Key Insights

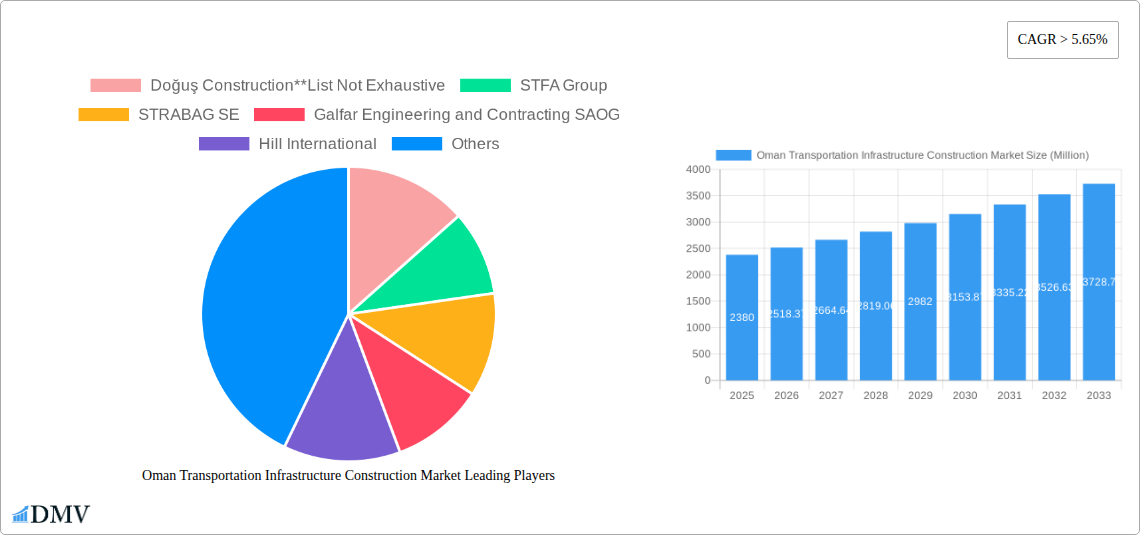

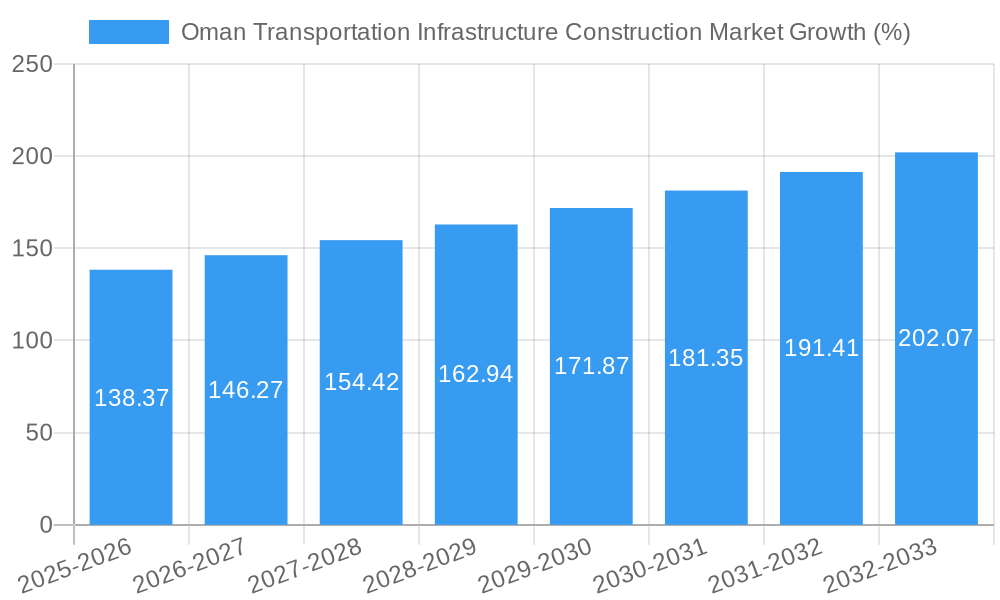

The Oman Transportation Infrastructure Construction market is experiencing robust growth, projected to reach a market size of $2.38 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 5.65% from 2025 to 2033. This expansion is fueled by Oman's strategic investments in upgrading its transportation network to support economic diversification and tourism initiatives. Government initiatives focused on improving road connectivity, expanding port facilities, and modernizing rail infrastructure are key drivers. Increased urbanization and a rising population are also contributing factors, placing higher demands on efficient transportation systems. The market segmentation, encompassing air, railway, road, port, and inland waterway projects, reflects the government's commitment to a multi-modal approach. Leading companies such as Doğuş Construction, STFA Group, STRABAG SE, and others are actively involved in these projects, leveraging their expertise in large-scale infrastructure development. While challenges such as fluctuating oil prices and global economic uncertainty could potentially act as restraints, the long-term outlook remains positive, driven by sustained governmental commitment and ongoing infrastructural projects.

The consistent growth trajectory indicates a promising investment landscape in Oman's transportation sector. The market's segmentation provides opportunities for specialized contractors focusing on specific modes of transport. Further growth is expected through public-private partnerships (PPPs) that attract both domestic and international investment. The country’s strategic location, facilitating regional trade, further bolsters the demand for efficient transportation infrastructure. Continuous modernization efforts, focusing on sustainability and technological advancements within the transportation sector, will likely shape future market trends. Increased focus on environmentally friendly construction practices and the adoption of smart technologies will contribute to the market's growth and sustainability. Competitive bidding processes and efficient project management will be crucial for ensuring timely project completion and optimizing resource allocation.

Oman Transportation Infrastructure Construction Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Oman transportation infrastructure construction market, offering a comprehensive overview of its current state, future trends, and growth opportunities. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period spanning 2025-2033. The historical period analyzed is 2019-2024. Key players such as Doğuş Construction, STFA Group, STRABAG SE, Galfar Engineering and Contracting SAOG, Hill International, Bechtel, Consolidated Contractors Company, Desert Line Group, and Khalid Bin Ahmed & Sons LLC are profiled, though the list is not exhaustive. The market is segmented by mode of transport: Air, Railways, Roadways, Ports, and Inland Waterways. The report projects a market value of xx Million USD by 2033.

Oman Transportation Infrastructure Construction Market Composition & Trends

The Oman transportation infrastructure construction market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Market share distribution is currently estimated at xx% for the top 5 players, with the remaining share distributed among numerous smaller companies. Innovation in this sector is driven by government initiatives promoting sustainable construction practices and technological advancements in materials and construction techniques. The regulatory landscape is primarily shaped by Oman’s Ministry of Transport, Communications, and Information Technology, which sets standards and regulations for construction projects. Substitute products, such as improved maintenance strategies for existing infrastructure, pose some competitive pressure, but the increasing demand for new infrastructure generally outpaces this influence. End-users primarily include the government, private sector developers, and logistics companies. M&A activity is relatively frequent, with deal values typically ranging from xx Million USD to xx Million USD, driven by the need to consolidate resources and expertise in large-scale projects. Recent mergers and acquisitions are summarized below:

- Deal 1: [Company A] acquired [Company B] for xx Million USD in [Year].

- Deal 2: [Company C] merged with [Company D] forming [New Company Name] in [Year].

Oman Transportation Infrastructure Construction Market Industry Evolution

The Oman transportation infrastructure construction market has witnessed consistent growth over the past five years, driven by government investments in mega-projects and a growing economy. The average annual growth rate (AAGR) from 2019 to 2024 is estimated at xx%. This growth is expected to continue, with a projected AAGR of xx% from 2025 to 2033, fueled by ongoing infrastructure development plans. Technological advancements, such as Building Information Modeling (BIM) and the adoption of prefabricated construction methods, are increasing efficiency and reducing project timelines. Shifting consumer demands are pushing for sustainable infrastructure solutions, creating opportunities for eco-friendly construction materials and practices. The adoption rate of BIM, for instance, is currently at xx% and is projected to reach xx% by 2033. Increased demand for high-speed rail and improved port facilities is also impacting market evolution. Government support for sustainable and smart infrastructure projects has played a vital role in shaping industry growth trajectories. The increasing focus on improving connectivity across the Sultanate has also contributed to the growth of the market.

Leading Regions, Countries, or Segments in Oman Transportation Infrastructure Construction Market

The Roadways segment currently dominates the Oman transportation infrastructure construction market, accounting for approximately xx% of the total market value in 2025. This dominance is primarily attributed to:

- Significant Government Investments: The government's substantial investment in expanding and upgrading Oman's road network fuels the segment’s growth. The recent dualisation plan for the Adam-Thamrait Road highlights this commitment.

- Economic Growth & Development: Oman’s economic growth and increasing urbanization necessitate improved road connectivity.

- Tourism Sector Expansion: The growth of Oman's tourism sector boosts demand for enhanced road infrastructure to cater to increased tourist traffic.

While Roadways hold the largest share, the Railways segment exhibits significant potential for growth due to cross-border initiatives like the proposed UAE-Oman joint railway project, which promises a significant influx of investments and construction activity. The Ports and Inland Waterways segments are also experiencing growth, driven by government initiatives to upgrade port facilities and enhance inland waterway transportation capabilities. The Air segment, while smaller in terms of construction value, displays steady growth due to investments in airport expansion and modernization projects.

Oman Transportation Infrastructure Construction Market Product Innovations

The Oman transportation infrastructure construction market is witnessing innovation in sustainable materials, such as recycled aggregates and low-carbon cement, alongside the integration of advanced technologies, like drones for site surveys and 3D printing for construction. These advancements enhance efficiency, reduce environmental impact, and improve overall project quality. The use of BIM for project management is also gaining traction, leading to reduced project timelines and cost overruns. Unique selling propositions of various companies often revolve around their specialized expertise, efficient project management, and use of sustainable and innovative materials.

Propelling Factors for Oman Transportation Infrastructure Construction Market Growth

Several factors are propelling the growth of Oman's transportation infrastructure construction market. Significant government investments in infrastructure projects are a primary driver. Economic growth and urbanization are increasing demand for improved transportation networks. Furthermore, Oman's strategic geographic location and focus on diversifying its economy are creating opportunities for infrastructure development. Technological advancements, such as BIM and prefabrication, are improving efficiency and sustainability. Supportive government regulations further encourage investment in this sector.

Obstacles in the Oman Transportation Infrastructure Construction Market

Despite significant growth potential, several challenges hinder the Oman transportation infrastructure construction market. Securing sufficient skilled labor can be difficult, and fluctuating material prices pose a risk. Stringent regulatory compliance and obtaining necessary permits can cause delays. Competition among numerous contractors can lead to price pressures. These obstacles can significantly impact project timelines and overall costs.

Future Opportunities in Oman Transportation Infrastructure Construction Market

Emerging opportunities include the development of sustainable and smart infrastructure solutions, the expansion of the railway network, and improvements to port and airport facilities. Government initiatives towards digitalization of project management will foster further growth. Investment in logistics and smart city projects will also create numerous construction opportunities. The adoption of innovative technologies and the pursuit of sustainable infrastructure development offer a strong growth trajectory for the future.

Major Players in the Oman Transportation Infrastructure Construction Market Ecosystem

- Doğuş Construction

- STFA Group

- STRABAG SE

- Galfar Engineering and Contracting SAOG

- Hill International

- Bechtel

- Consolidated Contractors Company

- Desert Line Group

- Khalid Bin Ahmed & Sons LLC

Key Developments in Oman Transportation Infrastructure Construction Market Industry

- February 2023: UAE and Oman signed an agreement to launch a joint railway company with an investment of about USD 3 Billion to link the two Gulf countries. This signifies a major boost to the railway sector.

- March 2023: The Government of Oman announced plans to expand nine existing roads, including the dualisation of the 437 km Adam-Thamrait Road. This substantial investment will significantly impact the roadways segment.

Strategic Oman Transportation Infrastructure Construction Market Forecast

The Oman transportation infrastructure construction market is poised for sustained growth, driven by ongoing government investments, economic expansion, and technological advancements. The focus on sustainable infrastructure and the development of key transportation links will create significant opportunities for market players. The market is expected to witness robust growth over the forecast period, attracting further investments and promoting innovation within the sector. This report offers a critical resource for strategic decision-making in this dynamic market.

Oman Transportation Infrastructure Construction Market Segmentation

-

1. Mode of Transport

- 1.1. Air

- 1.2. Railways

- 1.3. Roadways

- 1.4. Ports and Inland Waterways

Oman Transportation Infrastructure Construction Market Segmentation By Geography

- 1. Oman

Oman Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing urban population driving the growth of transportation infrastructure.; Sultanate's Economic Diversification Plan (Vision 2040) to provide new growth to the market

- 3.3. Market Restrains

- 3.3.1. Delay in project approvals; High cost of materials

- 3.4. Market Trends

- 3.4.1. Growing urban population driving the growth of transportation infrastructure.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.1.1. Air

- 5.1.2. Railways

- 5.1.3. Roadways

- 5.1.4. Ports and Inland Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Doğuş Construction**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 STFA Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 STRABAG SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Galfar Engineering and Contracting SAOG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hill International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bechtel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Consolidated Contractors Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Desert Line Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Khalid Bin Ahmed & Sons LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Doğuş Construction**List Not Exhaustive

List of Figures

- Figure 1: Oman Transportation Infrastructure Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman Transportation Infrastructure Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Oman Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode of Transport 2019 & 2032

- Table 3: Oman Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Oman Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Oman Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode of Transport 2019 & 2032

- Table 6: Oman Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Transportation Infrastructure Construction Market?

The projected CAGR is approximately > 5.65%.

2. Which companies are prominent players in the Oman Transportation Infrastructure Construction Market?

Key companies in the market include Doğuş Construction**List Not Exhaustive, STFA Group, STRABAG SE, Galfar Engineering and Contracting SAOG, Hill International, Bechtel, Consolidated Contractors Company, Desert Line Group, Khalid Bin Ahmed & Sons LLC.

3. What are the main segments of the Oman Transportation Infrastructure Construction Market?

The market segments include Mode of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing urban population driving the growth of transportation infrastructure.; Sultanate's Economic Diversification Plan (Vision 2040) to provide new growth to the market.

6. What are the notable trends driving market growth?

Growing urban population driving the growth of transportation infrastructure..

7. Are there any restraints impacting market growth?

Delay in project approvals; High cost of materials.

8. Can you provide examples of recent developments in the market?

March 2023: The Government of Oman plans to expand nine existing roads, including the dualisation of the 437 km Adam-Thamrait Road, which connects the Ad Dakhiliyah and Dhofar governorates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the Oman Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence