Key Insights

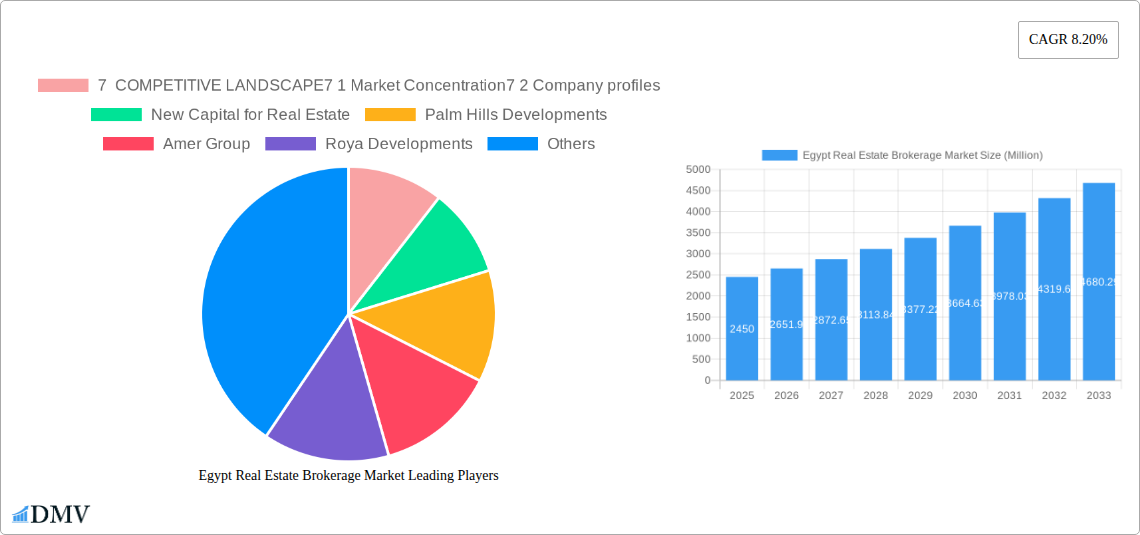

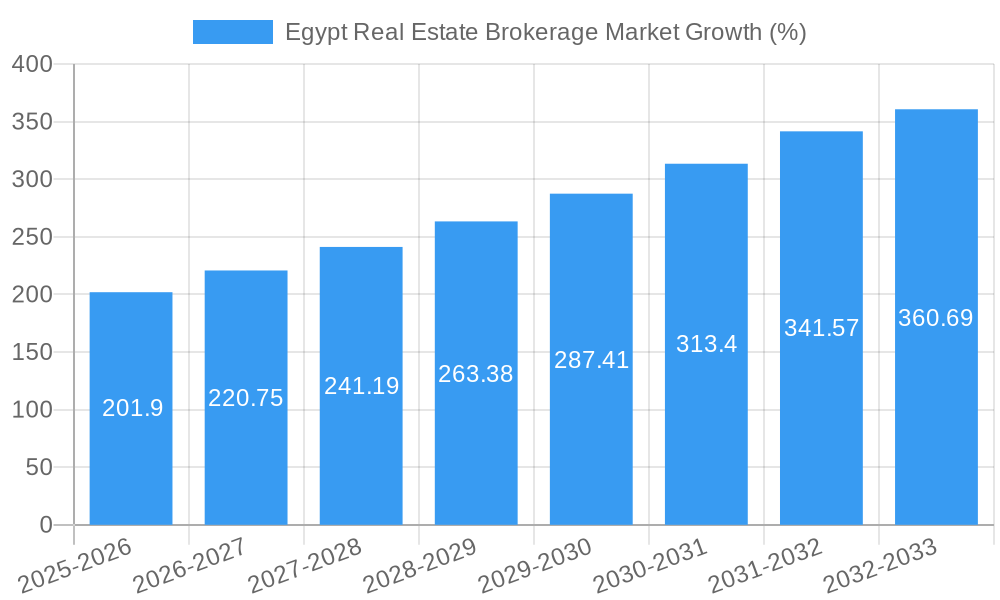

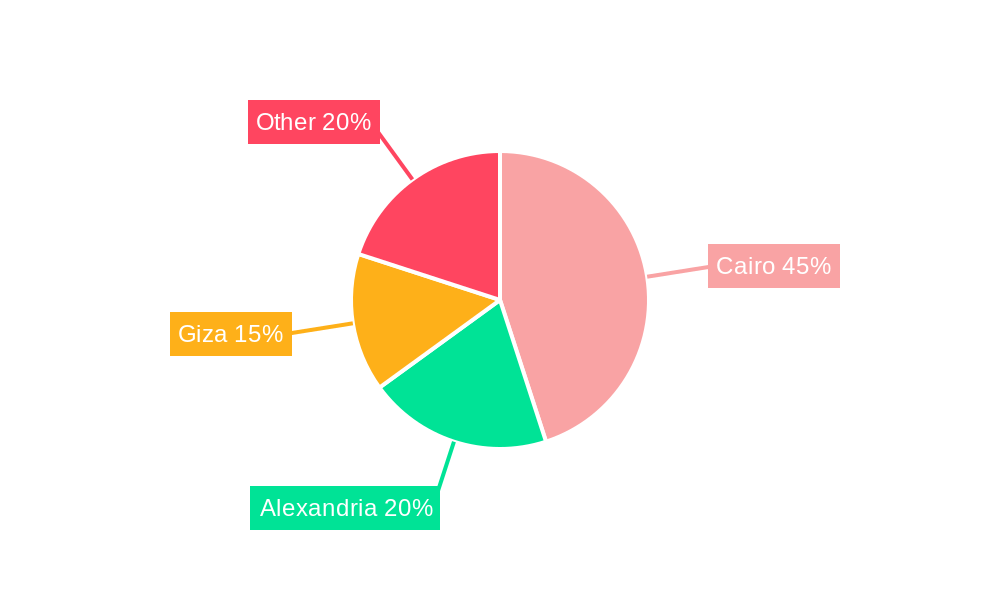

The Egypt real estate brokerage market is experiencing robust growth, with a market size of $2.45 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 8.20% from 2025 to 2033. This expansion is driven by several key factors. Firstly, a burgeoning population and rising urbanization in Egypt are fueling increased demand for housing and commercial properties. Secondly, government initiatives aimed at improving infrastructure and attracting foreign investment are creating a more favorable environment for real estate transactions. Thirdly, the increasing adoption of technology in the brokerage sector, including online platforms and property management software, is enhancing efficiency and transparency, attracting more clients and investors. However, economic instability and fluctuating interest rates remain potential restraints on market growth. The market is segmented by service type (residential, commercial, etc.), transaction size, and geographic location, with Cairo and Alexandria likely holding the largest shares. The competitive landscape is moderately concentrated, with established players like Palm Hills Developments, Amer Group, and Roya Developments competing alongside international brands such as Sotheby's International Realty and local firms like Alfajr Real Estate. The entry of new players and the consolidation of existing ones are expected to reshape the competitive dynamics in the coming years.

The forecast for the Egypt real estate brokerage market from 2025 to 2033 indicates sustained, albeit potentially fluctuating, growth. The CAGR of 8.20% suggests a significant increase in market value over the forecast period. However, realistic projections necessitate acknowledging potential economic headwinds. Variations in government policies, changes in interest rates, and global economic factors could influence the actual growth trajectory. Nevertheless, the long-term outlook for the market remains positive, underpinned by Egypt's demographic trends, ongoing infrastructure development, and the increasing sophistication of the real estate brokerage sector. The success of individual brokerage firms will depend on their ability to adapt to technological advancements, provide exceptional client service, and navigate the complexities of the Egyptian real estate market effectively.

Egypt Real Estate Brokerage Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Egypt real estate brokerage market, offering a comprehensive overview of its current state, future trajectory, and key players. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report leverages extensive data and in-depth analysis to present a clear picture for stakeholders seeking to navigate this dynamic market. The total market value is estimated at XXX Million in 2025, with projections extending to 2033.

Egypt Real Estate Brokerage Market Market Composition & Trends

This section delves into the intricate composition of the Egyptian real estate brokerage market, examining key metrics and influencing factors. Market concentration reveals a relatively fragmented landscape, with a handful of dominant players and numerous smaller firms competing for market share. The report analyzes the distribution of this market share amongst the top players, revealing a significant opportunity for consolidation and growth. Furthermore, the analysis encompasses M&A activities, with an estimated total deal value of XXX Million observed during the historical period (2019-2024). Innovation catalysts, such as the rise of proptech and evolving consumer preferences, are examined alongside the regulatory landscape, including licensing requirements and consumer protection laws. The report also considers substitute products and services, as well as the profiles of different end-users, ranging from individual buyers and sellers to large institutional investors.

- Market Concentration: Moderately fragmented, with the top 5 players holding approximately xx% of the market share in 2025.

- M&A Activity (2019-2024): Total deal value estimated at XXX Million. Deal sizes varied significantly, with larger transactions primarily involving established brokerage firms.

- Key End-User Segments: Individual buyers/sellers, institutional investors, developers, high-net-worth individuals.

- Regulatory Landscape: Focus on licensing, consumer protection, and transparency regulations shaping market dynamics.

Egypt Real Estate Brokerage Market Industry Evolution

This section presents a detailed analysis of the dynamic evolution of the Egyptian real estate brokerage market from 2019 to 2033. Market growth trajectories are projected to demonstrate a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by factors such as population growth, urbanization, and increasing foreign investment. Technological advancements, such as the adoption of online property portals and virtual tours, are reshaping how real estate transactions occur. The analysis includes specific data points on the adoption rates of these technologies and their impact on market efficiency. Shifting consumer demands, including preferences for personalized services and increased transparency, are carefully examined.

Leading Regions, Countries, or Segments in Egypt Real Estate Brokerage Market

The Cairo metropolitan area commands the largest market share within the Egyptian real estate brokerage sector, exhibiting robust growth fueled by significant population density, high demand for residential and commercial properties, and substantial government investment in infrastructure development. New urban communities, such as the New Capital, are also contributing significantly to this dominance. The report further dissects the key factors behind this regional dominance.

- Key Drivers of Cairo's Dominance:

- High population density and urbanization rates.

- Significant investment in infrastructure and real estate development.

- High demand for both residential and commercial properties.

- Presence of major real estate developers and brokerage firms.

- Government initiatives promoting real estate investment.

Egypt Real Estate Brokerage Market Product Innovations

Recent product innovations include the integration of sophisticated online platforms offering virtual tours, 3D property visualizations, and advanced search functionalities. These technologies enhance the customer experience by streamlining property searches and providing more comprehensive information. Many firms now offer specialized services catering to specific property types (luxury, commercial, etc.), alongside comprehensive wealth management solutions, as exemplified by Sotheby's International Realty’s recent initiatives. The impact of these innovations is measured by increased transaction efficiency and improved client satisfaction.

Propelling Factors for Egypt Real Estate Brokerage Market Growth

Several key factors contribute to the projected growth of the Egypt real estate brokerage market. Government initiatives promoting investment in real estate, infrastructure development, and tourism are significant drivers. Economic growth, an expanding middle class, and a growing population are also creating a surge in housing demand. Further, technological advancements, including the proliferation of online platforms, are streamlining transactions and expanding market reach.

Obstacles in the Egypt Real Estate Brokerage Market Market

Despite the growth potential, the market faces challenges. Regulatory complexities and bureaucratic hurdles can slow down transactions. Supply chain disruptions related to construction materials can impact project timelines and overall market performance. Furthermore, intense competition from established players and new entrants creates pressure on profit margins. These factors contribute to the market's overall risk profile.

Future Opportunities in Egypt Real Estate Brokerage Market

Emerging opportunities reside in the expansion of proptech solutions, catering to a digitally savvy consumer base. Specialization in niche market segments, such as sustainable real estate and luxury properties, represents significant potential. Leveraging data analytics for predictive market modeling and personalized client services is another emerging trend. Exploring new geographic areas outside Cairo and tapping into the growing tourism sector are also pathways to expansion.

Major Players in the Egypt Real Estate Brokerage Market Ecosystem

- New Capital for Real Estate

- Palm Hills Developments [Insert Link if Available]

- Amer Group [Insert Link if Available]

- Roya Developments [Insert Link if Available]

- Sotheby's International Realty [Insert Link if Available]

- Bluerock Real Estate [Insert Link if Available]

- Alfajr Real Estate [Insert Link if Available]

- The Address Investments [Insert Link if Available]

- MB Real Estate [Insert Link if Available]

- Remax [Insert Link if Available]

- Connect Homes [Insert Link if Available]

- Coldwell Banker [Insert Link if Available]

- List Not Exhaustive

Key Developments in Egypt Real Estate Brokerage Market Industry

- April 2024: Marriott International Inc. announced a strategic agreement with Palm Hills Developments to launch The Ritz-Carlton Cairo, Palm Hills, impacting the luxury segment and boosting market confidence.

- May 2024: Sotheby's International Realty launched a new service for ultra-high-net-worth individuals, signifying a shift toward high-end market specialization and integrated wealth management offerings.

Strategic Egypt Real Estate Brokerage Market Market Forecast

The Egypt real estate brokerage market is poised for sustained growth, driven by robust economic fundamentals and continuous infrastructural improvements. The expansion of proptech and the increased sophistication of client services will further fuel market expansion. The consistent government support for the real estate sector reinforces the long-term growth outlook, promising attractive returns on investment for stakeholders.

Egypt Real Estate Brokerage Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Non-Residential

-

2. Service

- 2.1. Sales

- 2.2. Rental

-

3. City

- 3.1. Cairo

- 3.2. Alexandria

- 3.3. Rest of Egypt

Egypt Real Estate Brokerage Market Segmentation By Geography

- 1. Egypt

Egypt Real Estate Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Population Growth and Urbanization Boosting the Market Demand; Rising Real Estate Prices Across Major Cities; Wealth Accretion in Youth Population; Technological Innovations in the Real Estate Brokerage Industry

- 3.3. Market Restrains

- 3.3.1. Population Growth and Urbanization Boosting the Market Demand; Rising Real Estate Prices Across Major Cities; Wealth Accretion in Youth Population; Technological Innovations in the Real Estate Brokerage Industry

- 3.4. Market Trends

- 3.4.1. Increasing Investments in Real Estate Development

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Real Estate Brokerage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Non-Residential

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Sales

- 5.2.2. Rental

- 5.3. Market Analysis, Insights and Forecast - by City

- 5.3.1. Cairo

- 5.3.2. Alexandria

- 5.3.3. Rest of Egypt

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 New Capital for Real Estate

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Palm Hills Developments

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amer Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Roya Developments

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sotheby's International Realty

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bluerock Real Estate

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alfajr Real Estate

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Address Investments

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MB Real Estate

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Remax

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Connect Homes

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Coldwell Banker*List Not Exhaustive 7 3 Other Companie

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles

List of Figures

- Figure 1: Egypt Real Estate Brokerage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Egypt Real Estate Brokerage Market Share (%) by Company 2024

List of Tables

- Table 1: Egypt Real Estate Brokerage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Egypt Real Estate Brokerage Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Egypt Real Estate Brokerage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Egypt Real Estate Brokerage Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Egypt Real Estate Brokerage Market Revenue Million Forecast, by Service 2019 & 2032

- Table 6: Egypt Real Estate Brokerage Market Volume Billion Forecast, by Service 2019 & 2032

- Table 7: Egypt Real Estate Brokerage Market Revenue Million Forecast, by City 2019 & 2032

- Table 8: Egypt Real Estate Brokerage Market Volume Billion Forecast, by City 2019 & 2032

- Table 9: Egypt Real Estate Brokerage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Egypt Real Estate Brokerage Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Egypt Real Estate Brokerage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Egypt Real Estate Brokerage Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Egypt Real Estate Brokerage Market Revenue Million Forecast, by Service 2019 & 2032

- Table 14: Egypt Real Estate Brokerage Market Volume Billion Forecast, by Service 2019 & 2032

- Table 15: Egypt Real Estate Brokerage Market Revenue Million Forecast, by City 2019 & 2032

- Table 16: Egypt Real Estate Brokerage Market Volume Billion Forecast, by City 2019 & 2032

- Table 17: Egypt Real Estate Brokerage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Egypt Real Estate Brokerage Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Real Estate Brokerage Market?

The projected CAGR is approximately 8.20%.

2. Which companies are prominent players in the Egypt Real Estate Brokerage Market?

Key companies in the market include 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles, New Capital for Real Estate, Palm Hills Developments, Amer Group, Roya Developments, Sotheby's International Realty, Bluerock Real Estate, Alfajr Real Estate, The Address Investments, MB Real Estate, Remax, Connect Homes, Coldwell Banker*List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Egypt Real Estate Brokerage Market?

The market segments include Type, Service, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Population Growth and Urbanization Boosting the Market Demand; Rising Real Estate Prices Across Major Cities; Wealth Accretion in Youth Population; Technological Innovations in the Real Estate Brokerage Industry.

6. What are the notable trends driving market growth?

Increasing Investments in Real Estate Development.

7. Are there any restraints impacting market growth?

Population Growth and Urbanization Boosting the Market Demand; Rising Real Estate Prices Across Major Cities; Wealth Accretion in Youth Population; Technological Innovations in the Real Estate Brokerage Industry.

8. Can you provide examples of recent developments in the market?

May 2024: Sotheby's International Realty, under the leadership of George Azar, Chairman and CEO of Dubai and Saudi Arabia Sotheby’s International Realty, unveiled a novel service tailored for ultra-high-net-worth individuals and multifamily offices. This service offers a comprehensive suite encompassing premier real estate luxury assets like fine art, jewelry, and automobiles alongside holistic wealth management, investment, and legal counsel.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Real Estate Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Real Estate Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Real Estate Brokerage Market?

To stay informed about further developments, trends, and reports in the Egypt Real Estate Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence