Key Insights

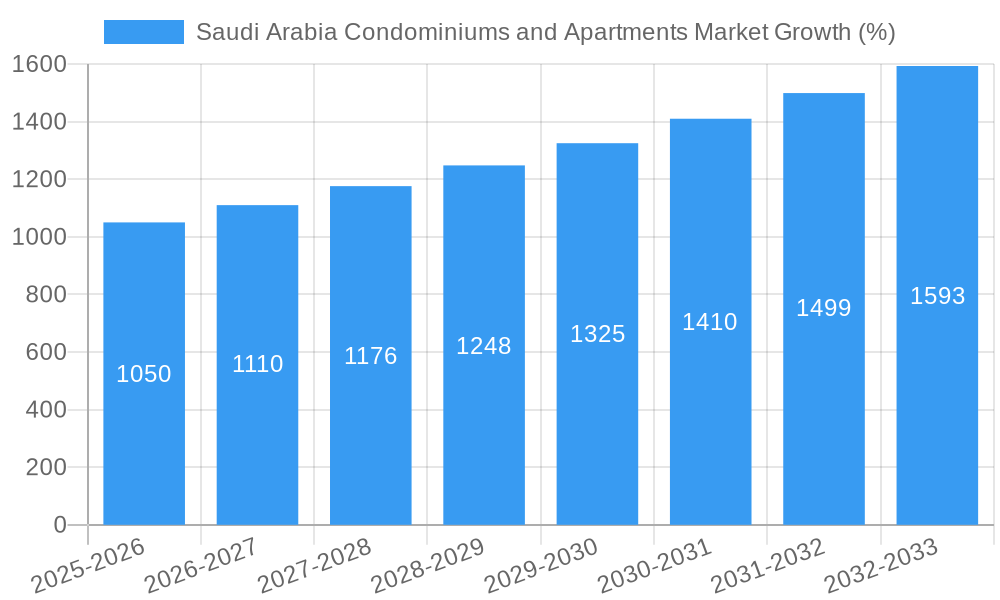

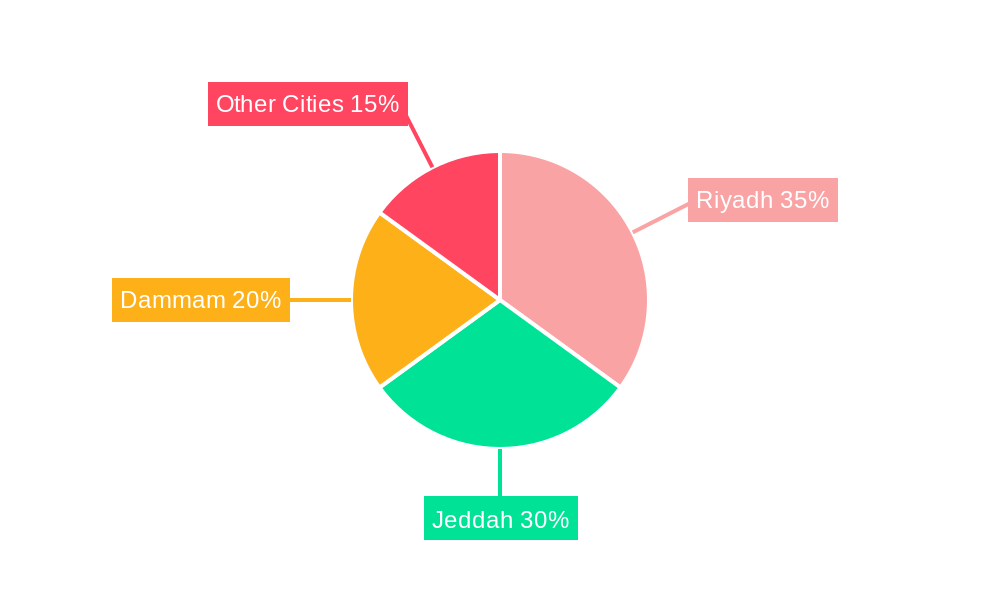

The Saudi Arabian condominiums and apartments market is experiencing robust growth, driven by a burgeoning population, rising urbanization, and government initiatives aimed at boosting housing development. The market, valued at approximately $XX million in 2025 (assuming a reasonable market size based on the provided CAGR and other market indicators), is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 7% through 2033. Key growth drivers include the Vision 2030 national development plan, which prioritizes infrastructure development and affordable housing, and a growing middle class with increased disposable income seeking modern housing options. Furthermore, tourism development and large-scale infrastructure projects are stimulating demand in major cities like Riyadh, Jeddah, and Dammam. The market is segmented geographically, with Riyadh, Jeddah, and the Dammam Metropolitan Area commanding the largest shares. Prominent developers such as Al Ra'idah Investment Company, Kingdom Holding Company, and Dar AI Arkan are shaping the market landscape, offering a variety of condominium and apartment projects to cater to diverse needs and price points. While the market faces certain restraints such as land scarcity and fluctuating construction costs, the overall outlook remains positive, indicating substantial investment opportunities in the coming years.

Despite these positive trends, challenges persist. The availability of affordable housing remains a key concern, especially for lower and middle-income families. Regulatory frameworks concerning property ownership and development approvals also require continued refinement to streamline the process and foster investor confidence. Competition amongst developers is intensifying, necessitating innovative project designs, strategic partnerships, and effective marketing strategies to secure market share. However, the long-term outlook for the Saudi Arabian condominium and apartment market remains optimistic, fueled by ongoing government support, population growth, and the expanding middle class, paving the way for continued expansion and development throughout the forecast period.

Saudi Arabia Condominiums and Apartments Market: A Comprehensive Forecast (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Saudi Arabia condominiums and apartments market, offering a comprehensive overview of market trends, key players, and future growth projections from 2019 to 2033. With a focus on the Base Year 2025 and an Estimated Year of 2025, this report is an indispensable resource for investors, developers, and industry stakeholders seeking to navigate this dynamic market. The forecast period spans from 2025 to 2033, building upon historical data from 2019-2024.

Saudi Arabia Condominiums and Apartments Market Composition & Trends

This section evaluates the competitive landscape, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user demographics, and merger & acquisition (M&A) activities within the Saudi Arabian condominium and apartment market. The report assesses market share distribution among key players, including Al Ra'idah Investment Company, Kingdom Holding Company, Dar AI Arkan, SEDCO Development, Ewaan, AL Nassar, AI Sedan, Rafal Real Estate Development Company, Alfirah United Company for Real Estate, and Al Saedan Real Estate (list not exhaustive). We analyze the impact of government regulations on market growth and the role of technological innovations in shaping consumer preferences. The analysis includes a detailed examination of M&A deal values, providing crucial insights into market consolidation and strategic partnerships. We delve into the evolving end-user profiles, identifying key demographic shifts and their influence on demand. Expected M&A deal values for the period are estimated at XX Million. Market share distribution in 2025 is predicted to be as follows:

- Top 3 Players: XX% combined market share.

- Remaining Players: XX% combined market share.

Saudi Arabia Condominiums and Apartments Market Industry Evolution

This section provides a comprehensive analysis of the evolution of the Saudi Arabian condominiums and apartments market, examining growth trajectories from 2019 to 2033. It explores the interplay of technological advancements, such as smart home integration and sustainable building practices, and shifting consumer preferences, such as demand for luxury amenities and prime locations. We detail the market's response to macroeconomic factors, government initiatives, and evolving lifestyle choices. Data points illustrating the market's dynamic nature will include year-on-year growth rates and adoption rates of new technologies. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be XX%. Key factors influencing this growth include: increased urbanization, government support for affordable housing initiatives, and the rising disposable incomes of the Saudi population. The report also meticulously examines the impact of Vision 2030 on the market's expansion and diversification.

Leading Regions, Countries, or Segments in Saudi Arabia Condominiums and Apartments Market

This section identifies the leading segments within the Saudi Arabian condominiums and apartments market, focusing on the key cities of Riyadh, Jeddah, and the Dammam Metropolitan Area, alongside "Other Cities." Each region's contribution to overall market growth is analyzed in detail.

Dominant Region: Riyadh

- Key Drivers: High concentration of employment opportunities, robust infrastructure development, and substantial government investments in real estate projects.

- Dominance Factors: Riyadh's status as the capital city, combined with its burgeoning population and economic activity, positions it as the most dominant market segment. This is further fueled by large-scale urban development projects that are driving significant demand for residential properties.

Jeddah and Dammam Metropolitan Area

- Key Drivers: Strong tourism sectors in Jeddah, and industrial growth in the Dammam area.

Other Cities

- Key Drivers: Emerging economic centers attracting both domestic and international investment.

The report provides a comparative analysis of these regions, highlighting factors driving their respective growth trajectories and identifying potential opportunities and challenges for each.

Saudi Arabia Condominiums and Apartments Market Product Innovations

Recent innovations in the Saudi Arabian condominium and apartment market include the integration of smart home technology, sustainable building materials, and the development of unique architectural designs catering to diverse lifestyles. These innovations are aimed at enhancing the overall living experience and increasing the value proposition for residents. The adoption of smart home technologies, for instance, is projected to reach XX% by 2033, driven by rising consumer demand for convenience and energy efficiency. Unique selling propositions such as unparalleled views, high-end amenities, and eco-friendly features are becoming increasingly important in attracting buyers.

Propelling Factors for Saudi Arabia Condominiums and Apartments Market Growth

Several factors are driving the growth of the Saudi Arabia condominiums and apartments market. These include supportive government policies fostering real estate investment, a growing population requiring more housing, increasing urbanization rates leading to higher demand for apartments in cities, and rising disposable incomes amongst the population. Furthermore, significant infrastructure development projects and the ongoing diversification of the Saudi economy further bolster market growth.

Obstacles in the Saudi Arabia Condominiums and Apartments Market

Challenges facing the market include the potential for supply chain disruptions impacting construction timelines and costs, and intense competition among developers. Regulatory complexities and obtaining necessary permits can also pose obstacles. Fluctuations in oil prices and macroeconomic factors can also influence investor confidence and market stability.

Future Opportunities in Saudi Arabia Condominiums and Apartments Market

Future opportunities lie in the development of sustainable and affordable housing solutions, expansion into new cities, and leveraging technological innovations to enhance the residential experience. Targeting specific niche markets, such as eco-conscious buyers or luxury apartment seekers, presents further growth potential. The government's Vision 2030 initiative provides a strong framework for long-term growth.

Major Players in the Saudi Arabia Condominiums and Apartments Market Ecosystem

- Al Ra'idah Investment Company

- Kingdom Holding Company

- Dar AI Arkan

- SEDCO Development

- Ewaan

- AL Nassar

- AI Sedan

- Rafal Real Estate Development Company

- Alfirah United Company for Real Estate

- Al Saedan Real Estate

Key Developments in Saudi Arabia Condominiums and Apartments Market Industry

- 2022 Q4: Launch of a new luxury condominium complex in Riyadh by Dar AI Arkan.

- 2023 Q1: Kingdom Holding Company announces a major investment in affordable housing projects in Jeddah.

- 2023 Q2: Acquisition of a regional developer by SEDCO Development. (Further details pending)

Strategic Saudi Arabia Condominiums and Apartments Market Forecast

The Saudi Arabia condominiums and apartments market is poised for sustained growth throughout the forecast period, driven by robust economic fundamentals and supportive government policies. Continued urbanization, rising disposable incomes, and the ongoing implementation of Vision 2030 will create significant opportunities for developers and investors alike. The market's dynamic nature presents considerable potential for innovative products and services that cater to the evolving needs and preferences of Saudi residents.

Saudi Arabia Condominiums and Apartments Market Segmentation

-

1. City

- 1.1. Riyadh

- 1.2. Jeddah

- 1.3. Dammam Metropolitan Area

- 1.4. Other Cities

Saudi Arabia Condominiums and Apartments Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urabanization4.; Increasing government investments

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market

- 3.4. Market Trends

- 3.4.1. Increasing Demand in Saudi Arabia's Apartment Rental Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by City

- 5.1.1. Riyadh

- 5.1.2. Jeddah

- 5.1.3. Dammam Metropolitan Area

- 5.1.4. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by City

- 6. Central Saudi Arabia Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Al Ra'idah Investment Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kingdom Holding Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dar AI Arkan

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SEDCO Development

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Ewaan

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 AL Nassar**List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 AI Sedan

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Rafal Real Estate Development Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Alfirah United Company for Real Estate

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Al Saedan Real Estate

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Al Ra'idah Investment Company

List of Figures

- Figure 1: Saudi Arabia Condominiums and Apartments Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Condominiums and Apartments Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Condominiums and Apartments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Condominiums and Apartments Market Revenue Million Forecast, by City 2019 & 2032

- Table 3: Saudi Arabia Condominiums and Apartments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Saudi Arabia Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Central Saudi Arabia Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Eastern Saudi Arabia Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Saudi Arabia Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Saudi Arabia Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Condominiums and Apartments Market Revenue Million Forecast, by City 2019 & 2032

- Table 10: Saudi Arabia Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Condominiums and Apartments Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Saudi Arabia Condominiums and Apartments Market?

Key companies in the market include Al Ra'idah Investment Company, Kingdom Holding Company, Dar AI Arkan, SEDCO Development, Ewaan, AL Nassar**List Not Exhaustive, AI Sedan, Rafal Real Estate Development Company, Alfirah United Company for Real Estate, Al Saedan Real Estate.

3. What are the main segments of the Saudi Arabia Condominiums and Apartments Market?

The market segments include City.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urabanization4.; Increasing government investments.

6. What are the notable trends driving market growth?

Increasing Demand in Saudi Arabia's Apartment Rental Market.

7. Are there any restraints impacting market growth?

4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence