Key Insights

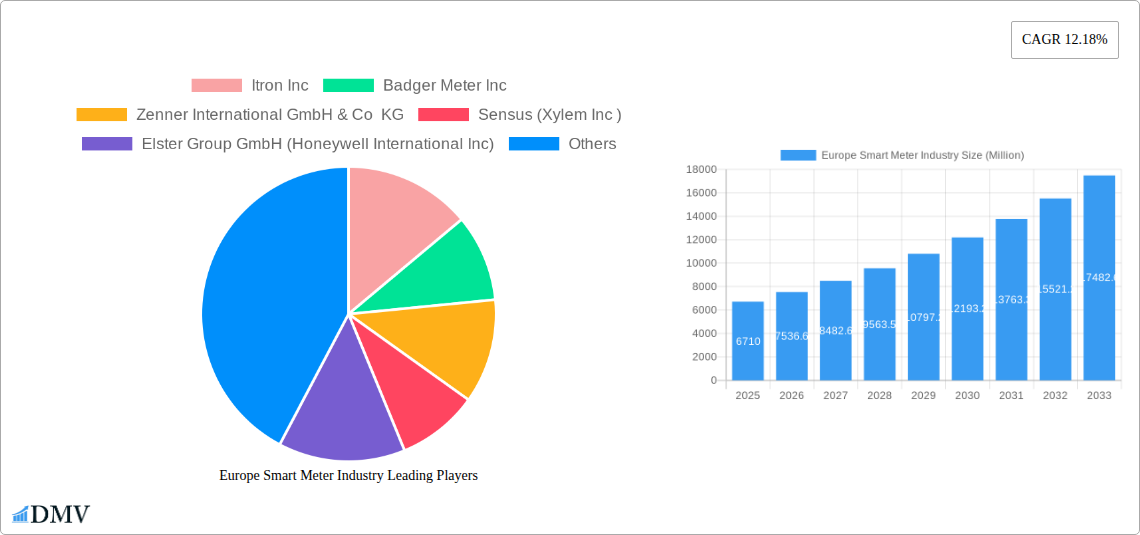

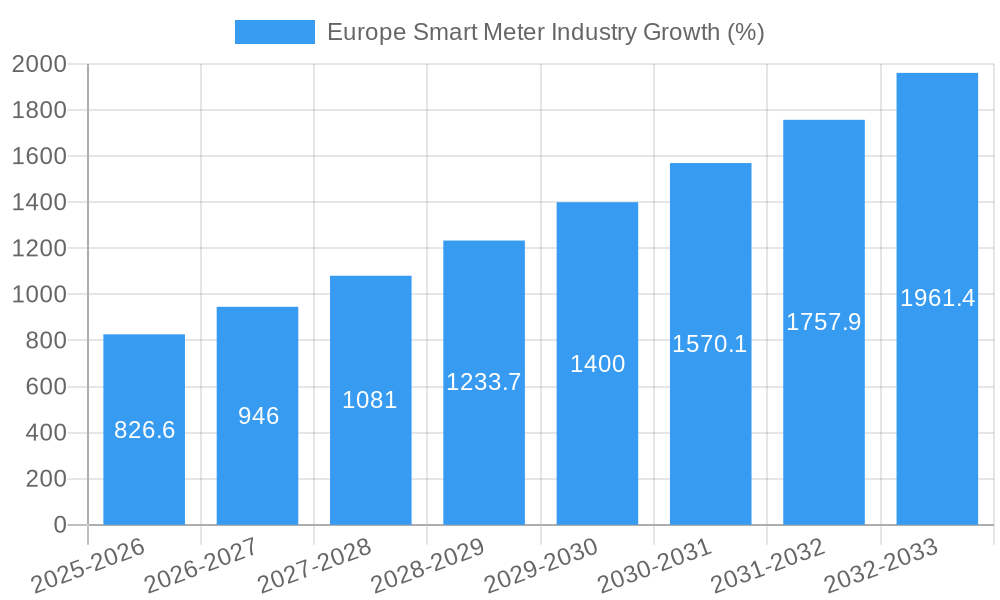

The European smart meter market, valued at €6.71 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 12.18% from 2025 to 2033. This significant expansion is driven by several key factors. Stringent government regulations aimed at improving energy efficiency and grid modernization are compelling utilities to adopt smart metering technologies. Furthermore, the increasing focus on renewable energy integration and the need for advanced grid management solutions are fueling demand. The rising adoption of smart home technologies and the growing awareness of energy consumption patterns among consumers also contribute to market growth. Within the market segmentation, smart electricity meters currently hold the largest share, followed by smart gas and smart water meters. The residential sector dominates end-user adoption, although the commercial and industrial segments are witnessing substantial growth driven by operational efficiency and cost optimization initiatives. Germany, the United Kingdom, and France are the leading national markets in Europe, benefiting from well-established infrastructure and supportive government policies. However, market penetration in other European countries such as Italy and Spain is increasing rapidly as these nations implement smart grid initiatives and modernize their energy infrastructure.

Competition in the European smart meter market is intense, with both established players and emerging companies vying for market share. Major players like Itron, Badger Meter, and Landis+GYR are leveraging their technological expertise and extensive distribution networks to maintain their dominance. However, innovative companies are entering the market with advanced solutions, such as advanced analytics and data management capabilities, and smart grid integration solutions. This competitive landscape is pushing industry players to continuously innovate and improve their offerings to meet the evolving demands of consumers and utilities. The forecast period will witness continued expansion, primarily due to expanding smart grid deployments across various European countries, the increasing adoption of advanced metering infrastructure (AMI), and the development of next-generation smart meters with enhanced functionalities. This includes integration with other smart home technologies and the ability to provide real-time energy consumption data to customers.

Europe Smart Meter Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European smart meter industry, encompassing market size, segmentation, leading players, technological advancements, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for stakeholders across the value chain. The forecast period covers 2025-2033, while the historical period analyzed is 2019-2024. The market is segmented by meter type (smart gas, water, and electricity meters), end-user (residential, commercial, and industrial), and country (United Kingdom, Germany, France, Italy, Spain, and Rest of Europe). The report projects a total market value exceeding xx Million by 2033.

Europe Smart Meter Industry Market Composition & Trends

The European smart meter market is characterized by a moderately concentrated landscape, with key players like Itron Inc, Badger Meter Inc, and Landis+GYR Group AG holding significant market share. However, the emergence of smaller, innovative companies is fostering competition. The market is driven by stringent government regulations promoting energy efficiency and smart grid infrastructure, alongside increasing consumer demand for improved energy management. Technological advancements, such as the integration of IoT and advanced data analytics capabilities, are further stimulating market growth. Substitute products, while limited, include traditional mechanical meters, but their prevalence is decreasing due to the advantages offered by smart meters. Mergers and acquisitions (M&A) activity is moderate, with deal values averaging around xx Million annually in recent years.

- Market Share Distribution (2024 Estimate): Itron Inc (20%), Landis+GYR Group AG (15%), Badger Meter Inc (12%), Others (53%)

- M&A Deal Values (2019-2024): Average annual deal value: xx Million

- Key Innovation Catalysts: IoT integration, advanced analytics, improved communication protocols

- Regulatory Landscape: Varying regulations across European countries, driving both opportunities and challenges

- End-User Profiles: Residential segment holds the largest market share, followed by commercial and industrial sectors.

Europe Smart Meter Industry Industry Evolution

The European smart meter market has witnessed robust growth throughout the historical period (2019-2024), driven primarily by government initiatives aimed at modernizing energy grids and enhancing energy efficiency. This growth trajectory is expected to continue throughout the forecast period (2025-2033), albeit at a slightly moderated pace compared to the earlier years. Technological advancements, particularly in the areas of communication technologies (NB-IoT, LoRaWAN), data analytics, and cybersecurity, are crucial drivers. Consumer demand is evolving, with greater emphasis on data-driven insights for energy consumption management and cost savings. The adoption rate of smart meters is steadily increasing across Europe, with significant variations across countries reflecting differing regulatory frameworks and infrastructure readiness. Growth rates are expected to average around xx% annually during the forecast period, reaching xx Million units shipped by 2033. Adoption of smart water meters is lagging behind electricity meters, but exhibiting strong growth potential.

Leading Regions, Countries, or Segments in Europe Smart Meter Industry

The United Kingdom, Germany, and France represent the largest markets for smart meters in Europe, driven by strong government support for smart grid initiatives and higher levels of infrastructure development. Among the different meter types, smart electricity meters hold the largest market share, followed by smart gas and water meters. The residential sector remains the dominant end-user segment.

- Key Drivers for UK Dominance: Extensive government investment in smart meter rollouts, well-established infrastructure.

- Key Drivers for German Dominance: Strong regulatory framework, high adoption rates in commercial and industrial sectors.

- Key Drivers for French Dominance: Growing focus on energy efficiency, government incentives for smart meter installations.

- By Meter Type: Smart electricity meters account for the highest revenue and unit shipments.

- By End User: Residential users form the biggest customer base, representing xx% of the market.

Europe Smart Meter Industry Product Innovations

Recent innovations have focused on enhancing functionalities, reducing costs, and improving communication reliability. Landis+Gyr's new ultrasonic smart water meters, for example, leverage IoT technologies to provide comprehensive data on water usage, temperature, and potential issues. This data provides valuable insights for utilities and consumers alike. Other key innovations include advanced data analytics capabilities for predictive maintenance and improved cybersecurity features to protect against data breaches. These developments are strengthening the value proposition of smart meters and driving adoption.

Propelling Factors for Europe Smart Meter Industry Growth

Several factors contribute to the ongoing expansion of the European smart meter market. Government policies promoting energy efficiency and smart grid modernization provide a strong impetus. Technological advancements, such as improved communication protocols and data analytics capabilities, enhance the functionality and value of smart meters. Furthermore, increasing consumer awareness of the benefits of energy monitoring and cost savings drives demand. The rising adoption of renewable energy sources also necessitates more efficient grid management, increasing the need for smart meters.

Obstacles in the Europe Smart Meter Industry Market

Despite the positive outlook, the European smart meter market faces challenges. The high initial investment cost of implementing smart metering infrastructure can be a barrier, particularly for smaller utility companies. Supply chain disruptions can impact production and deployment schedules. Additionally, cybersecurity concerns and the need for robust data protection measures present ongoing obstacles. Competition among established and emerging players adds complexity to market dynamics.

Future Opportunities in Europe Smart Meter Industry

Future growth prospects for the European smart meter industry are promising. Expanding into new markets, such as smart agriculture and smart cities, offers significant potential. The integration of Artificial Intelligence (AI) and machine learning into smart meter data analysis will enhance predictive maintenance and optimize energy distribution. The development of more advanced communication technologies will further improve efficiency and reliability. Increased consumer demand for smart home solutions creates opportunities for seamless integration of smart meters into broader home automation systems.

Major Players in the Europe Smart Meter Industry Ecosystem

- Itron Inc

- Badger Meter Inc

- Zenner International GmbH & Co KG

- Sensus (Xylem Inc)

- Elster Group GmbH (Honeywell International Inc)

- Kamstrup A/S

- Apator SA

- Arad Group

- Diehl Stiftung & Co KG

- Landis+GYR Group AG

- Ningbo Sanxing Electric Co Ltd

- AEM

- General Electric Company

Key Developments in Europe Smart Meter Industry Industry

- November 2022: Landis+Gyr launched its latest ultrasonic smart water meters (W270 and W370), incorporating NB-IoT communication for enhanced data collection and remote control capabilities, significantly improving smart water network management.

- December 2022: Trilliant secured a contract to supply smart meters for Ireland's National Smart Metering Programme (NSMP), highlighting the ongoing expansion of smart metering infrastructure across Europe.

Strategic Europe Smart Meter Industry Market Forecast

The European smart meter market is poised for sustained growth, driven by supportive government policies, technological advancements, and increasing consumer demand for energy efficiency. Opportunities abound in the expansion of smart water and gas metering, the integration of AI for enhanced data analysis, and the development of new applications in emerging sectors. The market's potential remains significant, with substantial growth expected throughout the forecast period, creating lucrative opportunities for established and new players alike.

Europe Smart Meter Industry Segmentation

-

1. Type of Meter (Revenue and Unit Shipments)

- 1.1. Smart Gas Meter

- 1.2. Smart Water Meter

- 1.3. Smart Electricity Meter

-

2. End User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

Europe Smart Meter Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Smart Meter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.18% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Investments in Smart Grid Projects; Growth in Smart City Deployment; Supportive Government Regulations

- 3.3. Market Restrains

- 3.3.1. High Costs and Security Concerns; Integration Difficulties with Smart Meters

- 3.4. Market Trends

- 3.4.1. Increased investments in smart grid projects in expected to drive the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Smart Meter Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Meter (Revenue and Unit Shipments)

- 5.1.1. Smart Gas Meter

- 5.1.2. Smart Water Meter

- 5.1.3. Smart Electricity Meter

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Meter (Revenue and Unit Shipments)

- 6. Germany Europe Smart Meter Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Smart Meter Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Smart Meter Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Smart Meter Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Smart Meter Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Smart Meter Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Smart Meter Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Itron Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Badger Meter Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Zenner International GmbH & Co KG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Sensus (Xylem Inc )

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Elster Group GmbH (Honeywell International Inc)

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Kamstrup A/S

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Apator SA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Arad Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Diehl Stiftung & Co KG

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Landis+ GYR Group AG

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Ningbo Sanxing Electric Co Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 AEM

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 General Electric Company

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.1 Itron Inc

List of Figures

- Figure 1: Europe Smart Meter Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Smart Meter Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Smart Meter Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Smart Meter Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe Smart Meter Industry Revenue Million Forecast, by Type of Meter (Revenue and Unit Shipments) 2019 & 2032

- Table 4: Europe Smart Meter Industry Volume K Unit Forecast, by Type of Meter (Revenue and Unit Shipments) 2019 & 2032

- Table 5: Europe Smart Meter Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Europe Smart Meter Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 7: Europe Smart Meter Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Smart Meter Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Europe Smart Meter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Smart Meter Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: France Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Europe Smart Meter Industry Revenue Million Forecast, by Type of Meter (Revenue and Unit Shipments) 2019 & 2032

- Table 26: Europe Smart Meter Industry Volume K Unit Forecast, by Type of Meter (Revenue and Unit Shipments) 2019 & 2032

- Table 27: Europe Smart Meter Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 28: Europe Smart Meter Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 29: Europe Smart Meter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Smart Meter Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: United Kingdom Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United Kingdom Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Germany Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: France Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Italy Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Italy Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Spain Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Spain Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Netherlands Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Netherlands Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Belgium Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Belgium Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Sweden Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Sweden Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Norway Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Norway Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Poland Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Poland Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Denmark Europe Smart Meter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Denmark Europe Smart Meter Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Smart Meter Industry?

The projected CAGR is approximately 12.18%.

2. Which companies are prominent players in the Europe Smart Meter Industry?

Key companies in the market include Itron Inc, Badger Meter Inc, Zenner International GmbH & Co KG, Sensus (Xylem Inc ), Elster Group GmbH (Honeywell International Inc), Kamstrup A/S, Apator SA, Arad Group, Diehl Stiftung & Co KG, Landis+ GYR Group AG, Ningbo Sanxing Electric Co Ltd, AEM, General Electric Company.

3. What are the main segments of the Europe Smart Meter Industry?

The market segments include Type of Meter (Revenue and Unit Shipments), End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Investments in Smart Grid Projects; Growth in Smart City Deployment; Supportive Government Regulations.

6. What are the notable trends driving market growth?

Increased investments in smart grid projects in expected to drive the market growth.

7. Are there any restraints impacting market growth?

High Costs and Security Concerns; Integration Difficulties with Smart Meters.

8. Can you provide examples of recent developments in the market?

December 2022: Trilliant, a leading provider of solutions for advanced metering infrastructure (AMI), smart cities, smart grid, and IIoT, announced the selection of its UK division, Trilliant Networks Operations (UK) Ltd., as one of the suppliers to provide smart meters to support the rollout of Ireland’s National Smart Metering Programme (NSMP) by ESB Networks. The program aims to help customers manage their energy use, save money, and lower their carbon footprint.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Smart Meter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Smart Meter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Smart Meter Industry?

To stay informed about further developments, trends, and reports in the Europe Smart Meter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence