Key Insights

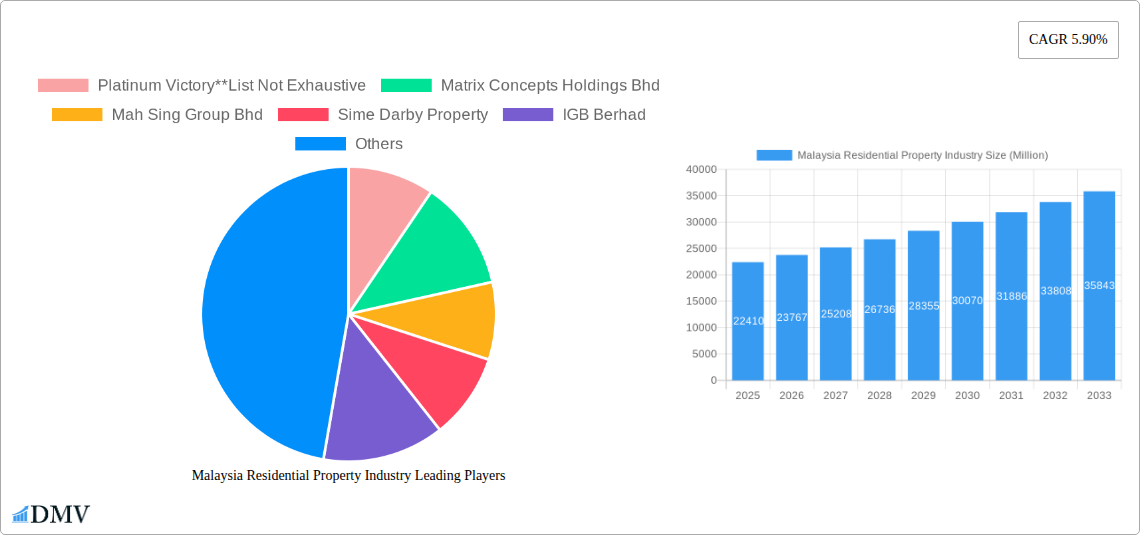

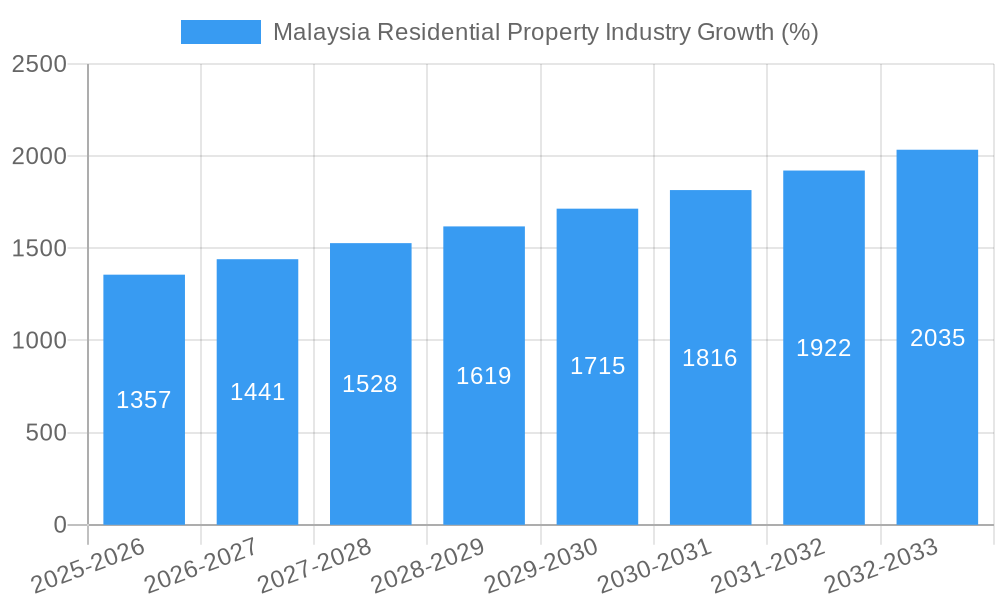

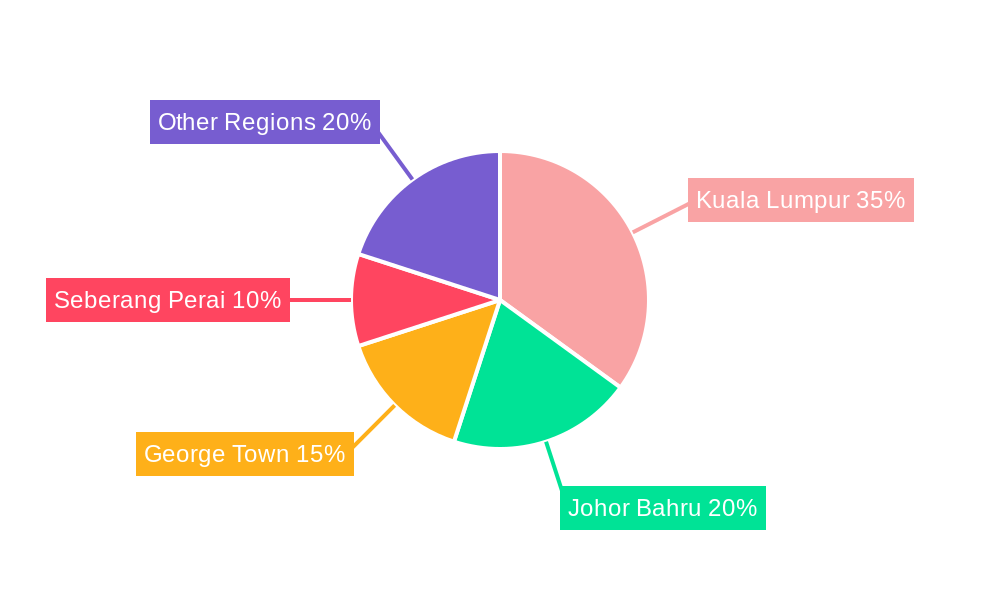

The Malaysian residential property market, valued at RM 22.41 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.90% from 2025 to 2033. This growth is fueled by several key factors. Increasing urbanization, particularly in major cities like Kuala Lumpur, Johor Bahru, George Town, and Seberang Perai, drives consistent demand for housing. A growing young population entering the workforce and a rising middle class with increased disposable income further bolster market expansion. Government initiatives aimed at affordable housing and infrastructure development also contribute positively to market dynamics. However, challenges exist, including fluctuating interest rates which can impact affordability, and the availability of land suitable for development within desirable urban areas. The market is segmented by property type (apartments & condominiums, landed houses & villas) and geographic location, with Kuala Lumpur consistently commanding the largest share. Leading developers such as Sime Darby Property, SP Setia, and Eco World Development Group Berhad are key players shaping the market landscape, constantly innovating to meet evolving consumer preferences and market demands.

The forecast period (2025-2033) promises sustained expansion, though the pace may fluctuate depending on macroeconomic conditions and government policies. The continued development of integrated townships offering a blend of residential, commercial, and recreational facilities will likely be a significant trend. Competition among developers is intense, encouraging innovation in design, technology, and sustainable building practices. The market’s evolution will be closely tied to economic stability, infrastructure development, and the effective implementation of policies addressing affordability and sustainability. Understanding these factors will be crucial for developers, investors, and policymakers seeking to navigate the dynamic landscape of the Malaysian residential property sector successfully.

Malaysia Residential Property Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Malaysia residential property industry, encompassing historical data (2019-2024), current market conditions (Base Year: 2025), and future projections (Forecast Period: 2025-2033). It offers critical insights for stakeholders, investors, and industry professionals seeking to navigate this dynamic market. The report delves into market segmentation, leading players, emerging trends, and significant developments, offering a crucial roadmap for strategic decision-making. The total market value is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Malaysia Residential Property Industry Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory environment, substitute products, end-user demographics, and mergers & acquisitions (M&A) activity within the Malaysian residential property market. We analyze market share distribution among key players, revealing the concentration levels and the influence of major firms. M&A deal values are analyzed to assess investment activity and market consolidation trends.

- Market Concentration: The Malaysian residential property market exhibits a moderately concentrated structure, with several large players commanding significant market share. For example, SP Setia and Sime Darby Property are major players, while other companies contribute to the fragmented segment. Further analysis reveals the precise market share distribution among these leading players and smaller developers. The market share of top 5 players is estimated at xx%.

- Innovation Catalysts: Technological advancements, such as PropTech solutions and improved construction techniques, are driving innovation within the industry. The increasing adoption of digital platforms for property search and transaction management is reshaping market dynamics.

- Regulatory Landscape: Government policies, including housing affordability initiatives and regulations on foreign ownership, significantly influence market trends. Changes in these policies can impact supply, demand, and overall market value.

- Substitute Products: The availability of affordable rental options and alternative housing solutions influences the demand for residential properties. This factor is particularly crucial in analysing market trends and long-term growth prospects.

- End-User Profiles: The report details the demographic characteristics, preferences, and purchasing power of various end-user segments, including first-time homebuyers, upgraders, and investors, to understand their influence on market demand.

- M&A Activities: Recent significant M&A deals, such as the PropertyGuru Group's acquisition of iProperty Malaysia (December 2022) for xx Million and Knight Frank Malaysia's acquisition of Property Hub Sdn Bhd (April 2022) for xx Million, are assessed for their impact on market consolidation and future competition. The report analyzes these transactions further to understand their implications on market structure and industry growth.

Malaysia Residential Property Industry Industry Evolution

This section details the historical growth trajectory of the Malaysian residential property market from 2019 to 2024, projecting its evolution until 2033. We analyze factors driving market expansion, technological progress, and shifting consumer preferences. The analysis incorporates data points such as compound annual growth rates (CAGR) for various segments and adoption rates of new technologies. This section extensively discusses how technological advancements such as digital marketing and virtual reality tours have influenced property sales. Further, it discusses the changing preferences of consumers towards smart homes and sustainable living. Moreover, the report illustrates how these aspects have influenced the market growth. The impacts of economic fluctuations on home prices, affordability, and the overall market size are also discussed at length.

Leading Regions, Countries, or Segments in Malaysia Residential Property Industry

This section identifies the dominant regions and segments within the Malaysian residential property market. Key drivers, such as investment trends and regulatory support, are examined using bullet points, while in-depth analysis utilizes paragraph form.

By Type:

- Apartments and Condominiums: Kuala Lumpur remains the leading market for apartments and condominiums, driven by high population density and strong investor interest. The demand is boosted by factors like improved infrastructure, proximity to business districts, and lifestyle amenities.

- Landed Houses and Villas: Areas like Seberang Perai and Johor Bahru exhibit higher demand for landed properties, reflecting preferences for spacious living and a quieter lifestyle. This segment is often favored by larger families and higher income brackets looking for privacy and space.

By Key Cities:

- Kuala Lumpur: Kuala Lumpur's dominance is fuelled by its position as the economic and administrative hub, attracting significant investment and driving high property values. The ongoing development projects and the city's appeal to both local and international buyers sustain its leading position.

- Johor Bahru: Johor Bahru experiences substantial growth due to its proximity to Singapore, attracting both investors and cross-border commuters. This leads to high demand and boosts market growth within the region.

- Seberang Perai & George Town: These areas show steady growth driven by affordability relative to Kuala Lumpur and Johor Bahru and increasing infrastructural developments.

Malaysia Residential Property Industry Product Innovations

Recent innovations include the integration of smart home technologies, such as automated lighting and security systems, into new developments. Sustainable design features, such as energy-efficient appliances and rainwater harvesting systems, are gaining traction, appealing to environmentally conscious buyers. The use of virtual reality and augmented reality tools in marketing and sales efforts provides a more engaging experience for potential buyers. These innovations enhance value propositions and contribute to the growth of the high-end property segment.

Propelling Factors for Malaysia Residential Property Industry Growth

Key growth drivers include increasing urbanization, rising disposable incomes, government initiatives to improve housing affordability, and the ongoing development of infrastructure projects. The implementation of supportive policies that encourage private investments further accelerates growth within the market. Technological advancements, such as the use of big data and analytics, improve efficiency and transparency in the property market.

Obstacles in the Malaysia Residential Property Industry Market

Challenges include high property prices affecting affordability, particularly in prime locations like Kuala Lumpur. Supply chain disruptions, such as material shortages and labor constraints, can cause delays and increase construction costs. Competition among developers can also impact profitability. Additionally, stringent regulations can increase the hurdles for project approvals and development. These factors contribute to market uncertainty and can negatively affect market expansion.

Future Opportunities in Malaysia Residential Property Industry

Opportunities lie in the growing demand for affordable housing solutions, particularly in underserved areas. The rising adoption of sustainable building practices opens up new avenues for innovation and competitive differentiation. PropTech is expected to continue to transform the market, creating new opportunities for efficiency and improved customer experience. Finally, the growth of the tourism industry can contribute to increasing property demand in tourist areas.

Major Players in the Malaysia Residential Property Industry Ecosystem

- Platinum Victory

- Matrix Concepts Holdings Bhd

- Mah Sing Group Bhd

- Sime Darby Property

- IGB Berhad

- IOI Properties

- Glomac Bhd

- S P Setia

- UEM Sunrise

- Eco World Development Group Berhad

Key Developments in Malaysia Residential Property Industry Industry

- December 2022: PropertyGuru Group acquires iProperty Malaysia, leading to a significant consolidation in the online property market and potentially reshaping the landscape of property marketing and sales in Malaysia.

- April 2022: Knight Frank Malaysia expands its reach in the residential market through the acquisition of Property Hub Sdn Bhd, potentially strengthening its market position and influence on market transactions.

Strategic Malaysia Residential Property Industry Market Forecast

The Malaysian residential property market is poised for continued growth over the forecast period, driven by urbanization, economic expansion, and ongoing infrastructure development. While challenges remain, particularly regarding affordability and regulatory hurdles, the market is expected to demonstrate significant resilience. Strategic investments in PropTech and sustainable development will play a key role in shaping future growth.

Malaysia Residential Property Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Key Cities

- 2.1. Kuala Lumpur

- 2.2. Seberang Perai

- 2.3. George Town

- 2.4. Johor Bahru

Malaysia Residential Property Industry Segmentation By Geography

- 1. Malaysia

Malaysia Residential Property Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Residential Real Estate Demand by Young People4.; Increase in Average Housing Price in Mexico

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Affordable Housing Inhibiting the Growth of the Market4.; Economic Instability Affecting the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Increase in Urbanization Boosting Demand for Residential Real Estate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Residential Property Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Kuala Lumpur

- 5.2.2. Seberang Perai

- 5.2.3. George Town

- 5.2.4. Johor Bahru

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Platinum Victory**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Matrix Concepts Holdings Bhd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mah Sing Group Bhd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sime Darby Property

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IGB Berhad

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IOI Properties

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Glomac Bhd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 S P Setia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 UEM Sunrise

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eco World Development Group Berhad

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Platinum Victory**List Not Exhaustive

List of Figures

- Figure 1: Malaysia Residential Property Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Residential Property Industry Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Residential Property Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Residential Property Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Malaysia Residential Property Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Malaysia Residential Property Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Malaysia Residential Property Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Malaysia Residential Property Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Malaysia Residential Property Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Malaysia Residential Property Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Residential Property Industry?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Malaysia Residential Property Industry?

Key companies in the market include Platinum Victory**List Not Exhaustive, Matrix Concepts Holdings Bhd, Mah Sing Group Bhd, Sime Darby Property, IGB Berhad, IOI Properties, Glomac Bhd, S P Setia, UEM Sunrise, Eco World Development Group Berhad.

3. What are the main segments of the Malaysia Residential Property Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.41 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Residential Real Estate Demand by Young People4.; Increase in Average Housing Price in Mexico.

6. What are the notable trends driving market growth?

Increase in Urbanization Boosting Demand for Residential Real Estate.

7. Are there any restraints impacting market growth?

4.; Lack of Affordable Housing Inhibiting the Growth of the Market4.; Economic Instability Affecting the Growth of the Market.

8. Can you provide examples of recent developments in the market?

December 2022: The south-east Asian real estate technology company, The PropertyGuru Group, has finalized the acquisition of iProperty Malaysia. Given that two brands (PropertyGuru and iProperty) are merging, they currently have a huge duty. The acquisition enables them to concentrate on what they believe is necessary to support their clients, and they aim to provide them with even more value.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Residential Property Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Residential Property Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Residential Property Industry?

To stay informed about further developments, trends, and reports in the Malaysia Residential Property Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence