Key Insights

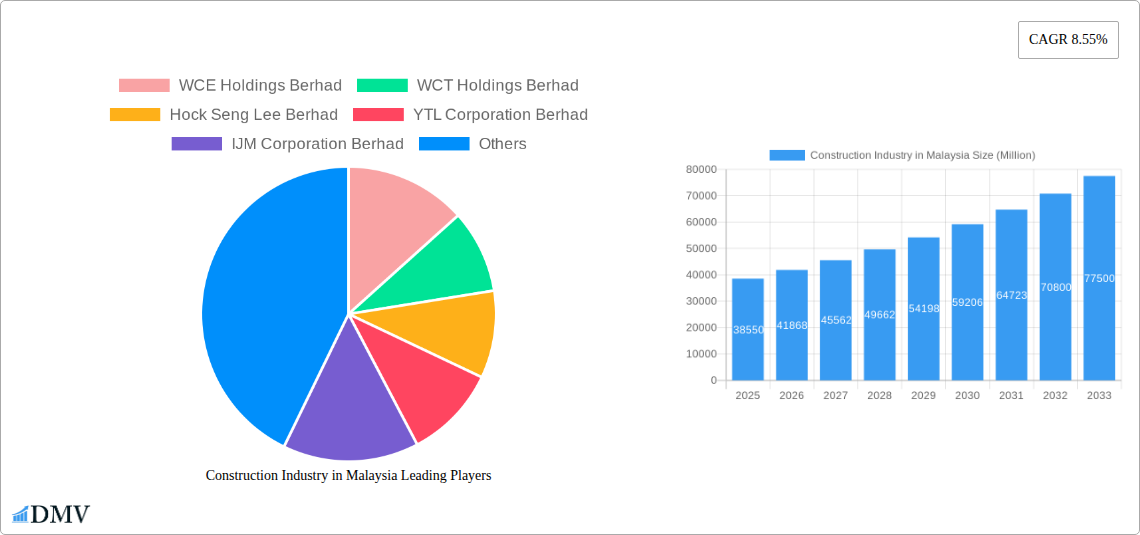

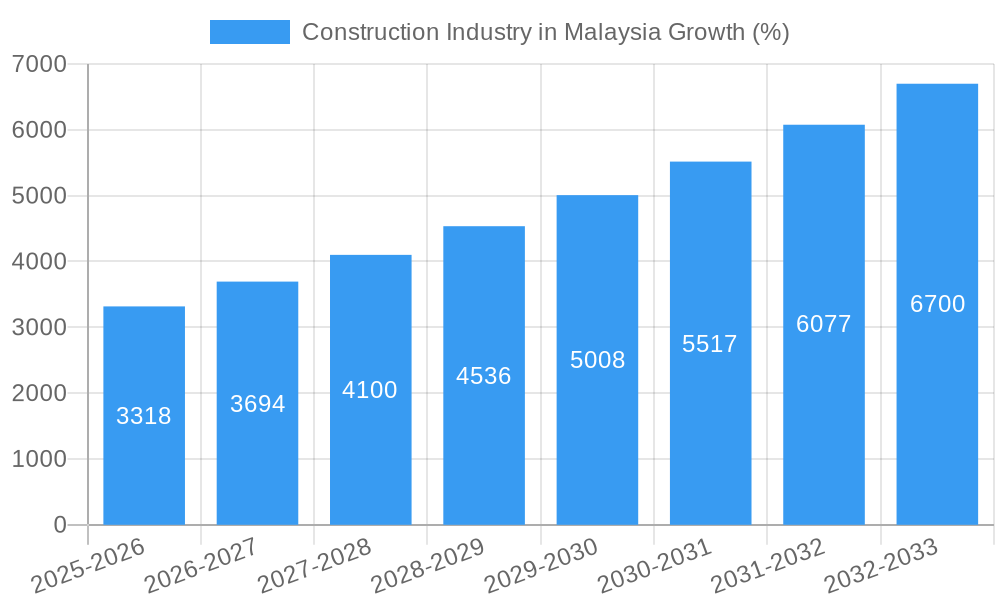

The Malaysian construction industry, valued at RM 38.55 billion in 2025, is projected to experience robust growth, fueled by a Compound Annual Growth Rate (CAGR) of 8.55% from 2025 to 2033. This expansion is driven by several key factors. Firstly, significant government investments in infrastructure projects, particularly within transportation and energy sectors, are stimulating demand. Secondly, a burgeoning population and increasing urbanization are creating a strong need for new residential and commercial constructions. The ongoing development of sustainable and green building technologies further contributes to the market's dynamism. However, challenges exist; fluctuating material costs, skilled labor shortages, and potential economic downturns pose potential restraints to this growth trajectory. The industry is segmented by construction type (additions, demolition, and new construction) and sector (commercial, residential, industrial, infrastructure, and energy/utilities), each offering distinct investment opportunities. Major players like WCE Holdings Berhad, WCT Holdings Berhad, and IJM Corporation Berhad are well-positioned to capitalize on these opportunities.

The segmentation of the market allows for a granular analysis of growth potential within specific niches. The infrastructure (transportation) construction segment is expected to dominate due to substantial government investment in highways, railways, and airports. Residential construction will also see consistent growth, driven by population increase and rising middle-class incomes. However, the industrial construction segment might exhibit moderate growth compared to others, dependent on broader economic factors and industrial investments. Analyzing trends within each segment is crucial for businesses to make informed strategic decisions. The increasing adoption of Building Information Modeling (BIM) and prefabrication techniques reflects a move towards efficiency and cost reduction. While challenges exist, the long-term outlook for the Malaysian construction industry remains positive, particularly with ongoing government support and initiatives to modernize the sector.

Construction Industry in Malaysia: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Malaysian construction industry, offering a comprehensive overview of its market dynamics, key players, and future prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and navigate this dynamic sector. The report utilizes robust data and analysis to paint a clear picture of the current state and future trajectory of the Malaysian construction market, encompassing a market value exceeding RM xx Million.

Construction Industry in Malaysia Market Composition & Trends

This section delves into the intricacies of the Malaysian construction market, analyzing its competitive landscape, innovation drivers, regulatory environment, and key market trends. We examine market concentration, revealing the market share distribution among leading players such as IJM Corporation Berhad, Gamuda Berhad, and WCT Holdings Berhad. The report quantifies the impact of mergers and acquisitions (M&A) activity, estimating the total value of M&A deals at RM xx Million during the historical period (2019-2024). Innovation catalysts, including government initiatives promoting sustainable construction and technological advancements, are meticulously analyzed. The regulatory landscape is assessed, highlighting key policies and their influence on market dynamics. Furthermore, the report examines substitute products and their potential impact on market growth, alongside a detailed profile of end-users across various sectors.

- Market Share Distribution: IJM Corporation Berhad (xx%), Gamuda Berhad (xx%), WCT Holdings Berhad (xx%), others (xx%).

- M&A Deal Value (2019-2024): RM xx Million

- Key Regulatory Factors: Focus on sustainable building practices, infrastructure development plans.

- Substitute Products: Prefabricated building materials, alternative construction technologies.

Construction Industry in Malaysia Industry Evolution

This section provides a comprehensive analysis of the evolution of the Malaysian construction industry from 2019 to 2033. We examine the historical growth trajectory (2019-2024), projecting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The impact of technological advancements, including Building Information Modeling (BIM) and 3D printing, on construction methods and efficiency is extensively covered. Furthermore, we analyze shifts in consumer demands, such as a growing preference for sustainable and technologically advanced buildings. The report will quantify the adoption rates of these technologies and illustrate their impact on industry productivity and cost-effectiveness. The analysis will include detailed discussion on the increasing demand for green building certifications and the implications for the industry.

Leading Regions, Countries, or Segments in Construction Industry in Malaysia

This section identifies the leading segments within the Malaysian construction industry, considering both sectoral and construction type classifications.

By Sector:

- Infrastructure (Transportation) Construction: This segment is projected to be the dominant sector, driven by significant government investments in transportation infrastructure projects, including highways, railways, and airports. Key drivers include robust government spending and the need to improve connectivity throughout Malaysia.

- Residential Construction: Driven by a growing population and urbanization, this sector displays strong growth potential, although subject to fluctuating property market conditions.

- Commercial Construction: This sector witnesses significant activity, fueled by economic growth and the development of commercial centers and office spaces. Investment trends in major cities like Kuala Lumpur significantly impact this sector.

- Industrial Construction: Growth in this sector is closely linked to industrial development and Foreign Direct Investment (FDI), showcasing fluctuating demand based on economic cycles and industrial expansion projects.

- Energy and Utilities Construction: This sector is projected for moderate growth, influenced by government initiatives towards renewable energy and infrastructure upgrades for power and water distribution.

By Construction Type:

- New Construction: This remains the most significant segment, representing the bulk of construction activity.

- Additions and Renovations: This segment demonstrates consistent demand, driven by aging infrastructure and building renovations.

- Demolition: This segment fluctuates based on redevelopment projects and infrastructure upgrades.

Construction Industry in Malaysia Product Innovations

The Malaysian construction industry is embracing innovation, incorporating advanced materials like high-performance concrete and sustainable building materials. These innovations are improving construction efficiency, reducing environmental impact, and enhancing building performance. The adoption of prefabrication techniques is also increasing, leading to faster project completion and reduced labor costs. Technological advancements such as BIM and IoT-enabled construction equipment are enhancing productivity and optimizing resource utilization, leading to significant cost savings and improved project outcomes.

Propelling Factors for Construction Industry in Malaysia Growth

Several factors contribute to the growth of the Malaysian construction industry. Government investments in large-scale infrastructure projects, like the Mass Rapid Transit (MRT) system and the East Coast Rail Link (ECRL), are stimulating substantial demand. Economic growth and rising urbanization are also key drivers, fueling demand for residential, commercial, and industrial construction. Furthermore, government initiatives promoting sustainable construction practices are creating opportunities for eco-friendly building materials and technologies.

Obstacles in the Construction Industry in Malaysia Market

Despite the positive outlook, the Malaysian construction industry faces challenges. The industry is often impacted by supply chain disruptions, leading to material cost increases and project delays. Regulatory complexities and bureaucratic hurdles can slow down project approvals and increase development costs. Furthermore, intense competition among construction firms can put pressure on profit margins. The skill shortage in the construction workforce poses a significant constraint on productivity and project timelines.

Future Opportunities in Construction Industry in Malaysia

The future of the Malaysian construction industry holds significant opportunities. The growing focus on sustainable and green buildings presents a vast market for eco-friendly construction materials and technologies. The increasing adoption of advanced technologies, such as BIM and 3D printing, offers opportunities for enhanced efficiency and productivity. Government initiatives aimed at developing smart cities and improving infrastructure will continue to drive growth. Furthermore, the expanding tourism sector offers significant opportunities for hospitality and related construction projects.

Major Players in the Construction Industry in Malaysia Ecosystem

- WCE Holdings Berhad

- WCT Holdings Berhad

- Hock Seng Lee Berhad

- YTL Corporation Berhad

- IJM Corporation Berhad

- Muhibbah Engineering (M) Bhd

- Malaysian Resources Corporation Berhad

- Gamuda Berhad

- Mudajaya Group Berhad

- UEM Group Berhad

Key Developments in Construction Industry in Malaysia Industry

- October 2023: Gamuda Bhd's joint venture secures a MYR 4 billion (USD 0.86 billion) hydroelectric power plant project in Sabah, signifying significant investment in renewable energy infrastructure.

- July 2023: IJM Corporation Berhad's partnership to develop logistics hubs marks its entry into the Klang Valley's industrial property market, demonstrating diversification strategies within the sector.

Strategic Construction Industry in Malaysia Market Forecast

The Malaysian construction industry is poised for continued growth, driven by robust government infrastructure spending, economic expansion, and increasing urbanization. The adoption of innovative technologies and sustainable construction practices will further enhance efficiency and market competitiveness. The focus on developing smart cities and improving connectivity will create significant opportunities for construction companies. The market is expected to witness a sustained increase in value, exceeding RM xx Million by 2033.

Construction Industry in Malaysia Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utilities Construction

-

2. Construction Type

- 2.1. Additions

- 2.2. Demolition and New Construction

Construction Industry in Malaysia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Construction Industry in Malaysia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise in Demand for Residential Property4.; Increase in Infrastructure Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Increase in Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Residential Construction Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. Additions

- 5.2.2. Demolition and New Construction

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Commercial Construction

- 6.1.2. Residential Construction

- 6.1.3. Industrial Construction

- 6.1.4. Infrastructure (Transportation) Construction

- 6.1.5. Energy and Utilities Construction

- 6.2. Market Analysis, Insights and Forecast - by Construction Type

- 6.2.1. Additions

- 6.2.2. Demolition and New Construction

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Commercial Construction

- 7.1.2. Residential Construction

- 7.1.3. Industrial Construction

- 7.1.4. Infrastructure (Transportation) Construction

- 7.1.5. Energy and Utilities Construction

- 7.2. Market Analysis, Insights and Forecast - by Construction Type

- 7.2.1. Additions

- 7.2.2. Demolition and New Construction

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Commercial Construction

- 8.1.2. Residential Construction

- 8.1.3. Industrial Construction

- 8.1.4. Infrastructure (Transportation) Construction

- 8.1.5. Energy and Utilities Construction

- 8.2. Market Analysis, Insights and Forecast - by Construction Type

- 8.2.1. Additions

- 8.2.2. Demolition and New Construction

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Commercial Construction

- 9.1.2. Residential Construction

- 9.1.3. Industrial Construction

- 9.1.4. Infrastructure (Transportation) Construction

- 9.1.5. Energy and Utilities Construction

- 9.2. Market Analysis, Insights and Forecast - by Construction Type

- 9.2.1. Additions

- 9.2.2. Demolition and New Construction

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Commercial Construction

- 10.1.2. Residential Construction

- 10.1.3. Industrial Construction

- 10.1.4. Infrastructure (Transportation) Construction

- 10.1.5. Energy and Utilities Construction

- 10.2. Market Analysis, Insights and Forecast - by Construction Type

- 10.2.1. Additions

- 10.2.2. Demolition and New Construction

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 WCE Holdings Berhad

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 WCT Holdings Berhad

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hock Seng Lee Berhad

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 YTL Corporation Berhad

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IJM Corporation Berhad

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Muhibbah Engineering (M) Bhd**List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Malaysian Resources Corporation Berhad

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gamuda Berhad

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mudajaya Group Berhad

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 UEM Group Berhad

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 WCE Holdings Berhad

List of Figures

- Figure 1: Global Construction Industry in Malaysia Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Malaysia Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 3: Malaysia Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Construction Industry in Malaysia Revenue (Million), by Sector 2024 & 2032

- Figure 5: North America Construction Industry in Malaysia Revenue Share (%), by Sector 2024 & 2032

- Figure 6: North America Construction Industry in Malaysia Revenue (Million), by Construction Type 2024 & 2032

- Figure 7: North America Construction Industry in Malaysia Revenue Share (%), by Construction Type 2024 & 2032

- Figure 8: North America Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Construction Industry in Malaysia Revenue (Million), by Sector 2024 & 2032

- Figure 11: South America Construction Industry in Malaysia Revenue Share (%), by Sector 2024 & 2032

- Figure 12: South America Construction Industry in Malaysia Revenue (Million), by Construction Type 2024 & 2032

- Figure 13: South America Construction Industry in Malaysia Revenue Share (%), by Construction Type 2024 & 2032

- Figure 14: South America Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Construction Industry in Malaysia Revenue (Million), by Sector 2024 & 2032

- Figure 17: Europe Construction Industry in Malaysia Revenue Share (%), by Sector 2024 & 2032

- Figure 18: Europe Construction Industry in Malaysia Revenue (Million), by Construction Type 2024 & 2032

- Figure 19: Europe Construction Industry in Malaysia Revenue Share (%), by Construction Type 2024 & 2032

- Figure 20: Europe Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Construction Industry in Malaysia Revenue (Million), by Sector 2024 & 2032

- Figure 23: Middle East & Africa Construction Industry in Malaysia Revenue Share (%), by Sector 2024 & 2032

- Figure 24: Middle East & Africa Construction Industry in Malaysia Revenue (Million), by Construction Type 2024 & 2032

- Figure 25: Middle East & Africa Construction Industry in Malaysia Revenue Share (%), by Construction Type 2024 & 2032

- Figure 26: Middle East & Africa Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Construction Industry in Malaysia Revenue (Million), by Sector 2024 & 2032

- Figure 29: Asia Pacific Construction Industry in Malaysia Revenue Share (%), by Sector 2024 & 2032

- Figure 30: Asia Pacific Construction Industry in Malaysia Revenue (Million), by Construction Type 2024 & 2032

- Figure 31: Asia Pacific Construction Industry in Malaysia Revenue Share (%), by Construction Type 2024 & 2032

- Figure 32: Asia Pacific Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Construction Industry in Malaysia Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 4: Global Construction Industry in Malaysia Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 7: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 8: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 13: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 14: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 19: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 20: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 31: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 32: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 40: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 41: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Industry in Malaysia?

The projected CAGR is approximately 8.55%.

2. Which companies are prominent players in the Construction Industry in Malaysia?

Key companies in the market include WCE Holdings Berhad, WCT Holdings Berhad, Hock Seng Lee Berhad, YTL Corporation Berhad, IJM Corporation Berhad, Muhibbah Engineering (M) Bhd**List Not Exhaustive, Malaysian Resources Corporation Berhad, Gamuda Berhad, Mudajaya Group Berhad, UEM Group Berhad.

3. What are the main segments of the Construction Industry in Malaysia?

The market segments include Sector, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.55 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise in Demand for Residential Property4.; Increase in Infrastructure Projects.

6. What are the notable trends driving market growth?

Residential Construction Driving the Market.

7. Are there any restraints impacting market growth?

4.; Increase in Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

October 2023: Gamuda Bhd entered into a joint-venture agreement with Sabah Energy Corp Sdn Bhd (SEC) and Kerjaya Kagum Hitech JV Sdn Bhd (KKHJV) to undertake a private finance initiative for the development of the MYR 4 billion (USD 0.86 billion) 187.5 MW hydroelectric power plant in Tenom, Sabah.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Industry in Malaysia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Industry in Malaysia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Industry in Malaysia?

To stay informed about further developments, trends, and reports in the Construction Industry in Malaysia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence