Key Insights

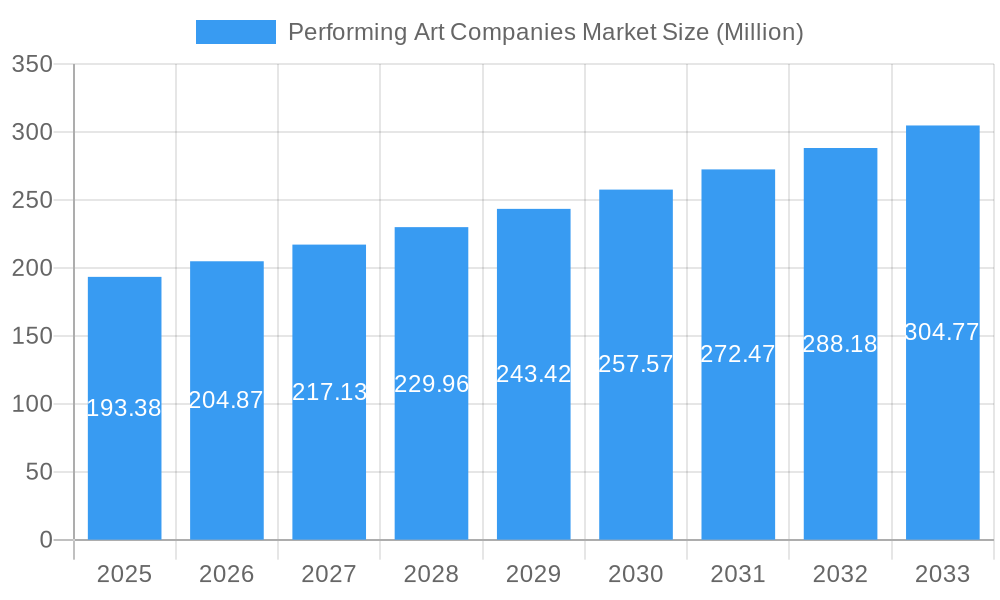

The global performing arts companies market, valued at $193.38 million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 5.67% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing disposable incomes in developing economies and a growing preference for live entertainment experiences are boosting demand for theatrical productions, concerts, and other performing arts events. Secondly, technological advancements, such as improved streaming capabilities and virtual reality experiences, are creating new avenues for audience engagement and revenue generation for performing arts companies. Furthermore, strategic partnerships between companies and the rise of innovative marketing strategies are enhancing reach and broadening the audience base. The market also benefits from the enduring appeal of established performing arts forms alongside the emergence of fresh, diverse talent and innovative performance styles.

Performing Art Companies Market Market Size (In Million)

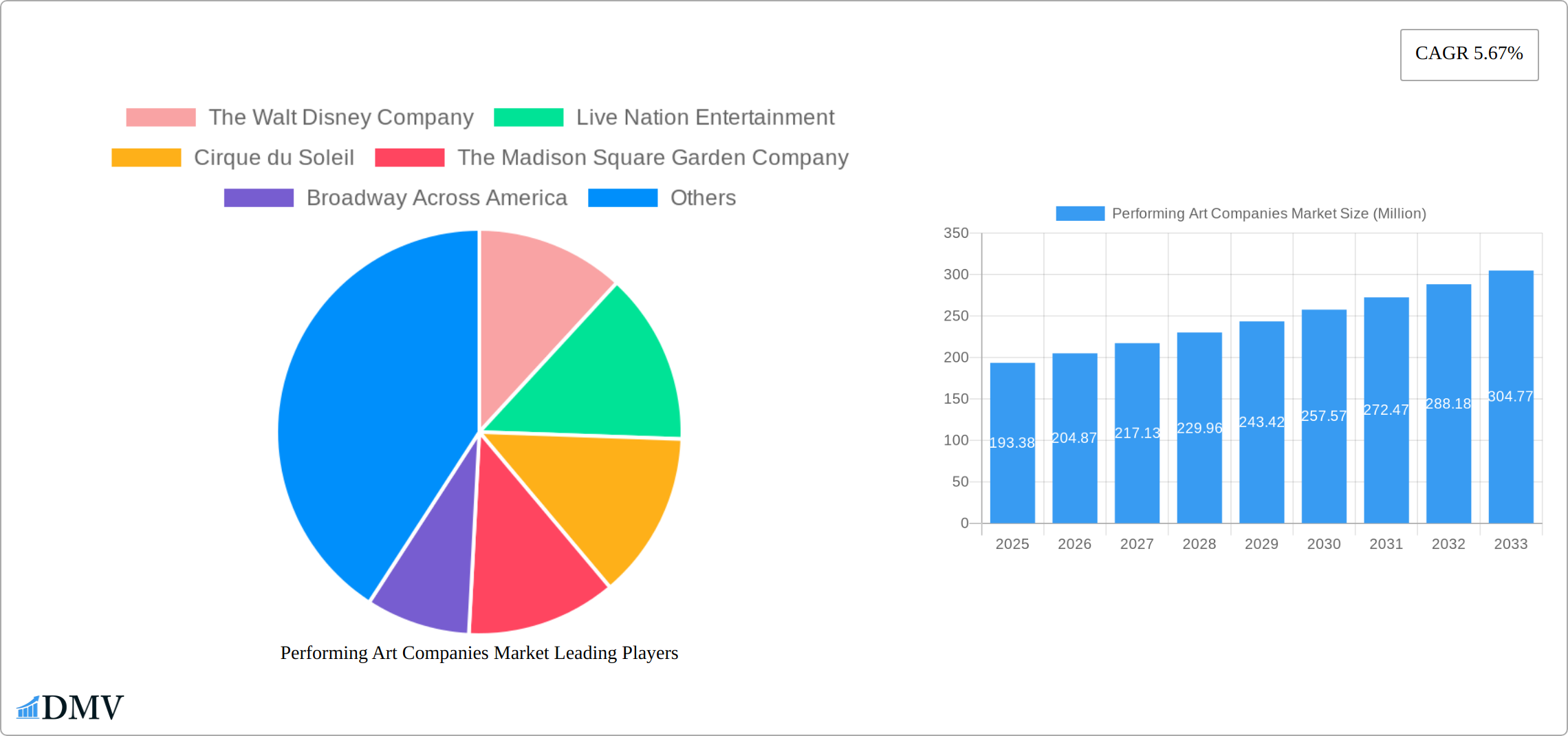

However, the market faces certain challenges. Competition from other entertainment options, including streaming services and video games, poses a significant threat. Economic downturns can impact consumer spending on discretionary entertainment, affecting ticket sales and overall revenue. Furthermore, the industry's susceptibility to external factors like pandemics and geopolitical instability necessitates adaptability and robust risk management strategies. Despite these hurdles, the market's inherent resilience and capacity for innovation suggest a positive outlook for the coming years. The segment encompassing Broadway-style productions and large-scale touring shows is expected to remain a key revenue driver, while smaller, independent companies are expected to contribute to market diversification and growth through niche offerings and unique performances. The continued engagement of established players like The Walt Disney Company, Live Nation Entertainment, and Cirque du Soleil will be critical to shaping the market’s trajectory.

Performing Art Companies Market Company Market Share

Performing Art Companies Market Market Composition & Trends

The Performing Art Companies Market is characterized by a dynamic interplay of market concentration, innovation catalysts, and regulatory landscapes. The market concentration is high, with the top ten companies, including The Walt Disney Company, Live Nation Entertainment, and Cirque du Soleil, holding a significant share of the market. For instance, The Walt Disney Company alone commands approximately 20% of the global market share, showcasing the dominance of established players.

- Innovation Catalysts: Technological advancements such as virtual reality (VR) and augmented reality (AR) are driving innovation in live performances, enhancing audience engagement and expanding market reach. The integration of digital platforms has also facilitated new revenue streams through online ticket sales and streaming services.

- Regulatory Landscapes: The market is influenced by varying regulations across regions, impacting the operational flexibility of companies. In Europe, stringent labor laws and copyright regulations pose challenges, whereas in North America, a more relaxed regulatory environment fosters growth.

- Substitute Products: The rise of digital entertainment, including streaming services and video games, presents significant competition. However, the unique live experience of performing arts remains a strong differentiator.

- End-User Profiles: The primary audience includes a broad demographic, ranging from young adults to seniors, with a growing interest in cultural experiences among millennials and Gen Z.

- M&A Activities: The market has witnessed several mergers and acquisitions, with deal values reaching up to $500 Million in recent years. Notable M&As include Live Nation Entertainment's acquisition of smaller regional promoters to expand its global footprint.

Performing Art Companies Market Industry Evolution

The Performing Art Companies Market has evolved significantly over the study period from 2019 to 2033, with a notable shift towards digitalization and globalization. The base year of 2025 marks a pivotal point where the industry began to recover from the global economic downturn, with an estimated market size of $50 Billion. The forecast period from 2025 to 2033 projects a Compound Annual Growth Rate (CAGR) of 5%, driven by increased consumer demand for immersive and personalized experiences.

Technological advancements have played a crucial role in this evolution. The adoption of VR and AR technologies has surged, with over 30% of performing arts companies now offering digital experiences. This shift not only caters to a broader audience but also opens new revenue channels. Additionally, the integration of data analytics has allowed companies to better understand audience preferences, leading to more tailored content and marketing strategies.

Consumer demands have also shifted, with a growing preference for unique and culturally rich experiences. This trend is particularly evident in the rise of international collaborations and the global touring of shows, which has increased by 20% since 2019. The historical period from 2019 to 2024 saw a temporary decline due to global health challenges, but the market has since rebounded strongly, with a renewed focus on innovation and audience engagement.

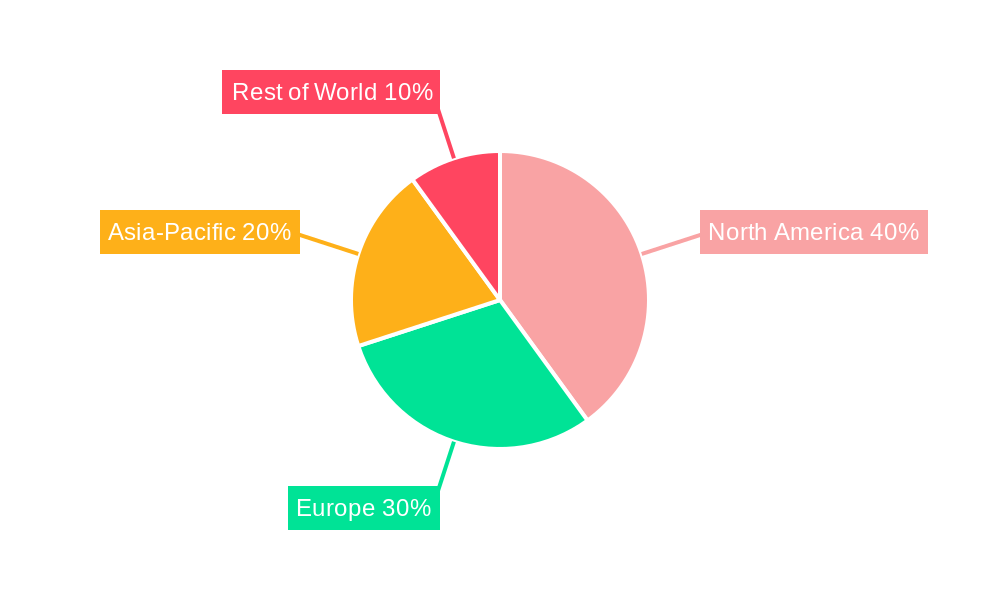

Leading Regions, Countries, or Segments in Performing Art Companies Market

North America stands out as the leading region in the Performing Art Companies Market, driven by a robust entertainment industry and high consumer spending on cultural activities. The United States, in particular, is a dominant player, with cities like New York and Las Vegas being global hubs for performing arts.

- Investment Trends: The region sees significant investments in infrastructure and technology, with over $10 Billion allocated annually to enhance performance venues and digital platforms.

- Regulatory Support: A favorable regulatory environment supports the growth of the market, with tax incentives and grants available for arts organizations.

- Cultural Diversity: The diverse population of North America fuels demand for a wide range of performing arts, from Broadway shows to ballet and opera.

In-depth analysis reveals that North America's dominance is further solidified by the presence of major industry players like The Walt Disney Company and Live Nation Entertainment. These companies leverage their extensive networks to promote and distribute performances, both domestically and internationally. The region's strong economic conditions and high disposable income levels also contribute to sustained market growth, with an expected CAGR of 6% during the forecast period.

Performing Art Companies Market Product Innovations

Innovations within the Performing Art Companies Market are continuously pushing the boundaries of creative expression and audience interaction. A significant trend is the integration of cutting-edge technologies to foster deeper engagement and extend the reach of performances. The adoption of Virtual Reality (VR) and Augmented Reality (AR) is revolutionizing the audience experience, enabling immersive virtual tours of rehearsal spaces and backstage glimpses, as well as interactive elements that can be seamlessly woven into live productions. This not only elevates the viewer's connection to the art but also dismantles geographical barriers, allowing companies to connect with a global audience like never before. Furthermore, the strategic deployment of AI-driven analytics is proving invaluable in understanding and predicting audience preferences. By analyzing viewing patterns and feedback, companies can now tailor programming, marketing, and even the nuances of a performance to resonate more profoundly, thereby cultivating stronger audience loyalty and satisfaction.

Propelling Factors for Performing Art Companies Market Growth

The Performing Art Companies Market is experiencing robust growth, fueled by a confluence of influential factors. Technologically, the accelerating embrace of digital platforms, coupled with the transformative potential of VR and AR, is significantly widening the market's accessibility and enriching the audience's overall experience. Economically, a notable rise in disposable incomes, particularly within the burgeoning middle class of emerging economies, is translating into increased consumer expenditure on enriching cultural activities. Regulatory landscapes also play a crucial role, with governmental support for the arts manifesting in the form of grants, subsidies, and favorable tax incentives, which provide a vital lifeline for artistic endeavors. A prime example of this is the National Endowment for the Arts in the U.S., which consistently provides crucial funding that empowers performing arts organizations to innovate and thrive.

Obstacles in the Performing Art Companies Market Market

Despite its growth trajectory, the Performing Art Companies Market navigates a landscape fraught with potential impediments. Regulatory complexities, including increasingly stringent labor laws and evolving copyright regulations, can impose significant operational costs and curtail the flexibility needed for agile adaptation. Supply chain vulnerabilities, especially concerning the procurement of specialized materials for sets and costumes, pose a tangible risk of performance delays and subsequent revenue losses. Moreover, the pervasive influence of digital entertainment platforms presents an intense competitive challenge, with a notable portion of potential audiences diverting their attention and spending towards readily accessible online content, thus impacting traditional revenue streams.

Future Opportunities in Performing Art Companies Market

The Performing Art Companies Market is poised for significant expansion, with promising opportunities emerging on multiple fronts. A key area of growth lies in penetrating new geographical markets, with a particular focus on Asia and Africa, regions experiencing a surge in cultural tourism and a growing appetite for diverse artistic expressions. Technological advancements are opening up exciting new possibilities, from the utilization of blockchain technology to streamline and secure ticket sales, to the application of AI for delivering hyper-personalized content recommendations and engagement strategies. Furthermore, the prevailing consumer trend towards experiential and immersive entertainment provides fertile ground for companies to innovate, develop novel performance formats, and captivate emerging demographics seeking unique and memorable cultural experiences.

Major Players in the Performing Art Companies Market Ecosystem

- The Walt Disney Company

- Live Nation Entertainment

- Cirque du Soleil

- The Madison Square Garden Company

- Broadway Across America

- National Theatre Company

- Royal Shakespeare Company

- Cameron Mackintosh Limited

- The Shubert Organization

- The Royal Opera House

List Not Exhaustive

Key Developments in Performing Art Companies Market Industry

- April 2023: Live Nation Entertainment and PayPal signed a multi-year deal to expand simple and secure payments to fans buying tickets worldwide. This partnership enhances the purchasing experience and is expected to drive ticket sales growth.

- January 2022: The Walt Disney Company established an international content organization to boost its global direct-to-consumer business and increase the pipeline of local content. This move strengthens Disney's position in the global market and caters to diverse audience preferences.

Strategic Performing Art Companies Market Market Forecast

The outlook for the Performing Art Companies Market is overwhelmingly positive, with projections indicating a Compound Annual Growth Rate (CAGR) of approximately 5% between 2025 and 2033. This optimistic forecast is underpinned by several key growth drivers. The continued and accelerated adoption of digital technologies will be instrumental in broadening audience access and enhancing engagement. Strategic expansion into underserved and emerging markets will unlock new revenue streams and diversify fan bases. Capitalizing on the strong consumer desire for experiential and immersive entertainment will encourage innovative programming and operational strategies. The confluence of opportunities in developing economies and the transformative potential of technologies like AI and blockchain are set to significantly amplify the market's potential, positioning the industry for sustained expansion and a more profound global resonance.

Performing Art Companies Market Segmentation

-

1. Type of Performing Arts

- 1.1. Theatre

- 1.2. Music and Opera

- 1.3. Dance

- 1.4. Circus and Other Art Forms

-

2. Venue Type

- 2.1. Concert Halls

- 2.2. Theatres

- 2.3. Stadiums

-

3. Ticket Pricing

- 3.1. Premium

- 3.2. Mid-range

- 3.3. Economy

Performing Art Companies Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Asia Pacific

- 2.1. India

- 2.2. China

- 2.3. Rest of Asia Pacific

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Peru

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Performing Art Companies Market Regional Market Share

Geographic Coverage of Performing Art Companies Market

Performing Art Companies Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Unique and Immersive Experiences; Growing Popularity of Social Media and Online Platforms

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Unique and Immersive Experiences; Growing Popularity of Social Media and Online Platforms

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Live Dance Performances

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Performing Art Companies Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Performing Arts

- 5.1.1. Theatre

- 5.1.2. Music and Opera

- 5.1.3. Dance

- 5.1.4. Circus and Other Art Forms

- 5.2. Market Analysis, Insights and Forecast - by Venue Type

- 5.2.1. Concert Halls

- 5.2.2. Theatres

- 5.2.3. Stadiums

- 5.3. Market Analysis, Insights and Forecast - by Ticket Pricing

- 5.3.1. Premium

- 5.3.2. Mid-range

- 5.3.3. Economy

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Asia Pacific

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Performing Arts

- 6. North America Performing Art Companies Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Performing Arts

- 6.1.1. Theatre

- 6.1.2. Music and Opera

- 6.1.3. Dance

- 6.1.4. Circus and Other Art Forms

- 6.2. Market Analysis, Insights and Forecast - by Venue Type

- 6.2.1. Concert Halls

- 6.2.2. Theatres

- 6.2.3. Stadiums

- 6.3. Market Analysis, Insights and Forecast - by Ticket Pricing

- 6.3.1. Premium

- 6.3.2. Mid-range

- 6.3.3. Economy

- 6.1. Market Analysis, Insights and Forecast - by Type of Performing Arts

- 7. Asia Pacific Performing Art Companies Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Performing Arts

- 7.1.1. Theatre

- 7.1.2. Music and Opera

- 7.1.3. Dance

- 7.1.4. Circus and Other Art Forms

- 7.2. Market Analysis, Insights and Forecast - by Venue Type

- 7.2.1. Concert Halls

- 7.2.2. Theatres

- 7.2.3. Stadiums

- 7.3. Market Analysis, Insights and Forecast - by Ticket Pricing

- 7.3.1. Premium

- 7.3.2. Mid-range

- 7.3.3. Economy

- 7.1. Market Analysis, Insights and Forecast - by Type of Performing Arts

- 8. Europe Performing Art Companies Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Performing Arts

- 8.1.1. Theatre

- 8.1.2. Music and Opera

- 8.1.3. Dance

- 8.1.4. Circus and Other Art Forms

- 8.2. Market Analysis, Insights and Forecast - by Venue Type

- 8.2.1. Concert Halls

- 8.2.2. Theatres

- 8.2.3. Stadiums

- 8.3. Market Analysis, Insights and Forecast - by Ticket Pricing

- 8.3.1. Premium

- 8.3.2. Mid-range

- 8.3.3. Economy

- 8.1. Market Analysis, Insights and Forecast - by Type of Performing Arts

- 9. South America Performing Art Companies Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Performing Arts

- 9.1.1. Theatre

- 9.1.2. Music and Opera

- 9.1.3. Dance

- 9.1.4. Circus and Other Art Forms

- 9.2. Market Analysis, Insights and Forecast - by Venue Type

- 9.2.1. Concert Halls

- 9.2.2. Theatres

- 9.2.3. Stadiums

- 9.3. Market Analysis, Insights and Forecast - by Ticket Pricing

- 9.3.1. Premium

- 9.3.2. Mid-range

- 9.3.3. Economy

- 9.1. Market Analysis, Insights and Forecast - by Type of Performing Arts

- 10. Middle East and Africa Performing Art Companies Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Performing Arts

- 10.1.1. Theatre

- 10.1.2. Music and Opera

- 10.1.3. Dance

- 10.1.4. Circus and Other Art Forms

- 10.2. Market Analysis, Insights and Forecast - by Venue Type

- 10.2.1. Concert Halls

- 10.2.2. Theatres

- 10.2.3. Stadiums

- 10.3. Market Analysis, Insights and Forecast - by Ticket Pricing

- 10.3.1. Premium

- 10.3.2. Mid-range

- 10.3.3. Economy

- 10.1. Market Analysis, Insights and Forecast - by Type of Performing Arts

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Walt Disney Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Live Nation Entertainment

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cirque du Soleil

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Madison Square Garden Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Broadway Across America

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 National Theatre Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Royal Shakespeare Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cameron Mackintosh Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Shubert Organization

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Royal Opera House**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 The Walt Disney Company

List of Figures

- Figure 1: Global Performing Art Companies Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Performing Art Companies Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Performing Art Companies Market Revenue (Million), by Type of Performing Arts 2025 & 2033

- Figure 4: North America Performing Art Companies Market Volume (Billion), by Type of Performing Arts 2025 & 2033

- Figure 5: North America Performing Art Companies Market Revenue Share (%), by Type of Performing Arts 2025 & 2033

- Figure 6: North America Performing Art Companies Market Volume Share (%), by Type of Performing Arts 2025 & 2033

- Figure 7: North America Performing Art Companies Market Revenue (Million), by Venue Type 2025 & 2033

- Figure 8: North America Performing Art Companies Market Volume (Billion), by Venue Type 2025 & 2033

- Figure 9: North America Performing Art Companies Market Revenue Share (%), by Venue Type 2025 & 2033

- Figure 10: North America Performing Art Companies Market Volume Share (%), by Venue Type 2025 & 2033

- Figure 11: North America Performing Art Companies Market Revenue (Million), by Ticket Pricing 2025 & 2033

- Figure 12: North America Performing Art Companies Market Volume (Billion), by Ticket Pricing 2025 & 2033

- Figure 13: North America Performing Art Companies Market Revenue Share (%), by Ticket Pricing 2025 & 2033

- Figure 14: North America Performing Art Companies Market Volume Share (%), by Ticket Pricing 2025 & 2033

- Figure 15: North America Performing Art Companies Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Performing Art Companies Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Performing Art Companies Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Performing Art Companies Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Performing Art Companies Market Revenue (Million), by Type of Performing Arts 2025 & 2033

- Figure 20: Asia Pacific Performing Art Companies Market Volume (Billion), by Type of Performing Arts 2025 & 2033

- Figure 21: Asia Pacific Performing Art Companies Market Revenue Share (%), by Type of Performing Arts 2025 & 2033

- Figure 22: Asia Pacific Performing Art Companies Market Volume Share (%), by Type of Performing Arts 2025 & 2033

- Figure 23: Asia Pacific Performing Art Companies Market Revenue (Million), by Venue Type 2025 & 2033

- Figure 24: Asia Pacific Performing Art Companies Market Volume (Billion), by Venue Type 2025 & 2033

- Figure 25: Asia Pacific Performing Art Companies Market Revenue Share (%), by Venue Type 2025 & 2033

- Figure 26: Asia Pacific Performing Art Companies Market Volume Share (%), by Venue Type 2025 & 2033

- Figure 27: Asia Pacific Performing Art Companies Market Revenue (Million), by Ticket Pricing 2025 & 2033

- Figure 28: Asia Pacific Performing Art Companies Market Volume (Billion), by Ticket Pricing 2025 & 2033

- Figure 29: Asia Pacific Performing Art Companies Market Revenue Share (%), by Ticket Pricing 2025 & 2033

- Figure 30: Asia Pacific Performing Art Companies Market Volume Share (%), by Ticket Pricing 2025 & 2033

- Figure 31: Asia Pacific Performing Art Companies Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Asia Pacific Performing Art Companies Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Asia Pacific Performing Art Companies Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Performing Art Companies Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Performing Art Companies Market Revenue (Million), by Type of Performing Arts 2025 & 2033

- Figure 36: Europe Performing Art Companies Market Volume (Billion), by Type of Performing Arts 2025 & 2033

- Figure 37: Europe Performing Art Companies Market Revenue Share (%), by Type of Performing Arts 2025 & 2033

- Figure 38: Europe Performing Art Companies Market Volume Share (%), by Type of Performing Arts 2025 & 2033

- Figure 39: Europe Performing Art Companies Market Revenue (Million), by Venue Type 2025 & 2033

- Figure 40: Europe Performing Art Companies Market Volume (Billion), by Venue Type 2025 & 2033

- Figure 41: Europe Performing Art Companies Market Revenue Share (%), by Venue Type 2025 & 2033

- Figure 42: Europe Performing Art Companies Market Volume Share (%), by Venue Type 2025 & 2033

- Figure 43: Europe Performing Art Companies Market Revenue (Million), by Ticket Pricing 2025 & 2033

- Figure 44: Europe Performing Art Companies Market Volume (Billion), by Ticket Pricing 2025 & 2033

- Figure 45: Europe Performing Art Companies Market Revenue Share (%), by Ticket Pricing 2025 & 2033

- Figure 46: Europe Performing Art Companies Market Volume Share (%), by Ticket Pricing 2025 & 2033

- Figure 47: Europe Performing Art Companies Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe Performing Art Companies Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Europe Performing Art Companies Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Performing Art Companies Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Performing Art Companies Market Revenue (Million), by Type of Performing Arts 2025 & 2033

- Figure 52: South America Performing Art Companies Market Volume (Billion), by Type of Performing Arts 2025 & 2033

- Figure 53: South America Performing Art Companies Market Revenue Share (%), by Type of Performing Arts 2025 & 2033

- Figure 54: South America Performing Art Companies Market Volume Share (%), by Type of Performing Arts 2025 & 2033

- Figure 55: South America Performing Art Companies Market Revenue (Million), by Venue Type 2025 & 2033

- Figure 56: South America Performing Art Companies Market Volume (Billion), by Venue Type 2025 & 2033

- Figure 57: South America Performing Art Companies Market Revenue Share (%), by Venue Type 2025 & 2033

- Figure 58: South America Performing Art Companies Market Volume Share (%), by Venue Type 2025 & 2033

- Figure 59: South America Performing Art Companies Market Revenue (Million), by Ticket Pricing 2025 & 2033

- Figure 60: South America Performing Art Companies Market Volume (Billion), by Ticket Pricing 2025 & 2033

- Figure 61: South America Performing Art Companies Market Revenue Share (%), by Ticket Pricing 2025 & 2033

- Figure 62: South America Performing Art Companies Market Volume Share (%), by Ticket Pricing 2025 & 2033

- Figure 63: South America Performing Art Companies Market Revenue (Million), by Country 2025 & 2033

- Figure 64: South America Performing Art Companies Market Volume (Billion), by Country 2025 & 2033

- Figure 65: South America Performing Art Companies Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Performing Art Companies Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Performing Art Companies Market Revenue (Million), by Type of Performing Arts 2025 & 2033

- Figure 68: Middle East and Africa Performing Art Companies Market Volume (Billion), by Type of Performing Arts 2025 & 2033

- Figure 69: Middle East and Africa Performing Art Companies Market Revenue Share (%), by Type of Performing Arts 2025 & 2033

- Figure 70: Middle East and Africa Performing Art Companies Market Volume Share (%), by Type of Performing Arts 2025 & 2033

- Figure 71: Middle East and Africa Performing Art Companies Market Revenue (Million), by Venue Type 2025 & 2033

- Figure 72: Middle East and Africa Performing Art Companies Market Volume (Billion), by Venue Type 2025 & 2033

- Figure 73: Middle East and Africa Performing Art Companies Market Revenue Share (%), by Venue Type 2025 & 2033

- Figure 74: Middle East and Africa Performing Art Companies Market Volume Share (%), by Venue Type 2025 & 2033

- Figure 75: Middle East and Africa Performing Art Companies Market Revenue (Million), by Ticket Pricing 2025 & 2033

- Figure 76: Middle East and Africa Performing Art Companies Market Volume (Billion), by Ticket Pricing 2025 & 2033

- Figure 77: Middle East and Africa Performing Art Companies Market Revenue Share (%), by Ticket Pricing 2025 & 2033

- Figure 78: Middle East and Africa Performing Art Companies Market Volume Share (%), by Ticket Pricing 2025 & 2033

- Figure 79: Middle East and Africa Performing Art Companies Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Performing Art Companies Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Middle East and Africa Performing Art Companies Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Performing Art Companies Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Performing Art Companies Market Revenue Million Forecast, by Type of Performing Arts 2020 & 2033

- Table 2: Global Performing Art Companies Market Volume Billion Forecast, by Type of Performing Arts 2020 & 2033

- Table 3: Global Performing Art Companies Market Revenue Million Forecast, by Venue Type 2020 & 2033

- Table 4: Global Performing Art Companies Market Volume Billion Forecast, by Venue Type 2020 & 2033

- Table 5: Global Performing Art Companies Market Revenue Million Forecast, by Ticket Pricing 2020 & 2033

- Table 6: Global Performing Art Companies Market Volume Billion Forecast, by Ticket Pricing 2020 & 2033

- Table 7: Global Performing Art Companies Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Performing Art Companies Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Performing Art Companies Market Revenue Million Forecast, by Type of Performing Arts 2020 & 2033

- Table 10: Global Performing Art Companies Market Volume Billion Forecast, by Type of Performing Arts 2020 & 2033

- Table 11: Global Performing Art Companies Market Revenue Million Forecast, by Venue Type 2020 & 2033

- Table 12: Global Performing Art Companies Market Volume Billion Forecast, by Venue Type 2020 & 2033

- Table 13: Global Performing Art Companies Market Revenue Million Forecast, by Ticket Pricing 2020 & 2033

- Table 14: Global Performing Art Companies Market Volume Billion Forecast, by Ticket Pricing 2020 & 2033

- Table 15: Global Performing Art Companies Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Performing Art Companies Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States Performing Art Companies Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Performing Art Companies Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Performing Art Companies Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Performing Art Companies Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of North America Performing Art Companies Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of North America Performing Art Companies Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Global Performing Art Companies Market Revenue Million Forecast, by Type of Performing Arts 2020 & 2033

- Table 24: Global Performing Art Companies Market Volume Billion Forecast, by Type of Performing Arts 2020 & 2033

- Table 25: Global Performing Art Companies Market Revenue Million Forecast, by Venue Type 2020 & 2033

- Table 26: Global Performing Art Companies Market Volume Billion Forecast, by Venue Type 2020 & 2033

- Table 27: Global Performing Art Companies Market Revenue Million Forecast, by Ticket Pricing 2020 & 2033

- Table 28: Global Performing Art Companies Market Volume Billion Forecast, by Ticket Pricing 2020 & 2033

- Table 29: Global Performing Art Companies Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Performing Art Companies Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: India Performing Art Companies Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: India Performing Art Companies Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: China Performing Art Companies Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: China Performing Art Companies Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Asia Pacific Performing Art Companies Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Asia Pacific Performing Art Companies Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Global Performing Art Companies Market Revenue Million Forecast, by Type of Performing Arts 2020 & 2033

- Table 38: Global Performing Art Companies Market Volume Billion Forecast, by Type of Performing Arts 2020 & 2033

- Table 39: Global Performing Art Companies Market Revenue Million Forecast, by Venue Type 2020 & 2033

- Table 40: Global Performing Art Companies Market Volume Billion Forecast, by Venue Type 2020 & 2033

- Table 41: Global Performing Art Companies Market Revenue Million Forecast, by Ticket Pricing 2020 & 2033

- Table 42: Global Performing Art Companies Market Volume Billion Forecast, by Ticket Pricing 2020 & 2033

- Table 43: Global Performing Art Companies Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Performing Art Companies Market Volume Billion Forecast, by Country 2020 & 2033

- Table 45: United Kingdom Performing Art Companies Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Performing Art Companies Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Germany Performing Art Companies Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Germany Performing Art Companies Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Rest of Europe Performing Art Companies Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Europe Performing Art Companies Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Global Performing Art Companies Market Revenue Million Forecast, by Type of Performing Arts 2020 & 2033

- Table 52: Global Performing Art Companies Market Volume Billion Forecast, by Type of Performing Arts 2020 & 2033

- Table 53: Global Performing Art Companies Market Revenue Million Forecast, by Venue Type 2020 & 2033

- Table 54: Global Performing Art Companies Market Volume Billion Forecast, by Venue Type 2020 & 2033

- Table 55: Global Performing Art Companies Market Revenue Million Forecast, by Ticket Pricing 2020 & 2033

- Table 56: Global Performing Art Companies Market Volume Billion Forecast, by Ticket Pricing 2020 & 2033

- Table 57: Global Performing Art Companies Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: Global Performing Art Companies Market Volume Billion Forecast, by Country 2020 & 2033

- Table 59: Brazil Performing Art Companies Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Brazil Performing Art Companies Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Peru Performing Art Companies Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Peru Performing Art Companies Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Rest of South America Performing Art Companies Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of South America Performing Art Companies Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Global Performing Art Companies Market Revenue Million Forecast, by Type of Performing Arts 2020 & 2033

- Table 66: Global Performing Art Companies Market Volume Billion Forecast, by Type of Performing Arts 2020 & 2033

- Table 67: Global Performing Art Companies Market Revenue Million Forecast, by Venue Type 2020 & 2033

- Table 68: Global Performing Art Companies Market Volume Billion Forecast, by Venue Type 2020 & 2033

- Table 69: Global Performing Art Companies Market Revenue Million Forecast, by Ticket Pricing 2020 & 2033

- Table 70: Global Performing Art Companies Market Volume Billion Forecast, by Ticket Pricing 2020 & 2033

- Table 71: Global Performing Art Companies Market Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Performing Art Companies Market Volume Billion Forecast, by Country 2020 & 2033

- Table 73: Saudi Arabia Performing Art Companies Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Saudi Arabia Performing Art Companies Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: United Arab Emirates Performing Art Companies Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: United Arab Emirates Performing Art Companies Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: Rest of Middle East and Africa Performing Art Companies Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Rest of Middle East and Africa Performing Art Companies Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Performing Art Companies Market?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the Performing Art Companies Market?

Key companies in the market include The Walt Disney Company, Live Nation Entertainment, Cirque du Soleil, The Madison Square Garden Company, Broadway Across America, National Theatre Company, Royal Shakespeare Company, Cameron Mackintosh Limited, The Shubert Organization, The Royal Opera House**List Not Exhaustive.

3. What are the main segments of the Performing Art Companies Market?

The market segments include Type of Performing Arts, Venue Type, Ticket Pricing.

4. Can you provide details about the market size?

The market size is estimated to be USD 193.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Unique and Immersive Experiences; Growing Popularity of Social Media and Online Platforms.

6. What are the notable trends driving market growth?

Increasing Demand for Live Dance Performances.

7. Are there any restraints impacting market growth?

Increasing Demand for Unique and Immersive Experiences; Growing Popularity of Social Media and Online Platforms.

8. Can you provide examples of recent developments in the market?

April 2023: Live Nation Entertainment and PayPal signed a multi-year deal to expand simple and secure payments to fans buying tickets worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Performing Art Companies Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Performing Art Companies Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Performing Art Companies Market?

To stay informed about further developments, trends, and reports in the Performing Art Companies Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence