Key Insights

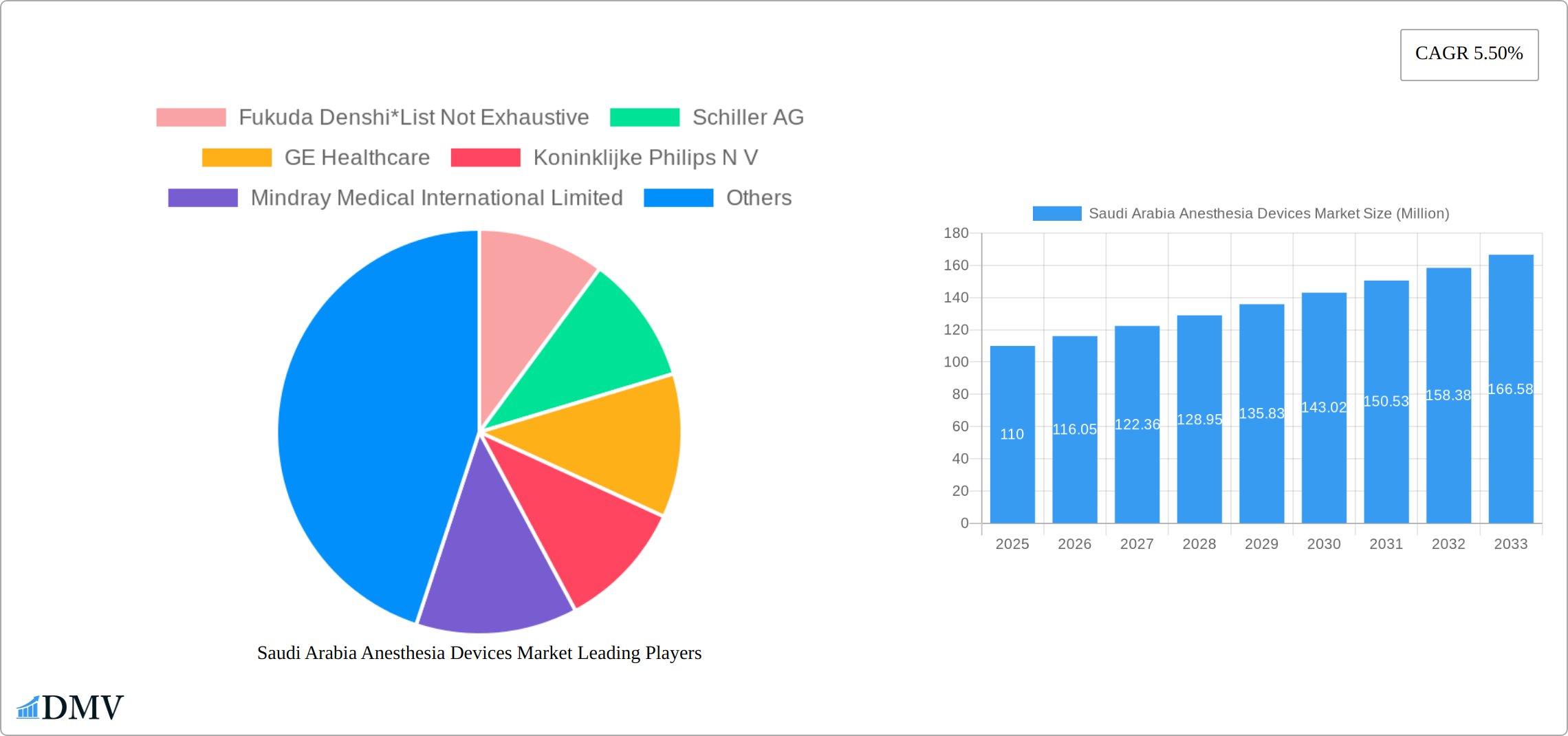

The Saudi Arabian anesthesia devices market is experiencing robust growth, driven by a rising prevalence of chronic diseases necessitating surgical procedures, increasing geriatric population, and a government focus on improving healthcare infrastructure. The market's Compound Annual Growth Rate (CAGR) of 5.50% from 2019 to 2024 suggests a consistently expanding demand for anesthesia machines, disposables, and accessories. The segmentation reveals a significant portion of the market is dedicated to disposables such as anesthesia circuits, masks, endotracheal tubes (ETTs), and laryngeal mask airways (LMAs), reflecting the consumable nature of these products and the high volume of procedures performed. Key players, including Fukuda Denshi, Schiller AG, GE Healthcare, Philips, Mindray, Cardinal Health, Medtronic, Dräger, and Nihon Kohden, are actively competing in this market, driving innovation and offering a range of advanced technologies. The regional distribution across Central, Eastern, Western, and Southern Saudi Arabia indicates potential for further expansion, especially in areas with developing healthcare infrastructure. Considering the 5.5% CAGR from 2019-2024 and projecting conservatively, we can estimate a market size exceeding $100 million in 2025, with continued growth anticipated through 2033, driven by factors including advancements in minimally invasive surgeries, technological innovation, and ongoing investments in the healthcare sector.

The market's growth is further bolstered by government initiatives to enhance healthcare access and quality. This involves increased investments in hospitals and medical facilities, as well as training programs for medical professionals. However, potential restraints include price sensitivity in certain market segments, stringent regulatory requirements for medical device approvals, and competition from both established international players and emerging domestic companies. Despite these challenges, the long-term outlook for the Saudi Arabian anesthesia devices market remains positive, with continued expansion predicted based on the country's growing population, economic development, and commitment to advancing healthcare standards. The diverse product segments, coupled with the presence of both global and regional players, creates a dynamic and competitive landscape that will shape future market trends.

Saudi Arabia Anesthesia Devices Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Saudi Arabia anesthesia devices market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025 as the base and estimated year, this study is essential for stakeholders seeking to understand this dynamic market. The report meticulously examines market size, segmentation, growth drivers, challenges, and opportunities, providing actionable intelligence for strategic decision-making. The total market value in 2025 is estimated at XXX Million, with projections extending to 2033.

Saudi Arabia Anesthesia Devices Market Composition & Trends

This section dissects the competitive landscape of the Saudi Arabian anesthesia devices market, evaluating market concentration and identifying key trends influencing its evolution. The market is characterized by a mix of multinational corporations and regional players, resulting in a moderately concentrated market. Market share distribution among the top five players is estimated at approximately 60% in 2025, with significant potential for consolidation through mergers and acquisitions (M&A). Recent M&A activity valued at approximately XXX Million reflects this trend. The regulatory environment plays a crucial role, with stringent standards impacting product approvals and market entry. Substitute products, although limited, pose a minor challenge to market growth. The primary end-users are hospitals and ambulatory surgical centers, with a growing demand driven by increasing surgical procedures and rising prevalence of chronic diseases.

- Market Concentration: Moderately concentrated, with top 5 players holding ~60% market share (2025).

- Innovation Catalysts: Technological advancements in minimally invasive surgeries and increasing adoption of advanced anesthesia techniques.

- Regulatory Landscape: Stringent regulatory approvals and compliance requirements.

- Substitute Products: Limited, posing minimal competitive threat.

- End-User Profiles: Predominantly hospitals and ambulatory surgical centers.

- M&A Activity: Recent deals valued at approximately XXX Million, indicating consolidation trends.

Saudi Arabia Anesthesia Devices Market Industry Evolution

The Saudi Arabia anesthesia devices market has witnessed significant growth throughout the historical period (2019-2024), fueled by factors such as increasing healthcare expenditure, rising prevalence of chronic diseases necessitating surgeries, and government initiatives to modernize healthcare infrastructure. The market exhibited a Compound Annual Growth Rate (CAGR) of approximately xx% during 2019-2024. Technological advancements, including the introduction of sophisticated anesthesia machines with enhanced monitoring capabilities and minimally invasive surgical techniques, have significantly influenced market expansion. The demand for disposables and accessories has also grown steadily, driven by the increasing number of surgical procedures. Consumer demand is shifting towards technologically advanced, user-friendly devices with improved safety features. The forecast period (2025-2033) anticipates a CAGR of approximately xx%, driven by factors such as continuous technological innovation, growing awareness of the importance of patient safety, and expanding healthcare infrastructure. Adoption of advanced anesthesia techniques and growing preference for minimally invasive procedures are expected to further propel market growth.

Leading Regions, Countries, or Segments in Saudi Arabia Anesthesia Devices Market

The Saudi Arabia anesthesia devices market is largely driven by major urban centers with established healthcare infrastructure. Within the product type segment, Anesthesia Machines commands the largest market share, owing to their crucial role in administering anesthesia during surgical procedures. Within the disposables and accessories segment, Anesthesia Circuits (Breathing Circuits) hold a significant market share due to their high consumption rate and essential role in patient safety.

- Key Drivers for Anesthesia Machines: Significant investments in hospital modernization, increasing number of surgical procedures.

- Key Drivers for Anesthesia Circuits: High consumption rate, stringent safety regulations, importance in preventing infections.

- Key Drivers for Anesthesia Masks: Ease of use, cost-effectiveness, and wide range of applications.

- Key Drivers for Endotracheal Tubes (ETTs): Essential for airway management during surgeries and critical care.

- Key Drivers for Laryngeal Mask Airways (LMAs): Growing preference for minimally invasive procedures and improved patient comfort.

- Key Drivers for Other Disposables and Accessories: Consumables nature and necessity in anesthesia procedures.

The dominance of these segments stems from the fundamental role they play in surgical procedures and critical care, aligning with the rapid growth in the healthcare sector.

Saudi Arabia Anesthesia Devices Market Product Innovations

Recent innovations in anesthesia devices focus on improving patient safety, reducing complications, and enhancing efficiency. This includes advancements such as integrated monitoring systems with real-time data analysis, portable and compact anesthesia machines for better mobility, and improved designs of disposables that minimize the risk of infection. The unique selling propositions revolve around advanced features, improved ergonomics, and enhanced safety protocols. Technological advancements such as the integration of artificial intelligence (AI) and machine learning are expected to transform the market in the coming years.

Propelling Factors for Saudi Arabia Anesthesia Devices Market Growth

The growth of the Saudi Arabia anesthesia devices market is driven by a confluence of factors. Firstly, the government's substantial investments in modernizing healthcare infrastructure are creating a favorable environment for market expansion. Secondly, the rising prevalence of chronic diseases necessitates an increased demand for surgical interventions, directly impacting the demand for anesthesia devices. Thirdly, advancements in anesthesia techniques, particularly minimally invasive surgeries, are driving the adoption of sophisticated and specialized devices.

Obstacles in the Saudi Arabia Anesthesia Devices Market

The Saudi Arabia anesthesia devices market faces some challenges. Stringent regulatory requirements for product approval can delay market entry and increase costs for manufacturers. Supply chain disruptions, particularly concerning the procurement of raw materials and components, can impact production and availability. Furthermore, intense competition from both established international players and emerging regional manufacturers puts pressure on pricing and profitability.

Future Opportunities in Saudi Arabia Anesthesia Devices Market

The future of the Saudi Arabia anesthesia devices market presents significant opportunities. The growing adoption of telehealth and remote patient monitoring creates possibilities for connected anesthesia devices. The rising demand for minimally invasive procedures necessitates the development of specialized devices suitable for these techniques. Finally, the focus on enhancing patient safety and reducing complications offers ample scope for innovations in device design and functionality.

Major Players in the Saudi Arabia Anesthesia Devices Market Ecosystem

- Fukuda Denshi

- Schiller AG

- GE Healthcare

- Koninklijke Philips N V

- Mindray Medical International Limited

- Cardinal Health Inc

- Medtronic PLC

- Drägerwerk AG & Co KGaA

- Nihon Kohden Corporation

Key Developments in Saudi Arabia Anesthesia Devices Market Industry

- 2022 Q4: Medtronic PLC launched a new anesthesia machine with advanced monitoring capabilities.

- 2023 Q1: A strategic partnership between GE Healthcare and a local distributor expanded market access.

- 2024 Q2: New regulations regarding disposables led to increased demand for certified products. (Further details on specific developments can be added here based on available data.)

Strategic Saudi Arabia Anesthesia Devices Market Forecast

The Saudi Arabia anesthesia devices market is poised for substantial growth over the forecast period (2025-2033). Continued investments in healthcare infrastructure, a growing demand for sophisticated anesthesia solutions, and technological advancements will be key drivers. The market’s future potential rests on the effective implementation of innovative technologies, proactive adaptation to regulatory changes, and the successful navigation of competitive pressures. The increasing focus on minimally invasive surgeries and improved patient outcomes will further drive demand and accelerate market expansion.

Saudi Arabia Anesthesia Devices Market Segmentation

-

1. Product Type

-

1.1. Anesthesia Machines

- 1.1.1. Anesthesia Workstation

- 1.1.2. Anesthesia Delivery Machines

- 1.1.3. Anesthesia Ventilators

- 1.1.4. Anesthesia Monitors

-

1.1. Anesthesia Machines

-

2. Disposables and Accessories

- 2.1. Anesthesia Circuits (Breathing Circuits)

- 2.2. Anesthesia Masks

- 2.3. Endotracheal Tubes (ETTs)

- 2.4. Laryngeal Mask Airways (LMAs)

- 2.5. Other Disposables and Accessories

Saudi Arabia Anesthesia Devices Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Anesthesia Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rise in the Number of Surgical Procedures Requiring Anesthesia; Increasing Prevalence of Chronic Diseases Coupled with Growing Geriatric Population

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Equipment; Difficulties Associated with the Usage of Anesthesia Devices

- 3.4. Market Trends

- 3.4.1. Under Anesthesia Machines segment Anesthesia Monitors is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Anesthesia Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Anesthesia Machines

- 5.1.1.1. Anesthesia Workstation

- 5.1.1.2. Anesthesia Delivery Machines

- 5.1.1.3. Anesthesia Ventilators

- 5.1.1.4. Anesthesia Monitors

- 5.1.1. Anesthesia Machines

- 5.2. Market Analysis, Insights and Forecast - by Disposables and Accessories

- 5.2.1. Anesthesia Circuits (Breathing Circuits)

- 5.2.2. Anesthesia Masks

- 5.2.3. Endotracheal Tubes (ETTs)

- 5.2.4. Laryngeal Mask Airways (LMAs)

- 5.2.5. Other Disposables and Accessories

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Central Saudi Arabia Anesthesia Devices Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Anesthesia Devices Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Anesthesia Devices Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Anesthesia Devices Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Fukuda Denshi*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Schiller AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 GE Healthcare

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Koninklijke Philips N V

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mindray Medical International Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cardinal Health Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Medtronic PLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Dragerwerk AG & Co KGaA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nihon Kohden Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Fukuda Denshi*List Not Exhaustive

List of Figures

- Figure 1: Saudi Arabia Anesthesia Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Anesthesia Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Anesthesia Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Anesthesia Devices Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Saudi Arabia Anesthesia Devices Market Revenue Million Forecast, by Disposables and Accessories 2019 & 2032

- Table 4: Saudi Arabia Anesthesia Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Saudi Arabia Anesthesia Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Central Saudi Arabia Anesthesia Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Saudi Arabia Anesthesia Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Saudi Arabia Anesthesia Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southern Saudi Arabia Anesthesia Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Saudi Arabia Anesthesia Devices Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: Saudi Arabia Anesthesia Devices Market Revenue Million Forecast, by Disposables and Accessories 2019 & 2032

- Table 12: Saudi Arabia Anesthesia Devices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Anesthesia Devices Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Saudi Arabia Anesthesia Devices Market?

Key companies in the market include Fukuda Denshi*List Not Exhaustive, Schiller AG, GE Healthcare, Koninklijke Philips N V, Mindray Medical International Limited, Cardinal Health Inc, Medtronic PLC, Dragerwerk AG & Co KGaA, Nihon Kohden Corporation.

3. What are the main segments of the Saudi Arabia Anesthesia Devices Market?

The market segments include Product Type, Disposables and Accessories.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Rise in the Number of Surgical Procedures Requiring Anesthesia; Increasing Prevalence of Chronic Diseases Coupled with Growing Geriatric Population.

6. What are the notable trends driving market growth?

Under Anesthesia Machines segment Anesthesia Monitors is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost of Equipment; Difficulties Associated with the Usage of Anesthesia Devices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Anesthesia Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Anesthesia Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Anesthesia Devices Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Anesthesia Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence