global UAE Flexible Office Industry Revenue Million Forecast, by End Use 2019 & 2032

- Table 23: Global UAE Flexible Office Industry Revenue Million Forecast, by User 2019 & 2032

- Table 24: Global UAE Flexible Office Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Spain UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Benelux UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Nordics UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global UAE Flexible Office Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global UAE Flexible Office Industry Revenue Million Forecast, by End Use 2019 & 2032

- Table 36: Global UAE Flexible Office Industry Revenue Million Forecast, by User 2019 & 2032

- Table 37: Global UAE Flexible Office Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global UAE Flexible Office Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 45: Global UAE Flexible Office Industry Revenue Million Forecast, by End Use 2019 & 2032

- Table 46: Global UAE Flexible Office Industry Revenue Million Forecast, by User 2019 & 2032

- Table 47: Global UAE Flexible Office Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 48: China UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: India UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Korea UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: ASEAN UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Oceania UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific UAE Flexible Office Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Flexible Office Industry?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the UAE Flexible Office Industry?

Key companies in the market include ServCorp, Letswork Inc, DTEC**List Not Exhaustive, Nasab, Nook, Astrolabs, Instant Group, WeWork Management LLC, WitWork, Regus Group.

3. What are the main segments of the UAE Flexible Office Industry?

The market segments include Type, End Use, User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Oil and Gas Sector.

6. What are the notable trends driving market growth?

Increasing Demand for Commercial Working Space.

7. Are there any restraints impacting market growth?

Skills shortages..

8. Can you provide examples of recent developments in the market?

February 2022: Asset management firm Merex Investment has signed a commercial office lease agreement with Talabat, MENA's leading tech company, to set up its regional and UAE headquarters at City Walk, Dubai's centrally located design-inspired, mixed-use destination. Talabat's regional HQ will span almost 150,000 sq ft of premises, featuring a custom-built office environment that can cater to over 2,000 employees.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Flexible Office Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Flexible Office Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Flexible Office Industry?

To stay informed about further developments, trends, and reports in the UAE Flexible Office Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence