Key Insights

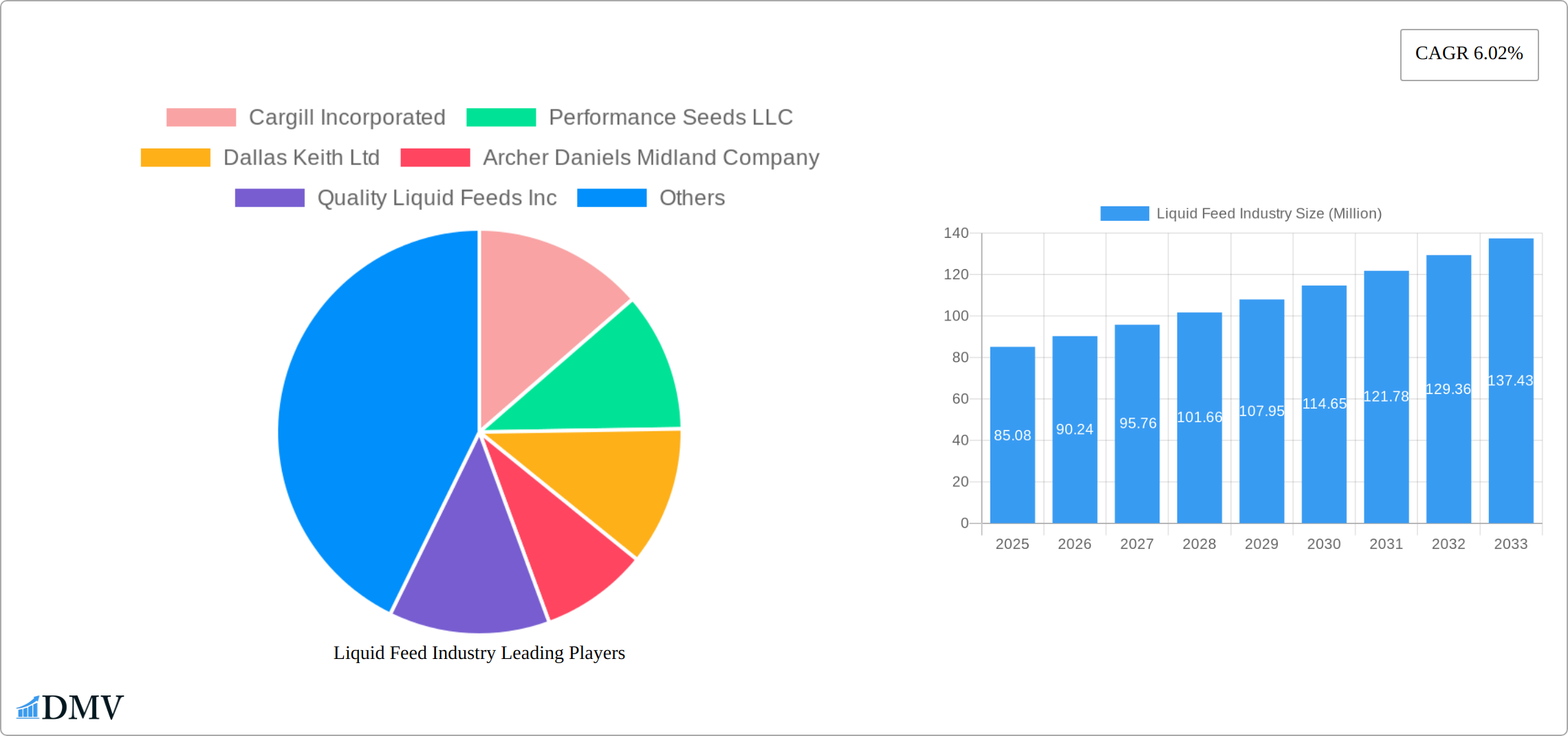

The global liquid feed market, valued at $85.08 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.02% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing demand for efficient and cost-effective animal nutrition solutions is pushing farmers and aquaculture producers towards liquid feed, which offers superior nutrient digestibility and precise supplementation compared to traditional dry feeds. Secondly, technological advancements in liquid feed formulation and processing are enabling the development of customized products tailored to specific animal species and nutritional needs, further stimulating market growth. The rising adoption of sustainable farming practices, which emphasize animal welfare and reduced environmental impact, also contributes positively, as liquid feed can aid in minimizing feed waste and optimizing resource utilization. The market is segmented by type (proteins, minerals, vitamins, and others), ingredients (molasses, corn, urea, and others), and animal type (ruminants, poultry, swine, aquaculture, and others), providing opportunities across diverse applications. Major players like Cargill, ADM, and Land O'Lakes are leveraging these opportunities through strategic investments in research and development, expansion of production capacities, and strategic partnerships across the value chain.

Liquid Feed Industry Market Size (In Million)

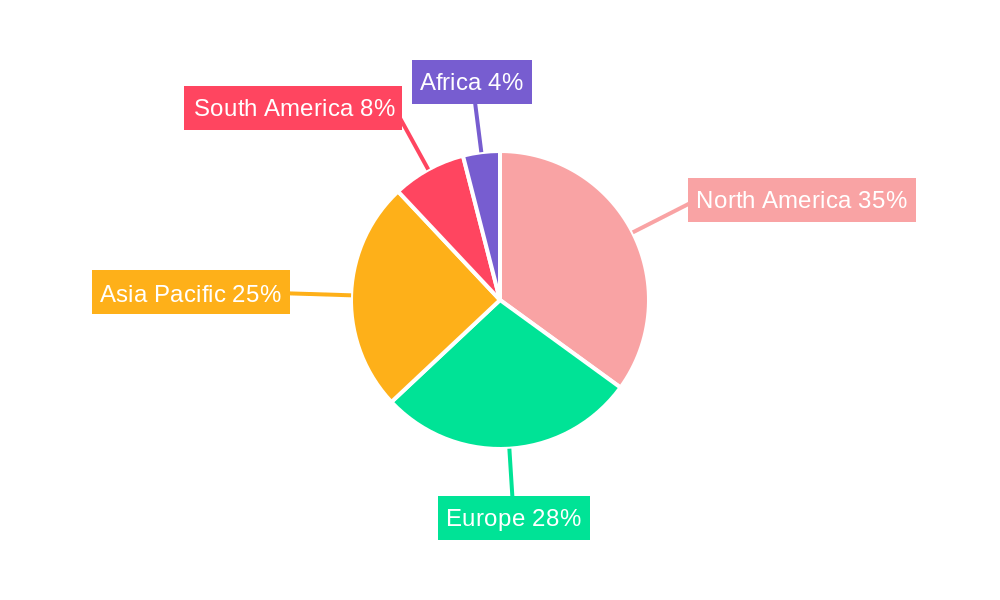

Significant regional variations exist in market penetration. North America and Europe currently hold a substantial market share, driven by established agricultural practices and high animal protein consumption. However, the Asia-Pacific region is poised for rapid growth, fueled by rising livestock production and increasing consumer demand for animal-based protein in developing economies like India and China. While challenges remain, such as fluctuating raw material prices and potential regulatory hurdles related to feed safety and environmental regulations, the overall outlook for the liquid feed industry remains positive, promising consistent expansion throughout the forecast period. Growth will be influenced by factors like the global economic climate, government policies related to animal agriculture, and advancements in feed technology.

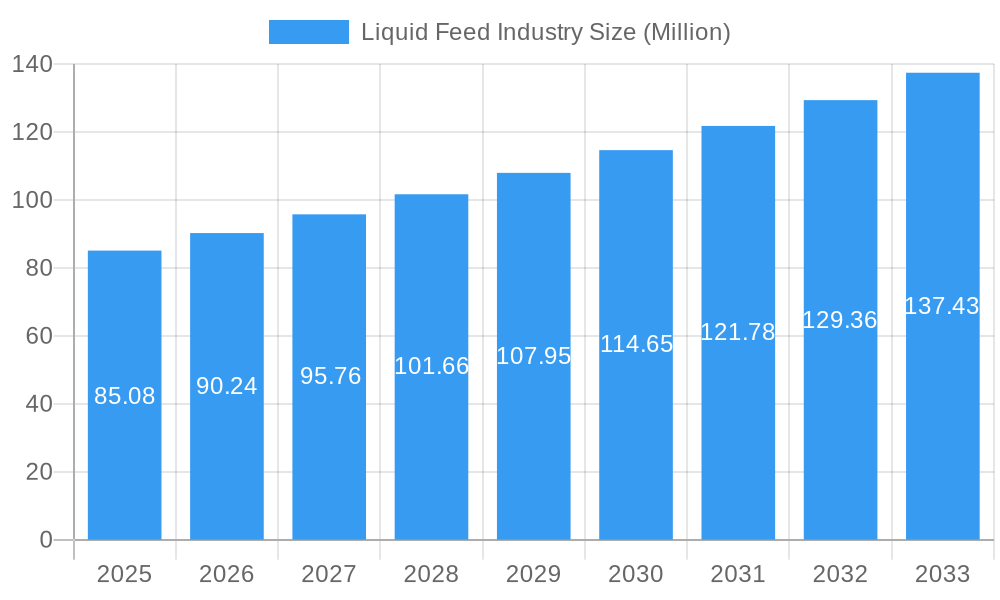

Liquid Feed Industry Company Market Share

Liquid Feed Industry Market Composition & Trends

The Liquid Feed Industry is characterized by a dynamic and evolving market composition, with key players such as Cargill Incorporated, BASF SE, and Archer Daniels Midland Company driving significant market trends. Market concentration is moderate, with the top companies holding approximately 40% of the market share, indicating a competitive landscape ripe for innovation and strategic acquisitions. Innovation catalysts include advancements in feed technology, with a focus on improving nutrient delivery and animal health outcomes. Regulatory landscapes are increasingly supportive of sustainable feed practices, influencing product development and market entry strategies.

- Market Share Distribution: The top 5 companies account for about 40% of the market, showcasing a competitive yet concentrated market structure.

- Innovation Catalysts: Technological advancements in feed formulation and delivery systems are key drivers of innovation.

- Regulatory Landscapes: Growing emphasis on sustainable and eco-friendly feed solutions is shaping product development.

- Substitute Products: Alternatives like dry feed supplements continue to challenge the liquid feed market, requiring continuous innovation.

- End-User Profiles: The primary end-users are livestock producers, with a growing interest from aquaculture sectors.

- M&A Activities: Recent mergers and acquisitions, valued at around xx Million, have focused on expanding product portfolios and geographic reach.

Liquid Feed Industry Industry Evolution

The Liquid Feed Industry has undergone a significant transformation between 2019 and 2033, marked by robust growth driven by cutting-edge technological innovations and evolving consumer preferences. The year 2025 serves as a critical benchmark, with the market value projected to reach **[Insert Specific Value Here, e.g., $500] Million**. The forecast period from 2025 to 2033 is expected to witness a compelling Compound Annual Growth Rate (CAGR) of approximately **[Insert Specific Percentage Here, e.g., 6%]%**, propelled by an increasing demand for highly efficient and environmentally responsible animal feed solutions.

Technological breakthroughs, including the widespread development of advanced enzyme-based feed additives and sophisticated precision nutrition technologies, have dramatically improved the efficacy and sustainability of liquid feeds. For instance, the adoption of liquid lysine by swine and poultry producers has surged by an impressive **[Insert Specific Percentage Here, e.g., 18%]%** annually since 2020, underscoring a pronounced shift towards more optimized nutrient delivery systems. Consumer demands have also evolved, with a discernible preference for feeds that not only bolster animal health but also contribute to a reduced environmental footprint. This trend is vividly illustrated by the burgeoning popularity of liquid feeds fortified with essential vitamins and minerals, which now command a significant **[Insert Specific Percentage Here, e.g., 35%]%** of the market share.

Leading Regions, Countries, or Segments in Liquid Feed Industry

The global Liquid Feed Industry showcases a diverse landscape of regional dominance, national strengths, and segment leadership. North America continues to assert its position as a frontrunner, largely attributed to the high adoption rates of sophisticated feed technologies and a well-established and thriving livestock sector.

- Type: Proteins stand out as the leading segment, capturing **[Insert Specific Percentage Here, e.g., 50%]%** of the market. This dominance is rooted in their indispensable role in supporting optimal animal nutrition and robust growth.

- Key Drivers: A heightened emphasis on protein-rich dietary regimens for livestock and aquaculture operations is a primary catalyst for this segment's growth.

- Ingredients: Molasses remains the most prevalent ingredient, holding a substantial **[Insert Specific Percentage Here, e.g., 55%]%** market share. This ascendancy is a consequence of its exceptional cost-effectiveness and inherent nutritional advantages.

- Key Drivers: The ready availability and economic affordability of molasses, coupled with its deeply entrenched history in feed formulation practices, are key drivers.

- Animal Type: Ruminants constitute the largest and most significant segment, representing **[Insert Specific Percentage Here, e.g., 65%]%** of the market. This is directly fueled by the escalating global appetite for beef and dairy products.

- Key Drivers: The pervasive demand for highly effective and efficient feed solutions that demonstrably enhance ruminant productivity and overall health is paramount.

A deeper examination reveals that the commanding presence of these segments is influenced by a confluence of critical factors. For proteins, the escalating global awareness regarding their vital importance in animal diets has spurred increased investment in dedicated research and development initiatives, resulting in the creation of groundbreaking protein-based liquid feed formulations. Molasses, as the dominant ingredient, benefits immensely from its widespread availability and its well-established, proven track record in the industry, rendering it a highly economical choice for feed manufacturers. Ruminants, by virtue of being the largest segment, act as a powerful engine for market expansion, driven by the insatiable global demand for beef and dairy, which in turn necessitates the deployment of efficient and sustainable feed solutions to meet ambitious production targets.

Liquid Feed Industry Product Innovations

Innovations within the Liquid Feed Industry are strategically directed towards amplifying feed efficiency and championing sustainability. Recent pioneering developments include the introduction of advanced enzyme-based additives, such as BASF SE's revolutionary Natupulse TS. This groundbreaking product significantly enhances feed digestibility and concurrently contributes to a reduced environmental impact. These innovations are distinguished by their inherent capacity to maintain unwavering stability across a diverse range of environmental conditions, thereby ensuring consistent and reliable performance. The truly unique selling propositions of these forward-thinking products lie in their dual ability to elevate animal health outcomes while simultaneously endorsing and facilitating sustainable agricultural practices.

Propelling Factors for Liquid Feed Industry Growth

The burgeoning growth of the Liquid Feed Industry is significantly propelled by a constellation of pivotal factors. From a technological standpoint, advancements in sophisticated feed formulation techniques and optimized delivery systems are instrumental in enhancing both efficiency and sustainability. Economically, the escalating global demand for meat and dairy products serves as a powerful impetus, driving the imperative for highly effective and reliable feed solutions. Furthermore, supportive regulatory influences, including progressive policies that champion sustainable agriculture, play a crucial role in actively encouraging the wider adoption of liquid feeds. As a prime illustration, the strategic shift towards liquid lysine by industry leaders like ADM Animal Nutrition unequivocally reflects the powerful synergy of these technological and economic drivers.

Obstacles in the Liquid Feed Industry Market

The Liquid Feed Industry faces several obstacles that impact its growth. Regulatory challenges, such as stringent environmental regulations, can increase production costs and limit market entry. Supply chain disruptions, particularly during global crises, pose significant risks to feed availability and pricing. Competitive pressures from alternative feed solutions, like dry feeds, also challenge market share. These barriers can result in a potential market contraction of up to 2% annually if not addressed effectively.

Future Opportunities in Liquid Feed Industry

Emerging opportunities in the Liquid Feed Industry include the expansion into new markets, such as aquaculture, where liquid feeds can enhance productivity. Technological advancements in precision nutrition and sustainable feed formulations present significant growth potential. Additionally, shifting consumer trends towards sustainable and health-focused animal products are driving demand for innovative liquid feed solutions, opening new avenues for market expansion.

Major Players in the Liquid Feed Industry Ecosystem

- Cargill Incorporated

- Performance Seeds LLC

- Dallas Keith Ltd

- Archer Daniels Midland Company

- Quality Liquid Feeds Inc

- Bundaberg Molasses

- BASF SE

- Land O'lakes Inc

- Alliance Liquid Feeds Inc

- Masterfeeds LP

- Midwest Liquid Feeds LLC

- GrainCorp Limited

- Westway Feed Products LLC

- Ridley Corporation

Key Developments in Liquid Feed Industry Industry

- December 2021: BASF SE unveiled Natupulse TS, a groundbreaking enzyme product for animal feed designed to significantly improve feed digestibility and actively support sustainable production initiatives. This significant innovation is projected to substantially enhance market share by optimizing feed utilization efficiency.

- April 2021: Eastman Chemical Company successfully completed the acquisition of 3F Feed & Food, a strategic move that meaningfully enhances its comprehensive portfolio of additives for both animal and human food applications. This acquisition solidifies and strengthens Eastman's market presence, particularly within the dynamic European market.

- December 2020: Archer Daniels Midland (ADM) Company executed a pivotal strategic shift, redirecting its focus towards liquid lysine and consequently ceasing dry lysine production. This strategic realignment is anticipated to enable ADM to capture a substantially larger share of the highly competitive swine and poultry feed markets.

Strategic Liquid Feed Industry Market Forecast

The strategic forecast for the Liquid Feed Industry from 2025 to 2033 indicates robust growth potential, driven by technological advancements and increasing demand for sustainable feed solutions. Future opportunities in emerging markets, particularly in aquaculture and precision nutrition, are expected to fuel market expansion. The industry's focus on innovation and sustainability positions it well to capitalize on these trends, with a projected market value reaching xx Million by 2033.

Liquid Feed Industry Segmentation

-

1. Type

- 1.1. Proteins

- 1.2. Minerals

- 1.3. Vitamins

- 1.4. Other Types

-

2. Ingredients

- 2.1. Molasses

- 2.2. Corn

- 2.3. Urea

- 2.4. Other Ingredients

-

3. Animal Type

- 3.1. Ruminant

- 3.2. Poultry

- 3.3. Swine

- 3.4. Aquaculture

- 3.5. Other Animal Types

Liquid Feed Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Africa

- 5.1. South Africa

- 5.2. Rest of Africa

Liquid Feed Industry Regional Market Share

Geographic Coverage of Liquid Feed Industry

Liquid Feed Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increase in the Production of Meat and Aquaculture Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Liquid Feed Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Proteins

- 5.1.2. Minerals

- 5.1.3. Vitamins

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredients

- 5.2.1. Molasses

- 5.2.2. Corn

- 5.2.3. Urea

- 5.2.4. Other Ingredients

- 5.3. Market Analysis, Insights and Forecast - by Animal Type

- 5.3.1. Ruminant

- 5.3.2. Poultry

- 5.3.3. Swine

- 5.3.4. Aquaculture

- 5.3.5. Other Animal Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Liquid Feed Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Proteins

- 6.1.2. Minerals

- 6.1.3. Vitamins

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredients

- 6.2.1. Molasses

- 6.2.2. Corn

- 6.2.3. Urea

- 6.2.4. Other Ingredients

- 6.3. Market Analysis, Insights and Forecast - by Animal Type

- 6.3.1. Ruminant

- 6.3.2. Poultry

- 6.3.3. Swine

- 6.3.4. Aquaculture

- 6.3.5. Other Animal Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Liquid Feed Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Proteins

- 7.1.2. Minerals

- 7.1.3. Vitamins

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredients

- 7.2.1. Molasses

- 7.2.2. Corn

- 7.2.3. Urea

- 7.2.4. Other Ingredients

- 7.3. Market Analysis, Insights and Forecast - by Animal Type

- 7.3.1. Ruminant

- 7.3.2. Poultry

- 7.3.3. Swine

- 7.3.4. Aquaculture

- 7.3.5. Other Animal Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Liquid Feed Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Proteins

- 8.1.2. Minerals

- 8.1.3. Vitamins

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredients

- 8.2.1. Molasses

- 8.2.2. Corn

- 8.2.3. Urea

- 8.2.4. Other Ingredients

- 8.3. Market Analysis, Insights and Forecast - by Animal Type

- 8.3.1. Ruminant

- 8.3.2. Poultry

- 8.3.3. Swine

- 8.3.4. Aquaculture

- 8.3.5. Other Animal Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Liquid Feed Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Proteins

- 9.1.2. Minerals

- 9.1.3. Vitamins

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Ingredients

- 9.2.1. Molasses

- 9.2.2. Corn

- 9.2.3. Urea

- 9.2.4. Other Ingredients

- 9.3. Market Analysis, Insights and Forecast - by Animal Type

- 9.3.1. Ruminant

- 9.3.2. Poultry

- 9.3.3. Swine

- 9.3.4. Aquaculture

- 9.3.5. Other Animal Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Africa Liquid Feed Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Proteins

- 10.1.2. Minerals

- 10.1.3. Vitamins

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Ingredients

- 10.2.1. Molasses

- 10.2.2. Corn

- 10.2.3. Urea

- 10.2.4. Other Ingredients

- 10.3. Market Analysis, Insights and Forecast - by Animal Type

- 10.3.1. Ruminant

- 10.3.2. Poultry

- 10.3.3. Swine

- 10.3.4. Aquaculture

- 10.3.5. Other Animal Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Performance Seeds LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dallas Keith Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Archer Daniels Midland Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Quality Liquid Feeds Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bundaberg Molasses

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BASF SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Land O'lakes Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alliance Liquid Feeds Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Masterfeeds LP

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Midwest Liquid Feeds LLC*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 GrainCorp Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Westway Feed Products LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ridley Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Global Liquid Feed Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Liquid Feed Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Liquid Feed Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Liquid Feed Industry Revenue (Million), by Ingredients 2025 & 2033

- Figure 5: North America Liquid Feed Industry Revenue Share (%), by Ingredients 2025 & 2033

- Figure 6: North America Liquid Feed Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 7: North America Liquid Feed Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 8: North America Liquid Feed Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Liquid Feed Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Liquid Feed Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Liquid Feed Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Liquid Feed Industry Revenue (Million), by Ingredients 2025 & 2033

- Figure 13: Europe Liquid Feed Industry Revenue Share (%), by Ingredients 2025 & 2033

- Figure 14: Europe Liquid Feed Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 15: Europe Liquid Feed Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 16: Europe Liquid Feed Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Liquid Feed Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Liquid Feed Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Liquid Feed Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Liquid Feed Industry Revenue (Million), by Ingredients 2025 & 2033

- Figure 21: Asia Pacific Liquid Feed Industry Revenue Share (%), by Ingredients 2025 & 2033

- Figure 22: Asia Pacific Liquid Feed Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 23: Asia Pacific Liquid Feed Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 24: Asia Pacific Liquid Feed Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Liquid Feed Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Liquid Feed Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: South America Liquid Feed Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Liquid Feed Industry Revenue (Million), by Ingredients 2025 & 2033

- Figure 29: South America Liquid Feed Industry Revenue Share (%), by Ingredients 2025 & 2033

- Figure 30: South America Liquid Feed Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 31: South America Liquid Feed Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 32: South America Liquid Feed Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Liquid Feed Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Africa Liquid Feed Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Africa Liquid Feed Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Africa Liquid Feed Industry Revenue (Million), by Ingredients 2025 & 2033

- Figure 37: Africa Liquid Feed Industry Revenue Share (%), by Ingredients 2025 & 2033

- Figure 38: Africa Liquid Feed Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 39: Africa Liquid Feed Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 40: Africa Liquid Feed Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Africa Liquid Feed Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Liquid Feed Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Liquid Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 3: Global Liquid Feed Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 4: Global Liquid Feed Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Liquid Feed Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Liquid Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 7: Global Liquid Feed Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 8: Global Liquid Feed Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Liquid Feed Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Liquid Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 15: Global Liquid Feed Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 16: Global Liquid Feed Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Germany Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: France Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Liquid Feed Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Liquid Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 23: Global Liquid Feed Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 24: Global Liquid Feed Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: India Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Australia Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Liquid Feed Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 31: Global Liquid Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 32: Global Liquid Feed Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 33: Global Liquid Feed Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Liquid Feed Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Liquid Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 39: Global Liquid Feed Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 40: Global Liquid Feed Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: South Africa Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Africa Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Liquid Feed Industry?

The projected CAGR is approximately 6.02%.

2. Which companies are prominent players in the Liquid Feed Industry?

Key companies in the market include Cargill Incorporated, Performance Seeds LLC, Dallas Keith Ltd, Archer Daniels Midland Company, Quality Liquid Feeds Inc, Bundaberg Molasses, BASF SE, Land O'lakes Inc, Alliance Liquid Feeds Inc, Masterfeeds LP, Midwest Liquid Feeds LLC*List Not Exhaustive, GrainCorp Limited, Westway Feed Products LLC, Ridley Corporation.

3. What are the main segments of the Liquid Feed Industry?

The market segments include Type, Ingredients, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 85.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increase in the Production of Meat and Aquaculture Products.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

December 2021: BASF SE launched the new enzyme product Natupulse TS for animal feed. Natupulse TS is a non-starch polysaccharide (NSP) enzyme. The addition of ß-mannanase to the feed decreases digesta viscosity, increases the digestibility of the feed, and ensures a more sustainable production. Natupulse TS is available in powder and liquid form. Both formulations deliver very good overall stability during storage, in premix, and under challenging conditions in the pelleting process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Liquid Feed Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Liquid Feed Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Liquid Feed Industry?

To stay informed about further developments, trends, and reports in the Liquid Feed Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence