Key Insights

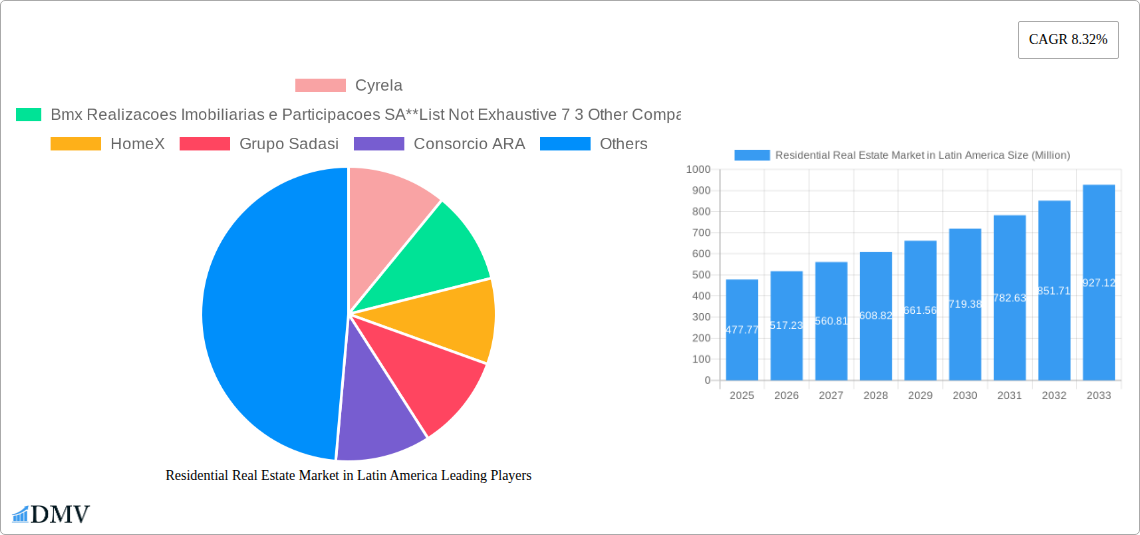

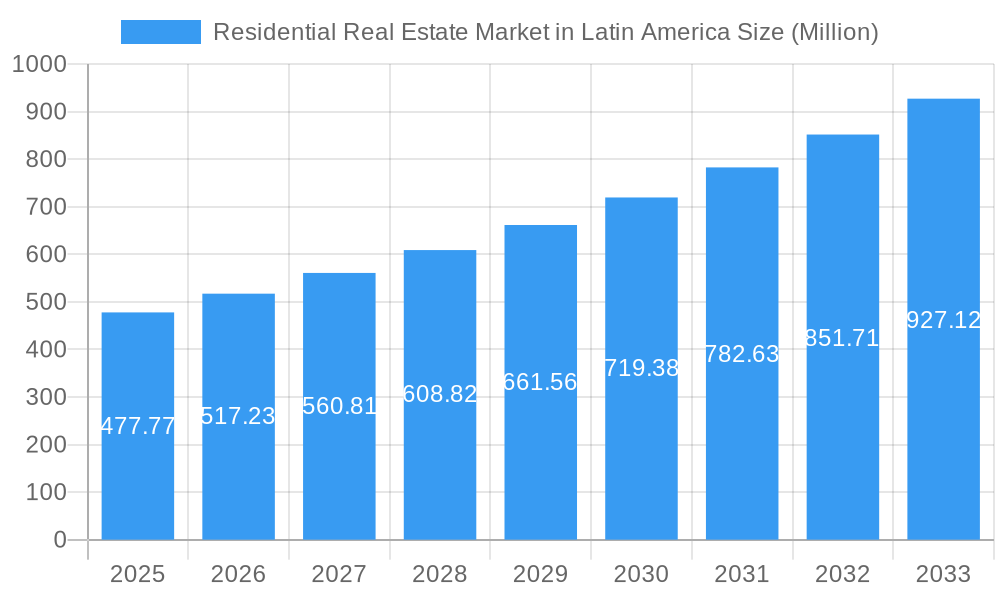

The Latin American residential real estate market, valued at $477.77 million in 2025, is projected to experience robust growth, driven by a burgeoning middle class, increasing urbanization, and government initiatives promoting affordable housing. A Compound Annual Growth Rate (CAGR) of 8.32% from 2025 to 2033 indicates a significant expansion, with the market expected to surpass $1 billion by the end of the forecast period. Key market segments include apartments and condominiums, which are expected to dominate due to high population density in major cities, and landed houses and villas, catering to higher-income segments seeking more spacious living options. Brazil, Mexico, and Argentina are the largest markets within the region, contributing significantly to the overall market size. However, factors such as economic instability in certain countries and fluctuating interest rates pose potential challenges to market growth. The market is seeing increased investment from both domestic and international players, leading to innovative projects and the integration of smart home technology. Competition is fierce, with established players like Cyrela, MRV Engenharia, and Grupo Sadasi vying for market share alongside international firms such as JLL and CBRE. The continued growth is also fueled by the growing demand for sustainable and eco-friendly housing options. The expansion of e-commerce in real estate is also contributing to greater accessibility and transparency for potential buyers.

Residential Real Estate Market in Latin America Market Size (In Million)

The market's success hinges on addressing affordability concerns and streamlining regulatory processes. Government policies incentivizing homeownership and investment in infrastructure will play a crucial role in sustaining this growth. The increasing adoption of technology in real estate transactions, including virtual tours and online platforms, will further enhance market accessibility and transparency. Future growth will likely see a diversification of housing options to meet the demands of a wider range of income levels, and a greater focus on sustainable development practices in response to climate change concerns. Strategic partnerships between developers and technology companies will be crucial in enhancing the customer experience and driving market expansion. The competitive landscape will remain dynamic, with consolidation and strategic acquisitions likely to shape the market in the coming years.

Residential Real Estate Market in Latin America Company Market Share

Residential Real Estate Market in Latin America: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Residential Real Estate Market in Latin America, covering the period from 2019 to 2033. With a focus on market trends, leading players, and future opportunities, this report is an essential resource for investors, developers, and industry stakeholders seeking to understand and capitalize on the dynamic Latin American real estate landscape. The report uses 2025 as its base year and includes detailed forecasts from 2025 to 2033. Total market value predictions are in Millions (M).

Residential Real Estate Market in Latin America Market Composition & Trends

This section delves into the intricate composition of the Latin American residential real estate market, examining market concentration, innovation, regulatory influences, substitute products, end-user demographics, and mergers & acquisitions (M&A) activities. The analysis considers the competitive landscape, highlighting key players like Cyrela, BMX Realizações Imobiliárias e Participações SA, HomeX, Grupo Sadasi, Consorcio ARA, MRV Engenharia e Participações SA, Groupe CARSO, Multiplan Real Estate Asset Management, JLL, and CBRE, among others.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2025. This share is projected to xx% by 2033.

- Innovation Catalysts: Technological advancements in construction and property management are driving efficiency and attracting investment. The adoption of smart home technology is also gaining traction.

- Regulatory Landscape: Varying regulations across Latin American countries significantly impact market dynamics. Streamlined processes in some regions are boosting investment while stricter regulations in others present challenges.

- Substitute Products: Limited readily available substitutes exist. Rental markets serve as alternatives, impacting ownership trends.

- End-User Profiles: The market caters to diverse segments, including first-time homebuyers, families, and high-net-worth individuals, with purchasing patterns influenced by economic factors and demographics.

- M&A Activities: The period 2019-2024 saw xx M&A deals, totaling an estimated value of USD xx Million. A further increase in M&A activity is anticipated during the forecast period, driven by consolidation and expansion strategies.

Residential Real Estate Market in Latin America Industry Evolution

This section analyzes the evolution of the Latin American residential real estate market, charting its growth trajectory, exploring technological advancements, and examining the shifting preferences of consumers. The analysis will cover the historical period (2019-2024), base year (2025), and forecast period (2025-2033). The market experienced a CAGR of xx% during 2019-2024, driven by factors such as urbanization, population growth, and rising middle-class incomes. Technological advancements, including BIM (Building Information Modeling) and 3D printing, are increasing construction efficiency and reducing costs. The increasing adoption of proptech solutions is also transforming the way properties are marketed, sold, and managed. Changing consumer preferences towards sustainable and smart homes are shaping the design and features of new residential developments. The market is forecast to grow at a CAGR of xx% from 2025 to 2033. The increasing preference for sustainable and smart homes is expected to drive the demand for green building materials and technologies.

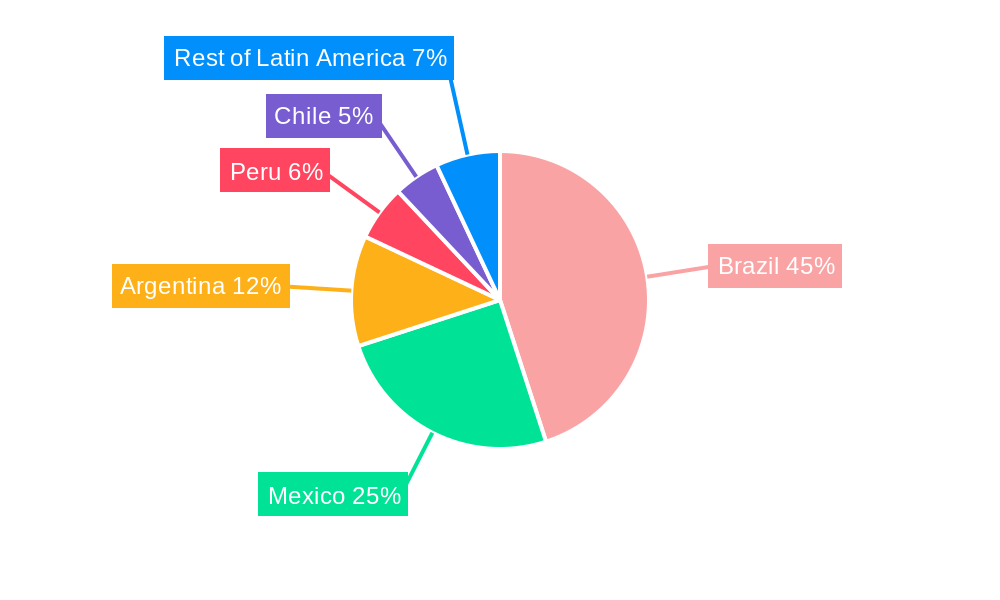

Leading Regions, Countries, or Segments in Residential Real Estate Market in Latin America

This section identifies the leading regions, countries, and segments within the Latin American residential real estate market. While precise data on market share dominance is not yet available to determine which is the leading segment (Apartments and Condominiums vs. Landed Houses and Villas), it is expected that Brazil, Mexico, and Colombia will be the top performers.

- Key Drivers for Dominant Regions/Countries:

- Brazil: Strong economic growth, urbanization, and government initiatives supporting affordable housing.

- Mexico: Growing middle class, increased foreign investment, and proximity to the US market.

- Colombia: Improved economic stability and rising demand for both high and affordable-housing segments.

- Analysis of Dominance: The dominance of specific regions stems from factors such as economic growth, population density, government policies, and investment inflows. Each region possesses unique characteristics that influence market dynamics.

Residential Real Estate Market in Latin America Product Innovations

Recent innovations focus on sustainable and smart features. Green building materials, energy-efficient appliances, and smart home automation systems are becoming increasingly common in new residential developments. This enhances the value proposition for buyers seeking energy savings and environmentally friendly living spaces.

Propelling Factors for Residential Real Estate Market in Latin America Growth

Several factors contribute to the growth of the Latin American residential real estate market. These include:

- Urbanization: Rapid urbanization leads to increased housing demand in major cities.

- Economic Growth: Economic growth in several Latin American countries boosts purchasing power and investment in real estate.

- Government Initiatives: Supportive government policies and affordable housing programs stimulate the market.

- Technological Advancements: Innovation in construction technologies and proptech solutions improve efficiency and reduce costs.

Obstacles in the Residential Real Estate Market in Latin America Market

Challenges facing the market include:

- Economic Volatility: Economic instability in some regions can impact consumer confidence and investment.

- Regulatory Hurdles: Bureaucracy and inconsistent regulations across countries can hinder development.

- Infrastructure Deficiencies: Inadequate infrastructure in certain areas limits growth potential.

- Supply Chain Disruptions: Global events impacting supply chains can increase construction costs and delays.

Future Opportunities in Residential Real Estate Market in Latin America

Future opportunities lie in:

- Affordable Housing: The significant demand for affordable housing presents a major opportunity for developers.

- Green Building: Growing awareness of environmental issues drives demand for sustainable residential properties.

- Proptech Adoption: Leveraging technology to streamline processes and improve customer experience creates significant opportunities.

- Investment from abroad: Foreign direct investment (FDI) is expected to continue playing a significant role in the market's growth.

Major Players in the Residential Real Estate Market in Latin America Ecosystem

- Cyrela

- BMX Realizações Imobiliárias e Participações SA

- 73 Other Companies

- HomeX

- Grupo Sadasi

- Consorcio ARA

- MRV Engenharia e Participações SA

- Groupe CARSO

- Multiplan Real Estate Asset Management

- JLL

- CBRE

Key Developments in Residential Real Estate Market in Latin America Industry

- November 2023: CBRE launched the Latam-Iberia platform to boost cross-regional investment and collaboration in the real estate sector.

- May 2023: CJ do Brasil's USD 57 Million plant expansion in Piracicaba, Brazil, included the construction of new residential facilities, signifying a positive impact on the residential market in the region.

Strategic Residential Real Estate Market in Latin America Market Forecast

The Latin American residential real estate market is poised for significant growth in the coming years, driven by urbanization, economic expansion, and technological advancements. The demand for sustainable and affordable housing, coupled with increased investment in proptech solutions, will present lucrative opportunities for developers and investors. While challenges persist, the long-term outlook remains positive, pointing towards a robust and dynamic market.

Residential Real Estate Market in Latin America Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Geography

- 2.1. Mexico

- 2.2. Brazil

- 2.3. Colombia

- 2.4. Rest of Latin America

Residential Real Estate Market in Latin America Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Colombia

- 4. Rest of Latin America

Residential Real Estate Market in Latin America Regional Market Share

Geographic Coverage of Residential Real Estate Market in Latin America

Residential Real Estate Market in Latin America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Population is Boosting the Residential Real Estate Market; Rapid Growth in Urbanization

- 3.3. Market Restrains

- 3.3.1. Accelerated Increase in Construction Costs

- 3.4. Market Trends

- 3.4.1. Increase in Urbanization Boosting Demand for Residential Real Estate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Mexico

- 5.2.2. Brazil

- 5.2.3. Colombia

- 5.2.4. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.3.2. Brazil

- 5.3.3. Colombia

- 5.3.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Mexico Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Mexico

- 6.2.2. Brazil

- 6.2.3. Colombia

- 6.2.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Brazil Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Mexico

- 7.2.2. Brazil

- 7.2.3. Colombia

- 7.2.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Colombia Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Landed Houses and Villas

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Mexico

- 8.2.2. Brazil

- 8.2.3. Colombia

- 8.2.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Latin America Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Landed Houses and Villas

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Mexico

- 9.2.2. Brazil

- 9.2.3. Colombia

- 9.2.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Cyrela

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bmx Realizacoes Imobiliarias e Participacoes SA**List Not Exhaustive 7 3 Other Companie

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 HomeX

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Grupo Sadasi

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Consorcio ARA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mrv Engenharia e Participacoes SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Groupe CARSO

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Multiplan Real Estate Asset Management

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 JLL

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 CBRE

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Cyrela

List of Figures

- Figure 1: Residential Real Estate Market in Latin America Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Residential Real Estate Market in Latin America Share (%) by Company 2025

List of Tables

- Table 1: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Residential Real Estate Market in Latin America Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Real Estate Market in Latin America?

The projected CAGR is approximately 8.32%.

2. Which companies are prominent players in the Residential Real Estate Market in Latin America?

Key companies in the market include Cyrela, Bmx Realizacoes Imobiliarias e Participacoes SA**List Not Exhaustive 7 3 Other Companie, HomeX, Grupo Sadasi, Consorcio ARA, Mrv Engenharia e Participacoes SA, Groupe CARSO, Multiplan Real Estate Asset Management, JLL, CBRE.

3. What are the main segments of the Residential Real Estate Market in Latin America?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 477.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Population is Boosting the Residential Real Estate Market; Rapid Growth in Urbanization.

6. What are the notable trends driving market growth?

Increase in Urbanization Boosting Demand for Residential Real Estate.

7. Are there any restraints impacting market growth?

Accelerated Increase in Construction Costs.

8. Can you provide examples of recent developments in the market?

November 2023: CBRE, a prominent global consultancy and real estate services firm, unveiled its latest initiative, the Latam-Iberia platform. The platform's primary goal is to reinvigorate the real estate markets in Europe and Latin America while fostering investment ties between the two regions. By enhancing business collaborations and amplifying the visibility of real estate solutions, CBRE aims to catalyze growth in the sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Residential Real Estate Market in Latin America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Residential Real Estate Market in Latin America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Residential Real Estate Market in Latin America?

To stay informed about further developments, trends, and reports in the Residential Real Estate Market in Latin America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence