Key Insights

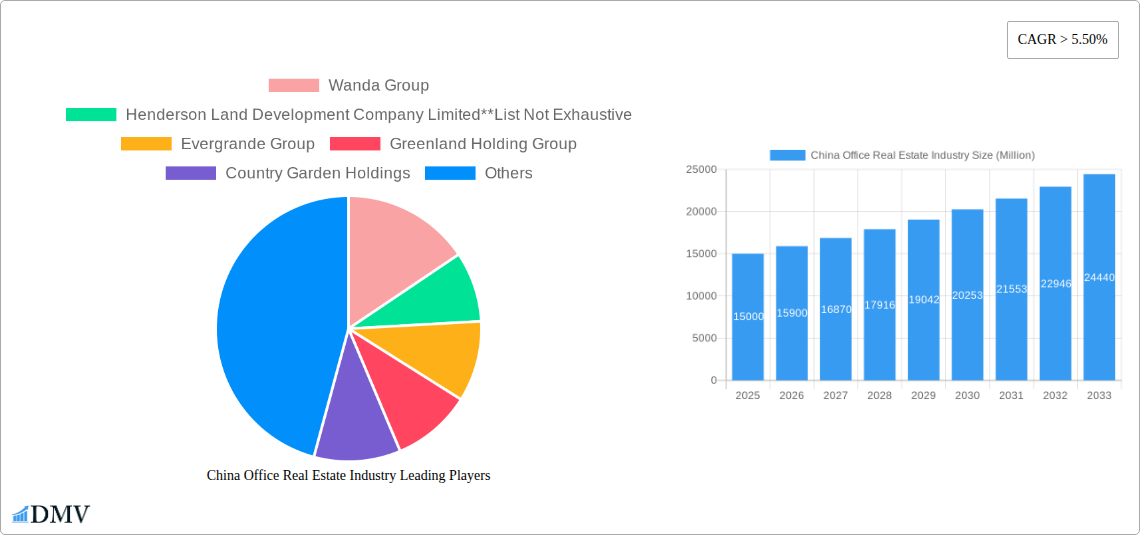

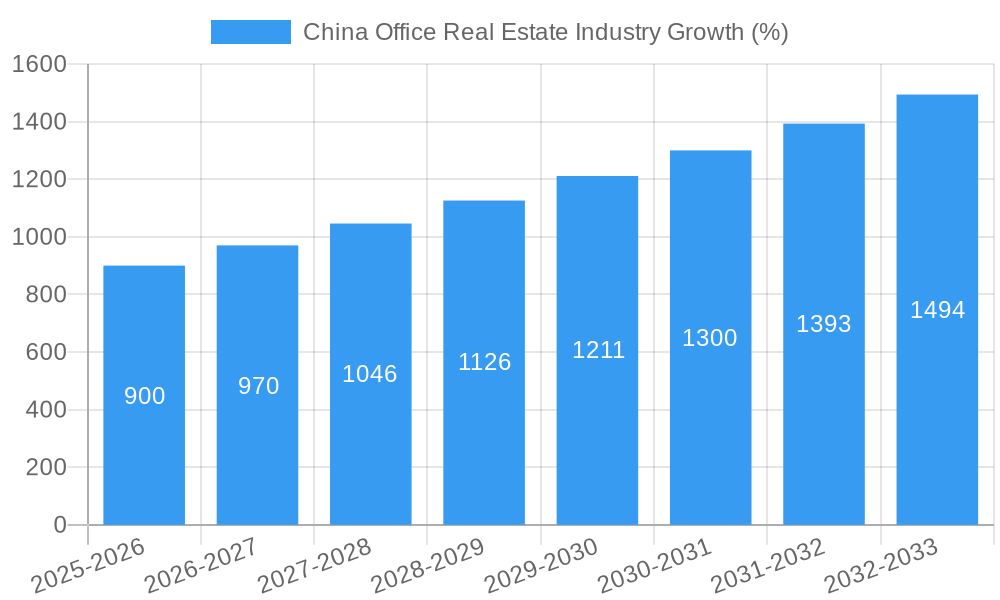

The China office real estate market, a significant component of the nation's economy, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5.5% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning Information Technology (IT and ITES) sector, along with the continued growth of the Banking, Financial Services, and Insurance (BFSI) industry, are driving significant demand for modern office spaces in major cities like Beijing and Shanghai. Furthermore, the expansion of consulting and other service sectors contributes to this demand. While the market faces constraints such as fluctuating economic conditions and potential oversupply in certain localized areas, the overall outlook remains positive, supported by long-term economic growth projections and ongoing urbanization. Major players like Wanda Group, Henderson Land, and Evergrande Group are shaping the market landscape, influencing development trends and influencing pricing strategies. The diverse range of segments, spanning different sectors and geographic locations, provides opportunities for both large developers and niche players to capitalize on the expanding market. Growth is likely to be concentrated in Tier 1 and Tier 2 cities that serve as hubs for technological innovation and financial activity.

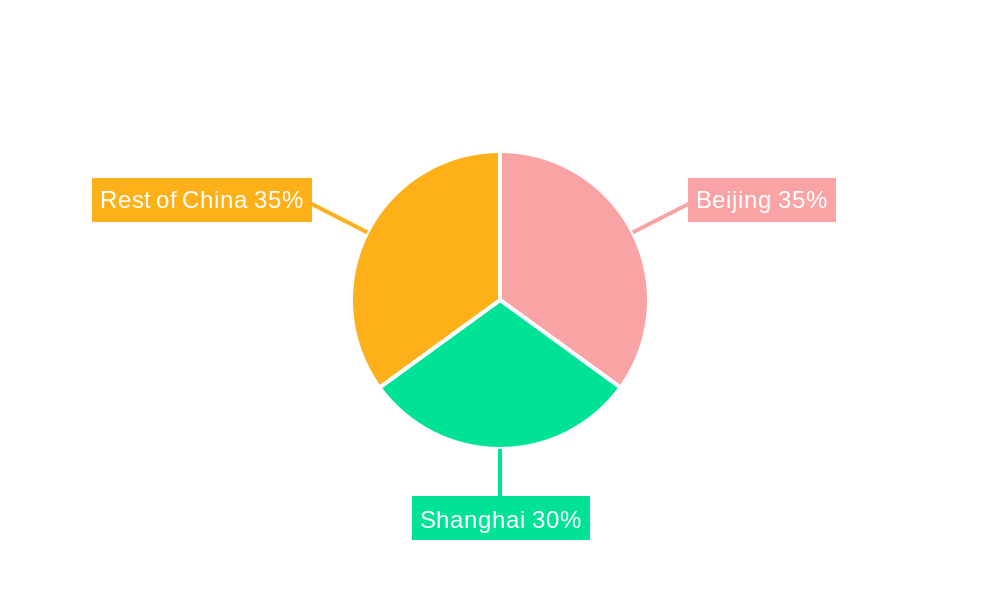

The segmentation of the market by major cities (Beijing, Shanghai, and Rest of China) reveals distinct dynamics. Beijing and Shanghai, as major financial and technological centers, will likely dominate market share, fueled by high demand from multinational corporations and domestic tech giants. The "Rest of China" segment, however, presents significant growth potential, driven by expanding economic activity and infrastructure development in secondary and tertiary cities. Analyzing the sectoral distribution, the IT and ITES sectors, with their high demand for flexible and modern workspaces, are predicted to be leading drivers of growth. The BFSI sector, with its large and established presence, will continue to contribute significantly, while the consulting sector is expected to see an increase in demand as the Chinese economy continues to become more complex and globally integrated. The consistent growth across these sectors and the large market size indicate a promising trajectory for the Chinese office real estate market in the coming years.

China Office Real Estate Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the China office real estate industry, covering market trends, leading players, and future growth prospects. With a detailed examination of the period from 2019 to 2033, including a base year of 2025 and a forecast period spanning 2025-2033, this report is an essential resource for stakeholders seeking to understand and navigate this dynamic market. The report utilizes a predicted value of xx Million where data was unavailable.

China Office Real Estate Industry Market Composition & Trends

This section evaluates the competitive landscape of the China office real estate market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The report delves into the market share distribution among key players like Wanda Group, Henderson Land Development Company Limited, Evergrande Group, Greenland Holding Group, and others, offering a detailed understanding of the market's competitive dynamics. M&A activity is analyzed based on deal values (in Millions), identifying significant transactions and their impact on market structure. The regulatory landscape's influence on market behavior is examined, highlighting significant legislation and its effect on investment and development. Furthermore, the report analyzes substitute products, end-user segmentation by industry (IT, Manufacturing, BFSI, Consulting, and Other Services), and profiles of key end-users.

- Market Concentration: Analysis of market share distribution among top players (e.g., Wanda Group holding xx% market share).

- Innovation Catalysts: Examination of technological advancements driving market innovation.

- Regulatory Landscape: Detailed analysis of key regulations impacting the sector.

- Substitute Products: Evaluation of alternative office space solutions and their market impact.

- End-User Profiles: Comprehensive analysis of end-user needs and preferences across diverse sectors.

- M&A Activities: Review of significant M&A deals with associated values (in Millions) and their strategic implications. For example, the xx Million acquisition of [Property Name] by [Company Name] in [Year].

China Office Real Estate Industry Industry Evolution

This section analyzes the evolutionary trajectory of the China office real estate industry, focusing on market growth trajectories, technological advancements, and changing consumer demands. It provides insights into historical growth rates (2019-2024), projected growth rates (2025-2033), and adoption metrics for emerging technologies within the sector. The influence of technological advancements, such as smart building technologies and flexible workspace solutions, on market growth is explored. Additionally, the report examines shifting consumer preferences, such as the increasing demand for sustainable and technologically advanced office spaces, and their impact on market dynamics. The analysis incorporates data points illustrating market growth rates, technological adoption, and evolving consumer demands, revealing the industry's dynamic evolution. The total market size in 2025 is predicted to be xx Million.

Leading Regions, Countries, or Segments in China Office Real Estate Industry

This section identifies the dominant regions and sectors within the China office real estate market. It conducts an in-depth analysis of leading cities (Beijing, Shanghai, Rest of China) and industry sectors (IT, Manufacturing, BFSI, Consulting, Other Services), focusing on factors contributing to their dominance.

- By Major Cities:

- Beijing: High concentration of multinational corporations, robust government support, and a developed infrastructure contribute to Beijing's leading position.

- Shanghai: Strong financial sector, international business hub status, and a large pool of skilled talent drive Shanghai's dominance.

- Rest of China: Growth driven by increasing urbanization, rising disposable incomes, and government initiatives to stimulate regional development.

- By Sector:

- Information Technology (IT and ITES): High demand for modern, technologically advanced office spaces fuels growth in this sector.

- BFSI (Banking, Financial Services, and Insurance): The financial sector's needs for secure and prestigious office locations drive significant demand.

- Manufacturing: Expansion of manufacturing hubs in various regions fuels demand for industrial and office spaces.

The detailed analysis explains why specific regions and sectors are thriving, identifying key drivers such as investment trends, regulatory support, and market demand.

China Office Real Estate Industry Product Innovations

This section highlights notable product innovations, applications, and performance metrics within the China office real estate industry. Recent advancements include the integration of smart building technologies, enhancing energy efficiency and optimizing workspace utilization. Flexible workspace solutions cater to the changing needs of businesses, offering adaptable and shared office spaces. These innovations improve operational efficiency, increase tenant satisfaction, and contribute to the overall sustainability of office buildings. The market is seeing a growing adoption of these innovative products, driving further growth and development within the sector.

Propelling Factors for China Office Real Estate Industry Growth

Several key factors drive the growth of the China office real estate industry. Technological advancements, such as smart building technologies and improved infrastructure, significantly impact market growth. Economic factors, including a growing middle class and increasing urbanization, create a surge in demand for office spaces. Government policies and regulations play a pivotal role in shaping market dynamics, with supportive policies fostering investment and development. The government's focus on sustainable development further influences the construction of eco-friendly office buildings.

Obstacles in the China Office Real Estate Industry Market

Despite significant growth potential, several challenges hinder the China office real estate market. Regulatory hurdles, such as complex approval processes and fluctuating policies, can create uncertainty and delays. Supply chain disruptions, stemming from global events and domestic factors, affect construction timelines and project costs. Intense competition among developers, both domestic and international, leads to price pressures and necessitates innovative strategies for success. These challenges, combined, can negatively impact market growth if not addressed effectively.

Future Opportunities in China Office Real Estate Industry

The China office real estate industry presents substantial future opportunities. Expansion into Tier 2 and Tier 3 cities offers untapped potential, with growing demand for office spaces in these developing regions. The adoption of cutting-edge technologies, such as AI-powered building management systems and sustainable design practices, presents lucrative opportunities for innovation. Catering to evolving business models, such as flexible workspaces and co-working hubs, further expands the market potential. These emerging trends promise exciting prospects for future growth and development.

Major Players in the China Office Real Estate Industry Ecosystem

- Wanda Group

- Henderson Land Development Company Limited

- Evergrande Group

- Greenland Holding Group

- Country Garden Holdings

- China Overseas Land & Investment Ltd

- China Vanke Co

- Gemdale Corporation

- Sunac China Holdings

- China Merchants Shekou Industrial Zone Holdings

- China Resources Land Ltd

- Poly Real Estate

Key Developments in China Office Real Estate Industry Industry

- April 2023: Launch of China's new private equity real estate pilot program aimed at boosting investment and attracting foreign capital, significantly impacting market liquidity and developer debt ratios.

- March 2023: CapitaLand Investment Private Fund's acquisition of the Beijing Suning Life Plaza for approximately US$400 Million, demonstrating significant M&A activity within the market.

Strategic China Office Real Estate Industry Market Forecast

The future of the China office real estate market is bright, driven by continued urbanization, economic growth, and technological advancements. The increasing demand for flexible and sustainable office spaces, coupled with government support for infrastructure development, will fuel substantial growth in the coming years. Expansion into new markets and the adoption of innovative technologies will further contribute to the market's overall potential. The market is expected to experience robust growth, with a predicted market value of xx Million by 2033, representing a significant increase from the 2025 base year.

China Office Real Estate Industry Segmentation

-

1. Major Cities

- 1.1. Beijing

- 1.2. Shanghai

- 1.3. Rest of China

-

2. Sector

- 2.1. Information Technology (IT and ITES)

- 2.2. Manufacturing

- 2.3. BFSI (Banking, Financial Services, and Insurance)

- 2.4. Consulting

- 2.5. Other Services

China Office Real Estate Industry Segmentation By Geography

- 1. China

China Office Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Demand and Rising Construction Activities to Drive the Market; Rising House Prices in Germany Affecting Demand in the Market

- 3.3. Market Restrains

- 3.3.1. Weak economic environment

- 3.4. Market Trends

- 3.4.1. Robust Leasing Demand For the Office Spaces Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Major Cities

- 5.1.1. Beijing

- 5.1.2. Shanghai

- 5.1.3. Rest of China

- 5.2. Market Analysis, Insights and Forecast - by Sector

- 5.2.1. Information Technology (IT and ITES)

- 5.2.2. Manufacturing

- 5.2.3. BFSI (Banking, Financial Services, and Insurance)

- 5.2.4. Consulting

- 5.2.5. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Major Cities

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Wanda Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Henderson Land Development Company Limited**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Evergrande Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Greenland Holding Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Country Garden Holdings

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Overseas Land & Investment Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Vanke Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gemdale Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sunac China Holdings

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Merchants Shekou Industrial Zone Holdings

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 China Resources Land Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Poly Real Estate

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Wanda Group

List of Figures

- Figure 1: China Office Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Office Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: China Office Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Office Real Estate Industry Revenue Million Forecast, by Major Cities 2019 & 2032

- Table 3: China Office Real Estate Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: China Office Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Office Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Office Real Estate Industry Revenue Million Forecast, by Major Cities 2019 & 2032

- Table 7: China Office Real Estate Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 8: China Office Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Office Real Estate Industry?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the China Office Real Estate Industry?

Key companies in the market include Wanda Group, Henderson Land Development Company Limited**List Not Exhaustive, Evergrande Group, Greenland Holding Group, Country Garden Holdings, China Overseas Land & Investment Ltd, China Vanke Co, Gemdale Corporation, Sunac China Holdings, China Merchants Shekou Industrial Zone Holdings, China Resources Land Ltd, Poly Real Estate.

3. What are the main segments of the China Office Real Estate Industry?

The market segments include Major Cities, Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Strong Demand and Rising Construction Activities to Drive the Market; Rising House Prices in Germany Affecting Demand in the Market.

6. What are the notable trends driving market growth?

Robust Leasing Demand For the Office Spaces Driving the Market.

7. Are there any restraints impacting market growth?

Weak economic environment.

8. Can you provide examples of recent developments in the market?

April 2023: China's new private equity real estate pilot programme is designed to boost investment in the property sector and attract increased foreign investment. The pilot programme, announced by the Securities Regulatory Commission (CSRC) last month, is intended to boost private investment in the Chinese real estate market and open the door to foreign investors. The aim is to improve liquidity and reduce property developers' debt ratios.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Office Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Office Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Office Real Estate Industry?

To stay informed about further developments, trends, and reports in the China Office Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence