Key Insights

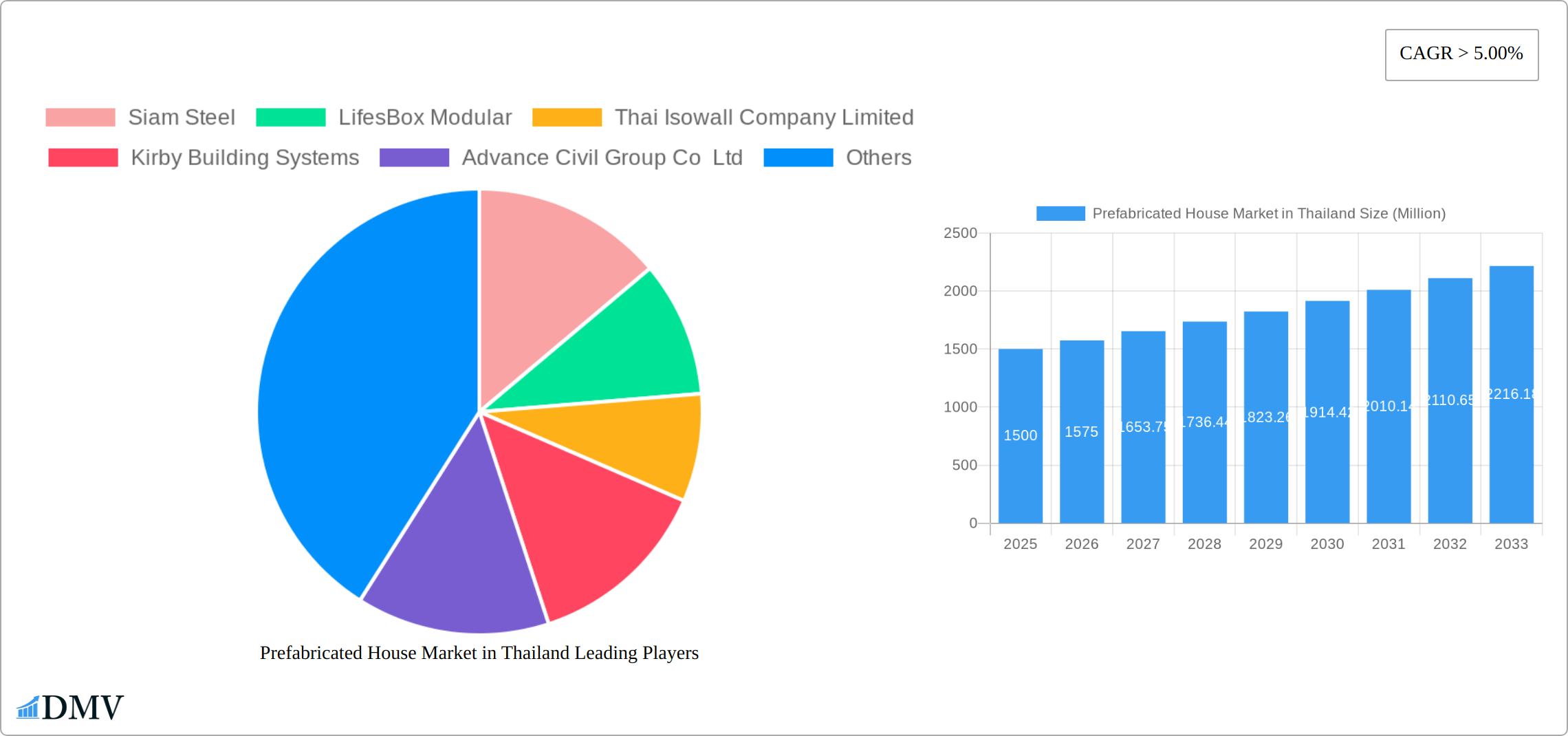

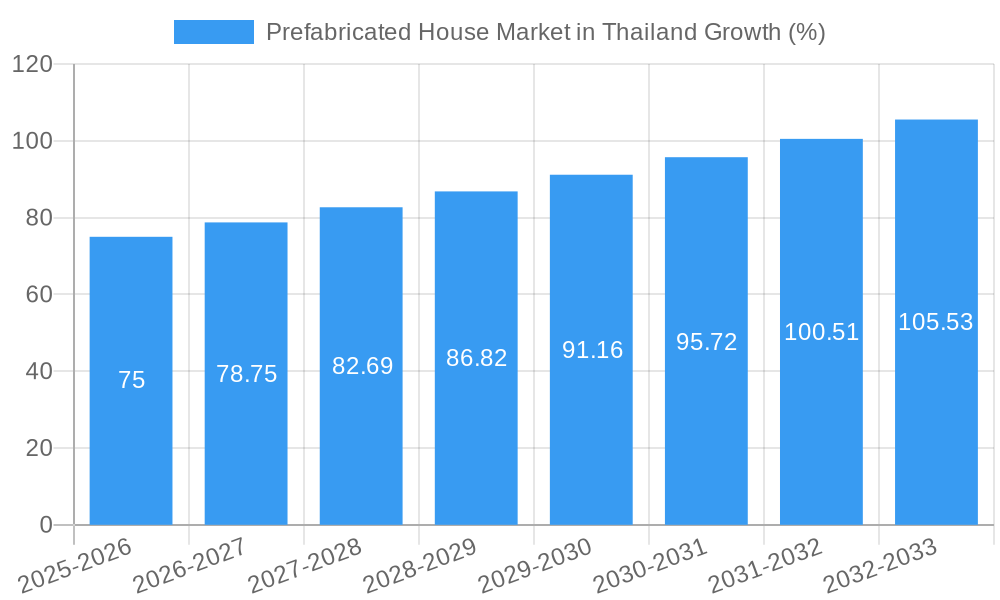

The prefabricated house market in Thailand is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, increasing urbanization and a burgeoning population are creating a significant demand for affordable and rapidly deployable housing solutions. Prefabricated construction offers a faster, more efficient, and often more cost-effective alternative to traditional methods, particularly appealing in a developing market like Thailand. Secondly, the government's focus on infrastructure development and initiatives promoting sustainable construction practices are further bolstering market growth. Prefabricated houses are often associated with reduced construction waste and faster project completion times, aligning well with these governmental objectives. Finally, the rising popularity of modular and sustainable building materials is enhancing the attractiveness of prefabricated houses among environmentally conscious consumers. While challenges such as regulatory hurdles and potential workforce resistance to new construction techniques exist, the overall market outlook remains positive.

The market segmentation reveals a strong presence across residential and commercial applications. Residential construction dominates the market share, driven by the demand for affordable housing and the shorter construction times offered by prefabricated solutions. The commercial sector is also contributing significantly to market growth, particularly with the increasing use of prefabricated buildings for offices, shops, and other commercial structures. Key players like Siam Steel, LifesBox Modular, and Thai Isowall Company Limited are shaping the market landscape, driving innovation and expanding product offerings to cater to diverse customer needs. The competitive landscape is characterized by a mix of large established players and smaller, more specialized companies, indicating a dynamic and evolving market with ample room for expansion and innovation. Future growth will likely be driven by further technological advancements, government support, and increasing consumer acceptance of prefabricated housing options.

Prefabricated House Market in Thailand: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Prefabricated House Market in Thailand, offering a comprehensive overview of market dynamics, key players, and future growth projections from 2019 to 2033. The study meticulously examines market segmentation, technological advancements, and regulatory influences shaping this rapidly evolving sector. With a focus on both historical data (2019-2024) and future forecasts (2025-2033), this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within the Thai prefabricated housing market. The base year for this analysis is 2025, with estimations also provided for the same year. Total market value projections are in Millions.

Prefabricated House Market in Thailand Market Composition & Trends

This section delves into the intricate composition of the Thai prefabricated house market, analyzing market concentration, innovation drivers, and regulatory landscapes. We examine the influence of substitute products, detailed end-user profiles, and the impact of mergers and acquisitions (M&A) activities. Market share distribution among key players is assessed, alongside an evaluation of M&A deal values. The analysis reveals a dynamic market with a growing number of both local and international players. The report provides detailed insights into the competitive landscape and identifies emerging trends shaping the future of this sector. For example, the increasing adoption of sustainable building materials and innovative construction techniques is significantly impacting the market. The regulatory landscape is analyzed to understand its impact on market growth.

- Market Concentration: xx% market share held by top 5 players (Siam Steel, LifesBox Modular, Thai Isowall Company Limited, Kirby Building Systems, Advance Civil Group Co Ltd), indicating a moderately concentrated market with significant potential for consolidation.

- Innovation Catalysts: Growing demand for affordable and sustainable housing solutions, technological advancements in prefabrication techniques, and government initiatives supporting sustainable construction are major drivers of innovation.

- Regulatory Landscape: The report analyzes existing building codes and regulations impacting the adoption of prefabricated housing, identifying potential areas for improvement and streamlining.

- Substitute Products: The report considers alternative housing solutions and analyzes their impact on market share and growth projections.

- End-User Profiles: The report details the characteristics of different end-user segments (residential, commercial, industrial) and their specific needs and preferences.

- M&A Activities: The report examines recent M&A activity in the market, including deal values (xx Million USD in the last 5 years) and their impact on market consolidation and competition.

Prefabricated House Market in Thailand Industry Evolution

This section provides a comprehensive analysis of the evolutionary trajectory of the Thai prefabricated house market. It covers market growth rates, technological advancements, and evolving consumer preferences. We examine factors such as the increasing adoption of sustainable construction methods, the integration of smart home technologies, and changing lifestyle preferences driving demand for innovative housing solutions. The analysis includes detailed data points, highlighting growth rates and adoption metrics across different segments. For example, the residential segment witnessed an xx% Compound Annual Growth Rate (CAGR) between 2019 and 2024. Technological advancements, such as the use of Building Information Modeling (BIM) and 3D printing, are changing the prefabrication industry.

The shift in consumer demand towards energy-efficient, environmentally friendly, and customizable housing solutions has significantly impacted market growth. The market is witnessing an increasing preference for modular and prefabricated homes offering faster construction timelines and cost-effectiveness. Government initiatives promoting sustainable construction and affordable housing further support this growth.

Leading Regions, Countries, or Segments in Prefabricated House Market in Thailand

This section identifies the dominant region(s), country(ies), or segment(s) within the Thai prefabricated house market, focusing on the application types: Residential, Commercial, and Other Applications (Infrastructure and Industrial). The analysis reveals the key drivers contributing to the dominance of specific segments, considering factors like investment trends, regulatory support, and market size. The residential segment is expected to maintain its leading position owing to factors like rapid urbanization and rising demand for affordable housing. The analysis also covers the commercial and infrastructure sectors' growth trajectories and their potential for expansion.

- Residential Segment:

- Key Drivers: Rapid urbanization, rising demand for affordable housing, government initiatives promoting affordable housing schemes, and increasing preference for faster construction timelines.

- Dominance Factors: High demand, large market size, and significant investments in residential projects.

- Commercial Segment:

- Key Drivers: Growth of the service sector, expansion of businesses, and demand for flexible and cost-effective commercial spaces.

- Dominance Factors: Expanding commercial infrastructure, rising office space requirements, and the advantages offered by modular construction for businesses.

- Other Applications (Infrastructure and Industrial):

- Key Drivers: Government investments in infrastructure projects, increased industrial activity, and demand for efficient and rapidly deployable facilities.

- Dominance Factors: Government spending on infrastructure, growth of the manufacturing and logistics sectors, and suitability of prefabricated structures for industrial and infrastructure applications.

Prefabricated House Market in Thailand Product Innovations

The Thai prefabricated house market witnesses continuous product innovations driven by technological advancements and changing consumer preferences. Manufacturers are introducing houses with enhanced features like improved insulation, energy efficiency, and sustainable building materials. Smart home integration is gaining traction, adding value through automation and convenient features. Prefabricated designs are becoming more customizable, enabling buyers to personalize their homes while benefiting from faster construction timelines. New building materials such as cross-laminated timber (CLT) and insulated concrete forms (ICFs) are gaining popularity due to their sustainability and performance benefits.

Propelling Factors for Prefabricated House Market in Thailand Growth

Several factors contribute to the growth of the Thai prefabricated house market. Technological advancements, like advanced building materials and construction techniques, accelerate the adoption of prefabricated solutions. Economically, the demand for affordable and efficient housing solutions fuels market growth. Government policies and regulations supporting sustainable and affordable housing provide further impetus. The increasing awareness of environmental benefits and the speed of construction contribute to the appeal of these building methods.

Obstacles in the Prefabricated House Market in Thailand Market

Despite its growth, the market faces some challenges. Regulatory hurdles and complex approval processes can slow down construction and create uncertainties. Supply chain disruptions, particularly in the availability of certain materials, pose logistical challenges. Intense competition among established players and new entrants can create price pressures. Furthermore, overcoming consumer perceptions regarding the quality and durability of prefabricated houses remains a key challenge.

Future Opportunities in Prefabricated House Market in Thailand

The future of the Thai prefabricated house market is promising, with substantial opportunities for growth. Expansion into new markets, such as rural areas with limited infrastructure, can drive market penetration. Technological innovations such as 3D printing and the use of advanced materials, will continue to improve construction efficiency and product quality. Emerging consumer trends such as demand for sustainable and smart homes offer significant growth avenues.

Major Players in the Prefabricated House Market in Thailand Ecosystem

- Siam Steel

- LifesBox Modular

- Thai Isowall Company Limited

- Kirby Building Systems

- Advance Civil Group Co Ltd

- Unibuild

- Modern Modular Co Ltd

- Container Kings

- Karmod Prefabricated Technologies

- Maxxi Factory

Key Developments in Prefabricated House Market in Thailand Industry

- June 2022: The successful completion of a 1,600 sq ft prefabricated UAS Operations Support Facility at U-Tapao Royal Thai Navy Airfield demonstrates the efficiency and speed of prefabricated construction in meeting specialized needs. This showcases the adaptability of the technology.

- March 2021: The partnership between Panasonic and Siam Steel International marked a significant step towards the mainstream adoption of prefabricated housing in Thailand, offering a range of mid-priced housing options (THB 5-10 Million per unit). This signifies the entry of major international players and a widening of the market's addressable segment.

Strategic Prefabricated House Market in Thailand Market Forecast

The Thai prefabricated house market is poised for substantial growth, driven by robust demand, technological advancements, and government support. Continued urbanization, increasing disposable incomes, and the need for affordable and sustainable housing will fuel market expansion. Innovations in construction techniques and building materials will enhance the appeal and competitiveness of prefabricated homes. Strategic partnerships and investments in the sector will further accelerate market growth, creating significant opportunities for existing and emerging players.

Prefabricated House Market in Thailand Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Other Applications (Infrastructure and Industrial)

Prefabricated House Market in Thailand Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Prefabricated House Market in Thailand REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing number of startups

- 3.3. Market Restrains

- 3.3.1. Low Awareness and Privacy Issues

- 3.4. Market Trends

- 3.4.1. Construction Investment to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Other Applications (Infrastructure and Industrial)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Other Applications (Infrastructure and Industrial)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Other Applications (Infrastructure and Industrial)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Other Applications (Infrastructure and Industrial)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Other Applications (Infrastructure and Industrial)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Other Applications (Infrastructure and Industrial)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Siam Steel

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LifesBox Modular

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Thai Isowall Company Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kirby Building Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Advance Civil Group Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Unibuild

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Modern Modular Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Container Kings

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Karmod Prefabricated Technologies**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Maxxi Factory

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Siam Steel

List of Figures

- Figure 1: Global Prefabricated House Market in Thailand Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Thailand Prefabricated House Market in Thailand Revenue (Million), by Country 2024 & 2032

- Figure 3: Thailand Prefabricated House Market in Thailand Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Prefabricated House Market in Thailand Revenue (Million), by Application 2024 & 2032

- Figure 5: North America Prefabricated House Market in Thailand Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Prefabricated House Market in Thailand Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Prefabricated House Market in Thailand Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Prefabricated House Market in Thailand Revenue (Million), by Application 2024 & 2032

- Figure 9: South America Prefabricated House Market in Thailand Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Prefabricated House Market in Thailand Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Prefabricated House Market in Thailand Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Prefabricated House Market in Thailand Revenue (Million), by Application 2024 & 2032

- Figure 13: Europe Prefabricated House Market in Thailand Revenue Share (%), by Application 2024 & 2032

- Figure 14: Europe Prefabricated House Market in Thailand Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Prefabricated House Market in Thailand Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Prefabricated House Market in Thailand Revenue (Million), by Application 2024 & 2032

- Figure 17: Middle East & Africa Prefabricated House Market in Thailand Revenue Share (%), by Application 2024 & 2032

- Figure 18: Middle East & Africa Prefabricated House Market in Thailand Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Prefabricated House Market in Thailand Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Prefabricated House Market in Thailand Revenue (Million), by Application 2024 & 2032

- Figure 21: Asia Pacific Prefabricated House Market in Thailand Revenue Share (%), by Application 2024 & 2032

- Figure 22: Asia Pacific Prefabricated House Market in Thailand Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Prefabricated House Market in Thailand Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Prefabricated House Market in Thailand Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Prefabricated House Market in Thailand Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Prefabricated House Market in Thailand Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Prefabricated House Market in Thailand Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Prefabricated House Market in Thailand Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global Prefabricated House Market in Thailand Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Prefabricated House Market in Thailand Revenue Million Forecast, by Application 2019 & 2032

- Table 11: Global Prefabricated House Market in Thailand Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Prefabricated House Market in Thailand Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Global Prefabricated House Market in Thailand Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Prefabricated House Market in Thailand Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Global Prefabricated House Market in Thailand Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Prefabricated House Market in Thailand Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Global Prefabricated House Market in Thailand Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Prefabricated House Market in Thailand Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Prefabricated House Market in Thailand?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Prefabricated House Market in Thailand?

Key companies in the market include Siam Steel, LifesBox Modular, Thai Isowall Company Limited, Kirby Building Systems, Advance Civil Group Co Ltd, Unibuild, Modern Modular Co Ltd, Container Kings, Karmod Prefabricated Technologies**List Not Exhaustive, Maxxi Factory.

3. What are the main segments of the Prefabricated House Market in Thailand?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing number of startups.

6. What are the notable trends driving market growth?

Construction Investment to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Low Awareness and Privacy Issues.

8. Can you provide examples of recent developments in the market?

June 2022: Naval Facilities Engineering Systems Command (NAVFAC) Pacific Resident Officer in Charge of Construction (ROICC) Thailand completed construction of an Unmanned Aerial System (UAS) Operations Support Facility on June 9 at U-Tapao Royal Thai Navy Airfield in Thailand. ROICC Thailand awarded a 100-day construction contract to a local Thai company to provide a 1,600 square feet two-story facility with a control room, maintenance room, and storage for the launch and retrieval equipment. The prefabricated facility was assembled on-site in record time.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Prefabricated House Market in Thailand," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Prefabricated House Market in Thailand report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Prefabricated House Market in Thailand?

To stay informed about further developments, trends, and reports in the Prefabricated House Market in Thailand, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence