Key Insights

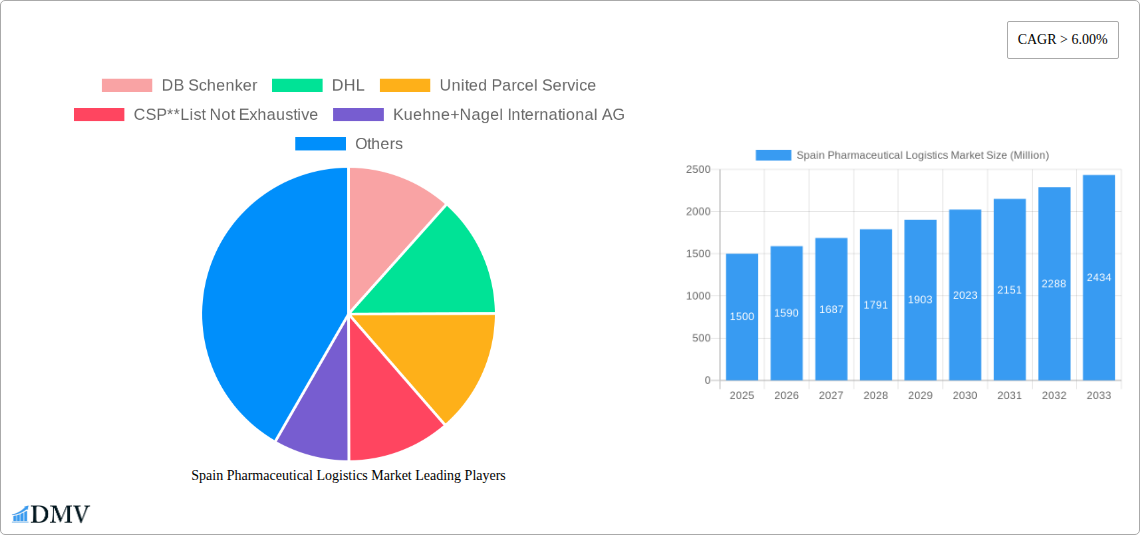

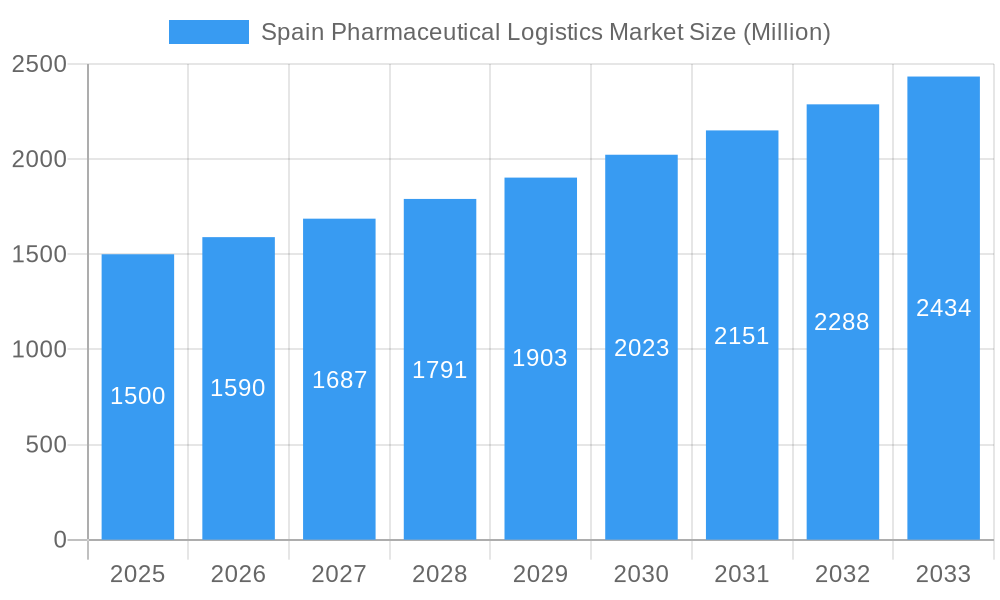

The Spain Pharmaceutical Logistics market is experiencing robust growth, projected to maintain a CAGR exceeding 6% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing prevalence of chronic diseases and an aging population fuel demand for pharmaceuticals, necessitating efficient logistics solutions. Secondly, the stringent regulatory environment surrounding pharmaceutical transportation, including temperature-sensitive drug handling (cold chain logistics), necessitates specialized logistics providers capable of meeting these complex requirements. Thirdly, the growth of e-commerce in pharmaceuticals is boosting demand for faster and more reliable delivery services. The market is segmented by mode of transport (air, rail, road, sea), product type (generic and branded drugs), operational mode (cold chain and non-cold chain), and application (biopharma and chemical pharma). Major players like DB Schenker, DHL, UPS, FedEx, and Kuehne+Nagel are competing for market share, focusing on developing innovative solutions to meet evolving industry needs, such as real-time tracking and enhanced supply chain visibility. The Spanish market's geographic location also plays a crucial role, acting as a key gateway for pharmaceutical distribution within Europe and beyond, further boosting its growth potential.

Spain Pharmaceutical Logistics Market Market Size (In Billion)

The market segmentation reveals that cold chain logistics is a rapidly growing segment due to the high proportion of temperature-sensitive pharmaceuticals. Air shipping is likely the dominant mode of transport for time-sensitive deliveries, while road shipping plays a vital role in last-mile delivery. The branded drugs segment might hold a larger market share compared to generics, given the higher pricing and greater emphasis on maintaining the integrity of the product. The biopharma segment is expected to be a significant driver of growth, due to the increasing complexity and value of biopharmaceutical products, requiring specialized handling and transportation. Competitive pressures are driving innovation within the sector, with companies investing in technology to improve efficiency and traceability, enhancing overall supply chain resilience and security. Future market growth will depend on factors such as government regulations, economic growth, technological advancements, and the changing healthcare landscape within Spain.

Spain Pharmaceutical Logistics Market Company Market Share

Spain Pharmaceutical Logistics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Spain Pharmaceutical Logistics Market, offering a comprehensive overview of market trends, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is estimated to be worth xx Million in 2025.

Spain Pharmaceutical Logistics Market Composition & Trends

This section delves into the intricacies of the Spanish pharmaceutical logistics market, examining its competitive landscape, driving forces, and regulatory environment. We analyze market concentration, highlighting the market share distribution amongst key players such as DB Schenker, DHL, United Parcel Service, and Kuehne+Nagel International AG, amongst others. The report also explores innovation catalysts, including technological advancements in cold chain logistics and the increasing adoption of digital solutions. Furthermore, the regulatory landscape, including its impact on market access and operations, is thoroughly examined. The influence of substitute products, evolving end-user profiles (hospitals, pharmacies, distributors), and significant M&A activities, such as the recent acquisitions and investments detailed later in this report, are also meticulously analyzed. We provide a detailed assessment of M&A deal values and their impact on market consolidation and competitive dynamics. This comprehensive analysis provides a robust understanding of the current market structure and its future trajectory.

- Market Concentration: Analysis of market share distribution among top players (e.g., DB Schenker holds xx% market share).

- Innovation Catalysts: Focus on technological advancements (e.g., AI-powered route optimization, blockchain for tracking).

- Regulatory Landscape: Examination of regulations impacting pharmaceutical logistics (e.g., GDP guidelines, temperature control mandates).

- Substitute Products & Services: Evaluation of alternative logistics solutions and their market penetration.

- End-User Profiles: Detailed analysis of the needs and preferences of key end-users.

- M&A Activities: Review of recent mergers, acquisitions, and joint ventures, including deal values and their impact.

Spain Pharmaceutical Logistics Market Industry Evolution

This section traces the evolution of the Spanish pharmaceutical logistics market from 2019 to the present, projecting trends through 2033. We analyze historical growth trajectories, identifying periods of expansion and contraction. Technological advancements, such as the integration of IoT devices for real-time monitoring and predictive maintenance, are examined for their impact on efficiency and cost reduction. We also consider shifting consumer demands, including the increasing need for specialized cold chain solutions for temperature-sensitive pharmaceuticals. Specific data points, such as compound annual growth rates (CAGR) for various segments, and adoption metrics for new technologies are provided to support our analysis. The impact of factors like increased e-commerce penetration and growing demand for personalized medicine on logistics are also thoroughly explored. The section provides a detailed perspective on the industry's dynamic nature and its potential for future growth.

Leading Regions, Countries, or Segments in Spain Pharmaceutical Logistics Market

This section identifies the dominant regions, countries, or segments within the Spanish pharmaceutical logistics market. A detailed examination of the market’s breakdown by mode of transport (air, rail, road, sea), product type (generic, branded drugs), mode of operation (cold chain, non-cold chain), and application (biopharma, chemical pharma) is included. The analysis pinpoints the leading segment and explores the key factors driving its dominance.

- By Mode of Transport: Road shipping is currently dominant due to its cost-effectiveness and accessibility, although air shipping holds significant share for time-sensitive deliveries.

- By Product: Branded drugs often command higher logistics costs due to stringent handling requirements and higher value.

- By Mode of Operation: Cold chain logistics is a rapidly expanding segment due to the growing market for temperature-sensitive pharmaceuticals.

- By Application: The biopharma segment shows strong growth due to increasing R&D investment and innovation in biotechnological drugs.

Detailed analysis of the factors behind this dominance will be provided, including investment trends, regulatory support, and infrastructure development. For example, the strong road network in Spain supports road shipping’s dominance.

Spain Pharmaceutical Logistics Market Product Innovations

This section highlights recent product innovations within the Spanish pharmaceutical logistics sector. We discuss advancements in temperature-controlled containers, tracking and monitoring technologies, and software solutions that enhance supply chain visibility and efficiency. We also analyze the unique selling propositions of these innovations and their impact on market competitiveness. Specific examples of cutting-edge technologies and their performance metrics (e.g., reduction in transit times, improved temperature control) will be detailed.

Propelling Factors for Spain Pharmaceutical Logistics Market Growth

Several factors contribute to the growth of the Spanish pharmaceutical logistics market. Technological advancements, such as improved cold chain technologies and real-time tracking systems, enhance efficiency and security. Economic growth and increasing healthcare spending within Spain fuel demand for pharmaceutical products, directly impacting the logistics sector. Furthermore, supportive government regulations and policies promoting the development of efficient logistics infrastructure also drive market growth. The implementation of stricter guidelines concerning pharmaceutical transportation and storage further enhances the need for specialized logistics solutions.

Obstacles in the Spain Pharmaceutical Logistics Market

The Spanish pharmaceutical logistics market faces several challenges. Stringent regulatory compliance requirements can increase operational complexity and costs. Supply chain disruptions, such as those caused by geopolitical instability or natural disasters, can significantly impact the timely delivery of pharmaceuticals. Intense competition among logistics providers puts pressure on pricing and profit margins. These challenges demand innovative solutions and adaptive strategies from market participants.

Future Opportunities in Spain Pharmaceutical Logistics Market

The Spanish pharmaceutical logistics market presents several promising future opportunities. The increasing demand for personalized medicine necessitates specialized logistics solutions for smaller, more frequent shipments. The growing adoption of e-commerce for pharmaceutical products creates new opportunities for efficient last-mile delivery services. The development of innovative cold chain technologies and digital solutions further enhances efficiency and cost optimization. These trends create opportunities for companies able to adapt and invest in the latest technologies.

Major Players in the Spain Pharmaceutical Logistics Market Ecosystem

- DB Schenker

- DHL

- United Parcel Service

- CSP (List Not Exhaustive)

- Kuehne+Nagel International AG

- FedEx

- CEVA Logistics

- Agility Logistics

- C.H. Robinson

- Movianto

- Eurotranspharma

Key Developments in Spain Pharmaceutical Logistics Market Industry

- August 2022: Lineage Logistics announced its intention to acquire Grupo Fuentes, expanding its cold storage capacity in Spain by 100,000 pallet positions. This significantly increases cold chain capacity, impacting market competition and service offerings.

- January 2022: Movianto invested €38 million (USD 41.88 million) in a new, large-scale temperature-controlled facility, substantially boosting its storage and handling capacity in Spain. This expansion demonstrates significant investment in the Spanish market and its growing demand.

Strategic Spain Pharmaceutical Logistics Market Forecast

The Spanish pharmaceutical logistics market is poised for continued growth, driven by factors such as technological advancements, increased healthcare spending, and supportive government regulations. Future opportunities lie in specialized cold chain logistics, efficient last-mile delivery solutions, and the adoption of digital technologies to enhance supply chain visibility and efficiency. The market’s expansion is expected to attract further investment and innovation, solidifying Spain's position as a key player in European pharmaceutical logistics.

Spain Pharmaceutical Logistics Market Segmentation

-

1. Product

- 1.1. Generic Drugs

- 1.2. Branded Drugs

-

2. Mode of Operation

- 2.1. Cold Chain Logistics

- 2.2. Non-cold Chain Logistics

-

3. Application

- 3.1. Bio Pharma

- 3.2. Chemical Pharma

-

4. Mode Of Transport

- 4.1. Air Shipping

- 4.2. Rail Shipping

- 4.3. Road Shipping

- 4.4. Sea Shipping

Spain Pharmaceutical Logistics Market Segmentation By Geography

- 1. Spain

Spain Pharmaceutical Logistics Market Regional Market Share

Geographic Coverage of Spain Pharmaceutical Logistics Market

Spain Pharmaceutical Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Over the Counter Drugs Across the European Region; Growing Manufacture Activity from Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Transportation Ordered

- 3.4. Market Trends

- 3.4.1. Increase in Pharmaceutical Sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Pharmaceutical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Generic Drugs

- 5.1.2. Branded Drugs

- 5.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.2.1. Cold Chain Logistics

- 5.2.2. Non-cold Chain Logistics

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bio Pharma

- 5.3.2. Chemical Pharma

- 5.4. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.4.1. Air Shipping

- 5.4.2. Rail Shipping

- 5.4.3. Road Shipping

- 5.4.4. Sea Shipping

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 United Parcel Service

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CSP**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kuehne+Nagel International AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agility Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 C H Robinson

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Movianto

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Eurotranspharma

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Spain Pharmaceutical Logistics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Spain Pharmaceutical Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Mode of Operation 2020 & 2033

- Table 3: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Mode Of Transport 2020 & 2033

- Table 5: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 7: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Mode of Operation 2020 & 2033

- Table 8: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Mode Of Transport 2020 & 2033

- Table 10: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Pharmaceutical Logistics Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Spain Pharmaceutical Logistics Market?

Key companies in the market include DB Schenker, DHL, United Parcel Service, CSP**List Not Exhaustive, Kuehne+Nagel International AG, FedEx, CEVA Logistics, Agility Logistics, C H Robinson, Movianto, Eurotranspharma.

3. What are the main segments of the Spain Pharmaceutical Logistics Market?

The market segments include Product, Mode of Operation, Application, Mode Of Transport .

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Over the Counter Drugs Across the European Region; Growing Manufacture Activity from Pharmaceutical Companies.

6. What are the notable trends driving market growth?

Increase in Pharmaceutical Sales.

7. Are there any restraints impacting market growth?

High Cost Associated with the Transportation Ordered.

8. Can you provide examples of recent developments in the market?

August 2022: Lineage Logistics, LLC ('Lineage' or the 'Company'), one of the world's leading temperature-controlled industrial REIT and logistics solutions providers, announced its intention to acquire Grupo Fuentes, a major operator of transport and cold storage facilities, headquartered in Murcia, Spain. Grupo Fuentes has a cold storage warehouse in Murcia with 60,000 pallet positions and plans to expand the site with an additional 40,000 pallet positions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Pharmaceutical Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Pharmaceutical Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Pharmaceutical Logistics Market?

To stay informed about further developments, trends, and reports in the Spain Pharmaceutical Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence