Key Insights

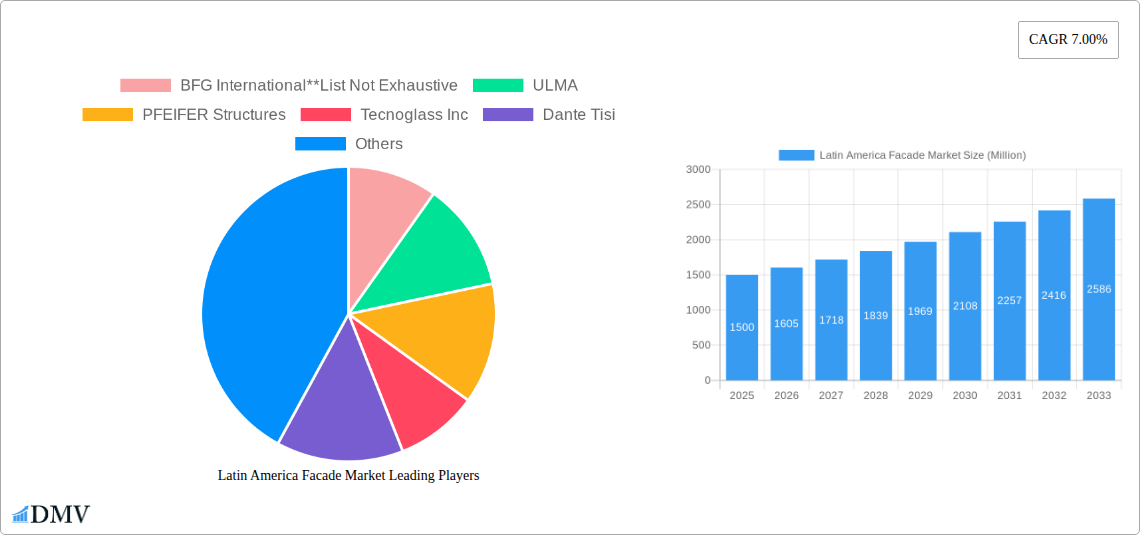

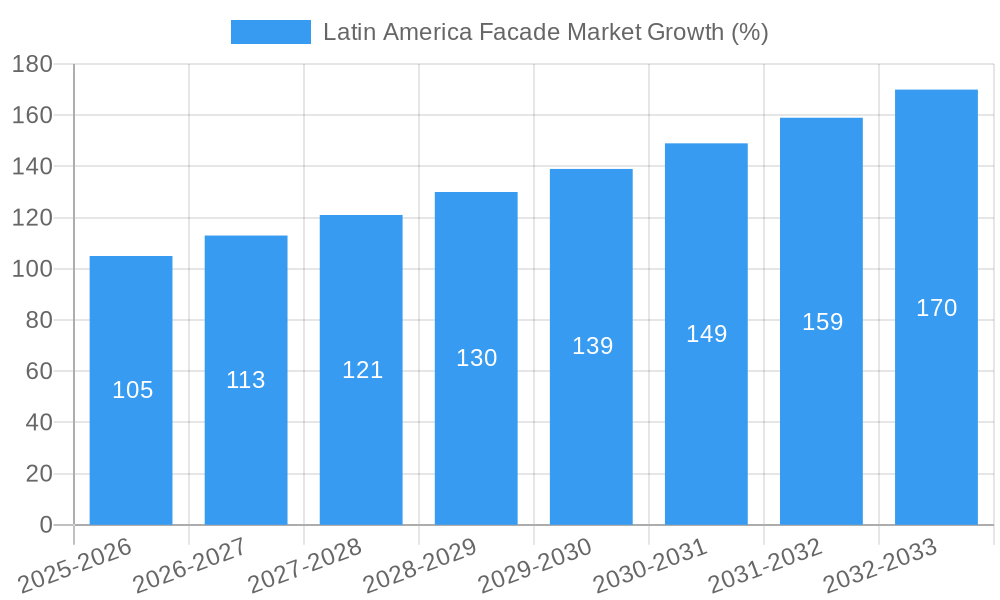

The Latin American facade market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.00% from 2025 to 2033. This expansion is driven by several key factors. Significant investments in infrastructure development across major economies like Brazil, Mexico, and Argentina are fueling demand for modern and aesthetically pleasing building facades. The burgeoning construction sector, particularly in commercial and residential segments, further contributes to market growth. Increasing urbanization and a rising middle class are also driving demand for improved building aesthetics and energy efficiency, boosting the adoption of ventilated and energy-efficient facade systems. Furthermore, architectural trends favoring innovative facade designs and the growing adoption of sustainable building materials, like those with high thermal performance, are shaping market dynamics. While challenges such as economic fluctuations in some Latin American countries and potential supply chain disruptions could act as restraints, the overall outlook for the market remains positive.

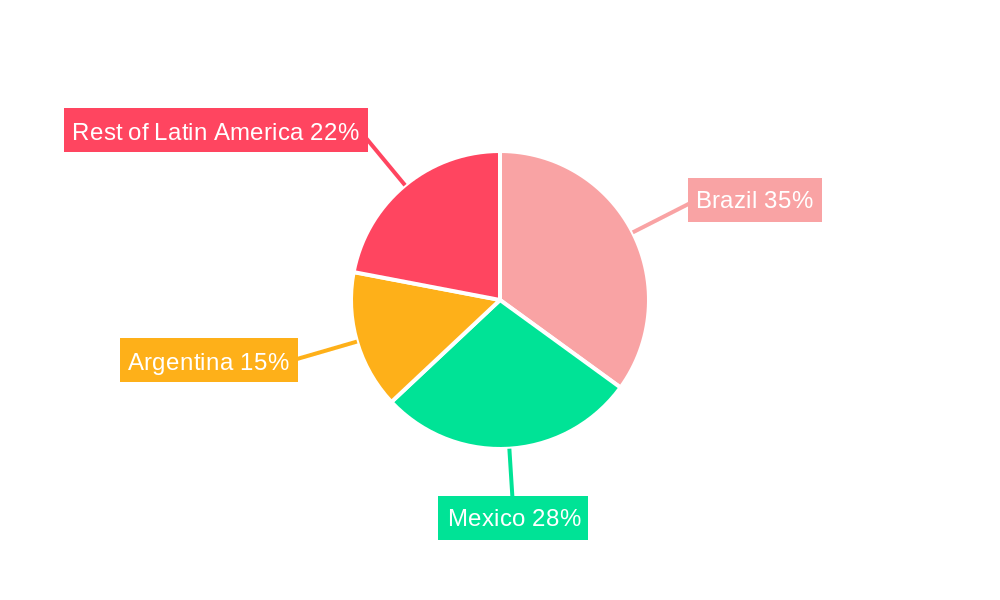

The market segmentation reveals strong growth potential across different types, materials, and end-users. Ventilated facades are gaining traction due to their energy efficiency benefits, while the material segment is witnessing increased demand for durable and aesthetically versatile options such as glass and metal. The commercial sector is expected to dominate the end-user segment due to high construction activity in major cities and the growing preference for modern and visually appealing commercial buildings. Companies like BFG International, ULMA, and Tecnoglass Inc. are key players, contributing to the market's competitiveness through innovation and expansion strategies. Regional analysis indicates Brazil, Mexico, and Argentina as the leading markets within Latin America, driven by robust construction activity and economic development in these regions. The continued focus on sustainable building practices and infrastructure development will be instrumental in shaping the future trajectory of the Latin American facade market over the forecast period.

Latin America Facade Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Latin America facade market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. From market sizing and segmentation to competitive landscapes and future projections, this report delivers a 360° view of the current state and future trajectory of the Latin American facade industry. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Latin America Facade Market Composition & Trends

This section meticulously dissects the Latin America facade market's structure and prevailing trends. We delve into market concentration, identifying key players and their respective market shares. The report explores innovation catalysts driving advancements in facade technology, analyzing the influence of regulatory landscapes, substitute products, and evolving end-user preferences. Furthermore, the impact of mergers and acquisitions (M&A) activities is examined, including deal values and their consequences on market dynamics.

- Market Concentration: The market is moderately concentrated, with the top 5 players holding approximately xx% market share in 2025.

- Innovation Catalysts: Emphasis on sustainable building materials and energy-efficient designs is driving innovation.

- Regulatory Landscape: Building codes and regulations vary across Latin American countries, impacting material choices and installation practices.

- Substitute Products: The emergence of innovative materials such as high-performance concrete and composite panels presents challenges to traditional facade solutions.

- End-User Profiles: Residential construction constitutes a significant share of the market, followed by commercial and industrial sectors.

- M&A Activity: The total value of M&A deals in the Latin American facade market during 2019-2024 was approximately xx Million, with an average deal size of xx Million.

Latin America Facade Market Industry Evolution

This section provides a detailed analysis of the Latin America facade market's evolutionary path, charting its growth trajectory from 2019 to 2033. We examine technological advancements, such as the integration of smart building technologies and the increasing adoption of Building Information Modeling (BIM), and their influence on market growth. The evolving consumer preferences, with a rising demand for aesthetically pleasing and sustainable facades, are thoroughly investigated. Specific data points, including compound annual growth rates (CAGR) and adoption rates of new technologies, are presented. The market is experiencing a CAGR of xx% during the forecast period, driven by increasing urbanization and infrastructural development. The adoption rate of BIM in facade design is projected to reach xx% by 2033.

Leading Regions, Countries, or Segments in Latin America Facade Market

This section identifies the leading regions, countries, and segments within the Latin American facade market. We analyze factors driving their dominance, including investment trends, regulatory support, and market-specific dynamics. A detailed breakdown by type (ventilated, non-ventilated, others), material (wood, glass, metal, stone, ceramic, others), and end-user (residential, commercial, industrial) is presented.

- By Type: The ventilated facade segment holds the largest market share due to its superior performance in terms of thermal insulation and aesthetics.

- By Material: Glass dominates the material segment due to its versatility, aesthetic appeal, and advanced technological capabilities.

- By End-User: The commercial sector exhibits robust growth, driven by large-scale construction projects and corporate investments.

Key Drivers:

- Brazil: Strong economic growth and government investments in infrastructure are propelling market expansion.

- Mexico: Increasing urbanization and a burgeoning construction industry are contributing to market growth.

- Colombia: A focus on sustainable development initiatives and investments in green building technologies are driving demand.

Latin America Facade Market Product Innovations

This section highlights the latest product innovations, emphasizing their unique selling propositions and technological advancements. We examine various applications of these innovations and their impact on the overall performance of facade systems, including energy efficiency, durability, and aesthetic appeal. The market is witnessing innovations in self-cleaning glass, smart facade systems with integrated sensors, and lightweight, high-strength composite materials.

Propelling Factors for Latin America Facade Market Growth

Several key factors are driving the growth of the Latin America facade market. These include robust economic growth in several key countries, increasing urbanization and infrastructure development, and the growing adoption of sustainable building practices and green building certifications. Government regulations promoting energy efficiency in buildings are further stimulating demand.

Obstacles in the Latin America Facade Market

Despite the positive growth outlook, several challenges hinder the market's expansion. These include supply chain disruptions impacting the availability and cost of raw materials, stringent building regulations, and intense competition among facade system providers. Furthermore, economic volatility in certain regions can impact investment decisions.

Future Opportunities in Latin America Facade Market

The Latin America facade market presents exciting future opportunities. The growing demand for sustainable and energy-efficient building materials, coupled with technological advancements in smart facade systems and BIM integration, opens new avenues for market growth. Expanding into previously untapped markets and capitalizing on evolving consumer preferences will also be crucial for success.

Major Players in the Latin America Facade Market Ecosystem

- BFG International

- ULMA

- PFEIFER Structures

- Tecnoglass Inc

- Dante Tisi

- Shackerley (Holdings) Group

- Mallol Arquitectos

- Au-Mex

- Roofway

- Estudio Marshall & Associates

- Ventanar

Key Developments in Latin America Facade Market Industry

- 2024 Q4: Tecnoglass Inc. launched a new line of sustainable glass facades.

- 2023 Q3: A major merger between two leading facade companies resulted in increased market consolidation.

- 2022 Q1: New building codes were implemented in Mexico, affecting the demand for certain types of facade materials.

Strategic Latin America Facade Market Forecast

The Latin America facade market is poised for sustained growth driven by urbanization, infrastructure development, and a shift towards sustainable building practices. The market's potential is significant, presenting opportunities for innovation, expansion, and strategic partnerships. Technological advancements, including smart facade systems and the increasing adoption of BIM, will play a crucial role in shaping the future of the market.

Latin America Facade Market Segmentation

-

1. Type

- 1.1. Ventilated

- 1.2. Non-Ventilated

- 1.3. Others

-

2. Material

- 2.1. Wood

- 2.2. Glass

- 2.3. Metal

- 2.4. Stone

- 2.5. Ceramic

- 2.6. Others

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

Latin America Facade Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Facade Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions

- 3.3. Market Restrains

- 3.3.1. The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. Increasing Construction Sector Boosting the Demand for Facade Installations

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Facade Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ventilated

- 5.1.2. Non-Ventilated

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Wood

- 5.2.2. Glass

- 5.2.3. Metal

- 5.2.4. Stone

- 5.2.5. Ceramic

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Latin America Facade Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Facade Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Facade Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Facade Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Facade Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Facade Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 BFG International**List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 ULMA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 PFEIFER Structures

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Tecnoglass Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Dante Tisi

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Shackerley (Holdings) Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Mallol Arquitectos

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Au-Mex

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Roofway

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Estudio Marshall & Associates

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Ventanar

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 BFG International**List Not Exhaustive

List of Figures

- Figure 1: Latin America Facade Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Facade Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Facade Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Facade Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Latin America Facade Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: Latin America Facade Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Latin America Facade Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Latin America Facade Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Peru Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Chile Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Latin America Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Latin America Facade Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Latin America Facade Market Revenue Million Forecast, by Material 2019 & 2032

- Table 15: Latin America Facade Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: Latin America Facade Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Chile Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Colombia Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Peru Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Venezuela Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Ecuador Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Bolivia Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Paraguay Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Facade Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Latin America Facade Market?

Key companies in the market include BFG International**List Not Exhaustive, ULMA, PFEIFER Structures, Tecnoglass Inc, Dante Tisi, Shackerley (Holdings) Group, Mallol Arquitectos, Au-Mex, Roofway, Estudio Marshall & Associates, Ventanar.

3. What are the main segments of the Latin America Facade Market?

The market segments include Type, Material, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions.

6. What are the notable trends driving market growth?

Increasing Construction Sector Boosting the Demand for Facade Installations.

7. Are there any restraints impacting market growth?

The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Facade Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Facade Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Facade Market?

To stay informed about further developments, trends, and reports in the Latin America Facade Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence