Key Insights

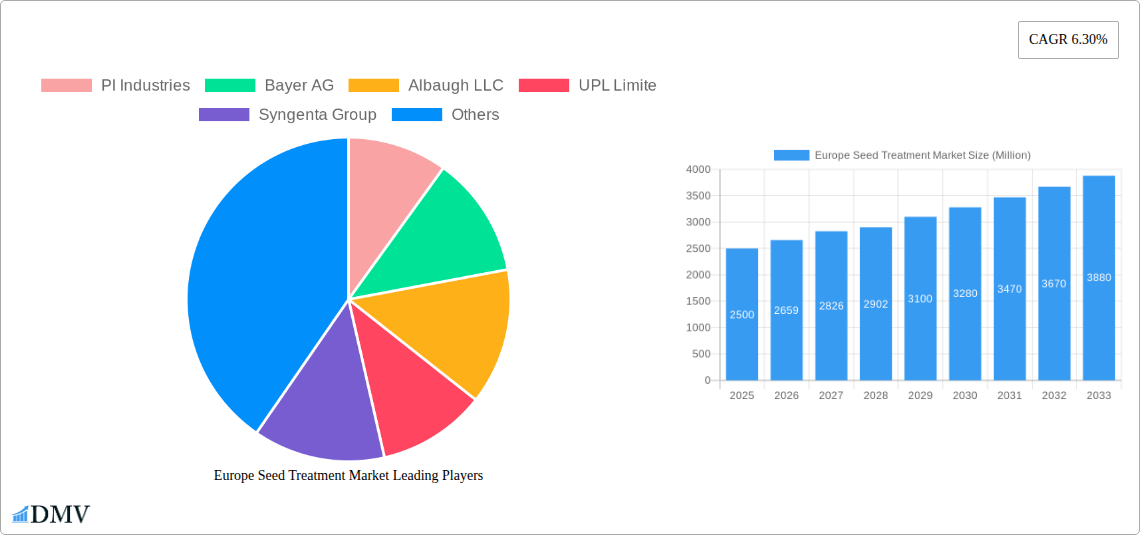

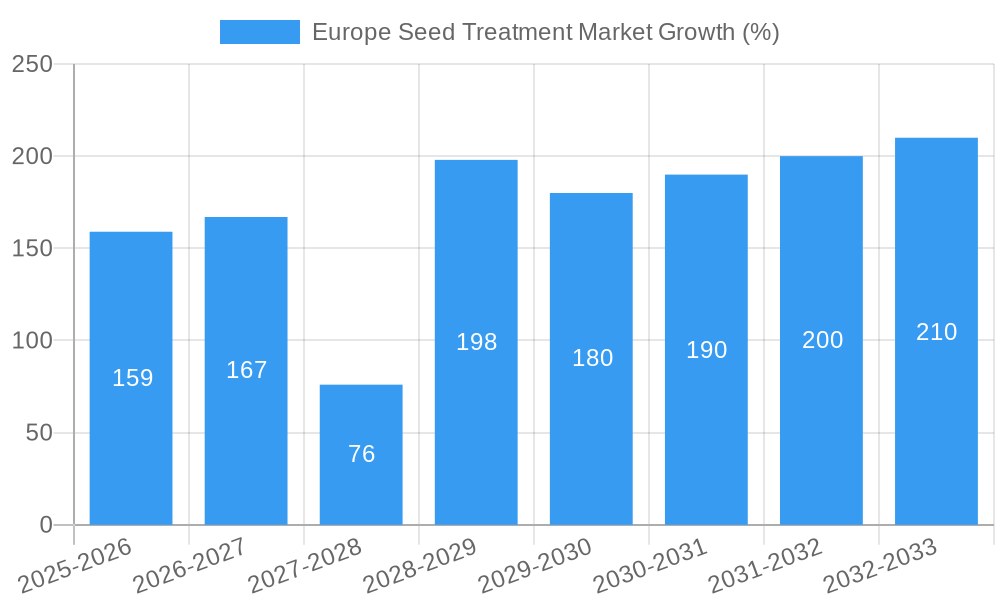

The European seed treatment market, valued at approximately €2.5 billion in 2025, is projected to experience robust growth, driven by increasing demand for high-yielding crops, rising agricultural output, and the escalating adoption of advanced seed treatment technologies. The market's Compound Annual Growth Rate (CAGR) of 6.30% from 2025 to 2033 indicates a significant expansion, fueled by factors such as stringent regulations on chemical pesticides, encouraging the shift towards environmentally friendly seed treatments. Furthermore, the growing prevalence of soilborne diseases and insect pests necessitates effective seed treatments for crop protection, contributing to market expansion. The key segments driving growth include fungicides, insecticides, and nematicides, with commercial crops, fruits & vegetables, and grains & cereals leading in crop type demand. Germany, France, and the UK represent major market contributors within Europe, reflecting their substantial agricultural sectors. Leading companies like Bayer AG, Syngenta Group, and Corteva Agriscience are driving innovation and market competition through the introduction of new products and technologies.

The market segmentation reveals significant opportunities for specialized seed treatments catering to specific crop needs and regional challenges. For instance, the growing demand for organic farming practices is fostering the development of eco-friendly seed treatment solutions. However, factors like fluctuating raw material prices and stringent regulatory approvals may pose challenges to market growth. Nevertheless, the overall outlook for the European seed treatment market remains positive, with continuous technological advancements and increasing awareness of the benefits of seed treatment promising sustained expansion throughout the forecast period. The market's expansion is anticipated to be fuelled by heightened consumer awareness of food security and the necessity for optimized agricultural practices.

Europe Seed Treatment Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Seed Treatment Market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this comprehensive study unveils market trends, competitive landscapes, and future growth opportunities. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

Europe Seed Treatment Market Composition & Trends

This section meticulously examines the intricate composition and prevailing trends within the European seed treatment market. We delve into market concentration, analyzing the market share distribution amongst key players like Bayer AG, Syngenta Group, and Corteva Agriscience. The report also explores the innovative forces shaping the market, including the development of biopesticides and advancements in seed coating technologies. A thorough evaluation of the regulatory landscape, encompassing EU directives and national regulations, is provided, alongside an analysis of substitute products and their impact on market dynamics. Further, we profile the end-user segments—from large-scale commercial farms to smaller-scale fruit and vegetable growers—and scrutinize recent mergers and acquisitions (M&A) activities, including deal values and their implications for market consolidation.

- Market Concentration: Highly concentrated, with the top 5 players holding approximately xx% market share in 2024.

- Innovation Catalysts: Increasing demand for sustainable agriculture, coupled with stringent regulations on chemical pesticides, is driving innovation.

- Regulatory Landscape: EU regulations on pesticide use and approval significantly influence market dynamics.

- M&A Activity: Significant M&A activity observed between 2019-2024, with deal values totaling an estimated xx Million.

Europe Seed Treatment Market Industry Evolution

This section provides a detailed analysis of the evolutionary trajectory of the Europe seed treatment market. We trace the market's growth trajectory from 2019 to 2024, highlighting key milestones and inflection points. The report examines technological advancements, such as the development of novel seed treatment formulations and precision application techniques, and their impact on market growth rates. We also analyze shifting consumer demands, including a growing preference for sustainable and environmentally friendly seed treatments, and assess their influence on market segmentation and product development strategies. The analysis includes granular data points on growth rates, adoption rates of new technologies, and changes in consumer preferences across various crop types.

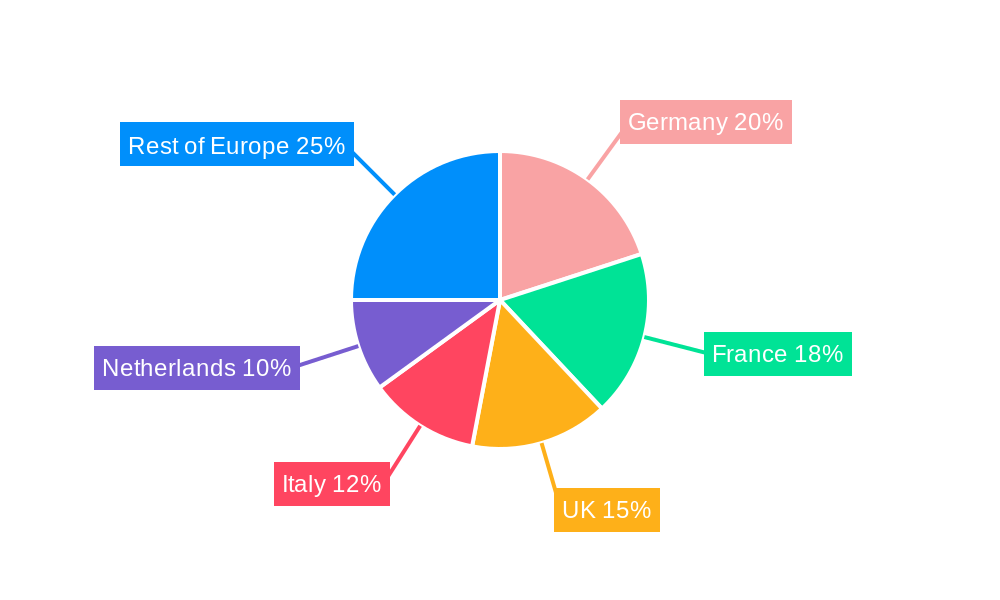

Leading Regions, Countries, or Segments in Europe Seed Treatment Market

This section identifies the leading regions, countries, and segments within the European seed treatment market. We analyze the factors driving the dominance of specific regions (e.g., Western Europe's higher adoption of advanced technologies) and countries (e.g., France and Germany's large agricultural sectors). The analysis also examines the performance of different segments based on function (fungicide, insecticide, nematicide), crop type (grains & cereals, fruits & vegetables, etc.), and country-specific nuances.

- Key Drivers (France): Strong agricultural sector, high adoption of advanced technologies, favorable government policies.

- Key Drivers (Germany): Similar to France, with a strong emphasis on sustainable agricultural practices.

- Dominant Segment (Function): Fungicides currently dominate, driven by prevalent fungal diseases.

- Dominant Segment (Crop Type): Grains & cereals represent the largest segment due to high acreage.

The detailed analysis explains the reasons behind the dominance of specific regions, countries, and segments, providing valuable insights for strategic decision-making.

Europe Seed Treatment Market Product Innovations

Recent years have witnessed significant product innovations within the European seed treatment market. Companies are focusing on developing seed treatments with enhanced efficacy, improved environmental profiles, and greater ease of application. This includes the introduction of novel formulations, such as polymeric coatings and microencapsulation technologies, that improve the efficacy and longevity of active ingredients. Furthermore, the development of biopesticides and other environmentally friendly alternatives is gaining momentum, driven by consumer demand and regulatory pressures.

Propelling Factors for Europe Seed Treatment Market Growth

Several key factors are driving the growth of the Europe seed treatment market. Technological advancements, such as the development of new active ingredients and more efficient application methods, are boosting market expansion. Economic factors, including rising agricultural productivity and increasing demand for food, are also contributing to market growth. Finally, supportive regulatory frameworks and government initiatives aimed at promoting sustainable agriculture are playing a significant role in stimulating market expansion.

Obstacles in the Europe Seed Treatment Market

Despite its strong growth trajectory, the Europe seed treatment market faces certain obstacles. Stringent regulatory requirements for pesticide approvals can delay product launches and increase development costs. Supply chain disruptions can impact the availability of raw materials and finished products. Finally, intense competition from established players and new entrants can create downward pressure on pricing and profitability. These obstacles could potentially impact the overall market growth, especially in the short term.

Future Opportunities in Europe Seed Treatment Market

The Europe seed treatment market presents several promising future opportunities. The expanding adoption of precision agriculture technologies, coupled with growing demand for organic and sustainable seed treatments, creates significant potential for market expansion. Further, exploring new market segments, such as turf and ornamental applications, and developing innovative seed treatment products tailored to specific crop needs, could unlock new avenues for growth.

Major Players in the Europe Seed Treatment Market Ecosystem

- PI Industries

- Bayer AG

- Albaugh LLC

- UPL Limited

- Syngenta Group

- Mitsui & Co Ltd (Certis Belchim)

- Corteva Agriscience

Key Developments in Europe Seed Treatment Market Industry

- January 2023: Bayer partnered with Oerth Bio to develop eco-friendly crop protection solutions. This signifies a shift towards sustainable practices within the industry.

- May 2022: Corteva Agriscience opened a new seed treatment laboratory in South Africa, expanding its global reach and capacity. This demonstrates a commitment to supporting global food security.

- March 2022: Mitsui & Co. Ltd merged Belchim Crop Protection and Certis Europe, creating Certis Belchim BV. This consolidation reflects industry consolidation and increased competition.

Strategic Europe Seed Treatment Market Forecast

The Europe seed treatment market is poised for continued growth, driven by technological advancements, increasing agricultural productivity, and a growing focus on sustainable agriculture. The market is expected to witness the adoption of novel seed treatment technologies and a rise in demand for biopesticides. These factors, combined with supportive regulatory frameworks and increasing investment in agricultural research and development, suggest a robust outlook for the market in the coming years.

Europe Seed Treatment Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Seed Treatment Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Seed Treatment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Schemes like the European Seed Treatment Assurance Scheme drive the seed treatment market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Seed Treatment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Germany Europe Seed Treatment Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Seed Treatment Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Seed Treatment Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Seed Treatment Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Seed Treatment Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Seed Treatment Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Seed Treatment Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 PI Industries

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bayer AG

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Albaugh LLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 UPL Limite

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Syngenta Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Mitsui & Co Ltd (Certis Belchim)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Corteva Agriscience

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.1 PI Industries

List of Figures

- Figure 1: Europe Seed Treatment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Seed Treatment Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Seed Treatment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Seed Treatment Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Europe Seed Treatment Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Europe Seed Treatment Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Europe Seed Treatment Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Europe Seed Treatment Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Europe Seed Treatment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Seed Treatment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Netherlands Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sweden Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Europe Seed Treatment Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Europe Seed Treatment Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Europe Seed Treatment Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Europe Seed Treatment Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Europe Seed Treatment Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Europe Seed Treatment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Belgium Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Sweden Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Norway Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Poland Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Denmark Europe Seed Treatment Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Seed Treatment Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Europe Seed Treatment Market?

Key companies in the market include PI Industries, Bayer AG, Albaugh LLC, UPL Limite, Syngenta Group, Mitsui & Co Ltd (Certis Belchim), Corteva Agriscience.

3. What are the main segments of the Europe Seed Treatment Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Schemes like the European Seed Treatment Assurance Scheme drive the seed treatment market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.May 2022: Corteva Agriscience expanded its product development capabilities by opening a seed treatment laboratory in Rosslyn, South Africa. The site is well-positioned to fulfill the ongoing needs of grain producers throughout Africa and the Middle East (AME) and is connected to Corteva's worldwide CSAT network.March 2022: A new company called Certis Belchim BV was formed by Mitsui & Co. Ltd by merging its recently acquired Belchim Crop Protection and its European subsidiary Certis Europe. This was done in accordance with the terms of a definitive agreement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Seed Treatment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Seed Treatment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Seed Treatment Market?

To stay informed about further developments, trends, and reports in the Europe Seed Treatment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence