Key Insights

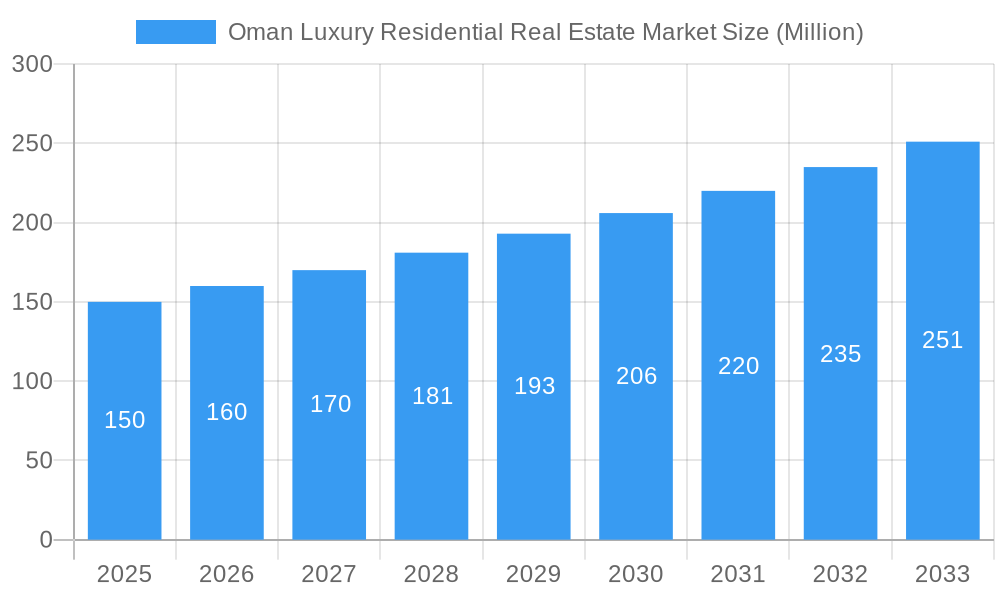

The Oman luxury residential real estate market is projected to reach $4.78 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 9.19% during the forecast period of 2025-2033. This substantial growth is fueled by a rising number of high-net-worth individuals (HNWIs) in Oman, an increasing demand for premium living experiences, and strategic government initiatives focused on tourism and infrastructure enhancement. The market is segmented by property types, including condominiums, apartments, villas, and landed houses, and by key cities such as Muscat, Dhofar, Musandam, Salalah, and other Omani regions. Muscat currently holds the largest market share, attributed to its developed infrastructure and concentration of HNWIs. Emerging trends include a growing preference for sustainable and eco-friendly luxury properties, alongside the integration of smart home technologies.

Oman Luxury Residential Real Estate Market Market Size (In Billion)

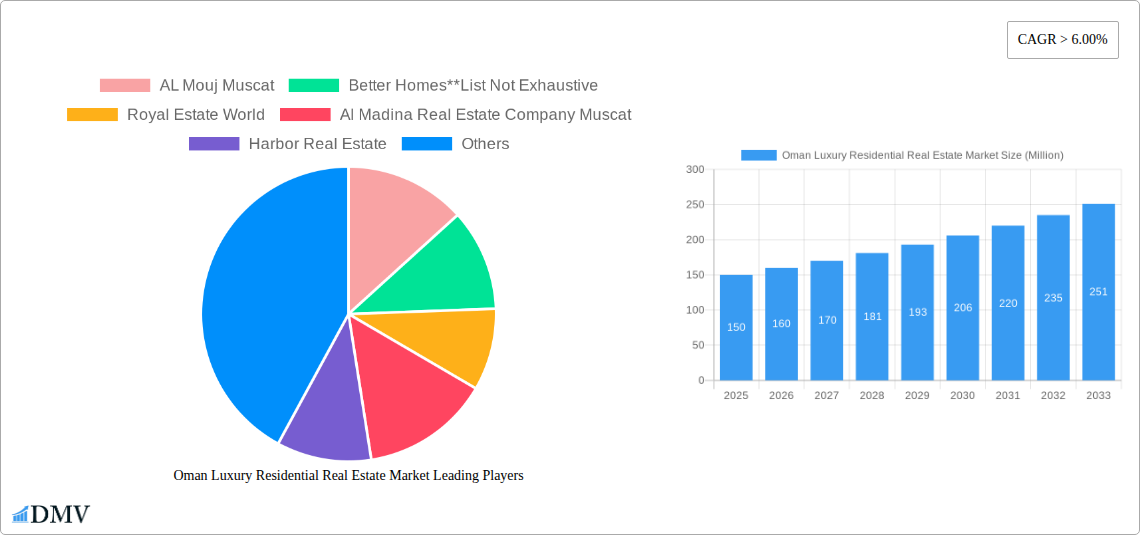

Despite positive growth prospects, potential market restraints include the volatility of oil prices, stringent government regulations, and a limited supply of luxury properties in select locations. The competitive landscape features prominent local and international real estate developers such as AL Mouj Muscat, Better Homes, Royal Estate World, Al Madina Real Estate Company Muscat, Harbor Real Estate, Al-Taher Group, Alfardan Heights, Maysan properties SAOC, Wujha Real Estate, and Noor Oman. Future expansion will be contingent upon the successful completion of ongoing infrastructure projects, further advancements in tourism, and overall national economic stability. The sector anticipates a significant influx of both domestic and international investment, reinforcing its continued growth trajectory.

Oman Luxury Residential Real Estate Market Company Market Share

Oman Luxury Residential Real Estate Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Oman luxury residential real estate market, encompassing historical trends (2019-2024), the current state (2025), and future projections (2025-2033). It offers invaluable insights for investors, developers, and stakeholders seeking to navigate this dynamic market. The report leverages extensive data analysis to paint a clear picture of market composition, growth drivers, challenges, and future opportunities, with a focus on key segments, leading players, and significant industry developments. The total market value is estimated at xx Million in 2025, projected to reach xx Million by 2033.

Oman Luxury Residential Real Estate Market Composition & Trends

This section meticulously examines the structure and dynamics of Oman's luxury residential real estate market. We delve into market concentration, analyzing the market share distribution among key players like AL Mouj Muscat, Better Homes, Royal Estate World, Al Madina Real Estate Company Muscat, Harbor Real Estate, Al-Taher Group, Alfardan Heights, Maysan properties SAOC, Wujha Real Estate, and Noor Oman. The report also explores the influence of innovation, regulatory frameworks, the availability of substitute products, and the evolving profiles of end-users. Furthermore, it assesses the impact of mergers and acquisitions (M&A) activities, including deal values and their implications for market consolidation.

- Market Concentration: The market exhibits a [High/Medium/Low] level of concentration, with the top 5 players holding approximately xx% of the market share in 2025.

- Innovation Catalysts: [Describe key technological or design innovations influencing the market, e.g., smart home technology adoption.]

- Regulatory Landscape: [Analyze the impact of government policies and regulations on the market.]

- Substitute Products: [Discuss alternative investment options and their impact on market demand.]

- End-User Profiles: [Describe the demographics and preferences of luxury homebuyers in Oman.]

- M&A Activity: Total M&A deal value in the period 2019-2024 reached approximately xx Million. [Include details of significant transactions if available].

Oman Luxury Residential Real Estate Market Industry Evolution

This section charts the evolution of Oman's luxury residential real estate market from 2019 to 2033. We analyze market growth trajectories, technological advancements, and changing consumer preferences. Specific data points such as compound annual growth rates (CAGR) and adoption rates of new technologies are provided. The analysis incorporates factors driving market expansion, including government initiatives, infrastructural developments, and shifts in lifestyle preferences. The rising demand for luxury properties in specific locations and the impact of economic conditions on market performance are also discussed in detail. The report further explores how these factors are influencing investment strategies and shaping the future of the market.

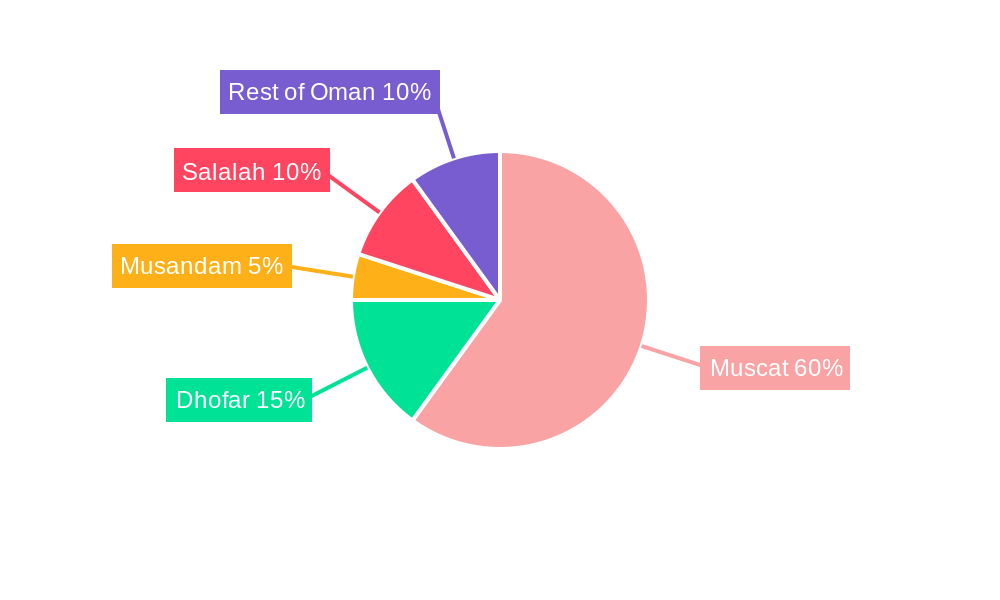

Leading Regions, Countries, or Segments in Oman Luxury Residential Real Estate Market

This section identifies the dominant regions, countries, and segments within the Oman luxury residential real estate market. We analyze market performance across key cities (Muscat, Dhofar, Musandam, Salalah, Rest of Oman) and property types (Condominiums and Apartments, Villas and Landed Houses).

By Type:

- Villas and Landed Houses: This segment dominates the luxury market due to [Reasons for dominance, e.g., strong demand for larger properties with private outdoor spaces].

- Condominiums and Apartments: This segment shows [Growth/Decline] due to [Reasons for growth/decline, e.g., increasing preference for low-maintenance living in prime locations].

By Key Cities:

- Muscat: The highest concentration of luxury properties is in Muscat, driven by [Reasons for dominance, e.g., strong economic activity, proximity to key infrastructure, and established luxury communities].

- Dhofar: Growing demand is observed in Dhofar, particularly in Salalah, fueled by [Reasons for growth, e.g., tourism growth, government investments in infrastructure].

- Musandam, Salalah, Rest of Oman: These regions exhibit [Growth/Stagnation] in the luxury residential market due to [Reasons for growth/stagnation, e.g., limited infrastructure development, less access to amenities].

Oman Luxury Residential Real Estate Market Product Innovations

Recent innovations in the Oman luxury residential market include [Describe specific examples, e.g., sustainable building materials, smart home integration, unique architectural designs]. These innovations cater to the evolving preferences of high-net-worth individuals, emphasizing energy efficiency, advanced security systems, and personalized living experiences. The focus on creating exclusive and bespoke properties is a key element driving innovation in this sector.

Propelling Factors for Oman Luxury Residential Real Estate Market Growth

Several factors contribute to the growth of Oman's luxury residential real estate market. Government initiatives aimed at promoting tourism and foreign investment, coupled with economic diversification efforts, play a crucial role. The increasing affluence of the population, especially high-net-worth individuals, further fuels demand. Moreover, infrastructural developments and improved connectivity enhance the appeal of luxury properties in key locations.

Obstacles in the Oman Luxury Residential Real Estate Market

Challenges hindering market growth include land scarcity in prime locations, which drives up prices and limits supply. Stringent building regulations and approval processes can also delay project completion. Furthermore, competition from established international luxury developers and fluctuating economic conditions influence investor sentiment and market stability.

Future Opportunities in Oman Luxury Residential Real Estate Market

Future opportunities lie in the development of sustainable and eco-friendly luxury housing, catering to environmentally conscious buyers. Integration of smart technologies and the creation of unique, experiential living environments will also attract significant investments. Expansion into untapped markets within Oman and focusing on specific niche segments represent substantial growth potentials.

Major Players in the Oman Luxury Residential Real Estate Market Ecosystem

- AL Mouj Muscat

- Better Homes

- Royal Estate World

- Al Madina Real Estate Company Muscat

- Harbor Real Estate

- Al-Taher Group

- Alfardan Heights

- Maysan properties SAOC

- Wujha Real Estate

- Noor Oman

Key Developments in Oman Luxury Residential Real Estate Market Industry

- March 2023: Tibiaan Properties and Al Tamman Real Estate Company launched 'Ajwaa', a commercial development in Al Saada, Salalah, featuring office spaces, retail units, restaurants, and cafes. This project reflects the rising demand for premium real estate in the Dhofar Governorate.

- April 2022: Barka Real Estate Development Company and Tibiaan Properties launched "Massar," an integrated commercial project in Barka, South Batinah governorate.

Strategic Oman Luxury Residential Real Estate Market Forecast

The Oman luxury residential real estate market is poised for sustained growth, driven by continued economic diversification, government initiatives, and increasing demand for upscale properties. The focus on sustainable development and smart home technologies will further enhance the market's appeal to investors and buyers. The projected growth indicates significant potential for long-term investment in this sector.

Oman Luxury Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Condominiums and Apartments

- 1.2. Villas and Landed Houses

-

2. Key Cities

- 2.1. Muscat

- 2.2. Dhofar

- 2.3. Musandam

- 2.4. Salalh

- 2.5. Rest of Oman

Oman Luxury Residential Real Estate Market Segmentation By Geography

- 1. Oman

Oman Luxury Residential Real Estate Market Regional Market Share

Geographic Coverage of Oman Luxury Residential Real Estate Market

Oman Luxury Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio

- 3.3. Market Restrains

- 3.3.1. Lack of awareness of senior living options; Relatively small size of senior living population

- 3.4. Market Trends

- 3.4.1. Supply of Residential Buildings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condominiums and Apartments

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Muscat

- 5.2.2. Dhofar

- 5.2.3. Musandam

- 5.2.4. Salalh

- 5.2.5. Rest of Oman

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AL Mouj Muscat

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Better Homes**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Royal Estate World

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Al Madina Real Estate Company Muscat

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Harbor Real Estate

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Al-Taher Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alfardan Heights

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Maysan properties SAOC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wujha Real Estate

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Noor Oman

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AL Mouj Muscat

List of Figures

- Figure 1: Oman Luxury Residential Real Estate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Oman Luxury Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 3: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 6: Oman Luxury Residential Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Luxury Residential Real Estate Market?

The projected CAGR is approximately 9.19%.

2. Which companies are prominent players in the Oman Luxury Residential Real Estate Market?

Key companies in the market include AL Mouj Muscat, Better Homes**List Not Exhaustive, Royal Estate World, Al Madina Real Estate Company Muscat, Harbor Real Estate, Al-Taher Group, Alfardan Heights, Maysan properties SAOC, Wujha Real Estate, Noor Oman.

3. What are the main segments of the Oman Luxury Residential Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio.

6. What are the notable trends driving market growth?

Supply of Residential Buildings.

7. Are there any restraints impacting market growth?

Lack of awareness of senior living options; Relatively small size of senior living population.

8. Can you provide examples of recent developments in the market?

March 2023: Tibiaan Properties and Al Tamman Real Estate Company, a subsidiary of Muscat Overseas Group, signed a contract to develop and market the first commercial development of its kind in the Dhofar Governorate specifically in Al Saada area, Salalah. This project will include commercial units dedicated to various activities such as office spaces, retail spaces, restaurants, cafes, etc. This cooperation comes into place to deliver premium projects in Dhofar Governorate, where demand is rising for quality real estate projects. The project name 'Ajwaa' is an Arabic word that refers to the beautiful weather Salalah is enjoying throughout the year, thus reflecting the opportunities this project offers to investors in both corporates and individuals capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Luxury Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Luxury Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Luxury Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Oman Luxury Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence