Key Insights

The North American flexible office space market, encompassing private offices, co-working spaces, and virtual offices, is experiencing robust growth, driven by the increasing adoption of hybrid work models and the evolving needs of businesses across diverse sectors. The market's value, currently estimated at $XX million in 2025 (assuming a reasonable market size based on global trends and the provided CAGR), is projected to expand significantly over the forecast period (2025-2033). Key drivers include the demand for cost-effective and adaptable workspaces, the rise of entrepreneurial activity and startups, and the increasing preference for collaborative work environments. The IT and telecommunications sector, along with media and entertainment, are major end-users, fueling this expansion. However, economic fluctuations and competition from traditional office spaces pose potential restraints on market growth. The segment breakdown indicates a strong demand for both co-working spaces and private offices, reflecting the varied needs of businesses of different sizes and operational structures. The considerable presence of major players like WeWork, Regus, and Industrious, alongside a thriving ecosystem of smaller providers, suggests a competitive yet dynamic market landscape.

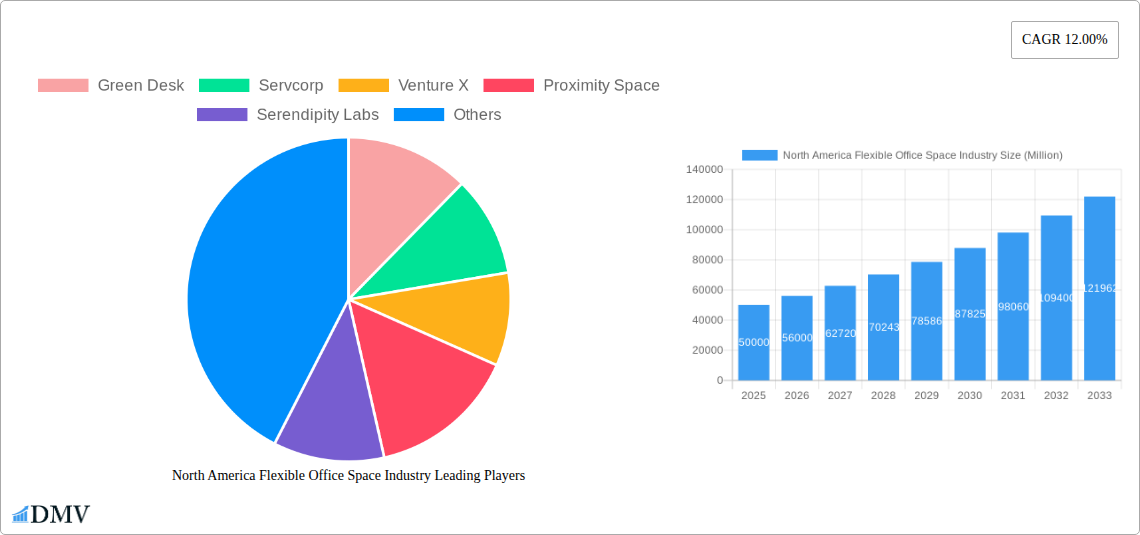

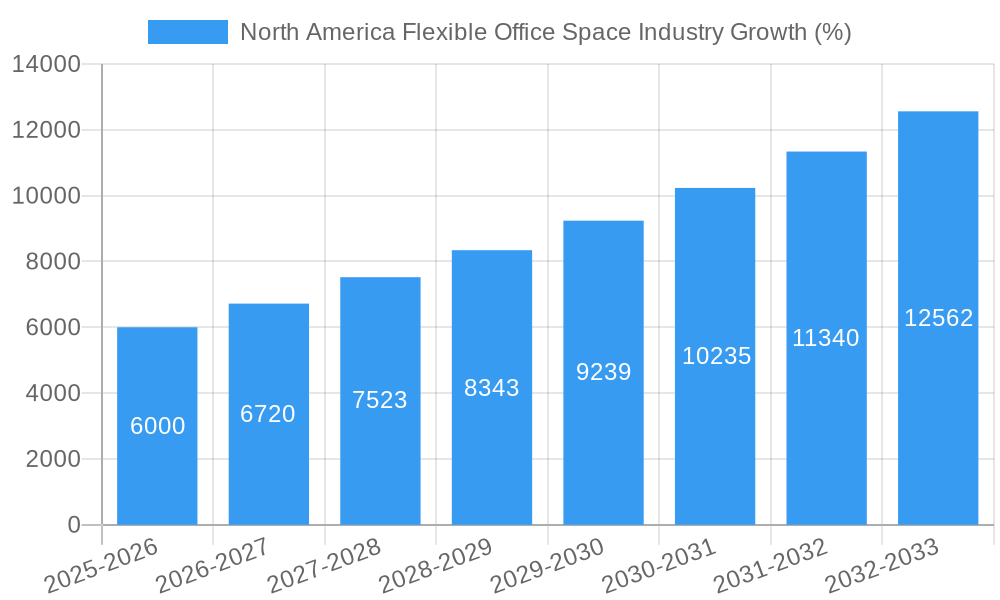

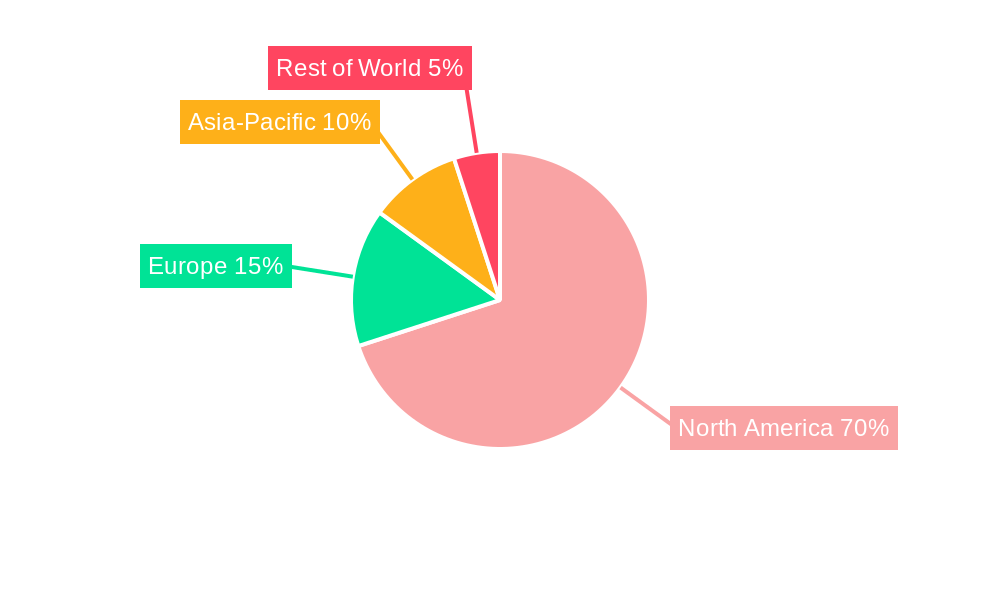

The projected Compound Annual Growth Rate (CAGR) of 12% indicates a consistently expanding market throughout the forecast period. This growth is expected to be fueled by continued technological advancements supporting remote work, increased emphasis on employee well-being and workplace flexibility, and a sustained preference for agile and scalable work arrangements. While the United States currently dominates the North American market, Canada and Mexico are also witnessing substantial growth. Future projections suggest a continued increase in market share for co-working spaces, driven by the appeal of their cost-effectiveness and collaborative features, particularly amongst smaller businesses and freelancers. However, private office demand will likely remain robust, driven by larger companies requiring more customized and secure work environments. The market's success will depend on the continued adaptation of providers to evolving technological trends and business requirements.

North America Flexible Office Space Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides a detailed analysis of the North America flexible office space industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period 2019-2033, with a base year of 2025 and forecast extending to 2033, this report dissects market trends, identifies key players, and projects future growth. The report's meticulous research incorporates data from the historical period (2019-2024) and offers a robust estimation for 2025. This in-depth analysis is crucial for strategic decision-making within the rapidly evolving flexible workspace landscape.

North America Flexible Office Space Industry Market Composition & Trends

This section examines the North American flexible office space market's competitive landscape, identifying key trends and drivers influencing its evolution. The market is characterized by a moderate level of concentration, with several major players and a large number of smaller operators vying for market share. We analyze the distribution of this market share amongst key players like WeWork Inc, Regus Corporation, Industrious Office, and others such as Green Desk, Servcorp, Venture X, Proximity Space, Serendipity Labs, Knotel Inc, and Office Freedom. Innovation within the industry is driven by technological advancements, such as smart building technologies and flexible workspace management software. Regulatory landscapes vary across North American regions, influencing operational costs and expansion strategies. Substitute products include traditional leased office spaces and home offices, impacting market growth. The report delves into end-user profiles, focusing on sectors like IT & Telecommunications, Media & Entertainment, and Retail & Consumer Goods, determining their specific needs and preferences within the flexible workspace market. Finally, we analyze recent mergers and acquisitions (M&A) activities, estimating the total M&A deal value in the industry at approximately $XX Million over the historical period. The highest M&A deal value was approximately $XX Million, impacting the market significantly.

- Market Share Distribution (2025 Estimate): WeWork Inc (XX%), Regus Corporation (XX%), Industrious Office (XX%), Others (XX%)

- Key M&A Activities (2019-2024): Detailed analysis of significant acquisitions and their impact on market dynamics.

- Regulatory Landscape: Analysis of key regulations and their impact on market growth across different regions.

- Innovation Catalysts: Deep dive into technological advancements, design innovations and service offerings.

North America Flexible Office Space Industry Industry Evolution

The North America flexible office space industry has experienced remarkable growth over the past five years (2019-2024), with a Compound Annual Growth Rate (CAGR) of approximately XX%. This growth is propelled by several factors, including the increasing adoption of remote work and hybrid work models, the changing preferences of millennials and Gen Z, and the increasing demand for flexible and cost-effective workspace solutions among start-ups and small businesses. Technological advancements in workplace technology, such as booking systems, access control, and communication platforms have further boosted efficiency and user experience, fueling market expansion. Shifting consumer demands are increasingly towards customizable, amenity-rich spaces which offer networking opportunities. We project a continued growth trajectory for the forecast period (2025-2033), estimating a CAGR of approximately XX%. The market size is expected to reach approximately $XX Million by 2033, highlighting the immense growth potential of this sector. This growth is further fueled by increasing investments in flexible office spaces from both public and private entities. Adoption metrics show a consistent upward trend, with a projected increase of XX% in the number of flexible workspace users by 2033.

Leading Regions, Countries, or Segments in North America Flexible Office Space Industry

The leading segment within the North American flexible office space market is currently co-working space, accounting for XX% of the total market share in 2025. Key drivers for this dominance include its affordability, scalability, and collaborative environment, making it popular across various industries. The major region for flexible office space is the West Coast, particularly California, driven by substantial investment in tech start-ups.

Key Drivers of Co-working Space Dominance:

- High Demand from Startups and SMEs: Lower upfront costs and flexible lease terms attract numerous small and medium businesses.

- Cost-Effectiveness: Shared amenities and resources reduce operational expenditures for businesses.

- Networking Opportunities: Co-working spaces facilitate interaction among entrepreneurs and professionals.

Dominance Factors in the West Coast Region:

- High Concentration of Tech Companies: The region's robust tech sector fuels the demand for flexible workspaces.

- Venture Capital Investment: Significant capital investment further boosts expansion and adoption.

- Progressive Work Culture: A receptive environment for flexible work arrangements exists.

Other segments, such as private offices and virtual offices, also contribute significantly, but co-working spaces have demonstrated the most remarkable growth and market share. Similarly, within the end-user segments, IT and Telecommunications exhibit significant demand for flexible office solutions owing to the nature of their projects and needs for collaboration.

North America Flexible Office Space Industry Product Innovations

Recent product innovations have centered on enhancing user experience and functionality. This includes the integration of smart building technologies for improved energy efficiency and workspace management, as well as the introduction of modular design concepts to increase flexibility and customization options. Advanced booking systems and virtual office solutions provide enhanced convenience and control to users. These innovations enhance user experience through streamlined processes and technologically advanced solutions, creating unique selling propositions and driving competitive advantage.

Propelling Factors for North America Flexible Office Space Industry Growth

Several factors contribute to the growth of the North American flexible office space industry. Firstly, the increasing popularity of remote work and hybrid work models has created a significant demand for flexible workspace solutions. Secondly, technological advancements such as sophisticated booking platforms and smart building technologies have enhanced the efficiency and appeal of these spaces. Finally, supportive government policies and investment incentives are encouraging the development of flexible office infrastructure across various regions.

Obstacles in the North America Flexible Office Space Industry Market

The industry faces several challenges. Firstly, the high initial investment costs associated with setting up flexible workspace facilities can be a significant barrier to entry. Secondly, competition among established players and new entrants intensifies pressure on pricing and profitability. Thirdly, economic downturns or fluctuations in the real estate market could directly affect demand and expansion plans.

Future Opportunities in North America Flexible Office Space Industry

Future opportunities lie in expanding into underserved markets, integrating cutting-edge technologies such as AI-powered workspace optimization tools, and catering to the evolving preferences of diverse workforce segments. Growth opportunities in secondary markets and expansion into specialized niche markets present significant potential for the industry.

Major Players in the North America Flexible Office Space Industry Ecosystem

- Green Desk

- Servcorp

- Venture X

- Proximity Space

- Serendipity Labs

- Knotel Inc

- Office Freedom

- WeWork Inc

- Industrious Office

- Regus Corporation

Key Developments in North America Flexible Office Space Industry Industry

- 2022 Q4: WeWork Inc announces a major restructuring plan, focusing on profitability.

- 2023 Q1: Regus Corporation launches a new subscription-based flexible workspace platform.

- 2023 Q3: Several smaller flexible workspace providers merge, consolidating market share. (Further key developments with dates will be included in the full report)

Strategic North America Flexible Office Space Industry Market Forecast

The North America flexible office space industry is poised for continued growth, driven by evolving work styles, technological advancements, and favorable economic conditions. The increasing adoption of hybrid work models and the rising demand for flexible and customizable workspace solutions will significantly contribute to market expansion. The focus on providing amenity-rich spaces that foster community and networking will remain a key trend. This suggests a robust future for the industry with significant opportunities for growth and innovation.

North America Flexible Office Space Industry Segmentation

-

1. Type

- 1.1. Private offices

- 1.2. Co-working space

- 1.3. Virtual offices

-

2. End User

- 2.1. IT and Telecommunications

- 2.2. Media and Entertainment

- 2.3. Retail and consumer goods

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Flexible Office Space Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Flexible Office Space Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise in e-commerce and digitalization

- 3.3. Market Restrains

- 3.3.1. The Complexity of regulations and property ownership

- 3.4. Market Trends

- 3.4.1. Increase in Office Space Vacancy Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Private offices

- 5.1.2. Co-working space

- 5.1.3. Virtual offices

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecommunications

- 5.2.2. Media and Entertainment

- 5.2.3. Retail and consumer goods

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Private offices

- 6.1.2. Co-working space

- 6.1.3. Virtual offices

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. IT and Telecommunications

- 6.2.2. Media and Entertainment

- 6.2.3. Retail and consumer goods

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Private offices

- 7.1.2. Co-working space

- 7.1.3. Virtual offices

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. IT and Telecommunications

- 7.2.2. Media and Entertainment

- 7.2.3. Retail and consumer goods

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Private offices

- 8.1.2. Co-working space

- 8.1.3. Virtual offices

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. IT and Telecommunications

- 8.2.2. Media and Entertainment

- 8.2.3. Retail and consumer goods

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Private offices

- 9.1.2. Co-working space

- 9.1.3. Virtual offices

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. IT and Telecommunications

- 9.2.2. Media and Entertainment

- 9.2.3. Retail and consumer goods

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. United States North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Green Desk

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Servcorp

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Venture X

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Proximity Space

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Serendipity Labs

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Knotel Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Office Freedom**List Not Exhaustive

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Wework Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Industrious Office

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Regus Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Green Desk

List of Figures

- Figure 1: North America Flexible Office Space Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Flexible Office Space Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Flexible Office Space Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Flexible Office Space Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Flexible Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: North America Flexible Office Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Flexible Office Space Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Flexible Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Flexible Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Flexible Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Flexible Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Flexible Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Flexible Office Space Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Flexible Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 13: North America Flexible Office Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Flexible Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Flexible Office Space Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 16: North America Flexible Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 17: North America Flexible Office Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Flexible Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Flexible Office Space Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: North America Flexible Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 21: North America Flexible Office Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Flexible Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: North America Flexible Office Space Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: North America Flexible Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 25: North America Flexible Office Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Flexible Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Flexible Office Space Industry?

The projected CAGR is approximately 12.00%.

2. Which companies are prominent players in the North America Flexible Office Space Industry?

Key companies in the market include Green Desk, Servcorp, Venture X, Proximity Space, Serendipity Labs, Knotel Inc, Office Freedom**List Not Exhaustive, Wework Inc, Industrious Office, Regus Corporation.

3. What are the main segments of the North America Flexible Office Space Industry?

The market segments include Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rise in e-commerce and digitalization.

6. What are the notable trends driving market growth?

Increase in Office Space Vacancy Rate.

7. Are there any restraints impacting market growth?

The Complexity of regulations and property ownership.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Flexible Office Space Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Flexible Office Space Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Flexible Office Space Industry?

To stay informed about further developments, trends, and reports in the North America Flexible Office Space Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence