Key Insights

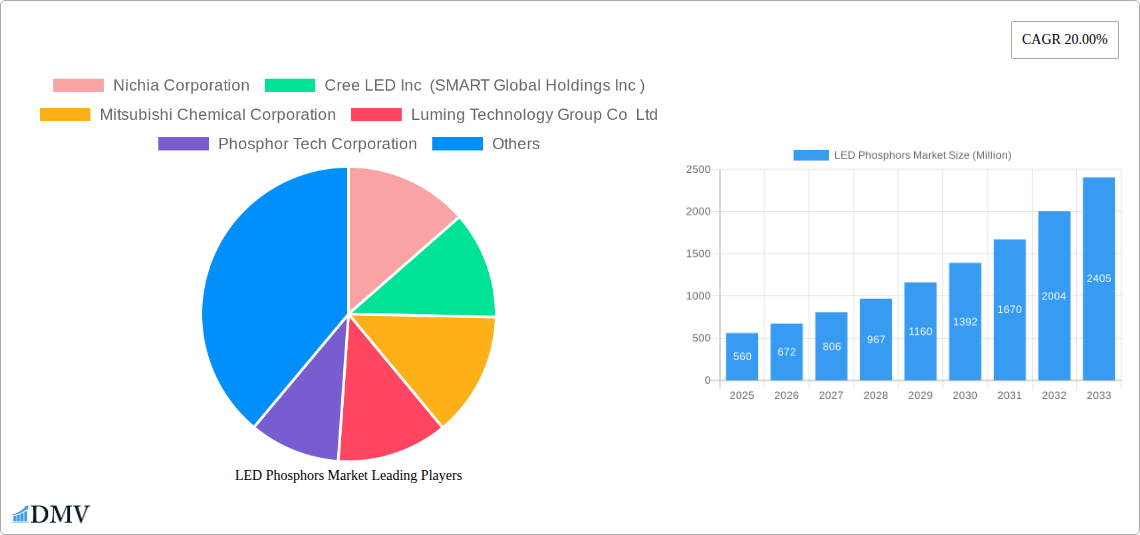

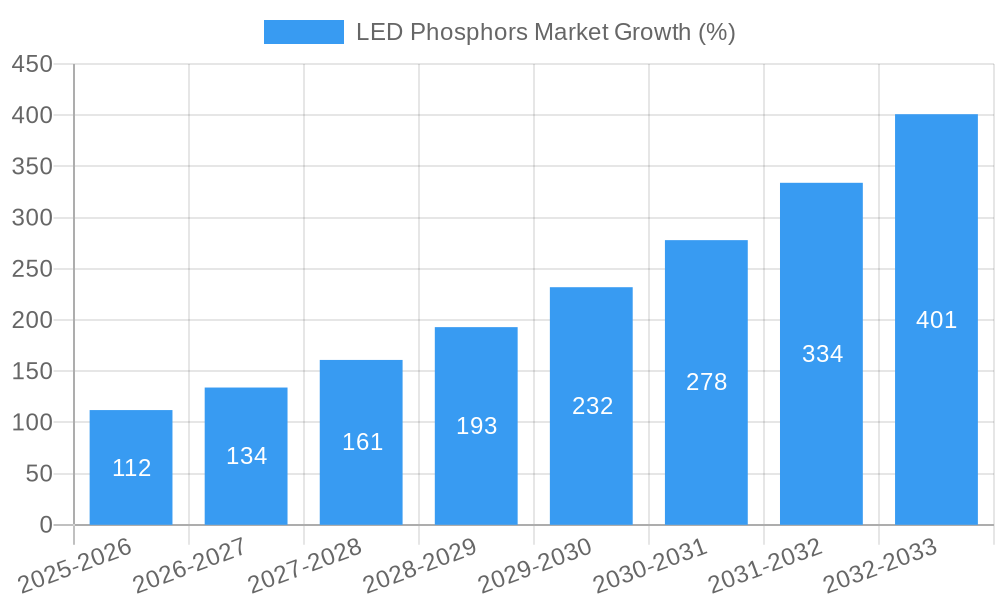

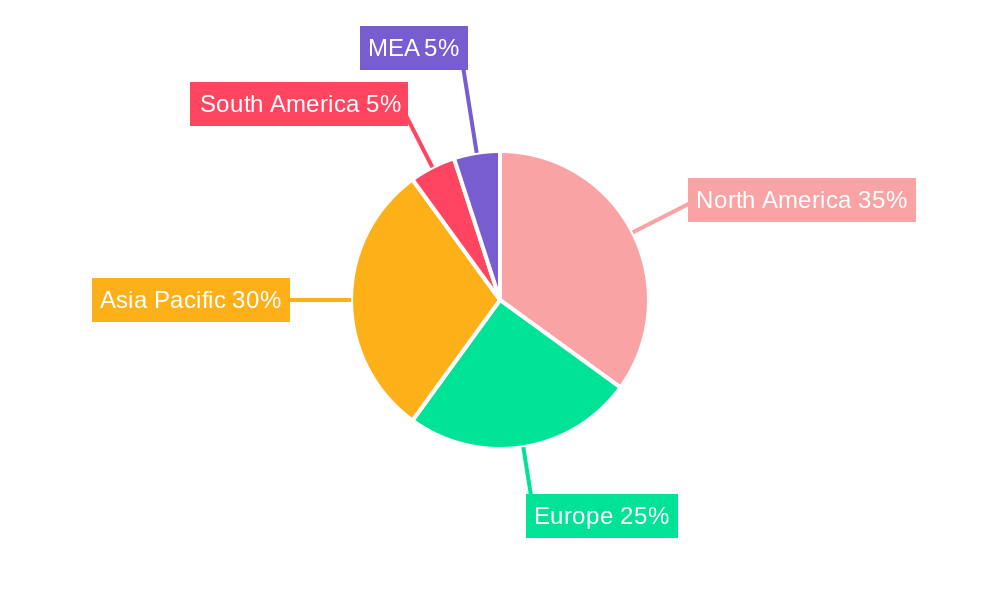

The LED Phosphors market, valued at $0.56 billion in 2025, is projected to experience robust growth, driven by the increasing demand for energy-efficient lighting solutions and advancements in display technologies. A Compound Annual Growth Rate (CAGR) of 20% from 2025 to 2033 indicates a significant expansion of this market. Key drivers include the rising adoption of LEDs in smartphones, LCD TVs, laptops, and automotive lighting, fueled by their superior energy efficiency, longer lifespan, and improved brightness compared to traditional lighting technologies. The growing demand for advanced lighting features in smart homes and the increasing penetration of LED lighting in commercial and industrial applications are further contributing to market expansion. While supply chain disruptions and fluctuating raw material prices present challenges, the long-term outlook for LED phosphors remains positive, driven by ongoing technological innovations and government initiatives promoting energy efficiency. Segmentation by application highlights smartphones and LCD TVs as major consumers, followed by laptops/tablets and the automotive sector, which is witnessing substantial growth due to the increasing adoption of LED headlights and taillights. The geographical distribution reveals a strong presence in North America and Asia-Pacific regions, primarily due to the large manufacturing hubs and significant consumer demand in these areas.

The competitive landscape is characterized by the presence of both established players and emerging companies. Key players like Nichia Corporation, Cree LED Inc., and Mitsubishi Chemical Corporation are leveraging their technological expertise and established market presence to maintain their leadership. However, smaller players and start-ups are focusing on niche applications and innovative technologies to gain market share. The continuous research and development efforts towards enhancing phosphor efficiency, color rendering, and stability are shaping the market dynamics. The future growth of the LED phosphors market will depend on factors such as advancements in phosphor materials, the development of new applications, and the increasing government regulations promoting energy-efficient technologies. The overall market trajectory suggests a promising outlook with significant opportunities for both established and new entrants.

LED Phosphors Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the global LED Phosphors market, offering a detailed overview of market dynamics, growth drivers, challenges, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the evolving LED Phosphors landscape. The market is projected to reach xx Million by 2033, demonstrating significant growth potential.

LED Phosphors Market Composition & Trends

This section delves into the competitive landscape of the LED Phosphors market, analyzing market concentration, innovation drivers, regulatory influences, substitute product analysis, end-user profiles, and merger and acquisition (M&A) activities. The report examines the market share distribution amongst key players such as Nichia Corporation, Cree LED Inc (SMART Global Holdings Inc), Mitsubishi Chemical Corporation, Luming Technology Group Co Ltd, Phosphor Tech Corporation, Philips Lumileds Lighting Company, Citizen Electronics Co Ltd, Intematix Corporation, Denka Co Ltd, and Beijing Yuji International Co Ltd.

- Market Concentration: The report quantifies market concentration using metrics such as the Herfindahl-Hirschman Index (HHI) and assesses the presence of any dominant players or significant competitive rivalry. The market appears to be moderately concentrated with a few major players holding significant shares.

- Innovation Catalysts: Advancements in material science, particularly in the development of novel phosphor materials with enhanced efficiency and color rendering capabilities, are driving innovation.

- Regulatory Landscape: The report analyzes relevant environmental regulations and safety standards impacting the manufacturing and use of LED phosphors, including RoHS compliance and waste management policies.

- Substitute Products: The report assesses the competitive threat from alternative technologies such as quantum dots and explores their potential market impact.

- End-User Profiles: A detailed breakdown of end-user segments (Smartphones, LCD TVs, Laptops/Tablets, Automotive, Lighting (Residential and Industrial), Other Applications) and their respective demand trends is provided.

- M&A Activities: The report tracks significant M&A activities within the LED Phosphors market during the study period (2019-2024), analyzing deal values and their implications for market consolidation and innovation. Total M&A deal value during this period is estimated to be around xx Million.

LED Phosphors Market Industry Evolution

This section provides a detailed analysis of the LED Phosphors market's evolution, focusing on growth trajectories, technological advancements, and evolving consumer preferences. The report examines historical market growth (2019-2024), analyzing factors that have influenced its trajectory. The Compound Annual Growth Rate (CAGR) during this period is estimated to be xx%. Furthermore, the report projects future market growth (2025-2033), anticipating a CAGR of xx% based on an analysis of macroeconomic factors, technological innovation, and evolving application trends. This analysis incorporates detailed forecasts for each major application segment, illustrating their unique growth patterns and driving forces. The report also explores the impact of technological advancements such as the development of high-efficiency phosphors, improved color rendering, and advancements in packaging techniques. Finally, the study investigates changes in consumer demand, such as the increasing preference for energy-efficient lighting solutions and the rising adoption of LED displays in various electronic devices.

Leading Regions, Countries, or Segments in LED Phosphors Market

This section identifies the dominant regions, countries, or segments within the LED Phosphors market. Based on the analysis, the lighting (residential and industrial) segment is predicted to hold the largest market share by 2033, driven by the global transition towards energy-efficient lighting solutions. Asia-Pacific is expected to remain the leading region due to high demand from China and other rapidly developing economies.

Key Drivers for Dominant Segments:

- Lighting (Residential and Industrial): Stringent energy efficiency regulations, government initiatives promoting energy conservation, and the increasing affordability of LED lighting are driving market growth in this segment. Significant investments in smart city projects and infrastructure development are further fueling demand.

- Smartphones: Growing penetration of smartphones globally, particularly in emerging markets, is pushing the demand for high-quality LED backlights. Advancements in display technology requiring higher-performing phosphors also contribute.

- Automotive: Growing adoption of advanced driver-assistance systems (ADAS) and the increasing integration of LED lighting systems in vehicles drive growth in this sector. This trend is further fueled by stringent automotive lighting regulations in several regions.

Dominance Factors: The dominance of certain segments is influenced by factors such as government regulations, technological advancements, consumer preferences, and economic growth in specific regions.

LED Phosphors Market Product Innovations

Recent product innovations within the LED Phosphors market have focused on enhancing color rendering, improving efficiency, and expanding the range of available colors. Manufacturers are developing phosphors with higher quantum yields and improved thermal stability, resulting in longer-lasting and more energy-efficient LED lighting. Novel phosphor compositions, including those incorporating rare-earth elements and other materials, are continuously being explored to achieve better performance and broader color gamut. These innovations are driving the adoption of LED technology across various applications, enhancing visual experience and reducing energy consumption.

Propelling Factors for LED Phosphors Market Growth

The LED Phosphors market's growth is primarily driven by the increasing demand for energy-efficient lighting solutions, fueled by government regulations promoting energy conservation and rising environmental awareness. The expanding adoption of LED displays in consumer electronics, particularly smartphones and TVs, also contributes significantly. Technological advancements, such as the development of high-efficiency phosphors, are further driving market growth. Additionally, economic growth in developing countries is increasing demand for LED lighting and displays, stimulating market expansion.

Obstacles in the LED Phosphors Market

The LED Phosphors market faces challenges, including the fluctuating prices of raw materials, particularly rare-earth elements. Supply chain disruptions can lead to production delays and cost increases, impacting market stability. Furthermore, intense competition among manufacturers, coupled with the continuous development of alternative lighting technologies, poses a significant challenge. Regulatory compliance requirements and environmental concerns related to rare-earth element mining and disposal add to the complexities faced by industry participants. This can lead to increased production costs and hinder market growth.

Future Opportunities in LED Phosphors Market

Future opportunities lie in the development of novel phosphor materials with enhanced performance characteristics, such as improved color rendering and higher efficiency. Expansion into new applications, including advanced lighting systems for automotive and aerospace industries, presents a significant growth potential. The growing demand for miniaturized and flexible displays presents a vast opportunity for tailored phosphor solutions. The exploration of sustainable and environmentally friendly phosphor materials will also play a crucial role in shaping the future of the market.

Major Players in the LED Phosphors Market Ecosystem

- Nichia Corporation

- Cree LED Inc (SMART Global Holdings Inc)

- Mitsubishi Chemical Corporation

- Luming Technology Group Co Ltd

- Phosphor Tech Corporation

- Philips Lumileds Lighting Company

- Citizen Electronics Co Ltd

- Intematix Corporation

- Denka Co Ltd

- Beijing Yuji International Co Ltd

Key Developments in LED Phosphors Market Industry

- August 2023: Signify announced the opening of its largest LED lighting manufacturing site globally in Jiujiang, Jiangxi Province, China, significantly boosting LED lighting production capacity and market penetration.

- May 2022: Samsung unveiled its 2022 model of The Wall (IWB), a modular Micro LED display, highlighting advancements in high-resolution display technology and showcasing the increasing demand for superior LED backlighting solutions.

Strategic LED Phosphors Market Forecast

The LED Phosphors market is poised for continued growth, driven by the increasing adoption of energy-efficient lighting solutions and the advancement of display technologies. Opportunities abound in the development of high-efficiency, customized phosphor materials for diverse applications. The market's expansion will be influenced by ongoing technological innovations, favorable government policies, and increasing consumer demand for energy-efficient and visually appealing lighting and display systems. The integration of LED phosphor technology in emerging applications like augmented reality and virtual reality displays will further contribute to the growth of this dynamic market.

LED Phosphors Market Segmentation

-

1. Application

- 1.1. Smartphones

- 1.2. LCD TVs

- 1.3. Laptops/Tablets

- 1.4. Automotive

- 1.5. Lighting (Residential and Industrial)

- 1.6. Other Applications

LED Phosphors Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

LED Phosphors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Usage of Smart Lighting Systems; Advanced Technological Developments in LED Phosphors

- 3.3. Market Restrains

- 3.3.1. Trust and Safety Issues

- 3.4. Market Trends

- 3.4.1. Smartphone to be the Fastest Growing Application

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LED Phosphors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Smartphones

- 5.1.2. LCD TVs

- 5.1.3. Laptops/Tablets

- 5.1.4. Automotive

- 5.1.5. Lighting (Residential and Industrial)

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America LED Phosphors Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Smartphones

- 6.1.2. LCD TVs

- 6.1.3. Laptops/Tablets

- 6.1.4. Automotive

- 6.1.5. Lighting (Residential and Industrial)

- 6.1.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe LED Phosphors Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Smartphones

- 7.1.2. LCD TVs

- 7.1.3. Laptops/Tablets

- 7.1.4. Automotive

- 7.1.5. Lighting (Residential and Industrial)

- 7.1.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia LED Phosphors Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Smartphones

- 8.1.2. LCD TVs

- 8.1.3. Laptops/Tablets

- 8.1.4. Automotive

- 8.1.5. Lighting (Residential and Industrial)

- 8.1.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Australia and New Zealand LED Phosphors Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Smartphones

- 9.1.2. LCD TVs

- 9.1.3. Laptops/Tablets

- 9.1.4. Automotive

- 9.1.5. Lighting (Residential and Industrial)

- 9.1.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Latin America LED Phosphors Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Smartphones

- 10.1.2. LCD TVs

- 10.1.3. Laptops/Tablets

- 10.1.4. Automotive

- 10.1.5. Lighting (Residential and Industrial)

- 10.1.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Middle East and Africa LED Phosphors Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Smartphones

- 11.1.2. LCD TVs

- 11.1.3. Laptops/Tablets

- 11.1.4. Automotive

- 11.1.5. Lighting (Residential and Industrial)

- 11.1.6. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. North America LED Phosphors Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe LED Phosphors Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Spain

- 13.1.5 Italy

- 13.1.6 Spain

- 13.1.7 Belgium

- 13.1.8 Netherland

- 13.1.9 Nordics

- 13.1.10 Rest of Europe

- 14. Asia Pacific LED Phosphors Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Southeast Asia

- 14.1.6 Australia

- 14.1.7 Indonesia

- 14.1.8 Phillipes

- 14.1.9 Singapore

- 14.1.10 Thailandc

- 14.1.11 Rest of Asia Pacific

- 15. South America LED Phosphors Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Peru

- 15.1.4 Chile

- 15.1.5 Colombia

- 15.1.6 Ecuador

- 15.1.7 Venezuela

- 15.1.8 Rest of South America

- 16. North America LED Phosphors Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United States

- 16.1.2 Canada

- 16.1.3 Mexico

- 17. MEA LED Phosphors Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 United Arab Emirates

- 17.1.2 Saudi Arabia

- 17.1.3 South Africa

- 17.1.4 Rest of Middle East and Africa

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Nichia Corporation

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Cree LED Inc (SMART Global Holdings Inc )

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Mitsubishi Chemical Corporation

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Luming Technology Group Co Ltd

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Phosphor Tech Corporation

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Philips Lumileds Lighting Company

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Citizen Electronics Co Ltd

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Intematix Corporation

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Denka Co Ltd

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Beijing Yuji International Co Ltd

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Nichia Corporation

List of Figures

- Figure 1: Global LED Phosphors Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America LED Phosphors Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America LED Phosphors Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe LED Phosphors Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe LED Phosphors Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific LED Phosphors Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific LED Phosphors Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America LED Phosphors Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America LED Phosphors Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America LED Phosphors Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America LED Phosphors Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA LED Phosphors Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA LED Phosphors Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America LED Phosphors Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America LED Phosphors Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America LED Phosphors Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America LED Phosphors Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe LED Phosphors Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe LED Phosphors Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe LED Phosphors Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe LED Phosphors Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia LED Phosphors Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Asia LED Phosphors Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Asia LED Phosphors Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia LED Phosphors Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Australia and New Zealand LED Phosphors Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Australia and New Zealand LED Phosphors Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Australia and New Zealand LED Phosphors Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Australia and New Zealand LED Phosphors Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America LED Phosphors Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Latin America LED Phosphors Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Latin America LED Phosphors Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Latin America LED Phosphors Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East and Africa LED Phosphors Market Revenue (Million), by Application 2024 & 2032

- Figure 35: Middle East and Africa LED Phosphors Market Revenue Share (%), by Application 2024 & 2032

- Figure 36: Middle East and Africa LED Phosphors Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Middle East and Africa LED Phosphors Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global LED Phosphors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global LED Phosphors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global LED Phosphors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global LED Phosphors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global LED Phosphors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Spain LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Belgium LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Netherland LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Nordics LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global LED Phosphors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Korea LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Southeast Asia LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Australia LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Indonesia LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Phillipes LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Singapore LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Thailandc LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Asia Pacific LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global LED Phosphors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Brazil LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Argentina LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Peru LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Chile LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Colombia LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Ecuador LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Venezuela LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of South America LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global LED Phosphors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: United States LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Canada LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Mexico LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global LED Phosphors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: United Arab Emirates LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Saudi Arabia LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East and Africa LED Phosphors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global LED Phosphors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 50: Global LED Phosphors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 51: Global LED Phosphors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global LED Phosphors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global LED Phosphors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 54: Global LED Phosphors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Global LED Phosphors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 56: Global LED Phosphors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Global LED Phosphors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 58: Global LED Phosphors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global LED Phosphors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 60: Global LED Phosphors Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LED Phosphors Market?

The projected CAGR is approximately 20.00%.

2. Which companies are prominent players in the LED Phosphors Market?

Key companies in the market include Nichia Corporation, Cree LED Inc (SMART Global Holdings Inc ), Mitsubishi Chemical Corporation, Luming Technology Group Co Ltd, Phosphor Tech Corporation, Philips Lumileds Lighting Company, Citizen Electronics Co Ltd, Intematix Corporation, Denka Co Ltd, Beijing Yuji International Co Ltd.

3. What are the main segments of the LED Phosphors Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Usage of Smart Lighting Systems; Advanced Technological Developments in LED Phosphors.

6. What are the notable trends driving market growth?

Smartphone to be the Fastest Growing Application.

7. Are there any restraints impacting market growth?

Trust and Safety Issues.

8. Can you provide examples of recent developments in the market?

August 2023: Signify announced the opening of its biggest LED lighting manufacturing site in the world in Jiujiang, Jiangxi Province, China. The new factory of Signify's joint venture company, Zhejiang Klite Lighting Holdings Co., Ltd, will manufacture high-quality branded LED lighting products for China and the global market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LED Phosphors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LED Phosphors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LED Phosphors Market?

To stay informed about further developments, trends, and reports in the LED Phosphors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence