Key Insights

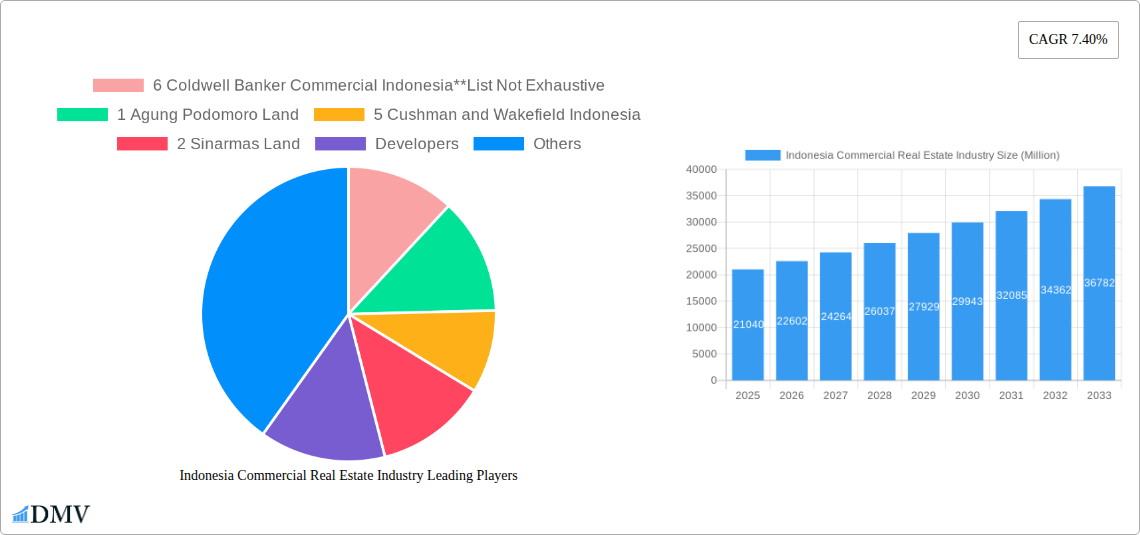

The Indonesian commercial real estate market, valued at $21.04 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 7.40% from 2025 to 2033. This expansion is fueled by several key drivers. Rapid urbanization, particularly in major cities like Jakarta, Surabaya, and Semarang, is creating significant demand for office, retail, and industrial spaces. A burgeoning e-commerce sector necessitates increased logistics space, further driving market growth. Moreover, the Indonesian government's infrastructure development initiatives and sustained economic growth contribute to a positive outlook for the sector. The market is segmented by property type (offices, retail, industrial, logistics, multi-family, hospitality) and key cities, allowing investors to target specific niches. While challenges such as fluctuating economic conditions and potential regulatory changes might present headwinds, the long-term growth prospects remain promising due to Indonesia's expanding economy and increasing population.

The market's competitive landscape includes a mix of established players like Agung Podomoro Land, Sinarmas Land, Ciputra Group, and Lippo Karawaci, alongside international firms like Cushman & Wakefield Indonesia and Coldwell Banker Commercial Indonesia, and innovative co-working space providers such as GoWork and CoHive. This blend of established developers and agile newcomers reflects the dynamic nature of the market. The presence of numerous real estate agencies and startups further indicates a vibrant and competitive ecosystem. Future growth will depend on effective adaptation to changing market demands, innovative approaches to sustainable development, and strategic partnerships. The continued growth of the Indonesian economy and its burgeoning middle class will ensure the long-term attractiveness of this market for investors.

Indonesia Commercial Real Estate Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Indonesian commercial real estate market, covering the period 2019-2033, with a focus on 2025. We delve into market composition, key players, emerging trends, and future growth prospects, offering invaluable insights for stakeholders across the industry. With a detailed examination of key segments – Offices, Retail, Industrial, Logistics, Multi-family, and Hospitality – across major cities like Jakarta, Surabaya, and Semarang, this report is essential for informed decision-making. The total market value in 2025 is estimated at xx Million USD.

Indonesia Commercial Real Estate Industry Market Composition & Trends

This section evaluates the Indonesian commercial real estate market's concentration, innovation, regulatory landscape, substitute products, end-user profiles, and M&A activities. The market is characterized by a mix of large established players and emerging startups, with a total market size estimated at xx Million USD in 2025. Market share is largely concentrated amongst a few major players, with Agung Podomoro Land, Sinarmas Land, and Ciputra Group holding significant positions. However, the entry of global players like Equinix signifies increasing competition.

- Market Share Distribution (2025): Agung Podomoro Land (xx%), Sinarmas Land (xx%), Ciputra Group (xx%), Others (xx%). These figures are estimates based on available data and market analysis.

- M&A Activity (2019-2024): Total deal value estimated at xx Million USD, with a notable acquisition being EMPG's purchase of OLX Indonesia property assets in January 2022. Further detailed analysis of M&A activity is provided within the report.

- Regulatory Landscape: The Indonesian government's policies on foreign investment and infrastructure development significantly influence market dynamics.

- Innovation Catalysts: Technological advancements in property management, PropTech startups, and the rise of co-working spaces are driving innovation.

- Substitute Products: The emergence of alternative workspace solutions poses a challenge to traditional office spaces.

- End-User Profiles: The report profiles key end-users, including multinational corporations, local businesses, and individual investors.

Indonesia Commercial Real Estate Industry Industry Evolution

This section analyzes the Indonesian commercial real estate market's growth trajectory from 2019 to 2033. The market experienced significant growth in the pre-pandemic years, followed by a period of adjustment. However, a rebound is expected driven by strong economic growth and increasing urbanization. Technological advancements, such as the adoption of smart building technologies and digital platforms for property transactions, are transforming the sector. The shift towards flexible workspaces and e-commerce is also reshaping demand. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is projected to be xx%. Specific data points, including growth rates for each segment and adoption metrics for new technologies, are detailed in the full report.

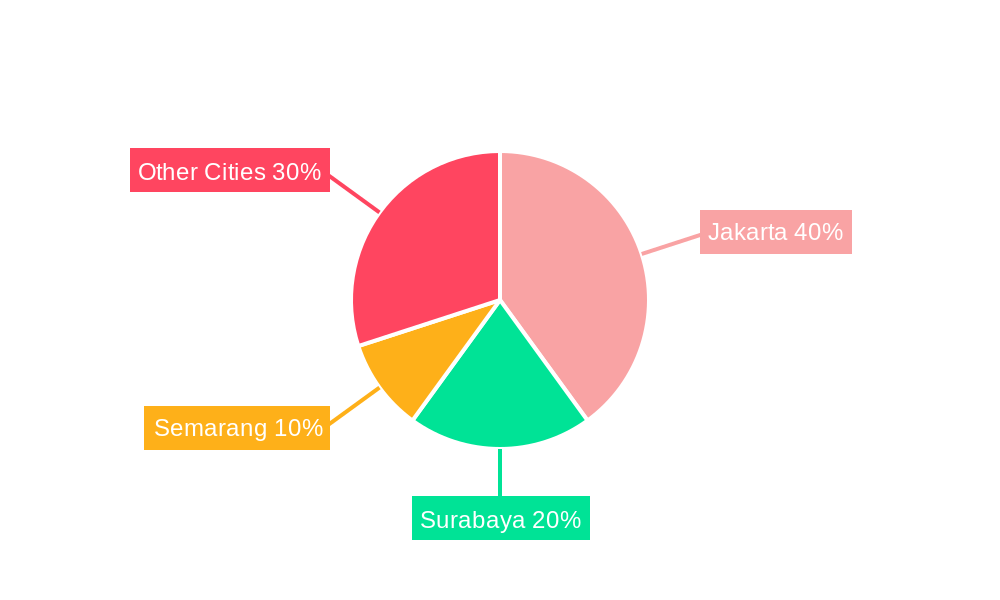

Leading Regions, Countries, or Segments in Indonesia Commercial Real Estate Industry

Jakarta remains the dominant market within Indonesia's commercial real estate sector, followed by Surabaya and Semarang. This dominance is driven by several factors:

- Jakarta: High concentration of businesses, strong economic activity, extensive infrastructure, and high demand for office and retail spaces.

- Surabaya: Significant industrial and manufacturing activities, growing population, and increasing foreign investment.

- Semarang: Strategic location, growing port activities, and increasing infrastructure development.

The Office segment currently holds the largest market share, followed by Retail. However, the Industrial and Logistics sectors are experiencing rapid growth due to increasing e-commerce activity and foreign direct investment in manufacturing. Detailed analysis of the drivers for each segment's dominance is presented in the full report.

Indonesia Commercial Real Estate Industry Product Innovations

The Indonesian commercial real estate sector is witnessing significant product innovations, including the development of smart buildings incorporating IoT technologies, flexible and co-working office spaces catering to the changing needs of businesses, and the integration of sustainable and green building practices. These innovations are enhancing efficiency, reducing operational costs, and attracting environmentally conscious tenants. Furthermore, the application of data analytics is providing valuable insights for improved decision-making and resource optimization.

Propelling Factors for Indonesia Commercial Real Estate Industry Growth

Several factors contribute to the growth of Indonesia's commercial real estate market:

- Rapid Urbanization: Indonesia's rapidly growing urban population fuels demand for residential and commercial properties.

- Economic Growth: Sustained economic expansion and increasing foreign direct investment create a positive environment for real estate development.

- Government Initiatives: Government policies promoting infrastructure development and investment in the real estate sector stimulate growth.

- Technological Advancements: The adoption of PropTech and smart building technologies improves efficiency and attractiveness.

Obstacles in the Indonesia Commercial Real Estate Industry Market

Challenges facing the Indonesian commercial real estate market include:

- Regulatory Hurdles: Navigating complex regulations and obtaining necessary permits can delay projects and increase costs.

- Infrastructure Gaps: Inadequate infrastructure in certain areas can hinder development and limit accessibility.

- Competitive Pressures: Increasing competition from both local and international players puts pressure on pricing and profitability.

- Economic Volatility: Global economic uncertainty can impact investment decisions and market sentiment.

Future Opportunities in Indonesia Commercial Real Estate Industry

Future opportunities lie in:

- Sustainable and Green Buildings: Growing demand for environmentally friendly properties presents significant opportunities for developers.

- Logistics and E-commerce: The booming e-commerce sector is driving demand for warehousing and logistics facilities.

- Tech-Enabled Property Management: Adoption of PropTech solutions enhances efficiency and improves tenant experience.

- Expansion into Tier 2 and Tier 3 Cities: Development in secondary and tertiary cities offers promising growth potential.

Major Players in the Indonesia Commercial Real Estate Industry Ecosystem

- 6 Coldwell Banker Commercial Indonesia

- 1 Agung Podomoro Land

- 5 Cushman and Wakefield Indonesia

- 2 Sinarmas Land

- Developers

- 4 UnionSpace

- 3 GoWork

- Other Companies (Real Estate Agencies Startups Associations etc )

- 4 Ciputra Group

- 5 RDTX Group

- 2 CoHive

- 7 Dutta Angada Realty

- 1 Carigudang

- 6 PP Properti

- 3 Lippo Karawaci

Key Developments in Indonesia Commercial Real Estate Industry Industry

- October 2022: Equinix, Inc. announces a USD 74 Million investment in a new data center in Jakarta, boosting the digital infrastructure sector and attracting further investment.

- January 2022: EMPG acquires OLX Indonesia property assets, consolidating market share and influencing online property platforms.

Strategic Indonesia Commercial Real Estate Industry Market Forecast

The Indonesian commercial real estate market is poised for continued growth over the forecast period (2025-2033), driven by robust economic expansion, increasing urbanization, and technological advancements. The development of sustainable and tech-enabled properties will be key drivers. Strong growth is anticipated in the logistics and data center segments. The market is expected to reach xx Million USD by 2033, presenting significant opportunities for investors and developers.

Indonesia Commercial Real Estate Industry Segmentation

-

1. Type

- 1.1. Offices

- 1.2. Retail

- 1.3. Industrial

- 1.4. Logistics

- 1.5. Multi-family

- 1.6. Hospitality

-

2. Key Cities

- 2.1. Jakarta

- 2.2. Surabaya

- 2.3. Semarang

Indonesia Commercial Real Estate Industry Segmentation By Geography

- 1. Indonesia

Indonesia Commercial Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Fluctuating Construction Materials Costs

- 3.4. Market Trends

- 3.4.1. The demand for office remains strong in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Commercial Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Offices

- 5.1.2. Retail

- 5.1.3. Industrial

- 5.1.4. Logistics

- 5.1.5. Multi-family

- 5.1.6. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Jakarta

- 5.2.2. Surabaya

- 5.2.3. Semarang

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 6 Coldwell Banker Commercial Indonesia**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 1 Agung Podomoro Land

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 5 Cushman and Wakefield Indonesia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 2 Sinarmas Land

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Developers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 4 UnionSpace

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 3 GoWork

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Other Companies (Real Estate Agencies Startups Associations etc )

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 4 Ciputra Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 5 RDTX Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 2 CoHive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 7 Dutta Angada Realty

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 1 Carigudang

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 6 PP Properti

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 3 Lippo Karawaci

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 6 Coldwell Banker Commercial Indonesia**List Not Exhaustive

List of Figures

- Figure 1: Indonesia Commercial Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Commercial Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Commercial Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Commercial Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Indonesia Commercial Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Indonesia Commercial Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Indonesia Commercial Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Indonesia Commercial Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Indonesia Commercial Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Indonesia Commercial Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Commercial Real Estate Industry?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the Indonesia Commercial Real Estate Industry?

Key companies in the market include 6 Coldwell Banker Commercial Indonesia**List Not Exhaustive, 1 Agung Podomoro Land, 5 Cushman and Wakefield Indonesia, 2 Sinarmas Land, Developers, 4 UnionSpace, 3 GoWork, Other Companies (Real Estate Agencies Startups Associations etc ), 4 Ciputra Group, 5 RDTX Group, 2 CoHive, 7 Dutta Angada Realty, 1 Carigudang, 6 PP Properti, 3 Lippo Karawaci.

3. What are the main segments of the Indonesia Commercial Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes.

6. What are the notable trends driving market growth?

The demand for office remains strong in the country.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Fluctuating Construction Materials Costs.

8. Can you provide examples of recent developments in the market?

October 2022: Global digital infrastructure company Equinix., Inc. has announced its expansion into Indonesia with a planned approximately USD 74 million International Business Exchange (IBX®) data center in the heart of Jakarta. With this expansion, Equinix will enable Indonesian companies and multinationals based in Indonesia to leverage its proven platform to consolidate and connect the underlying infrastructure of their business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Commercial Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Commercial Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Commercial Real Estate Industry?

To stay informed about further developments, trends, and reports in the Indonesia Commercial Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence