Key Insights

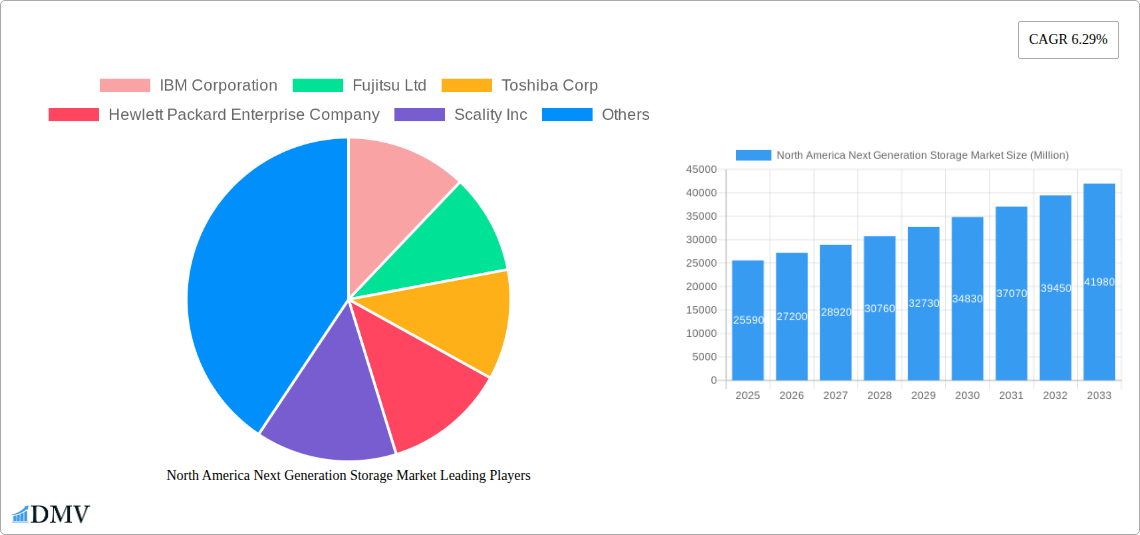

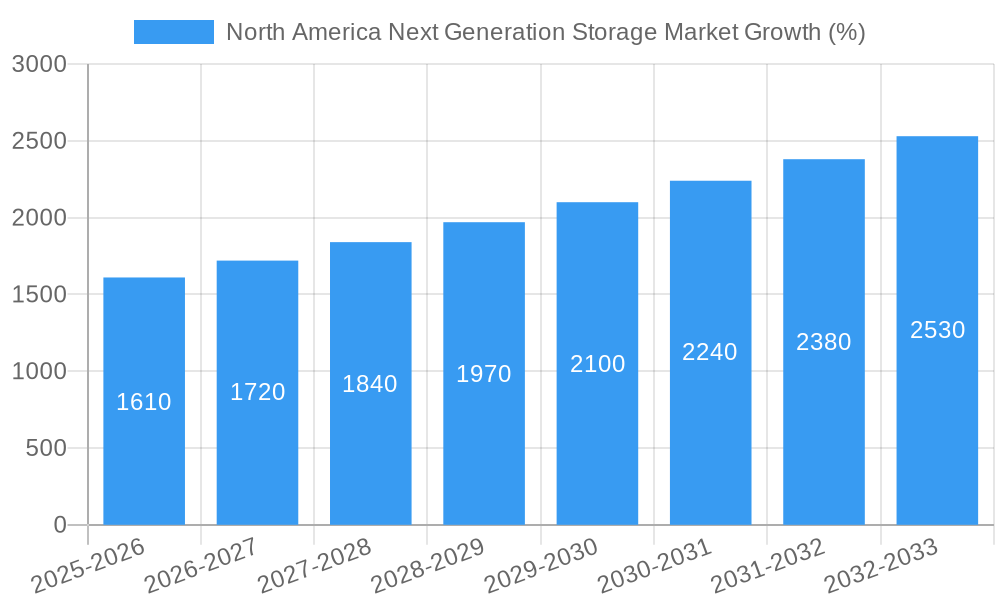

The North America next-generation storage market is experiencing robust growth, projected to reach \$25.59 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.29% from 2025 to 2033. This expansion is fueled by several key factors. The increasing adoption of cloud computing and big data analytics necessitates advanced storage solutions capable of handling massive datasets and ensuring high availability and performance. Furthermore, the rising demand for data security and disaster recovery solutions is driving investment in robust, scalable storage systems. Within the market, Network Attached Storage (NAS) and Storage Area Networks (SAN) are experiencing significant traction due to their ability to centralize data management and improve efficiency. The BFSI (Banking, Financial Services, and Insurance), IT and Telecom, and Healthcare sectors are leading adopters, driven by their stringent data management and compliance requirements. Growth is also spurred by the transition towards File and Object-based Storage (FOBS) architectures, offering improved scalability and cost-effectiveness compared to traditional block storage. Competition within the market is intense, with established players like IBM, Hewlett Packard Enterprise, and NetApp facing challenges from emerging vendors offering innovative solutions and competitive pricing. The increasing adoption of hybrid cloud strategies further shapes the landscape, requiring storage solutions that seamlessly integrate on-premise and cloud environments.

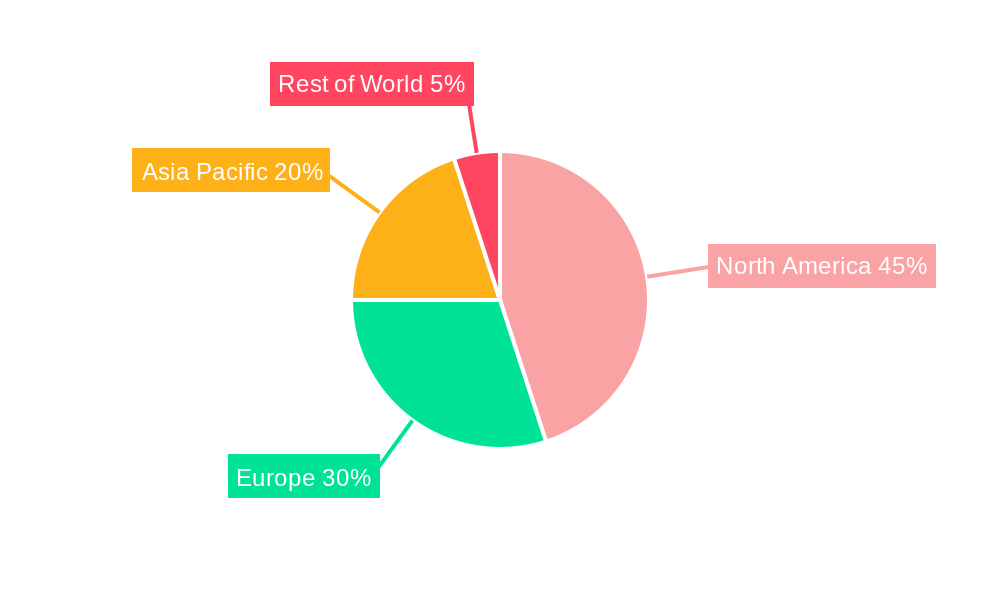

The North American region dominates the market due to its advanced technological infrastructure, high adoption rates of cloud services, and strong presence of major technology companies. However, challenges remain. The complexity of managing next-generation storage systems, the need for skilled IT professionals, and high initial investment costs can hinder adoption, particularly among smaller organizations. Future market growth will depend on the continued advancements in storage technologies, including NVMe (Non-Volatile Memory Express) technology and the development of more efficient and secure storage management tools. The increasing focus on edge computing and the Internet of Things (IoT) will further expand the market, necessitating solutions capable of handling the ever-growing volume of data generated at the edge. The market's evolution is expected to continue being shaped by the ongoing consolidation of vendors and the development of innovative solutions tailored to specific industry needs.

North America Next Generation Storage Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the North America Next Generation Storage Market, offering a comprehensive analysis of market dynamics, technological advancements, and future growth prospects from 2019 to 2033. The study period covers 2019-2033, with 2025 as the base and estimated year, and the forecast period spanning 2025-2033. This detailed analysis is crucial for stakeholders, investors, and businesses seeking to understand and capitalize on the opportunities within this rapidly evolving market, projected to reach xx Million by 2033.

North America Next Generation Storage Market Composition & Trends

This section meticulously analyzes the competitive landscape of the North America Next Generation Storage market, encompassing market concentration, innovation drivers, regulatory frameworks, substitute product analysis, end-user profiling, and mergers & acquisitions (M&A) activity. The report delves into the market share distribution amongst key players like IBM Corporation, Fujitsu Ltd, Toshiba Corp, Hewlett Packard Enterprise Company, Scality Inc, Hitachi Ltd, Netgear Inc, Dell Inc, DataDirect Networks, NetApp Inc, and Pure Storage Inc. Further analysis explores the impact of M&A activities, including deal values and their influence on market consolidation. We examine the increasing adoption of cloud storage and its effect on traditional storage solutions, and the regulatory landscape's role in shaping market growth and innovation.

- Market Concentration: Detailed analysis of market share distribution among major players.

- Innovation Catalysts: Examination of technological advancements driving market growth.

- Regulatory Landscape: Impact of regulations on market competition and expansion.

- Substitute Products: Assessment of alternative storage solutions and their impact.

- End-User Profiles: Profiling key end-user industries and their specific storage needs.

- M&A Activity: Analysis of recent mergers and acquisitions, including deal values and implications. Estimated total M&A deal value for the period 2019-2024: xx Million.

North America Next Generation Storage Market Industry Evolution

This section provides a detailed overview of the North America Next Generation Storage market's evolution, tracing its growth trajectory, technological breakthroughs, and the shifts in consumer demand. We analyze the transition from traditional storage solutions to next-generation technologies, including the impact of cloud computing, big data analytics, and the Internet of Things (IoT). The report features detailed data points on market growth rates, adoption metrics across various segments (DAS, NAS, SAN, FOBS, Block Storage), and the influence of emerging technologies like NVMe and storage-class memory. Key factors influencing market growth, including advancements in cloud storage technologies, increasing data volumes, and the growing adoption of virtualization, are meticulously examined.

Leading Regions, Countries, or Segments in North America Next Generation Storage Market

This section identifies the leading regions, countries, and segments within the North America Next Generation Storage Market. Detailed analysis focuses on the key drivers propelling growth in dominant sectors, including:

Dominant Segments: The report identifies the leading segment based on detailed analysis of market size, growth rate, and adoption across:

- Storage System: Direct Attached Storage (DAS), Network Attached Storage (NAS), Storage Area Network (SAN)

- Storage Architecture: File and Object-based Storage (FOBS), Block Storage

- End-User Industry: BFSI, Retail, IT and Telecom, Healthcare, Media and Entertainment

Key Drivers:

- BFSI: Stringent regulatory compliance and data security needs drive adoption of advanced storage solutions.

- Retail: Growing e-commerce and omnichannel strategies require scalable and reliable storage infrastructure.

- IT and Telecom: Rapid data growth and the need for high-performance computing fuel demand.

- Healthcare: Stringent data privacy regulations and increasing data volumes drive demand.

- Media and Entertainment: Large data sets and high bandwidth requirements necessitate efficient storage solutions.

North America Next Generation Storage Market Product Innovations

This section showcases the latest product innovations, applications, and performance metrics within the North American Next Generation Storage market. We highlight unique selling propositions (USPs) and technological advancements, focusing on improvements in speed, capacity, security, and cost-effectiveness. The analysis covers new product introductions and their impact on market competitiveness, encompassing features such as enhanced data protection, improved scalability, and simplified management.

Propelling Factors for North America Next Generation Storage Market Growth

Several factors are driving the growth of the North America Next Generation Storage Market. These include:

- Technological Advancements: The continuous development of faster, more efficient storage technologies, such as NVMe and flash storage.

- Economic Growth: Increased investment in IT infrastructure across various sectors.

- Regulatory Compliance: The need to comply with stringent data security and privacy regulations.

Obstacles in the North America Next Generation Storage Market

Despite the growth potential, the North America Next Generation Storage market faces several challenges:

- Regulatory Challenges: Navigating complex data privacy regulations and compliance requirements.

- Supply Chain Disruptions: Global supply chain issues impacting the availability and cost of storage components.

- Competitive Pressures: Intense competition among established and emerging players.

Future Opportunities in North America Next Generation Storage Market

Future opportunities in the North America Next Generation Storage market include:

- Emerging Technologies: Adoption of new technologies like AI and machine learning for data management and storage optimization.

- New Markets: Expansion into untapped markets and verticals.

- Consumer Trends: Meeting the evolving needs of consumers for secure, scalable, and cost-effective storage solutions.

Major Players in the North America Next Generation Storage Market Ecosystem

- IBM Corporation

- Fujitsu Ltd

- Toshiba Corp

- Hewlett Packard Enterprise Company

- Scality Inc

- Hitachi Ltd

- Netgear Inc

- Dell Inc

- DataDirect Networks

- NetApp Inc

- Pure Storage Inc

Key Developments in North America Next Generation Storage Market Industry

- July 2022: QNAP Systems, Inc. launched the TS-i410X, an industrial 10GbE NAS designed for harsh environments. This signifies growing demand for robust storage solutions in industrial settings.

- June 2022: Nasuni Corporation's acquisition of Storage Made Easy expands its cloud file services portfolio, strengthening its position in the market and highlighting the growing importance of cloud-based storage solutions.

Strategic North America Next Generation Storage Market Forecast

The North America Next Generation Storage market is poised for significant growth driven by the convergence of technological advancements, increasing data volumes, and rising demand for robust and secure storage solutions across various industries. The market is expected to experience substantial expansion over the forecast period, with specific growth drivers such as the adoption of cloud-based storage and the increasing demand for edge computing contributing to its overall expansion. The report provides detailed forecasts for various segments and key players, providing valuable insights for strategic decision-making.

North America Next Generation Storage Market Segmentation

-

1. Storage System

- 1.1. Direct Attached Storage (DAS)

- 1.2. Network Attached Storage (NAS)

- 1.3. Storage Area Network (SAN)

-

2. Storage Architecture

- 2.1. File and Object-based Storage (FOBS)

- 2.2. Block Storage

-

3. End-User Industry

- 3.1. BFSI

- 3.2. Retail

- 3.3. IT and Telecom

- 3.4. Healthcare

- 3.5. Media and Entertainment

North America Next Generation Storage Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Next Generation Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.29% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Volume of Digital Data; Rising Adoption of Solid-state Devices; Increasing Proliferation of Smartphones

- 3.2.2 Laptops

- 3.2.3 and Tablets

- 3.3. Market Restrains

- 3.3.1. Lack of Data Security in Cloud- and Server-based Services

- 3.4. Market Trends

- 3.4.1 Increasing Proliferation of Smartphones

- 3.4.2 connected devices and electronic devices will drive the market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Storage System

- 5.1.1. Direct Attached Storage (DAS)

- 5.1.2. Network Attached Storage (NAS)

- 5.1.3. Storage Area Network (SAN)

- 5.2. Market Analysis, Insights and Forecast - by Storage Architecture

- 5.2.1. File and Object-based Storage (FOBS)

- 5.2.2. Block Storage

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. IT and Telecom

- 5.3.4. Healthcare

- 5.3.5. Media and Entertainment

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Storage System

- 6. United States North America Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 IBM Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Fujitsu Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toshiba Corp

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hewlett Packard Enterprise Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Scality Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hitachi Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Netgear Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Dell Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 DataDirect Networks

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 NetApp Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Pure Storage Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 IBM Corporation

List of Figures

- Figure 1: North America Next Generation Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Next Generation Storage Market Share (%) by Company 2024

List of Tables

- Table 1: North America Next Generation Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Next Generation Storage Market Revenue Million Forecast, by Storage System 2019 & 2032

- Table 3: North America Next Generation Storage Market Revenue Million Forecast, by Storage Architecture 2019 & 2032

- Table 4: North America Next Generation Storage Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: North America Next Generation Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Next Generation Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Next Generation Storage Market Revenue Million Forecast, by Storage System 2019 & 2032

- Table 12: North America Next Generation Storage Market Revenue Million Forecast, by Storage Architecture 2019 & 2032

- Table 13: North America Next Generation Storage Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 14: North America Next Generation Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Next Generation Storage Market?

The projected CAGR is approximately 6.29%.

2. Which companies are prominent players in the North America Next Generation Storage Market?

Key companies in the market include IBM Corporation, Fujitsu Ltd, Toshiba Corp, Hewlett Packard Enterprise Company, Scality Inc, Hitachi Ltd, Netgear Inc , Dell Inc, DataDirect Networks, NetApp Inc, Pure Storage Inc.

3. What are the main segments of the North America Next Generation Storage Market?

The market segments include Storage System, Storage Architecture, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Volume of Digital Data; Rising Adoption of Solid-state Devices; Increasing Proliferation of Smartphones. Laptops. and Tablets.

6. What are the notable trends driving market growth?

Increasing Proliferation of Smartphones. connected devices and electronic devices will drive the market..

7. Are there any restraints impacting market growth?

Lack of Data Security in Cloud- and Server-based Services.

8. Can you provide examples of recent developments in the market?

July 2022: QNAP Systems, Inc., a computing, networking, and storage solutions provider, announced the launch of an industrial 10GbE NAS - TS-i410X. It is built with a fanless design, a rock-solid chassis, multiple flexible installation options, and a wide-range temperature and DC power support. The solution is suited for factories and warehouses, semi-outdoor environments, and transportation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Next Generation Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Next Generation Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Next Generation Storage Market?

To stay informed about further developments, trends, and reports in the North America Next Generation Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence