Key Insights

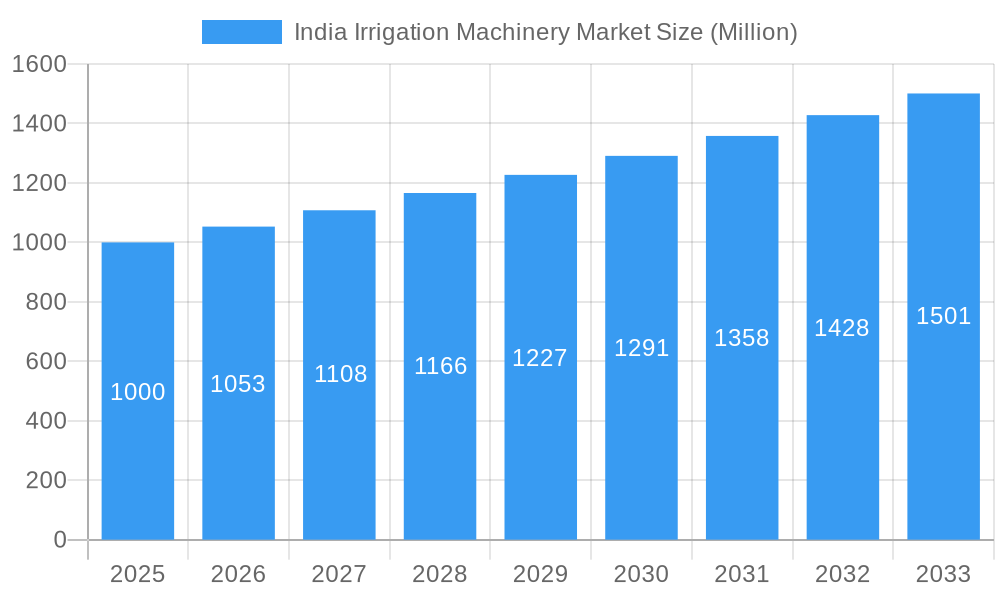

The India Irrigation Machinery Market is experiencing robust growth, fueled by increasing agricultural output demands, government initiatives promoting efficient water management, and a rising adoption of advanced irrigation technologies. The market, valued at approximately ₹[Estimate based on "Market size XX" and "Value Unit Million"; let's assume ₹1000 million in 2025 for example purposes] in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 5.30% from 2025 to 2033. Key drivers include the need to improve crop yields in a water-scarce environment, government support for precision agriculture, and increasing farmer awareness of the benefits of efficient irrigation systems. The market is segmented by irrigation type (drip, sprinkler, pivot), crop type (food crops, fruits, non-crop), and region (North, South, East, and West India). The growing adoption of drip irrigation systems, particularly in regions with limited water resources, contributes significantly to market growth. Furthermore, the increasing penetration of technology-driven solutions like sensor-based irrigation control systems and automated irrigation equipment is shaping the market's trajectory. Competition is intense, with both domestic and international players vying for market share. Companies like Jain Irrigation Systems Ltd, Netafim Ltd, and Lindsay Corporation are major players, offering a diverse range of products and services. However, challenges such as high initial investment costs for advanced systems and the need for robust after-sales service in rural areas could potentially impede market growth to some extent. Despite these challenges, the long-term outlook for the India Irrigation Machinery Market remains positive, driven by the country's agricultural focus and the imperative for sustainable water management practices.

India Irrigation Machinery Market Market Size (In Billion)

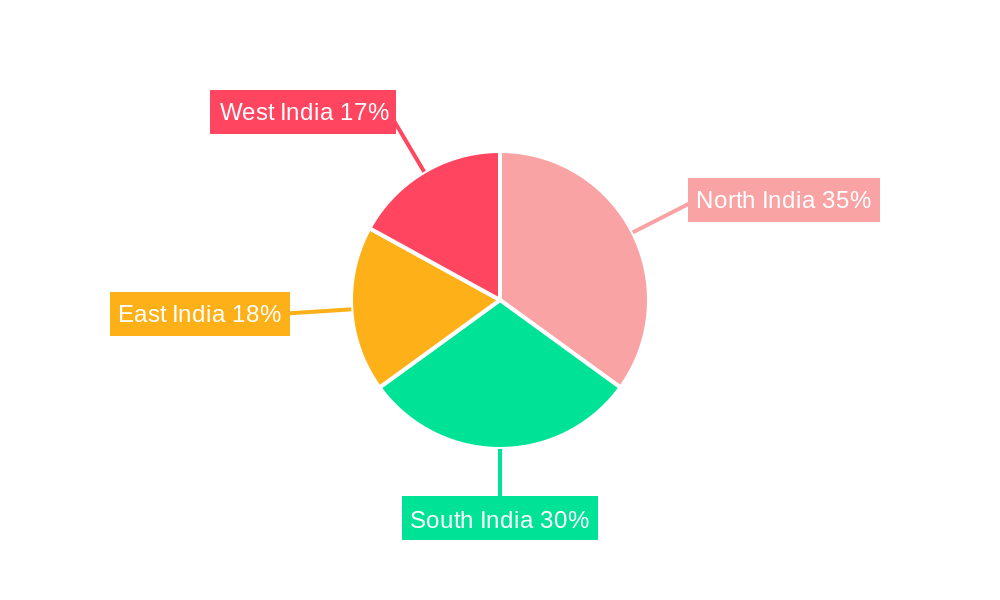

The regional distribution of the market reflects varying agricultural practices and water availability across India. Northern and Southern India, with their large agricultural sectors, are likely to hold the largest market shares. However, increasing investments in irrigation infrastructure in other regions are expected to drive growth in Eastern and Western India as well. The market is witnessing a trend towards advanced irrigation technologies such as precision irrigation and water-saving techniques which are slowly replacing older, less efficient methods. This shift reflects a broader push towards sustainable and efficient agricultural practices in India. The presence of both established multinational corporations and local players ensures competitiveness and innovation within the market. Ongoing technological advancements in sensor technology, data analytics and automation will continue to shape the future of irrigation in India, further boosting market expansion in the coming years.

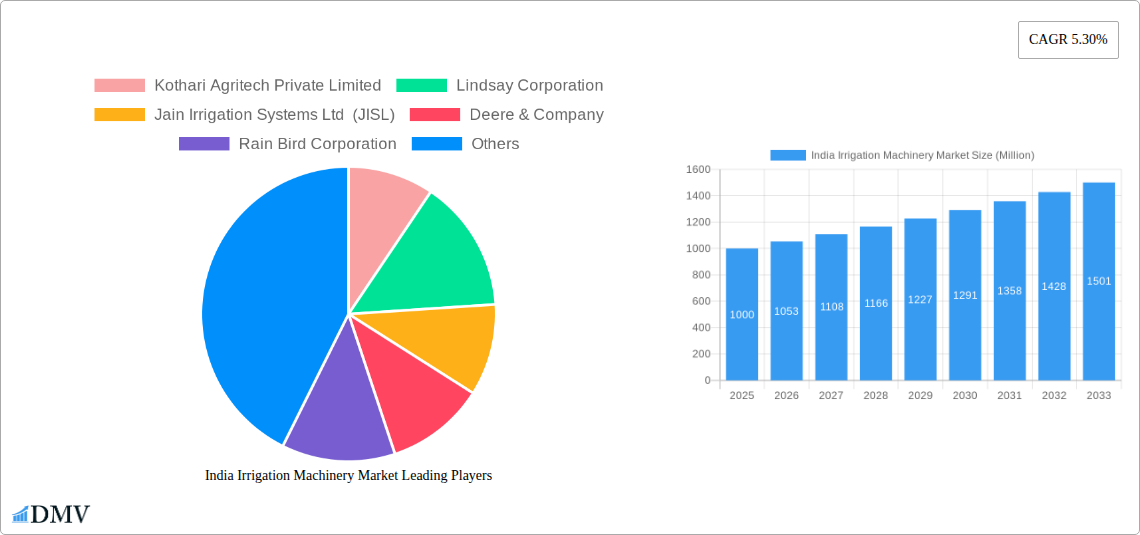

India Irrigation Machinery Market Company Market Share

India Irrigation Machinery Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the India Irrigation Machinery Market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is estimated to be worth xx Million in 2025. The report covers key segments including drip irrigation, pivot irrigation, sprinkler irrigation, and applications across crop and non-crop sectors. Leading companies like Jain Irrigation Systems Ltd (JISL), Netafim Ltd, and Rivulis Irrigation Ltd are analyzed in detail.

India Irrigation Machinery Market Composition & Trends

The India Irrigation Machinery market exhibits a moderately concentrated structure, with a few major players holding significant market share, while numerous smaller companies cater to niche segments. The market share distribution is dynamic, influenced by technological advancements, government initiatives, and strategic mergers & acquisitions (M&A). Innovation is driven by the need for water-efficient solutions and improved farm productivity, leading to the development of smart irrigation systems, precision farming technologies, and automation. The regulatory landscape plays a crucial role, with government policies promoting water conservation and sustainable agriculture influencing market growth. Substitute products, such as traditional water management methods, pose a competitive threat, particularly in regions with low technology adoption. End-users are primarily farmers, ranging from smallholder to large-scale commercial operations.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- M&A Activity: Significant M&A activity observed, with deal values exceeding xx Million in the past five years. For instance, the Jain Irrigation and Rivulis merger significantly reshaped the market landscape.

- Innovation Catalysts: Water scarcity, government incentives for efficient irrigation, and growing demand for higher crop yields.

- Regulatory Landscape: Government policies promoting water conservation and sustainable agriculture influence technology adoption.

- Substitute Products: Traditional farming methods and inefficient irrigation techniques pose a competitive threat.

- End-User Profile: Diverse, including smallholder farmers, medium-scale farms, and large-scale commercial agricultural operations.

India Irrigation Machinery Market Industry Evolution

The India Irrigation Machinery market has experienced substantial growth over the historical period (2019-2024), driven by factors such as increasing water scarcity, government initiatives promoting water-efficient irrigation technologies, and rising demand for improved crop yields. The market witnessed a Compound Annual Growth Rate (CAGR) of approximately xx% during this period. Technological advancements, including the adoption of smart irrigation systems, precision farming techniques, and automation, are transforming the industry. Consumer demands are shifting towards water-efficient and technologically advanced solutions, pushing manufacturers to innovate and offer advanced products. The market is expected to continue its robust growth trajectory during the forecast period (2025-2033), with a projected CAGR of xx%. This growth will be further fueled by government support for irrigation modernization, growing adoption of precision farming techniques, and rising awareness among farmers about the benefits of efficient irrigation. Specific examples of technological advancements include the rise of sensor-based irrigation systems, remote monitoring capabilities, and data-driven decision-making tools for optimal water usage.

Leading Regions, Countries, or Segments in India Irrigation Machinery Market

The Indian Irrigation Machinery market is characterized by regional variations in adoption rates and technological maturity. While data on specific regions is limited, several factors contribute to the dominance of particular areas. Drip irrigation, particularly in the water-stressed regions of the country such as Rajasthan, Punjab, and Uttar Pradesh, has gained popularity. The crop segment dominates applications due to the high volume of irrigation demands in this sector, followed by fruit and non-crop applications.

- Key Drivers for Dominant Regions/Segments:

- Government Subsidies and Incentives: Targeted support for water-efficient irrigation technologies in specific regions.

- Water Scarcity: High demand for water-efficient irrigation in arid and semi-arid regions.

- Technological Readiness: Higher adoption rates in regions with better infrastructure and access to technology.

- Crop Type and Productivity: Higher concentration of irrigation machinery in areas with high crop production and value.

The dominance of certain segments and regions stems from the interplay between government policies, climatic conditions, and agricultural practices. Regions with strong government support and programs promoting water conservation are witnessing higher adoption rates of advanced irrigation technologies. Furthermore, regions facing chronic water shortages are investing more heavily in water-efficient irrigation solutions.

India Irrigation Machinery Market Product Innovations

Recent years have witnessed significant product innovations in the India Irrigation Machinery market. Companies are focusing on developing smart irrigation systems, integrating IoT technologies for remote monitoring and control, and enhancing water-use efficiency through precision farming techniques. These innovations address the growing concerns regarding water scarcity and the need for sustainable agricultural practices. Unique selling propositions include features such as real-time data analysis, automated irrigation scheduling, and customized irrigation solutions for different crops and soil types. Technological advancements include the incorporation of sensors, cloud connectivity, and advanced algorithms to optimize water usage and improve crop yields.

Propelling Factors for India Irrigation Machinery Market Growth

Several factors are driving the growth of the India Irrigation Machinery market. Technological advancements, such as the development of smart irrigation systems, offer improved water-use efficiency and increased crop yields. Economic factors, such as rising disposable incomes among farmers and government support for agricultural modernization, also contribute to market expansion. Furthermore, supportive government policies, including subsidies and incentives for the adoption of water-efficient irrigation technologies, promote market growth. The increasing awareness among farmers about water conservation and sustainable agricultural practices further accelerates the adoption of modern irrigation technologies.

Obstacles in the India Irrigation Machinery Market

Despite the growth potential, the India Irrigation Machinery market faces several challenges. Regulatory hurdles, such as complex approval processes for new technologies and varying regulations across different states, can hinder market expansion. Supply chain disruptions, particularly during periods of geopolitical instability or natural disasters, can impact the availability and cost of irrigation machinery. Intense competition among established players and new entrants also creates pricing pressure and limits profit margins.

Future Opportunities in India Irrigation Machinery Market

The India Irrigation Machinery market presents numerous opportunities for growth. The expansion into untapped markets, particularly in remote and underserved areas, offers significant potential. The development and adoption of innovative technologies, such as AI-powered irrigation systems and advanced sensor technologies, promise further efficiency improvements. The increasing focus on sustainable agriculture and water conservation presents new opportunities for companies offering environmentally friendly solutions. Finally, changing consumer trends towards precision farming and data-driven decision-making will further stimulate demand for advanced irrigation technologies.

Major Players in the India Irrigation Machinery Market Ecosystem

- Kothari Agritech Private Limited

- Lindsay Corporation (Lindsay Corporation)

- Jain Irrigation Systems Ltd (JISL) (Jain Irrigation Systems Ltd)

- Deere & Company (Deere & Company)

- Rain Bird Corporation (Rain Bird Corporation)

- Harvel Agua India Private Limited

- Avanijal Agri Automation Pvt Lt

- Rivulis Irrigation Ltd (Rivulis Irrigation Ltd)

- Netafim Ltd (Netafim Ltd)

- EPC Industries Ltd

- Agsmartic Technologies Pvt Ltd

- Valmont Industries (Valmont Industries)

Key Developments in India Irrigation Machinery Market Industry

- December 2021: Netafim India launches Flexi Sprinkler Kit, aiming to reach 15,000 farmers by 2022.

- March 2022: PepsiCo India and N-Drip collaborate to improve water efficiency across thousands of hectares by 2025.

- June 2022: Jain Irrigation merges with Rivulis, creating a global irrigation leader.

- October 2022: Rivulis India launches ReelView, a tool providing agronomic satellite images and expert advice to farmers.

Strategic India Irrigation Machinery Market Forecast

The India Irrigation Machinery market is poised for significant growth driven by increasing water scarcity, government support for water-efficient technologies, and rising demand for improved crop yields. Future opportunities lie in the adoption of innovative technologies, expansion into untapped markets, and the growing focus on sustainable agricultural practices. The market's robust growth trajectory is expected to continue throughout the forecast period, presenting considerable potential for investors and industry participants.

India Irrigation Machinery Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Irrigation Machinery Market Segmentation By Geography

- 1. India

India Irrigation Machinery Market Regional Market Share

Geographic Coverage of India Irrigation Machinery Market

India Irrigation Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Custom Product Development; Use of CROs for Regulatory Services

- 3.3. Market Restrains

- 3.3.1. Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry

- 3.4. Market Trends

- 3.4.1. Rising Greenhouse Cultivation in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Irrigation Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kothari Agritech Private Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lindsay Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jain Irrigation Systems Ltd (JISL)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Deere & Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rain Bird Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Harvel Agua India Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Avanijal Agri Automation Pvt Lt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rivulis Irrigation Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Netafim Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 EPC Industries Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Agsmartic Technologies Pvt Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Valmont Industries

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Kothari Agritech Private Limited

List of Figures

- Figure 1: India Irrigation Machinery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Irrigation Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: India Irrigation Machinery Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: India Irrigation Machinery Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Irrigation Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Irrigation Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Irrigation Machinery Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Irrigation Machinery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: India Irrigation Machinery Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: India Irrigation Machinery Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Irrigation Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Irrigation Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Irrigation Machinery Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Irrigation Machinery Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Irrigation Machinery Market?

The projected CAGR is approximately 5.30%.

2. Which companies are prominent players in the India Irrigation Machinery Market?

Key companies in the market include Kothari Agritech Private Limited, Lindsay Corporation, Jain Irrigation Systems Ltd (JISL), Deere & Company, Rain Bird Corporation, Harvel Agua India Private Limited, Avanijal Agri Automation Pvt Lt, Rivulis Irrigation Ltd, Netafim Ltd, EPC Industries Ltd, Agsmartic Technologies Pvt Ltd, Valmont Industries.

3. What are the main segments of the India Irrigation Machinery Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Need for Custom Product Development; Use of CROs for Regulatory Services.

6. What are the notable trends driving market growth?

Rising Greenhouse Cultivation in the Country.

7. Are there any restraints impacting market growth?

Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry.

8. Can you provide examples of recent developments in the market?

October 2022: Rivulis India has launched a new tool to assist Indian farmers in making informed decisions about irrigation requirements in their fields. This tool is available in the Indian vernacular language for farmers. Rivulis ReelView, which provides agronomic satellite images of your crops as well as expert product advice directly on your mobile device, is free with the purchase of the Rivulis Drip Line and Drip Tape.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Irrigation Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Irrigation Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Irrigation Machinery Market?

To stay informed about further developments, trends, and reports in the India Irrigation Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence