Key Insights

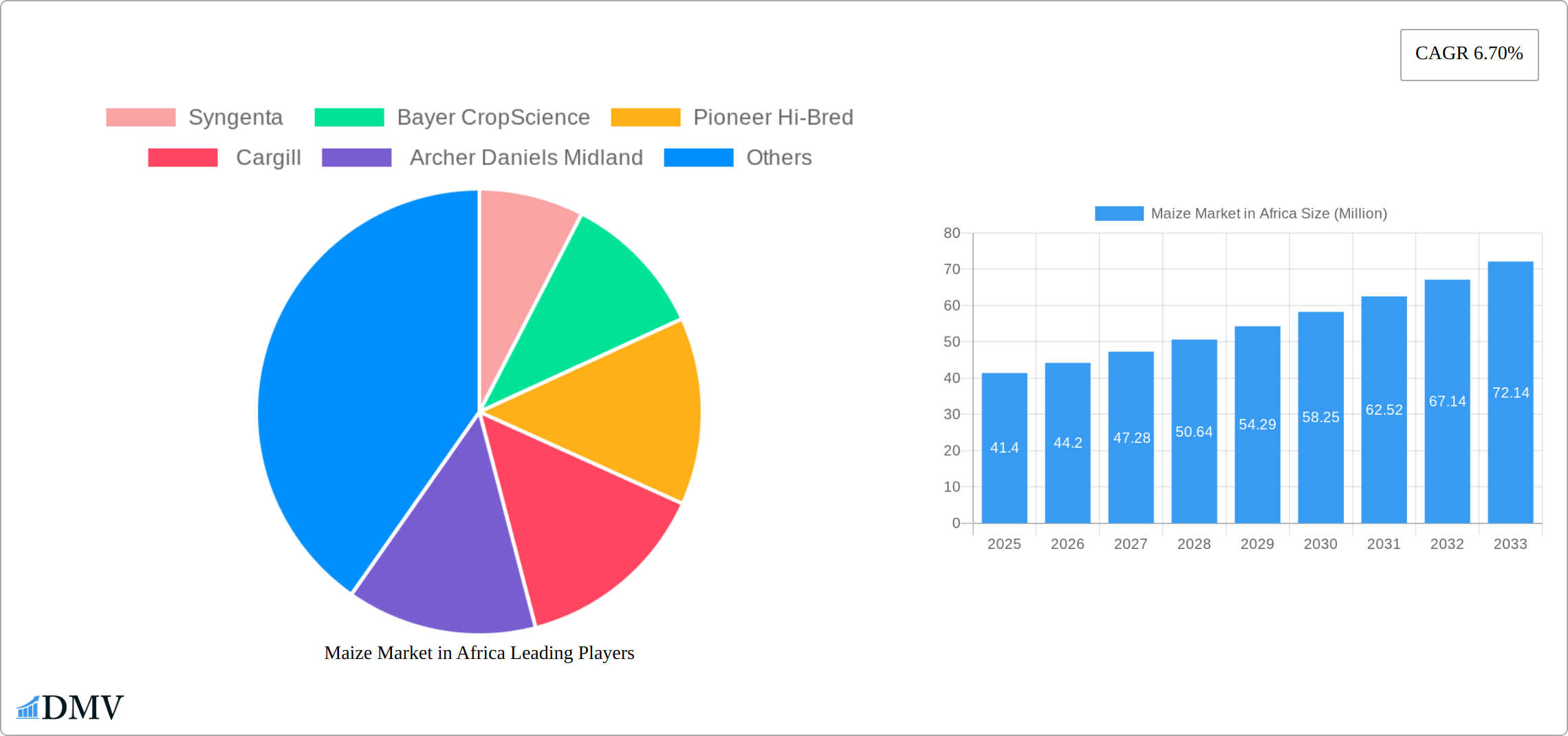

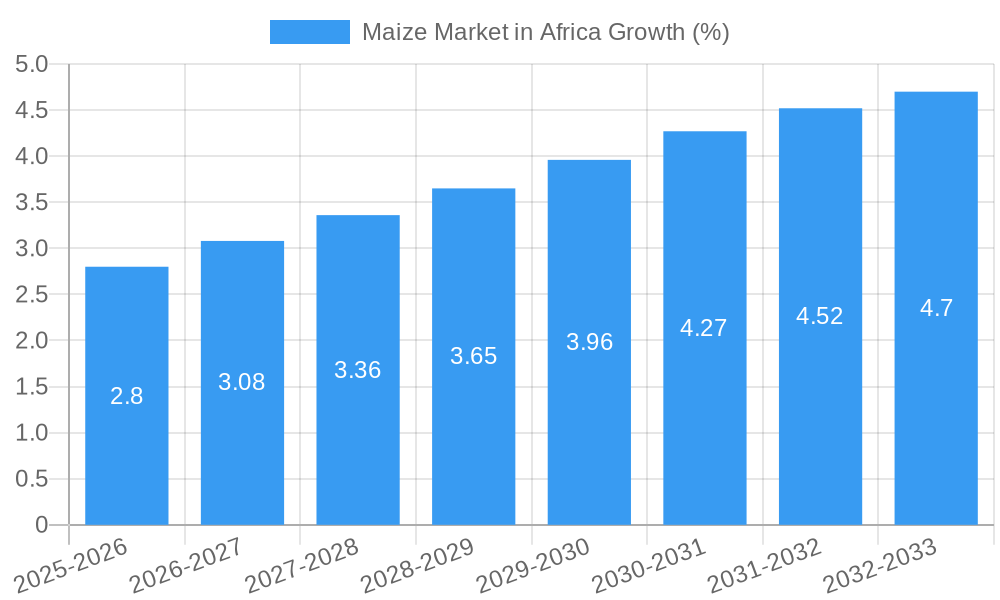

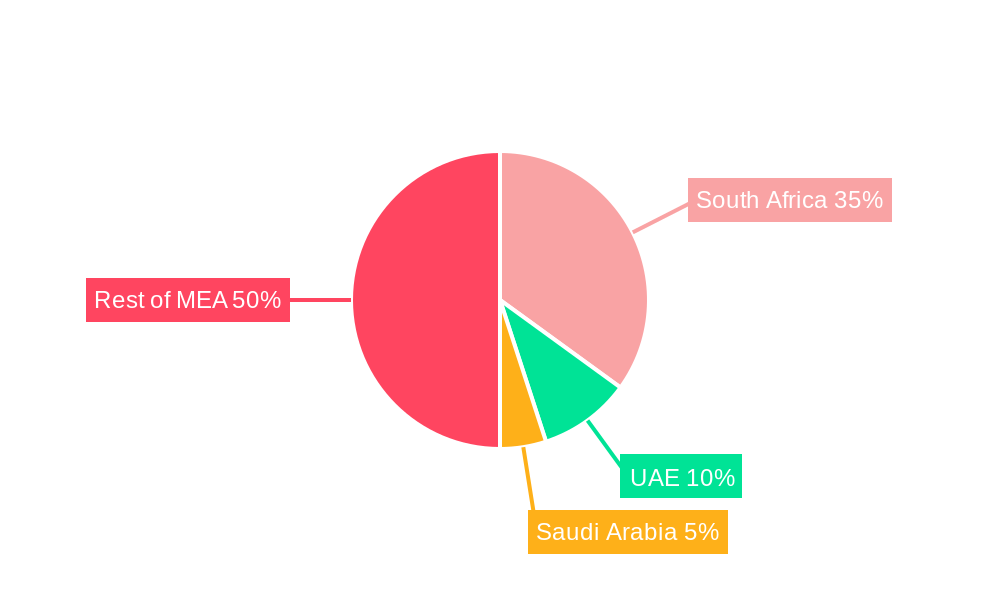

The African maize market, valued at $41.40 million in 2025, is projected to experience robust growth, driven by increasing demand for food, feed, and biofuel applications. A Compound Annual Growth Rate (CAGR) of 6.70% from 2025 to 2033 indicates a significant expansion of this market. This growth is fueled by a rising population, increasing urbanization leading to higher food consumption, and the growing adoption of maize as a key ingredient in animal feed. Furthermore, the burgeoning biofuel industry in certain African nations is creating additional demand, stimulating investment in maize production and processing. Key players like Syngenta, Bayer CropScience, Pioneer Hi-Bred, Cargill, and Archer Daniels Midland are actively shaping the market landscape through technological advancements in hybrid seeds and improved farming practices. The market segmentation, encompassing hybrid seeds and open-pollinated varieties across food, feed, and biofuel applications, offers diverse investment opportunities. The Middle East and Africa (MEA) region, particularly countries like South Africa, UAE, and Saudi Arabia, represent significant pockets of growth within the broader African context. This regional focus is strategically important due to these nations' investment in agricultural infrastructure and the adoption of modern farming techniques.

The market's growth, however, is not without challenges. Constraints such as climate change impacting crop yields, inconsistent rainfall patterns, and the availability of irrigation systems can pose significant hurdles. Furthermore, improving storage and post-harvest handling infrastructure is crucial to reducing waste and maintaining product quality. While opportunities abound, strategic investments in agricultural technology, infrastructure development, and sustainable farming practices are essential to realizing the full potential of the African maize market. Focusing on improved seed varieties tailored to specific regional climates and supporting smallholder farmers will be vital in achieving sustainable and inclusive growth within this sector. This involves addressing challenges related to access to finance, training, and market linkages for smallholder farmers, empowering them to participate effectively in the expanding maize market.

Maize Market in Africa: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Maize Market in Africa, covering the period 2019-2033, with a focus on market trends, industry evolution, key players, and future growth opportunities. The report uses 2025 as its base and estimated year, forecasting market dynamics until 2033. This in-depth analysis is crucial for stakeholders seeking to understand the complexities and potential of this dynamic market.

Maize Market in Africa Market Composition & Trends

This section delves into the intricate structure of the African maize market, examining key aspects that influence its growth and evolution. The market is characterized by a moderately concentrated landscape, with major players like Syngenta, Bayer CropScience, Pioneer Hi-Bred, Cargill, and Archer Daniels Midland holding significant market shares. However, a large number of smaller regional players also contribute to the overall market volume. Market share distribution fluctuates based on factors like climate conditions, government policies, and technological advancements. Innovation in seed technology (hybrid seeds and open-pollinated varieties) is a key driver, with companies investing heavily in research and development to create climate-resilient and high-yielding varieties. The regulatory landscape varies across African nations, impacting market entry and operations. Substitute products like sorghum and millet pose some competition, particularly in regions with less favorable maize-growing conditions. End-users include food processors, feed manufacturers, biofuel producers, and individual farmers.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Innovation Catalysts: Investment in R&D for climate-resilient seeds and improved yields.

- Regulatory Landscape: Varies significantly across African countries; GMO regulations are a key determinant.

- Substitute Products: Sorghum, millet, and other grains.

- End-User Profiles: Food processors, feed manufacturers, biofuel producers, and smallholder farmers.

- M&A Activities: Significant M&A activity valued at approximately xx Million USD during the historical period (2019-2024), driven by consolidation and expansion strategies.

Maize Market in Africa Industry Evolution

The African maize market has experienced considerable evolution over the past few years, exhibiting a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024). This growth is fueled by rising population, increasing demand for food and feed, and growing interest in biofuel production. Technological advancements, such as the development of improved seed varieties and precision farming techniques, are further enhancing productivity and efficiency. Consumer demand is shifting towards higher-quality, nutrient-rich maize varieties, driving innovation in the sector. Government initiatives promoting agricultural development and food security are also playing a significant role in boosting market growth. Adoption of improved seed varieties is gradually increasing, with xx% of farmers utilizing hybrid seeds in 2024, compared to xx% in 2019. However, challenges such as climate change, infrastructure limitations, and access to credit continue to hinder market growth in some regions. The projected CAGR for the forecast period (2025-2033) is estimated at xx%.

Leading Regions, Countries, or Segments in Maize Market in Africa

This section identifies the dominant regions, countries, and segments within the African maize market.

Dominant Region: East Africa (Kenya, Tanzania, Uganda) shows the highest maize production and consumption. This is driven by favourable climatic conditions in certain areas, large population density, and increasing agricultural investment.

Dominant Country: Kenya and South Africa lead in terms of maize production, processing, and trade. This dominance is supported by a combination of factors. Kenya boasts the largest consumption, leading to substantial market size. South Africa leads in terms of technological advancement, efficient agricultural practices, and export capacity, securing an important position in the regional and global markets.

Dominant Product Type: Hybrid seeds are gaining increasing popularity due to their superior yield and resilience, showing a higher growth rate than open-pollinated varieties.

Dominant Application: The food segment accounts for the largest share, driven by the rising demand for maize-based products. The feed industry is also showing rapid growth due to expansion of the livestock sector. Biofuel production is emerging as a significant application, creating additional demand, primarily in countries with supportive policies.

Key Drivers:

- Investment Trends: Significant public and private investment in agricultural development, seed research, and infrastructure.

- Regulatory Support: Government policies promoting maize production, including subsidies, improved access to finance, and improved market access.

- Climate Conditions: Favourable climatic conditions in specific regions contribute to higher yields.

- Technological Advancements: Use of improved seed varieties and precision farming technologies.

Maize Market in Africa Product Innovations

Recent innovations in the maize market focus on developing drought-tolerant, pest-resistant, and high-yielding hybrid varieties. Companies are utilizing advanced genetic engineering techniques to enhance nutritional content and improve shelf life. These innovations directly address the challenges faced by African farmers, improving farm yields and contributing to food security. The development of climate-smart agriculture practices, including precision irrigation and integrated pest management, also contributes to better crop resilience and enhanced yields. Unique selling propositions frequently emphasize superior yield, disease resistance, and adaptability to diverse agro-climatic conditions.

Propelling Factors for Maize Market in Africa Growth

Several factors contribute to the growth of the African maize market. Firstly, the rapidly growing population is driving up demand for maize as a staple food. Secondly, the increasing demand for animal feed creates a strong pull for maize production. Government initiatives promoting agricultural development and investing in improved seed varieties are creating enabling conditions for growth. Finally, the emergence of biofuel production as a significant application for maize further strengthens demand.

Obstacles in the Maize Market in Africa Market

The African maize market faces several challenges. Erratic weather patterns and climate change pose major risks to crop yields. Inadequate infrastructure limits access to markets and increases post-harvest losses. Limited access to finance and credit hinders investments in improved farming practices and technology adoption. Competition from other staple crops also influences market growth and price volatility. These constraints negatively impact overall production and market growth.

Future Opportunities in Maize Market in Africa

Future opportunities lie in expanding the use of improved seed varieties, particularly drought-tolerant and pest-resistant hybrids. The development of value-added maize products, including processed foods and animal feeds, offers significant potential for market expansion. Investing in infrastructure improvements to reduce post-harvest losses and improve market access will significantly bolster production and market growth. Finally, exploring the potential of maize in the biofuel sector, aligning with government regulations and environmental sustainability, opens doors for additional revenue streams.

Major Players in the Maize Market in Africa Ecosystem

Key Developments in Maize Market in Africa Industry

July 2022: The African Development Bank granted USD 5.4 Million to Burundi for the Emergency Agricultural Production Project, focusing on climate-resilient maize and rice seeds. This initiative directly supports improved seed adoption and increased productivity.

August 2022: The United States pledged USD 120 Million towards improving livelihoods and nutrition in Africa, including investment in high-quality seeds for maize, wheat, and rice over four years. This substantial investment signifies a commitment to improving agricultural production and strengthening food security.

October 2022: Kenya lifted its 10-year ban on GMOs, paving the way for the adoption of genetically modified maize varieties. This regulatory change is expected to significantly impact maize production in Kenya and potentially other African nations, leading to increased yields and improved crop resilience.

Strategic Maize Market in Africa Market Forecast

The African maize market is poised for robust growth in the forecast period (2025-2033), driven by increasing demand, technological advancements, and supportive government policies. The continued adoption of improved seed varieties, coupled with investments in agricultural infrastructure and technology, will contribute significantly to higher yields and increased production. The growing interest in value-added maize products and the biofuel sector provides further impetus for market expansion. The overall market is expected to experience significant growth, with substantial opportunities for both established and emerging players.

Maize Market in Africa Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Maize Market in Africa Segmentation By Geography

- 1. South Africa

- 2. Ethiopia

- 3. Zambia

- 4. Nigeria

- 5. Malawi

Maize Market in Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Climatic Conditions; Higher Market Entry Cost

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Animal Feed Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Maize Market in Africa Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.6.2. Ethiopia

- 5.6.3. Zambia

- 5.6.4. Nigeria

- 5.6.5. Malawi

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. South Africa Maize Market in Africa Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Ethiopia Maize Market in Africa Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Zambia Maize Market in Africa Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Nigeria Maize Market in Africa Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Malawi Maize Market in Africa Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. UAE Maize Market in Africa Analysis, Insights and Forecast, 2019-2031

- 12. South Africa Maize Market in Africa Analysis, Insights and Forecast, 2019-2031

- 13. Saudi Arabia Maize Market in Africa Analysis, Insights and Forecast, 2019-2031

- 14. Rest of MEA Maize Market in Africa Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Syngenta

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Bayer CropScience

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Pioneer Hi-Bred

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Cargill

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Archer Daniels Midland

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.1 Syngenta

List of Figures

- Figure 1: Maize Market in Africa Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Maize Market in Africa Share (%) by Company 2024

List of Tables

- Table 1: Maize Market in Africa Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Maize Market in Africa Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Maize Market in Africa Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Maize Market in Africa Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Maize Market in Africa Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Maize Market in Africa Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Maize Market in Africa Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Maize Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 9: UAE Maize Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Africa Maize Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Saudi Arabia Maize Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of MEA Maize Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Maize Market in Africa Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: Maize Market in Africa Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: Maize Market in Africa Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: Maize Market in Africa Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: Maize Market in Africa Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: Maize Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Maize Market in Africa Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 20: Maize Market in Africa Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 21: Maize Market in Africa Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 22: Maize Market in Africa Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 23: Maize Market in Africa Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 24: Maize Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Maize Market in Africa Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 26: Maize Market in Africa Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 27: Maize Market in Africa Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 28: Maize Market in Africa Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 29: Maize Market in Africa Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 30: Maize Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Maize Market in Africa Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 32: Maize Market in Africa Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 33: Maize Market in Africa Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 34: Maize Market in Africa Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 35: Maize Market in Africa Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 36: Maize Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Maize Market in Africa Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 38: Maize Market in Africa Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 39: Maize Market in Africa Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 40: Maize Market in Africa Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 41: Maize Market in Africa Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 42: Maize Market in Africa Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Maize Market in Africa?

The projected CAGR is approximately 6.70%.

2. Which companies are prominent players in the Maize Market in Africa?

Key companies in the market include Syngenta , Bayer CropScience, Pioneer Hi-Bred, Cargill, Archer Daniels Midland.

3. What are the main segments of the Maize Market in Africa?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.40 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle.

6. What are the notable trends driving market growth?

Increasing Demand from the Animal Feed Industry.

7. Are there any restraints impacting market growth?

; Unfavorable Climatic Conditions; Higher Market Entry Cost.

8. Can you provide examples of recent developments in the market?

October 2022: Kenya approved GMOs after a 10-year ban on the use of this technology, and this is expected to bring a major shift in the current crop production scenario in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Maize Market in Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Maize Market in Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Maize Market in Africa?

To stay informed about further developments, trends, and reports in the Maize Market in Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence