Key Insights

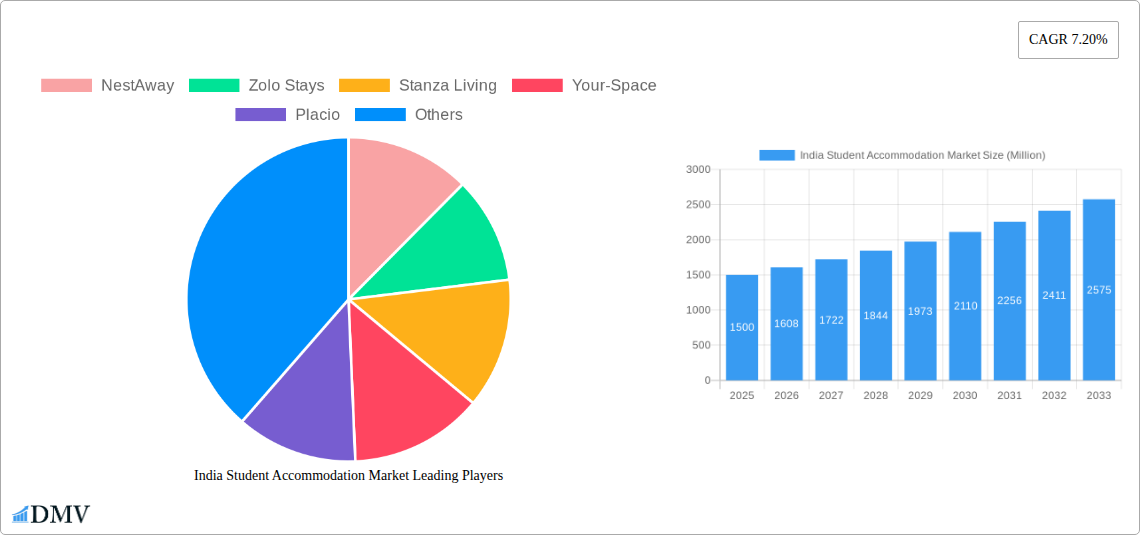

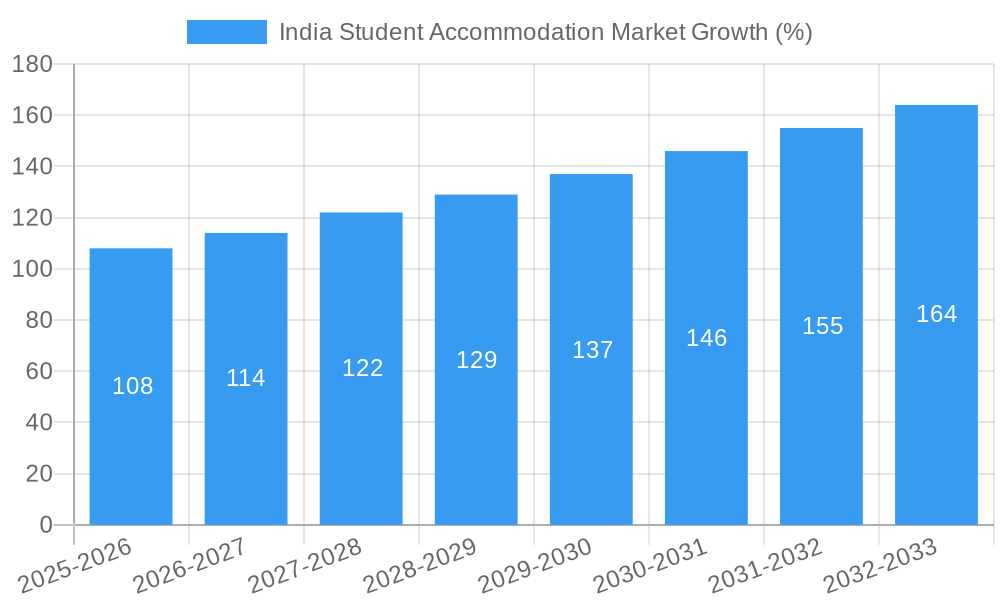

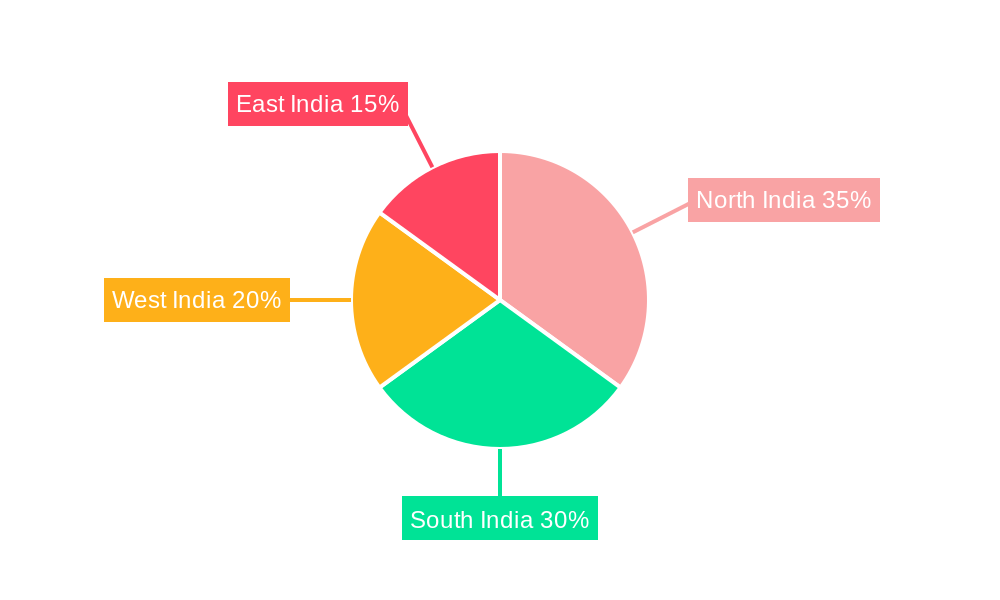

The Indian student accommodation market is experiencing robust growth, driven by increasing urbanization, rising student enrollment numbers, and a preference for convenient, managed living spaces. The market, valued at approximately ₹1500 million (estimated based on provided CAGR and market size) in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 7.20% from 2025 to 2033. This expansion is fueled by several key trends: the emergence of organized players offering professionally managed PGs, PBSAs, and studio apartments; growing demand for amenities like Wi-Fi, laundry services, and parking; and a shift from traditional, unorganized accommodation towards safer, more comfortable options. The market is segmented by service type (Wi-Fi, laundry, utilities, dishwasher, parking) and accommodation type (PGs, PBSAs, studio apartments, on-campus, and off-campus housing). While the prevalence of PGs currently dominates, the PBSA segment is exhibiting significant growth potential given the rising disposable incomes and preference for upscale living among students. Geographic variations exist, with metropolitan areas in North and South India currently leading the market, but significant growth opportunities remain in the East and West regions as infrastructure develops and student populations expand. Restraints include land scarcity in prime urban areas and the need for consistent regulatory frameworks governing student housing.

The competitive landscape is dynamic, with established players like NestAway, Zolo Stays, Stanza Living, and others vying for market share. These companies are focusing on technology-driven solutions to enhance operational efficiency and customer experience. Further growth is expected through strategic partnerships with educational institutions, improved property management practices, and the adoption of innovative service offerings to cater to the evolving needs of a diverse student population. Future growth will depend on expanding into tier-2 and tier-3 cities, catering to diverse budgets, and maintaining high standards of quality and safety to build trust and solidify market leadership. Continued investment in technology and infrastructure will be crucial for meeting the increasing demand for quality student accommodation across India.

India Student Accommodation Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning India Student Accommodation Market, offering crucial data and forecasts from 2019 to 2033. With a focus on key market players like NestAway, Zolo Stays, Stanza Living, Your-Space, Placio, StayAbode, Weroom, OYO Life, and CoHo (list not exhaustive), this report is essential for stakeholders seeking to understand market dynamics, investment opportunities, and future growth trajectories. The report covers a market valued at xx Million in 2025, projected to reach xx Million by 2033.

India Student Accommodation Market Composition & Trends

The Indian student accommodation market is experiencing rapid growth, driven by increasing student enrollment and urbanization. Market concentration is moderate, with several key players vying for market share. NestAway, Zolo Stays, and Stanza Living hold significant positions, but the market remains fragmented with numerous smaller players. Innovation is evident in the introduction of tech-enabled platforms for booking, improved amenities, and focus on community building. Regulatory landscapes, while evolving, are generally supportive of the sector. Substitute products, such as traditional PGs (Paying Guest accommodations), are facing stiff competition from managed accommodations offering better amenities and security. End-users primarily comprise students from diverse socioeconomic backgrounds across various educational institutions. M&A activity has been notable, with deal values reaching xx Million in recent years, further consolidating the market.

- Market Share Distribution (2025): NestAway (15%), Zolo Stays (12%), Stanza Living (10%), Others (63%)

- M&A Deal Values (2019-2024): Total value estimated at xx Million.

India Student Accommodation Market Industry Evolution

The Indian student accommodation market has transitioned from a largely unorganized sector to a more formalized and professionally managed one. This transformation is primarily fueled by rapid urbanization, rising student populations, and the increasing demand for safe, comfortable, and amenity-rich accommodations. The market has witnessed a significant growth trajectory, expanding at a CAGR of xx% during the historical period (2019-2024). Technological advancements, such as online booking platforms and smart building technologies, are improving the efficiency and convenience of the sector. Shifting consumer demands are pushing for better amenities, including high-speed Wi-Fi, laundry services, and co-living spaces. The adoption of technology in student housing management has increased by xx% from 2019-2024. The market is expected to maintain a robust growth momentum, driven by sustained increases in student enrollment and a preference for managed accommodations. The projected CAGR for the forecast period (2025-2033) is xx%.

Leading Regions, Countries, or Segments in India Student Accommodation Market

Metropolitan cities like Mumbai, Delhi, Bangalore, and Chennai dominate the Indian student accommodation market. The high concentration of educational institutions and a large student population are key drivers.

By Service Type:

- Wi-Fi: High-speed internet is almost universally expected, driving demand.

- Laundry: On-site laundry services are increasingly common, adding value.

- Utilities: Reliable electricity and water supply are crucial considerations.

- Dishwasher: While less prevalent, it's gaining traction in premium segments.

- Parking: Availability of parking is a significant advantage in congested cities.

By Type:

- PGs: Remain a significant segment, especially in budget-conscious markets.

- PBSA (Purpose-Built Student Accommodation): Rapidly expanding segment with modern amenities and managed services.

- Studio Apartments: Appealing to students seeking independence and privacy.

- Live-in On-Campus Housing: Limited availability but high demand in premier institutions.

- Live-in Off-Campus Housing: The largest segment, driven by increasing student numbers and limited on-campus options.

Key drivers for the dominance of these segments include increasing investment in purpose-built student accommodation, supportive government policies, and the growing preference for modern, managed living spaces.

India Student Accommodation Market Product Innovations

Recent innovations include smart-home technology integration, co-living spaces designed for enhanced social interaction, and customized accommodation packages tailored to specific student needs. These innovations enhance living experiences, improve security, and increase operational efficiency. Unique selling propositions (USPs) often involve flexible lease terms, convenient online booking, and high-quality amenities. Technological advancements in areas such as property management systems and online payment gateways are streamlining processes and improving customer experience.

Propelling Factors for India Student Accommodation Market Growth

Several factors propel the market's growth. The expanding higher education sector fuels demand. Technological advancements, particularly in online booking and property management systems, enhance market efficiency. Government initiatives supporting affordable housing and infrastructure development provide further impetus. Furthermore, rising disposable incomes among students and their families contribute significantly to market expansion.

Obstacles in the India Student Accommodation Market

Challenges include land acquisition difficulties in major cities, increasing construction costs, and intense competition among providers. Regulatory hurdles and inconsistent policy frameworks also pose challenges. Supply chain disruptions, particularly during economic downturns, can negatively impact the sector. Competition, especially from established players and new entrants, exerts pressure on pricing and profitability.

Future Opportunities in India Student Accommodation Market

Expanding into tier-2 and tier-3 cities presents significant growth opportunities. The adoption of sustainable building practices and green technologies creates a niche market. Targeting specific student demographics with specialized accommodation offers (e.g., women-only residences) also presents potential.

Major Players in the India Student Accommodation Market Ecosystem

- NestAway

- Zolo Stays

- Stanza Living

- Your-Space

- Placio

- StayAbode

- Weroom

- OYO Life

- CoHo

Key Developments in India Student Accommodation Market Industry

- 2022 Q4: Zolo Stays announces expansion into five new cities.

- 2023 Q1: Stanza Living launches a new premium accommodation line.

- 2023 Q2: NestAway partners with a technology firm to integrate smart-home features. (Further developments to be added)

Strategic India Student Accommodation Market Forecast

The Indian student accommodation market is poised for significant growth in the coming years. Continued urbanization, increasing student enrollment, and rising demand for high-quality accommodation will drive market expansion. The focus on technological innovation and strategic partnerships will further enhance the sector's potential. The market's robust growth trajectory is expected to continue, driven by these positive factors.

India Student Accommodation Market Segmentation

-

1. Service Type

- 1.1. Wi-Fi

- 1.2. Laundry

- 1.3. Utilities

- 1.4. Dishwasher

- 1.5. Parking

-

2. Type

- 2.1. PG

- 2.2. PBSA

- 2.3. Studio Apartment

- 2.4. Live in On-Campus Housing

- 2.5. Live in Off-Campus Housing

India Student Accommodation Market Segmentation By Geography

- 1. India

India Student Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Education Sector; Rising Demand for Quality Accomodation

- 3.3. Market Restrains

- 3.3.1. Enrolment Fluctuations

- 3.4. Market Trends

- 3.4.1. Urbanization Helping to Grow the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Student Accommodation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Wi-Fi

- 5.1.2. Laundry

- 5.1.3. Utilities

- 5.1.4. Dishwasher

- 5.1.5. Parking

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. PG

- 5.2.2. PBSA

- 5.2.3. Studio Apartment

- 5.2.4. Live in On-Campus Housing

- 5.2.5. Live in Off-Campus Housing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North India India Student Accommodation Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Student Accommodation Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Student Accommodation Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Student Accommodation Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 NestAway

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Zolo Stays

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Stanza Living

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Your-Space

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Placio

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 StayAbode

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Weroom**List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 OYO Life

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 CoHo

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 NestAway

List of Figures

- Figure 1: India Student Accommodation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Student Accommodation Market Share (%) by Company 2024

List of Tables

- Table 1: India Student Accommodation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Student Accommodation Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: India Student Accommodation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: India Student Accommodation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Student Accommodation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Student Accommodation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Student Accommodation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Student Accommodation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Student Accommodation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Student Accommodation Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 11: India Student Accommodation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: India Student Accommodation Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Student Accommodation Market?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the India Student Accommodation Market?

Key companies in the market include NestAway, Zolo Stays, Stanza Living, Your-Space, Placio, StayAbode, Weroom**List Not Exhaustive, OYO Life, CoHo.

3. What are the main segments of the India Student Accommodation Market?

The market segments include Service Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of Education Sector; Rising Demand for Quality Accomodation.

6. What are the notable trends driving market growth?

Urbanization Helping to Grow the Market.

7. Are there any restraints impacting market growth?

Enrolment Fluctuations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Student Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Student Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Student Accommodation Market?

To stay informed about further developments, trends, and reports in the India Student Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence