Key Insights

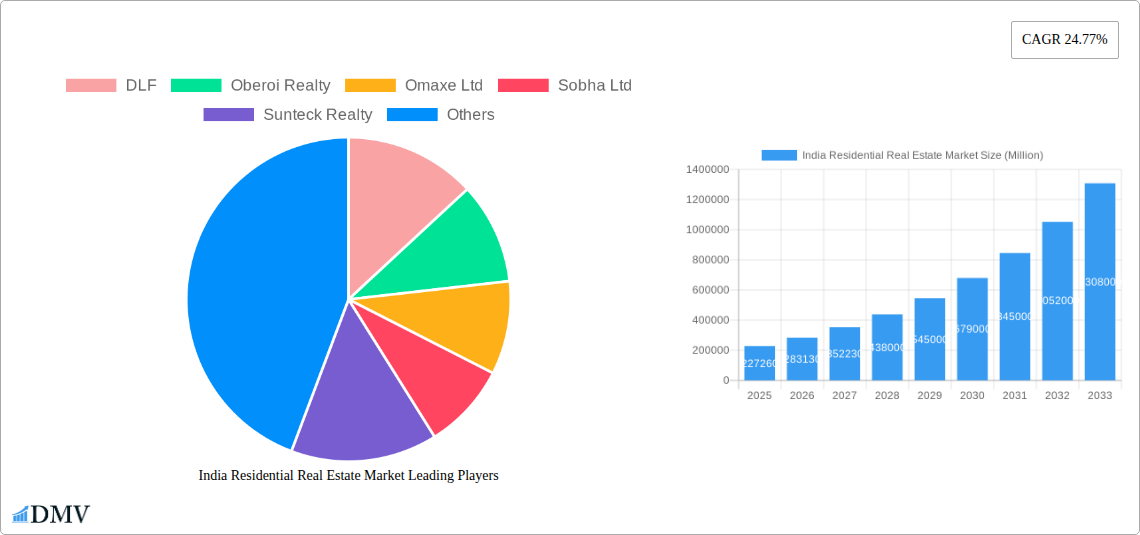

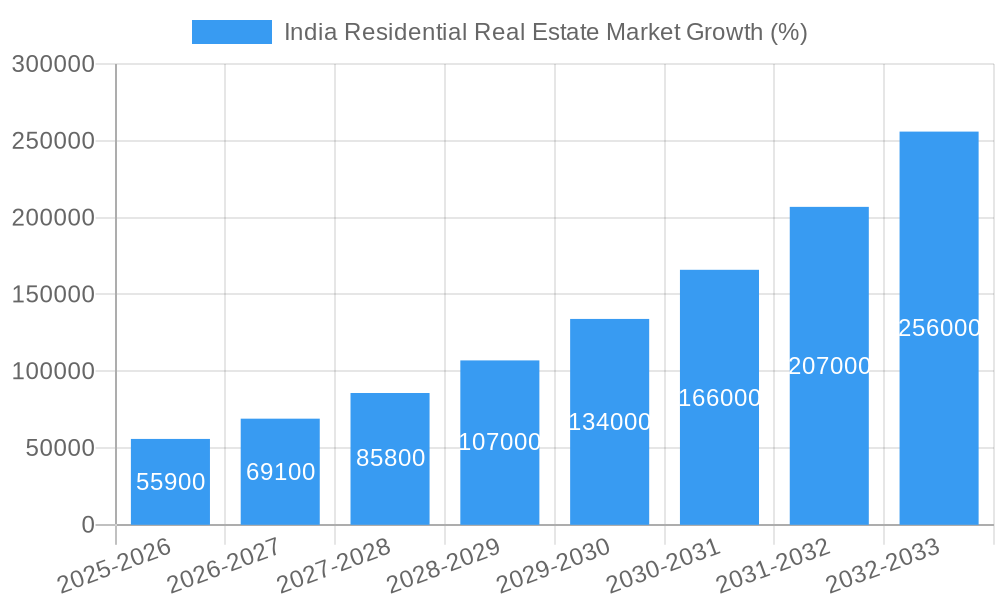

The Indian residential real estate market, valued at ₹227.26 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 24.77% from 2025 to 2033. This surge is driven by several key factors. A burgeoning young population entering the workforce fuels increasing demand for housing, particularly in urban centers experiencing rapid urbanization. Government initiatives promoting affordable housing and infrastructure development further stimulate the market. Growing disposable incomes and favorable lending rates enhance affordability, enabling wider access to homeownership. Furthermore, the preference for larger, modern homes, particularly in the condominium and villa segments, is shaping market trends. This segment demonstrates significant growth potential, with strong demand in both established and developing urban areas.

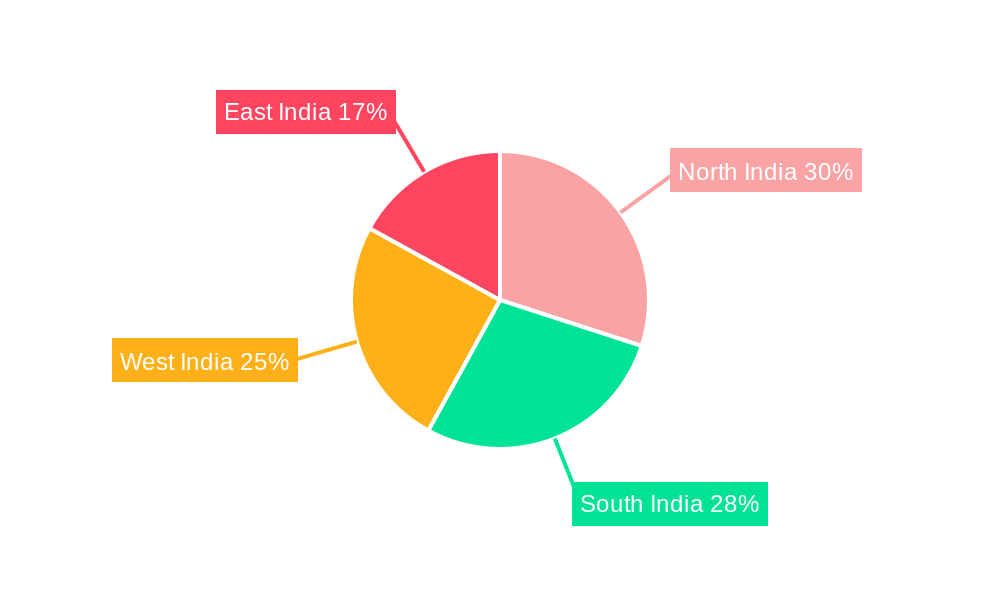

However, the market also faces certain challenges. The fluctuating cost of construction materials, coupled with potential regulatory hurdles and land acquisition complexities, present significant constraints on overall growth. Inflationary pressures and shifting interest rates can influence buyer sentiment and affordability. Nonetheless, the positive outlook for the Indian economy, sustained by technological advancements and improved infrastructure, indicates a favorable long-term trajectory for the residential real estate sector. Strategic investments in smart city projects and improved connectivity are expected to boost the attractiveness of certain regions, notably South and West India, which are expected to witness comparatively higher growth rates. The segmentation by property type (Condominiums, Villas, Other) presents distinct investment opportunities depending on risk tolerance and market dynamics. The presence of established players like DLF, Oberoi Realty, and Godrej Properties, alongside emerging developers, indicates a dynamic and competitive market landscape.

India Residential Real Estate Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the India Residential Real Estate Market, covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. It delves into market composition, industry evolution, key players, and future opportunities, offering valuable insights for stakeholders across the real estate sector. The report leverages extensive data analysis to project a market valued at xx Million USD by 2033, revealing significant growth potential.

India Residential Real Estate Market Composition & Trends

This section evaluates the market's competitive landscape, innovation drivers, regulatory environment, and market dynamics. We analyze market share distribution among key players like DLF, Oberoi Realty, Omaxe Ltd, Sobha Ltd, Sunteck Realty, Prestige Estate, Brigade Enterprises, Indiabulls Real Estate, NBCC (India), Dlip Buildcon, Ansal Properties and Infrastructure Ltd, Godrej Properties, L&T Realty Ltd, and Phoenix Mills (list not exhaustive), examining their strategies and market positions. The report further explores the impact of M&A activities, including deal values and their influence on market consolidation.

- Market Concentration: Analysis of market share held by top 5 players, revealing a moderately concentrated market with opportunities for both established players and new entrants.

- Innovation Catalysts: Examination of technological advancements, such as PropTech solutions and sustainable building practices, shaping the sector.

- Regulatory Landscape: Assessment of government policies, regulations, and their influence on market growth and investment.

- Substitute Products: Identification and analysis of substitute investment avenues and their impact on market demand.

- End-User Profiles: Segmentation of the consumer base based on demographics, income levels, and housing preferences.

- M&A Activities: Detailed analysis of recent mergers and acquisitions, including deal values (e.g., xx Million USD), and their implications for market structure and competition. Total M&A deal value for the period 2019-2024 is estimated at xx Million USD.

India Residential Real Estate Market Industry Evolution

This section charts the evolution of the Indian residential real estate market from 2019 to 2024 and projects its trajectory to 2033. We analyze market growth trajectories, technological disruptions, and evolving consumer preferences. The historical period (2019-2024) witnessed an average annual growth rate (AAGR) of xx%, driven by factors such as [Insert specific factors]. The forecast period (2025-2033) projects an AAGR of xx%, influenced by [Insert specific factors]. The report incorporates data points on adoption rates of new technologies and shifting consumer preferences towards sustainable and smart homes.

Leading Regions, Countries, or Segments in India Residential Real Estate Market

This section identifies the leading segments within the market – Condominiums, Villas, and Other Types – analyzing their market share and growth drivers. We delve into the reasons behind their dominance, examining investment trends, regulatory support, and infrastructural developments.

- Condominiums: [Paragraph discussing market share, key drivers like affordability and location preferences. Include quantitative data, e.g., percentage of total market share and projected growth]. Key drivers include:

- Increased affordability through government schemes.

- Growing urbanization and migration to metropolitan areas.

- Availability of financing options.

- Villas: [Paragraph discussing market share, key drivers like luxury segment growth and preference for independent living. Include quantitative data]. Key drivers include:

- Rising disposable incomes and a preference for luxury living.

- Demand for larger living spaces and enhanced privacy.

- Growth of gated communities and integrated townships.

- Other Types: [Paragraph discussing market share and key drivers. Include quantitative data]. Key drivers include:

- Growing demand for affordable housing options in tier-2 and tier-3 cities.

- Government initiatives to promote affordable housing.

India Residential Real Estate Market Product Innovations

This section highlights recent product innovations in the residential real estate sector in India. Smart home technology integration, sustainable building materials, and innovative designs are transforming the market. The focus on energy efficiency and environmentally friendly features is attracting eco-conscious buyers, leading to premium pricing for green buildings. Furthermore, modular construction techniques are gaining traction, leading to faster construction times and reduced costs.

Propelling Factors for India Residential Real Estate Market Growth

Several factors are fueling the growth of the Indian residential real estate market. Government initiatives such as affordable housing schemes stimulate demand in the lower-income segments. Furthermore, increasing urbanization and rising disposable incomes are driving demand for higher-quality housing, particularly in metropolitan areas. The growth of the Indian economy and its positive outlook further contribute to the market's expansion.

Obstacles in the India Residential Real Estate Market

The Indian residential real estate market faces several challenges. Regulatory complexities, including land acquisition issues and approval processes, can delay projects and increase costs. Fluctuations in construction material prices and supply chain disruptions can negatively impact profitability. Intense competition among developers and rising interest rates also pose obstacles.

Future Opportunities in India Residential Real Estate Market

The Indian residential real estate market presents significant future opportunities. The growing demand for affordable housing in tier-2 and tier-3 cities presents a vast potential market. Technological innovations, such as the adoption of BIM and digital twin technologies, offer opportunities for increased efficiency and reduced costs. The rise of co-living spaces and flexible housing options caters to the evolving needs of younger generations.

Major Players in the India Residential Real Estate Market Ecosystem

- DLF

- Oberoi Realty

- Omaxe Ltd

- Sobha Ltd

- Sunteck Realty

- Prestige Estate

- Brigade Enterprises

- Indiabulls Real Estate

- NBCC (India)

- Dlip Buildcon

- Ansal Properties and Infrastructure Ltd

- Godrej Properties

- L&T Realty Ltd

- Phoenix Mills

Key Developments in India Residential Real Estate Market Industry

- October 2022: Shriram Properties Ltd and ASK Property Fund announced a INR 500 crore (USD 608.98 million) investment platform for acquiring housing projects in Bengaluru, Chennai, and Hyderabad. This signifies increased institutional investment in the sector.

- October 2022: Magnolia Quality Development Corporation (MQDC) explored acquiring land for a luxury residential project in the NCR, indicating interest from international developers in the Indian market.

Strategic India Residential Real Estate Market Forecast

The Indian residential real estate market is poised for robust growth, driven by a combination of factors including increasing urbanization, rising disposable incomes, and supportive government policies. Continued technological advancements and evolving consumer preferences will shape the market’s future, creating new opportunities for innovation and expansion. The market is expected to witness sustained growth over the forecast period, with xx Million USD projected by 2033.

India Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Condominiums and Apartments

- 1.2. Villas and Landed House

India Residential Real Estate Market Segmentation By Geography

- 1. India

India Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.77% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing urban population driving the growth of transportation infrastructure.; Sultanate's Economic Diversification Plan (Vision 2040) to provide new growth to the market

- 3.3. Market Restrains

- 3.3.1. Delay in project approvals; High cost of materials

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Big Residential Spaces Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condominiums and Apartments

- 5.1.2. Villas and Landed House

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 DLF

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Oberoi Realty

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Omaxe Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sobha Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Sunteck Realty

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Prestige Estate

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Brigade Enterprises**List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Indiabulls Real Estate

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 NBCC (India)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dlip Buildcon

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Ansal Properties and Infrastructure Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Godrej Properties

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 L&T Realty Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Phoenix Mills

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 DLF

List of Figures

- Figure 1: India Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Residential Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: India Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: India Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North India India Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South India India Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: East India India Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: West India India Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: India Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Residential Real Estate Market?

The projected CAGR is approximately 24.77%.

2. Which companies are prominent players in the India Residential Real Estate Market?

Key companies in the market include DLF, Oberoi Realty, Omaxe Ltd, Sobha Ltd, Sunteck Realty, Prestige Estate, Brigade Enterprises**List Not Exhaustive, Indiabulls Real Estate, NBCC (India), Dlip Buildcon, Ansal Properties and Infrastructure Ltd, Godrej Properties, L&T Realty Ltd, Phoenix Mills.

3. What are the main segments of the India Residential Real Estate Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 227.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing urban population driving the growth of transportation infrastructure.; Sultanate's Economic Diversification Plan (Vision 2040) to provide new growth to the market.

6. What are the notable trends driving market growth?

Increasing Demand for Big Residential Spaces Driving the Market.

7. Are there any restraints impacting market growth?

Delay in project approvals; High cost of materials.

8. Can you provide examples of recent developments in the market?

October 2022- Shriram Properties Ltd and ASK Property Fund agreed to establish an INR 500 crore (USD 608.98 million) investment platform to acquire housing projects. Both companies have signed an agreement to establish an investment platform to acquire residential real estate projects. Shriram and ASK will co-invest in plotted residential development projects in Bengaluru, Chennai, and Hyderabad as part of the platform agreement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the India Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence