Key Insights

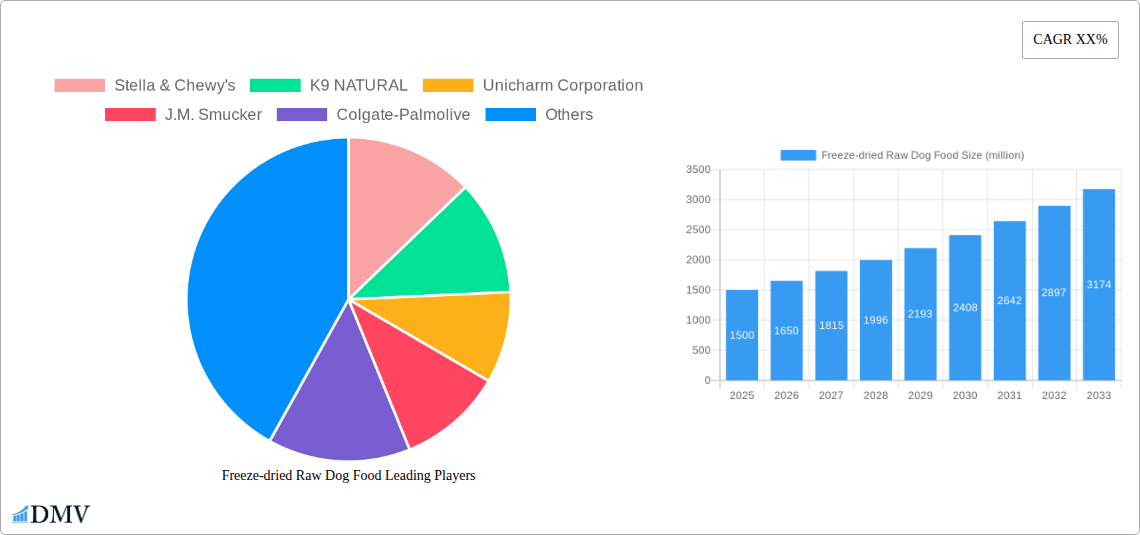

The freeze-dried raw dog food market is experiencing robust growth, driven by increasing pet humanization, a heightened awareness of pet nutrition, and a shift towards premium and natural pet food options. Consumers are increasingly seeking out diets that mimic their dogs' ancestral eating habits, believing raw food provides superior nutritional benefits and promotes better health. This trend is particularly evident among millennial and Gen Z pet owners who are more informed and willing to invest in higher-quality pet food. The market's expansion is further fueled by product innovation, with companies introducing convenient packaging, diverse protein sources, and functional additions like probiotics and antioxidants to cater to specific dietary needs and preferences. While pricing remains a barrier for some consumers, the convenience and perceived health benefits are strong drivers, offsetting this concern for a significant portion of the market. Competition is fierce, with established players like Nestlé and Mars Incorporated alongside specialized brands like Stella & Chewy's and K9 Natural vying for market share. This competitive landscape fosters continuous innovation and enhances the overall quality and availability of freeze-dried raw dog food products.

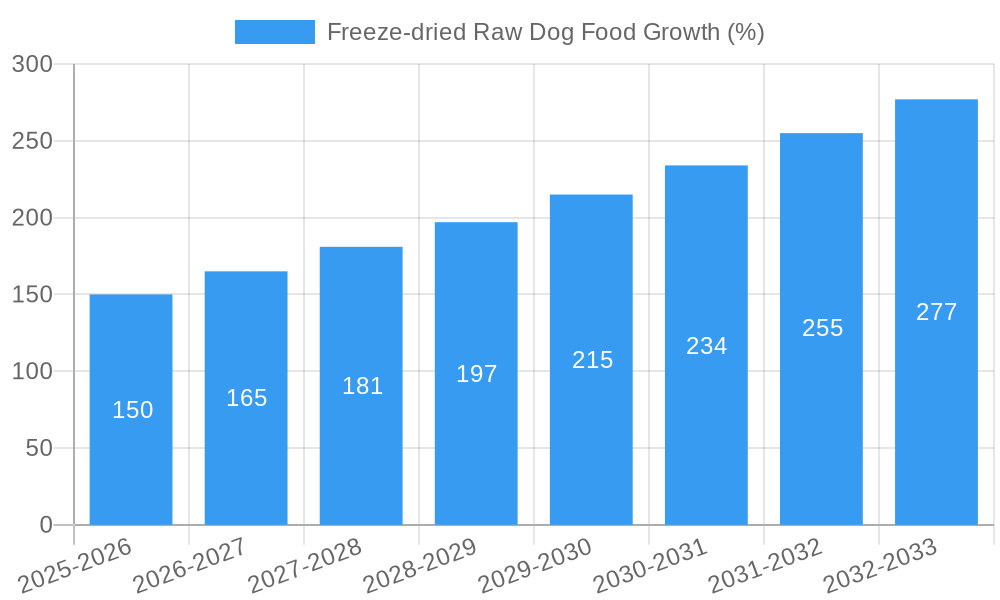

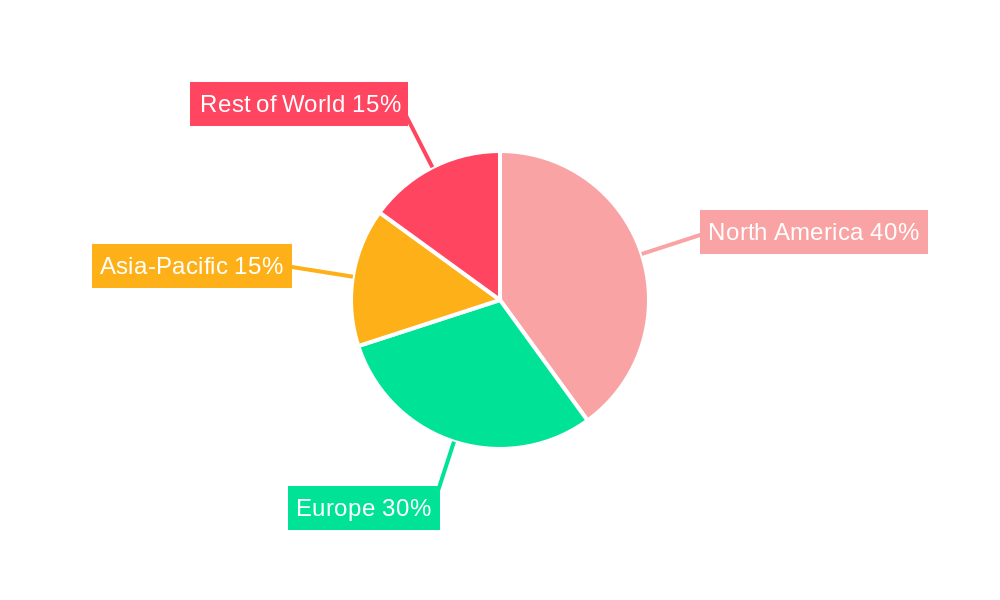

The forecast period of 2025-2033 projects continued growth, though at a potentially moderating CAGR compared to the earlier, higher growth years. This moderation is likely due to the market reaching a certain level of saturation in established regions and the need for continued innovation and expansion into new markets to sustain high growth rates. Regulatory landscape changes and concerns regarding food safety and potential bacterial contamination will also play a significant role in shaping market trajectory. The market segmentation, currently dominated by specific protein sources (e.g., beef, chicken), will likely diversify to incorporate more niche offerings catering to specific breeds and dietary sensitivities. Regional variations are also anticipated, with North America and Europe maintaining a strong market share but with significant growth potential in Asia-Pacific and other emerging markets fueled by increasing pet ownership and changing consumer attitudes.

Freeze-Dried Raw Dog Food Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global freeze-dried raw dog food market, projecting a market value exceeding $XX million by 2033. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. It meticulously examines market trends, competitive dynamics, and future growth prospects, offering invaluable insights for stakeholders across the industry. Key players such as Stella & Chewy's, K9 Natural, and Mars Incorporated are analyzed, alongside emerging players, to provide a complete view of this rapidly expanding sector.

Freeze-dried Raw Dog Food Market Composition & Trends

This section delves into the intricate structure of the freeze-dried raw dog food market, evaluating its concentration, innovation drivers, and regulatory influences. The report analyzes the market share distribution amongst key players, revealing that the top five companies collectively hold approximately XX% of the market, with Stella & Chewy's and K9 Natural leading the pack. The analysis also examines the impact of mergers and acquisitions (M&A) activities, with total M&A deal values exceeding $XX million in the past five years. Significant M&A activity reflects the consolidation trend within the industry, driven by the desire to increase market share, expand product portfolios, and gain access to new technologies.

- Market Concentration: Highly fragmented, with a few major players holding significant shares but numerous smaller brands competing intensely.

- Innovation Catalysts: Growing consumer demand for premium pet food, advancements in freeze-drying technology, and the focus on natural and raw ingredients.

- Regulatory Landscape: Varying regulations across different regions regarding raw pet food safety and labeling pose challenges but also create opportunities for companies that meet stringent standards.

- Substitute Products: Traditional kibble and canned dog food are the main substitutes, although the growing preference for raw diets reduces substitution rate.

- End-User Profiles: Primarily pet owners seeking high-quality, nutritious food for their dogs, often affluent and willing to pay a premium.

- M&A Activities: Consolidation through acquisitions is prominent, driven by expansion strategies and access to advanced technology and distribution networks.

Freeze-dried Raw Dog Food Industry Evolution

The freeze-dried raw dog food market has witnessed exponential growth, driven by several factors. Between 2019 and 2024, the market expanded at a CAGR of XX%, exceeding $XX million in 2024. This growth is attributed to increasing pet humanization, rising disposable incomes in key markets, and the increasing awareness of the health benefits of raw diets. Technological advancements in freeze-drying techniques have improved the shelf life and quality of freeze-dried raw food, contributing to increased adoption and consumer satisfaction. Consumer demand for premium, natural, and convenient pet food options is also a key driver, resulting in a notable shift away from traditional kibble toward more holistic and raw feeding options. This shift reflects a growing desire among pet owners to provide their animals with diets that better mimic their natural eating habits, leading to higher acceptance of freeze-dried products as a convenient alternative. Adoption rates have increased by approximately XX% annually over the past five years, demonstrating the growing market penetration.

Leading Regions, Countries, or Segments in Freeze-dried Raw Dog Food

North America currently dominates the global freeze-dried raw dog food market, accounting for approximately XX% of total revenue. This dominance can be attributed to several key drivers:

- High Pet Ownership: A significant pet-owning population with a high rate of pet humanization fuels demand for premium pet food.

- Strong Regulatory Framework: While complex, the North American regulatory landscape provides clarity and instills confidence among consumers.

- High Disposable Income: Consumers' willingness to spend more on premium products.

- Extensive Retail Networks: Well-established pet food retail channels supporting market growth.

- Innovation & Product Development: Significant investment in research and development leading to product innovations.

The continued growth in North America is expected, driven by strong economic factors and increasing consumer demand. Europe and Asia-Pacific regions are also showing significant growth potential, though at a slower pace than North America.

Freeze-dried Raw Dog Food Product Innovations

Recent innovations focus on enhancing the palatability, nutritional value, and convenience of freeze-dried raw dog food. Manufacturers are introducing novel recipes with a wider array of protein sources, incorporating functional ingredients like probiotics and prebiotics, and developing smaller, more convenient packaging options. Technological advancements in freeze-drying processes have also led to improved product quality and extended shelf life. Unique selling propositions often emphasize the use of human-grade ingredients, specific dietary formulations catering to different breeds and health conditions, and sustainable sourcing practices.

Propelling Factors for Freeze-dried Raw Dog Food Growth

The freeze-dried raw dog food market’s growth is propelled by several interconnected factors: increasing consumer awareness of the health benefits of raw diets, technological advancements allowing for improved quality and extended shelf life, and rising disposable incomes leading to higher spending on premium pet food. Furthermore, favorable regulatory environments in certain key markets encourage market expansion. The increasing availability of convenient packaging options further supports adoption rates.

Obstacles in the Freeze-dried Raw Dog Food Market

Despite strong growth prospects, several challenges hinder market expansion. Stricter regulations regarding raw pet food safety and labeling create hurdles for manufacturers, requiring costly compliance measures. Supply chain disruptions, particularly those linked to sourcing high-quality ingredients, can lead to production delays and increased costs. Intense competition among numerous players, including both established brands and smaller niche players, creates pricing pressures. These factors negatively impact the market and affect both profit margins and market accessibility.

Future Opportunities in Freeze-dried Raw Dog Food

Expanding into emerging markets in Asia-Pacific and Latin America presents significant growth opportunities. Further product innovation focusing on specialized dietary formulations for pets with specific health needs (e.g., allergies, sensitivities) and exploring the use of sustainable packaging materials offer exciting avenues. Leveraging e-commerce platforms and direct-to-consumer sales strategies can enhance market reach and bypass traditional retail challenges.

Major Players in the Freeze-dried Raw Dog Food Ecosystem

- Stella & Chewy's

- K9 Natural

- Unicharm Corporation

- J.M. Smucker

- Colgate-Palmolive

- Mars Incorporated

- Lupus Alimentos Ltda

- Nestle

- Total Alimentos

- Natures Menu

- TruDog

- Wisconsin Freeze Dried

- Canature Processing

- Natural Pet Food Group

- Stewart Pet Food

- Fresh Is Best

- Northwest Naturals

Key Developments in Freeze-dried Raw Dog Food Industry

- 2022 Q4: Stella & Chewy's launched a new line of freeze-dried raw dog food with added probiotics.

- 2023 Q1: K9 Natural announced a significant expansion into the European market.

- 2023 Q2: Mars Incorporated acquired a smaller freeze-dried raw food producer, strengthening its market position.

- 2024 Q1: New regulations regarding labeling of raw pet food came into effect in several major markets. (Further details on specific regulatory changes will be added within the full report).

Strategic Freeze-dried Raw Dog Food Market Forecast

The freeze-dried raw dog food market is poised for sustained growth, driven by ongoing product innovations, expanding consumer awareness, and increasing penetration in emerging markets. The forecast period (2025-2033) predicts a significant expansion, exceeding $XX million by 2033. Continued investment in research and development and strategic partnerships will further fuel market growth and drive industry consolidation. Emerging technologies and sustainable practices will continue to influence the market's future trajectory.

Freeze-dried Raw Dog Food Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Puppy Dog Food

- 2.2. Adult Dog Food

- 2.3. Others

Freeze-dried Raw Dog Food Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Freeze-dried Raw Dog Food REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Freeze-dried Raw Dog Food Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Puppy Dog Food

- 5.2.2. Adult Dog Food

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Freeze-dried Raw Dog Food Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Puppy Dog Food

- 6.2.2. Adult Dog Food

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Freeze-dried Raw Dog Food Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Puppy Dog Food

- 7.2.2. Adult Dog Food

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Freeze-dried Raw Dog Food Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Puppy Dog Food

- 8.2.2. Adult Dog Food

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Freeze-dried Raw Dog Food Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Puppy Dog Food

- 9.2.2. Adult Dog Food

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Freeze-dried Raw Dog Food Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Puppy Dog Food

- 10.2.2. Adult Dog Food

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Stella & Chewy's

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 K9 NATURAL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Unicharm Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 J.M. Smucker

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Colgate-Palmolive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mars Incorporated

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lupus Alimentos Ltda

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nestle

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Total Alimentos

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Natures Menu

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 TruDog

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Wisconsin Freeze Dried

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Canature Processing

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Natural Pet Food Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Stewart Pet Food

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Fresh Is Best

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Northwest Naturals

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Stella & Chewy's

List of Figures

- Figure 1: Global Freeze-dried Raw Dog Food Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Freeze-dried Raw Dog Food Revenue (million), by Application 2024 & 2032

- Figure 3: North America Freeze-dried Raw Dog Food Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Freeze-dried Raw Dog Food Revenue (million), by Types 2024 & 2032

- Figure 5: North America Freeze-dried Raw Dog Food Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Freeze-dried Raw Dog Food Revenue (million), by Country 2024 & 2032

- Figure 7: North America Freeze-dried Raw Dog Food Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Freeze-dried Raw Dog Food Revenue (million), by Application 2024 & 2032

- Figure 9: South America Freeze-dried Raw Dog Food Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Freeze-dried Raw Dog Food Revenue (million), by Types 2024 & 2032

- Figure 11: South America Freeze-dried Raw Dog Food Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Freeze-dried Raw Dog Food Revenue (million), by Country 2024 & 2032

- Figure 13: South America Freeze-dried Raw Dog Food Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Freeze-dried Raw Dog Food Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Freeze-dried Raw Dog Food Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Freeze-dried Raw Dog Food Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Freeze-dried Raw Dog Food Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Freeze-dried Raw Dog Food Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Freeze-dried Raw Dog Food Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Freeze-dried Raw Dog Food Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Freeze-dried Raw Dog Food Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Freeze-dried Raw Dog Food Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Freeze-dried Raw Dog Food Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Freeze-dried Raw Dog Food Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Freeze-dried Raw Dog Food Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Freeze-dried Raw Dog Food Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Freeze-dried Raw Dog Food Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Freeze-dried Raw Dog Food Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Freeze-dried Raw Dog Food Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Freeze-dried Raw Dog Food Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Freeze-dried Raw Dog Food Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Freeze-dried Raw Dog Food Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Freeze-dried Raw Dog Food Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Freeze-dried Raw Dog Food?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Freeze-dried Raw Dog Food?

Key companies in the market include Stella & Chewy's, K9 NATURAL, Unicharm Corporation, J.M. Smucker, Colgate-Palmolive, Mars Incorporated, Lupus Alimentos Ltda, Nestle, Total Alimentos, Natures Menu, TruDog, Wisconsin Freeze Dried, Canature Processing, Natural Pet Food Group, Stewart Pet Food, Fresh Is Best, Northwest Naturals.

3. What are the main segments of the Freeze-dried Raw Dog Food?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Freeze-dried Raw Dog Food," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Freeze-dried Raw Dog Food report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Freeze-dried Raw Dog Food?

To stay informed about further developments, trends, and reports in the Freeze-dried Raw Dog Food, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence