Key Insights

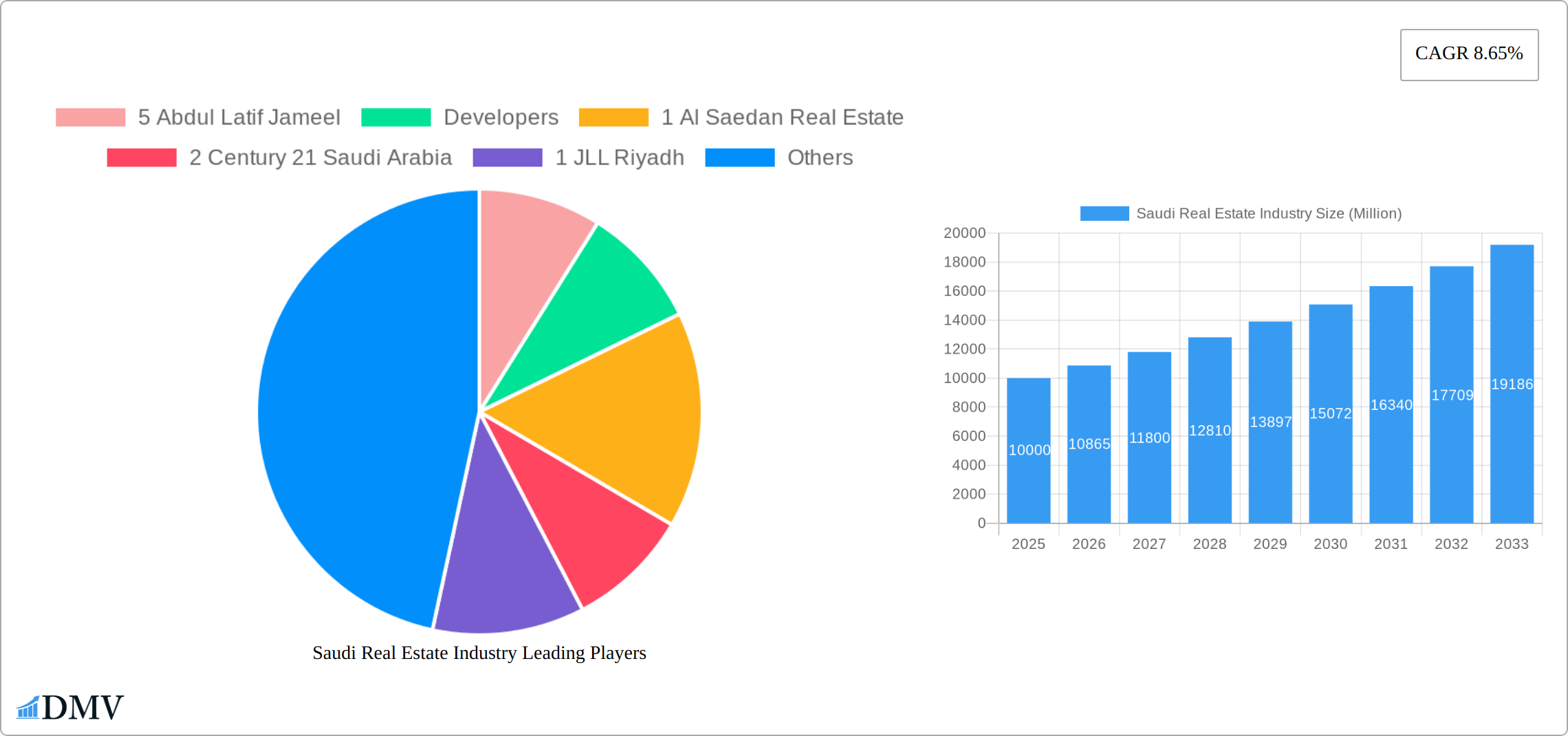

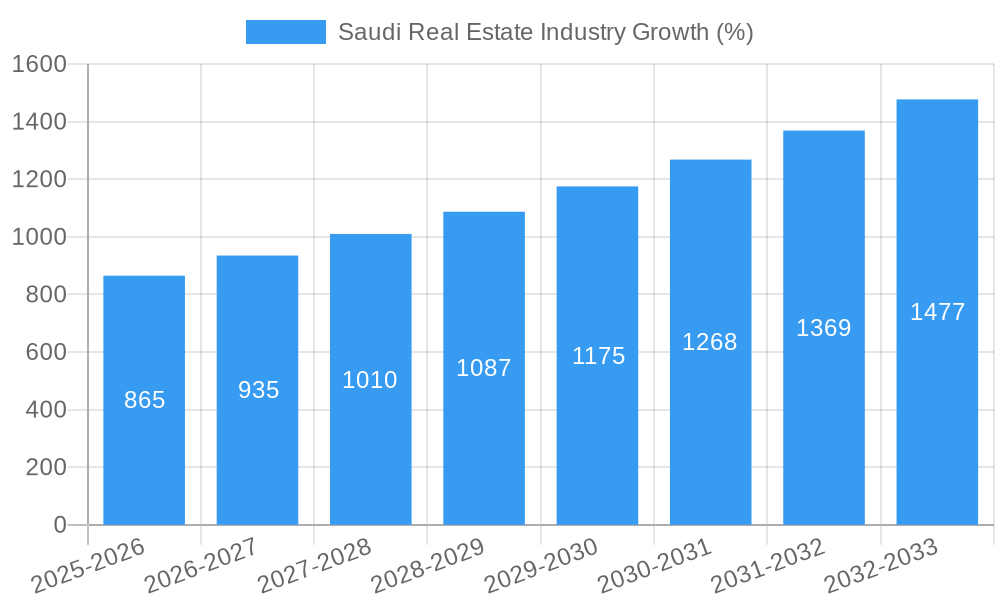

The Saudi Arabian real estate market, valued at approximately $XX million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 8.65% from 2025 to 2033. This expansion is fueled by several key drivers. Significant government investments in infrastructure projects like Neom and Vision 2030 are stimulating demand, particularly in commercial sectors like offices, retail, and logistics. The burgeoning population and a growing middle class are driving demand for residential properties, especially in major cities such as Riyadh, Jeddah, and Makkah. Furthermore, diversification of the Saudi economy beyond oil, coupled with increased foreign investment, is injecting further momentum into the market. The rise of proptech and the increasing adoption of digital platforms for property transactions are also contributing factors. However, challenges remain. Regulatory hurdles and fluctuating global economic conditions pose potential restraints, alongside the existing supply-demand imbalance in specific market segments. The market is segmented by property type (offices, retail, industrial, logistics, multi-family, hospitality) and key cities (Riyadh, Jeddah, Makkah), with significant activity from developers like Abdul Latif Jameel, Al Saedan Real Estate, and Jabal Omar, alongside international players like JLL and Century 21.

The market's growth trajectory is likely to be influenced by government policies aimed at boosting housing affordability and sustainable development. The ongoing expansion of public transportation networks and the development of smart cities will also impact market dynamics. While the industrial and logistics sectors benefit from the Kingdom's strategic location and focus on diversification, the hospitality sector is experiencing growth driven by increased tourism and mega-events. The competitive landscape is marked by a mix of established national and international players, alongside emerging real estate brokerage firms and startups. To navigate these complexities, a detailed understanding of regional market dynamics and evolving consumer preferences is crucial for investment and development strategies. The forecast period (2025-2033) promises continued expansion, but careful consideration of the market’s inherent nuances is vital for achieving long-term success.

Saudi Real Estate Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Saudi Arabian real estate market, covering historical data (2019-2024), the current landscape (2025), and a comprehensive forecast (2025-2033). We delve into market dynamics, key players, emerging trends, and future opportunities, offering invaluable insights for investors, developers, and stakeholders. The report utilizes data points and projections to illuminate the growth trajectory of this rapidly evolving sector.

Saudi Real Estate Industry Market Composition & Trends

This section evaluates the Saudi real estate market's concentration, analyzing key players and their market share. We examine innovation drivers, regulatory changes, substitute products, end-user profiles (residential, commercial, industrial), and merger & acquisition (M&A) activities. The study period spans 2019-2033, with 2025 serving as both the base and estimated year.

- Market Concentration: The Saudi real estate market exhibits a diverse landscape, with a mix of large established players and emerging developers. Key players such as Abdul Latif Jameel, Jabal Omar, Kingdom Holding Company, and SEDCO Development hold significant market share. However, a large number of smaller players including numerous brokerage firms contribute to a competitive environment. The precise market share distribution for each company will be detailed within the full report.

- M&A Activity: The report analyzes significant M&A deals over the study period, providing deal values (in Millions) and their impact on market consolidation. For example, we will examine transactions with values ranging from xx Million to xx Million (projected values where data is unavailable). The report also details the impact of Saudi Vision 2030 on M&A activities.

- Regulatory Landscape: The report will assess the influence of government regulations and policies such as Vision 2030 on market growth and investment. Impact of new regulations on different segments will be examined.

- Innovation Catalysts: This section will discuss technological advancements, sustainable building practices, and smart city initiatives impacting the market.

- Substitute Products: The availability of alternative investment options will be covered, along with their influence on real estate investment choices.

Saudi Real Estate Industry Industry Evolution

This in-depth analysis explores the Saudi real estate market's growth trajectory from 2019 to 2033. We examine technological advancements (e.g., PropTech adoption), shifting consumer preferences (towards sustainable and smart homes), and the evolving regulatory framework. The report will detail growth rates (in percentage points per annum) for various segments and provide insights on factors driving these changes. The impact of external factors, such as global economic trends and oil price fluctuations, on the market will also be assessed.

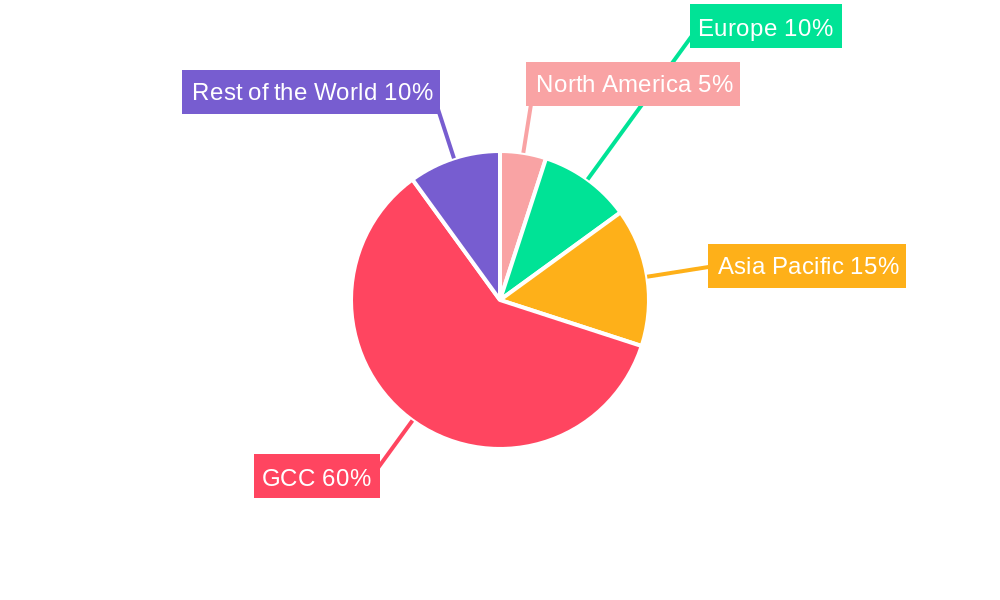

Leading Regions, Countries, or Segments in Saudi Real Estate Industry

This section identifies the dominant regions (Riyadh, Jeddah, Makkah), and segments (Offices, Retail, Industrial, Logistics, Multi-family, Hospitality) within the Saudi real estate market. We analyze the factors driving their dominance, including investment trends, regulatory support, and infrastructure development.

- Key Drivers:

- Riyadh: High population density, robust infrastructure, and significant government investment in mega-projects.

- Jeddah: Strategic location, thriving tourism sector, and growing foreign investment.

- Makkah: Religious tourism and pilgrimage-related development.

- Multi-family Residential: Increasing urbanization and population growth fuels demand.

- Hospitality: Growth in tourism and related infrastructure developments.

- Dominance Factors: Each segment’s market share and growth potential will be deeply analyzed, considering factors like affordability, future forecasts, and demand shifts. Data visualization charts will further clarify this analysis.

Saudi Real Estate Industry Product Innovations

This section details product innovation in the Saudi real estate sector, focusing on sustainable building materials, smart home technologies, and innovative design approaches. We will analyze their market adoption rates and impact on market competitiveness. The unique selling propositions of newly introduced products and technologies will be evaluated.

Propelling Factors for Saudi Real Estate Industry Growth

Key growth drivers for the Saudi real estate market include Vision 2030's emphasis on diversification, increasing government investment in infrastructure, and a growing young population. Technological advancements and improved financing options also contribute to market growth.

Obstacles in the Saudi Real Estate Industry Market

Challenges include regulatory complexities, potential supply chain disruptions, and price volatility. Competitive pressures from international players and the impact of fluctuating oil prices are also important factors to consider.

Future Opportunities in Saudi Real Estate Industry

Emerging opportunities lie in green building, PropTech integration, the development of affordable housing solutions, and the expansion into new markets, such as logistics and industrial real estate. The continued development of Saudi Arabia’s infrastructure and the growth of the tourism sector will create even further opportunities.

Major Players in the Saudi Real Estate Industry Ecosystem

- 5 Abdul Latif Jameel

- Developers

- 1 Al Saedan Real Estate

- 2 Century 21 Saudi Arabia

- 4 JLL Riyadh

- 5 Jabal Omar

- 4 360 Realtors LLP Riyadh (Note: This link may direct to the global site)

- 4 Nai Saudi Arabia

- 2 Kingdom Holding Company

- Other Companies (Real Estate Brokerage Firms, Startups, Associations, etc.)

- 3 SEDCO Development

- 6 Saudi Real Estate Company

- 3 Dar Ar Alkan

Key Developments in Saudi Real Estate Industry Industry

May 2023: Rotana's partnership with Memar Development & Investment signals significant growth in the hospitality sector, adding five new properties to its portfolio. This expands Rotana's presence within the Kingdom and contributes to the overall growth of the hospitality segment.

October 2022: ROSHN's collaboration with Esri highlights a commitment to sustainable development and leveraging technology for efficient urban planning. This partnership supports ROSHN's ambitious plan to develop 200 Million square meters of sustainable neighborhoods. This technological integration will impact both design and construction efficiency and will influence the market's approach to sustainability.

Strategic Saudi Real Estate Industry Market Forecast

The Saudi real estate market is poised for robust growth, driven by Vision 2030 initiatives, increased foreign investment, and a burgeoning population. The diverse segments offer significant opportunities for both established and new players, fostering a dynamic and competitive landscape. The report projects continued growth across various segments with varying rates based on market conditions and government policies.

Saudi Real Estate Industry Segmentation

-

1. Type

- 1.1. Offices

- 1.2. Retail

- 1.3. Industrial

- 1.4. Logistics

- 1.5. Multi-family

- 1.6. Hospitality

-

2. Key Cities

- 2.1. Riyadh

- 2.2. Jeddah

- 2.3. Makkah

Saudi Real Estate Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Saudi Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Spending on the Commercial Construction; Increasing Demand for Commercial Spaces Due to Increasing E-commerce

- 3.3. Market Restrains

- 3.3.1. Work-from-home Model; Materials and Labor Shortages

- 3.4. Market Trends

- 3.4.1. Rise in the retail sector in Riyadh driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Saudi Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Offices

- 5.1.2. Retail

- 5.1.3. Industrial

- 5.1.4. Logistics

- 5.1.5. Multi-family

- 5.1.6. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Riyadh

- 5.2.2. Jeddah

- 5.2.3. Makkah

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Saudi Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Offices

- 6.1.2. Retail

- 6.1.3. Industrial

- 6.1.4. Logistics

- 6.1.5. Multi-family

- 6.1.6. Hospitality

- 6.2. Market Analysis, Insights and Forecast - by Key Cities

- 6.2.1. Riyadh

- 6.2.2. Jeddah

- 6.2.3. Makkah

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Saudi Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Offices

- 7.1.2. Retail

- 7.1.3. Industrial

- 7.1.4. Logistics

- 7.1.5. Multi-family

- 7.1.6. Hospitality

- 7.2. Market Analysis, Insights and Forecast - by Key Cities

- 7.2.1. Riyadh

- 7.2.2. Jeddah

- 7.2.3. Makkah

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Saudi Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Offices

- 8.1.2. Retail

- 8.1.3. Industrial

- 8.1.4. Logistics

- 8.1.5. Multi-family

- 8.1.6. Hospitality

- 8.2. Market Analysis, Insights and Forecast - by Key Cities

- 8.2.1. Riyadh

- 8.2.2. Jeddah

- 8.2.3. Makkah

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Saudi Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Offices

- 9.1.2. Retail

- 9.1.3. Industrial

- 9.1.4. Logistics

- 9.1.5. Multi-family

- 9.1.6. Hospitality

- 9.2. Market Analysis, Insights and Forecast - by Key Cities

- 9.2.1. Riyadh

- 9.2.2. Jeddah

- 9.2.3. Makkah

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Saudi Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Offices

- 10.1.2. Retail

- 10.1.3. Industrial

- 10.1.4. Logistics

- 10.1.5. Multi-family

- 10.1.6. Hospitality

- 10.2. Market Analysis, Insights and Forecast - by Key Cities

- 10.2.1. Riyadh

- 10.2.2. Jeddah

- 10.2.3. Makkah

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Saudi Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Saudi Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Saudi Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. GCC Saudi Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Rest of the World Saudi Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 5 Abdul Latif Jameel

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Developers

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 1 Al Saedan Real Estate

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 2 Century 21 Saudi Arabia

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 1 JLL Riyadh

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 4 Jabal Omar

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 5 360 Realtors LLP Riyadh**List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 4 Nai Saudi Arabia

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 2 Kingdom Holding Company

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Other Companies (Real Estate Brokerage Firms Startups Associations etc )

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 3 SEDCO Development

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 3 Saudi Real Estate Company

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 6 Dar Ar Alkan

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 5 Abdul Latif Jameel

List of Figures

- Figure 1: Global Saudi Real Estate Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Saudi Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Saudi Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Asia Pacific Saudi Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Asia Pacific Saudi Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Saudi Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe Saudi Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: GCC Saudi Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: GCC Saudi Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Rest of the World Saudi Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Rest of the World Saudi Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Saudi Real Estate Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Saudi Real Estate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Saudi Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 15: North America Saudi Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 16: North America Saudi Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Saudi Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Saudi Real Estate Industry Revenue (Million), by Type 2024 & 2032

- Figure 19: South America Saudi Real Estate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 20: South America Saudi Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 21: South America Saudi Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 22: South America Saudi Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: South America Saudi Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Saudi Real Estate Industry Revenue (Million), by Type 2024 & 2032

- Figure 25: Europe Saudi Real Estate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 26: Europe Saudi Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 27: Europe Saudi Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 28: Europe Saudi Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Saudi Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East & Africa Saudi Real Estate Industry Revenue (Million), by Type 2024 & 2032

- Figure 31: Middle East & Africa Saudi Real Estate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 32: Middle East & Africa Saudi Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 33: Middle East & Africa Saudi Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 34: Middle East & Africa Saudi Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa Saudi Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Saudi Real Estate Industry Revenue (Million), by Type 2024 & 2032

- Figure 37: Asia Pacific Saudi Real Estate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 38: Asia Pacific Saudi Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 39: Asia Pacific Saudi Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 40: Asia Pacific Saudi Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific Saudi Real Estate Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Saudi Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Saudi Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Saudi Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Global Saudi Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Saudi Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Saudi Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Saudi Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Saudi Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Saudi Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Saudi Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Saudi Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 17: Global Saudi Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Canada Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Saudi Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Saudi Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 23: Global Saudi Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Brazil Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Argentina Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of South America Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Saudi Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Saudi Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 29: Global Saudi Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United Kingdom Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Germany Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Italy Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Spain Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Russia Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Benelux Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Nordics Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Saudi Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Saudi Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 41: Global Saudi Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Turkey Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Israel Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: GCC Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: North Africa Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Africa Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Middle East & Africa Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Saudi Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 49: Global Saudi Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 50: Global Saudi Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 51: China Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: India Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Japan Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Korea Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: ASEAN Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Oceania Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Rest of Asia Pacific Saudi Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Real Estate Industry?

The projected CAGR is approximately 8.65%.

2. Which companies are prominent players in the Saudi Real Estate Industry?

Key companies in the market include 5 Abdul Latif Jameel, Developers, 1 Al Saedan Real Estate, 2 Century 21 Saudi Arabia, 1 JLL Riyadh, 4 Jabal Omar, 5 360 Realtors LLP Riyadh**List Not Exhaustive, 4 Nai Saudi Arabia, 2 Kingdom Holding Company, Other Companies (Real Estate Brokerage Firms Startups Associations etc ), 3 SEDCO Development, 3 Saudi Real Estate Company, 6 Dar Ar Alkan.

3. What are the main segments of the Saudi Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Spending on the Commercial Construction; Increasing Demand for Commercial Spaces Due to Increasing E-commerce.

6. What are the notable trends driving market growth?

Rise in the retail sector in Riyadh driving the market.

7. Are there any restraints impacting market growth?

Work-from-home Model; Materials and Labor Shortages.

8. Can you provide examples of recent developments in the market?

May 2023: Rotana, one of the leading hotel management companies, has signed four 'Edge by Rotana' and one 'Rayhaan by Rotana' properties in partnership with Memar Development & Investment at the Future Hospitality Summit 2023. Rotana currently operates 73 hotels in the Middle East, Africa, Eastern Europe and Turkiye, serving more than six million guests per year, including 10,012 keys across 36 hotels in the UAE alone.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Real Estate Industry?

To stay informed about further developments, trends, and reports in the Saudi Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence