Key Insights

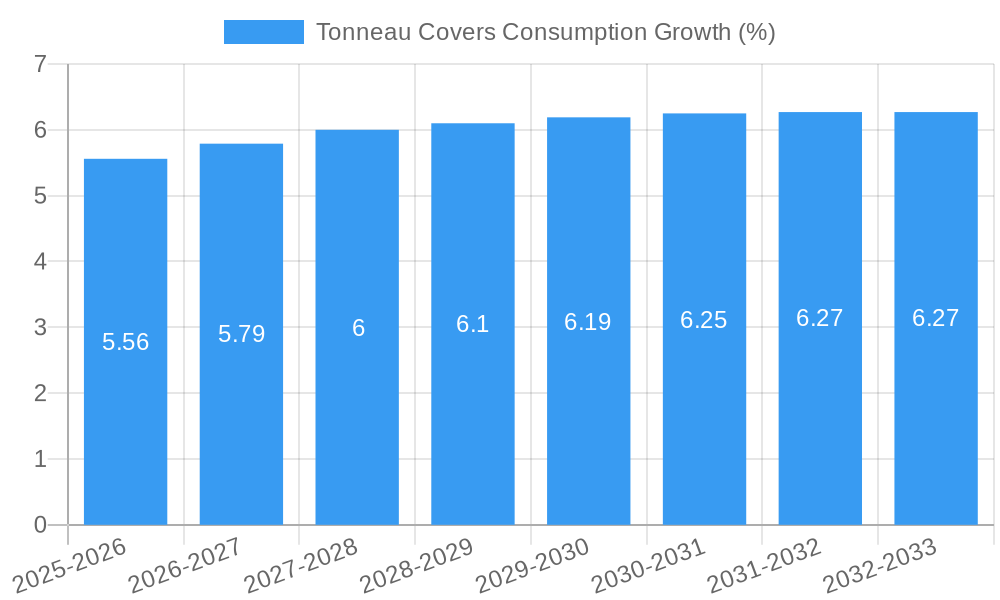

The global tonneau covers market is poised for robust growth, projected to reach approximately $1.8 billion by the end of 2025, with an estimated compound annual growth rate (CAGR) of 5.5% between 2025 and 2033. This expansion is primarily driven by the increasing popularity of pickup trucks across various applications, including passenger and commercial vehicles. The growing demand for enhanced cargo security, protection from environmental elements, and improved vehicle aesthetics are key factors fueling this market. Furthermore, the aftermarket segment is expected to witness significant traction as consumers seek to customize and upgrade their existing vehicles, contributing to overall market value.

The market is characterized by several key trends that will shape its trajectory. The rising adoption of advanced materials like aluminum and composite plastics, offering durability and lightweight properties, is a notable trend. Innovations in design, such as retractable and folding tonneau covers, are catering to consumer demand for convenience and versatility. While the market demonstrates strong growth potential, certain restraints could impede its full expansion. Economic fluctuations impacting consumer spending on vehicle accessories and the availability of cost-effective alternatives may pose challenges. However, the persistent demand for pickup trucks, particularly in developed regions like North America and emerging markets in Asia Pacific, coupled with ongoing product development and strategic partnerships among leading companies like Truck Hero and Bestop, will ensure sustained market expansion.

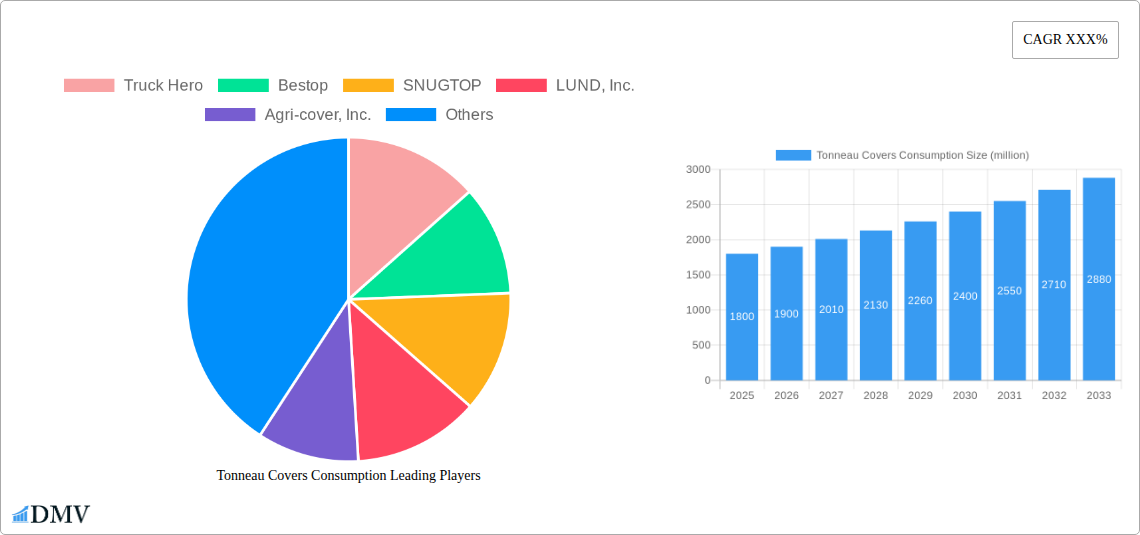

Tonneau Covers Consumption Market Composition & Trends

The tonneau covers consumption market, projected to reach a significant XX million in revenue by 2033, exhibits a dynamic landscape shaped by increasing demand for truck utility and aesthetic enhancements. Market concentration is moderate, with key players like Truck Hero, Bestop, SNUGTOP, LUND, Inc., Agri-cover, Inc., Diamond Back, and Truck Covers USA vying for market share. Innovation remains a critical catalyst, driven by advancements in materials, locking mechanisms, and smart integration features. The regulatory landscape, while not overtly restrictive, influences product design regarding safety and environmental considerations. Substitute products, such as truck caps and tonneau cover alternatives, present a constant competitive pressure. End-user profiles are diverse, encompassing both commercial vehicle operators seeking cargo protection and passenger vehicle owners prioritizing style and security. Mergers and acquisitions (M&A) activities, with estimated deal values in the tens of millions, continue to consolidate market power and expand product portfolios.

- Market Share Distribution: Truck Hero holds a commanding XX% market share, followed by Bestop at XX%, SNUGTOP at XX%, and LUND, Inc. at XX%. Agri-cover, Inc., Diamond Back, and Truck Covers USA collectively account for XX%.

- M&A Deal Values: Significant M&A activities in recent years have seen transactions valued between XX million and XX million, indicating industry consolidation and strategic growth.

- Innovation Focus: Primary innovation areas include electric retractable designs, integrated lighting systems, and advanced materials offering enhanced durability and weather resistance.

Tonneau Covers Consumption Industry Evolution

The tonneau covers consumption industry is poised for substantial growth, driven by a confluence of evolving consumer preferences, technological advancements, and increasing vehicle customization trends. Over the study period of 2019–2033, the market has witnessed a consistent upward trajectory, with the base year of 2025 serving as a pivotal point for projected expansion. The historical period from 2019 to 2024 laid the groundwork, characterized by increasing adoption of truck accessories for both utilitarian and aesthetic purposes. As we move into the forecast period of 2025–2033, significant market growth is anticipated, with an estimated Compound Annual Growth Rate (CAGR) of XX% from the 2025 base year. This growth is intrinsically linked to the burgeoning truck market, particularly in North America and emerging economies, where pickup trucks are increasingly utilized beyond their traditional workhorse roles.

Technological advancements have played a crucial role in shaping this evolution. The introduction of more durable, weather-resistant, and aesthetically pleasing materials, such as advanced composites and reinforced polymers, has enhanced the appeal and longevity of tonneau covers. Furthermore, the integration of smart technologies, including remote locking mechanisms, integrated lighting, and even solar-powered options, is catering to the demand for convenience and added functionality. Consumer demands are also shifting, with a greater emphasis on personalized solutions that align with individual driving needs and truck models. The aftermarket segment, in particular, is experiencing robust growth as owners seek to upgrade their vehicles with premium accessories that offer both protection and style. Regulatory influences, while not a primary growth driver, ensure product safety and environmental compliance, contributing to market maturity and consumer trust. The increasing availability of a wide array of tonneau cover types, from soft roll-ups and folding covers to rigid retractable and one-piece designs, ensures that the market can effectively cater to diverse customer needs and price points, further propelling overall industry evolution and consumption.

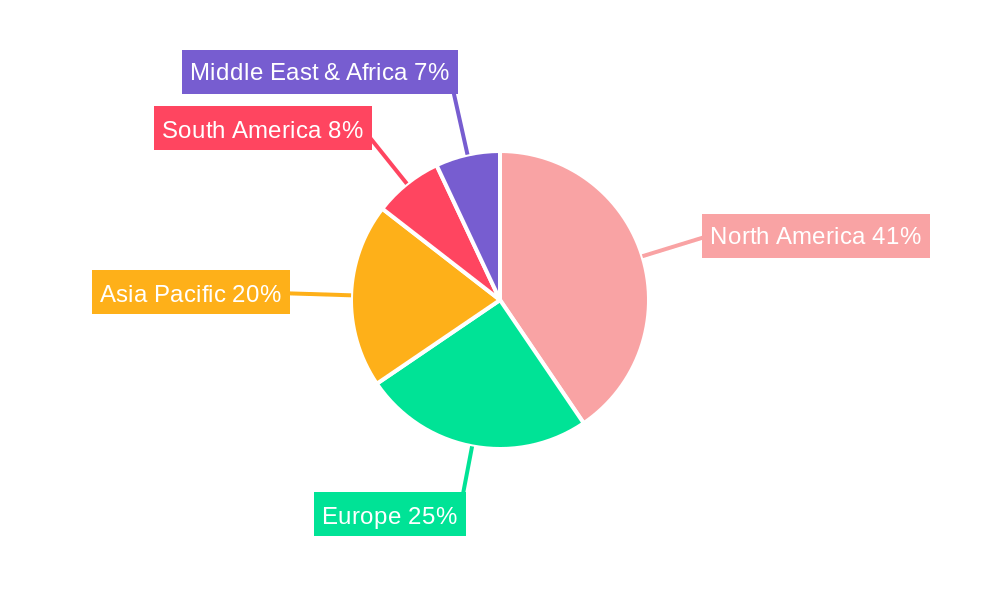

Leading Regions, Countries, or Segments in Tonneau Covers Consumption

The tonneau covers consumption market exhibits distinct regional dominance and segment leadership, driven by specific economic, cultural, and industrial factors. North America, particularly the United States, stands as the undisputed leader in tonneau cover consumption. This leadership is deeply rooted in the cultural affinity for pickup trucks, their widespread use as both work vehicles and personal transportation, and a strong aftermarket accessory culture. The sheer volume of truck sales in the US, coupled with a high propensity for vehicle customization, creates an immense demand for tonneau covers.

Within this leading region, the Application: Passenger Vehicle segment, although present, is dwarfed by the overwhelming dominance of Application: Commercial Vehicle. This is a direct reflection of the primary utility of pickup trucks in commercial operations, where securing and protecting cargo is paramount. However, the growing popularity of lifestyle trucks among consumers is steadily increasing the relevance of passenger vehicle applications for tonneau covers, particularly for those seeking enhanced cargo security for recreational gear or everyday items.

Analyzing by Type, the Aftermarket segment consistently outpaces the OEM (Original Equipment Manufacturer) segment in terms of volume and growth. While some truck manufacturers offer tonneau covers as factory options, the aftermarket provides a significantly broader selection of styles, materials, functionalities, and price points. This allows consumers to meticulously choose a cover that perfectly matches their specific needs, truck model, and budget. Investment trends in the aftermarket sector are robust, with companies continuously innovating and expanding their product lines to capture market share. Regulatory support, while indirect, focuses on safety standards that all aftermarket products must adhere to, fostering a competitive yet regulated environment.

- Regional Dominance Drivers (North America):

- High pickup truck ownership and usage rates.

- Strong culture of vehicle personalization and aftermarket customization.

- Extensive dealer network and retail availability of tonneau covers.

- Economic importance of industries relying on pickup trucks (agriculture, construction, etc.).

- Application Segment Drivers:

- Commercial Vehicle: Essential for cargo security, weather protection, and fuel efficiency in work-related operations.

- Passenger Vehicle: Growing demand for enhanced security for personal belongings, protection from elements, and aesthetic appeal.

- Type Segment Drivers:

- Aftermarket: Wider product variety, competitive pricing, advanced features, and ability to cater to specific truck models and user needs.

- OEM: Convenience of factory integration, perceived brand quality, but limited customization options and higher price points.

Tonneau Covers Consumption Product Innovations

Product innovation in the tonneau covers consumption market is intensely focused on enhancing user experience, durability, and functionality. Advanced materials, such as lightweight yet robust aluminum alloys and impact-resistant composites, are becoming standard, offering superior protection against the elements and theft. Key innovations include the development of seamless, automatic locking mechanisms that can be operated remotely or via smartphone apps, providing unparalleled security and convenience. Furthermore, integration of LED lighting systems within the covers is improving nighttime visibility and cargo access. Some cutting-edge designs are also exploring modularity and customizable inserts, allowing users to tailor the cover's internal configuration for specific storage needs. The pursuit of aerodynamic designs that can contribute to fuel efficiency is also a notable trend, further differentiating premium offerings in this competitive market.

Propelling Factors for Tonneau Covers Consumption Growth

Several key factors are propelling the growth of the tonneau covers consumption market. The ever-increasing popularity of pickup trucks across diverse demographics, extending beyond traditional commercial use to lifestyle and family vehicles, is a primary driver. This surge in truck ownership naturally fuels demand for accessories that enhance their utility and aesthetics. Technological advancements in materials science and manufacturing processes are leading to more durable, user-friendly, and feature-rich tonneau covers. For instance, the development of lightweight yet strong alloys and advanced sealing technologies significantly improves product performance. Furthermore, a growing consumer focus on vehicle customization and personalization encourages owners to invest in accessories like tonneau covers to protect their cargo and enhance their truck's appearance. The economic development in emerging markets is also contributing, as disposable incomes rise, leading to increased purchasing power for vehicle accessories.

Obstacles in the Tonneau Covers Consumption Market

Despite robust growth, the tonneau covers consumption market faces certain obstacles. Intense competition among numerous established and emerging players can lead to price wars and pressure on profit margins. The availability of substitute products, such as truck caps and cargo management systems, offers alternative solutions for truck owners, potentially limiting the market penetration of tonneau covers. Economic downturns and recessions can negatively impact discretionary spending on vehicle accessories, leading to a slowdown in demand. Furthermore, supply chain disruptions, such as raw material shortages or logistical challenges, can affect production costs and delivery times, posing a significant hurdle for manufacturers. Evolving environmental regulations concerning material sourcing and disposal could also introduce compliance costs and influence product development.

Future Opportunities in Tonneau Covers Consumption

The tonneau covers consumption market is ripe with future opportunities. The expansion into emerging markets with growing truck adoption presents a significant untapped potential. As more developing economies embrace pickup trucks, the demand for protective and functional accessories like tonneau covers is expected to surge. Continued technological innovation, particularly in areas like smart connectivity, integrated solar power, and advanced material science, will create premium product segments and attract discerning consumers. The increasing focus on electric vehicles (EVs), including electric pickup trucks, opens up opportunities for specialized tonneau covers designed to accommodate EV battery packs or enhance aerodynamic efficiency for longer ranges. Furthermore, the growing trend of DIY customization and personalization can be leveraged through modular designs and user-friendly installation options, catering to a broader consumer base.

Major Players in the Tonneau Covers Consumption Ecosystem

- Truck Hero

- Bestop

- SNUGTOP

- LUND, Inc.

- Agri-cover, Inc.

- Diamond Back

- Truck Covers USA

Key Developments in Tonneau Covers Consumption Industry

- 2023 November: Truck Hero announces the acquisition of Extang, further consolidating its market position and expanding its product portfolio.

- 2023 August: Bestop launches a new line of integrated LED lighting for its premium tonneau covers, enhancing visibility and user convenience.

- 2023 June: LUND, Inc. introduces a revolutionary electric retractable tonneau cover with smartphone integration, setting a new standard for smart truck accessories.

- 2023 March: SNUGTOP unveils a rugged, off-road specific tonneau cover designed for extreme durability and enhanced cargo security.

- 2022 December: Agri-cover, Inc. announces significant investments in sustainable material sourcing to meet growing environmental demands.

- 2022 September: Diamond Back launches a modular tonneau cover system allowing for customizable configurations to suit various cargo needs.

- 2022 May: Truck Covers USA innovates with the introduction of a solar-powered tonneau cover with integrated charging capabilities for electronic devices.

Strategic Tonneau Covers Consumption Market Forecast

The strategic forecast for the tonneau covers consumption market anticipates sustained and robust growth driven by multifaceted opportunities. The increasing adoption of pickup trucks globally, coupled with a pervasive culture of vehicle customization, will continue to be the bedrock of this expansion. Technological innovations, particularly in smart functionalities, advanced materials, and integration with electric vehicle platforms, will unlock premium market segments and drive higher average selling prices. Furthermore, the burgeoning aftermarket sector, offering a vast array of choices and competitive pricing, will cater to a broad spectrum of consumer needs. Strategic focus on emerging markets and the development of specialized covers for the growing EV truck segment will be crucial for long-term market leadership and value creation.

Tonneau Covers Consumption Segmentation

-

1. Application

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Type

- 2.1. OEM

- 2.2. Aftermarket

Tonneau Covers Consumption Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Tonneau Covers Consumption REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tonneau Covers Consumption Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. OEM

- 5.2.2. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Tonneau Covers Consumption Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Vehicle

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. OEM

- 6.2.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Tonneau Covers Consumption Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Vehicle

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. OEM

- 7.2.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Tonneau Covers Consumption Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Vehicle

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. OEM

- 8.2.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Tonneau Covers Consumption Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Vehicle

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. OEM

- 9.2.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Tonneau Covers Consumption Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Vehicle

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. OEM

- 10.2.2. Aftermarket

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Truck Hero

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bestop

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SNUGTOP

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LUND Inc.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Agri-cover Inc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Diamond Back

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Truck Covers USA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Truck Hero

List of Figures

- Figure 1: Global Tonneau Covers Consumption Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Tonneau Covers Consumption Revenue (million), by Application 2024 & 2032

- Figure 3: North America Tonneau Covers Consumption Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Tonneau Covers Consumption Revenue (million), by Type 2024 & 2032

- Figure 5: North America Tonneau Covers Consumption Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Tonneau Covers Consumption Revenue (million), by Country 2024 & 2032

- Figure 7: North America Tonneau Covers Consumption Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Tonneau Covers Consumption Revenue (million), by Application 2024 & 2032

- Figure 9: South America Tonneau Covers Consumption Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Tonneau Covers Consumption Revenue (million), by Type 2024 & 2032

- Figure 11: South America Tonneau Covers Consumption Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Tonneau Covers Consumption Revenue (million), by Country 2024 & 2032

- Figure 13: South America Tonneau Covers Consumption Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Tonneau Covers Consumption Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Tonneau Covers Consumption Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Tonneau Covers Consumption Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Tonneau Covers Consumption Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Tonneau Covers Consumption Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Tonneau Covers Consumption Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Tonneau Covers Consumption Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Tonneau Covers Consumption Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Tonneau Covers Consumption Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Tonneau Covers Consumption Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Tonneau Covers Consumption Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Tonneau Covers Consumption Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Tonneau Covers Consumption Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Tonneau Covers Consumption Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Tonneau Covers Consumption Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Tonneau Covers Consumption Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Tonneau Covers Consumption Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Tonneau Covers Consumption Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Tonneau Covers Consumption Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Tonneau Covers Consumption Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Tonneau Covers Consumption Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Tonneau Covers Consumption Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Tonneau Covers Consumption Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Tonneau Covers Consumption Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Tonneau Covers Consumption Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Tonneau Covers Consumption Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Tonneau Covers Consumption Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Tonneau Covers Consumption Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Tonneau Covers Consumption Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Tonneau Covers Consumption Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Tonneau Covers Consumption Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Tonneau Covers Consumption Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Tonneau Covers Consumption Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Tonneau Covers Consumption Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Tonneau Covers Consumption Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Tonneau Covers Consumption Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Tonneau Covers Consumption Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Tonneau Covers Consumption Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tonneau Covers Consumption?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Tonneau Covers Consumption?

Key companies in the market include Truck Hero, Bestop, SNUGTOP, LUND, Inc., Agri-cover, Inc., Diamond Back, Truck Covers USA.

3. What are the main segments of the Tonneau Covers Consumption?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tonneau Covers Consumption," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tonneau Covers Consumption report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tonneau Covers Consumption?

To stay informed about further developments, trends, and reports in the Tonneau Covers Consumption, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence