Key Insights

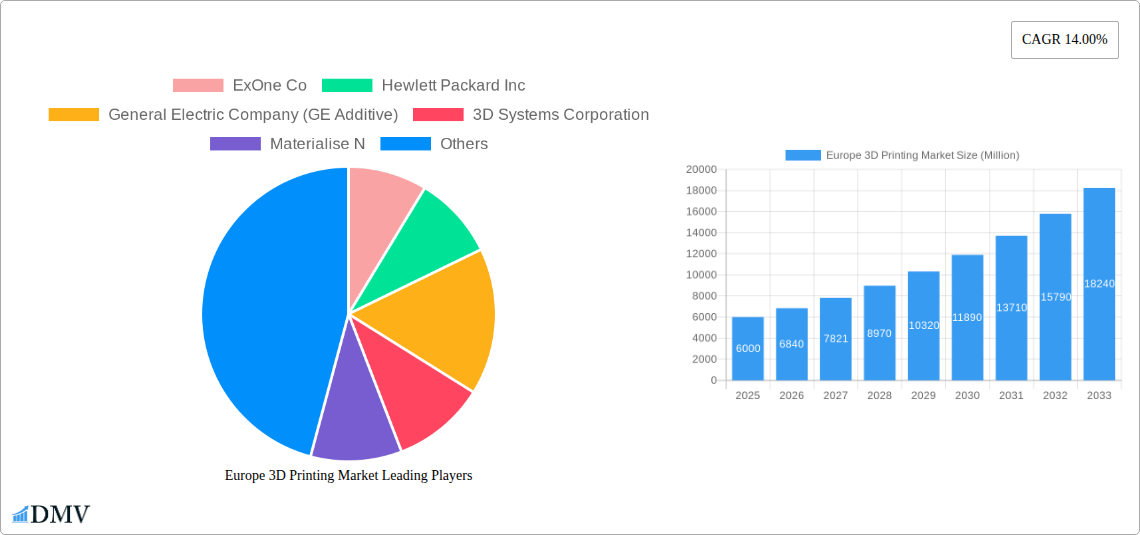

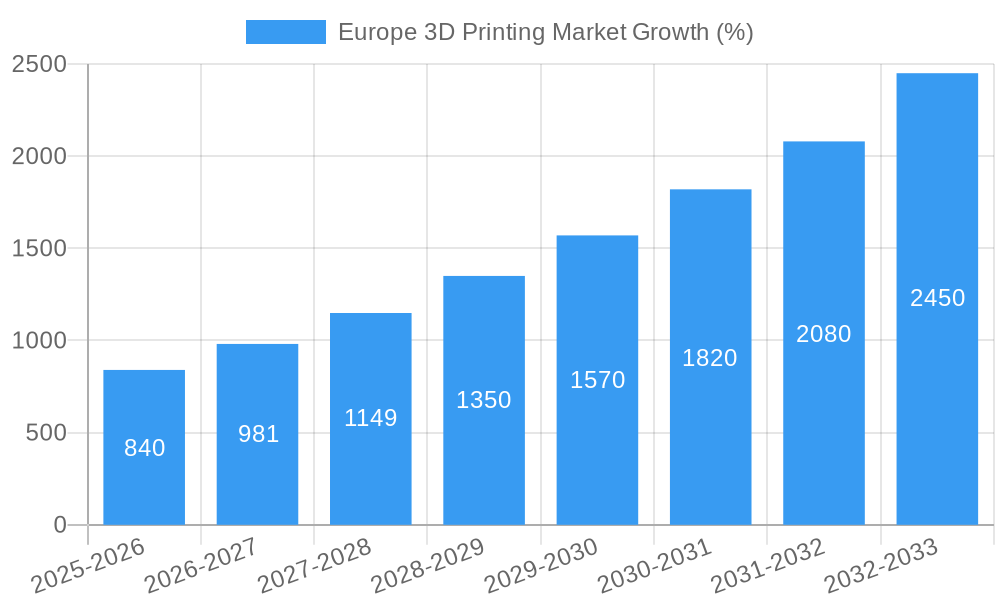

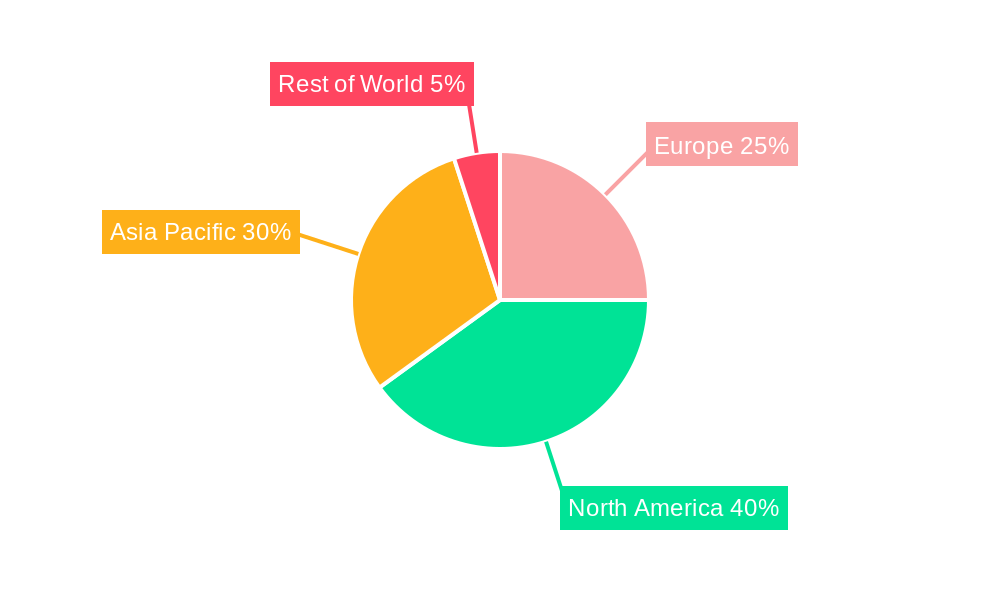

The European 3D printing market, valued at €6 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 14% from 2025 to 2033. This expansion is driven by several key factors. Increasing adoption across diverse sectors like automotive, aerospace, and healthcare, fueled by the need for rapid prototyping, customized designs, and reduced manufacturing costs, is a major catalyst. Advancements in 3D printing technologies, particularly in areas like SLA, FDM, and SLS, are enhancing print quality, speed, and material versatility, further stimulating market growth. Government initiatives promoting technological innovation and industrial automation across Europe are also contributing positively. While the market faces challenges such as high initial investment costs for equipment and the need for skilled labor, the overall positive trends significantly outweigh these limitations. Germany, the United Kingdom, and France represent the largest national markets within Europe, benefiting from a strong manufacturing base and technological expertise. The projected growth indicates significant opportunities for 3D printing companies, especially those offering innovative solutions, comprehensive services, and strong regional presence.

The diverse segments within the European 3D printing market present varied growth trajectories. The services segment is expected to witness faster growth compared to the hardware segment due to the increasing demand for design and printing services, particularly amongst small and medium-sized enterprises (SMEs) lacking in-house expertise. Within technologies, SLA and FDM maintain their dominance, but other technologies like SLS and electron beam melting are witnessing substantial growth, driven by their capabilities in producing high-strength and complex parts. The automotive and aerospace sectors are leading adopters, owing to the demand for lightweight, customized components. However, growth across healthcare, construction, and energy sectors is also accelerating, indicating a broadening market application. Competition among key players remains intense, with both established players and innovative startups vying for market share. Companies are focused on strategic partnerships, product innovation, and expansion into new geographical markets to maintain a competitive edge.

Europe 3D Printing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe 3D printing market, offering valuable insights for stakeholders across the value chain. Covering the period from 2019 to 2033, with a focus on 2025, this study meticulously examines market trends, technological advancements, and competitive dynamics, ultimately forecasting future growth trajectories. The report leverages extensive primary and secondary research, incorporating data from leading industry players, market research firms, and government publications. The total market size in 2025 is estimated at xx Million.

Europe 3D Printing Market Composition & Trends

The European 3D printing market exhibits a moderately concentrated landscape, with key players like Stratasys Ltd, 3D Systems Corporation, and HP Inc. holding significant market share. However, the emergence of innovative startups and the increasing adoption of 3D printing technologies across various sectors are fostering competition. The market's evolution is fueled by several factors, including:

- Technological Advancements: Continuous improvements in printing speed, resolution, material diversity (metals, polymers, composites), and software solutions are driving market expansion.

- Regulatory Landscape: Government initiatives promoting additive manufacturing and Industry 4.0 are creating favorable conditions for market growth, particularly in sectors like aerospace and healthcare.

- Substitute Products: Traditional manufacturing methods remain competitive in certain applications, limiting the overall market penetration of 3D printing. However, the unique capabilities of 3D printing, especially in prototyping and customized production, are steadily expanding its addressable market.

- End-User Profiles: Diverse end-user industries, including automotive, aerospace, healthcare, and consumer goods, are increasingly integrating 3D printing into their workflows, contributing to its consistent growth.

- M&A Activities: Recent high-value mergers and acquisitions, such as Nikon's acquisition of SLM Solutions (EUR 622 Million) and Stratasys' acquisition of Covestro's additive manufacturing materials business, highlight the sector's dynamism and consolidation. The total value of M&A deals within the European 3D printing market between 2019 and 2024 is estimated at xx Million. Market share distribution in 2025 is approximated as follows: Stratasys Ltd. (xx%), 3D Systems Corporation (xx%), HP Inc. (xx%), Others (xx%).

Europe 3D Printing Market Industry Evolution

The European 3D printing market has witnessed remarkable growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth trajectory is anticipated to continue during the forecast period (2025-2033), albeit at a potentially moderated pace, projecting a CAGR of xx%. Several factors have contributed to this expansion, including:

- Technological advancements: The continuous development of more efficient and cost-effective 3D printing technologies, especially in metal additive manufacturing, has expanded the range of applications and industries adopting this technology.

- Increased adoption rates: The adoption of 3D printing is accelerating across various sectors, driven by the need for rapid prototyping, customized designs, and on-demand manufacturing. The adoption rate in the automotive sector is estimated to increase from xx% in 2024 to xx% in 2033.

- Shifting consumer demands: Consumers increasingly demand personalized and customized products, fueling the growth of on-demand manufacturing capabilities offered by 3D printing.

- Growing investments in research and development: Significant investments in research and development (R&D) across both academia and the private sector continue to improve 3D printing technology, leading to higher precision and faster printing speeds. This includes advancements in materials science, software, and post-processing techniques.

- Government support and initiatives: Governments across Europe are actively promoting the development and adoption of 3D printing through various initiatives and funding programs.

Leading Regions, Countries, or Segments in Europe 3D Printing Market

By Component: The hardware segment currently dominates the market, driven by high demand for 3D printers across various applications. However, the services segment is experiencing rapid growth, fueled by the increasing need for specialized expertise in design, printing, and post-processing.

By Technology: Selective Laser Sintering (SLS) and Fused Deposition Modeling (FDM) technologies currently hold significant market share due to their versatility and relatively lower cost. However, advancements in other technologies like Electron Beam Melting (EBM) and Stereo Lithography (SLA) are expected to expand their market penetration in the coming years.

By End-user Industry: The aerospace and defense, automotive, and healthcare sectors are leading adopters of 3D printing, primarily driven by the technology's capabilities in rapid prototyping, lightweighting, and customized component production.

By Country: Germany holds the largest market share in Europe, due to its strong manufacturing base, presence of leading 3D printing companies, and supportive government policies. The UK, France, and Italy also represent significant markets, driven by investments in advanced manufacturing and R&D. Key drivers in these regions include:

- Germany: Strong automotive and industrial base, robust research infrastructure, and government support for Industry 4.0 initiatives.

- United Kingdom: Focus on aerospace and medical applications, coupled with government initiatives to promote advanced manufacturing.

- France: Growing adoption in aerospace, automotive, and healthcare sectors, supported by ongoing investments in digital technologies.

- Italy: Established manufacturing sector, particularly in the automotive and fashion industries, showing increasing interest in integrating 3D printing.

- Spain and Netherlands: These countries demonstrate growing interest in 3D printing, driven by the adoption of the technology in various sectors, such as healthcare and manufacturing.

Europe 3D Printing Market Product Innovations

Recent product innovations focus on enhanced material capabilities, improved printing speeds, and increased automation. For instance, new polymers are offering improved strength, durability, and biocompatibility, expanding applications in the medical and aerospace fields. Integration of AI and machine learning algorithms is driving automated processes, improving efficiency and reducing human error. Unique selling propositions (USPs) often involve proprietary materials, advanced software suites, or specialized applications targeting niche sectors.

Propelling Factors for Europe 3D Printing Market Growth

The European 3D printing market's growth is fueled by technological advancements such as improved resolution and printing speeds, economic incentives like reduced production costs and localized manufacturing, and supportive regulatory frameworks fostering innovation. For example, government grants and subsidies aimed at adopting Industry 4.0 technologies have spurred investment in 3D printing across various sectors. Additionally, the growing demand for personalized products and the increasing need for rapid prototyping in various industrial sectors are driving market expansion.

Obstacles in the Europe 3D Printing Market

Challenges include the high initial investment cost for advanced 3D printing equipment, supply chain disruptions impacting material availability and manufacturing costs, and intense competition from established players and emerging startups. Furthermore, stringent regulatory requirements for certain applications, particularly in the medical and aerospace industries, can pose significant barriers to entry. The overall impact of these restraints on market growth is estimated to be xx% in 2025.

Future Opportunities in Europe 3D Printing Market

Emerging opportunities lie in exploring new applications within sectors like personalized medicine, customized consumer goods, and sustainable manufacturing. Advancements in materials science, including bioprinting and the use of recycled materials, will further expand the market's potential. Furthermore, exploring new business models, such as 3D printing as a service (3DPaaS), can unlock growth opportunities and make the technology accessible to a wider range of users.

Major Players in the Europe 3D Printing Market Ecosystem

- ExOne Co

- Hewlett Packard Inc

- General Electric Company (GE Additive)

- 3D Systems Corporation

- Materialise N

- SLM Solutions Group AG

- EOS GmbH

- Sisma SPA

- Ultimaker BV

- Stratasys Ltd

Key Developments in Europe 3D Printing Market Industry

- April 2023: Stratasys Ltd. acquires Covestro AG's additive manufacturing materials business, significantly expanding its material portfolio and market reach. This acquisition is expected to bolster Stratasys' position as a leading provider of polymer 3D printing solutions.

- January 2023: Nikon's acquisition of SLM Solutions strengthens its position in the metal 3D printing market, providing access to advanced technologies and expanding its customer base.

Strategic Europe 3D Printing Market Forecast

The European 3D printing market is poised for continued growth, driven by technological advancements, increasing adoption across various sectors, and supportive government policies. The market's future potential is vast, with opportunities spanning diverse applications and industries. The forecast suggests a significant market expansion over the next decade, driven by ongoing innovation and the increasing integration of 3D printing into mainstream manufacturing processes. The market is expected to reach xx Million by 2033.

Europe 3D Printing Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Services

-

2. Technology

- 2.1. Stereo Lithography (SLA)

- 2.2. Fused Deposition Modeling (FDM)

- 2.3. Electron Beam Melting

- 2.4. Digital Light Processing

- 2.5. Selective Laser Sintering (SLS)

- 2.6. Other Technologies

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Aerospace and Defense

- 3.3. Healthcare

- 3.4. Construction and Architecture

- 3.5. Energy

- 3.6. Food

- 3.7. Other End-user Industries

Europe 3D Printing Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe 3D Printing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Initiatives and Spending By Government; Ease in Development of Customized Products

- 3.3. Market Restrains

- 3.3.1. Lack of Enough Space to Build Self-storage Facilities

- 3.4. Market Trends

- 3.4.1. High Adoption of 3D Prototype Parts in Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe 3D Printing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Stereo Lithography (SLA)

- 5.2.2. Fused Deposition Modeling (FDM)

- 5.2.3. Electron Beam Melting

- 5.2.4. Digital Light Processing

- 5.2.5. Selective Laser Sintering (SLS)

- 5.2.6. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Aerospace and Defense

- 5.3.3. Healthcare

- 5.3.4. Construction and Architecture

- 5.3.5. Energy

- 5.3.6. Food

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Germany Europe 3D Printing Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe 3D Printing Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe 3D Printing Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe 3D Printing Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe 3D Printing Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe 3D Printing Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe 3D Printing Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ExOne Co

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hewlett Packard Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 General Electric Company (GE Additive)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 3D Systems Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Materialise N

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 SLM Solutions Group AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 EOS GmbH

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Sisma SPA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Ultimaker BV

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Stratasys Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 ExOne Co

List of Figures

- Figure 1: Europe 3D Printing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe 3D Printing Market Share (%) by Company 2024

List of Tables

- Table 1: Europe 3D Printing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe 3D Printing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Europe 3D Printing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Europe 3D Printing Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Europe 3D Printing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe 3D Printing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe 3D Printing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 15: Europe 3D Printing Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: Europe 3D Printing Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Europe 3D Printing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe 3D Printing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe 3D Printing Market?

The projected CAGR is approximately 14.00%.

2. Which companies are prominent players in the Europe 3D Printing Market?

Key companies in the market include ExOne Co, Hewlett Packard Inc, General Electric Company (GE Additive), 3D Systems Corporation, Materialise N, SLM Solutions Group AG, EOS GmbH, Sisma SPA, Ultimaker BV, Stratasys Ltd.

3. What are the main segments of the Europe 3D Printing Market?

The market segments include Component, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6 Million as of 2022.

5. What are some drivers contributing to market growth?

Initiatives and Spending By Government; Ease in Development of Customized Products.

6. What are the notable trends driving market growth?

High Adoption of 3D Prototype Parts in Automotive Industry.

7. Are there any restraints impacting market growth?

Lack of Enough Space to Build Self-storage Facilities.

8. Can you provide examples of recent developments in the market?

April 2023: Stratasys Ltd., a company at the forefront of polymer 3D printing solutions, has announced that it has successfully acquired Covestro AG's additive manufacturing materials business (DAX: 1COV). The purchase includes R&D facilities, global development and sales teams in the US, Europe, and Asia, a collection of nearly 60 additive manufacturing materials, and a large intellectual property portfolio of hundreds of patents and pending patents. The acquisition will be immediately accretive.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe 3D Printing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe 3D Printing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe 3D Printing Market?

To stay informed about further developments, trends, and reports in the Europe 3D Printing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence