Key Insights

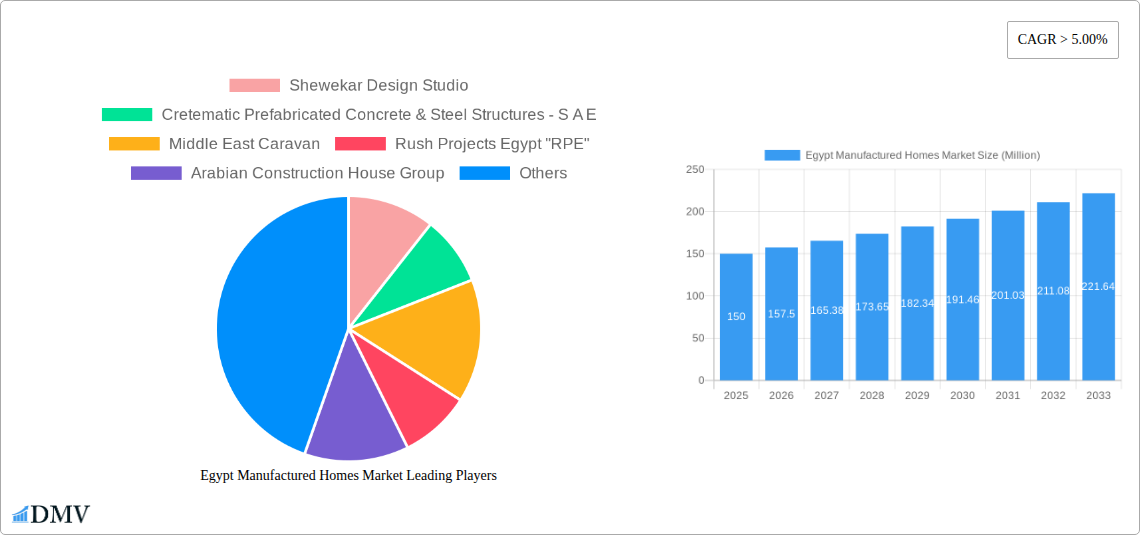

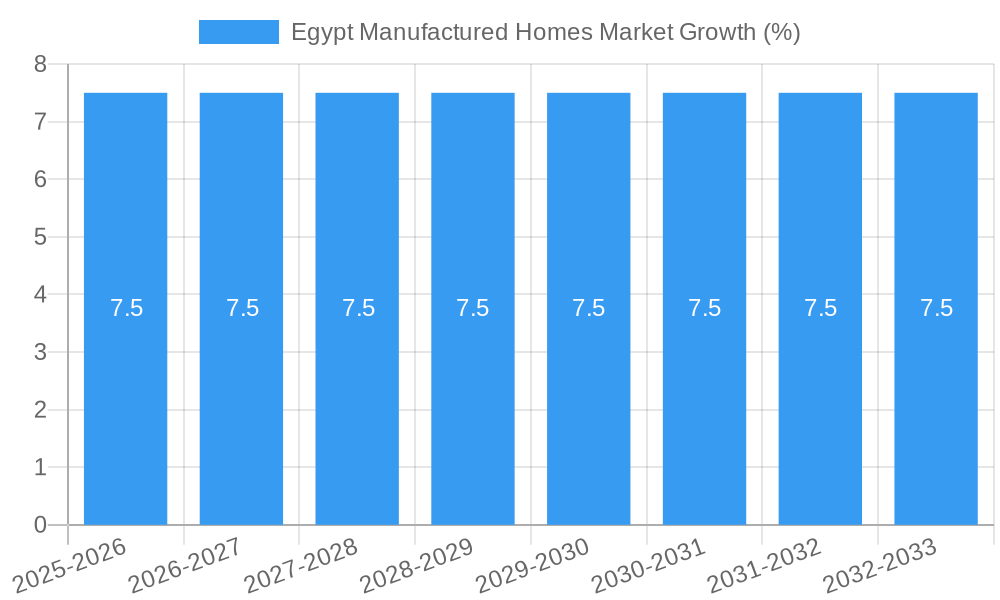

The Egypt manufactured homes market is experiencing robust growth, driven by factors such as increasing urbanization, rising population, and a government focus on affordable housing solutions. The market, estimated at $XX million in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is fueled by the cost-effectiveness and faster construction times associated with manufactured homes compared to traditional construction methods. The increasing demand for housing in Egypt, particularly in urban areas, is creating a significant opportunity for manufactured home manufacturers and developers. The market is segmented into single-family and multi-family units, with the single-family segment currently dominating. However, the multi-family segment is expected to witness significant growth due to the rising demand for affordable apartment complexes. Key players like Shewekar Design Studio, Cretematic Prefabricated Concrete & Steel Structures, and Karmod Prefabricated Building Technologies are leading the market, competing on factors such as design innovation, construction quality, and affordability. Government initiatives promoting sustainable and cost-effective housing will further contribute to market expansion. Challenges include regulatory hurdles, access to financing, and the need to address consumer perceptions regarding the quality and durability of manufactured homes. Addressing these challenges will be critical for realizing the full potential of the Egyptian manufactured homes market.

The sustained growth trajectory is expected to continue throughout the forecast period (2025-2033) due to several factors, including government investment in infrastructure development, which indirectly boosts the demand for housing, and improvements in technological advancements within the prefabricated construction sector. This will lead to more efficient manufacturing processes and enhanced product quality. Furthermore, ongoing urbanization and population growth in Egypt will continuously exert upward pressure on housing demand, making manufactured homes an attractive and readily available solution. The competitive landscape is characterized by both local and international players, each striving for market dominance through strategic partnerships, technological innovation, and efficient supply chain management. The market will continue to evolve, with increased focus on energy-efficient and sustainable designs.

Egypt Manufactured Homes Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Egypt manufactured homes market, offering crucial data and projections from 2019 to 2033. The study covers market size, segmentation, key players, growth drivers, challenges, and future opportunities, equipping stakeholders with the knowledge needed to navigate this dynamic sector. With a base year of 2025 and a forecast period extending to 2033, this report is an essential resource for investors, manufacturers, and industry professionals seeking to understand and capitalize on the evolving Egyptian manufactured housing landscape. The market is estimated to reach USD xx Million by 2033.

Egypt Manufactured Homes Market Market Composition & Trends

This section delves into the intricate composition of the Egyptian manufactured homes market, examining its structure, trends, and dynamics. The market exhibits a moderately concentrated structure, with a few major players commanding significant market share. However, the entry of innovative startups and increasing foreign investment suggest a potential shift towards a more fragmented landscape. Key players, including Shewekar Design Studio, Cretematic Prefabricated Concrete & Steel Structures - S A E, and Karmod Prefabricated Building Technologies, contribute significantly to the overall market volume. Innovation in materials, design, and construction technologies are key catalysts for market growth. The regulatory landscape, although evolving, presents both opportunities and challenges. The availability of substitute products like traditional brick-and-mortar housing influences market demand. End-users primarily comprise individual homeowners, real estate developers, and industrial entities requiring temporary or permanent housing solutions.

- Market Share Distribution (2024): Karmod Prefabricated Building Technologies: 20%; Cretematic Prefabricated Concrete & Steel Structures - S A E: 15%; Other Players: 65%

- M&A Activity (2019-2024): Total deal value estimated at USD xx Million, with an average deal size of USD xx Million. Majority of deals involve smaller firms being acquired by larger players.

- Innovation Catalysts: Sustainable building materials, prefabrication techniques, smart home integration.

- Regulatory Landscape: Building codes, environmental regulations, land use policies influence market growth.

- Substitute Products: Traditional construction methods, rental housing.

- End-User Profiles: Individual homeowners, real estate developers, industrial clients.

Egypt Manufactured Homes Market Industry Evolution

The Egyptian manufactured homes market has witnessed significant evolution over the historical period (2019-2024). Driven by factors such as rising urbanization, increasing demand for affordable housing, and advancements in construction technology, the market has experienced a compound annual growth rate (CAGR) of approximately xx% during this period. Technological advancements, including the adoption of prefabricated components, modular construction, and sustainable materials, have increased efficiency and reduced construction time. Changing consumer demands, specifically a preference for cost-effective, energy-efficient, and customizable homes, has also shaped market trends. The market demonstrates a significant shift towards multi-family units, driven by increased population density and government initiatives promoting affordable housing projects. Furthermore, the growing interest in eco-friendly construction practices is driving the adoption of sustainable building materials and energy-efficient designs, contributing to market expansion. By 2033, the market is projected to reach USD xx Million, exhibiting a robust CAGR of xx%.

Leading Regions, Countries, or Segments in Egypt Manufactured Homes Market

The demand for manufactured homes is concentrated in major urban areas and rapidly developing regions of Egypt. The single-family segment currently holds the largest market share, largely driven by a growing middle class and rising disposable incomes. However, the multi-family segment shows substantial growth potential, fueled by government initiatives focused on affordable housing solutions and a concentrated population in urban centers.

Key Drivers for Single Family Segment Dominance:

- Rising disposable incomes: Increased purchasing power allows more families to afford manufactured homes.

- Preference for suburban living: Demand for single-family homes is higher in suburban areas.

- Government incentives: Potential subsidies or tax breaks for single-family home purchases.

Key Drivers for Multi-Family Segment Growth:

- Government initiatives for affordable housing: Large-scale projects addressing the housing shortage.

- High population density in urban areas: Limited land availability drives demand for multi-family units.

- Cost-effectiveness: Multi-family projects offer economies of scale for developers.

The dominance of these segments is further reinforced by the ongoing investment in infrastructure development and a conducive regulatory environment in certain regions, driving the sector's expansion in the coming years.

Egypt Manufactured Homes Market Product Innovations

Recent innovations in the Egyptian manufactured homes market focus on incorporating sustainable materials, advanced prefabrication techniques, and smart home technologies. Manufacturers are emphasizing energy efficiency through enhanced insulation and the integration of renewable energy sources. Modular designs allow for customization and quicker construction times. The incorporation of smart home features such as automated lighting, security systems, and energy management tools adds value and caters to the evolving preferences of consumers. These innovations enhance the appeal of manufactured homes, creating unique selling propositions and driving market growth.

Propelling Factors for Egypt Manufactured Homes Market Growth

Several factors are driving the expansion of the Egypt manufactured homes market. Technological advancements, such as efficient prefabrication and sustainable materials, significantly reduce construction time and costs. Strong economic growth and a burgeoning middle class are increasing the demand for affordable housing options. Furthermore, supportive government policies, including initiatives promoting affordable housing projects and infrastructure development, are bolstering the market's expansion. The growing adoption of modular construction techniques enhances efficiency and customization, attracting a wider range of customers.

Obstacles in the Egypt Manufactured Homes Market Market

Despite positive growth prospects, several challenges hinder the market's full potential. Strict building codes and regulations can increase construction costs and complexities. Supply chain disruptions, especially in the procurement of materials, can cause delays and price fluctuations. Intense competition among established players and emerging startups necessitates continuous innovation and cost optimization. These factors necessitate strategic planning and adaptability for businesses operating within this market.

Future Opportunities in Egypt Manufactured Homes Market

The future holds substantial opportunities for growth within the Egyptian manufactured homes market. Expanding into previously untapped regions with a growing population and demand for housing presents significant potential. The adoption of cutting-edge construction technologies and sustainable materials further enhances opportunities for market expansion. Targeting niche segments, such as eco-friendly and smart homes, can create a competitive advantage.

Major Players in the Egypt Manufactured Homes Market Ecosystem

- Shewekar Design Studio

- Cretematic Prefabricated Concrete & Steel Structures - S A E

- Middle East Caravan

- Rush Projects Egypt "RPE"

- Arabian Construction House Group

- Karmod Prefabricated Building Technologies

- Al Quds Steel

- DTH PREFAB

- Dalal Steel Industries

- Ideal Prefab

- Industrial Engineering Company for Construction and Development (ICON)

Key Developments in Egypt Manufactured Homes Market Industry

- October 2022: Madinet Nasr for Housing and Development (MNHD) partnered with DMC to build 13 buildings in Taj City's Lake Park, representing a USD 11.82 Million investment. This signifies significant investment in multi-family housing projects using potentially manufactured housing components.

- October 2022: Seqoon, a FinTech startup, received USD 500,000 in pre-seed funding, indicating growing interest and investment in innovative solutions within the construction and housing sectors, which could indirectly support the manufactured housing market.

Strategic Egypt Manufactured Homes Market Market Forecast

The Egyptian manufactured homes market is poised for substantial growth over the forecast period (2025-2033). Continued government support for affordable housing initiatives, coupled with advancements in construction technologies and rising consumer demand, will drive market expansion. The increasing adoption of sustainable building practices and smart home technologies will create new market segments and attract a wider customer base. This creates a promising outlook for investors and businesses operating in this dynamic sector.

Egypt Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

Egypt Manufactured Homes Market Segmentation By Geography

- 1. Egypt

Egypt Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urbanization and Changing Lifestyle4.; Improved Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Construction Cost

- 3.4. Market Trends

- 3.4.1. Increasing residential real estate prices demanding more manufactured homes construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Shewekar Design Studio

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cretematic Prefabricated Concrete & Steel Structures - S A E

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Middle East Caravan

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rush Projects Egypt "RPE"

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arabian Construction House Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Karmod Prefabricated Building Technologies

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Al Quds Steel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DTH PREFAB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dalal Steel Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ideal Prefab**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Industrial Engineering Company for Construction and Development (ICON)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Shewekar Design Studio

List of Figures

- Figure 1: Egypt Manufactured Homes Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Egypt Manufactured Homes Market Share (%) by Company 2024

List of Tables

- Table 1: Egypt Manufactured Homes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Egypt Manufactured Homes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Egypt Manufactured Homes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Egypt Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Egypt Manufactured Homes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Egypt Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Manufactured Homes Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Egypt Manufactured Homes Market?

Key companies in the market include Shewekar Design Studio, Cretematic Prefabricated Concrete & Steel Structures - S A E, Middle East Caravan, Rush Projects Egypt "RPE", Arabian Construction House Group, Karmod Prefabricated Building Technologies, Al Quds Steel, DTH PREFAB, Dalal Steel Industries, Ideal Prefab**List Not Exhaustive, Industrial Engineering Company for Construction and Development (ICON).

3. What are the main segments of the Egypt Manufactured Homes Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urbanization and Changing Lifestyle4.; Improved Infrastructure.

6. What are the notable trends driving market growth?

Increasing residential real estate prices demanding more manufactured homes construction.

7. Are there any restraints impacting market growth?

4.; Rising Construction Cost.

8. Can you provide examples of recent developments in the market?

October 2022: Madinet Nasr for Housing and Development (MNHD) announced the signing of a partnership agreement with DMC, one of Egypt's leading general contracting and project construction companies, to build 13 buildings in Taj City's Lake Park project. The project's total investment is EGP 350 million (USD 11.82 million), and it is expected to be completed in 18 months.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the Egypt Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence