Key Insights

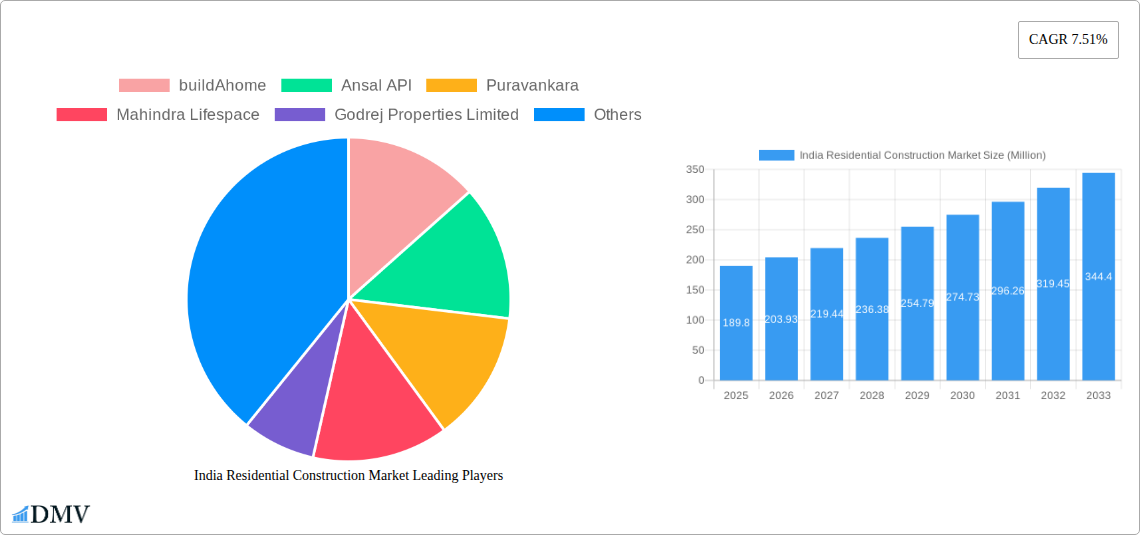

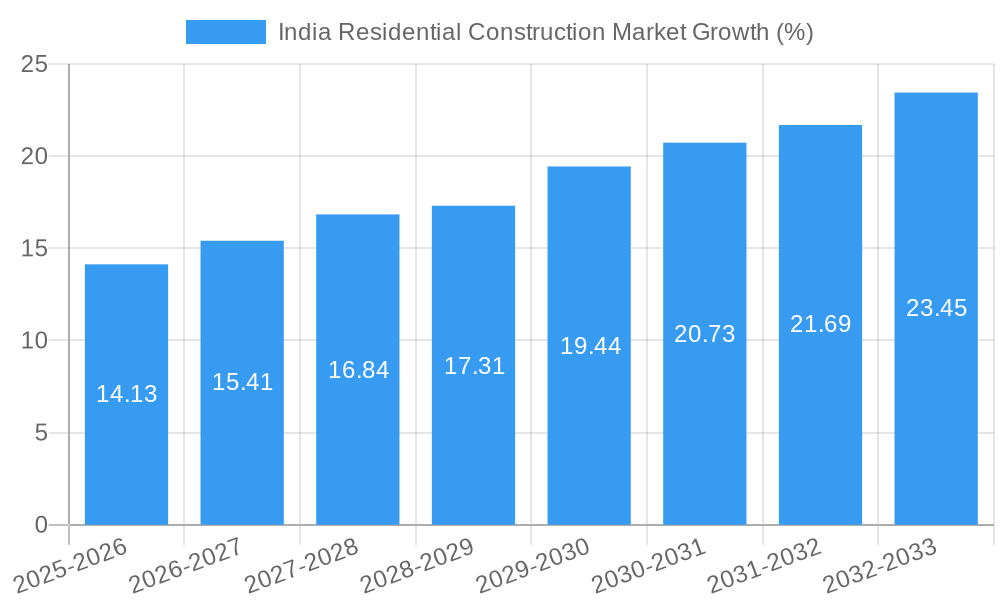

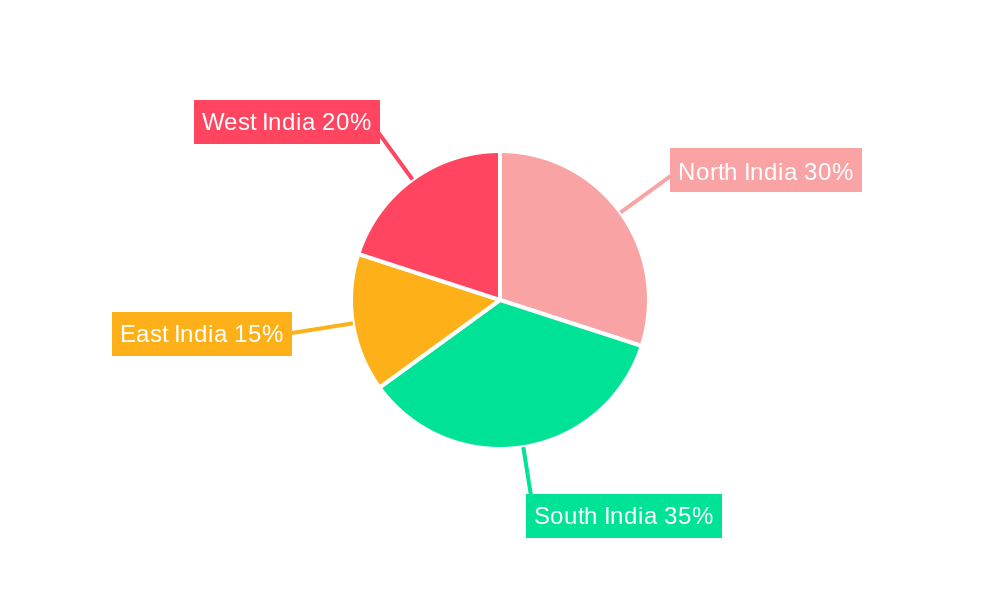

The India Residential Construction Market, valued at $189.80 million in 2025, is projected to experience robust growth, driven by factors such as rapid urbanization, rising disposable incomes, and a growing young population demanding improved housing. The market's Compound Annual Growth Rate (CAGR) of 7.51% from 2025 to 2033 indicates significant expansion potential. Key segments driving this growth include apartments and condominiums, which dominate the market share due to affordability and location advantages within major cities. New construction projects contribute substantially to overall market value, although renovation and redevelopment are also emerging as important segments, particularly in established urban areas. Regional variations exist, with South India potentially exhibiting faster growth due to its strong economic performance and infrastructure development, followed by West and North India. However, challenges such as land acquisition complexities, regulatory hurdles, and fluctuating material costs pose potential restraints to market growth. Prominent players like Puravankara, Godrej Properties, and Mahindra Lifespace are actively shaping the market landscape through innovative designs, sustainable building practices, and strategic expansions. The increasing demand for affordable housing initiatives also presents an opportunity for developers to tap into a larger customer base. Over the forecast period, the market is expected to see a continuous increase in the construction of high-rise buildings and integrated townships, reflecting a shift in consumer preferences towards modern living spaces with improved amenities.

This strong growth trajectory is further bolstered by government initiatives aimed at boosting affordable housing and improving infrastructure. The increasing adoption of sustainable and green building technologies is also shaping the market, with developers increasingly focusing on energy efficiency and environmental consciousness. Competition among established players and the entry of new entrants are likely to intensify, leading to greater innovation and improved affordability. However, maintaining a balance between affordability and quality will remain a key challenge for developers. The market's expansion will also necessitate strategic partnerships and collaborations to streamline the supply chain and reduce construction timelines. The market's long-term success hinges on overcoming regulatory barriers and fostering a conducive environment for sustainable and inclusive development.

India Residential Construction Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic India Residential Construction Market, offering a comprehensive overview of its current state, future trajectory, and key players. From market size and segmentation to growth drivers and challenges, this study offers invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is your essential guide to navigating this rapidly evolving market. The market is projected to reach xx Million by 2033.

India Residential Construction Market Composition & Trends

This section dives deep into the competitive landscape of the Indian residential construction market, analyzing market concentration, innovation, regulations, substitute products, end-user behavior, and mergers & acquisitions (M&A) activity. We examine the market share distribution amongst key players such as buildAhome, Ansal API, Puravankara, Mahindra Lifespace, Godrej Properties Limited, StepsStone Builders, Delhi Land & Finance, Merlin Group, VGN Projects Estates Pvt Ltd, and Prestige Group (list not exhaustive). The report quantifies market share, revealing the dominance of specific players and identifying emerging competitors. Furthermore, it assesses the influence of regulatory changes, such as building codes and environmental regulations, on market dynamics. The analysis also considers the impact of substitute products, including prefabricated housing and alternative building materials, and explores the role of M&A activity, detailing the value of significant deals and their implications for market consolidation. Finally, we profile end-users, differentiating between individual homebuyers, investors, and developers to better understand market demand.

- Market Share Distribution: Detailed breakdown of market share held by key players in 2024 and projected for 2033.

- M&A Activity: Analysis of significant M&A deals completed in the historical period (2019-2024) and projections for future deals, including estimated transaction values.

- Regulatory Landscape: Assessment of the impact of government policies and regulations on market growth and development.

- Innovation Catalysts: Identification of factors driving innovation within the industry, including technological advancements and evolving consumer preferences.

India Residential Construction Market Industry Evolution

This section provides a comprehensive analysis of the evolution of the India Residential Construction Market from 2019 to 2033. We explore the historical growth trajectory, pinpointing key milestones and analyzing the factors that influenced market expansion during this period. The analysis encompasses technological advancements, such as the adoption of Building Information Modeling (BIM) and sustainable construction techniques, and details their impact on construction efficiency and cost-effectiveness. The report also explores the evolution of consumer preferences, considering shifts in desired housing types, sizes, and features. Finally, we project future market growth, offering detailed forecasts for the coming years, supported by robust data and industry trends. Expected growth rates are analyzed for each segment. Specific data points on adoption rates of new technologies will be included.

Leading Regions, Countries, or Segments in India Residential Construction Market

This section identifies the dominant regions, countries, or segments within the Indian residential construction market, offering a granular analysis of their performance. The report focuses on the key segments: Apartments and Condominiums, Villas, and Other Types, as well as New Construction and Renovation projects. The analysis explores the driving forces behind the dominance of specific segments, examining investment trends, government support, and market-specific factors.

- By Type:

- Apartments and Condominiums: Detailed analysis of market size, growth drivers (e.g., urbanization, rising disposable incomes), and challenges.

- Villas: Exploration of market trends, including demand drivers and price sensitivities.

- Other Types: Overview of less prominent segments and their future potential.

- By Construction Type:

- New Construction: Analysis of market size, growth prospects, and key drivers.

- Renovation: Exploration of market potential, including trends in home improvement and refurbishment.

India Residential Construction Market Product Innovations

This section examines the latest innovations in residential construction products and technologies. We delve into the unique selling propositions (USPs) of new materials, construction techniques, and smart home features. The analysis includes performance metrics, demonstrating the impact of these innovations on efficiency, cost-effectiveness, and sustainability. Technological advancements, such as 3D printing and prefabrication, will be discussed and their anticipated impact on the market assessed.

Propelling Factors for India Residential Construction Market Growth

Several factors are driving the growth of the Indian residential construction market. These include rapid urbanization, rising disposable incomes, favorable government policies promoting affordable housing, and technological advancements leading to faster and more efficient construction methods. Government initiatives like PMAY (Pradhan Mantri Awas Yojana) are also significantly boosting the sector. The increasing demand for sustainable and green building practices is further adding to the market's growth.

Obstacles in the India Residential Construction Market

Despite the positive outlook, the Indian residential construction market faces certain obstacles. These include regulatory hurdles, such as land acquisition complexities and lengthy approval processes, as well as fluctuations in raw material prices, supply chain disruptions, and intense competition among players. These factors can lead to project delays and increased costs, impacting overall market growth. The report will quantify the impact of these challenges on project timelines and profitability.

Future Opportunities in India Residential Construction Market

The Indian residential construction market presents several lucrative opportunities. The growing demand for affordable housing, coupled with government initiatives and technological advancements, creates a positive outlook. Expanding into underserved markets, leveraging technological advancements like prefabrication and 3D printing, and catering to the growing demand for sustainable and green buildings present significant opportunities for growth.

Major Players in the India Residential Construction Market Ecosystem

- buildAhome

- Ansal API

- Puravankara

- Mahindra Lifespace

- Godrej Properties Limited

- StepsStone Builders

- Delhi Land & Finance

- Merlin Group

- VGN Projects Estates Pvt Ltd

- Prestige Group

Key Developments in India Residential Construction Market Industry

- [Month/Year]: Launch of a new affordable housing project by [Company Name]. Impact: Increased market share in the affordable housing segment.

- [Month/Year]: Merger between [Company A] and [Company B]. Impact: Consolidation of market share and increased operational efficiency.

- [Month/Year]: Introduction of a new construction technology by [Company Name]. Impact: Improved construction speed and reduced costs.

- (Add more bullet points as needed with specific examples and impacts)

Strategic India Residential Construction Market Market Forecast

The Indian residential construction market is poised for robust growth over the forecast period (2025-2033). Continued urbanization, rising incomes, and supportive government policies will drive demand. Technological advancements and innovative construction techniques will further enhance efficiency and sustainability. The market's potential is substantial, with significant opportunities for both established players and new entrants. The forecast incorporates assumptions regarding economic growth, regulatory changes, and technological advancements to provide a realistic and data-driven outlook.

India Residential Construction Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas

- 1.3. Other Types

-

2. Construction Type

- 2.1. New Construction

- 2.2. Renovation

India Residential Construction Market Segmentation By Geography

- 1. India

India Residential Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Fluctuating Construction Materials Costs

- 3.4. Market Trends

- 3.4.1. Need for Affordable Housing is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. New Construction

- 5.2.2. Renovation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 buildAhome

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ansal API

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Puravankara

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mahindra Lifespace

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Godrej Properties Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 StepsStone Builders

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Delhi Land & Finance

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Merlin Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 VGN Projects Estates Pvt Ltd **List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Prestige Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 buildAhome

List of Figures

- Figure 1: India Residential Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Residential Construction Market Share (%) by Company 2024

List of Tables

- Table 1: India Residential Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Residential Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Residential Construction Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 4: India Residential Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Residential Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Residential Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: India Residential Construction Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 12: India Residential Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Residential Construction Market?

The projected CAGR is approximately 7.51%.

2. Which companies are prominent players in the India Residential Construction Market?

Key companies in the market include buildAhome, Ansal API, Puravankara, Mahindra Lifespace, Godrej Properties Limited, StepsStone Builders, Delhi Land & Finance, Merlin Group, VGN Projects Estates Pvt Ltd **List Not Exhaustive, Prestige Group.

3. What are the main segments of the India Residential Construction Market?

The market segments include Type, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 189.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes.

6. What are the notable trends driving market growth?

Need for Affordable Housing is Driving the Market.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Fluctuating Construction Materials Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Residential Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Residential Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Residential Construction Market?

To stay informed about further developments, trends, and reports in the India Residential Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence