Key Insights

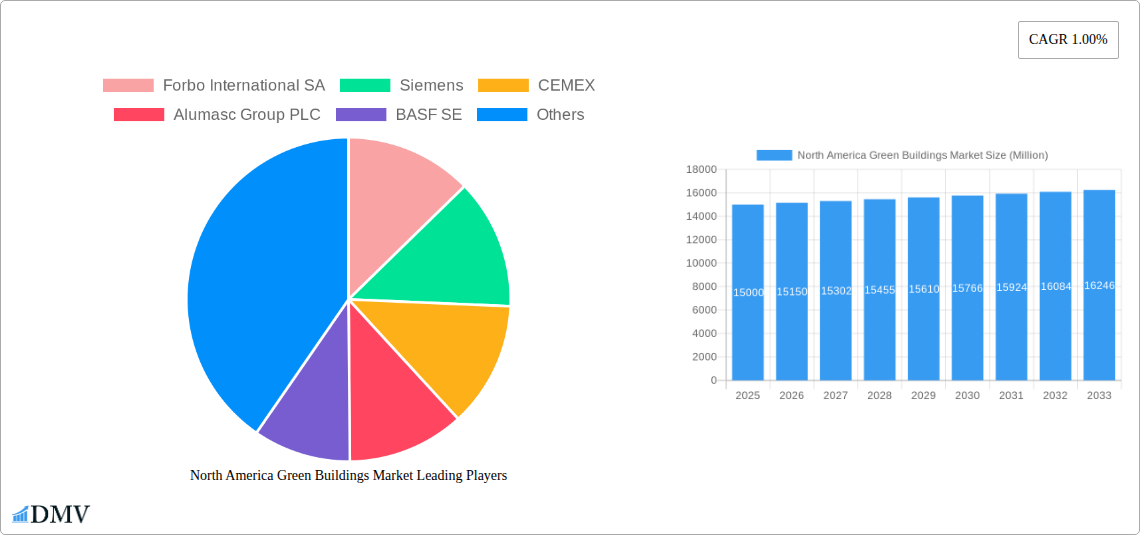

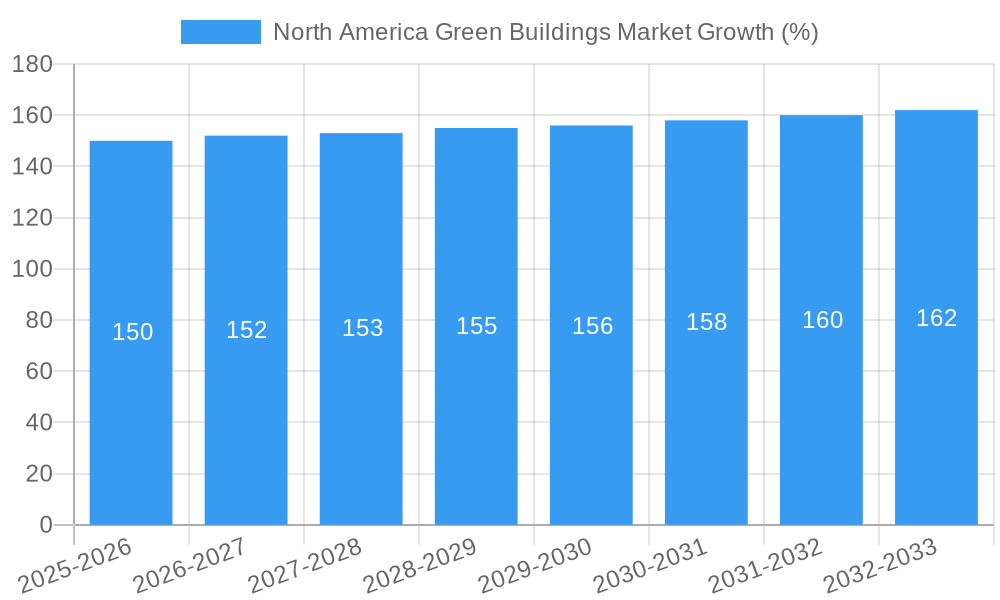

The North American green building market, while currently experiencing a period of consolidation and strategic investment, shows promising growth potential. While precise market size figures for 2025 are unavailable, the provided CAGR of 1.00% and the presence of significant players like Forbo, Siemens, CEMEX, and BASF suggest a substantial market already in place. The market is segmented by product (exterior, interior, and building systems like solar) and end-user (residential, office, retail, institutional). Driving growth are increasing environmental concerns, stringent government regulations promoting sustainability, and a growing awareness among consumers and businesses of the long-term cost savings associated with energy-efficient and environmentally responsible buildings. Trends such as the integration of smart building technologies, the increasing demand for sustainable building materials (like recycled content and bio-based products), and a focus on improved indoor air quality are shaping market dynamics. Despite these positive trends, restraints such as high initial investment costs for green building technologies, limited awareness in certain segments, and fluctuating material prices could potentially slow down market expansion in the short term. However, long-term projections, considering the increasing governmental incentives and the growing consumer demand for sustainable options, indicate a sustained positive growth trajectory.

The forecast period (2025-2033) will likely witness a steady increase in market value, driven by the aforementioned factors. The established presence of major international players indicates a degree of market maturity and a strong foundation for future development. The regional focus on North America (United States, Canada, Mexico) reflects the significant adoption of green building practices in these regions, influenced by robust regulatory frameworks and a high level of environmental consciousness. While precise figures remain unavailable without additional data, a reasonable projection based on CAGR and the market context suggests substantial growth throughout the forecast period. Market segmentation, considering the diverse applications of green building technologies across various sectors, highlights the need for targeted strategies by market players.

North America Green Buildings Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America green buildings market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils crucial market dynamics and presents actionable insights for stakeholders across the value chain. The market is expected to reach xx Million by 2033, showcasing significant growth potential.

North America Green Buildings Market Market Composition & Trends

This section delves into the competitive landscape of the North American green buildings market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user preferences, and merger & acquisition (M&A) activities. The market is moderately concentrated, with key players like Forbo International SA, Siemens, CEMEX, and BASF SE holding significant market share. However, several smaller, innovative companies are emerging, driving competition and innovation.

- Market Share Distribution (2025): Top 5 players hold approximately 40% of the market, with the remaining share distributed among numerous smaller companies.

- Innovation Catalysts: Stringent environmental regulations, rising energy costs, and increasing consumer awareness of sustainability are driving innovation in green building materials and technologies.

- Regulatory Landscape: Differing regulations across North American states and provinces create both opportunities and challenges. The upcoming changes to Canada's national building code (2025) and the new US building energy standards (2023) are significant examples.

- Substitute Products: Traditional building materials face increasing competition from sustainable alternatives.

- End-User Profiles: The residential and commercial sectors are the primary end-users, with significant growth potential in the institutional and retail sectors.

- M&A Activities (2019-2024): A total of xx M&A deals were recorded, with a total value of approximately xx Million, reflecting the market's consolidation and expansion.

North America Green Buildings Market Industry Evolution

This section analyzes the evolution of the North American green building market, examining growth trajectories, technological advancements, and evolving consumer preferences. The market has witnessed significant growth over the past five years, driven by factors like increasing government incentives, growing environmental awareness, and technological advancements in green building materials. Technological advancements such as innovative insulation materials, smart building technologies, and renewable energy integration are pushing the industry towards greater sustainability. Consumer demand for eco-friendly and energy-efficient buildings is also rising, influencing construction practices and material selection. The market is projected to grow at a CAGR of xx% from 2025 to 2033.

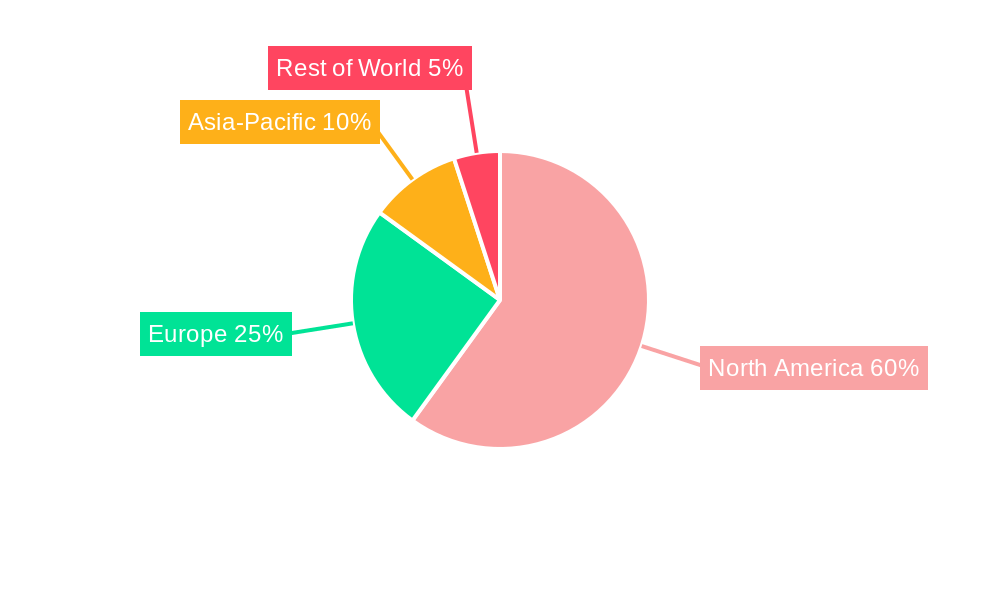

Leading Regions, Countries, or Segments in North America Green Buildings Market

This section identifies the leading regions, countries, and market segments within the North American green buildings market.

By Product: The exterior products segment currently dominates, driven by high demand for energy-efficient windows and roofing solutions. However, the interior products segment is projected to experience faster growth due to increasing focus on indoor air quality and sustainable interior finishes. The "Other Products" segment, encompassing building systems and solar systems, is also exhibiting strong growth due to technological advancements and government incentives.

By End-User: The residential sector is the largest segment, followed by the office sector. However, the institutional sector is exhibiting faster growth, driven by increasing government investment in sustainable infrastructure projects.

Key Drivers:

- California: Stringent environmental regulations and supportive government policies have made California a leading region.

- Northeastern US: High energy costs and a strong focus on sustainability are driving market growth.

- British Columbia, Canada: Similar to California, strong environmental regulations and government incentives support market growth.

North America Green Buildings Market Product Innovations

Recent innovations include advanced insulation materials offering superior thermal performance, self-healing concrete reducing material waste, and smart building technologies optimizing energy consumption. These innovations enhance the efficiency and sustainability of green buildings, creating unique selling propositions for manufacturers and driving market growth.

Propelling Factors for North America Green Buildings Market Growth

Several factors drive the growth of the North American green buildings market. Government incentives, such as tax credits and rebates, are significantly influencing market expansion. Stringent environmental regulations necessitate the adoption of green building practices. Technological advancements offer innovative and cost-effective solutions, making green building more accessible. Finally, rising consumer awareness of environmental issues is fuelling the demand for sustainable buildings.

Obstacles in the North America Green Buildings Market Market

Despite its growth potential, the market faces challenges. High upfront costs associated with green building technologies can be a barrier. Supply chain disruptions can affect the availability and cost of sustainable materials. Competition from traditional building materials remains significant.

Future Opportunities in North America Green Buildings Market

Future opportunities lie in the expansion of green building technologies into underserved markets, such as affordable housing. The integration of smart building technologies and renewable energy systems presents significant potential. Increased consumer demand for sustainable building practices continues to create numerous opportunities.

Major Players in the North America Green Buildings Market Ecosystem

- Forbo International SA

- Siemens

- CEMEX

- Alumasc Group PLC

- BASF SE

- Bauder Limited

- Owens Corning SA

- PPG Industries

- Amvic Inc

- Cold Mix Inc

- 7 other companies

Key Developments in North America Green Buildings Market Industry

May 2023: The Biden Administration announced new building energy standards for federally funded homes, impacting approximately 170,000 homes annually. This initiative will substantially increase demand for energy-efficient building materials and technologies.

June 2023: Canada's 2025 national building code will include technical requirements for existing building stock and address GHG emissions, driving renovations and retrofitting projects.

Strategic North America Green Buildings Market Market Forecast

The North America green buildings market is poised for robust growth driven by supportive government policies, technological advancements, and increasing consumer demand for sustainable living spaces. The market is expected to witness significant expansion across various segments, particularly in residential and institutional construction. The incorporation of innovative building technologies and materials will further accelerate this growth, offering substantial opportunities for industry participants.

North America Green Buildings Market Segmentation

-

1. Product

- 1.1. Exterior Products

- 1.2. Interior products

- 1.3. Other Pr

-

2. End User

- 2.1. Residential

- 2.2. Office

- 2.3. Retail

- 2.4. Institutional

- 2.5. Other End Users

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Green Buildings Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Green Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Energy Efficiency in Construction; Flexibility and Customization Options

- 3.3. Market Restrains

- 3.3.1. Limited Availability of Suitable Land for Construction; Lower Quality Compared to Traditional Construction

- 3.4. Market Trends

- 3.4.1. Leveraging Smart Buildings and IoT Integration for Enhanced Efficiency and Performance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Exterior Products

- 5.1.2. Interior products

- 5.1.3. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Office

- 5.2.3. Retail

- 5.2.4. Institutional

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Exterior Products

- 6.1.2. Interior products

- 6.1.3. Other Pr

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Office

- 6.2.3. Retail

- 6.2.4. Institutional

- 6.2.5. Other End Users

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Exterior Products

- 7.1.2. Interior products

- 7.1.3. Other Pr

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Office

- 7.2.3. Retail

- 7.2.4. Institutional

- 7.2.5. Other End Users

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico North America Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Exterior Products

- 8.1.2. Interior products

- 8.1.3. Other Pr

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Office

- 8.2.3. Retail

- 8.2.4. Institutional

- 8.2.5. Other End Users

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. United States North America Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Green Buildings Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Forbo International SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Siemens

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 CEMEX

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Alumasc Group PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BASF SE

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Bauder Limited

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Owens Corning SA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 PPG Industries

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Amvic Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Cold Mix Inc **List Not Exhaustive 7 3 Other Companie

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Forbo International SA

List of Figures

- Figure 1: North America Green Buildings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Green Buildings Market Share (%) by Company 2024

List of Tables

- Table 1: North America Green Buildings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Green Buildings Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: North America Green Buildings Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: North America Green Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Green Buildings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Green Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Green Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Green Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Green Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Green Buildings Market Revenue Million Forecast, by Product 2019 & 2032

- Table 12: North America Green Buildings Market Revenue Million Forecast, by End User 2019 & 2032

- Table 13: North America Green Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Green Buildings Market Revenue Million Forecast, by Product 2019 & 2032

- Table 16: North America Green Buildings Market Revenue Million Forecast, by End User 2019 & 2032

- Table 17: North America Green Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Green Buildings Market Revenue Million Forecast, by Product 2019 & 2032

- Table 20: North America Green Buildings Market Revenue Million Forecast, by End User 2019 & 2032

- Table 21: North America Green Buildings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Green Buildings Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Green Buildings Market?

The projected CAGR is approximately 1.00%.

2. Which companies are prominent players in the North America Green Buildings Market?

Key companies in the market include Forbo International SA, Siemens, CEMEX, Alumasc Group PLC, BASF SE, Bauder Limited, Owens Corning SA, PPG Industries, Amvic Inc, Cold Mix Inc **List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the North America Green Buildings Market?

The market segments include Product, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0 Million as of 2022.

5. What are some drivers contributing to market growth?

Energy Efficiency in Construction; Flexibility and Customization Options.

6. What are the notable trends driving market growth?

Leveraging Smart Buildings and IoT Integration for Enhanced Efficiency and Performance.

7. Are there any restraints impacting market growth?

Limited Availability of Suitable Land for Construction; Lower Quality Compared to Traditional Construction.

8. Can you provide examples of recent developments in the market?

June 2023: In 2025, a new version of Canada's national building code will be published, allowing builders to learn about two significant changes. At the Canada Green Building Council's 2023 Building Lasting Change conference in Vancouver, officials addressed the changes drafters of the 2025 code. The two significant changes coming to the code are introducing technical requirements for existing building stock and including GHG emissions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Green Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Green Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Green Buildings Market?

To stay informed about further developments, trends, and reports in the North America Green Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence