Key Insights

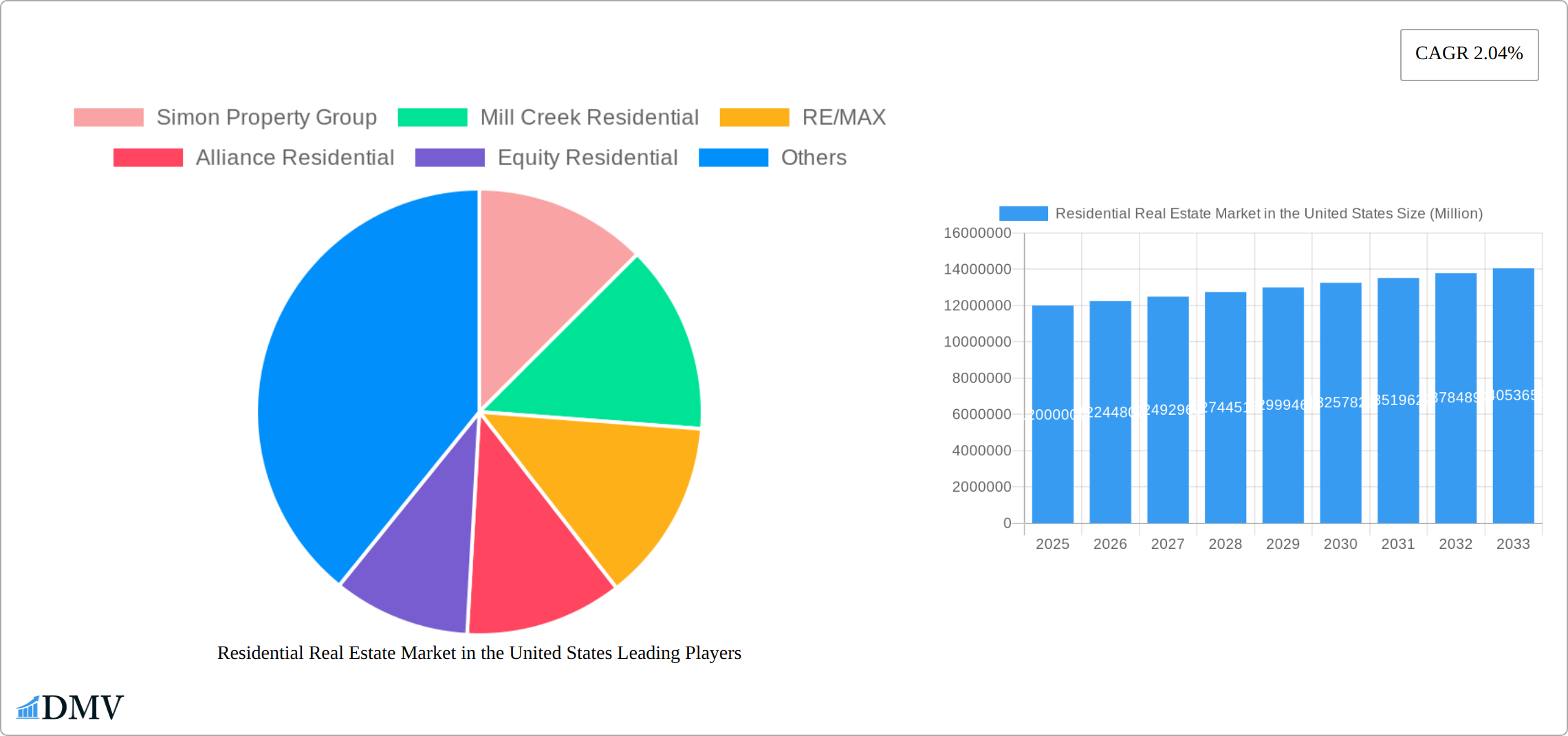

The U.S. residential real estate market, while exhibiting a moderate Compound Annual Growth Rate (CAGR) of 2.04%, presents a complex picture for 2025-2033. The market size, though not explicitly stated, can be reasonably estimated based on existing market reports and considering factors like population growth, economic conditions, and mortgage interest rates. Assuming a current market value in the trillions, a 2.04% CAGR suggests a steady, albeit not explosive, growth trajectory. Key drivers include increasing urbanization, a growing millennial population entering homeownership, and ongoing demand for specific property types like apartments and condominiums in urban centers. However, this growth faces constraints such as rising construction costs, limited housing inventory in certain areas, and fluctuating interest rates that can impact affordability and buyer confidence. The market segmentation reveals strong demand for apartments and condominiums, driven by younger demographics and preferences for urban living, while landed houses and villas maintain appeal among families and higher-income buyers. Leading companies such as Simon Property Group, Mill Creek Residential, and others, leverage their expertise in development, brokerage, and property management to navigate these market dynamics. Regional variations are expected, with certain states likely experiencing stronger growth than others due to job market trends, population shifts, and local economic conditions.

Further analysis suggests that understanding the interplay between these drivers and restraints is critical to predicting future market performance. The increasing use of technology in real estate, from online property listings to virtual tours, is changing the landscape, influencing buyer behavior and efficiency. Government policies and regulations pertaining to housing affordability and construction also exert considerable influence. The forecast period will likely witness a continuation of these trends, potentially with increased competition among firms, innovation in housing design, and ongoing adjustments to market pricing based on economic fluctuations. Sustained, albeit moderate, growth remains a realistic projection, underpinned by the fundamental drivers of population growth and the ongoing need for housing.

Residential Real Estate Market in the United States: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the US residential real estate market from 2019 to 2033, offering invaluable insights for stakeholders across the industry. From market composition and trends to future opportunities and key players, this report delivers a complete picture, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. The study covers various property types, including apartments, condominiums, landed houses, and villas, and analyzes the impact of major mergers and acquisitions (M&A) on market dynamics.

Residential Real Estate Market in the United States Market Composition & Trends

This section evaluates the US residential real estate market's concentration, innovative drivers, regulatory environment, substitute products, end-user profiles, and significant M&A activities. We analyze market share distribution amongst key players like Simon Property Group, Mill Creek Residential, RE/MAX, Alliance Residential, Equity Residential, Greystar Real Estate Partners, and Keller Williams Realty Inc. (List not exhaustive; also including Essex Property Trust, Brookfield, The Michaels Organization, AvalonBay Communities, and Lincoln Property Company). The analysis includes a detailed examination of M&A deal values, revealing the significant shifts in market power and investment strategies.

- Market Share Distribution: While precise figures require proprietary data, the report will provide an estimated market share distribution for major players, highlighting the competitive landscape. For example, we estimate that the top 5 players collectively hold approximately xx% of the market.

- M&A Deal Values: The report analyzes the impact of significant deals, such as the USD 3.7 Billion acquisition of Resource REIT Inc. by Blackstone in May 2022, and Blackstone's USD 6 Billion purchase of Preferred Apartment Communities in February 2022, on market consolidation and future growth trajectories. Further analysis includes the valuation and impact of other significant M&A activities.

- Regulatory Landscape: This section examines the evolving regulatory frameworks impacting the sector, including zoning laws, building codes, and environmental regulations, assessing their effects on market growth and development.

- Innovation Catalysts: The report identifies key technological advancements and innovative business models shaping the sector, such as the use of proptech solutions for property management and marketing.

Residential Real Estate Market in the United States Industry Evolution

This section provides a detailed analysis of the evolution of the US residential real estate market, encompassing market growth trajectories from 2019 to 2033, analyzing technological disruptions, and shifts in consumer preferences. We will project growth rates across different property types and geographic regions, factoring in macroeconomic trends, interest rates, and demographic shifts. The analysis will include data on the adoption rates of various technologies within the industry, such as virtual tours and online property management systems, and their influence on market dynamics. Specific data points will be presented on growth rates, highlighting periods of expansion and contraction, and quantifying the impact of technological advancements on market efficiency and consumer behavior. The report will also cover the emerging trend towards sustainable and eco-friendly housing developments and their market penetration. This detailed analysis will use data from credible sources and apply robust forecasting methodologies to offer reliable predictions.

Leading Regions, Countries, or Segments in Residential Real Estate Market in the United States

This section identifies the dominant regions, countries, or segments within the US residential real estate market. It compares the performance of different property types – Apartments and Condominiums, and Landed Houses and Villas – across various geographic locations.

Dominant Segment: The report will identify the dominant property type based on factors such as transaction volume, investment activity, and market capitalization. We predict that Apartments and Condominiums will remain a dominant segment, particularly in urban areas.

Key Drivers (Apartments and Condominiums):

- High rental yields in densely populated areas.

- Growing demand from young professionals and urban dwellers.

- Favorable government incentives and tax benefits for multi-family developments in specific locations.

Key Drivers (Landed Houses and Villas):

- Strong preference for suburban living and increased demand for larger living spaces.

- Growing disposable incomes and increasing affordability in certain regions.

- Investment appeal due to potential for capital appreciation.

The detailed analysis will reveal the dominant factors fueling the growth and performance of each segment, with regional variations clearly indicated.

Residential Real Estate Market in the United States Product Innovations

This section explores the latest innovations in the residential real estate sector, highlighting the unique selling propositions (USPs) of new product offerings and the adoption of advanced technologies. This includes smart home technologies, sustainable building materials, and innovative design features focused on energy efficiency, improved security, and increased convenience. We will analyze the performance metrics of these innovations, such as energy savings and market acceptance rates.

Propelling Factors for Residential Real Estate Market in the United States Growth

Several key factors contribute to the growth of the US residential real estate market. Strong economic growth leads to increased disposable income, boosting demand for housing. Favorable government policies, such as tax incentives for homebuyers or developers, stimulate market activity. Technological advancements, from smart home features to streamlined online platforms, enhance the overall user experience. Furthermore, a growing population and urbanization trends create continuous demand for housing across different segments.

Obstacles in the Residential Real Estate Market in the United States Market

The US residential real estate market faces several challenges. Stringent regulations and permitting processes can delay projects and increase costs. Supply chain disruptions and material shortages can affect the construction timelines and the cost of new housing. Intense competition among developers and real estate agents puts pressure on pricing and profitability. Furthermore, fluctuations in interest rates significantly influence affordability and consumer demand. The report will quantify the impact of these factors on market dynamics, providing a detailed analysis of potential bottlenecks.

Future Opportunities in Residential Real Estate Market in the United States

The future holds significant opportunities. The increasing demand for sustainable and eco-friendly housing creates a market for green building materials and energy-efficient designs. The adoption of proptech solutions and advancements in virtual and augmented reality will transform property transactions and management. The growth of remote work is generating demand for housing in secondary markets. Furthermore, the rising senior population fuels demand for age-restricted communities and senior-friendly housing options.

Major Players in the Residential Real Estate Market in the United States Ecosystem

- Simon Property Group

- Mill Creek Residential

- RE/MAX

- Alliance Residential

- Equity Residential

- Greystar Real Estate Partners

- Keller Williams Realty Inc

- Essex Property Trust

- Brookfield

- The Michaels Organization

- AvalonBay Communities

- Lincoln Property Company

Key Developments in Residential Real Estate Market in the United States Industry

- May 2022: Resource REIT Inc. was acquired by Blackstone Real Estate Income Trust Inc. for USD 3.7 Billion, significantly impacting the REIT sector and consolidating market share.

- February 2022: Blackstone's USD 6 Billion acquisition of Preferred Apartment Communities expanded its presence in the residential rental market, particularly in the Southeast.

These developments illustrate the ongoing consolidation and significant investment activity within the US residential real estate market.

Strategic Residential Real Estate Market in the United States Market Forecast

The US residential real estate market is poised for continued growth, driven by strong economic fundamentals, technological advancements, and evolving consumer preferences. The increasing demand for sustainable housing, coupled with the adoption of innovative technologies in property management and transactions, will create significant opportunities for industry players. The report projects a positive outlook for the market, with consistent growth anticipated throughout the forecast period (2025-2033). This projection takes into account macroeconomic factors, demographic trends, and regulatory influences.

Residential Real Estate Market in the United States Segmentation

-

1. Property Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

Residential Real Estate Market in the United States Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Residential Real Estate Market in the United States REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Investment Plan Towards Urban Rail Development

- 3.3. Market Restrains

- 3.3.1. Italy’s Fragmented Approach to Tenders

- 3.4. Market Trends

- 3.4.1. Existing Home Sales Witnessing Strong Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. North America Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Property Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.1. Market Analysis, Insights and Forecast - by Property Type

- 7. South America Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Property Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.1. Market Analysis, Insights and Forecast - by Property Type

- 8. Europe Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Property Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Landed Houses and Villas

- 8.1. Market Analysis, Insights and Forecast - by Property Type

- 9. Middle East & Africa Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Property Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Landed Houses and Villas

- 9.1. Market Analysis, Insights and Forecast - by Property Type

- 10. Asia Pacific Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Property Type

- 10.1.1. Apartments and Condominiums

- 10.1.2. Landed Houses and Villas

- 10.1. Market Analysis, Insights and Forecast - by Property Type

- 11. Brazil Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Mexico Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Argentina Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Colombia Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Chile Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Rest of Latin America Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Simon Property Group

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Mill Creek Residential

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 RE/MAX

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Alliance Residential

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Equity Residential

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Greystar Real Estate Partners

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Keller Williams Realty Inc **List Not Exhaustive

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Essex Property Trust

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Brookfield

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 The Michaels Organization

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 AvalonBay Communities

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Lincoln Property Company

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 Simon Property Group

List of Figures

- Figure 1: Global Residential Real Estate Market in the United States Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Brazil Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 3: Brazil Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 4: Mexico Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 5: Mexico Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 6: Argentina Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 7: Argentina Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 8: Colombia Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 9: Colombia Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 10: Chile Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 11: Chile Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 12: Rest of Latin America Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 13: Rest of Latin America Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Residential Real Estate Market in the United States Revenue (Million), by Property Type 2024 & 2032

- Figure 15: North America Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2024 & 2032

- Figure 16: North America Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Residential Real Estate Market in the United States Revenue (Million), by Property Type 2024 & 2032

- Figure 19: South America Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2024 & 2032

- Figure 20: South America Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 21: South America Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Residential Real Estate Market in the United States Revenue (Million), by Property Type 2024 & 2032

- Figure 23: Europe Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2024 & 2032

- Figure 24: Europe Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East & Africa Residential Real Estate Market in the United States Revenue (Million), by Property Type 2024 & 2032

- Figure 27: Middle East & Africa Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2024 & 2032

- Figure 28: Middle East & Africa Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 29: Middle East & Africa Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Residential Real Estate Market in the United States Revenue (Million), by Property Type 2024 & 2032

- Figure 31: Asia Pacific Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2024 & 2032

- Figure 32: Asia Pacific Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 3: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 17: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Canada Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 22: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 27: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 38: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 39: Turkey Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Israel Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: GCC Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: North Africa Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: South Africa Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Middle East & Africa Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 46: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Real Estate Market in the United States?

The projected CAGR is approximately 2.04%.

2. Which companies are prominent players in the Residential Real Estate Market in the United States?

Key companies in the market include Simon Property Group, Mill Creek Residential, RE/MAX, Alliance Residential, Equity Residential, Greystar Real Estate Partners, Keller Williams Realty Inc **List Not Exhaustive, Essex Property Trust, Brookfield, The Michaels Organization, AvalonBay Communities, Lincoln Property Company.

3. What are the main segments of the Residential Real Estate Market in the United States?

The market segments include Property Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Investment Plan Towards Urban Rail Development.

6. What are the notable trends driving market growth?

Existing Home Sales Witnessing Strong Growth.

7. Are there any restraints impacting market growth?

Italy’s Fragmented Approach to Tenders.

8. Can you provide examples of recent developments in the market?

May 2022: Resource REIT Inc. completed the sale of all of its outstanding shares of common stock to Blackstone Real Estate Income Trust Inc. for USD 14.75 per share in an all-cash deal valued at USD 3.7 billion, including the assumption of the REIT's debt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Residential Real Estate Market in the United States," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Residential Real Estate Market in the United States report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Residential Real Estate Market in the United States?

To stay informed about further developments, trends, and reports in the Residential Real Estate Market in the United States, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence