Key Insights

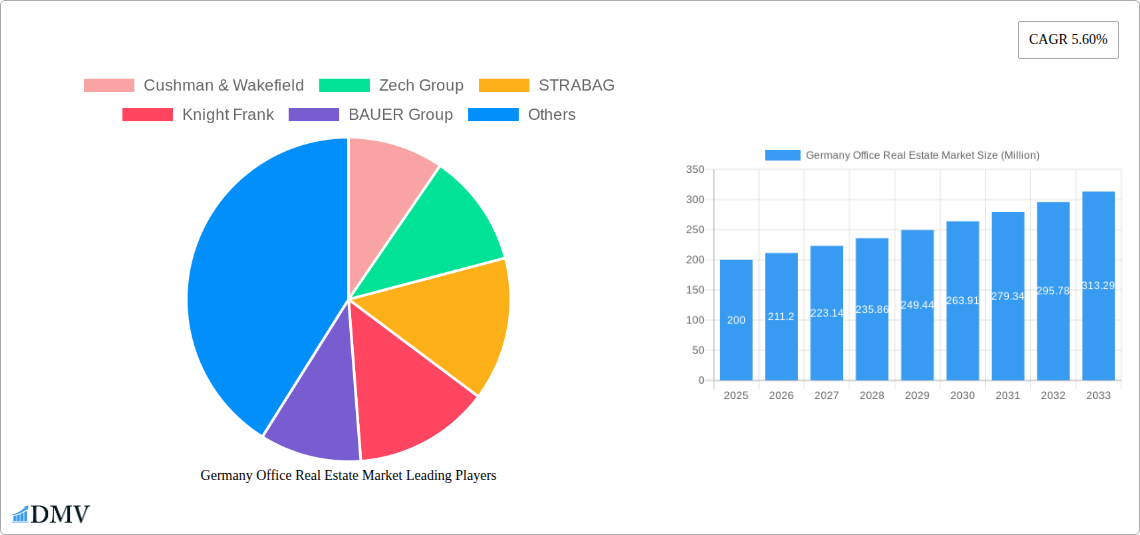

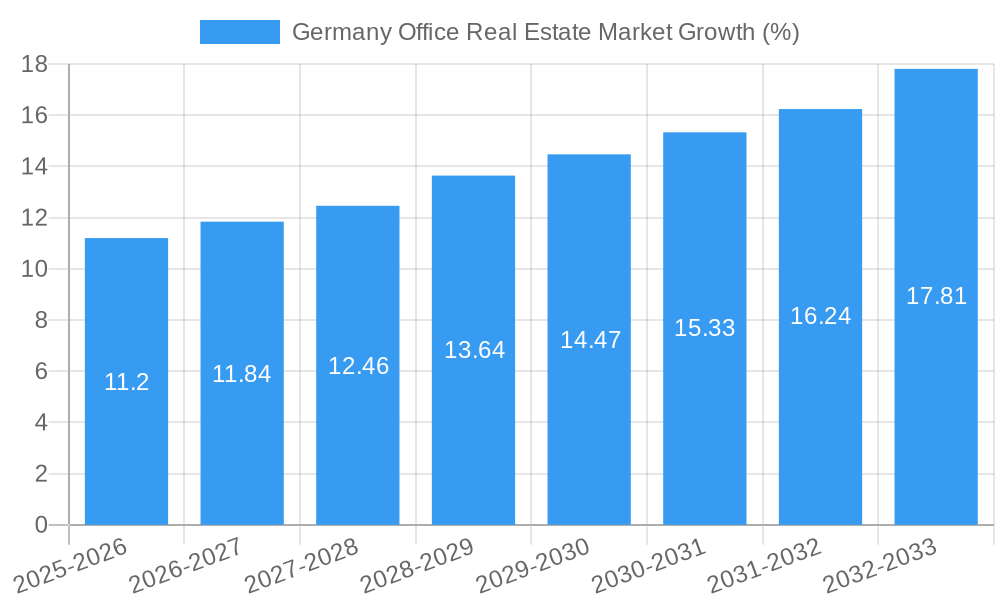

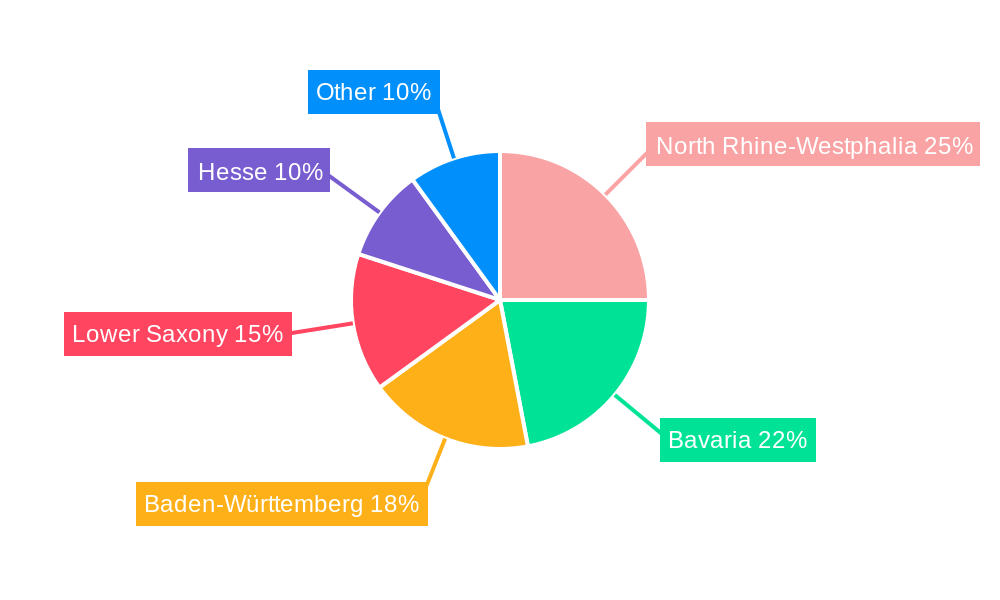

The German office real estate market, currently valued at approximately €[Estimate based on market size XX and value unit million - let's assume XX = 200 for illustration purposes. This would make the 2025 market size €200 million. Adjust this value based on the actual, unprovided "XX" value.], is projected to experience steady growth over the forecast period (2025-2033), fueled by a robust economy and increasing demand from diverse sectors. Key drivers include the expansion of technology companies, particularly in Berlin and Munich, alongside a growing need for flexible and modern workspaces. The trend towards sustainable and energy-efficient buildings further shapes the market, with developers increasingly prioritizing green certifications. While potential restraints exist, such as rising construction costs and economic uncertainty, the overall outlook remains positive. Strong performance is expected in major cities like Berlin, Hamburg, Munich, and Cologne, reflecting their established positions as economic hubs. Regional variations are anticipated, with North Rhine-Westphalia, Bavaria, and Baden-Württemberg likely to experience above-average growth, given their concentrated economic activity and established infrastructure. The presence of major players like Cushman & Wakefield, JLL, and others indicates a competitive but consolidated market landscape.

The market’s segmentation by key cities highlights a concentration of activity in major urban centers. Berlin’s tech scene and Hamburg's port activity are strong contributors, while Munich benefits from its robust financial and automotive industries. Cologne, as a significant business center, also sees significant investment. The "Other Cities" segment will experience growth driven by regional economic development and increasing decentralization trends; however, the growth rate will likely be lower compared to the main cities. The regional data underscores the importance of specific German states—North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse—in driving market expansion. The ongoing five-year CAGR of 5.60% suggests a continuous, albeit moderate, growth trajectory, with potential for acceleration dependent on macroeconomic factors and shifts in business strategies.

Germany Office Real Estate Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the German office real estate market, offering invaluable insights for investors, developers, and industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report unveils market trends, key players, and future opportunities within this dynamic sector. The report analyzes key cities including Berlin, Hamburg, Munich, and Cologne, providing granular data to guide strategic decision-making. Total market value in 2025 is estimated at xx Million.

Germany Office Real Estate Market Composition & Trends

This section analyzes the competitive landscape, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger and acquisition (M&A) activity within the German office real estate market from 2019-2024. The market exhibits a moderately concentrated structure, with key players like CBRE, JLL, and Cushman & Wakefield holding significant market share. However, smaller, specialized firms are also gaining traction, particularly in niche segments like sustainable buildings or co-working spaces. The total M&A deal value for 2024 is estimated to be xx Million.

- Market Concentration: The top five players account for approximately xx% of the market share in 2024.

- Innovation Catalysts: Growing demand for sustainable buildings and smart office technologies is driving innovation.

- Regulatory Landscape: Stringent building codes and environmental regulations shape market dynamics.

- Substitute Products: The rise of co-working spaces and remote work presents some level of substitution.

- End-User Profiles: Major tenants include technology firms, financial institutions, and government agencies.

- M&A Activities: Consolidation through M&A is anticipated to continue, driven by a desire for scale and expansion. The average deal size in 2024 is estimated at xx Million.

Germany Office Real Estate Market Industry Evolution

This section details the evolution of the German office real estate market from 2019 to 2024, exploring market growth trajectories, technological advancements, and evolving consumer preferences. The market witnessed substantial growth during the historical period, with an average annual growth rate (AAGR) of xx% from 2019 to 2024. This growth is attributed to several factors, including sustained economic growth, urbanization, and increasing demand from technology companies. However, the COVID-19 pandemic introduced a period of uncertainty, impacting office demand and prompting innovation in workspace design. The adoption of smart building technologies is also gradually increasing, creating opportunities for enhanced efficiency and sustainability. The forecast period (2025-2033) projects a continued, though potentially moderated, growth trajectory driven by long-term economic trends and adaptation to post-pandemic workplace dynamics. The projected AAGR for 2025-2033 is xx%.

Leading Regions, Countries, or Segments in Germany Office Real Estate Market

Berlin, Munich, and Hamburg consistently rank as the leading office real estate markets in Germany.

- Berlin: Strong tech sector growth, government presence, and a large talent pool fuel high demand.

- Munich: A strong financial and automotive industry contribute to significant office space demand.

- Hamburg: A thriving port city with a growing logistics and maritime sector.

- Cologne: A significant market, though smaller than the top three, with a diverse range of industries.

- Other Cities: These markets exhibit varying growth rates depending on local economic conditions and infrastructure development.

Berlin's dominance stems from its robust tech ecosystem, attracting significant investment and creating high demand for modern office spaces. The city's robust public transportation and thriving cultural scene also contribute to its appeal. Munich's strong presence in the automotive and financial industries, combined with its high quality of life, ensures steady office demand. Hamburg's port-related activities and growing logistics sector contribute significantly to its office real estate market.

Germany Office Real Estate Market Product Innovations

Recent innovations include the integration of smart building technologies, sustainable design features, and flexible workspace configurations. This includes incorporating IoT sensors for energy optimization, implementing smart access systems, and providing modular office layouts that cater to evolving workplace needs. These innovations aim to improve efficiency, reduce operational costs, and enhance occupant experience. The adoption rate of such innovations is steadily increasing, driven by rising awareness of sustainability and the pursuit of enhanced productivity.

Propelling Factors for Germany Office Real Estate Market Growth

Several factors propel growth: a robust German economy, increasing urbanization, government incentives for sustainable buildings, and the ongoing digital transformation across industries. These factors converge to fuel demand for high-quality office spaces, particularly in key cities. Technological advancements, such as smart building technologies, enhance building efficiency and attract tenants.

Obstacles in the Germany Office Real Estate Market Market

The market faces challenges including rising construction costs, stringent building regulations, and competition from alternative workspace solutions such as co-working spaces. The potential impact of economic slowdowns or geopolitical uncertainty also poses risks. Supply chain disruptions experienced in recent years added further complexity and cost increases to development projects.

Future Opportunities in Germany Office Real Estate Market

Future opportunities include the development of sustainable and energy-efficient office buildings, the expansion into smaller cities with growing economic potential, and the creation of flexible and adaptable workspaces to cater to evolving workplace needs. The integration of technology to optimize building performance and tenant experience also presents significant potential.

Major Players in the Germany Office Real Estate Market Ecosystem

- Cushman & Wakefield

- Zech Group

- STRABAG

- Knight Frank

- BAUER Group

- JLL

- Savills

- CBRE

- Hochtief

Key Developments in Germany Office Real Estate Market Industry

- June 2022: Prologis Inc. acquired a portfolio of 11 buildings across Germany, signifying significant investment in the logistics real estate sector.

- November 2022: NREP, a major urban investor, established a dedicated team in Germany, signaling increased interest in the German market.

Strategic Germany Office Real Estate Market Forecast

The German office real estate market is poised for continued growth, albeit at a potentially moderated pace compared to the previous period. The market will be shaped by technological advancements, evolving workplace dynamics, and a focus on sustainability. Opportunities exist for companies that can adapt to changing tenant demands and embrace innovative solutions. The long-term outlook remains positive, driven by underlying economic strength and a need for modern, efficient office spaces in key urban centers.

Germany Office Real Estate Market Segmentation

-

1. Key Cities

- 1.1. Berlin

- 1.2. Hamburg

- 1.3. Munich

- 1.4. Cologne

- 1.5. Other Cities

Germany Office Real Estate Market Segmentation By Geography

- 1. Germany

Germany Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Prime Rents Continue to Rise Due to Rental Adjustment Clauses in Leases

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 5.1.1. Berlin

- 5.1.2. Hamburg

- 5.1.3. Munich

- 5.1.4. Cologne

- 5.1.5. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 6. North Rhine-Westphalia Germany Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cushman & Wakefield

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zech Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 STRABAG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Knight Frank

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BAUER Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 JLL

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Savills

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CBRE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hochtie

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Cushman & Wakefield

List of Figures

- Figure 1: Germany Office Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Office Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Office Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 3: Germany Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Germany Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North Rhine-Westphalia Germany Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Bavaria Germany Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Baden-Württemberg Germany Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Lower Saxony Germany Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Hesse Germany Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Office Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 11: Germany Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Office Real Estate Market?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Germany Office Real Estate Market?

Key companies in the market include Cushman & Wakefield, Zech Group, STRABAG, Knight Frank, BAUER Group, JLL, Savills, CBRE, Hochtie.

3. What are the main segments of the Germany Office Real Estate Market?

The market segments include Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Prime Rents Continue to Rise Due to Rental Adjustment Clauses in Leases.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

November 2022: NREP, an urban investor with USD 19 billion of assets under management, announces the continued extension of its impact into Northern European countries following its first real estate investment in Germany and the establishment of a dedicated team of eight initial employees.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Germany Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence