Key Insights

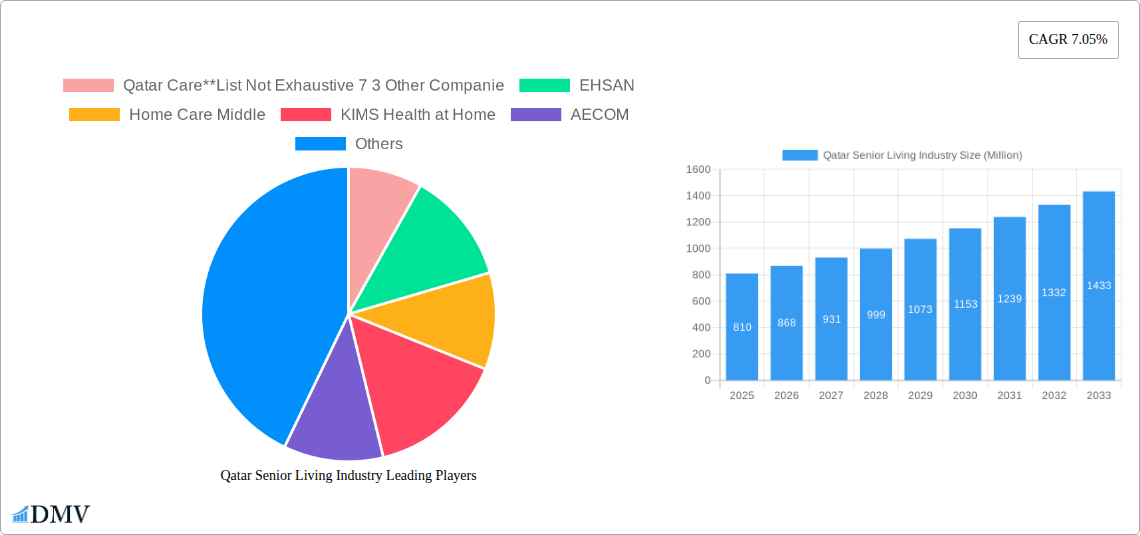

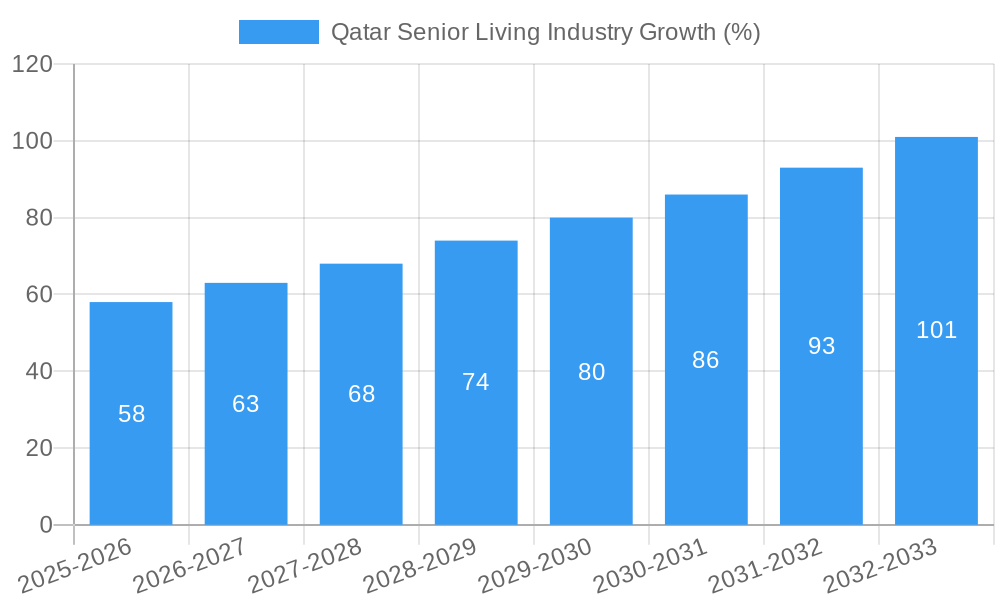

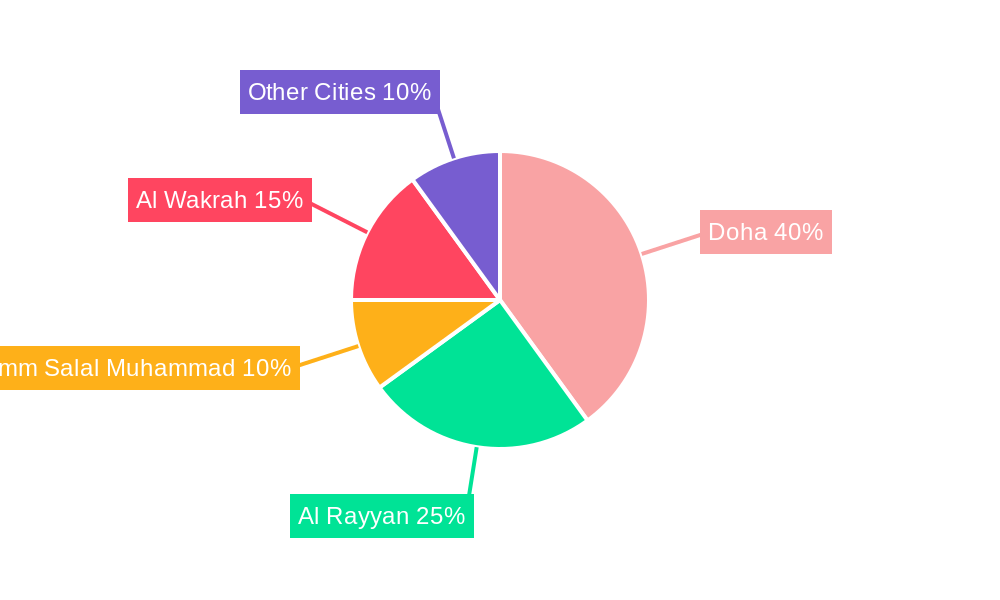

The Qatar senior living market, valued at $810 million in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 7.05% from 2025 to 2033. This expansion is fueled by several key factors. Qatar's aging population, coupled with increasing life expectancy and a rising prevalence of chronic diseases requiring specialized care, are driving demand for a wider range of senior living options. The government's focus on improving healthcare infrastructure and promoting elderly well-being further contributes to this growth. The market is segmented by city, with Doha, Al Rayyan, and Al Wakrah likely representing the largest shares due to higher population density and existing infrastructure. Property type segmentation reveals a diversified market encompassing assisted living, independent living, memory care, and nursing care facilities, catering to diverse needs and preferences among the senior population. Competition is present among established players like Qatar Care, EHSAN, Home Care Middle, KIMS Health at Home, and AECOM, alongside several smaller operators. Future growth will likely be influenced by the government's ongoing investments in healthcare, the development of innovative senior care models, and the increasing affordability of such services.

The market's growth trajectory suggests significant opportunities for both established and new entrants. However, potential challenges include the need for skilled healthcare professionals, the rising costs of healthcare services, and the need to address potential cultural sensitivities surrounding elder care. Strategies for success include focusing on specialized care offerings (e.g., dementia care), leveraging technology to improve service delivery and efficiency, and collaborating with healthcare providers to ensure seamless care transitions. Furthermore, companies need to adapt to the preferences of the senior population and build robust networks of support services to cater to the evolving needs of this segment. The market’s future will be characterized by increasing sophistication in care models and a broader spectrum of services aimed at enhancing the quality of life for Qatar's senior citizens.

Qatar Senior Living Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the Qatar senior living industry, encompassing market size, segmentation, key players, growth drivers, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on this rapidly evolving market. The total market size is projected to reach xx Million by 2033.

Qatar Senior Living Industry Market Composition & Trends

This section delves into the competitive landscape of the Qatari senior living market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user demographics. The report examines the M&A activity within the sector, quantifying deal values and their impact on market share distribution. The current market is characterized by a moderately concentrated landscape, with Qatar Care and seven other significant players accounting for approximately xx% of the market share in 2025. However, the emergence of smaller, specialized providers is increasing competition.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2025.

- Innovation Catalysts: Government initiatives promoting elderly care and technological advancements in telehealth and assistive technologies.

- Regulatory Landscape: Stringent regulations on healthcare facilities and licensing, impacting market entry and operational costs.

- Substitute Products: Home-based care services and informal family support networks present alternative options.

- End-User Profiles: Growing elderly population with increasing disposable incomes and demand for higher quality senior living options.

- M&A Activities: XX Million in M&A deal value recorded between 2019 and 2024, with further consolidation anticipated.

Qatar Senior Living Industry Industry Evolution

This section meticulously charts the trajectory of the Qatar senior living industry, examining its growth trajectory, technological innovations, and the evolution of consumer preferences from 2019 to 2033. The industry has experienced consistent growth, driven by an aging population and increased awareness of the need for specialized senior care. Technological advancements, such as telehealth platforms and AI-powered assistive devices, are transforming service delivery, improving efficiency, and enhancing the quality of life for residents. The increasing demand for personalized care and a preference for independent living options are also shaping industry development. The compound annual growth rate (CAGR) is projected to be xx% between 2025 and 2033.

Leading Regions, Countries, or Segments in Qatar Senior Living Industry

This segment pinpoints the leading regions and property types within the Qatari senior living market. Doha, as the capital, dominates the market due to higher population density, better infrastructure, and increased investment in healthcare facilities. Assisted living facilities are the most prevalent property type, reflecting the growing preference for supportive environments that maintain residents' independence.

- Dominant Region: Doha

- Key Drivers for Doha's Dominance:

- Highest concentration of the elderly population.

- Significant investment in healthcare infrastructure.

- Presence of major healthcare providers and senior living facilities.

- Dominant Property Type: Assisted Living

- Key Drivers for Assisted Living Dominance:

- Growing preference for supportive, yet independent, living arrangements.

- Increased demand for personalized care services.

- Favorable government policies and regulations.

- Other key regions include Al Rayyan, Umm Salal Muhammad, and Al Wakrah, showing moderate growth potential based on planned infrastructural development and population increase. Memory care and nursing care facilities represent expanding segments showing strong future growth potential, with a rising demand driven by a growing aged population with increased healthcare needs.

Qatar Senior Living Industry Product Innovations

The sector is witnessing significant innovations in senior care technology, including telehealth platforms for remote monitoring, smart home systems for safety and convenience, and robotic assistants for daily tasks. These innovations improve care quality, enhance resident independence, and streamline operational efficiency. Unique selling propositions are focused on personalized care, technology integration, and community engagement.

Propelling Factors for Qatar Senior Living Industry Growth

The Qatari senior living market is propelled by several factors. The burgeoning elderly population is a primary driver, coupled with increased government investments in healthcare infrastructure and initiatives promoting elderly well-being. Rising disposable incomes among the elderly and a growing preference for quality senior living options further stimulate market growth. The government's focus on improving healthcare access and the increasing adoption of technology within the sector also contribute significantly.

Obstacles in the Qatar Senior Living Industry Market

Challenges include the high cost of establishing and operating senior living facilities, competition from existing providers and the potential entry of new competitors, and the need for skilled personnel. Regulatory complexities and the relatively limited supply of specialized healthcare professionals pose further hurdles. These factors potentially limit market expansion and increase operating costs.

Future Opportunities in Qatar Senior Living Industry

Future opportunities lie in expanding into underserved areas, developing specialized facilities (e.g., dementia care), and integrating advanced technologies. The increasing focus on preventative health and wellness programs presents further growth avenues. Tailoring services to cater to the unique needs of the diverse elderly population in Qatar will also unlock further market potential.

Major Players in the Qatar Senior Living Industry Ecosystem

- Qatar Care

- List Not Exhaustive 7 3 Other Companies

- EHSAN

- Home Care Middle

- KIMS Health at Home

- AECOM

Key Developments in Qatar Senior Living Industry Industry

- June 2023: Launch of the Ejlal Home Oral Health Care Services Programme for the Elderly by PHCC, expanding access to crucial oral health services for seniors.

- August 2023: Launch of the second series of the “Hikma” training program, focusing on intergenerational communication and strengthening the social support network for the elderly. This initiative is expected to have a positive impact on the well-being of the elderly population and indirectly boost the sector's overall reputation.

Strategic Qatar Senior Living Industry Market Forecast

The Qatar senior living industry is poised for robust growth, driven by demographic shifts, government support, and technological advancements. Continued investment in infrastructure, alongside the adoption of innovative solutions, will shape the market’s evolution, promising significant opportunities for existing and new players. The market is expected to witness a strong growth trajectory over the forecast period (2025-2033), presenting attractive investment prospects.

Qatar Senior Living Industry Segmentation

-

1. Property Type

- 1.1. Assisted Living

- 1.2. Independent Living

- 1.3. Memory Care

- 1.4. Nursing Care

-

2. City

- 2.1. Doha

- 2.2. Al Rayyan

- 2.3. Umm Salal Muhammad

- 2.4. Al Wakrah

Qatar Senior Living Industry Segmentation By Geography

- 1. Qatar

Qatar Senior Living Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio

- 3.3. Market Restrains

- 3.3.1. Lack of awareness of senior living options; Relatively small size of senior living population

- 3.4. Market Trends

- 3.4.1. Increase in Senior Population and Life Expectancy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Senior Living Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Assisted Living

- 5.1.2. Independent Living

- 5.1.3. Memory Care

- 5.1.4. Nursing Care

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Doha

- 5.2.2. Al Rayyan

- 5.2.3. Umm Salal Muhammad

- 5.2.4. Al Wakrah

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Qatar Care**List Not Exhaustive 7 3 Other Companie

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EHSAN

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Home Care Middle

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KIMS Health at Home

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AECOM

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Qatar Care**List Not Exhaustive 7 3 Other Companie

List of Figures

- Figure 1: Qatar Senior Living Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Senior Living Industry Share (%) by Company 2024

List of Tables

- Table 1: Qatar Senior Living Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Senior Living Industry Revenue Million Forecast, by Property Type 2019 & 2032

- Table 3: Qatar Senior Living Industry Revenue Million Forecast, by City 2019 & 2032

- Table 4: Qatar Senior Living Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Qatar Senior Living Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Qatar Senior Living Industry Revenue Million Forecast, by Property Type 2019 & 2032

- Table 7: Qatar Senior Living Industry Revenue Million Forecast, by City 2019 & 2032

- Table 8: Qatar Senior Living Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Senior Living Industry?

The projected CAGR is approximately 7.05%.

2. Which companies are prominent players in the Qatar Senior Living Industry?

Key companies in the market include Qatar Care**List Not Exhaustive 7 3 Other Companie, EHSAN, Home Care Middle, KIMS Health at Home, AECOM.

3. What are the main segments of the Qatar Senior Living Industry?

The market segments include Property Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio.

6. What are the notable trends driving market growth?

Increase in Senior Population and Life Expectancy.

7. Are there any restraints impacting market growth?

Lack of awareness of senior living options; Relatively small size of senior living population.

8. Can you provide examples of recent developments in the market?

June 2023: The Primary Health Care Corporation’s (PHCC) Preventive Health Directorate has launched the pilot phase of the Ejlal Home Oral Health Care Services Programme for the Elderly in cooperation with the Home Health Care Services Department.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Senior Living Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Senior Living Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Senior Living Industry?

To stay informed about further developments, trends, and reports in the Qatar Senior Living Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence