Key Insights

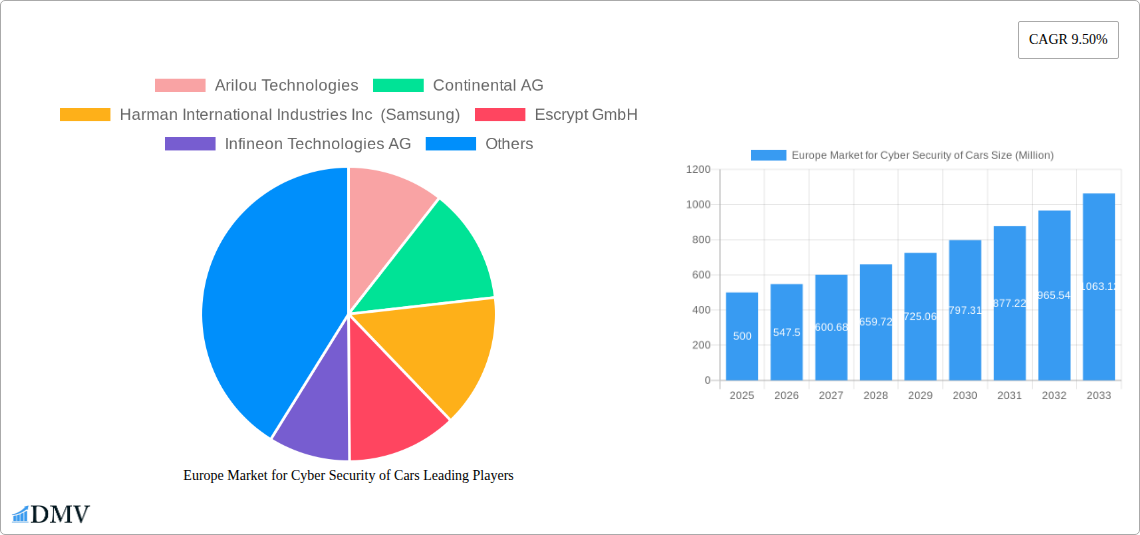

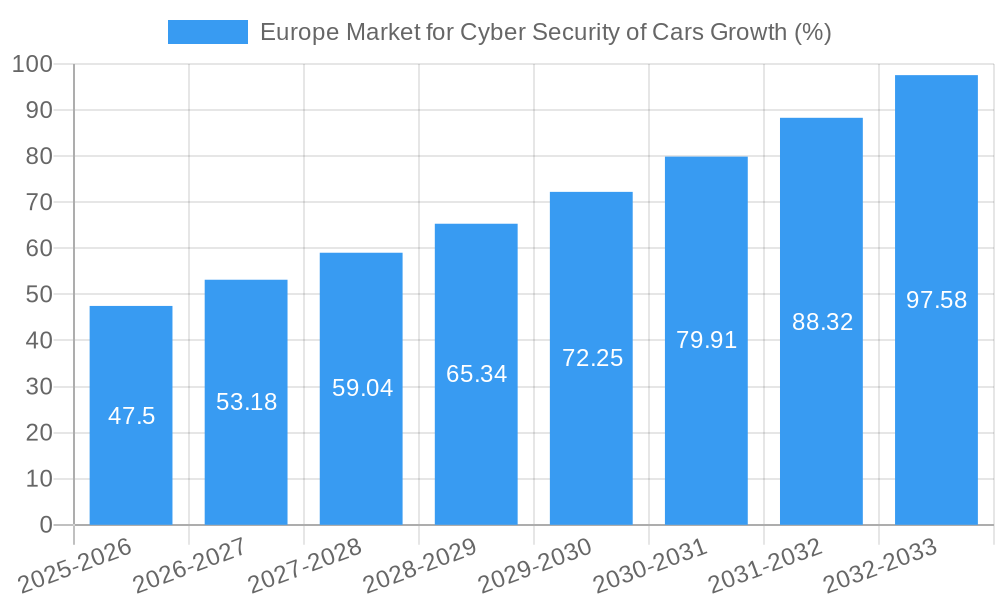

The European market for automotive cybersecurity is experiencing robust growth, driven by the increasing connectivity and sophistication of vehicles. The market, valued at approximately €[Estimate based on "XX" and context, e.g., €500 million] in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 9.50% from 2025 to 2033. This growth is fueled by several key factors. The rising adoption of connected car technologies, including advanced driver-assistance systems (ADAS) and infotainment systems, creates a larger attack surface, necessitating robust cybersecurity measures. Furthermore, stringent government regulations and increasing consumer awareness of data privacy and security concerns are pushing automakers and component suppliers to invest heavily in automotive cybersecurity solutions. The trend towards software-defined vehicles (SDVs) further accelerates market expansion, as software updates and over-the-air (OTA) capabilities introduce new security challenges. While the market faces restraints such as high initial investment costs for implementing security solutions and the complexity of integrating security into existing vehicle architectures, the overall growth trajectory remains positive. The market is segmented by solution type (software, hardware, services), equipment type (network, application, cloud security), and geography, with Germany, France, the UK, and Italy representing significant regional markets within Europe.

The competitive landscape is characterized by a mix of established automotive players, dedicated cybersecurity firms, and technology giants. Companies like Continental AG, Harman International, Infineon Technologies, and NXP Semiconductors are actively developing and integrating cybersecurity solutions into their automotive offerings. Specialized cybersecurity companies such as Argus Cybersecurity and Secunet AG are also playing a crucial role by providing advanced security technologies and services. The increasing collaboration between these players is fostering innovation and driving the adoption of comprehensive cybersecurity solutions across the European automotive industry. The forecast period to 2033 indicates a significant expansion of the market, driven by continuous technological advancements, regulatory compliance mandates, and escalating consumer demand for secure and reliable connected vehicles. The continued growth in electric vehicles (EVs) and autonomous vehicles (AVs) will further fuel this demand, emphasizing the critical need for sophisticated cybersecurity architectures.

Europe Market for Cyber Security of Cars: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Europe market for automotive cybersecurity, offering a comprehensive overview of market trends, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on this rapidly evolving market. The market is estimated to be worth xx Million in 2025.

Europe Market for Cyber Security of Cars Market Composition & Trends

This section delves into the competitive landscape of the European automotive cybersecurity market, examining market concentration, innovation drivers, regulatory influences, and merger & acquisition (M&A) activity. We analyze the market share distribution among key players, revealing the dominance of established players like Continental AG and newcomers such as Arilou Technologies. M&A activity is assessed, with an estimated xx Million in deal values recorded during the historical period (2019-2024).

- Market Concentration: Highly fragmented, with a few dominant players and numerous smaller, specialized firms.

- Innovation Catalysts: Increasing vehicle connectivity, stringent data privacy regulations (GDPR), and rising sophistication of cyberattacks are driving innovation.

- Regulatory Landscape: Evolving regulations across European nations are creating both challenges and opportunities for cybersecurity vendors.

- Substitute Products: Limited direct substitutes, but alternative security measures within vehicle systems exist.

- End-User Profiles: Automakers (OEMs), Tier-1 suppliers, and fleet operators are the primary end-users.

- M&A Activities: Consolidation is expected to increase, driven by the need for broader expertise and scale. The xx Million in M&A deals from 2019-2024 indicates significant investment and industry restructuring.

Europe Market for Cyber Security of Cars Industry Evolution

This section examines the historical and projected growth trajectories of the European automotive cybersecurity market. We analyze technological advancements, such as the increasing adoption of AI and machine learning in threat detection, and the shifting consumer demands for enhanced vehicle security. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching an estimated value of xx Million by 2033. This growth is fueled by rising vehicle connectivity, stricter regulations, and increasing consumer awareness of cybersecurity risks. Adoption rates for various cybersecurity solutions are analyzed, with software-based solutions showing the highest uptake due to their flexibility and cost-effectiveness.

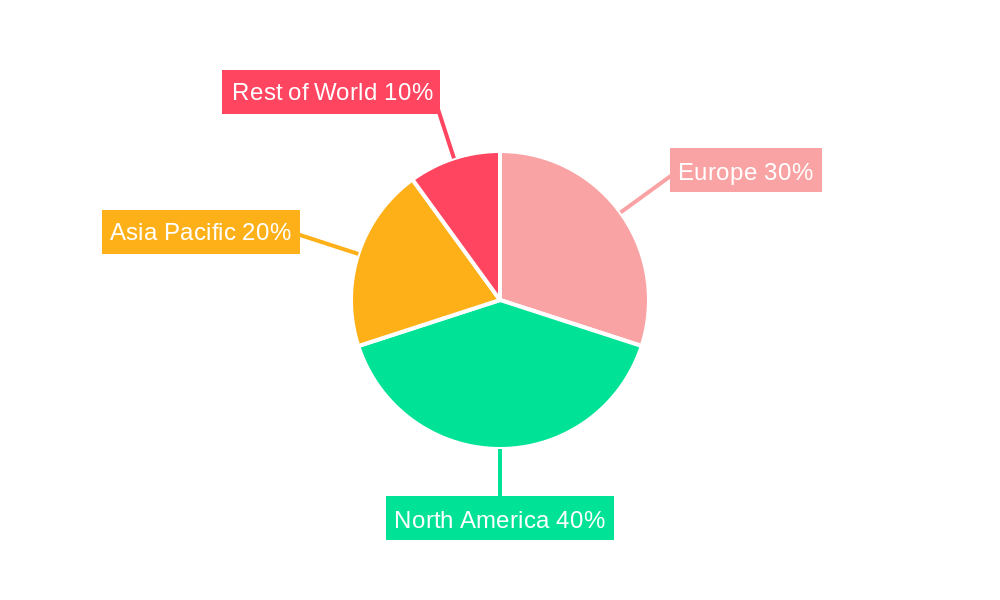

Leading Regions, Countries, or Segments in Europe Market for Cyber Security of Cars

This section identifies the leading regions, countries, and segments within the European automotive cybersecurity market. The UK, Germany, and France are currently the leading markets, driven by factors such as strong automotive industries, advanced technological infrastructure, and proactive regulatory frameworks.

- By Solution Type: Software-based solutions currently hold the largest market share, due to their flexibility and scalability.

- By Equipment Type: Network security solutions are leading due to the increasing connectivity of vehicles.

- By Country:

- United Kingdom: Strong automotive sector and early adoption of cybersecurity technologies.

- Germany: Leading automotive manufacturing hub with robust cybersecurity infrastructure.

- France: Growing automotive industry and increasing focus on digital transformation.

- Italy: A relatively smaller market but with growing potential due to investment in automotive innovation.

- Rest of Europe: Shows a steady growth rate, contributing significantly to the overall market expansion.

The dominance of specific regions and segments is analyzed, considering investment trends, regulatory support, and the presence of key players.

Europe Market for Cyber Security of Cars Product Innovations

Recent product innovations include advanced threat detection systems utilizing AI and machine learning, improved encryption algorithms for secure data transmission, and seamless integration of cybersecurity solutions within vehicle architectures. These innovations enhance the overall security posture of vehicles, offering better protection against a wide range of cyber threats. Unique selling propositions focus on ease of integration, real-time threat detection, and proactive mitigation strategies.

Propelling Factors for Europe Market for Cyber Security of Cars Growth

Several factors are driving market growth, including rising vehicle connectivity, increasing consumer awareness of cybersecurity risks, and the implementation of stringent data privacy regulations like GDPR. Government initiatives promoting cybersecurity in the automotive sector and technological advancements are also contributing to market expansion. The increasing adoption of over-the-air (OTA) updates for software-based solutions provides continuous security enhancements, further fueling market growth.

Obstacles in the Europe Market for Cyber Security of Cars Market

Despite promising growth prospects, challenges exist. These include the high cost of implementing sophisticated cybersecurity solutions, complexity of integrating these solutions across diverse vehicle architectures, and the risk of supply chain disruptions impacting the availability of critical components. Furthermore, ensuring compliance with constantly evolving data privacy regulations presents a significant hurdle for companies operating in this sector.

Future Opportunities in Europe Market for Cyber Security of Cars

Emerging opportunities lie in the development of advanced threat intelligence platforms, AI-powered predictive analytics for threat prevention, and the integration of cybersecurity solutions with autonomous driving technologies. Expanding into emerging markets within Europe and focusing on specialized security solutions for electric vehicles and connected car services will also offer lucrative opportunities.

Major Players in the Europe Market for Cyber Security of Cars Ecosystem

- Arilou Technologies

- Continental AG

- Harman International Industries Inc (Samsung)

- Escrypt GmbH

- Infineon Technologies AG

- Visteon Corporation

- Secunet AG

- Delphi Automotive PLC

- IBM Corporation

- NXP Semiconductors NV

- Argus Cybersecurity

- Cisco Systems Inc

- Honeywell International Inc

Key Developments in Europe Market for Cyber Security of Cars Industry

- January 2020: HARMAN launched the HARMAN Ignite Marketplace, providing automakers with a secure and efficient way to deliver and update services while mitigating cybersecurity risks. This launch signified a significant shift towards cloud-based solutions and OTA updates for automotive cybersecurity.

Strategic Europe Market for Cyber Security of Cars Market Forecast

The European automotive cybersecurity market is poised for significant growth, driven by increasing vehicle connectivity, stringent regulations, and technological advancements. The forecast period (2025-2033) anticipates robust expansion, with substantial opportunities for companies that can innovate, adapt to evolving regulatory landscapes, and provide comprehensive, integrated cybersecurity solutions. The market's future growth will be significantly influenced by the adoption of advanced technologies, such as AI and machine learning, in threat detection and prevention.

Europe Market for Cyber Security of Cars Segmentation

-

1. Solution Type

- 1.1. Software-based

- 1.2. Hardware-based

- 1.3. Professional Service

- 1.4. Integration

- 1.5. Other Types of Solution

-

2. Equipment Type

- 2.1. Network Security

- 2.2. Application Security

- 2.3. Cloud Security

- 2.4. Other Types of Security

Europe Market for Cyber Security of Cars Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Market for Cyber Security of Cars REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Security Threats as More Technologies Get Integrated Into Cars; Government Regulations

- 3.3. Market Restrains

- 3.3.1. Unavailability for skilled workforce

- 3.4. Market Trends

- 3.4.1. Cloud Security Expected to Witness Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Software-based

- 5.1.2. Hardware-based

- 5.1.3. Professional Service

- 5.1.4. Integration

- 5.1.5. Other Types of Solution

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Network Security

- 5.2.2. Application Security

- 5.2.3. Cloud Security

- 5.2.4. Other Types of Security

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Germany Europe Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Market for Cyber Security of Cars Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Arilou Technologies

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Continental AG

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Harman International Industries Inc (Samsung)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Escrypt GmbH

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Infineon Technologies AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Visteon Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Secunet AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Delphi Automotive PLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 IBM Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 NXP Semiconductors NV

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Argus Cybersecurity

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Cisco Systems Inc

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Honeywell International Inc

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.1 Arilou Technologies

List of Figures

- Figure 1: Europe Market for Cyber Security of Cars Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Market for Cyber Security of Cars Share (%) by Company 2024

List of Tables

- Table 1: Europe Market for Cyber Security of Cars Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Market for Cyber Security of Cars Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 3: Europe Market for Cyber Security of Cars Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 4: Europe Market for Cyber Security of Cars Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Market for Cyber Security of Cars Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Market for Cyber Security of Cars Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 14: Europe Market for Cyber Security of Cars Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 15: Europe Market for Cyber Security of Cars Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Market for Cyber Security of Cars Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Market for Cyber Security of Cars?

The projected CAGR is approximately 9.50%.

2. Which companies are prominent players in the Europe Market for Cyber Security of Cars?

Key companies in the market include Arilou Technologies, Continental AG, Harman International Industries Inc (Samsung), Escrypt GmbH, Infineon Technologies AG, Visteon Corporation, Secunet AG, Delphi Automotive PLC, IBM Corporation, NXP Semiconductors NV, Argus Cybersecurity, Cisco Systems Inc, Honeywell International Inc.

3. What are the main segments of the Europe Market for Cyber Security of Cars?

The market segments include Solution Type, Equipment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Security Threats as More Technologies Get Integrated Into Cars; Government Regulations.

6. What are the notable trends driving market growth?

Cloud Security Expected to Witness Significant Market Share.

7. Are there any restraints impacting market growth?

Unavailability for skilled workforce.

8. Can you provide examples of recent developments in the market?

January 2020 - HARMAN launched the HARMAN Ignite Marketplace, an extensive network of cloud-based applications and services available on the HARMAN Ignite Cloud Platform. The HARMAN Ignite platform provides a built-in Over-the-Air (OTA) functionality, which helps manage potential risks like network problems, file tampering, and cybersecurity attacks, due to which automakers are equipped with a secure and efficient way to deliver and frequently update a robust service ecosystem while still mitigating risk.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Market for Cyber Security of Cars," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Market for Cyber Security of Cars report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Market for Cyber Security of Cars?

To stay informed about further developments, trends, and reports in the Europe Market for Cyber Security of Cars, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence