Key Insights

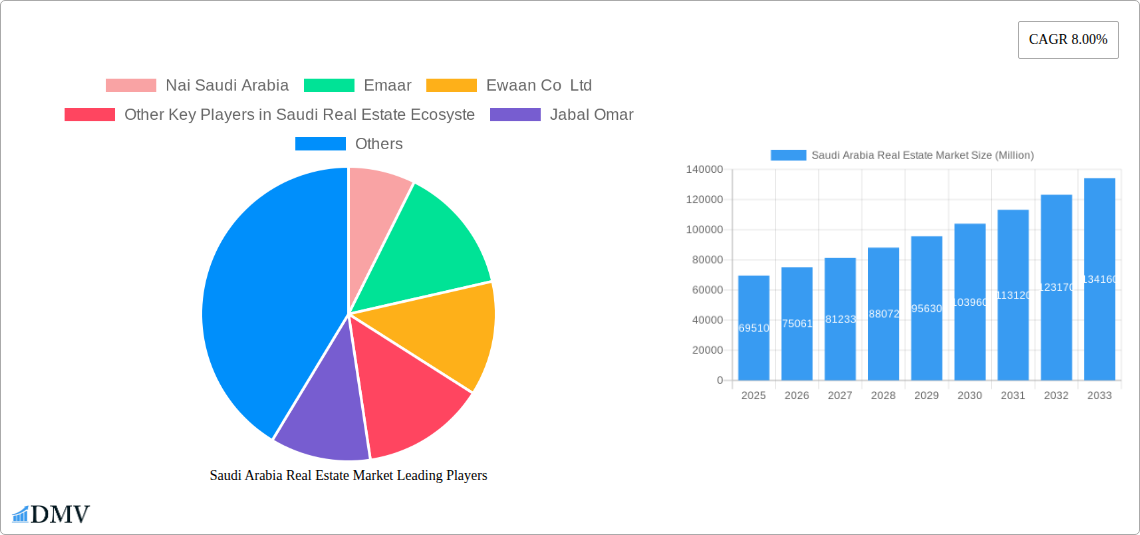

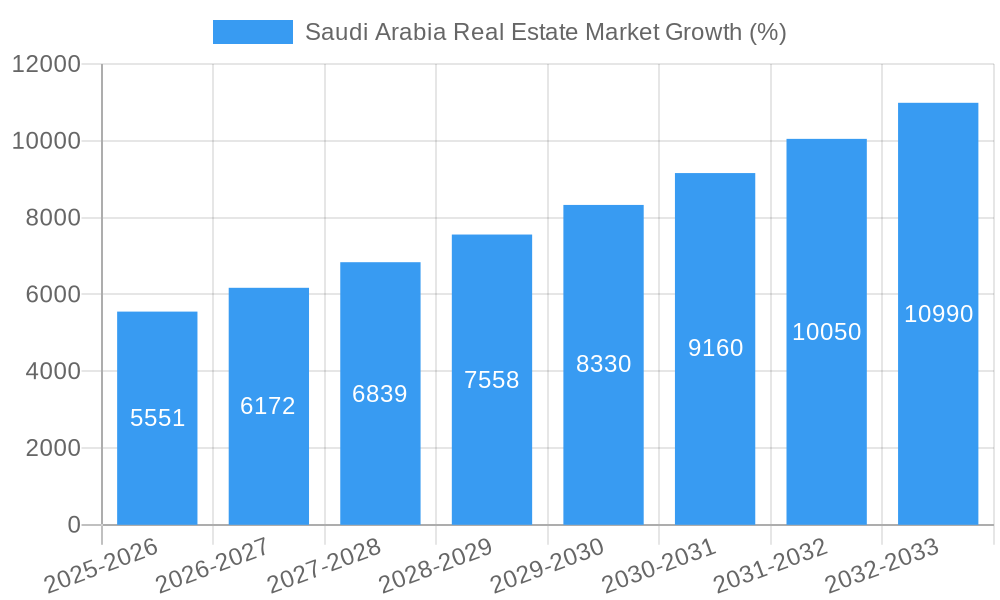

The Saudi Arabian real estate market, valued at $69.51 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8% from 2025 to 2033. This expansion is fueled by several key drivers. Government initiatives like Vision 2030, aimed at diversifying the economy and improving infrastructure, are significantly stimulating investment in both residential and commercial properties. A burgeoning population and increasing urbanization contribute to heightened demand, particularly in the residential sector. Furthermore, favorable financing options and a growing influx of foreign investment are bolstering market activity. The residential segment, encompassing both traditional housing and other types of residential properties, constitutes a substantial portion of the market, while the commercial sector benefits from increased business activity and the development of new economic zones. Competition within the market is dynamic, with major players like Emaar, Kingdom Holding Company, and JLL Riyadh vying for market share alongside numerous local and international firms. Potential restraints include fluctuations in oil prices and global economic conditions, which could impact investor sentiment and demand. However, the long-term outlook remains optimistic, given the government's commitment to sustainable development and diversification.

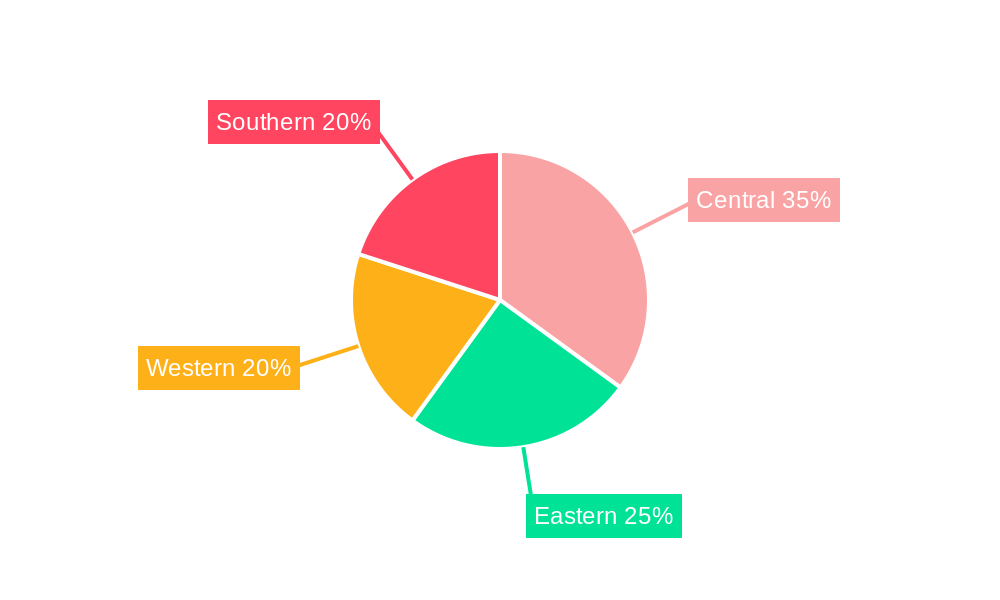

The regional distribution of the market reflects the varying levels of development and population density across Saudi Arabia. Regions like Central and Eastern Saudi Arabia, which contain major cities and economic hubs, are expected to dominate market share. However, significant investment is flowing into Western and Southern regions, indicating future potential growth in these areas. The segmentation of the market by property type (residential and commercial) allows for a granular understanding of growth dynamics within each sector. Analyzing these trends and regional variations provides crucial insights for stakeholders including investors, developers, and policymakers seeking opportunities in the dynamic Saudi Arabian real estate sector. The forecast period of 2025-2033 offers substantial opportunities, though careful consideration of market dynamics and potential risks is essential for successful navigation.

Saudi Arabia Real Estate Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Saudi Arabia real estate market, offering valuable insights for investors, stakeholders, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, growth drivers, and future opportunities within this dynamic sector. The report meticulously analyzes market composition, leading players, and key developments, offering a crucial roadmap for navigating the complexities of the Saudi Arabian real estate landscape.

Saudi Arabia Real Estate Market Composition & Trends

This section delves into the intricate structure of the Saudi Arabia real estate market, examining its concentration, innovative drivers, regulatory environment, substitute products, end-user profiles, and mergers and acquisitions (M&A) activity. The analysis considers market share distribution across key players and evaluates the financial impact of significant M&A deals. The market is characterized by a diverse range of players, from international giants to local developers, leading to a complex competitive landscape.

- Market Concentration: The market exhibits a moderately concentrated structure with key players such as Emaar, Jabal Omar, and Kingdom Holding Company holding significant market share, while numerous smaller players contribute to the overall market volume. Precise market share figures require further in-depth study, and are currently unavailable (xx%).

- Innovation Catalysts: Government initiatives promoting sustainable development and smart city projects are driving significant innovations in construction materials, design, and property management technologies.

- Regulatory Landscape: Government regulations and policies significantly impact market dynamics, including land ownership laws and building codes. These regulations are continually evolving, creating both challenges and opportunities for market participants.

- Substitute Products: Limited substitute products exist for real estate; however, factors such as economic conditions and changing lifestyle preferences can influence demand.

- End-User Profiles: The Saudi Arabian real estate market caters to a diverse range of end users, including residential buyers, commercial tenants, and investors. The profile of these end users varies significantly depending on the type of property (residential vs. commercial).

- M&A Activity: The sector has witnessed a moderate level of M&A activity in recent years, with deal values reaching several hundred Million USD. For example, SEDCO Capital REIT Fund's acquisition of two assets in 2022 valued at USD 187 Million illustrates this trend. Further analysis would be necessary to determine the average deal value and the number of deals over the study period.

Saudi Arabia Real Estate Market Industry Evolution

This section examines the evolution of the Saudi Arabia real estate market, analyzing growth trajectories, technological advancements, and shifting consumer demands from 2019 to 2033. The analysis incorporates specific data points to illustrate market growth rates and the adoption of new technologies. Key factors such as Vision 2030 and increasing urbanization have led to a significant increase in demand, while technological innovations are transforming the market and enhancing efficiency. The average annual growth rate (AAGR) from 2019 to 2024 is estimated at xx%, with a projected AAGR of xx% from 2025-2033. These projections account for expected fluctuations based on macroeconomic factors and ongoing government initiatives.

Leading Regions, Countries, or Segments in Saudi Arabia Real Estate Market

This section identifies the dominant segments within the Saudi Arabia real estate market, focusing on residential and commercial properties. The analysis highlights key drivers behind the dominance of specific regions or property types, drawing on investment trends and regulatory support.

- Key Drivers:

- Residential Real Estate: Strong population growth, government incentives for homeownership, and increasing disposable incomes are driving significant growth in the residential sector. Riyadh and Jeddah remain the most dominant regions for residential real estate development, driven by a high concentration of population and employment opportunities.

- Commercial Real Estate: The growth of the Saudi Arabian economy, particularly in sectors such as tourism, hospitality, and logistics, is fueling demand for commercial properties. Specific regions benefit from government investments and infrastructure development.

- Dominance Factors: The dominance of specific regions and property types is directly correlated to economic activity, government policy, and the availability of infrastructure.

Saudi Arabia Real Estate Market Product Innovations

Recent product innovations include the integration of smart home technology into residential properties, the development of sustainable building materials, and the rise of co-working spaces within the commercial sector. These innovations offer enhanced convenience, energy efficiency, and flexible work environments, which are proving highly attractive to consumers.

Propelling Factors for Saudi Arabia Real Estate Market Growth

Several factors contribute to the growth of the Saudi Arabia real estate market. Government initiatives like Vision 2030, aiming to diversify the economy and improve infrastructure, are significantly driving investment and development. The rising population and urbanization are also key drivers of increased demand. Furthermore, technological advancements in construction and property management enhance efficiency and sustainability.

Obstacles in the Saudi Arabia Real Estate Market Market

The Saudi Arabia real estate market faces challenges, including potential regulatory hurdles (specifically regarding construction permits and land acquisition), the impact of global economic uncertainty on investment flows, and intense competition amongst developers. Supply chain disruptions and material cost fluctuations can also impact development costs and project timelines. These challenges, although significant, are manageable through well-defined strategies and adaptation to dynamic market conditions.

Future Opportunities in Saudi Arabia Real Estate Market

Future opportunities abound in the Saudi Arabian real estate market, particularly in the sectors of sustainable development, affordable housing, and smart city initiatives. Emerging technologies such as Building Information Modeling (BIM) and the Internet of Things (IoT) present opportunities for increased efficiency and better property management. Moreover, the development of new cities and economic zones outside major urban centers could unlock substantial growth potential.

Major Players in the Saudi Arabia Real Estate Market Ecosystem

- Nai Saudi Arabia

- Emaar

- Ewaan Co Ltd

- Jabal Omar

- Kingdom Holding Company

- Jenan Real Estate Company

- Abdul Latif Jameel

- Sedco Development

- JLL Riyadh

- Dar Ar Alkan

- Century 21 Saudi Arabia

- Saudi Real Estate Company

- Al Saedan Real Estate

- Other Key Players in Saudi Real Estate Ecosystem (xx companies)

Key Developments in Saudi Arabia Real Estate Market Industry

- July 2022: SEDCO Capital REIT Fund acquired two income-generating real estate assets worth USD 187 Million, boosting its portfolio and positively impacting its performance.

- May 2023: The National Security Services Company (SAFE) acquired ABANA Enterprises Group Company's assets related to cash and valuable goods transit, signifying investment in security services within the real estate sector. This acquisition demonstrates the integration of security infrastructure into broader real estate development and management.

Strategic Saudi Arabia Real Estate Market Market Forecast

The Saudi Arabia real estate market is poised for continued growth driven by Vision 2030 initiatives, population growth, and technological advancements. The forecast period (2025-2033) anticipates a robust expansion, particularly in residential and commercial segments. Strategic investments in infrastructure and sustainable development will further propel market expansion. However, careful consideration of potential economic and regulatory factors is necessary for accurate forecasting and strategic planning.

Saudi Arabia Real Estate Market Segmentation

-

1. Property Type

-

1.1. Residential Real Estate

- 1.1.1. Apartments

- 1.1.2. Villas

-

1.2. Commercial Real Estate

- 1.2.1. Offices

- 1.2.2. Retail

- 1.2.3. Hospitality

- 1.2.4. Others

-

1.1. Residential Real Estate

Saudi Arabia Real Estate Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges

- 3.4. Market Trends

- 3.4.1. The Residential Sector Sustains Country's Real Estate Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Residential Real Estate

- 5.1.1.1. Apartments

- 5.1.1.2. Villas

- 5.1.2. Commercial Real Estate

- 5.1.2.1. Offices

- 5.1.2.2. Retail

- 5.1.2.3. Hospitality

- 5.1.2.4. Others

- 5.1.1. Residential Real Estate

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. Central Saudi Arabia Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Nai Saudi Arabia

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Emaar

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Ewaan Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Other Key Players in Saudi Real Estate Ecosyste

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Jabal Omar

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Kingdom Holding Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Jenan Real Estate Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Abdul Latif Jameel

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sedco Development

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 JLL Riyadh

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Dar Ar Alkan**List Not Exhaustive 6 3 Other Companies

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Century 21 Saudi Arabia

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Saudi Real Estate Company

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Al Saedan Real Estate

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Nai Saudi Arabia

List of Figures

- Figure 1: Saudi Arabia Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Real Estate Market Revenue Million Forecast, by Property Type 2019 & 2032

- Table 3: Saudi Arabia Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Saudi Arabia Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Central Saudi Arabia Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Eastern Saudi Arabia Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Saudi Arabia Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Saudi Arabia Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Real Estate Market Revenue Million Forecast, by Property Type 2019 & 2032

- Table 10: Saudi Arabia Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Real Estate Market?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Saudi Arabia Real Estate Market?

Key companies in the market include Nai Saudi Arabia, Emaar, Ewaan Co Ltd, Other Key Players in Saudi Real Estate Ecosyste, Jabal Omar, Kingdom Holding Company, Jenan Real Estate Company, Abdul Latif Jameel, Sedco Development, JLL Riyadh, Dar Ar Alkan**List Not Exhaustive 6 3 Other Companies, Century 21 Saudi Arabia, Saudi Real Estate Company, Al Saedan Real Estate.

3. What are the main segments of the Saudi Arabia Real Estate Market?

The market segments include Property Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 69.51 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units.

6. What are the notable trends driving market growth?

The Residential Sector Sustains Country's Real Estate Market.

7. Are there any restraints impacting market growth?

4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges.

8. Can you provide examples of recent developments in the market?

May 2023, The National Security Services Company (SAFE), which leads the transformation of the local security services sector, has signed an acquisition agreement to acquire ABANA Enterprises Group Company's assets connected to the transit of cash and valuable goods. ABANA Enterprises Group Company is at the forefront of providing such services in the Kingdom. The acquisition of ABANA Enterprises Group Company's assets connected to the transit of cash and valuable goods will help SAFE achieve its primary goal of providing the most advanced security solutions and services for customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Real Estate Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence