Key Insights

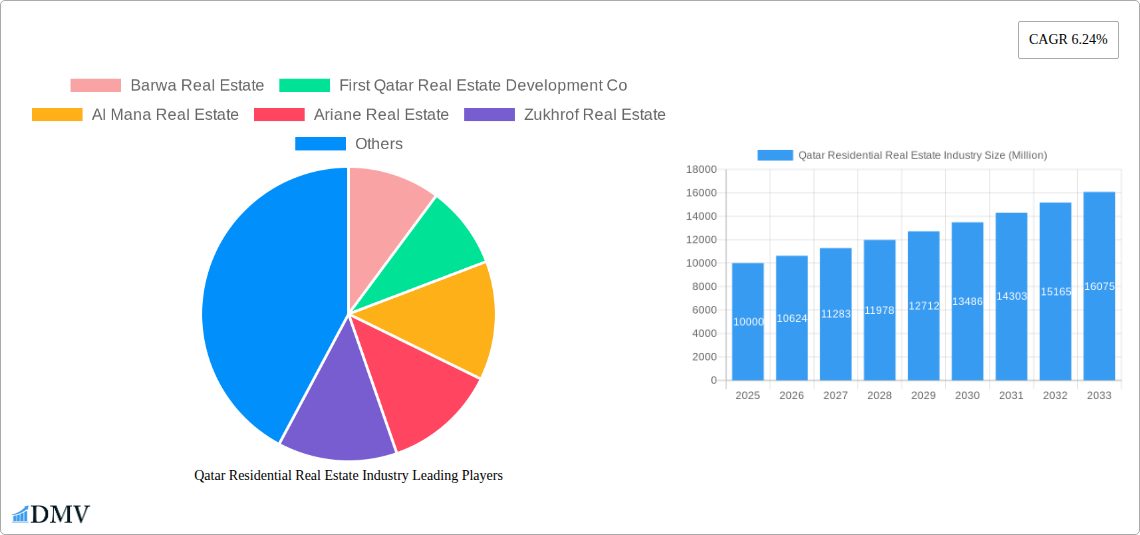

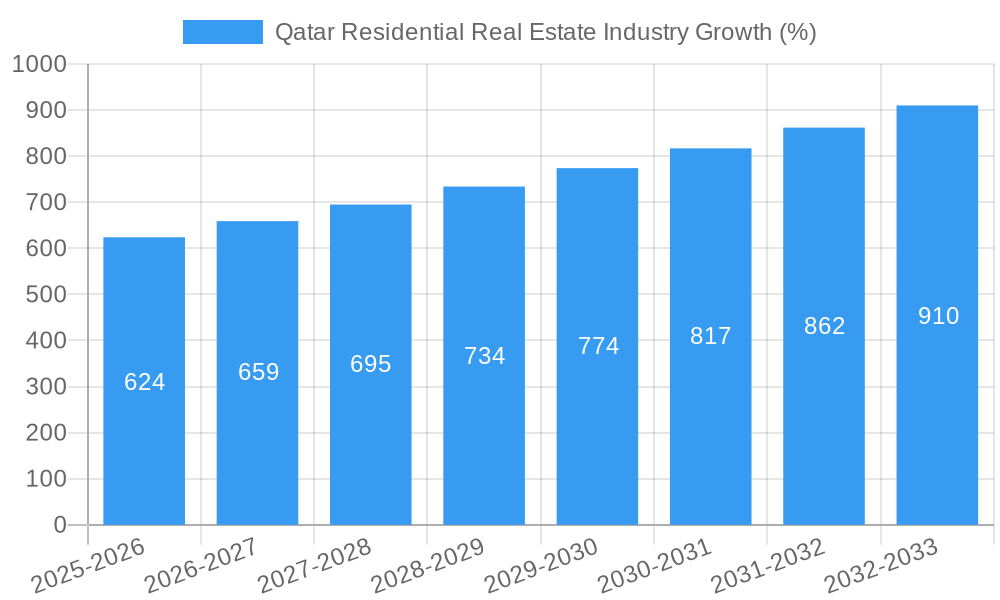

The Qatar residential real estate market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a burgeoning population, increasing urbanization, and significant government investments in infrastructure development. The 6.24% CAGR forecast for the period 2025-2033 indicates a steadily expanding market, with substantial opportunities for developers and investors. Key segments driving this growth include apartments and condominiums, catering to a large segment of the population, as well as villas and landed houses, appealing to high-net-worth individuals and families. Doha, Al Wakrah, and Al Rayyan are leading city markets, attracting significant investment due to their established infrastructure and proximity to key employment hubs. Challenges include the relatively high cost of construction and land acquisition, potentially limiting affordability for certain segments of the population. Furthermore, maintaining a balance between rapid development and preserving Qatar's cultural heritage presents a crucial challenge for the sector. Competition among established players like Barwa Real Estate, First Qatar Real Estate Development Co., and others, is intense, necessitating strategic innovation and targeted marketing approaches to capture market share. The market's success will be closely tied to the ongoing economic diversification efforts of the Qatari government and the continued influx of foreign investment into the country.

The forecast period, 2025-2033, will likely witness a diversification of product offerings to accommodate varying income levels and preferences. Expect increased investment in sustainable and smart building technologies, aligned with Qatar's broader sustainability goals. The rise of PropTech and online real estate platforms will reshape customer acquisition and property management strategies. The increasing emphasis on lifestyle amenities and community development will be a major differentiating factor for developers aiming to attract buyers and renters in this competitive market. Government initiatives aimed at improving public transport and infrastructure will play a significant role in shaping the desirability and value of properties in different locations within Qatar. The resilience of the market will also be dependent on global economic conditions and potential fluctuations in oil prices, impacting the wider Qatari economy.

Qatar Residential Real Estate Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Qatar residential real estate industry, offering a detailed outlook from 2019 to 2033. The study meticulously examines market dynamics, key players, and future growth prospects, providing invaluable insights for investors, developers, and stakeholders. With a focus on market segmentation by type (apartments & condominiums, villas & landed houses) and key cities (Doha, Al Wakrah, Al Rayyan, Rest of Qatar), this report delivers a granular understanding of this lucrative market. The report’s base year is 2025, with estimations and forecasts extending to 2033, building upon historical data from 2019-2024. The projected market value in 2025 is estimated at XX Million.

Qatar Residential Real Estate Industry Market Composition & Trends

This section analyzes the competitive landscape, regulatory environment, and key market trends within Qatar's residential real estate sector. We delve into market concentration, examining the market share distribution among major players such as Barwa Real Estate, First Qatar Real Estate Development Co, and Al Mana Real Estate. The report further investigates the influence of innovation catalysts, including sustainable building technologies and smart home integrations, alongside the impact of substitute products and evolving end-user profiles. An in-depth examination of mergers and acquisitions (M&A) activities, including deal values (estimated at XX Million in total for the period 2019-2024), will provide valuable insights into market consolidation and strategic investment patterns. Regulatory changes and their impact on the industry are also thoroughly assessed.

- Market Share Distribution: Barwa Real Estate holds an estimated xx% market share, followed by First Qatar at xx%, and Al Mana Real Estate at xx%. (Further breakdown for other key players provided in the full report).

- M&A Activity: Analysis of significant M&A deals, including deal values and their influence on market dynamics. (Specific deals and values detailed in the full report).

- Regulatory Landscape: Comprehensive overview of key regulations impacting the sector, such as building codes, land ownership laws, and foreign investment regulations.

- Innovation Catalysts: Discussion on the adoption of sustainable building practices and smart home technologies, and their effect on market growth.

Qatar Residential Real Estate Industry Industry Evolution

This section traces the evolution of Qatar's residential real estate market from 2019 to 2033, analyzing growth trajectories, technological advancements, and evolving consumer preferences. We examine the impact of mega-events like the FIFA World Cup 2022 on market growth and infrastructure development. The report presents detailed growth rate data, highlighting periods of expansion and contraction. We further analyze the adoption rates of new technologies, such as building information modeling (BIM) and proptech solutions, and their influence on construction efficiency and consumer experience. The changing demographics of Qatar and their impact on housing demand are also considered. The projected compound annual growth rate (CAGR) from 2025 to 2033 is estimated at xx%.

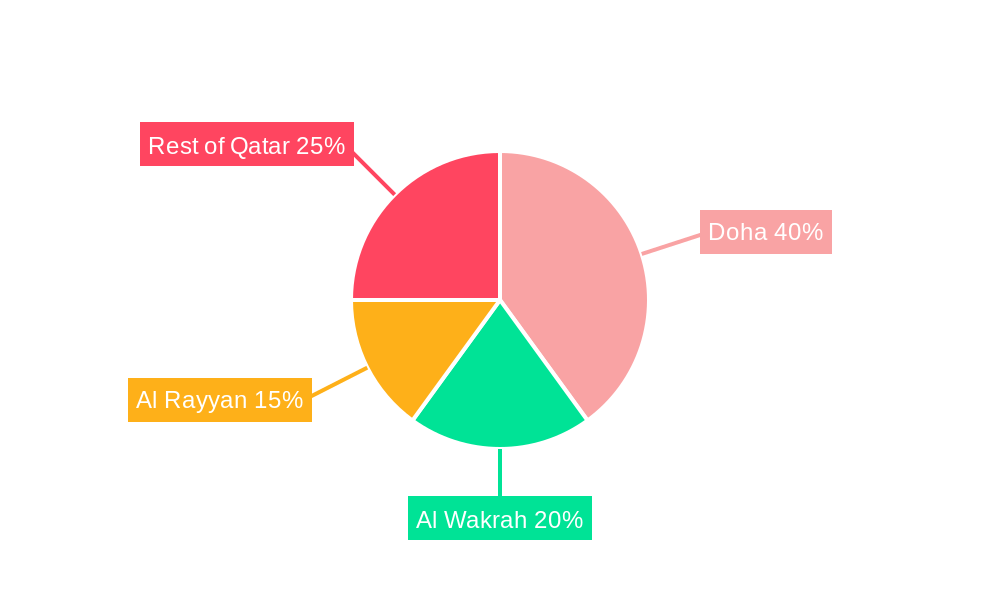

Leading Regions, Countries, or Segments in Qatar Residential Real Estate Industry

This section identifies the leading segments and geographic areas within the Qatar residential real estate market. The analysis focuses on performance by property type (apartments and condominiums vs. villas and landed houses) and key cities (Doha, Al Wakrah, Al Rayyan, and the Rest of Qatar).

- Dominant Segment: Detailed analysis of why either Apartments & Condominiums or Villas & Landed Houses is the leading segment. (Full report details the leading segment).

- Key City Analysis: Doha is expected to remain the dominant city due to its concentration of employment opportunities and infrastructure. (Further analysis of other cities in the full report).

- Key Drivers:

- Investment Trends: Analysis of investment flows into different segments and regions.

- Regulatory Support: Examination of government policies that promote development in specific areas.

- Infrastructure Development: The impact of ongoing infrastructure projects on property values.

Qatar Residential Real Estate Industry Product Innovations

The Qatar residential real estate market is witnessing significant product innovation, driven by the increasing demand for sustainable, technologically advanced housing. This section explores the latest advancements in building materials, construction techniques, and smart home technologies, highlighting unique selling propositions and performance metrics. The emphasis is on eco-friendly designs, energy-efficient appliances, and integrated smart home systems that enhance convenience and security. This includes analyzing the adoption of modular construction and prefabricated housing to accelerate project timelines and reduce construction costs.

Propelling Factors for Qatar Residential Real Estate Industry Growth

Several factors contribute to the projected growth of Qatar's residential real estate market. These include substantial government investment in infrastructure, a growing population, and increasing demand for high-quality housing. The ongoing diversification of the Qatari economy and the influx of foreign investment also play a significant role. Furthermore, favorable regulatory policies aimed at supporting real estate development contribute significantly to market expansion. The government's commitment to sustainable urban development initiatives further drives growth.

Obstacles in the Qatar Residential Real Estate Industry Market

Despite the promising growth outlook, the Qatar residential real estate sector faces certain challenges. These include potential fluctuations in global oil prices which can impact economic activity, the availability of skilled labor, and the cost of construction materials. Competition from established developers can also pose a significant challenge for new entrants. Furthermore, stringent regulatory requirements and potential supply chain disruptions may present obstacles to market growth. The impact of these challenges on overall market growth is quantitatively analyzed in the full report.

Future Opportunities in Qatar Residential Real Estate Industry

The Qatar residential real estate market presents promising opportunities for growth, particularly in the areas of sustainable and smart housing solutions. The increasing demand for affordable housing, especially for the growing expatriate population, represents a significant opportunity. The development of integrated communities with mixed-use facilities presents another area of opportunity. Technological advancements in construction and property management will continue to reshape the market, presenting possibilities for innovation and efficiency gains.

Major Players in the Qatar Residential Real Estate Industry Ecosystem

- Barwa Real Estate

- First Qatar Real Estate Development Co

- Al Mana Real Estate

- Ariane Real Estate

- Zukhrof Real Estate

- Mazaya Real Estate Development

- United Development Company

- Les Roses Real Estate

- Qatari Diar Real Estate Company

- Mirage International Property Consultants

- Ezdan Holding Group

- Al Asmakh Real Estate

Key Developments in Qatar Residential Real Estate Industry Industry

- 2022 Q4: Launch of several new residential projects in Doha, reflecting the post-World Cup investment surge.

- 2023 Q1: Increased focus on sustainable building practices with the introduction of new green building codes.

- 2023 Q3: A significant M&A deal involving two major players consolidated market share. (Specifics in full report).

- 2024 Q2: Government announces new initiatives to support affordable housing development.

Strategic Qatar Residential Real Estate Industry Market Forecast

The Qatar residential real estate market is poised for sustained growth over the forecast period (2025-2033). Driven by a robust economy, government initiatives, and increasing population, the sector is expected to witness significant expansion. The focus on sustainable development and technological advancements will further fuel growth. The predicted market value in 2033 is estimated at XX Million, reflecting a significant increase from the 2025 projection. The full report provides a detailed breakdown of growth projections across different segments and geographic locations.

Qatar Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments & Condominiums

- 1.2. Villas & Landed Houses

Qatar Residential Real Estate Industry Segmentation By Geography

- 1. Qatar

Qatar Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urabanization4.; Increasing government investments

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market

- 3.4. Market Trends

- 3.4.1. Qatar’s Housing Market is Gradually Improving

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments & Condominiums

- 5.1.2. Villas & Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Barwa Real Estate

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 First Qatar Real Estate Development Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Al Mana Real Estate

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ariane Real Estate

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zukhrof Real Estate

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mazaya Real Estate Development

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 United Development Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Les Roses Real Estate

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Qatari Diar Real Estate Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mirage International Property Consultants**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ezdan Holding Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Al Asmakh Real Estate

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Barwa Real Estate

List of Figures

- Figure 1: Qatar Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Qatar Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Qatar Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Qatar Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Qatar Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Qatar Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Residential Real Estate Industry?

The projected CAGR is approximately 6.24%.

2. Which companies are prominent players in the Qatar Residential Real Estate Industry?

Key companies in the market include Barwa Real Estate, First Qatar Real Estate Development Co, Al Mana Real Estate, Ariane Real Estate, Zukhrof Real Estate, Mazaya Real Estate Development, United Development Company, Les Roses Real Estate, Qatari Diar Real Estate Company, Mirage International Property Consultants**List Not Exhaustive, Ezdan Holding Group, Al Asmakh Real Estate.

3. What are the main segments of the Qatar Residential Real Estate Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urabanization4.; Increasing government investments.

6. What are the notable trends driving market growth?

Qatar’s Housing Market is Gradually Improving.

7. Are there any restraints impacting market growth?

4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Qatar Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence