Key Insights

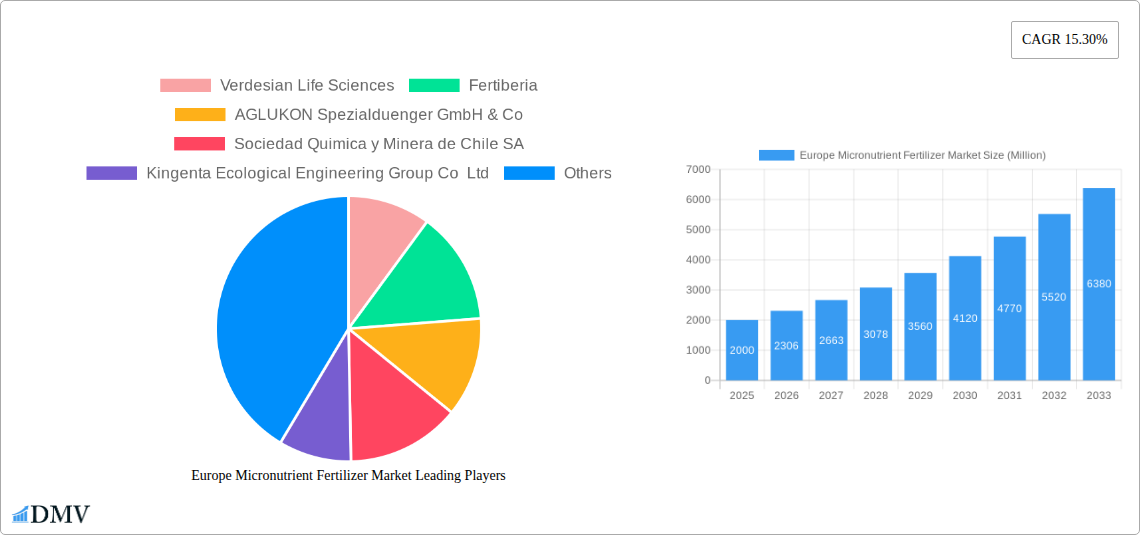

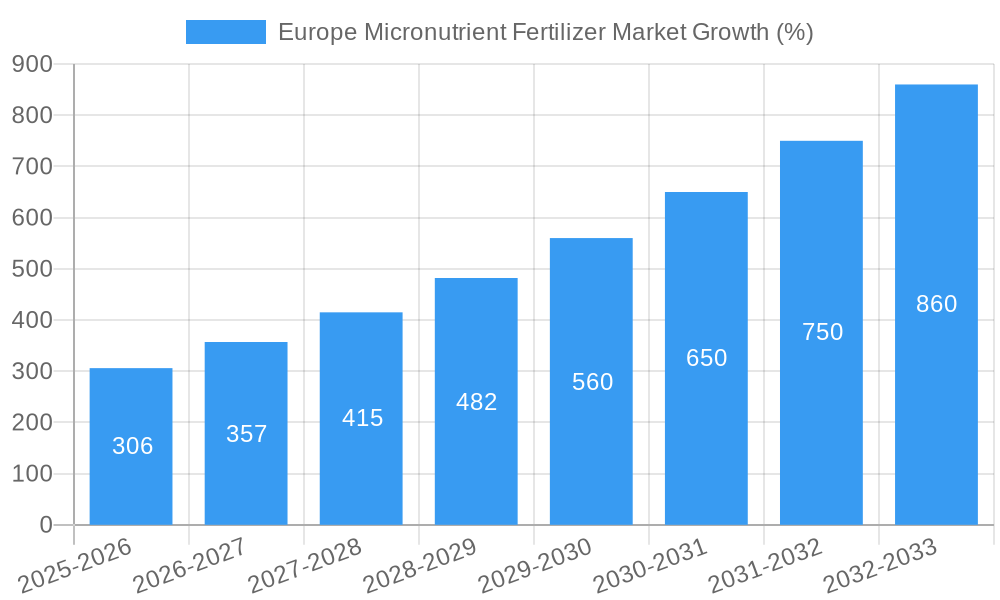

The European micronutrient fertilizer market, valued at approximately €[Estimate based on market size XX and value unit Million; let's assume XX = 2000 for illustration purposes] million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 15.30% from 2025 to 2033. This expansion is driven by several key factors. Intensified agricultural practices across Europe necessitate the supplementation of essential micronutrients like boron, copper, zinc, and manganese to enhance crop yields and quality, particularly in intensive farming systems. The rising prevalence of soil deficiencies due to intensive cropping and climate change further fuels the demand. Growing consumer awareness of the importance of nutrient-rich foods and the consequent demand for sustainably produced crops are additional drivers. Furthermore, technological advancements in fertilizer formulation and application techniques, such as fertigation, are streamlining nutrient delivery and improving efficiency, thereby boosting market growth. While potential regulatory changes and price fluctuations of raw materials pose some constraints, the overall market outlook remains positive.

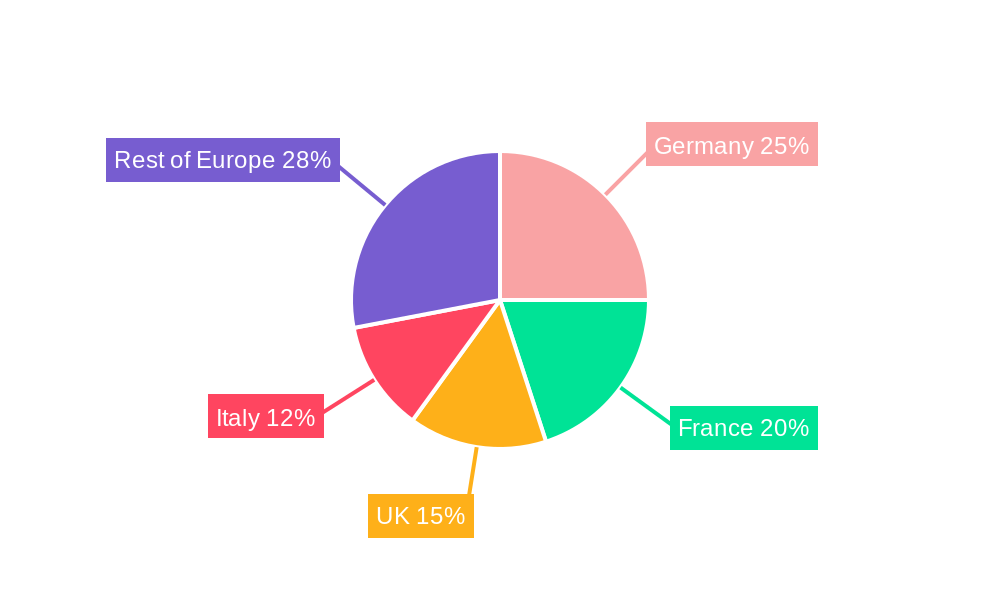

Segment analysis reveals that field crops currently dominate consumption, followed by horticultural crops and turf & ornamental applications. Fertigation application is gaining traction due to its precision and efficiency. Germany, France, and the United Kingdom represent major markets within Europe, driven by their large agricultural sectors and adoption of advanced farming techniques. Key players in the market, including Verdesian Life Sciences, Fertiberia, and Yara International, are focusing on innovation and strategic partnerships to consolidate their market positions and cater to evolving farmer needs. The continued emphasis on sustainable agricultural practices and the need to enhance crop yields in the face of climate change are expected to further propel the growth of the European micronutrient fertilizer market in the coming years. The market is predicted to reach a value of approximately €[Estimate based on CAGR and 2025 value, calculations needed here; for example, assuming €6000 million in 2033] million by 2033.

Europe Micronutrient Fertilizer Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe micronutrient fertilizer market, encompassing market size, growth drivers, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report offers a granular view of the market, segmented by product (Boron, Copper, Iron, Manganese, Molybdenum, Zinc, Others), application mode (Fertigation, Foliar, Soil), crop type (Field Crops, Horticultural Crops, Turf & Ornamental), and country (France, Germany, Italy, Netherlands, Russia, Spain, Ukraine, United Kingdom, Rest of Europe). The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Europe Micronutrient Fertilizer Market Market Composition & Trends

This section delves into the dynamics of the European micronutrient fertilizer market, examining market concentration, innovation, regulatory influences, substitute products, end-user behavior, and mergers & acquisitions (M&A) activity. The market exhibits a moderately concentrated structure, with top players holding xx% market share collectively in 2024. Innovation is driven by the need for sustainable and efficient nutrient delivery systems, with a strong focus on improving crop yields and reducing environmental impact. Regulatory landscapes vary across European countries, impacting product approvals and usage. Substitutes include organic fertilizers and bio-stimulants, although micronutrient fertilizers maintain a strong position due to their targeted efficacy. Key end-users are farmers (both large-scale and small-hold), horticultural businesses, and landscaping companies. M&A activity has been notable, with several key transactions impacting market share and competitive dynamics.

- Market Share Distribution (2024): Top 5 players: xx%; Others: xx%

- M&A Activity (2019-2024): Total deal value estimated at xx Million, with average deal size of xx Million. Key deals include the COMPO EXPERT merger with Grupa Azoty (2021).

Europe Micronutrient Fertilizer Market Industry Evolution

The European micronutrient fertilizer market has witnessed steady growth, driven by factors including rising agricultural intensification, increasing awareness of micronutrient deficiencies in soils, and technological advancements in fertilizer formulation and application. From 2019 to 2024, the market experienced a compound annual growth rate (CAGR) of xx%. This growth is expected to continue, though at a potentially moderated pace due to economic factors and supply chain considerations. Technological advancements, such as the development of advanced chelates and controlled-release formulations, are enhancing fertilizer efficiency and reducing environmental impact. Consumer demand is shifting towards more sustainable and environmentally friendly products, prompting manufacturers to focus on bio-based and biodegradable options. The rise of precision agriculture technologies is further enhancing the adoption of micronutrient fertilizers through targeted application techniques.

Leading Regions, Countries, or Segments in Europe Micronutrient Fertilizer Market

The leading segment varies across factors.

By Product: Iron and Zinc dominate the market due to their widespread application across multiple crops. By Application Mode: Foliar application is seeing significant growth due to its efficiency and rapid nutrient uptake by plants. By Crop Type: Field crops (particularly cereals and oilseeds) currently represent the largest share, although horticultural crops are exhibiting faster growth. By Country: Germany, France, and the United Kingdom consistently represent the largest markets due to their extensive agricultural landscapes and favorable regulatory environments.

- Key Drivers (Germany): High agricultural output, strong government support for sustainable agriculture, and robust R&D investment.

- Key Drivers (France): Large-scale farming operations, favorable climatic conditions, and high demand for high-yield crops.

- Key Drivers (United Kingdom): Developed horticultural sector and increasing focus on enhancing soil health.

Europe Micronutrient Fertilizer Market Product Innovations

Recent innovations focus on enhancing nutrient uptake, improving product efficacy, and minimizing environmental impact. The introduction of advanced chelates (e.g., Tradecorp's IsliFe 8.2) enhances nutrient availability under diverse soil conditions. Controlled-release formulations ensure gradual nutrient release, optimizing uptake efficiency and reducing nutrient runoff. Bio-stimulants are being integrated into micronutrient fertilizers to boost plant growth and stress tolerance, further enhancing overall crop yield.

Propelling Factors for Europe Micronutrient Fertilizer Market Growth

Several factors propel market growth, including rising agricultural output demand, increasing awareness of micronutrient deficiencies, and stringent environmental regulations that push for efficient fertilizer use. Technological advancements in precision agriculture, like variable rate application, further enhance fertilizer utilization, reducing waste and maximizing crop yields. Favorable government policies and subsidies in many EU countries support the adoption of sustainable agricultural practices, boosting micronutrient fertilizer uptake.

Obstacles in the Europe Micronutrient Fertilizer Market Market

Challenges to market growth include fluctuating raw material prices, which directly impact fertilizer costs. Supply chain disruptions caused by geopolitical events and climate change can also lead to shortages and price volatility. Furthermore, stringent environmental regulations and the potential for nutrient runoff place a limit on fertilizer usage and push innovation for sustainable alternatives. Competition from substitute products, like organic fertilizers, also presents a challenge.

Future Opportunities in Europe Micronutrient Fertilizer Market

Future opportunities lie in developing innovative, sustainable formulations with enhanced nutrient uptake efficiency. Expanding into niche markets, such as organic farming and vertical agriculture, also presents growth potential. Increasing demand for bio-stimulants integrated with micronutrients holds significant promise, and precision agriculture technologies will continue to drive efficiency gains and optimized fertilizer usage. Exploring novel nutrient delivery methods like nanotechnology could further boost market growth.

Major Players in the Europe Micronutrient Fertilizer Market Ecosystem

- Verdesian Life Sciences

- Fertiberia

- AGLUKON Spezialduenger GmbH & Co

- Sociedad Quimica y Minera de Chile SA

- Kingenta Ecological Engineering Group Co Ltd

- Haifa Group Ltd

- Compo Expert GmbH

- Trade Corporation International

- Yara International AS

- Valagro

Key Developments in Europe Micronutrient Fertilizer Market Industry

- July 2019: Tradecorp released IsliFe 8.2, a highly efficient iron chelate with progressive biodegradability.

- February 2020: Valagro announced Yaxe®, a joint venture focused on digital solutions in agriculture.

- August 2021: COMPO EXPERT merged with Grupa Azoty, expanding its reach in the European nitrogen fertilizer market.

Strategic Europe Micronutrient Fertilizer Market Market Forecast

The Europe micronutrient fertilizer market is poised for continued growth, fueled by technological advancements and sustainable farming practices. The market's future potential is significant, driven by the need for enhanced crop productivity and efficient resource utilization in a world facing increasing population and environmental challenges. The ongoing shift toward precision agriculture and the development of sustainable formulations will play a key role in shaping the market's trajectory in the coming years.

Europe Micronutrient Fertilizer Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Micronutrient Fertilizer Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Micronutrient Fertilizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Zinc is the largest segment by Product.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Micronutrient Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Germany Europe Micronutrient Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Micronutrient Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Micronutrient Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Micronutrient Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Micronutrient Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Micronutrient Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Micronutrient Fertilizer Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Verdesian Life Sciences

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Fertiberia

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 AGLUKON Spezialduenger GmbH & Co

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Sociedad Quimica y Minera de Chile SA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Kingenta Ecological Engineering Group Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Haifa Group Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Compo Expert GmbH

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Trade Corporation International

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Yara International AS

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Valagro

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Verdesian Life Sciences

List of Figures

- Figure 1: Europe Micronutrient Fertilizer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Micronutrient Fertilizer Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Micronutrient Fertilizer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Micronutrient Fertilizer Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Europe Micronutrient Fertilizer Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Europe Micronutrient Fertilizer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Europe Micronutrient Fertilizer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Europe Micronutrient Fertilizer Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Europe Micronutrient Fertilizer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Micronutrient Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Netherlands Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sweden Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Europe Micronutrient Fertilizer Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Europe Micronutrient Fertilizer Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Europe Micronutrient Fertilizer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Europe Micronutrient Fertilizer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Europe Micronutrient Fertilizer Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Europe Micronutrient Fertilizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Belgium Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Sweden Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Norway Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Poland Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Denmark Europe Micronutrient Fertilizer Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Micronutrient Fertilizer Market?

The projected CAGR is approximately 15.30%.

2. Which companies are prominent players in the Europe Micronutrient Fertilizer Market?

Key companies in the market include Verdesian Life Sciences, Fertiberia, AGLUKON Spezialduenger GmbH & Co, Sociedad Quimica y Minera de Chile SA, Kingenta Ecological Engineering Group Co Ltd, Haifa Group Ltd, Compo Expert GmbH, Trade Corporation International, Yara International AS, Valagro.

3. What are the main segments of the Europe Micronutrient Fertilizer Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Zinc is the largest segment by Product..

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

August 2021: COMPO EXPERT got merged into Groupa Azoty a largest nitrogen fertilizer manufacturing company in europe to devolop their business.February 2020: Valagro, announced Yaxe®, a joint venture with e-Novia, the Enterprises Factory based in Milan, Italy. The new venture is focused on innovative digital solutions in agriculture to help optimize crop inputs and resources at the farm level.July 2019: Tradecorp released highly efficient iron chelate with progressive biodegradability IsliFe 8.2, a new solution to identify and correct iron deficiencies even under unfavourable conditions such as calcsreous and alkaline soils as well as extreeme PH ranges.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Micronutrient Fertilizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Micronutrient Fertilizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Micronutrient Fertilizer Market?

To stay informed about further developments, trends, and reports in the Europe Micronutrient Fertilizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence