Key Insights

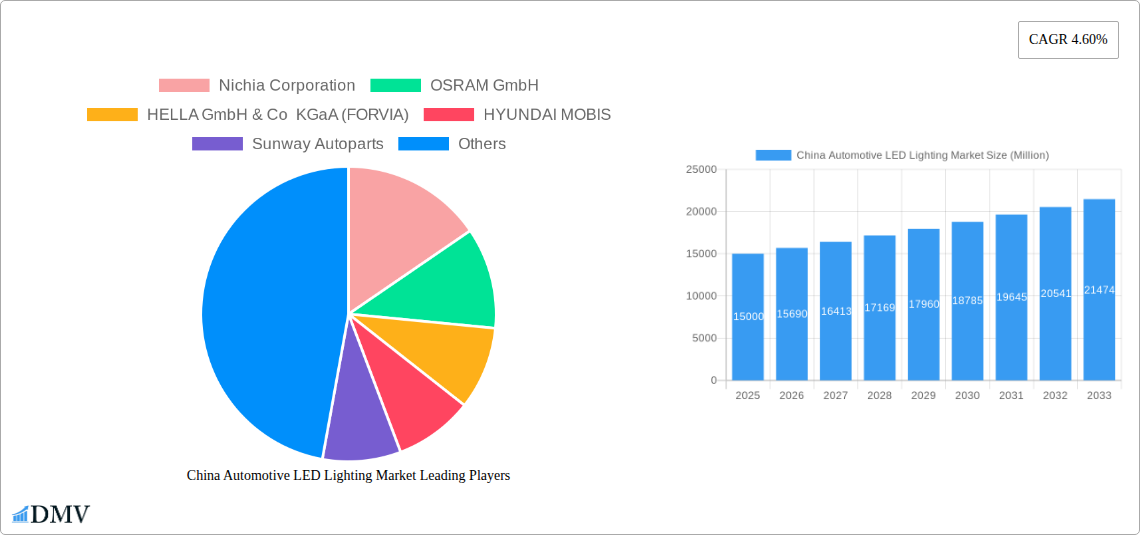

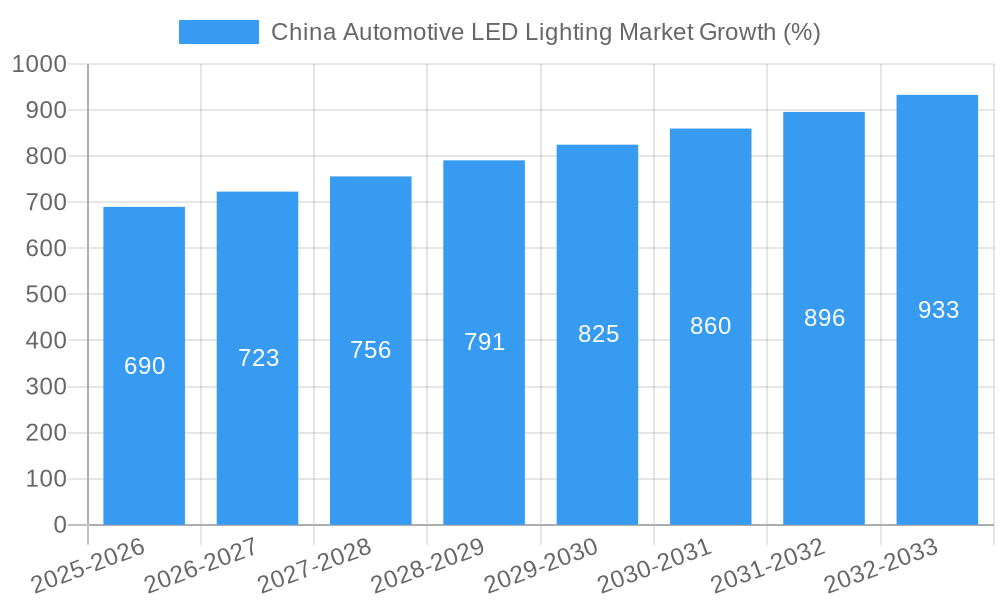

The China automotive LED lighting market is experiencing robust growth, driven by increasing vehicle production, stringent government regulations promoting energy efficiency and safety, and a rising consumer preference for advanced lighting technologies. The market's Compound Annual Growth Rate (CAGR) of 4.60% from 2019 to 2024 indicates a steady expansion, projected to continue over the forecast period (2025-2033). Key market segments include daytime running lights (DRLs), headlights, and taillights, with passenger cars currently dominating the vehicle segment, followed by commercial vehicles and two-wheelers. Leading players like Nichia Corporation, OSRAM, HELLA, and Hyundai Mobis are driving innovation with advanced LED technologies, contributing to improved vehicle safety and aesthetics. The substantial market size of China’s automotive sector creates a fertile ground for LED lighting adoption. Furthermore, ongoing advancements in LED technology, including higher lumen output, improved energy efficiency, and smaller form factors, are expected to fuel market expansion. The increasing adoption of smart lighting systems integrated with driver-assistance features presents a promising avenue for growth. However, factors such as the relatively high initial investment cost of LED lighting systems compared to traditional technologies and potential supply chain disruptions could pose challenges.

The continued expansion of the Chinese automotive industry, coupled with government initiatives promoting sustainable transportation, will likely offset these challenges. The market's segmentation provides numerous opportunities for specialized product development, catering to the unique needs of different vehicle types and lighting applications. The dominance of passenger cars indicates potential for increased market penetration in the commercial vehicle and two-wheeler segments. Focusing on innovative lighting solutions that enhance safety and driver convenience will be crucial for companies seeking to capitalize on this growth trajectory. Specifically, the integration of adaptive driving beam (ADB) technology and intelligent lighting systems offering improved visibility and reduced glare will be key differentiators in the market.

China Automotive LED Lighting Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning China automotive LED lighting market, offering crucial data and forecasts for stakeholders seeking to navigate this dynamic sector. From market composition and trends to future opportunities, this comprehensive study covers all key aspects, empowering informed decision-making and strategic planning. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

China Automotive LED Lighting Market Market Composition & Trends

This section meticulously examines the competitive landscape of the China automotive LED lighting market. We delve into market concentration, analyzing the market share distribution among key players such as Nichia Corporation, OSRAM GmbH, HELLA GmbH & Co KGaA (FORVIA), HYUNDAI MOBIS, Sunway Autoparts, Hasco Vision Technology Co Ltd, Changzhou Xingyu Automotive Lighting System Co Ltd, Valeo, Stanley Electric Co Ltd, and KOITO MANUFACTURING CO LTD. The report also assesses the influence of innovation catalysts, including technological advancements and R&D investments, on market dynamics. We further explore the regulatory landscape impacting the market, including safety standards and emission regulations. The impact of substitute products and the evolving end-user preferences are also thoroughly investigated. Finally, we analyze mergers and acquisitions (M&A) activities, quantifying deal values and their effects on market consolidation.

- Market Concentration: The market exhibits a [Describe concentration level - e.g., moderately concentrated] structure, with the top 5 players holding an estimated [xx]% market share in 2025.

- M&A Activity: Analysis reveals [xx] significant M&A deals in the historical period (2019-2024), with a total estimated value of [xx] Million.

- Innovation Catalysts: The increasing demand for energy-efficient lighting and advanced driver-assistance systems (ADAS) fuels continuous innovation in LED technology.

- Regulatory Landscape: Stringent government regulations regarding automotive lighting safety and efficiency drive market growth and standardization.

- End-User Profiles: The report profiles key end-users, including passenger car manufacturers, commercial vehicle producers, and two-wheeler manufacturers.

China Automotive LED Lighting Market Industry Evolution

This section charts the evolution of the China automotive LED lighting market, examining its growth trajectory from 2019 to 2033. We analyze technological advancements, such as the adoption of mini-LED and micro-LED technologies, and their influence on market trends. The impact of shifting consumer preferences towards enhanced aesthetics, safety, and advanced features is also explored, complemented by a detailed assessment of market growth rates and adoption metrics for different LED lighting types. The analysis considers macroeconomic factors, government policies, technological advancements, and evolving consumer preferences to provide a holistic view of the market's dynamic evolution. The CAGR for the forecast period (2025-2033) is projected to be [xx]%.

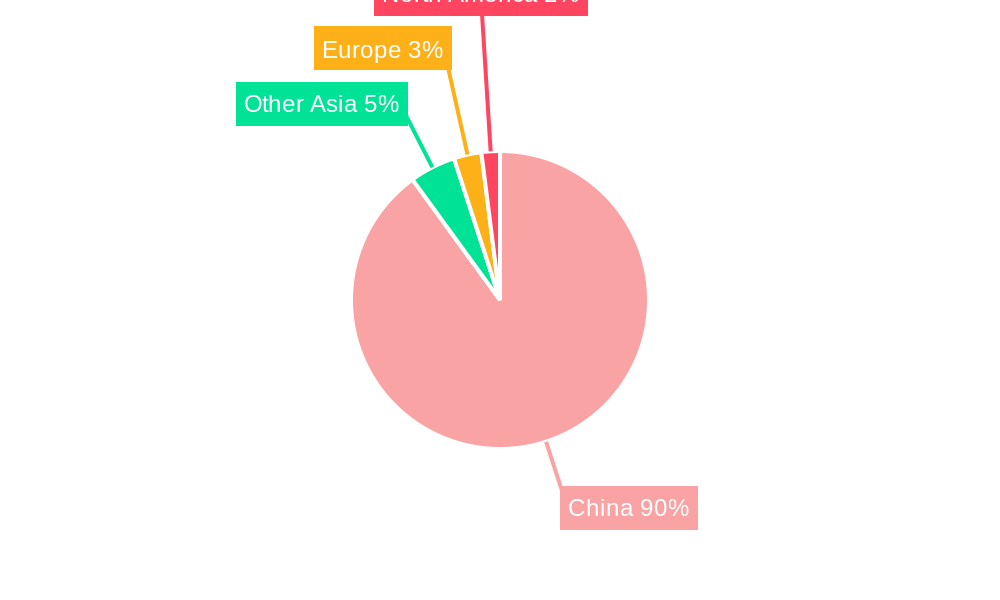

Leading Regions, Countries, or Segments in China Automotive LED Lighting Market

This section identifies the leading segments and regions within the China automotive LED lighting market. The analysis focuses on Automotive Utility Lighting (Daytime Running Lights (DRL), Directional Signal Lights, Headlights, Reverse Light, Stop Light, Tail Light, Others) and Automotive Vehicle Lighting (2 Wheelers, Commercial Vehicles, Passenger Cars). The report pinpoints the dominant segment and provides a detailed rationale for its leading position.

Key Drivers:

- Passenger Cars: High demand driven by increasing vehicle production and consumer preference for advanced lighting systems.

- Headlights: Significant market share due to safety regulations and technological advancements in beam patterns and adaptive lighting.

- Investment Trends: Significant investments in R&D and manufacturing capacity expansion within the automotive industry.

- Regulatory Support: Government policies promoting energy efficiency and safety standards within the automotive sector.

Dominance Factors: The dominance of specific segments is attributed to factors like increasing vehicle production, stringent safety regulations, technological innovation, and consumer preference for enhanced safety and aesthetics.

China Automotive LED Lighting Market Product Innovations

This section highlights recent product innovations in the China automotive LED lighting market. We detail unique selling propositions, such as improved energy efficiency, advanced lighting functionalities (adaptive headlights, dynamic turn signals), and enhanced design aesthetics. The report also discusses performance metrics, including luminous intensity, lifespan, and color rendering index (CRI), demonstrating how these innovations enhance the value proposition for automotive manufacturers and consumers. The advancements in miniaturization and integration of LED lighting systems with other automotive functionalities are also highlighted.

Propelling Factors for China Automotive LED Lighting Market Growth

Several factors drive the growth of the China automotive LED lighting market. Technological advancements, such as the development of more efficient and brighter LED chips, contribute significantly. The supportive economic environment, characterized by robust automotive production and rising disposable incomes, fuels demand. Stringent government regulations promoting vehicle safety and energy efficiency further accelerate market expansion.

Obstacles in the China Automotive LED Lighting Market Market

Despite its significant growth potential, the China automotive LED lighting market faces some challenges. Regulatory hurdles, particularly concerning product certification and homologation, can delay market entry and increase compliance costs. Supply chain disruptions, especially the impact of geopolitical tensions and global events, can negatively affect production and costs. Intense competition from both domestic and international players also exerts downward pressure on pricing and profit margins.

Future Opportunities in China Automotive LED Lighting Market

The future holds significant opportunities for the China automotive LED lighting market. The expansion of the electric vehicle (EV) market creates substantial demand for advanced lighting technologies, including energy-efficient LED lighting. The rising adoption of autonomous driving features presents opportunities for developing sophisticated and integrated lighting systems, such as LiDAR and adaptive driving beam systems. Furthermore, growing consumer demand for stylish and customized lighting options opens avenues for specialized and high-end products.

Major Players in the China Automotive LED Lighting Market Ecosystem

- Nichia Corporation

- OSRAM GmbH

- HELLA GmbH & Co KGaA (FORVIA)

- HYUNDAI MOBIS

- Sunway Autoparts

- Hasco Vision Technology Co Ltd

- Changzhou Xingyu Automotive Lighting System Co Ltd

- Valeo

- Stanley Electric Co Ltd

- KOITO MANUFACTURING CO LTD

Key Developments in China Automotive LED Lighting Market Industry

- December 2022: HELLA further expands its leading market position in chip-based headlamp technologies (SSL | HD). World's first series production of an SSL | HD headlamp started at the Lippstadt site.

- January 2023: HELLA brings FlatLight technology into series production as a daytime running light for the first time. Series production starts in 2025.

- March 2023: HELLA expands Black Magic auxiliary headlamp series with 32 new lightbars (14 for on-road, 18 for off-road use).

Strategic China Automotive LED Lighting Market Market Forecast

The China automotive LED lighting market is poised for sustained growth, driven by technological innovation, supportive government policies, and increasing consumer demand. The forecast period (2025-2033) anticipates robust expansion fueled by the increasing adoption of advanced driver-assistance systems (ADAS), the proliferation of electric vehicles (EVs), and the ongoing demand for improved vehicle safety and aesthetics. The market's growth potential is considerable, with opportunities across various segments and technological advancements expected to further propel its trajectory.

China Automotive LED Lighting Market Segmentation

-

1. Automotive Utility Lighting

- 1.1. Daytime Running Lights (DRL)

- 1.2. Directional Signal Lights

- 1.3. Headlights

- 1.4. Reverse Light

- 1.5. Stop Light

- 1.6. Tail Light

- 1.7. Others

-

2. Automotive Vehicle Lighting

- 2.1. 2 Wheelers

- 2.2. Commercial Vehicles

- 2.3. Passenger Cars

China Automotive LED Lighting Market Segmentation By Geography

- 1. China

China Automotive LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for Connected Devices; Surging Usage of Fossil Fuels has Increasing Demand for Power-Efficient Electronic Devices

- 3.3. Market Restrains

- 3.3.1 Limitations in Operations due to Constraints like Temperature

- 3.3.2 Frequency

- 3.3.3 Reverse Blocking Capacity

- 3.3.4 etc.

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Automotive LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 5.1.1. Daytime Running Lights (DRL)

- 5.1.2. Directional Signal Lights

- 5.1.3. Headlights

- 5.1.4. Reverse Light

- 5.1.5. Stop Light

- 5.1.6. Tail Light

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 5.2.1. 2 Wheelers

- 5.2.2. Commercial Vehicles

- 5.2.3. Passenger Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Nichia Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OSRAM GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HELLA GmbH & Co KGaA (FORVIA)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HYUNDAI MOBIS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sunway Autoparts

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hasco Vision Technology Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Changzhou Xingyu Automotive Lighting System Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vale

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stanley Electric Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 KOITO MANUFACTURING CO LTD

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nichia Corporation

List of Figures

- Figure 1: China Automotive LED Lighting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Automotive LED Lighting Market Share (%) by Company 2024

List of Tables

- Table 1: China Automotive LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Automotive LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: China Automotive LED Lighting Market Revenue Million Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 4: China Automotive LED Lighting Market Volume K Unit Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 5: China Automotive LED Lighting Market Revenue Million Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 6: China Automotive LED Lighting Market Volume K Unit Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 7: China Automotive LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China Automotive LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: China Automotive LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China Automotive LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: China Automotive LED Lighting Market Revenue Million Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 12: China Automotive LED Lighting Market Volume K Unit Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 13: China Automotive LED Lighting Market Revenue Million Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 14: China Automotive LED Lighting Market Volume K Unit Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 15: China Automotive LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Automotive LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Automotive LED Lighting Market?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the China Automotive LED Lighting Market?

Key companies in the market include Nichia Corporation, OSRAM GmbH, HELLA GmbH & Co KGaA (FORVIA), HYUNDAI MOBIS, Sunway Autoparts, Hasco Vision Technology Co Ltd, Changzhou Xingyu Automotive Lighting System Co Ltd, Vale, Stanley Electric Co Ltd, KOITO MANUFACTURING CO LTD.

3. What are the main segments of the China Automotive LED Lighting Market?

The market segments include Automotive Utility Lighting, Automotive Vehicle Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Connected Devices; Surging Usage of Fossil Fuels has Increasing Demand for Power-Efficient Electronic Devices.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limitations in Operations due to Constraints like Temperature. Frequency. Reverse Blocking Capacity. etc..

8. Can you provide examples of recent developments in the market?

March 2023: HELLA expands Black Magic auxiliary headlamp series with 32 new lightbars. Range expansion includes 14 lightbars with ECE approval for on-road use and 18 light-bars for off-road applicationsJanuary 2023: HELLA brings FlatLight technology into series production as a daytime running light for the first time. The lighting concept is successfully transferred from the rear combination lamp to an application in the front area; series production starts in 2025.December 2022: HELLA further expands its leading market position in chip-based headlamp technologies(SSL | HD). World's first series production of an SSL | HD headlamp started at the Lippstadt site

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Automotive LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Automotive LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Automotive LED Lighting Market?

To stay informed about further developments, trends, and reports in the China Automotive LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence