Key Insights

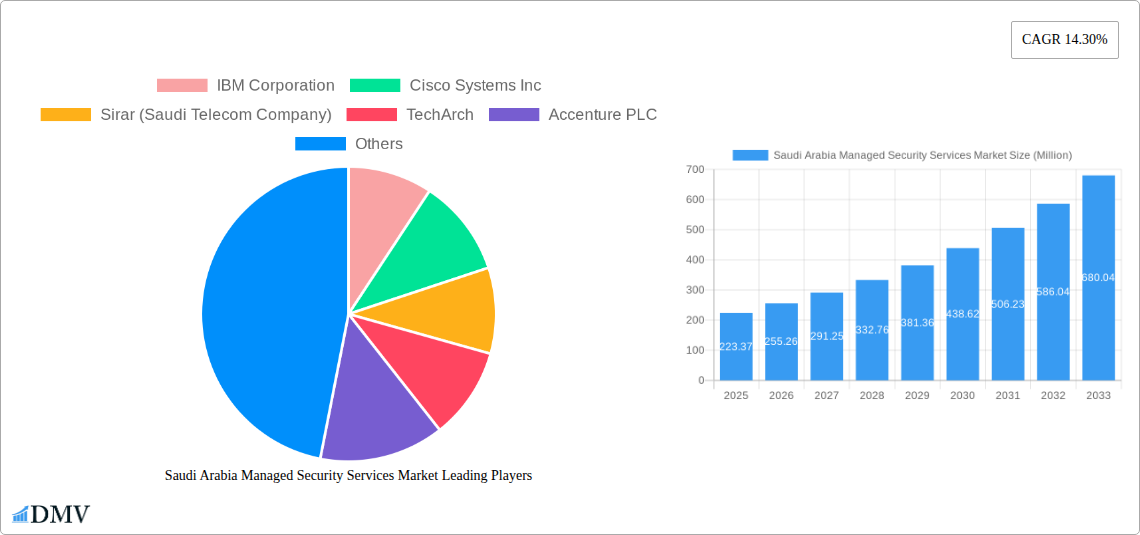

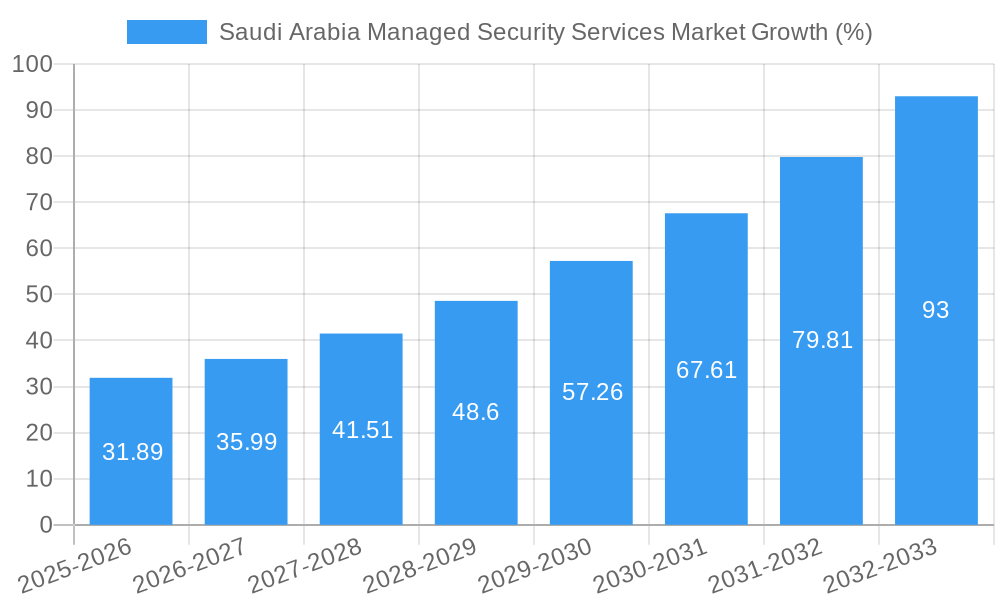

The Saudi Arabia Managed Security Services Market is experiencing robust growth, projected to reach \$223.37 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 14.30% from 2025 to 2033. This expansion is fueled by several key factors. The Kingdom's ongoing digital transformation initiatives, coupled with increasing government investments in cybersecurity infrastructure and a burgeoning adoption of cloud computing, are driving demand for sophisticated managed security services. Furthermore, the rising frequency and severity of cyber threats targeting both public and private sectors necessitate proactive security measures. Major players like IBM, Cisco, and Accenture are strategically positioned to capitalize on this growth, offering a wide array of services including threat detection and response, security information and event management (SIEM), vulnerability management, and cloud security. The presence of numerous local players like Saudi Telecom Company and Saudi Business Machines Ltd. indicates a growing local ecosystem capable of supporting the market's rapid expansion. The market segmentation, while not explicitly detailed, likely includes services based on deployment (cloud, on-premise), organization size (small, medium, large enterprises), and service type (security monitoring, incident response, vulnerability management). The continued growth is expected to be driven by increasing awareness of cybersecurity risks, stringent government regulations, and a growing emphasis on data privacy.

The market's considerable growth potential stems from Saudi Arabia's commitment to Vision 2030, which prioritizes technological advancement and diversification of the economy. This ambitious plan necessitates robust cybersecurity to protect critical infrastructure and sensitive data. The increasing reliance on digital technologies across all sectors, including finance, healthcare, and energy, translates into heightened vulnerability to cyberattacks. Consequently, organizations are increasingly outsourcing their security needs to specialized managed security service providers, resulting in substantial market expansion. While challenges like the need for skilled cybersecurity professionals and the evolving nature of cyber threats remain, the overall market outlook for managed security services in Saudi Arabia remains exceptionally positive, promising sustained high growth throughout the forecast period.

Saudi Arabia Managed Security Services Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Saudi Arabia Managed Security Services Market, offering a comprehensive overview of its current state, future trends, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving market. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Saudi Arabia Managed Security Services Market Composition & Trends

The Saudi Arabia Managed Security Services market is experiencing significant growth driven by increasing digitalization, stringent government regulations, and rising cyber threats. Market concentration is currently moderate, with several major players and a number of smaller, specialized firms. Innovation is largely driven by the need for advanced threat detection and response capabilities, particularly in areas like cloud security and IoT. The regulatory landscape, shaped by the Kingdom's Vision 2030 and the National Cybersecurity Strategy, is increasingly supportive of the growth of the managed security services sector. Substitute products include in-house security teams, but the increasing complexity of cyber threats is fueling demand for specialized external expertise. End-users span various sectors, with significant demand from government agencies, financial institutions, and the burgeoning telecommunications sector. M&A activity is picking up, with deal values exceeding xx Million in the past five years, reflecting consolidation and expansion strategies by major players.

- Market Share Distribution (2024): IBM Corporation (xx%), Cisco Systems Inc. (xx%), Sirar (Saudi Telecom Company) (xx%), Others (xx%). Exact figures are unavailable for this report.

- M&A Activity (2019-2024): A total of xx deals with a combined value exceeding xx Million. Specific deal values and companies involved are not readily available for this report.

Saudi Arabia Managed Security Services Market Industry Evolution

The Saudi Arabia Managed Security Services market has witnessed exponential growth over the past five years (2019-2024), fueled by increasing government investments in digital infrastructure and the growing awareness of cybersecurity risks. Technological advancements, such as AI-powered threat intelligence and automation, have improved efficiency and effectiveness. Shifting consumer demands are increasingly focused on proactive security measures, cloud-based solutions, and comprehensive risk management. The market is projected to exhibit strong growth throughout the forecast period (2025-2033), driven by continued digital transformation and the adoption of advanced security technologies. The adoption rate of cloud-based managed security services is expected to increase from xx% in 2024 to xx% by 2033. Growth rates for the market are estimated at xx% in 2025, and are predicted to fluctuate over the forecast period, with an average CAGR of xx%.

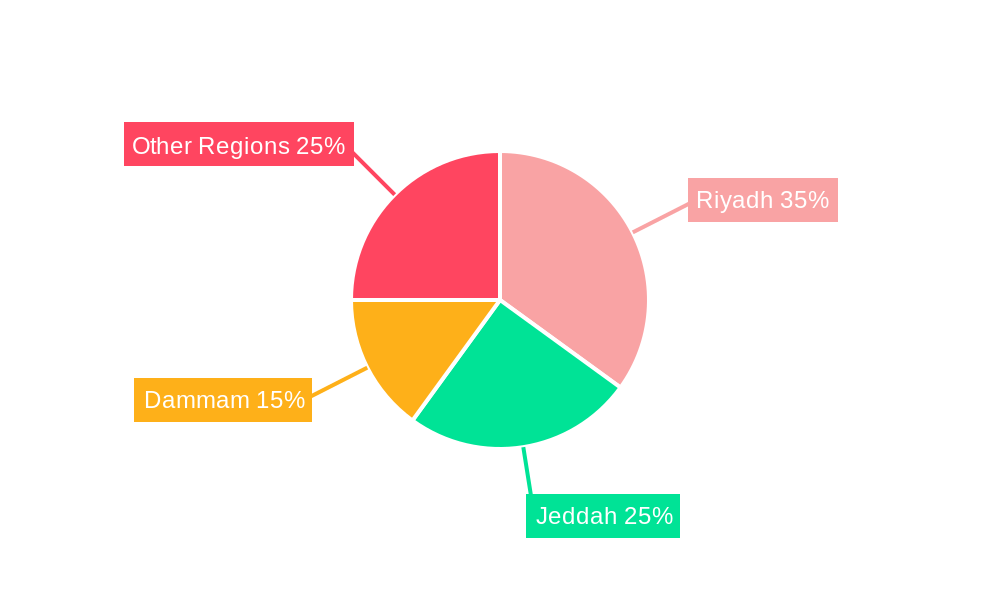

Leading Regions, Countries, or Segments in Saudi Arabia Managed Security Services Market

The Riyadh region currently dominates the Saudi Arabia Managed Security Services market, driven by its concentration of businesses, government agencies, and IT infrastructure. This dominance is reinforced by significant government investment in cybersecurity infrastructure and initiatives.

- Key Drivers for Riyadh's Dominance:

- High concentration of businesses and government entities.

- Significant investments in cybersecurity infrastructure.

- Presence of major managed security service providers.

- Strong regulatory support for cybersecurity enhancements.

The continued growth of the financial services and government sectors, along with substantial investments in digital transformation initiatives nationwide, are major factors contributing to the overall market dominance. The increasing sophistication of cyber threats is further fueling demand for advanced managed security services across all regions. The Eastern Province also shows promising growth potential given the expansion of its industrial sector.

Saudi Arabia Managed Security Services Market Product Innovations

Recent product innovations focus on AI-driven threat detection, automation of security operations, and integrated cloud security solutions. These offer enhanced threat visibility, reduced response times, and improved overall security posture. Unique selling propositions include customized solutions tailored to specific industry needs, proactive threat hunting capabilities, and managed security services delivered through secure cloud platforms. Key performance metrics include reduced security incidents, faster threat response times, and improved compliance with industry regulations.

Propelling Factors for Saudi Arabia Managed Security Services Market Growth

The Saudi Arabia Managed Security Services market is experiencing rapid growth due to several factors:

- Government Initiatives: Vision 2030's digital transformation initiatives and the National Cybersecurity Strategy are driving investment in cybersecurity infrastructure and services.

- Technological Advancements: AI-powered threat detection and automation are improving the efficiency and effectiveness of managed security services.

- Economic Growth: The Kingdom's strong economic growth is fueling investment in IT infrastructure and increasing the demand for robust cybersecurity solutions.

Obstacles in the Saudi Arabia Managed Security Services Market

The market faces challenges such as:

- Skills Gap: A shortage of skilled cybersecurity professionals limits the availability of qualified personnel.

- Cost: Implementing advanced managed security solutions can be expensive for some organizations.

- Competition: The market is becoming increasingly competitive, with both local and international players vying for market share.

Future Opportunities in Saudi Arabia Managed Security Services Market

Future opportunities include:

- Expansion into new sectors: Untapped potential in sectors like healthcare and education.

- Emerging technologies: Adoption of advanced technologies like extended detection and response (XDR) and zero trust security.

- Growth in cloud-based services: Increasing adoption of cloud-based managed security solutions.

Major Players in the Saudi Arabia Managed Security Services Market Ecosystem

- IBM Corporation

- Cisco Systems Inc

- Sirar (Saudi Telecom Company)

- TechArch

- Accenture PLC

- Capgemini SE

- SecurityHQ

- SecureWorks Corp

- Arabic Computer Systems (ACS)

- Eviden (Atos SE)

- Saudi Information Technology Company (SITE) (Public Investment Fund)

- Saudi Business Machines Ltd

- Innovative Solutions

- IT Security Training & Solutions I(TS)

- Cipher

- List Not Exhaustive

Key Developments in Saudi Arabia Managed Security Services Market Industry

- March 2024: Saudi Information Technology Company (SITE) and SITE Ventures invested over SAR 500 Million (approximately xx Million USD) in AhnLab Inc. to deploy and localize cybersecurity technologies across Saudi Arabia and the MENA region. This significantly boosts the Kingdom's cybersecurity capabilities and strengthens the market.

- March 2024: Emircom opened its EiSoC in Riyadh and received certification to deliver Cisco's XDR Managed Services. This expands the availability of advanced managed security services and enhances the overall security posture of organizations in the region.

Strategic Saudi Arabia Managed Security Services Market Forecast

The Saudi Arabia Managed Security Services market is poised for continued strong growth, driven by government initiatives, technological advancements, and the increasing awareness of cyber risks. Future opportunities lie in the expansion into new sectors, the adoption of emerging technologies, and the growth of cloud-based services. The market's potential is substantial, and strategic investments in cybersecurity infrastructure and talent development will be crucial for realizing this potential.

Saudi Arabia Managed Security Services Market Segmentation

-

1. Service

- 1.1. Managed Detection and Response (MDR)

- 1.2. Security Information and Event Management (SIEM)

- 1.3. Managed Identity and Access Management (IAM)

- 1.4. Vulnerability Management

- 1.5. Other Services

-

2. Size of Enterprises

- 2.1. Large Enterprises

- 2.2. Small and Medium-sized Enterprises (SMEs)

-

3. End-user Industry

- 3.1. IT and Telecom

- 3.2. BFSI

- 3.3. Retail and E-commerce

- 3.4. Construction and Real Estate

- 3.5. Government and Defense

- 3.6. Energy, Oil, and Gas

- 3.7. Other End-user Industries

Saudi Arabia Managed Security Services Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Managed Security Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Cybercrime

- 3.2.2 Digital Disruption

- 3.2.3 and Increased Compliance Demands; Growing Adoption of Cloud-based Technologies and Work-from-anywhere Initiatives; Increasing Sophistication of Attacks and Impact on Critical Infrastructure; Rapid Rise in Data Flow Considering the Customer-centric Approach of Industries; Advantage of Organizations Focus on Core Operations Through Seamless Service by MSSPs

- 3.3. Market Restrains

- 3.3.1 Rising Cybercrime

- 3.3.2 Digital Disruption

- 3.3.3 and Increased Compliance Demands; Growing Adoption of Cloud-based Technologies and Work-from-anywhere Initiatives; Increasing Sophistication of Attacks and Impact on Critical Infrastructure; Rapid Rise in Data Flow Considering the Customer-centric Approach of Industries; Advantage of Organizations Focus on Core Operations Through Seamless Service by MSSPs

- 3.4. Market Trends

- 3.4.1. Managed Detection and Response (MDR) Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Managed Security Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Managed Detection and Response (MDR)

- 5.1.2. Security Information and Event Management (SIEM)

- 5.1.3. Managed Identity and Access Management (IAM)

- 5.1.4. Vulnerability Management

- 5.1.5. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprises

- 5.2.1. Large Enterprises

- 5.2.2. Small and Medium-sized Enterprises (SMEs)

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Telecom

- 5.3.2. BFSI

- 5.3.3. Retail and E-commerce

- 5.3.4. Construction and Real Estate

- 5.3.5. Government and Defense

- 5.3.6. Energy, Oil, and Gas

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cisco Systems Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sirar (Saudi Telecom Company)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TechArch

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Accenture PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Capgemini SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SecurityHQ

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SecureWorks Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Arabic Computer Systems (ACS)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eviden (Atos SE)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Saudi Information Technology Company (SITE) (Public Investment Fund)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Saudi Business Machines Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Innovative Solutions

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 IT Security Training & Solutions I(TS)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Cipher*List Not Exhaustive

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Saudi Arabia Managed Security Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Managed Security Services Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Managed Security Services Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by Service 2019 & 2032

- Table 4: Saudi Arabia Managed Security Services Market Volume Million Forecast, by Service 2019 & 2032

- Table 5: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by Size of Enterprises 2019 & 2032

- Table 6: Saudi Arabia Managed Security Services Market Volume Million Forecast, by Size of Enterprises 2019 & 2032

- Table 7: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Saudi Arabia Managed Security Services Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 9: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Saudi Arabia Managed Security Services Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by Service 2019 & 2032

- Table 12: Saudi Arabia Managed Security Services Market Volume Million Forecast, by Service 2019 & 2032

- Table 13: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by Size of Enterprises 2019 & 2032

- Table 14: Saudi Arabia Managed Security Services Market Volume Million Forecast, by Size of Enterprises 2019 & 2032

- Table 15: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: Saudi Arabia Managed Security Services Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Saudi Arabia Managed Security Services Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Managed Security Services Market?

The projected CAGR is approximately 14.30%.

2. Which companies are prominent players in the Saudi Arabia Managed Security Services Market?

Key companies in the market include IBM Corporation, Cisco Systems Inc, Sirar (Saudi Telecom Company), TechArch, Accenture PLC, Capgemini SE, SecurityHQ, SecureWorks Corp, Arabic Computer Systems (ACS), Eviden (Atos SE), Saudi Information Technology Company (SITE) (Public Investment Fund), Saudi Business Machines Ltd, Innovative Solutions, IT Security Training & Solutions I(TS), Cipher*List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Managed Security Services Market?

The market segments include Service, Size of Enterprises, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 223.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Cybercrime. Digital Disruption. and Increased Compliance Demands; Growing Adoption of Cloud-based Technologies and Work-from-anywhere Initiatives; Increasing Sophistication of Attacks and Impact on Critical Infrastructure; Rapid Rise in Data Flow Considering the Customer-centric Approach of Industries; Advantage of Organizations Focus on Core Operations Through Seamless Service by MSSPs.

6. What are the notable trends driving market growth?

Managed Detection and Response (MDR) Witness Major Growth.

7. Are there any restraints impacting market growth?

Rising Cybercrime. Digital Disruption. and Increased Compliance Demands; Growing Adoption of Cloud-based Technologies and Work-from-anywhere Initiatives; Increasing Sophistication of Attacks and Impact on Critical Infrastructure; Rapid Rise in Data Flow Considering the Customer-centric Approach of Industries; Advantage of Organizations Focus on Core Operations Through Seamless Service by MSSPs.

8. Can you provide examples of recent developments in the market?

March 2024: Saudi Information Technology Company (SITE), a Public Investment Fund (PIF) entity and the national provider of cybersecurity, along with its subsidiary SITE Ventures, forged a dual investment exceeding SAR 500 million with AhnLab Inc., a cybersecurity firm based in South Korea, to collaborate with SITE and SITE Ventures. The aim is to deploy and localize various cybersecurity technologies in the Kingdom of Saudi Arabia and all throughout the broader Middle East & North Africa region.March 2024: Emircom announced the opening of its fully equipped Emircom Intelligent Security Operations Center (EiSoC) in Riyadh, Saudi Arabia, and received certification to deliver Cisco's Extended Detection and Response (XDR) Managed Services. This expansion reflects Emircom's commitment to enhancing cybersecurity defenses and provides a comprehensive suite of services aimed at protecting organizations' information systems from evolving threats.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Managed Security Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Managed Security Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Managed Security Services Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Managed Security Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence