Key Insights

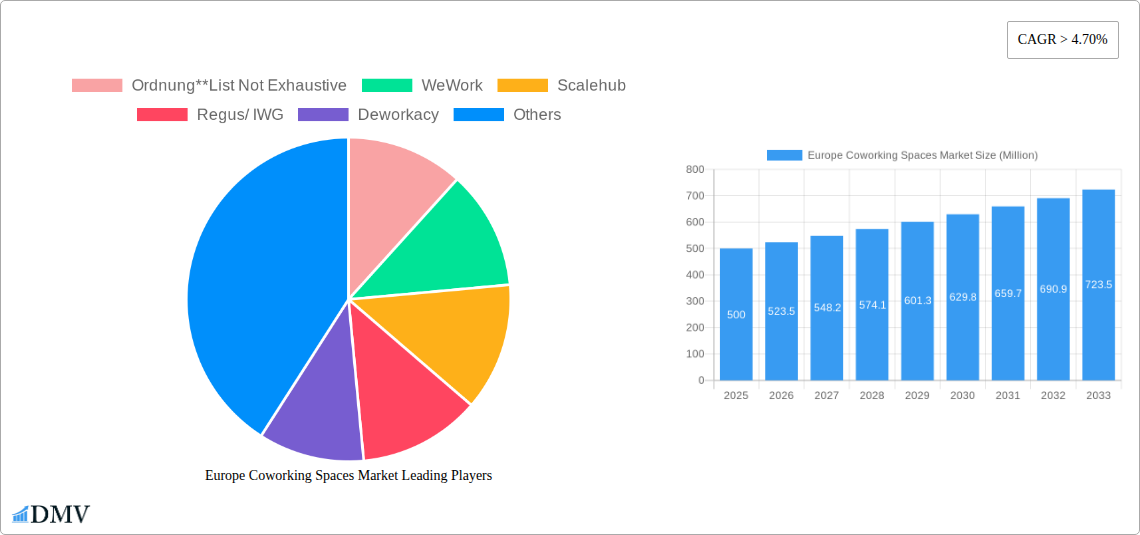

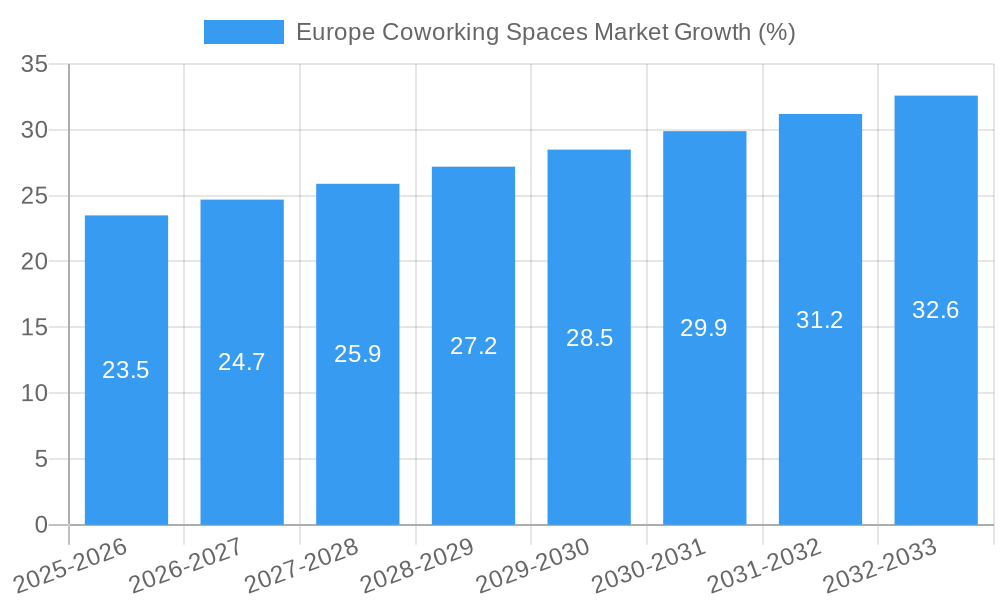

The European coworking spaces market is experiencing robust growth, fueled by a confluence of factors. The market, currently valued in the hundreds of millions (a precise figure cannot be provided without the missing market size "XX" value, but estimations based on similar markets and the provided CAGR suggest a figure in this range), is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4.70% from 2025 to 2033. This expansion is driven by several key trends: the increasing preference for flexible work arrangements among independent professionals, startup teams, and SMEs seeking cost-effective and collaborative work environments; the rise of remote work and the need for professional, well-equipped spaces outside of traditional offices; and the expansion of coworking spaces into diverse business models, such as sub-lease, revenue-sharing, and owner-operator models, catering to a wide array of user needs. Strong growth is expected across major European countries like the UK, Germany, France, and Spain, with significant potential in other emerging markets within the region.

The market segmentation highlights diverse opportunities. The demand for coworking spaces is particularly strong amongst SMEs and independent professionals, reflecting a broader shift towards agile and adaptable work practices. The "New Spaces" segment within the business type category also signifies a promising avenue for investment and growth, indicating a continuous expansion of the coworking infrastructure. However, challenges exist. Potential restraints include economic fluctuations that might impact the affordability of coworking spaces for smaller businesses, and competition from established office providers and increasingly sophisticated virtual office solutions. Nevertheless, the overall market outlook remains positive, with the projected growth suggesting a long-term opportunity for investors and operators in the European coworking spaces sector. The continued evolution of business models and the adaptability of coworking providers to the changing needs of their clients will be key to navigating the market's dynamics and capitalizing on its growth potential.

Europe Coworking Spaces Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic Europe coworking spaces market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Europe Coworking Spaces Market Composition & Trends

The European coworking spaces market is characterized by a moderate level of concentration, with key players like WeWork, Regus/IWG, and Scalehub holding significant market share. However, a large number of smaller, independent operators also contribute significantly to the overall market. The market's growth is fueled by several factors, including the increasing preference for flexible work arrangements, technological advancements facilitating remote work, and supportive government policies promoting entrepreneurship. Regulatory landscapes vary across European countries, influencing market access and operational costs. Substitute products, such as traditional office spaces and home offices, still exist but face increasing competition due to coworking's inherent flexibility and community features.

Market Share Distribution (Estimated 2025):

- WeWork: xx%

- Regus/IWG: xx%

- Scalehub: xx%

- Others: xx%

M&A Activities (2019-2024):

- Total deal value: xx Million

- Average deal size: xx Million

- Number of deals: xx

The report further analyzes end-user profiles, revealing a diverse customer base encompassing independent professionals, startup teams, SMEs, and large corporations. M&A activity has been significant, reflecting consolidation within the industry and strategic expansion by major players.

Europe Coworking Spaces Market Industry Evolution

The European coworking spaces market has experienced substantial growth since 2019, driven by a confluence of factors. The shift towards remote work, accelerated by the pandemic, has significantly boosted demand for flexible and collaborative workspaces. Technological advancements, such as high-speed internet and collaborative software, have further facilitated the adoption of coworking spaces. Changing consumer demands, emphasizing work-life balance and community engagement, are also contributing factors. Growth rates have varied across countries, with the UK, Germany, and France leading the way. Adoption metrics, such as the number of coworking spaces per capita and market penetration, are also analyzed in detail, highlighting regional variations and future growth potential. The industry has seen a significant increase in the number of spaces, particularly in major urban centers, with a notable shift towards more specialized offerings catering to specific industries or professional groups. Data points highlighting specific growth rates and adoption metrics are provided within the full report.

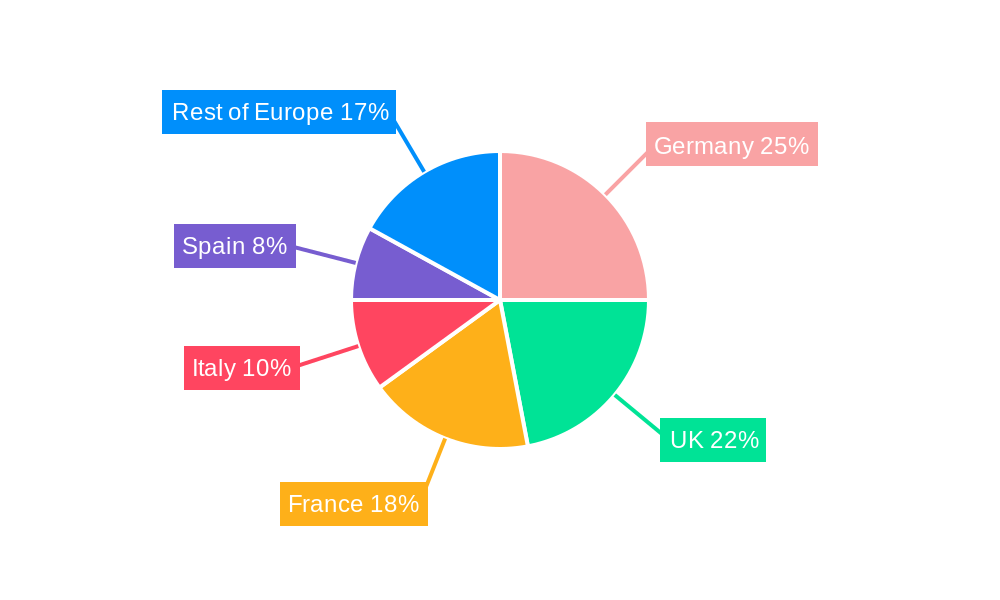

Leading Regions, Countries, or Segments in Europe Coworking Spaces Market

The UK currently holds the leading position in the European coworking spaces market, followed closely by Germany and France. This dominance is attributed to several factors:

Key Drivers:

- High density of startups and SMEs: These represent a major customer base for coworking spaces.

- Robust venture capital investment: Funding fuels the growth of both coworking operators and businesses utilizing these spaces.

- Supportive regulatory environment: Policies facilitating flexible work arrangements and business setup contribute to market expansion.

Dominance Factors (UK):

- Established ecosystem of coworking spaces.

- High concentration of multinational corporations utilizing coworking for satellite offices.

- Strong entrepreneurial culture.

Among end-user segments, SMEs currently represent the largest customer base, followed by independent professionals and startups. The "New Spaces" business type shows the highest growth, driven by increasing demand. The Revenue Sharing Model is the most prevalent business model. Further country-specific analysis is detailed within the report.

Europe Coworking Spaces Market Product Innovations

The coworking space industry is witnessing continuous product innovation, focusing on enhanced amenities, technological integration, and tailored services. Many spaces now offer advanced meeting room technology, high-speed internet, and dedicated community managers. Some operators are incorporating wellness features, such as gyms and meditation rooms, to attract a broader customer base. Unique selling propositions include specialized workspaces for specific industries, providing industry-focused events, mentorship programs, and networking opportunities. Technological advancements in booking systems, access control, and virtual office solutions are enhancing the overall user experience.

Propelling Factors for Europe Coworking Spaces Market Growth

Several factors contribute to the projected growth of the European coworking spaces market. Technological advancements, like high-speed internet and collaborative software, support remote work and flexible work arrangements. Favorable economic conditions, particularly in major European cities, fuel startup activity and expansion of SMEs, driving demand. Furthermore, government initiatives and policies encouraging entrepreneurship and flexible work arrangements are creating a supportive regulatory environment.

Obstacles in the Europe Coworking Spaces Market

The European coworking spaces market faces several challenges. Regulatory hurdles, such as zoning laws and licensing requirements, can hinder expansion. Supply chain disruptions, impacting construction and furnishing costs, can affect profitability. Intense competition among established players and new entrants creates pricing pressure. The report quantifies the impact of these factors on market growth.

Future Opportunities in Europe Coworking Spaces Market

Future opportunities lie in expanding into underserved markets within Europe, leveraging emerging technologies like AI and IoT to enhance the customer experience, and catering to the evolving needs of remote workers and hybrid teams. Specialized coworking spaces catering to specific industries or demographics represent a significant growth area. The focus on sustainable practices and environmentally friendly spaces will further attract customers.

Major Players in the Europe Coworking Spaces Market Ecosystem

- Ordnung

- WeWork

- Scalehub

- Regus/IWG

- Deworkacy

- Morning Coworking

- DBH Business Services

- The Office Group

- Klein Kantoor

- Matrikel1

Key Developments in Europe Coworking Spaces Market Industry

- 2022 Q3: WeWork announces expansion into several new European cities.

- 2023 Q1: Regus/IWG launches a new flexible office product with enhanced technology integration.

- 2024 Q2: A major merger occurs between two smaller coworking operators in Germany.

- (Further details within the complete report)

Strategic Europe Coworking Spaces Market Forecast

The European coworking spaces market is poised for continued growth, driven by sustained demand for flexible workspaces, technological innovation, and supportive policy environments. Emerging opportunities in specialized spaces, sustainable practices, and technological integration will shape the market's future. The market is expected to maintain a robust growth trajectory over the forecast period, presenting significant opportunities for established players and new entrants alike.

Europe Coworking Spaces Market Segmentation

-

1. End User

- 1.1. Information Technology (IT and ITES)

- 1.2. BFSI (Banking, Financial Services and Insurance)

- 1.3. Business Consulting & Professional Services

- 1.4. Other Se

-

2. User

- 2.1. Freelancers

- 2.2. Enterprises

- 2.3. Start Ups

- 2.4. Others

Europe Coworking Spaces Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Coworking Spaces Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise in e-commerce and digitalization

- 3.3. Market Restrains

- 3.3.1. The Complexity of regulations and property ownership

- 3.4. Market Trends

- 3.4.1. Increasing deals for coworking spaces in London and Paris

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Coworking Spaces Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Information Technology (IT and ITES)

- 5.1.2. BFSI (Banking, Financial Services and Insurance)

- 5.1.3. Business Consulting & Professional Services

- 5.1.4. Other Se

- 5.2. Market Analysis, Insights and Forecast - by User

- 5.2.1. Freelancers

- 5.2.2. Enterprises

- 5.2.3. Start Ups

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Germany Europe Coworking Spaces Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Coworking Spaces Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Coworking Spaces Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Coworking Spaces Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Coworking Spaces Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Coworking Spaces Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Coworking Spaces Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Ordnung**List Not Exhaustive

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 WeWork

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Scalehub

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Regus/ IWG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Deworkacy

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Morning Coworking

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 DBH Business Services

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 The Office Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Klein Kantoor

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Matrikel1

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Ordnung**List Not Exhaustive

List of Figures

- Figure 1: Europe Coworking Spaces Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Coworking Spaces Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Coworking Spaces Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Coworking Spaces Market Revenue Million Forecast, by End User 2019 & 2032

- Table 3: Europe Coworking Spaces Market Revenue Million Forecast, by User 2019 & 2032

- Table 4: Europe Coworking Spaces Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Coworking Spaces Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Coworking Spaces Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Europe Coworking Spaces Market Revenue Million Forecast, by User 2019 & 2032

- Table 15: Europe Coworking Spaces Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Coworking Spaces Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Coworking Spaces Market?

The projected CAGR is approximately > 4.70%.

2. Which companies are prominent players in the Europe Coworking Spaces Market?

Key companies in the market include Ordnung**List Not Exhaustive, WeWork, Scalehub, Regus/ IWG, Deworkacy, Morning Coworking, DBH Business Services, The Office Group, Klein Kantoor, Matrikel1.

3. What are the main segments of the Europe Coworking Spaces Market?

The market segments include End User, User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rise in e-commerce and digitalization.

6. What are the notable trends driving market growth?

Increasing deals for coworking spaces in London and Paris.

7. Are there any restraints impacting market growth?

The Complexity of regulations and property ownership.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Coworking Spaces Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Coworking Spaces Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Coworking Spaces Market?

To stay informed about further developments, trends, and reports in the Europe Coworking Spaces Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence