Key Insights

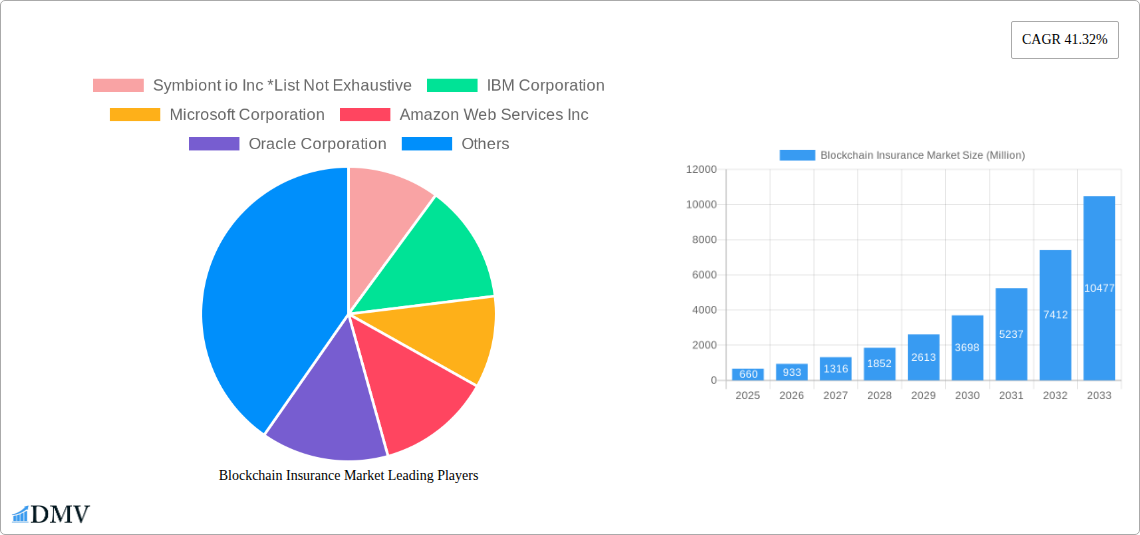

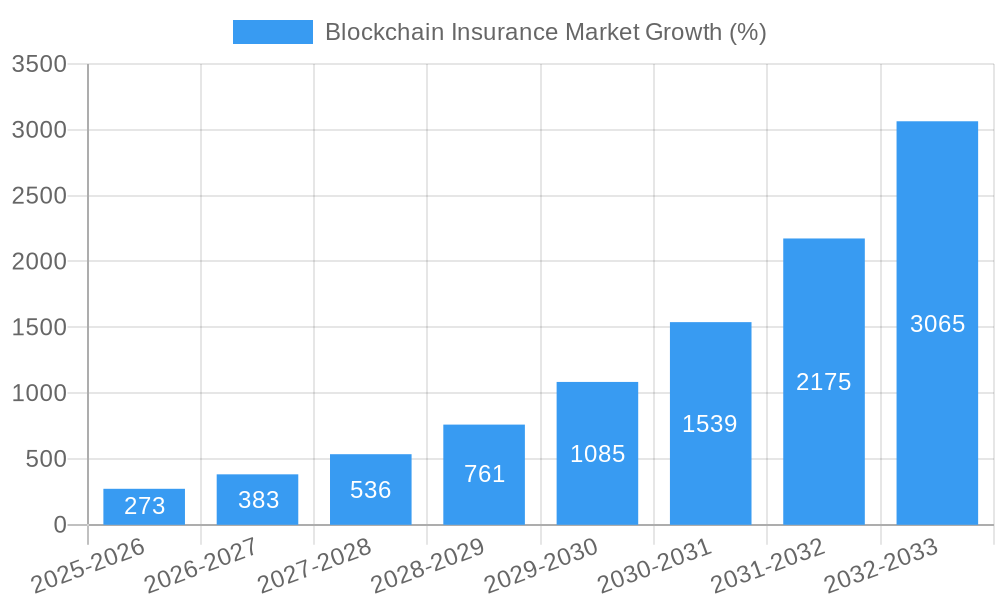

The Blockchain Insurance market is experiencing rapid growth, projected to reach a substantial size with a Compound Annual Growth Rate (CAGR) of 41.32% between 2025 and 2033. This explosive expansion is fueled by several key drivers. The increasing demand for enhanced security and transparency in insurance processes is a primary factor. Blockchain's inherent immutability and cryptographic security offer significant advantages over traditional systems, mitigating fraud and streamlining claims processing. Furthermore, the rise of smart contracts automates policy execution and claims settlement, reducing operational costs and improving efficiency. The integration of blockchain technology with Internet of Things (IoT) devices enables real-time risk assessment and personalized insurance products, further driving market growth. Growth is also being spurred by regulatory support and increasing adoption across various applications, including Governance, Risk, and Compliance (GRC) management, financial management (especially payments), identity management & fraud detection, and death and claims management. The cloud-based deployment model is expected to dominate the market due to its scalability and cost-effectiveness.

However, certain challenges hinder widespread adoption. High initial investment costs for implementing blockchain solutions and the lack of a standardized regulatory framework in some regions can slow down market penetration. Furthermore, the need for skilled professionals to manage and maintain blockchain systems poses another significant hurdle. Despite these restraints, the long-term outlook for the Blockchain Insurance market remains incredibly positive, driven by continued technological advancements, rising consumer demand for improved insurance services, and the proactive efforts of leading industry players like IBM, Microsoft, Amazon Web Services, and Oracle, among others, to develop innovative blockchain-based insurance solutions. The market segmentation by application, deployment, and type provides a granular understanding of the specific areas experiencing the most rapid growth, informing strategic investment decisions.

Blockchain Insurance Market: A Comprehensive Report (2019-2033)

This insightful report offers a detailed analysis of the Blockchain Insurance Market, providing stakeholders with a comprehensive understanding of its current state, future trajectory, and key players. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this report is an indispensable resource for strategic decision-making. The market is projected to reach xx Million by 2033, exhibiting substantial growth throughout the forecast period.

Blockchain Insurance Market Market Composition & Trends

This section delves into the intricacies of the Blockchain Insurance Market, examining its structure and evolution. We analyze market concentration, revealing the market share distribution among key players. We explore the innovative catalysts driving market growth, including technological advancements and regulatory changes, as well as the influence of substitute products. Further, we profile end-users and their adoption patterns, and examine the landscape of mergers and acquisitions (M&A) activities, including the estimated values of significant deals. The impact of evolving regulatory landscapes is meticulously assessed, detailing its effect on market dynamics. This analysis also considers factors such as increasing adoption of blockchain technology in the insurance sector and the growing awareness of its benefits.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few dominant players holding a significant market share. Further detailed market share distribution is included in the complete report.

- M&A Activity: The report details several significant M&A activities, including deal values and their impact on market consolidation. An estimated xx Million has been invested in M&A activities in the last five years.

- Innovation Catalysts: The rising demand for enhanced security, transparency, and efficiency in insurance processes is driving innovation in blockchain technology.

- Regulatory Landscape: Regulatory frameworks are evolving, impacting the adoption of blockchain solutions across different regions. The analysis includes details on these regional variations and potential future developments.

Blockchain Insurance Market Industry Evolution

This section provides a detailed analysis of the Blockchain Insurance Market's growth trajectory, technological advancements, and the ever-shifting demands of consumers. Growth rates for different segments are meticulously presented, supported by robust data analysis and detailed adoption metrics, illustrating the widespread uptake of blockchain technology in the insurance sector. The analysis accounts for the influence of emerging technologies, such as AI and machine learning, on the overall market evolution. The evolving consumer expectations regarding enhanced security, transparency, and efficiency drive the shift towards blockchain-based solutions. We detail historical growth (2019-2024) and project future trends (2025-2033), supported by a rigorous methodology. The report explores market size variations across different segments and identifies key trends shaping the future of the market.

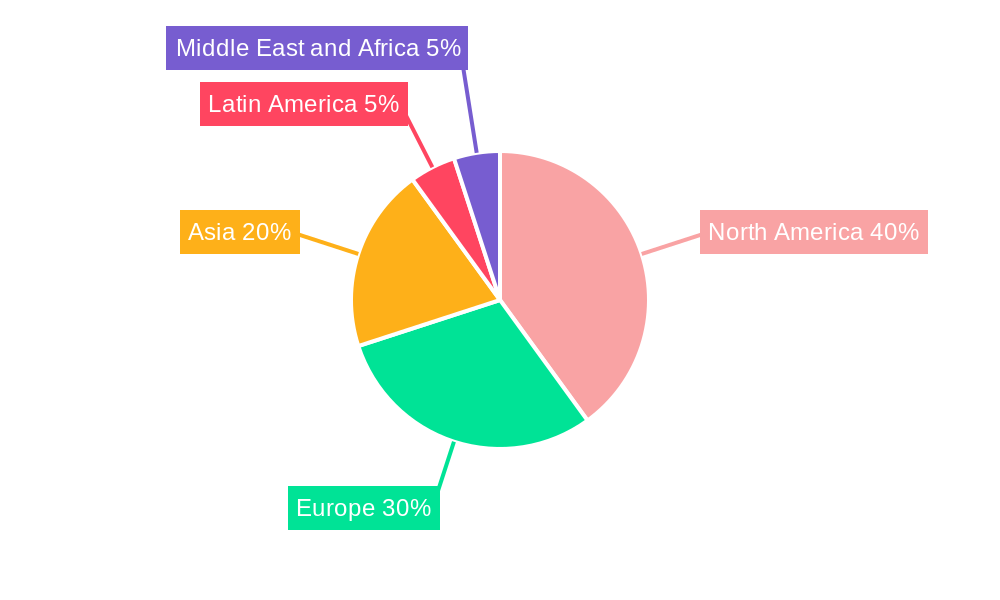

Leading Regions, Countries, or Segments in Blockchain Insurance Market

This section pinpoints the dominant regions, countries, and segments within the Blockchain Insurance Market. The analysis focuses on key drivers for growth in each segment.

By Application:

- GRC (Governance, Risk and Compliance) Management: High adoption is driven by the need for enhanced regulatory compliance and risk mitigation.

- Smart Contracts: Increasing adoption is fueled by the automation of insurance processes and reduced operational costs.

- Financial Management (Payments): Facilitates faster and more secure transactions, streamlining payment processing.

- Identity Management & Fraud Detection: Blockchain technology offers robust solutions for secure identity verification and fraud prevention.

- Death and Claims Management: Streamlines the claims process, ensuring transparency and efficiency.

- Other Applications: This segment includes emerging applications and niche uses of blockchain technology in the insurance domain.

By Deployment:

- Cloud-Based: Greater flexibility, scalability, and cost-effectiveness make it a preferred choice.

- On-Premise: Offers greater control over data and infrastructure, although it comes with higher upfront costs.

By Type:

- Public: Offers greater transparency and accessibility, but potential security concerns need to be addressed.

- Private: Provides enhanced security and privacy, but limits the accessibility and scalability of the solution.

The report provides in-depth analysis of the dominance factors, such as technological advancements, regulatory support, and investment trends.

Blockchain Insurance Market Product Innovations

This section highlights the most recent product innovations, focusing on their applications and performance metrics. We showcase the unique selling propositions (USPs) of these products, emphasizing the technological advancements driving the sector. This includes a discussion on new features, improved functionalities, and enhanced security features of blockchain-based insurance solutions. The analysis will explore how these innovations translate to improved efficiency, reduced costs, and enhanced customer satisfaction within the insurance industry.

Propelling Factors for Blockchain Insurance Market Growth

The growth of the Blockchain Insurance Market is propelled by several key factors. Technological advancements, such as the development of more efficient and scalable blockchain platforms, are instrumental in driving wider adoption. Economic factors, like the reduction in operational costs and increased efficiency, contribute to the market expansion. Favorable regulatory environments, including supportive government policies and initiatives, encourage innovation and investment in the sector. For instance, the increasing adoption of blockchain technology by large insurance companies shows a positive impact on the growth of this market.

Obstacles in the Blockchain Insurance Market Market

The Blockchain Insurance Market faces several challenges. Regulatory uncertainty in various jurisdictions creates hurdles for market expansion. Supply chain disruptions, especially those impacting the availability of critical components, can impact the production and deployment of blockchain solutions. Intense competition among established players and emerging startups presents a constant challenge, and this competitive landscape can impact pricing strategies and market share.

Future Opportunities in Blockchain Insurance Market

Emerging opportunities in the Blockchain Insurance Market are numerous. The expansion into new geographic markets, particularly in developing economies, presents significant potential. The integration of advanced technologies, such as artificial intelligence (AI) and machine learning, into blockchain solutions will open up new applications and enhance existing ones. Finally, evolving consumer preferences and demands, such as the need for greater transparency and personalized insurance products, create opportunities for innovative blockchain-based solutions.

Major Players in the Blockchain Insurance Market Ecosystem

- Symbiont io Inc

- IBM Corporation

- Microsoft Corporation

- Amazon Web Services Inc

- Oracle Corporation

- GuardTime AS

- Auxesis Group

- Chainthat Limited

- SAP SE

Key Developments in Blockchain Insurance Market Industry

- September 2022: XA Group unveiled Addenda, a blockchain-based solution for motor recovery receivables reconciliation in the MENA region. This development significantly improves efficiency and reduces disputes in the insurance sector.

- January 2023: Amazon Web Services partnered with Ava Labs to boost blockchain adoption across various sectors, facilitating easier node management and enhancing network flexibility. This collaboration significantly improves the infrastructure for blockchain applications in insurance.

Strategic Blockchain Insurance Market Market Forecast

The Blockchain Insurance Market is poised for significant growth driven by increasing demand for transparency, security, and efficiency in insurance operations. The market’s future potential is substantial, fueled by technological advancements and favorable regulatory developments. Continued innovation in blockchain technology and its integration with other emerging technologies will further accelerate market growth in the coming years, presenting numerous opportunities for both established and new players.

Blockchain Insurance Market Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud Based

-

2. Type

- 2.1. Public

- 2.2. Private

-

3. Application

- 3.1. GRC (Governance, Risk and Compliance) Management

- 3.2. Smart Contract

- 3.3. Financial Management (Payments)

- 3.4. Identity Management & Fraud Detection

- 3.5. Death and Claims Management

- 3.6. Other Applications

Blockchain Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. Singapore

- 3.4. Australia and New Zealand

- 4. Latin America

- 5. Middle East and Africa

Blockchain Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 41.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand of Automation Across the BFSI Sector; Increasing Need for Reducing the Total Cost of Ownership

- 3.3. Market Restrains

- 3.3.1. Security Vulnerability of Transaction Across the Insurance Platform using Blockchain Technology; Lack of Awareness about Blockchain in the Industry Professionals

- 3.4. Market Trends

- 3.4.1. The On-Premises Segment is Anticipated to Witness Increasing Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blockchain Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud Based

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Public

- 5.2.2. Private

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. GRC (Governance, Risk and Compliance) Management

- 5.3.2. Smart Contract

- 5.3.3. Financial Management (Payments)

- 5.3.4. Identity Management & Fraud Detection

- 5.3.5. Death and Claims Management

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Blockchain Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud Based

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Public

- 6.2.2. Private

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. GRC (Governance, Risk and Compliance) Management

- 6.3.2. Smart Contract

- 6.3.3. Financial Management (Payments)

- 6.3.4. Identity Management & Fraud Detection

- 6.3.5. Death and Claims Management

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Blockchain Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud Based

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Public

- 7.2.2. Private

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. GRC (Governance, Risk and Compliance) Management

- 7.3.2. Smart Contract

- 7.3.3. Financial Management (Payments)

- 7.3.4. Identity Management & Fraud Detection

- 7.3.5. Death and Claims Management

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Blockchain Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud Based

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Public

- 8.2.2. Private

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. GRC (Governance, Risk and Compliance) Management

- 8.3.2. Smart Contract

- 8.3.3. Financial Management (Payments)

- 8.3.4. Identity Management & Fraud Detection

- 8.3.5. Death and Claims Management

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Blockchain Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud Based

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Public

- 9.2.2. Private

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. GRC (Governance, Risk and Compliance) Management

- 9.3.2. Smart Contract

- 9.3.3. Financial Management (Payments)

- 9.3.4. Identity Management & Fraud Detection

- 9.3.5. Death and Claims Management

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East and Africa Blockchain Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On-premise

- 10.1.2. Cloud Based

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Public

- 10.2.2. Private

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. GRC (Governance, Risk and Compliance) Management

- 10.3.2. Smart Contract

- 10.3.3. Financial Management (Payments)

- 10.3.4. Identity Management & Fraud Detection

- 10.3.5. Death and Claims Management

- 10.3.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. North America Blockchain Insurance Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Blockchain Insurance Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 13. Asia Blockchain Insurance Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 Singapore

- 13.1.4 Australia and New Zealand

- 14. Latin America Blockchain Insurance Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Blockchain Insurance Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Symbiont io Inc *List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 IBM Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Microsoft Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Amazon Web Services Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Oracle Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 GuardTime AS

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Auxesis Group

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Chainthat Limited

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 SAP SE

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Symbiont io Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Blockchain Insurance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Blockchain Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Blockchain Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Blockchain Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Blockchain Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Blockchain Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Blockchain Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Blockchain Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Blockchain Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Blockchain Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Blockchain Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Blockchain Insurance Market Revenue (Million), by Deployment 2024 & 2032

- Figure 13: North America Blockchain Insurance Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 14: North America Blockchain Insurance Market Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Blockchain Insurance Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Blockchain Insurance Market Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Blockchain Insurance Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Blockchain Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Blockchain Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Blockchain Insurance Market Revenue (Million), by Deployment 2024 & 2032

- Figure 21: Europe Blockchain Insurance Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 22: Europe Blockchain Insurance Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Blockchain Insurance Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Blockchain Insurance Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Europe Blockchain Insurance Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe Blockchain Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Blockchain Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Blockchain Insurance Market Revenue (Million), by Deployment 2024 & 2032

- Figure 29: Asia Blockchain Insurance Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 30: Asia Blockchain Insurance Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Blockchain Insurance Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Blockchain Insurance Market Revenue (Million), by Application 2024 & 2032

- Figure 33: Asia Blockchain Insurance Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Asia Blockchain Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Blockchain Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Blockchain Insurance Market Revenue (Million), by Deployment 2024 & 2032

- Figure 37: Latin America Blockchain Insurance Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 38: Latin America Blockchain Insurance Market Revenue (Million), by Type 2024 & 2032

- Figure 39: Latin America Blockchain Insurance Market Revenue Share (%), by Type 2024 & 2032

- Figure 40: Latin America Blockchain Insurance Market Revenue (Million), by Application 2024 & 2032

- Figure 41: Latin America Blockchain Insurance Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: Latin America Blockchain Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Blockchain Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Blockchain Insurance Market Revenue (Million), by Deployment 2024 & 2032

- Figure 45: Middle East and Africa Blockchain Insurance Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 46: Middle East and Africa Blockchain Insurance Market Revenue (Million), by Type 2024 & 2032

- Figure 47: Middle East and Africa Blockchain Insurance Market Revenue Share (%), by Type 2024 & 2032

- Figure 48: Middle East and Africa Blockchain Insurance Market Revenue (Million), by Application 2024 & 2032

- Figure 49: Middle East and Africa Blockchain Insurance Market Revenue Share (%), by Application 2024 & 2032

- Figure 50: Middle East and Africa Blockchain Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Blockchain Insurance Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Blockchain Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Blockchain Insurance Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: Global Blockchain Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Blockchain Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Blockchain Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Blockchain Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Blockchain Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Blockchain Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Singapore Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Australia and New Zealand Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Blockchain Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Blockchain Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Blockchain Insurance Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 23: Global Blockchain Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global Blockchain Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Blockchain Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United States Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Canada Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Blockchain Insurance Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 29: Global Blockchain Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Global Blockchain Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Global Blockchain Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United Kingdom Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Germany Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Blockchain Insurance Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 36: Global Blockchain Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 37: Global Blockchain Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 38: Global Blockchain Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 39: China Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Japan Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Singapore Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Australia and New Zealand Blockchain Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Blockchain Insurance Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 44: Global Blockchain Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 45: Global Blockchain Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 46: Global Blockchain Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: Global Blockchain Insurance Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 48: Global Blockchain Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 49: Global Blockchain Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 50: Global Blockchain Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blockchain Insurance Market?

The projected CAGR is approximately 41.32%.

2. Which companies are prominent players in the Blockchain Insurance Market?

Key companies in the market include Symbiont io Inc *List Not Exhaustive, IBM Corporation, Microsoft Corporation, Amazon Web Services Inc, Oracle Corporation, GuardTime AS, Auxesis Group, Chainthat Limited, SAP SE.

3. What are the main segments of the Blockchain Insurance Market?

The market segments include Deployment, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand of Automation Across the BFSI Sector; Increasing Need for Reducing the Total Cost of Ownership.

6. What are the notable trends driving market growth?

The On-Premises Segment is Anticipated to Witness Increasing Market Growth.

7. Are there any restraints impacting market growth?

Security Vulnerability of Transaction Across the Insurance Platform using Blockchain Technology; Lack of Awareness about Blockchain in the Industry Professionals.

8. Can you provide examples of recent developments in the market?

January 2023 - Amazon Web Services partnered with Ava Labs, a company building out layer-1 blockchain Avalanche, to assist in scaling blockchain adoption across institutions, enterprises, and governments. The partnership intends to make it more uncomplicated for individuals to launch and manage nodes on Avalanche while also seeking to give the network more strength and flexibility for developers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blockchain Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blockchain Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blockchain Insurance Market?

To stay informed about further developments, trends, and reports in the Blockchain Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence