Key Insights

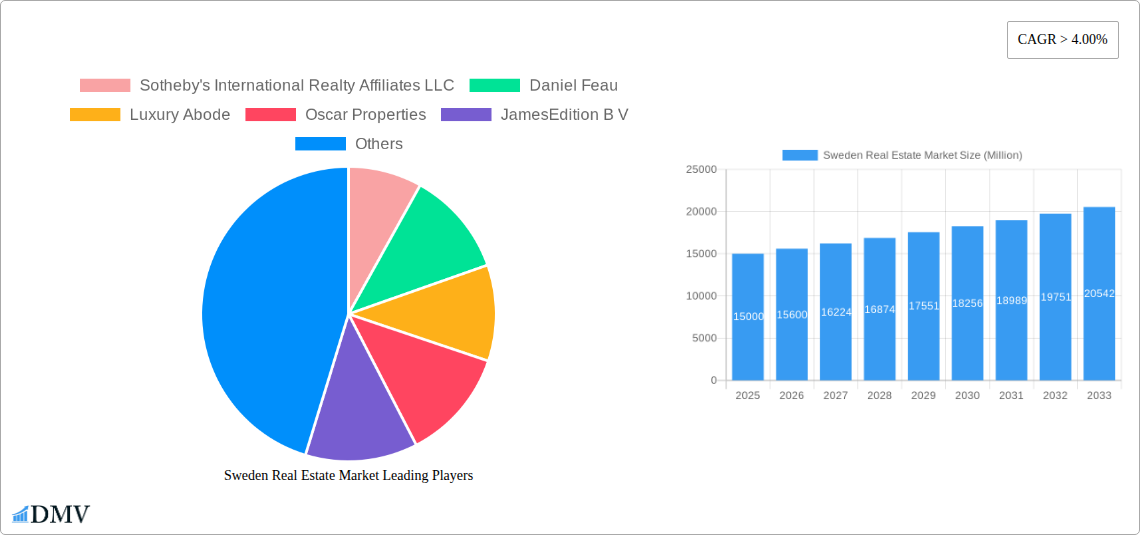

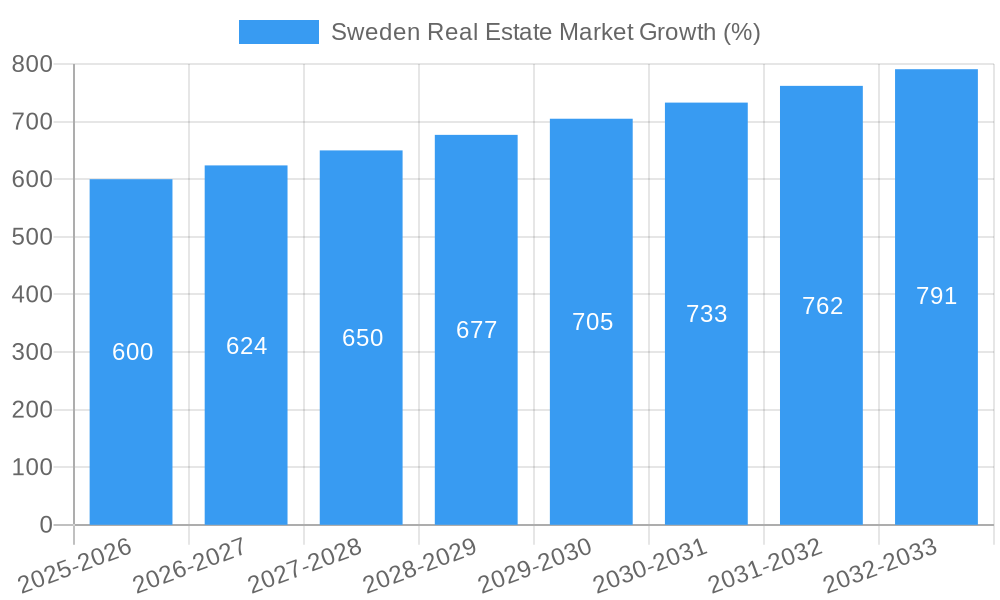

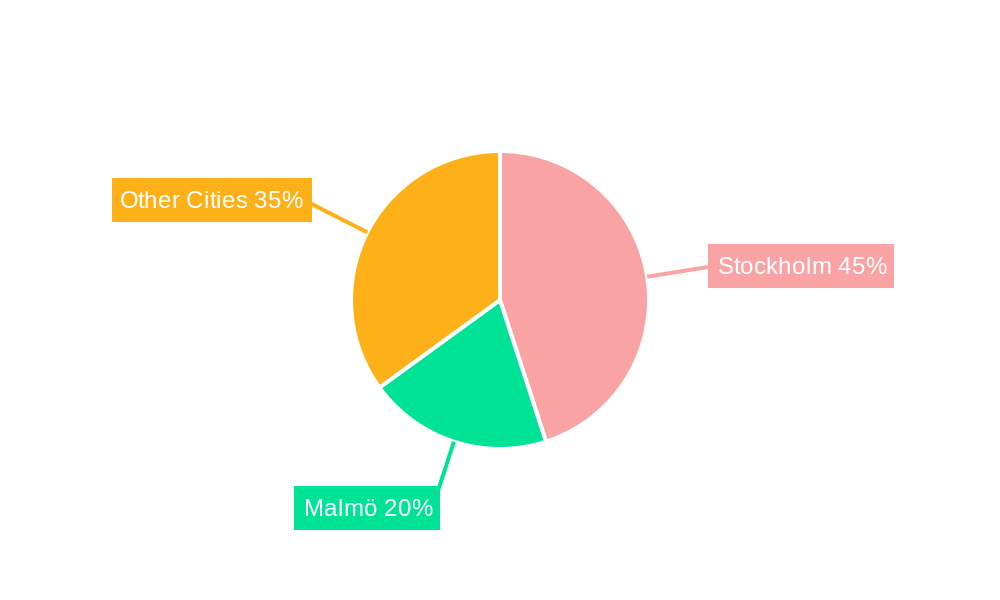

The Swedish real estate market, specifically the luxury segment encompassing apartments, condominiums, landed houses, and villas, exhibits robust growth potential. Driven by a strong economy, increasing urbanization particularly in major cities like Stockholm and Malmö, and a rising high-net-worth individual (HNWI) population seeking premium properties, the market is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4.00% from 2025 to 2033. This growth is further fueled by limited land availability in desirable urban areas, contributing to increased property values and attracting both domestic and international investors. While challenges exist, such as fluctuating interest rates and potential regulatory changes impacting foreign investment, the overall market outlook remains positive, supported by a steady influx of skilled workers and a thriving tech sector boosting demand for high-end housing. The segment breakdown reveals a significant concentration of luxury properties in Stockholm and Malmö, though other cities also contribute to the overall market expansion. Key players like Sotheby's International Realty, Luxury Abode, and Fantastic Frank are well-positioned to capitalize on this growth, showcasing the market's competitiveness and diverse range of services.

The success of these companies hinges on their ability to adapt to evolving consumer preferences. Technological advancements, particularly in online property portals and virtual tours, are transforming the buyer experience. Sustainability and energy efficiency are increasingly crucial considerations for luxury buyers, pushing developers and sellers to prioritize green building practices. Furthermore, the market’s resilience against economic downturns will be a significant factor in its continued success. Strategic partnerships, innovative marketing strategies, and a focus on personalized client service will be essential for companies to thrive in this dynamic and competitive market landscape. Analyzing historical data from 2019-2024 and projecting forward, a clear path towards sustained growth for the Swedish luxury real estate sector is evident, provided that the macroeconomic environment remains favorable.

Sweden Real Estate Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Swedish real estate market, covering the period from 2019 to 2033, with a focus on 2025. It delves into market composition, industry evolution, leading segments, product innovations, growth drivers, and future opportunities, offering valuable insights for stakeholders across the real estate sector. The report meticulously examines the market's performance, identifying key trends and forecasting future growth. With data-driven analysis and expert insights, this report is an indispensable resource for investors, developers, policymakers, and anyone seeking a comprehensive understanding of the dynamic Swedish real estate landscape. The total market value in 2025 is estimated at XX Million.

Sweden Real Estate Market Composition & Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market dynamics within the Swedish real estate market from 2019 to 2024. The study period covers a period of significant change, influenced by macroeconomic factors and technological advancements.

Market Concentration & M&A Activity:

- The Swedish real estate market exhibits a moderately concentrated structure, with a few major players commanding significant market share. However, numerous smaller firms also contribute significantly. The market share of the top 5 players in 2024 was estimated to be xx%.

- M&A activity has been relatively consistent over the past few years, with deal values ranging from XX Million to XX Million. Consolidation within the industry is expected to continue as larger firms seek to expand their market presence.

- Notable M&A activities include [mention specific examples if available, with deal values].

Innovation Catalysts and Regulatory Landscape:

- Technological advancements such as proptech solutions, virtual tours, and online property platforms are disrupting traditional real estate practices, impacting both sales and rental markets. The adoption rate for these technologies is steadily increasing.

- The regulatory environment in Sweden plays a significant role in shaping market dynamics. Regulations concerning property taxes, zoning laws, and building codes directly impact investment decisions and market growth. Recent changes in regulations have led to [mention specific impact].

- Substitute products, particularly in the rental market (e.g., co-living spaces), are gaining popularity, creating competitive pressure.

- End-user profiles are diverse, including individual buyers, investors, and rental tenants. Changing demographics and evolving lifestyles are impacting the demand for different property types.

Sweden Real Estate Market Industry Evolution

This section examines the growth trajectories, technological innovations, and evolving consumer preferences shaping the Swedish real estate market's evolution from 2019-2033. The forecast period (2025-2033) anticipates significant market transformation driven by factors such as urbanization, population growth, and technological disruptions.

The Swedish real estate market experienced an annual growth rate (CAGR) of approximately xx% between 2019 and 2024. This growth reflects increased demand, particularly in key urban areas. Technological advancements, including the rise of proptech and the increased use of online platforms, have streamlined property transactions and broadened market reach. Furthermore, shifting consumer preferences toward sustainable and energy-efficient housing are reshaping the market, influencing investment decisions and new construction projects.

The forecast period (2025-2033) projects a CAGR of xx%, driven by several factors including sustained population growth in key cities and ongoing infrastructure development. The continued integration of technology into real estate operations is expected to fuel efficiency and transparency, while regulatory changes will likely shape investment strategies and market dynamics.

Leading Regions, Countries, or Segments in Sweden Real Estate Market

This section identifies and analyzes the dominant segments and regions within the Swedish real estate market based on property type (apartments and condominiums, landed houses and villas) and key cities (Stockholm, Malmö, other cities).

Dominant Segments:

Apartments and Condominiums: This segment consistently dominates the market, driven by high demand from both first-time buyers and investors. Stockholm and Malmö show the highest concentration. Key drivers include:

- High population density and urbanisation trends.

- Relatively lower initial investment compared to landed properties.

- Government incentives and policies promoting apartment ownership.

Landed Houses and Villas: This segment displays strong performance, particularly in suburban and rural areas surrounding major cities. Growth is influenced by:

- Increased preference for larger living spaces.

- Growing demand for proximity to nature and improved quality of life.

- Increased disposable income in certain demographic groups.

Dominant Cities:

- Stockholm: Remains the most dominant market, fuelled by economic activity, job creation, and high population density.

- Malmö: Shows significant growth driven by relatively lower property prices compared to Stockholm.

Sweden Real Estate Market Product Innovations

Recent innovations in the Swedish real estate market include the adoption of smart home technology in new constructions, increasing energy efficiency standards, and the development of sustainable building materials. These innovations are driving premium pricing and enhancing the appeal to environmentally conscious buyers. Platforms offering virtual tours and 3D models have enhanced transparency and convenience in the buying process.

Propelling Factors for Sweden Real Estate Market Growth

The Swedish real estate market's growth is fueled by several factors:

- Strong Economic Performance: Consistent economic growth has increased disposable incomes, driving demand for housing.

- Population Growth: Sweden's growing population necessitates increased housing supply.

- Favorable Regulatory Environment: Government initiatives and incentives promote investment in real estate development.

Obstacles in the Sweden Real Estate Market Market

Challenges to growth include:

- High Property Prices: Affordability remains a significant barrier for many potential buyers.

- Supply Shortages: Insufficient housing supply in certain areas contributes to high prices and limited options.

- Interest Rate Fluctuations: Changes in interest rates can impact purchasing power and investment decisions.

Future Opportunities in Sweden Real Estate Market

Emerging opportunities lie in:

- Sustainable Real Estate: Demand for environmentally friendly homes is increasing, creating opportunities for green building projects.

- Technological Advancements: The integration of proptech solutions offers efficiency gains and improved market access.

- Expansion into Underserved Markets: Development in smaller cities and towns presents potential growth.

Major Players in the Sweden Real Estate Market Ecosystem

- Sotheby's International Realty Affiliates LLC

- Daniel Feau

- Luxury Abode

- Oscar Properties

- JamesEdition B V

- Bolaget Fastighetsformedling

- Per Jansson Fastighetsformedling AB

- MANSION GLOBAL

- Fantastic Frank

- Christies International Real Estate

- LuxuryEstate

Key Developments in Sweden Real Estate Market Industry

- [Month, Year]: Launch of a new proptech platform simplifying property searches and transactions. This significantly increased market transparency.

- [Month, Year]: Government announcement of new incentives for sustainable building materials, impacting the construction sector and demand for eco-friendly properties.

- [Month, Year]: Significant M&A activity involving two major real estate companies, resulting in increased market concentration.

Strategic Sweden Real Estate Market Market Forecast

The Swedish real estate market is projected to experience continued growth over the forecast period (2025-2033), driven by sustained economic expansion, population growth, and ongoing infrastructure development. Emerging trends, including increased demand for sustainable housing and the integration of technological innovations, will further shape market dynamics. The market is expected to see increased consolidation and further innovation within the proptech sector.

Sweden Real Estate Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Key Cities

- 2.1. Stockholm

- 2.2. Malmo

- 2.3. Other Cities

Sweden Real Estate Market Segmentation By Geography

- 1. Sweden

Sweden Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urbanization and population growth; Government policies and Foreign Investnents

- 3.3. Market Restrains

- 3.3.1. Skilled Labor Shortage; Material Price Fluctuations

- 3.4. Market Trends

- 3.4.1. Rise in Construction of New Dwellings Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Stockholm

- 5.2.2. Malmo

- 5.2.3. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sotheby's International Realty Affiliates LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Daniel Feau

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Luxury Abode

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oscar Properties

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JamesEdition B V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bolaget Fastighetsformedling

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Per Jansson Fastighetsformedling AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MANSION GLOBAL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fantastic Frank*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Christies International Real Estate

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 LuxuryEstate

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Sotheby's International Realty Affiliates LLC

List of Figures

- Figure 1: Sweden Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sweden Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Sweden Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sweden Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Sweden Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Sweden Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Sweden Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Sweden Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Sweden Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Sweden Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Real Estate Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Sweden Real Estate Market?

Key companies in the market include Sotheby's International Realty Affiliates LLC, Daniel Feau, Luxury Abode, Oscar Properties, JamesEdition B V, Bolaget Fastighetsformedling, Per Jansson Fastighetsformedling AB, MANSION GLOBAL, Fantastic Frank*List Not Exhaustive, Christies International Real Estate, LuxuryEstate.

3. What are the main segments of the Sweden Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Urbanization and population growth; Government policies and Foreign Investnents.

6. What are the notable trends driving market growth?

Rise in Construction of New Dwellings Driving the Market.

7. Are there any restraints impacting market growth?

Skilled Labor Shortage; Material Price Fluctuations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Real Estate Market?

To stay informed about further developments, trends, and reports in the Sweden Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence