Key Insights

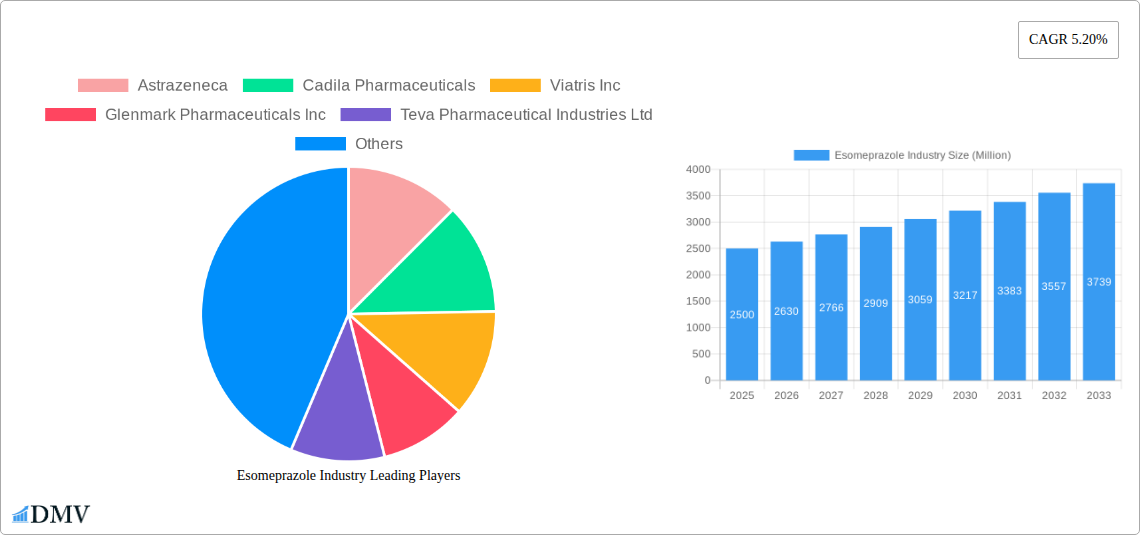

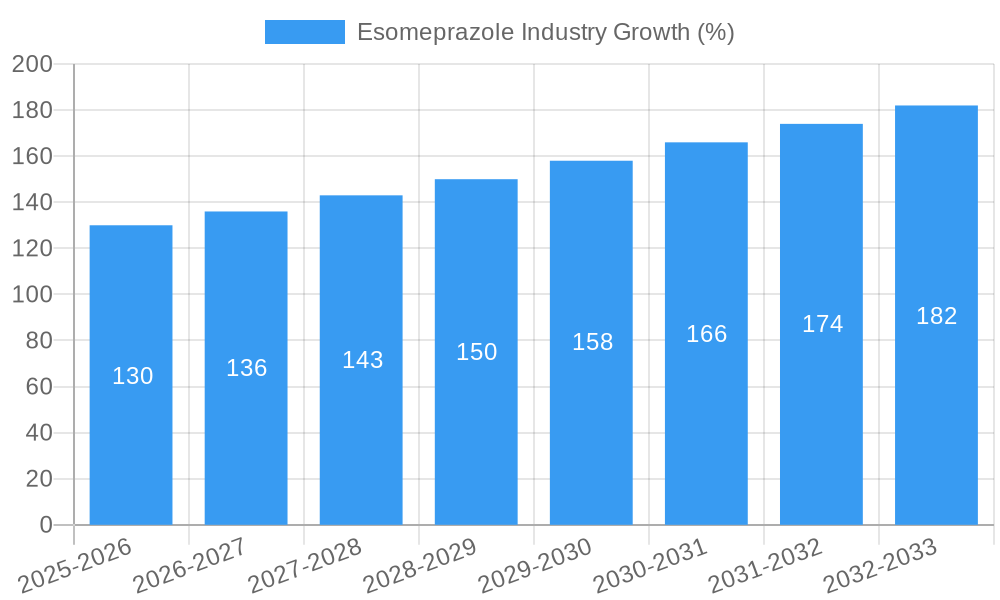

The global esomeprazole market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.20% from 2025 to 2033. This expansion is fueled by several key factors. The increasing prevalence of gastrointestinal disorders like GERD and stomach ulcers, coupled with a rising geriatric population more susceptible to these conditions, significantly boosts demand. Furthermore, the growing awareness of these diseases and improved access to healthcare, particularly in developing economies, contributes to market growth. The availability of esomeprazole in various dosage forms, including tablets and capsules, caters to diverse patient preferences and enhances market penetration. Generic competition is influencing pricing strategies, making esomeprazole more accessible and affordable, further propelling market expansion. However, potential side effects associated with long-term use and the emergence of alternative therapies present challenges to market growth.

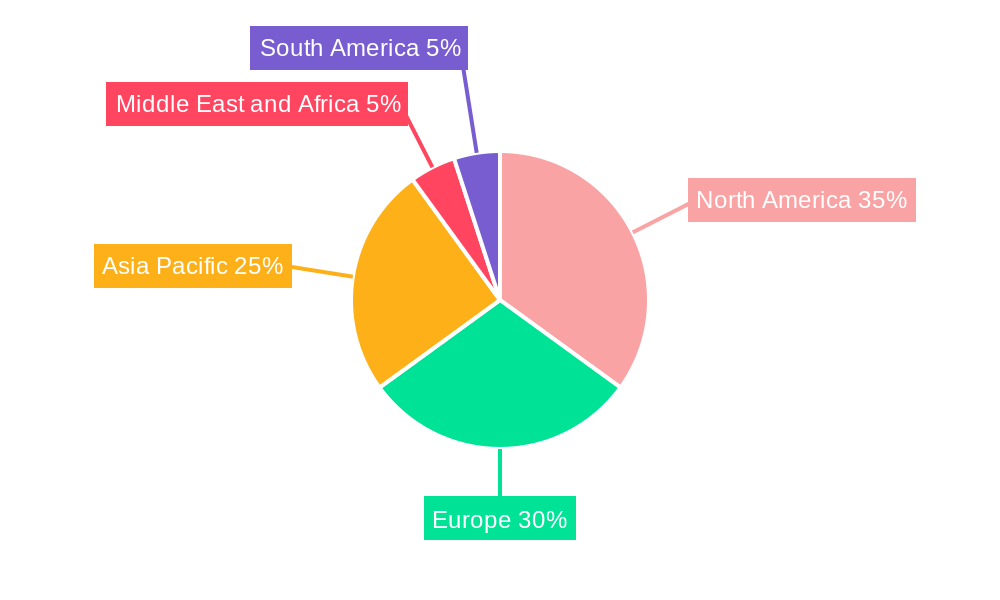

Segment-wise, the tablets dosage form currently dominates the market, reflecting its convenience and widespread adoption. GERD treatment accounts for a substantial portion of the application segment, given its high prevalence. Geographically, North America and Europe currently hold significant market shares due to high healthcare expenditure and advanced healthcare infrastructure. However, the Asia-Pacific region is expected to witness substantial growth in the coming years, driven by increasing healthcare awareness and rising disposable incomes. Major pharmaceutical companies like AstraZeneca, Cadila Pharmaceuticals, and others are actively involved in the market, driving innovation and competition. Strategic collaborations, new product launches, and expansion into emerging markets are expected to shape the future landscape of the esomeprazole market.

Esomeprazole Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global Esomeprazole market, offering invaluable insights for stakeholders across the pharmaceutical industry. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, competitive dynamics, and future growth potential. The report leverages extensive data analysis, forecasting models, and expert insights to deliver actionable intelligence for strategic decision-making.

Esomeprazole Industry Market Composition & Trends

The global esomeprazole market, valued at $XX Million in 2024, is projected to reach $XX Million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033). Market concentration is moderate, with key players like AstraZeneca, Cadila Pharmaceuticals, Viatris Inc., and others holding significant market share. However, the presence of numerous generic manufacturers contributes to a competitive landscape. Innovation in formulation (e.g., extended-release versions) and delivery systems drives market growth, while stringent regulatory approvals and the emergence of biosimilars pose challenges. Substitute products, such as other proton pump inhibitors (PPIs) and H2 blockers, exert competitive pressure, yet esomeprazole maintains a strong position due to its efficacy and established market presence. The primary end-users are hospitals, clinics, and pharmacies.

- Market Share Distribution (2024): AstraZeneca (XX%), Cadila Pharmaceuticals (XX%), Viatris Inc. (XX%), Others (XX%). (Note: Specific percentages unavailable, replaced with XX)

- M&A Activity (2019-2024): Total deal value estimated at $XX Million, with most transactions involving generic manufacturers expanding their portfolios. (Note: Specific deal values unavailable, replaced with XX)

Esomeprazole Industry Evolution

The esomeprazole market has witnessed significant evolution since 2019. The initial period (2019-2024) was characterized by the growth of generic competition, leading to price erosion. However, innovation in extended-release formulations and the rise of combination therapies (e.g., esomeprazole with antibiotics for H. pylori treatment) have driven market expansion. This is further fueled by the growing prevalence of GERD and stomach ulcers globally, especially in aging populations. Technological advancements, such as improved manufacturing processes and enhanced analytical techniques, have boosted efficiency and quality control. Consumer demand is shifting towards more convenient dosage forms like once-daily formulations. The market is experiencing increased penetration in emerging markets, particularly in Asia and Africa, owing to rising healthcare spending and improved diagnosis capabilities. This period shows an overall growth rate of XX% (2019-2024) while the predicted growth rate for 2025-2033 is XX%. Adoption of newer formulations is estimated to be at XX% by 2033.

Leading Regions, Countries, or Segments in Esomeprazole Industry

North America currently dominates the esomeprazole market, followed by Europe and Asia-Pacific. This dominance is primarily attributed to high healthcare expenditure, robust regulatory frameworks supporting pharmaceutical innovation, and a high prevalence of GERD and peptic ulcers. Within dosage types, tablets represent the largest segment, followed by capsules. GERD remains the leading application, accounting for the majority of esomeprazole consumption globally.

- Key Drivers in North America: High prevalence of GERD, robust healthcare infrastructure, advanced medical technologies, strong regulatory support for pharmaceutical innovations, and high per capita income.

- Key Drivers in Europe: High healthcare expenditure, aging population with higher prevalence of GERD and other related conditions, strong regulatory environment, and robust research and development activities.

- Key Drivers in Asia-Pacific: Growing awareness of GERD, rising healthcare spending, increased affordability of esomeprazole due to generic competition, and a growing elderly population.

Esomeprazole Industry Product Innovations

Recent innovations in esomeprazole focus on improved formulations, such as extended-release capsules and tablets for once-daily dosing, enhancing patient compliance. Combination therapies incorporating esomeprazole with other drugs for the treatment of H. pylori infection represent a key area of innovation. Furthermore, advancements in drug delivery systems aim to improve absorption and reduce side effects. These innovations emphasize improved patient outcomes and convenience, strengthening the product's competitive advantage.

Propelling Factors for Esomeprazole Industry Growth

Several factors fuel the growth of the esomeprazole market. The rising prevalence of GERD and stomach ulcers globally, particularly in aging populations, significantly contributes to increased demand. Technological advancements in formulations and delivery systems enhance efficacy and patient compliance. Expanding healthcare infrastructure, especially in developing countries, broadens access to esomeprazole. Favorable regulatory environments, facilitating product approvals and market entry, also drive growth.

Obstacles in the Esomeprazole Industry Market

Significant obstacles challenge the esomeprazole market. Stringent regulatory requirements for approvals and post-market surveillance can delay product launches and increase costs. The intense competition from generic manufacturers leads to price erosion, squeezing profit margins for branded products. Supply chain disruptions due to geopolitical instability or manufacturing bottlenecks can impact product availability.

Future Opportunities in Esomeprazole Industry

Emerging markets in Asia, Africa, and Latin America present significant growth opportunities. Innovations in combination therapies, particularly for treating H. pylori infections, offer considerable market potential. Development of novel drug delivery systems, such as targeted therapies or biosimilars, could enhance esomeprazole's therapeutic profile.

Major Players in the Esomeprazole Industry Ecosystem

- AstraZeneca

- Cadila Pharmaceuticals

- Viatris Inc.

- Glenmark Pharmaceuticals Inc

- Teva Pharmaceutical Industries Ltd

- DAIICHI SANKYO COMPANY LIMITED

- Amneal Pharmaceuticals LLC

- Sun Pharmaceutical Industries Ltd

- Torrent Pharmaceuticals Ltd

- Dr Reddy's Laboratories Ltd

Key Developments in Esomeprazole Industry Industry

- October 2022: Shandong Luoxin Pharmaceutical Group Stock Co., Ltd. initiated a clinical study comparing tegoprazan to esomeprazole-bismuth quadruple therapy for H. pylori eradication in China. This highlights the ongoing research into alternative treatments and competitive pressure.

- July 2022: Boehringer Ingelheim conducted a clinical trial evaluating the interaction between esomeprazole and BI 1819479, potentially impacting future drug combinations and interactions.

Strategic Esomeprazole Industry Market Forecast

The esomeprazole market is poised for continued growth, driven by the persistent demand for effective treatment of GERD and other acid-related disorders. New formulations, combination therapies, and expansion into emerging markets will significantly contribute to market expansion. The forecast suggests robust growth, particularly in regions with rising healthcare spending and growing awareness of gastrointestinal diseases. However, sustained competitive pressure from generics and regulatory challenges will continue to shape market dynamics.

Esomeprazole Industry Segmentation

-

1. Dosage Type

- 1.1. Tablets

- 1.2. Capsules

- 1.3. Others

-

2. Application

- 2.1. Gastroesophageal Reflux Disease (GERD)

- 2.2. Stomach Ulcers

- 2.3. Others

Esomeprazole Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Esomeprazole Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Gastroesophageal Reflux Disease (GERD); Rising Acceptance of Novel Drug Delivery Systems

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Capsules Segment is Expected to Witness a Significant Growth in the Esomeprazole Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Esomeprazole Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Dosage Type

- 5.1.1. Tablets

- 5.1.2. Capsules

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gastroesophageal Reflux Disease (GERD)

- 5.2.2. Stomach Ulcers

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Dosage Type

- 6. North America Esomeprazole Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Dosage Type

- 6.1.1. Tablets

- 6.1.2. Capsules

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Gastroesophageal Reflux Disease (GERD)

- 6.2.2. Stomach Ulcers

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Dosage Type

- 7. Europe Esomeprazole Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Dosage Type

- 7.1.1. Tablets

- 7.1.2. Capsules

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Gastroesophageal Reflux Disease (GERD)

- 7.2.2. Stomach Ulcers

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Dosage Type

- 8. Asia Pacific Esomeprazole Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Dosage Type

- 8.1.1. Tablets

- 8.1.2. Capsules

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Gastroesophageal Reflux Disease (GERD)

- 8.2.2. Stomach Ulcers

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Dosage Type

- 9. Middle East and Africa Esomeprazole Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Dosage Type

- 9.1.1. Tablets

- 9.1.2. Capsules

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Gastroesophageal Reflux Disease (GERD)

- 9.2.2. Stomach Ulcers

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Dosage Type

- 10. South America Esomeprazole Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Dosage Type

- 10.1.1. Tablets

- 10.1.2. Capsules

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Gastroesophageal Reflux Disease (GERD)

- 10.2.2. Stomach Ulcers

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Dosage Type

- 11. North America Esomeprazole Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Esomeprazole Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Esomeprazole Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Esomeprazole Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Esomeprazole Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Astrazeneca

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Cadila Pharmaceuticals

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Viatris Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Glenmark Pharmaceuticals Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Teva Pharmaceutical Industries Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 DAIICHI SANKYO COMPANY LIMITED

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Amneal Pharmaceuticals LLC

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Sun Pharmaceutical Industries Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Torrent Pharmaceuticals Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Dr Reddy's Laboratories Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Astrazeneca

List of Figures

- Figure 1: Global Esomeprazole Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Esomeprazole Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Esomeprazole Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Esomeprazole Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Esomeprazole Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Esomeprazole Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Esomeprazole Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Esomeprazole Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Esomeprazole Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Esomeprazole Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Esomeprazole Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Esomeprazole Industry Revenue (Million), by Dosage Type 2024 & 2032

- Figure 13: North America Esomeprazole Industry Revenue Share (%), by Dosage Type 2024 & 2032

- Figure 14: North America Esomeprazole Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Esomeprazole Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Esomeprazole Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Esomeprazole Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Esomeprazole Industry Revenue (Million), by Dosage Type 2024 & 2032

- Figure 19: Europe Esomeprazole Industry Revenue Share (%), by Dosage Type 2024 & 2032

- Figure 20: Europe Esomeprazole Industry Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Esomeprazole Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Esomeprazole Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Esomeprazole Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Esomeprazole Industry Revenue (Million), by Dosage Type 2024 & 2032

- Figure 25: Asia Pacific Esomeprazole Industry Revenue Share (%), by Dosage Type 2024 & 2032

- Figure 26: Asia Pacific Esomeprazole Industry Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Esomeprazole Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Esomeprazole Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Esomeprazole Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Esomeprazole Industry Revenue (Million), by Dosage Type 2024 & 2032

- Figure 31: Middle East and Africa Esomeprazole Industry Revenue Share (%), by Dosage Type 2024 & 2032

- Figure 32: Middle East and Africa Esomeprazole Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: Middle East and Africa Esomeprazole Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Middle East and Africa Esomeprazole Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Esomeprazole Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Esomeprazole Industry Revenue (Million), by Dosage Type 2024 & 2032

- Figure 37: South America Esomeprazole Industry Revenue Share (%), by Dosage Type 2024 & 2032

- Figure 38: South America Esomeprazole Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: South America Esomeprazole Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: South America Esomeprazole Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Esomeprazole Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Esomeprazole Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Esomeprazole Industry Revenue Million Forecast, by Dosage Type 2019 & 2032

- Table 3: Global Esomeprazole Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Esomeprazole Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Esomeprazole Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Esomeprazole Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Esomeprazole Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Esomeprazole Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Esomeprazole Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Esomeprazole Industry Revenue Million Forecast, by Dosage Type 2019 & 2032

- Table 32: Global Esomeprazole Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Global Esomeprazole Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Esomeprazole Industry Revenue Million Forecast, by Dosage Type 2019 & 2032

- Table 38: Global Esomeprazole Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 39: Global Esomeprazole Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Esomeprazole Industry Revenue Million Forecast, by Dosage Type 2019 & 2032

- Table 47: Global Esomeprazole Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 48: Global Esomeprazole Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: India Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Esomeprazole Industry Revenue Million Forecast, by Dosage Type 2019 & 2032

- Table 56: Global Esomeprazole Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 57: Global Esomeprazole Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: GCC Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Esomeprazole Industry Revenue Million Forecast, by Dosage Type 2019 & 2032

- Table 62: Global Esomeprazole Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 63: Global Esomeprazole Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Brazil Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Argentina Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Esomeprazole Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Esomeprazole Industry?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Esomeprazole Industry?

Key companies in the market include Astrazeneca, Cadila Pharmaceuticals, Viatris Inc, Glenmark Pharmaceuticals Inc, Teva Pharmaceutical Industries Ltd, DAIICHI SANKYO COMPANY LIMITED, Amneal Pharmaceuticals LLC, Sun Pharmaceutical Industries Ltd, Torrent Pharmaceuticals Ltd, Dr Reddy's Laboratories Ltd.

3. What are the main segments of the Esomeprazole Industry?

The market segments include Dosage Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Gastroesophageal Reflux Disease (GERD); Rising Acceptance of Novel Drug Delivery Systems.

6. What are the notable trends driving market growth?

Capsules Segment is Expected to Witness a Significant Growth in the Esomeprazole Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

October 2022: Shandong Luoxin Pharmaceutical Group Stock Co., Ltd. sponsored a clinical study to evaluate the efficacy and safety of tegoprazan versus esomeprazole-containing bismuth quadruple therapy in patients infected with Helicobacter pylori in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Esomeprazole Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Esomeprazole Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Esomeprazole Industry?

To stay informed about further developments, trends, and reports in the Esomeprazole Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence